Sonic

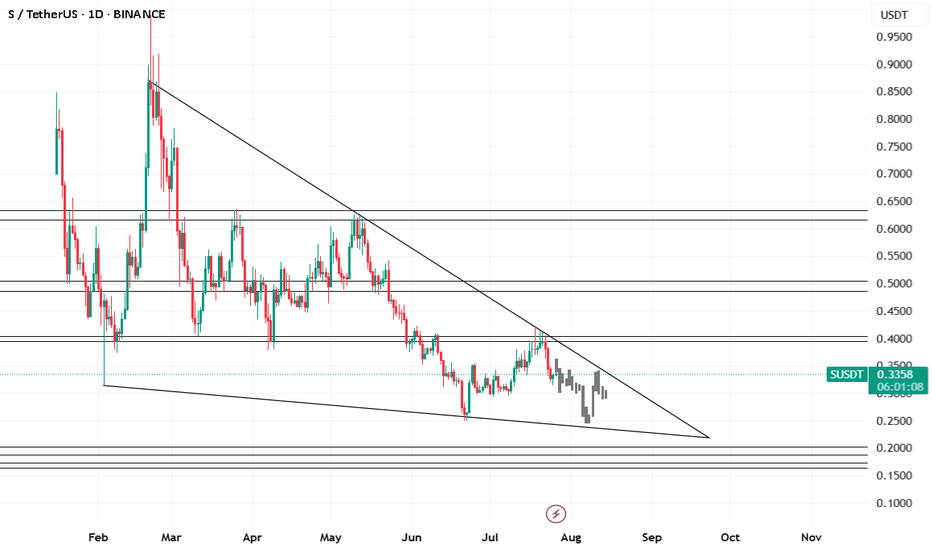

S - SONIC 1DSonic lacks the buying volume to break through its resistances.

The project, after a name change, has become Matic 2.

I expect that we'll soon reach support levels of 30 cents and 25 cents after the pullback is complete. If these supports are broken, the next support levels will be 20 cents and 17 cents.

If the 40 to 43 cent resistance breaks with high volume, there's a possibility of growth to 50 cents. If 50 cents is broken, growth to 63 cents becomes possible.

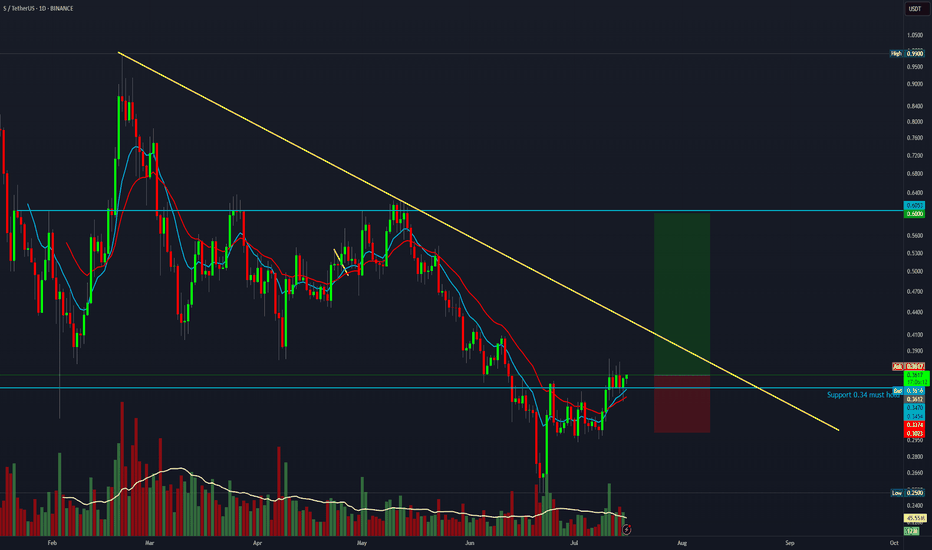

$SUSDT (or S , ex FANTOM): good entry for a long setupCrypto Market Outlook

The overall crypto market is in a clear uptrend.

The money printer is running, and USD dominance is dropping — all signs pointing to a potential continuation of the rally in the coming months.

Unless a black swan event hits, it's not too late to position yourself if you’re still on the sidelines.

⚠️ Always manage your risk with a proper stop loss — altcoins move fast and can reverse just as quickly.

One interesting setup: $S

✅ Relatively new

✅ Didn’t pump too hard

✅ Broke out of its downtrend

✅ Found solid support

The Fib levels offer good targets for take profit zones.

🔍 Ideal entry: within the green box or lower.

Let the pump cool off — it could offer a perfect entry opportunity. Be patient and wait for a good position.

If $S pumps from here without retrace:

→ Jump in with a tight stop loss

→ Or look elsewhere for a better risk/reward setup.

DYOR.

#Crypto #Altcoins #Bitcoin #ETH #Trading #CryptoMarket #TechnicalAnalysis #RiskManagement #DYOR

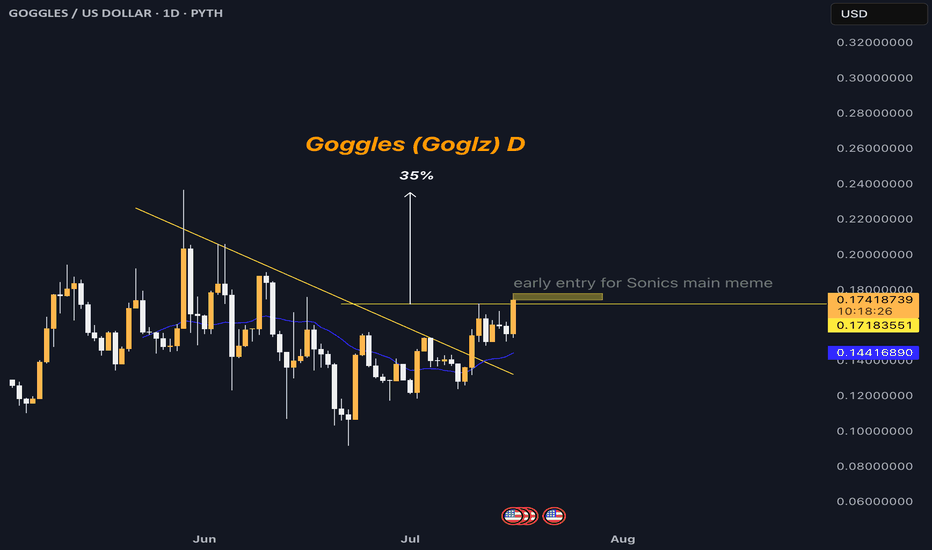

Sonic meme Goglz looking good for explosive moveSonic airdrop in a few days. I will be very surprised if Sonic's main memecoin Goglz doesn't ride the wave a bit. The graph looks good and with some momentum and a continued strong market, 35% TP shouldn't be too far off. Who knows where Sonic and Goglz will be in November/December 2025.

This is a risky idea for those who like memecoins and high risk. I like the timing of the graph and Sonic airdrop (stimulus meme money).

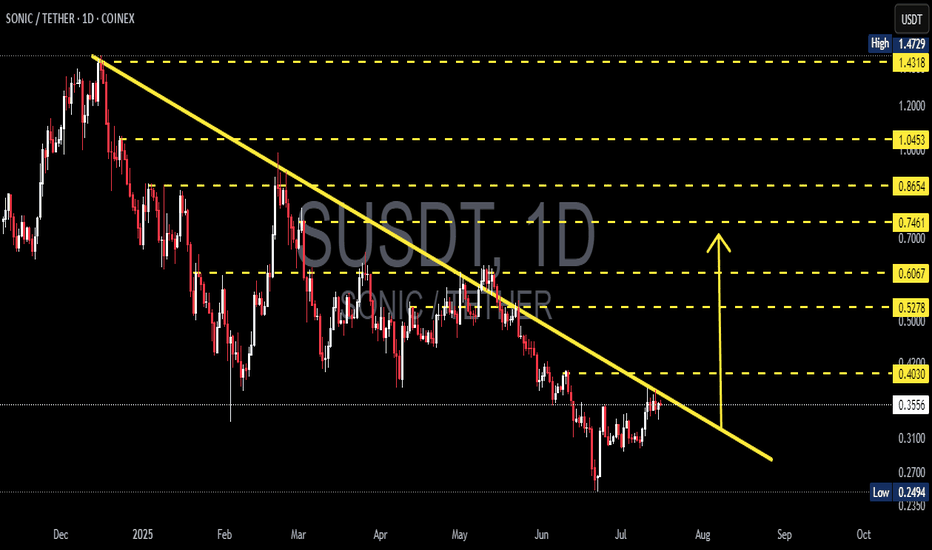

SONIC/USDT Breakout in Progress? Watch This Critical Level Close🧠 Technical Breakdown – Daily Chart (1D, Coinex)

The SONIC/USDT pair is currently exhibiting a textbook descending trendline breakout setup, formed over the past 7+ months. This long-term downtrend has been respected since late November 2024, connecting multiple lower highs and establishing a well-defined bearish structure.

However, recent price action shows a potential trend reversal as the pair consolidates tightly near the apex of the structure, with signs of breakout momentum building.

📐 Pattern Identification:

✅ Falling Wedge / Descending Triangle

✅ Continuous lower highs connected by a descending trendline

✅ Support held above $0.25 (strong demand zone)

✅ Price now testing the upper boundary of the trendline

This is a classic bullish reversal pattern—especially when price breaks out after long-term compression.

🚀 Bullish Scenario:

Should SONIC successfully break and close above the $0.4030 level (trendline + horizontal resistance), it could unlock a wave of bullish momentum. Here are the key upside targets based on Fibonacci retracement from the previous high ($1.4729) to the local low ($0.2494):

🎯 Resistance Level Significance

$0.5278 0.382 Fib – First major target post-breakout

$0.6067 Key confluence level – psychological barrier

$0.7461 0.618 Fib – Bullish continuation zone

$0.8654 High momentum extension

$1.0453 0.786 Fib – Reversal confirmation

$1.4318 Retest of the all-time high

If volume supports the breakout, we could see a sharp move toward these zones.

🧨 Bearish Scenario:

If price fails to break out and gets rejected from the trendline:

It could retrace back toward $0.3100 and $0.2700

A daily close below $0.2494 (previous low) would invalidate the bullish setup, signaling potential continuation of the downtrend

Traders should monitor RSI divergence and volume drop as warning signs

📌 Why This Setup Matters:

This is not just a short-term play. A successful breakout here signals the end of a multi-month downtrend and the potential start of a new macro uptrend. SONIC has been heavily compressed — and the tighter the coil, the bigger the move.

Smart money often enters before the breakout confirmation. Monitor for volume surges, candle structure changes, and key breakout retests.

✅ Summary:

🔄 Trendline breakout imminent

🟢 Watch for breakout confirmation above $0.4030

🔴 Breakdown below $0.2494 invalidates the bullish thesis

🧭 Fibonacci levels offer reliable target zones for profit-taking

This is a critical make-or-break zone for SONIC/USDT. Traders, be ready.

#SONICUSDT #BreakoutSetup #AltcoinAlert #CryptoAnalysis #TrendReversal #TechnicalAnalysis #CryptoTA #Altseason #FibonacciLevels #PriceAction

Idea for Sonic bulls - swap Sonic to BRUSH (Paintswap)!I might have unreasonable expectations for Sonic. But I see Sonic as the most underrated L1.

Airdrop and big news coming up for Sonic in the coming week(s).

If you are a mega Sonic bull as I am, you probably just want to accumulate some more Sonic!

This is an idea how you can accumulate more Sonic...

A part Sonics airdrop is traded as an NFT on Paintswap exchange, which is a great NFT platform. If the airdrop "trading" goes smoothly, I think a portion of the airdrop money will go straight into BRUSH (Paintswap exchange token). The airdrop will create momentum and bring more traffic and new users to Paintswap.

My long term goal (as a Sonic bull) is to accumulate more Sonic. One way to do that could be to swap some Sonic -> BRUSH. I think a confirmed "break of trend" will be a good timing to swap a small amount of Sonic to BRUSH.

It looks timing wise that BRUSH breakout will happen at the same time as the airdrop.

If the swap S->BRUSH idea plays out it could give 60% more Sonic.

No financial advice

Sonic Moves Next · Expect Massive Growth Coming Weeks —300% EasyTwo pairs-projects will be moving strongly in the coming weeks, Sonic and Usual. This is the chart for SUSDT (Sonic) on the daily timeframe.

Notice how the action is moving back above the 3-February 2025 low (bullish). Notice the stop-loss hunt event recently. This events marks a bottom once it happens. After the event we see growth.

Finally, notice the very strong increase in trading volume. SUSDT is trading safely above EMA34. All these signals confirm strong growth in the coming weeks starting now basically, it is already happening as the action has been bullish since 22-June.

I am always giving you the best charts, the best timing in the Universe with the best results. I will continue to share daily but you need to follow. You can get notifications each time I publish and in this way you can be up to date with the Cryptocurrency market, the altcoins are moving ahead and this only happens once every four years. There are bullish waves in-between the bear market and transition years, but nothing like 2025.

The 300% on the chart is an easy target. This target can be achieved short-term maximum mid-term. Imagine the 100 years old index funds, it would take you 30 years to earn 300%. Oh my god! Leave that to your grandparents this is not for us.

My heart goes out to all the people still buying index funds related to the stock market. It is like using floppy disk still in the year 2025, we have USB sticks and smartphones, floppy disk were discontinued long ago. Buying SPX index funds and such stocks instead of Crypto is like buying CD-roms to store music, we streaming now not even MP3.

The future of finance is Crypto. Altcoins is the way to go. If you are already in this market you are ahead of the pack. You will look like a genius 10, 15, 20 years from now. For you and for me it is normal but actually, only the minority knows well enough the game. There is plenty of room left available for growth. Crypto is young.

Namaste.

GOGLZ - Sonic main meme coin, longGOGLZ - a risky memecoin for degens or a big opportunity for smart investors?

Every chain should have one king of memecoins. I think GOGLZ is Sonics chosen one.

Airdrop will soon land on Sonic users - the Sonic momentum will follow?

GOGLZ thin 4 million dollar market cap could be a lot more soon.

When GOGLZ pops its gonna run fast. I think it could be the right time to take a small before the opportunity is gone!

No financial advice - risky meme coin...and I'm a Sonic bull!

First target is a 70% move

Long Sonic (S) - before altcoin seasonSonic (S) - One of the strongest coins when it comes to fundandamentals.

Now listed on Coinbase. I expect more good news to come soon.

The risk reward now is incredible good for investors.

I think it is likely that we will see a bounce between 0.30-0.31 to set a higher low. that could be a killer entry before the altcoin season kicks off.

My idea is to buy and hold

I see 0.30 as a really good long term investment entry.

No financial advice.

The Altcoins Bull Market is Here: Sonic Enters New Uptrend"Everything can change in a day."

It is amazing just how fast everything can change. One day the market is bearish, it is the end; the next day everything is green and we are certain of a strong bullish wave. Watch-out, stay alert! Everything can change in a day.

Everything is already changing for the better and this is great. The greatest part of all is the fact that we are early, extremely early and us knowing that this bullish wave will be the biggest since 2021.

If you are reading this now you are blessed. You are very smart, you waited patiently or simply, you work within the Cryptocurrency space. The time is now. Take advantage of all the opportunities all around you because soon they will be gone. There will be growth long-term but bottom prices only last for a few days.

Technical analysis

SUSDT (Sonic) already produced a strong rounded bottom, high volume and ready to break the downtrend. The end of a downtrend leads to an uptrend; uptrend means long-term growth.

Thank you for reading.

Namaste.

LRC, LOOPRING, HOW MANY LOOPRINGS DO YOU THINK SONIC COULD EAT?Something is going on with this coin on the technical side.

There is literally no downside target that I can see right now, so I just labeled in MASSIVE SUPPORT TREND.

It looks like it is really close to making a move to the upside.

Somewhere around .8

Then it will likely hit some resistance there, but has a lot of potential to keep building support and climbing.

This coin looks incredibly bullish right now.

Things can change fast and if they do it will likely be a break of this trend (green).

The run up can take it to .45 and maybe a little higher, but the buy the dip price looks to be around .245. which would then take price higher to over 1 and beyond.

I'm gonna go with 3684 looprings for sonic.

What even is a loopring?

I'll attach more crypto TA to this idea.

oh and don't follow the guideline, pay more attention to the trends and price zones.

Sonic Reversal Play with a High R/R SetupPrice has dropped right back into the same demand zone that held everything together during the last major flush. I noticed we’re getting clear RSI divergence thus price is bleeding lower, but momentum isn’t following. That usually means to me that sellers are getting tired.

There’s also a large gap in the chart above it’s current base. If we reclaim even the low $0.40s, there’s room to rip to the upside. The liquidity supports the thesis of a 200%+ move straight into that inefficiency zone sitting just under $1.10.

Why this matters:

• RSI isn’t confirming the breakdown

• Strong historical support is holding (green box)

• That gap above hasn’t been revisited—yet

• The crowd is convinced it’s dead, which is usually when it wakes up

My levels:

• Entry: Here, while it’s still bleeding

• TP1: $0.50

• TP2: $0.90

• TP3: $1.10

• SL: Tight, just under $0.32

I’m not calling a moonshot. I’m just saying this chart is screaming for attention, and the reward looks too clean to ignore.

Long Trade set-up SUSDT:SonicUSDT: A clean bounce from the lower trendline of the ascending channel is showing strength! 📈

We’re seeing price reclaim the EMA support with strong structure holding.

🎯 Targets ahead:

• TP1: $0.6298

• TP2: $0.8147

🔒 SL below: $0.4718

Risk-managed and technically sound setup.

✅ Keep this one on your radar — or jump in if price retests near entry!

ALTS - Altcoins you MUST WATCH for ALTSEASON1) ONDO | BYBIT:ONDOUSDT

After some consistent higher lows, ONDO is likely on its way back towards it's previous ATH:

2) ATOM | BINANCE:ATOMUSDT

Cosmos is one of my favorites, and I'm patiently waiting for the parabolic run on this one:

3) SONIC | BYBIT:SONICUSDT

SONIC / previously FTM is trading nearly 290% away from its previous ATH, with great upside potential.

4) AAVE | BINANCE:AAVEUSDT

AAVE still has a bit to gain before reaching its previous ATH, and the parabolic run has actually already started:

5) ENA | BINANCE:ENAUSDT

IF ENA can hold it's current support, there's a huge upside awaiting this alt:

😊🧡 Please like and follow !!

TradeCityPro | S: Trendline Break Signals Key Support Retest👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the S coin—one of the Layer 1 coins for the Sonic network.

💥 This coin currently holds a market cap of $1.43 billion and ranks 58th on CoinMarketCap.

⏳ 1-Hour Timeframe

On the 4-hour chart, as you can see, there’s a large range box between the 0.3939 and 0.6147 levels where price has been moving sideways.

🔍 A key support zone also exists between 0.45 and 0.46, which has received strong bullish reactions, pushing the price upward toward the 0.6147 top via a trendline.

✔️ Currently, this trendline has been broken, and a new support level has formed at 0.4888, which has been tested several times.

✨ If this 0.4888 level breaks, a short position targeting the 0.45 zone and 0.3939 becomes viable.

📈 For a long position, the first trigger is the 0.5266 level. A breakout here would confirm support at 0.4888 and open the path toward the 0.6147 resistance.

🎲 The RSI oscillator is hovering near the 50 level. A sustained move above this could increase the likelihood of the bullish scenario playing out.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️