Solusdtsignal

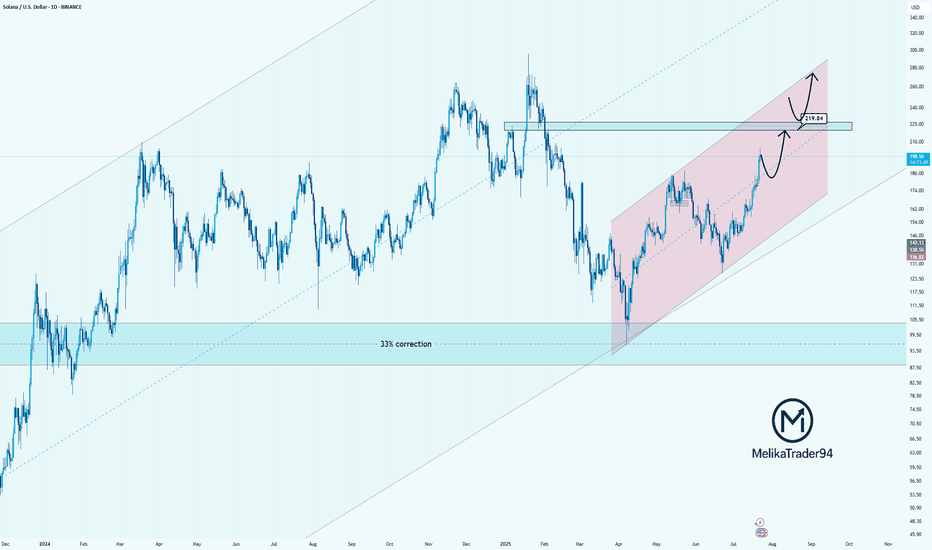

Solana Approaching Key Resistance: watch for $219Hello guys!

Solana has been trending strongly inside a rising parallel channel, recovering steadily after a significant 33% correction. The bullish momentum is clear, and the price is now approaching a key resistance zone near $219.84, which previously acted as a major turning point.

Here’s what I’m watching:

Strong uptrend within the pink channel shows controlled and healthy growth.

$219.84 is a critical decision zone. Price could:

React with a pullback before pushing higher,

Or break through it and flip the level into support for the next bullish leg.

The reaction in this zone will determine the next structure.

Whether we see a temporary correction or continuation to new highs.

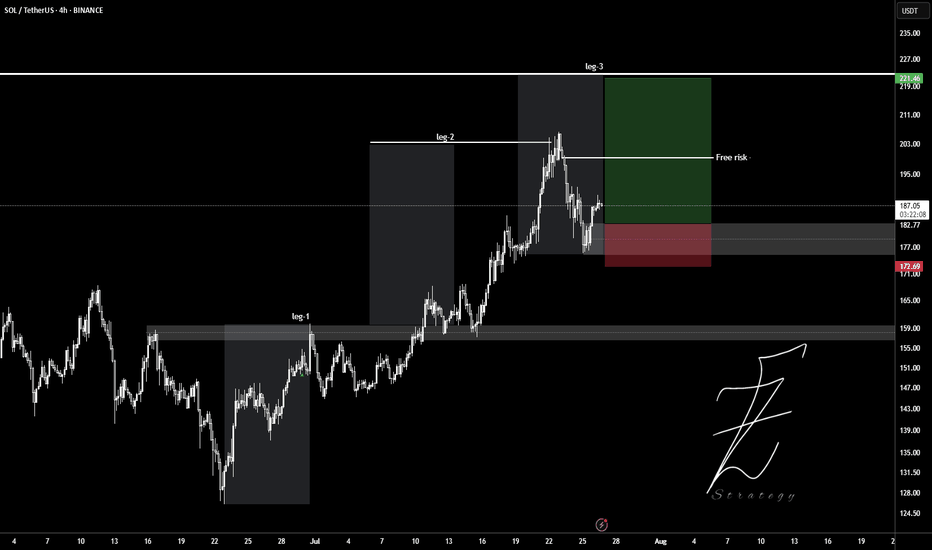

SOLANA UPDATEHello friends🙌

📉Given the decline we had, you can see that buyers came in and supported the price and were able to change the trend and create an ascending channel.

📈Now, considering that the price is hitting higher ceilings and floors, we can expect an ascending wave until the ceiling of the channel.

Don't forget risk and capital management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

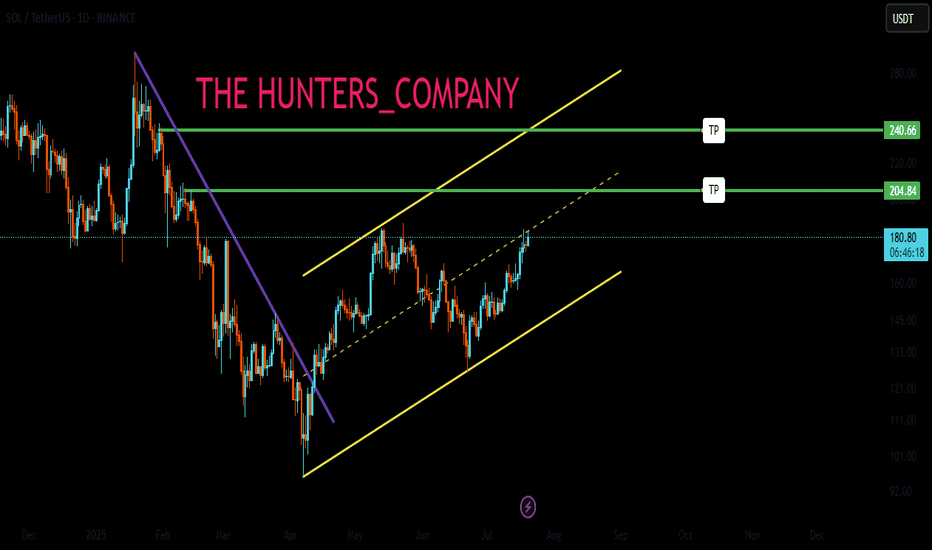

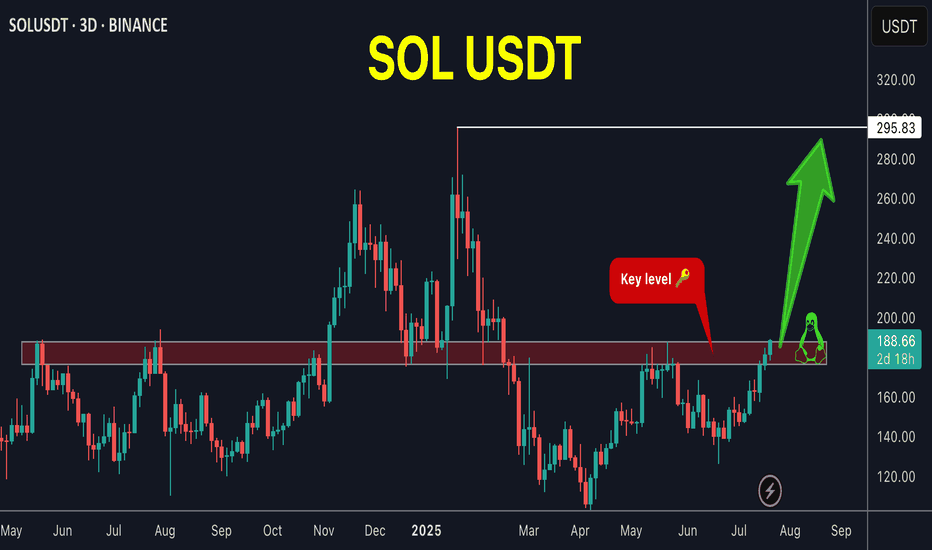

Solana Price Faces Reversal At $200 As Profits Hit 5-Month HighBINANCE:SOLUSDT price has risen 21% in the past week , now trading at $199. Despite breaching the $200 mark, Solana has failed to maintain this level, marking a five-month high.

The Net Unrealized Profit/Loss (NUPL) indicator for BINANCE:SOLUSDT shows that profits have reached a five-month high . This signals that many investors are in profit, raising concerns about a potential sell-off.

If these factors hold true, BINANCE:SOLUSDT price could decline toward the support levels of $188 or even drop to $176 . A move below these levels could erase a significant portion of the recent gains and shift the altcoin into a bearish trend.

However, if investor confidence remains strong and the market continues to show bullish signs, BINANCE:SOLUSDT could stabilize above $200 . Securing this level as support could propel the price back toward $221, invalidating the bearish outlook.

SOLUSDT on Fire! Bullish Wedge Fuels INSANE Upside Potential!BINANCE:SOLUSDT has been exhibiting strong bullish momentum, currently trading within a broadening wedge pattern. This technical structure often signals increased volatility and the potential for decisive moves in either direction. In the present scenario, the breakout above the psychological $200 resistance level suggests that bulls are firmly in control, fueling hopes of further upside.

The continuation of momentum hints at the market preparing for another leg up. The immediate price target lies at $300, where traders may expect some profit-taking and resistance. However, should momentum sustain and buying pressure persist, BINANCE:SOLUSDT has the potential to surge toward the $700 region, aligning with the pattern’s projected price expansion.

As always, managing risk is key. Use a well-placed stop loss below the support level to protect your capital. Breakouts can be explosive, but discipline and proper risk management make all the difference.

BINANCE:SOLUSDT Currently trading at $201

Buy level : Above $200

Stop loss : Below $150

Target 1: $250

Target 2: $300

Target 3: $500

Target 4: $700

Max leverage 2x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

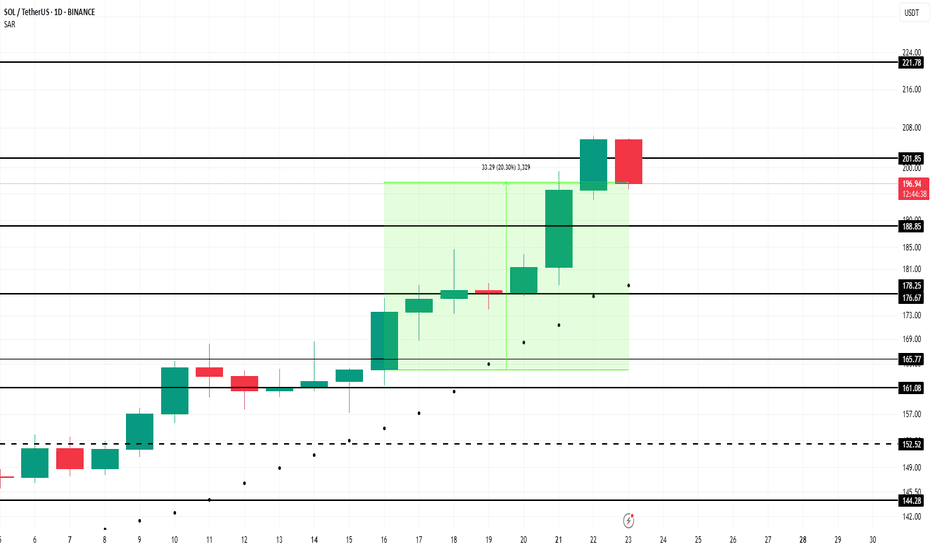

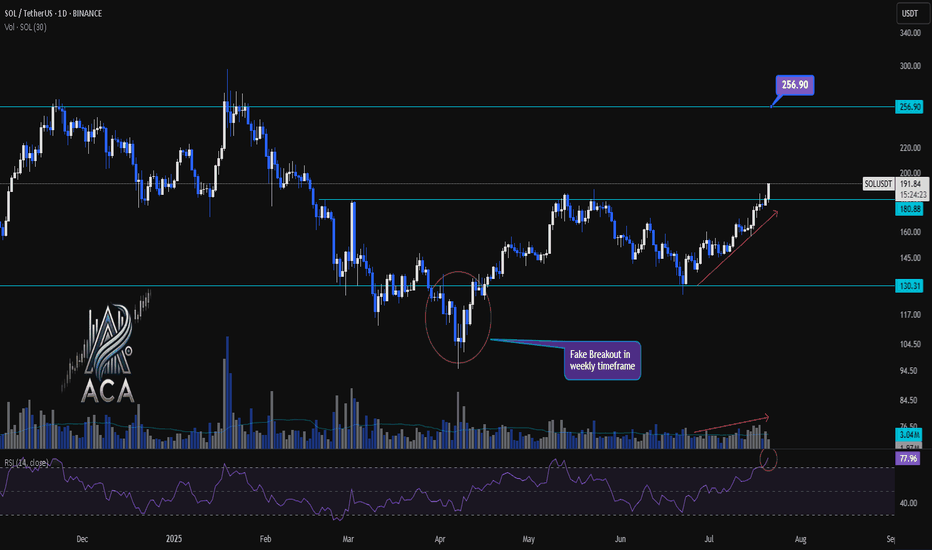

SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals....SOLUSDT 1D Chart Analysis | Accumulation Breakout Signals Fresh Momentum

🔍 Let’s drill into the SOL/USDT daily chart, focusing on the recent breakout above the accumulation range, key support and resistance levels, RSI momentum, and volume confirmation for a robust bullish scenario.

⏳ Daily Overview

SOLUSDT has decisively broken out above a prolonged accumulation box, marking a significant shift in market structure. A daily close beyond this range now serves as a strong indicator for renewed bullish momentum. RSI is currently above 77, signaling that buyers are commanding momentum. Notably, volume has surged in tandem with price, confirming trader participation behind this breakout move.

📈 Technical Convergence and Trend Structure

- Accumulation Zone Break: After consolidating within a clear box for weeks, SOLUSDT closed above the upper boundary (around $180.88–$191.05), signaling a possible trend reversal or continuation.

- Daily Close Signal: A daily close outside the accumulation box offers high conviction for bullish continuation. This close acts as a potential entry signal for trend-followers.

- RSI Momentum: The RSI sits above 77—deep in the overbought territory. A close here not only confirms buyer strength but often precedes sustained uptrends when accompanied by price breakouts.

- Volume Surge: Volume has increased with the breakout, providing confirmation the move isn’t a false start, but likely fueled by real demand.

- Weekly Fake Breakout: There was a notable false breakout in the weekly timeframe, quickly reclaimed by bulls. This flip suggests buyers fended off downside attempts and now drive higher prices.

🔺 Bullish Setup & Targets

- First Target: $256.90 — marking the next major resistance on the chart and a logical upside objective for traders.

- Key Trigger: A confirmed daily (or weekly) close above the accumulation range with strong volume is essential for validating the upward trajectory.

📊 Key Highlights

- The breakdown of the accumulation box—now turned support—marks a pivotal structural change.

- RSI and price are making new local highs, solidifying the case for continued bullish momentum.

- Volume is climbing in sync with the move, offering real confirmation versus a potential fakeout.

- Recent fake breakout on the weekly chart, immediately negated, emphasizes that buyers are regaining—and likely maintaining—control.

🚨 Conclusion

SOLUSDT appears set for higher prices following the confirmed breakout above the accumulation range. Signs of trend health include an overbought RSI, volume confirmation, and the swift invalidation of a recent weekly fake breakout. As long as daily closes stay above the breakout level, the path remains clear for a rally toward $256.90. A strong daily close and continued volume will be your best signals for bullish continuation.

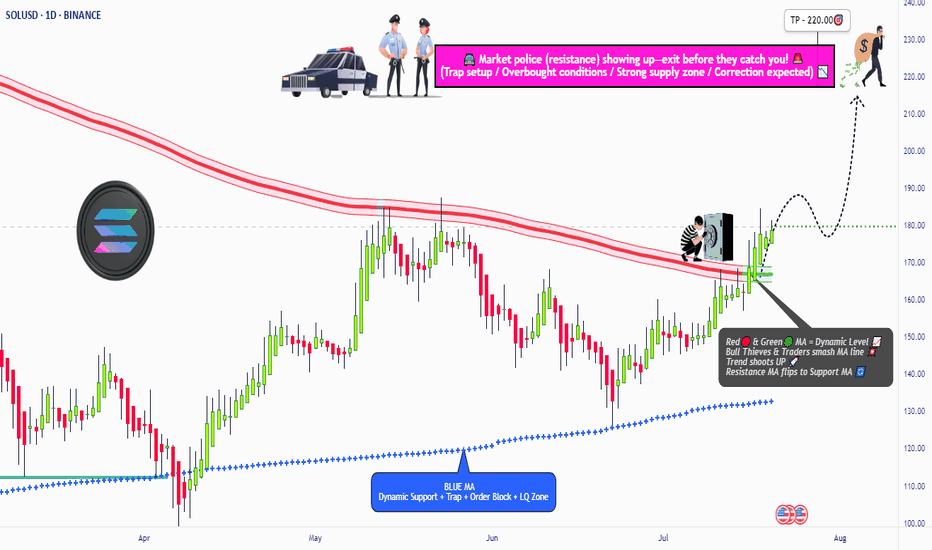

"SOL/USD BULLISH HEIST! Steal Profits Like a Pro"🏆 "SOLANA HEIST ALERT! 🚨 Bullish Loot Ahead – Thief Trading Style (SOL/USD)" 🏆

💸 Steal Profits Like a Pro – Day/Swing Trade Plan 💸

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

Hola! Bonjour! Hallo! Marhaba! 🤑 Dear Thieves & Trend Snipers, the SOL/USD vault is WIDE OPEN! Time to execute the heist with precision.

🔥 THIEF TRADING MASTER PLAN 🔥

🎯 Mission: LONG SOLANA (Escape Near Blue ATR Line)

⚠️ Danger Zone: Overbought | Consolidation | Bear Trap Ahead

🏆 Rule: "Take Profit & Treat Yourself – You’ve Earned It!" 💪💰

📈 ENTRY STRATEGY (The Heist Begins!)

"SWIPE THE BULLISH LOOT!" – Enter at any price, but smart thieves use:

Buy Limit Orders (15-30min timeframe)

Swing Low/High Pullbacks for optimal entry

DCA/Layering Strategy (Multiple limit orders for max loot)

🛑 STOP-LOSS (Escape Plan)

📍 Thief SL: Below nearest low (Daily MA @ $160.00)

⚠️ Adjust SL based on: Risk tolerance, lot size, & DCA layers.

Pro Tip: Tighten SL if market flips bearish!

🎯 TARGETS (Profit Escape Routes)

🎯 Main Take-Profit: $220.00 (or exit earlier if momentum fades)

🧲 Scalpers: Only LONG! Use trailing SL to lock gains.

💰 Big Bank Thieves: Go all-in. Smaller Raiders: Join swing traders.

📰 WHY SOLANA? (Fundamental Boosters)

Bullish Momentum (Tech + Sentiment Driving Price)

Macro Trends, On-Chain Signals 👉 Check Liinkss 🔗

Intermarket Analysis: Crypto & equities syncing for gains!

⚠️ TRADING ALERTS (News & Risk Control)

🚨 News = VOLATILITY! Avoid new trades during major releases.

🔒 Protect Running Trades: Use trailing stops to secure profits.

💥 SUPPORT THE HEIST! (Boost & Win Together) 💥

🔥 Hit the "LIKE" & "BOOST" button to strengthen our Thief Trading Squad!

🚀 More Heist Plans Coming Soon – Stay Tuned! 🤑🎉

📌 Reminder: This is NOT financial advice – DYOR & manage risk!

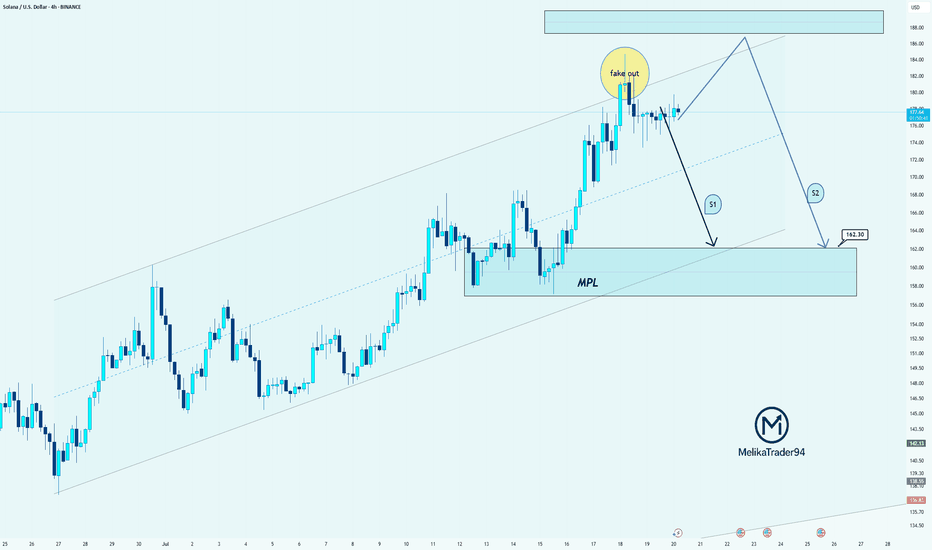

SOL: Clean Fakeout & Two Bearish Scenarios AheadHello guys!

Price just created a textbook fakeout above the resistance zone, grabbing liquidity and quickly dropping back into the range!

Here’s what the chart is showing:

Price is still inside the ascending channel, but the breakout attempt failed

The MPL (maximum pain level) around $162.30 is the key downside target

Two possible paths:

S1: Direct drop from here toward the MPL

S2: Another move up to retest the highs or form a lower high before the deeper drop

I think the S2 is more probable!

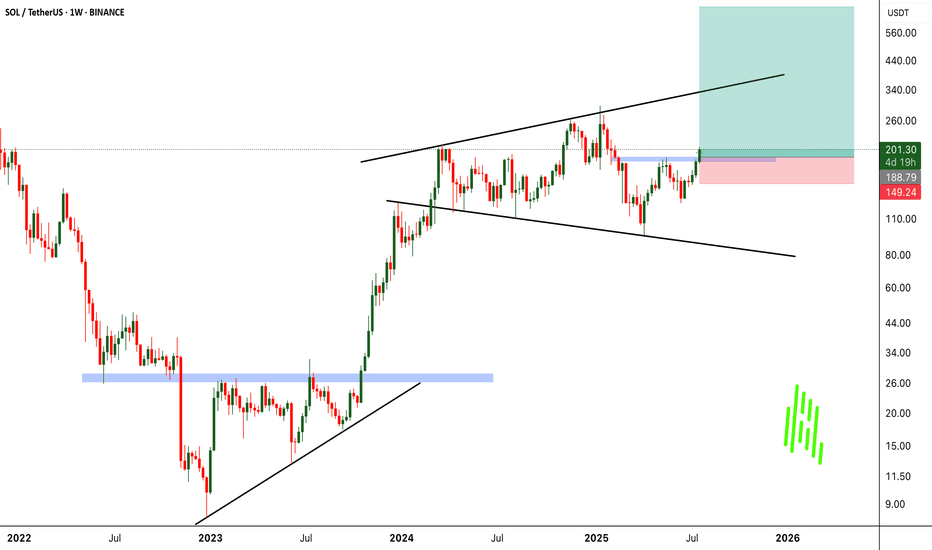

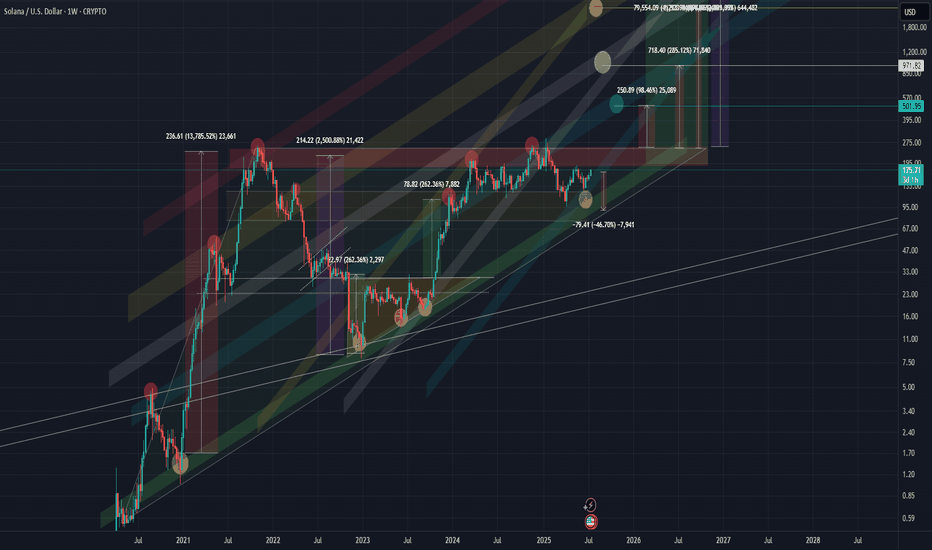

SOLANA SOL 1WThis coin is showing very interesting development, and the market maker seems to be painting clear structural patterns.

🔷 Macro Structure: Rising Triangle

On the higher timeframes, we can clearly see a rising triangle formation taking shape. If this pattern breaks out to the upside, the potential measured move suggests a target of up to ~2,500% from current levels.

📊 Chart Overview

Wide zones = key support and resistance

Former resistance often becomes support after a breakout

All target levels and zones are clearly marked on the chart

⚠️ Risk Warning & Realistic Scenario

Be mindful of market behavior:

Often before a bullish breakout, we see a fake breakdown — a trap to liquidate early longs — followed by a return into the triangle and a strong move upward. Don’t rush. Let the pattern confirm itself.

💡 Plan Accordingly

If you're already in, consider protecting your position with a stop-loss

Don’t overleverage, and take profit partially on strong levels

Solana UpdateHello friends🙌

After the price growth we had, the price hit the resistance level of $160 twice and failed to break it, which caused a double top pattern to form, which if confirmed, there is a possibility of falling to the specified areas.😉

The specified areas are good prices for buying in steps, of course, with capital and risk management.✔

🔥Join us for more signals🔥

*Trade safely with us*

Solana:Daily free signalhello friends👋

As you can see, after the drop that we had, insider buyers showed and were able to support the price well.

But it was not enough, and as you can see, a noisy pattern has formed, which can indicate a further decrease in the price.

Now we can take advantage of this opportunity and make step-by-step purchases with risk and capital management in the support areas that we have obtained for you and move to the specified goals.

🔥Follow us for more signals🔥

*Trade safely with us*

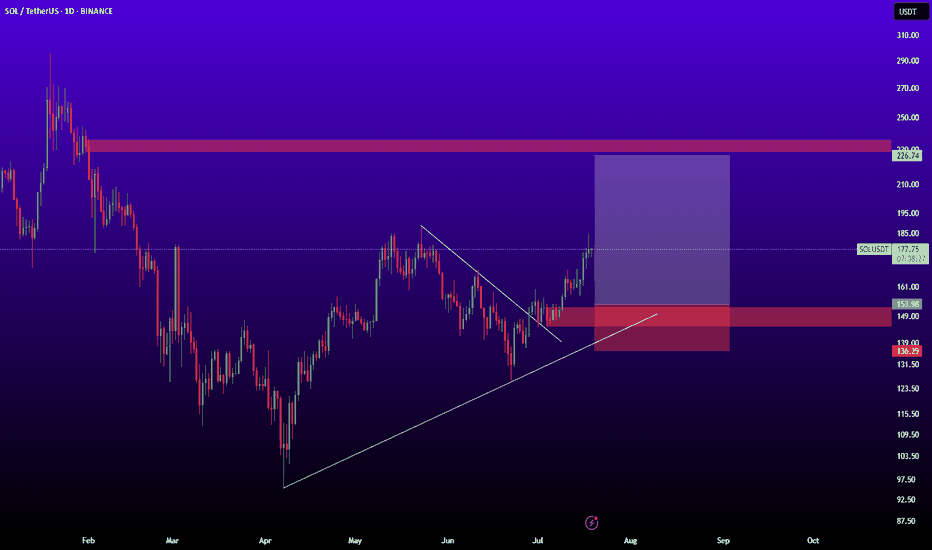

#SOL/USDT Loves THIS Pattern | BULLISH#SOL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 143.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 142, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the moving average of 100.

Entry price: 149.

First target: 153.

Second target: 156.

Third target: 159.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

"Solana Heist in Progress! Will the Breakout Hold or Fake Out?"🔥🚨 "SOLANA HEIST ALERT: The Ultimate Bullish Raid Plan (Breakout or Fakeout?)" 🚨🔥

🌍👋 Greetings, Market Pirates & Profit Bandits!

(English, Spanish, Portuguese, French, German, Arabic—we speak MONEY.)

💎 STRATEGY BASED ON THIEF TRADING STYLE 💎

(High-risk, high-reward—steal the trend or get caught in consolidation!)

🎯 MISSION: SOL/USD (Solana vs. Dollar) CRYPTO HEIST

🐂 Direction: LONG (But watch for traps—cops & bears lurk nearby!)

🚀 Escape Zone: ATR line (High-Risk Profit-Taking Area)

⚠️ Warning: Overbought? Reversal? Police line at resistance? TAKE PROFITS EARLY!

📈 ENTRY: "THE BREAKOUT HEIST BEGINS!"

Trigger: Wait for candle close ABOVE 148.50 (MA)

Alternative Entry: Buy stop above MA OR buy limit on pullback (15m-30m TF)

🛎️ SET AN ALERT! Don’t miss the breakout—thieves strike fast.

🛑 STOP LOSS: "DON’T GET CAUGHT!"

Thief SL: 136.00 (2H Previous structure Swing Low) (Adjust based on your risk & lot size!)

⚠️ Warning: If you ignore this, you’re gambling—your loss, not mine.

🎯 TARGET: "LOOT & BOUNCE!"

🎯 167.00 (or escape earlier if the trend weakens!)

🧨 Scalpers: Only play LONG—use trailing stops to lock in gains!

📢 NEWS & RISK WARNING

🚨 Avoid new trades during high-impact news! (Volatility kills heists.

🔒 Use trailing stops to protect profits if the market turns.

💥 BOOST THIS HEIST! (More boosts = more profit raids!)

👉 Like ✅ | Follow 🚀 | Share 🔄

💬 Comment your take—bullish or bearish trap?

🚀 Next heist coming soon… Stay tuned, bandits! 🤑

Solana Price Poised to Explode — But Only If This Level BreaksThe chart shows Solana trading around $153.85 USDT after a corrective rally from the June lows. Overall market structure has shifted in recent sessions, highlighted by a clear Break of Structure (BOS) on June 29, which signaled the first real attempt to reclaim higher ground after persistent weakness. However, the price has now approached a cluster of supply zones, which could either trigger a further rally if absorbed or mark a fresh rejection.

Above the current level, you can see strong red zones between 160–180 USDT, representing prior swing high supply and institutional sell interest. These are areas where large sellers previously stepped in to push price lower, so if Solana fails to break above this region with convincing volume, sellers may become more active again. In contrast, the nearest major demand zone sits around 137–140 USDT, highlighted in blue. This zone has acted as a key support and liquidity pocket where price has rebounded multiple times.

The Smart Money Concepts on the chart, including frequent CHoCH (Change of Character) and EQ/CHoCH labels, indicate that liquidity sweeps and engineered reversals have been common. This suggests the market may be preparing to hunt stops above recent highs or below recent lows before committing to a longer-term move.

At this point, the trend bias is cautiously neutral to bullish in the short term because the BOS suggests an attempt to reclaim higher levels. However, this bullish bias remains unconfirmed until Solana cleanly breaks and holds above 160–170 USDT. If sellers defend that area, the market could revert to the 137–140 zone.

Below is a clear trade scenario based on what the chart is showing:

Potential Trade Setup (Not Financial Advice)

Scenario: Short from Supply Resistance

o Entry: 153.85–154.35 USDT (currently being tested)

o Stop Loss: Above 160 USDT (invalidates bearish rejection)

o Take Profit Target: 137–140 USDT demand zone

Alternatively, if Solana rejects and returns to retest demand, this would offer a possible buy scenario for traders looking to play the rebound:

Scenario: Long from Demand

o Entry: 137–140 USDT demand zone

o Stop Loss: Below 135 USDT (confirms demand failure)

o Take Profit Target 1: 153.85 USDT resistance retest

o Take Profit Target 2: 170 USDT upper supply

At the moment, the price is balanced between these zones, so a wait-and-see approach can help confirm whether supply breaks or holds. A clean break above 160 USDT with strong momentum could invalidate the short idea and favor continuation higher toward the upper supply region around 170–180 USDT.

In summary, the chart structure is showing early signs of potential accumulation but still faces significant overhead resistance. Careful confirmation around the 154–160 level is critical before committing to either direction. If you’d like, I can help you refine these plans further or overlay additional indicators like volume or moving averages for extra confirmation.

#SOL/USDTSOLANA →

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 142, acting as strong support from which the price can rebound.

Entry price: 144

First target: 146

Second target: 149

Third target: 152

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

SOLUSDT Bullish Flag Pattern!Price has formed a Bullish Flag pattern on the daily timeframe. After multiple touches of both support and resistance, the price has now broken out above the falg resistance, signaling a potential trend reversal. and price trading above 50 and 100 EMA

Currently, SOL is bouncing from the channel breakout level, indicating strong bullish momentum. A clean breakout candle confirms buying interest, and the setup favors a strong bullish continuation if the breakout sustains.

Entry: Above $150

Stop-loss: Below $135

CRYPTOCAP:SOL TRADENATION:SOLANA