Weekly Momentum Analysis On Major Pairs (Wk34/2019)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume , Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slight Bearish

Gold & Silver: Bullish Still (Haha)

XXX/JPY: Mixed

Stock Indexes: Bearish

BitCoin: Bearish

Sonicrmastery

View On Ethereum ETH/USD (Bears still rule)View On ETH/USD (15 August 2019)

ETH is still under the downtrend. As long as it cannot break down below $221/$225, it can go lower toward $165 to $170 area.

DYODD, Our trade analysis may not suitable to intraday (or) short time frame trading.

Whatever method you use if you do not follow the proper rule of risk management, it will have detrimental effects on your account.

Feel Free to "Follow", press "LIKE" "Comment".

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Dow Jones Index (Short Term Bear)View On Dow Jones (13 Aug 2019)

The recent rebound seems to get weaken around the region of 26,400.

So we can bias 26,400 to 26,700 region a good resistant region.

Overall, we shall stand on sligh bearishness. and of course, watch your risk too.

The nearest decent support region is 25,675.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Weekly Momentum Analysis On Major Pairs (Wk33/2019)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume, Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Mixed (EU is bullish while GU is very bearish)

Gold & Silver: Very Bullish

XXX/JPY: Very Bearish

Stock Indexes: Bearish

BitCoin: Very Bullish

Week 33 (12 Aug 2019)

Gold XAU/USD (It is knocking on heavens door!)View On Gold XAU/USD (5 Aug 2019)

Did you follow our previous analysis?

We expected Gold shall be supported at $1,400 and resisted well at $1,450. It worked like a clockwork.

Is it luck?. Maybe not. We may use some tools that many traders do not know.

Anyway, Gold is in the strong UP tick momentum on early Monday and it is trying to break down the resistant of $1,450.

We can expect more upside as long as $1,420-$1,435 regions and $1,400 region support the price well.

I expect they can achieve it sooner or later and it should test $1,460 region pretty soon too.

Let's see and I will update again as the market continues to unfold.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

YZJ ShipBuilding ($1.40 is an immediate support region)View On YZJ Ship Building WTI Oil (22 May 2019)

Back Ground: YZJ is in the strong BEAR momentum since last late Apr. To me, it is more of reducing the excess fat rather than the full-blown sell down.

Now it is approaching a decent support region of $1.40 region. The next strong support region (region 2) is 1.20 to 1.30. I expect the price shall not go lower than the region 2.

Target(s): Late to short, early to long.

SHTF: NA

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

USD/MXN (Will the history repeat itself?)Updated View On USD/MXN (29 July 2019)

Will the history repeat itself on the potential upside?

It is very likely so. The previous analysis was a good one and it runs its course to the TP region.

Now it is 'range zone' again and likely to go up further.

It should go to 19.17, 19.30 again.

DYODD, Our trade analysis may not suitable to intraday (or) short time frame trading.

Whatever method you use if you do not follow the proper rule of risk management, it will have detrimental effects on your account.

Feel Free to "Follow", press "LIKE" "Comment".

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

EUR/USD (Minor Bullish Signs are showing up in D1 timeframe)View On EUR/USD (4 Aug 2019)

We are in the strong downtrend in weekly and higher timeframe on this pair but in D1 or lower TF, it is picking up.

As a typical swing move, it can swing up to 1.115 as retest.

So, if you want to follow the trend and go short, you can do so later. It is better for you to wait first at. 1.15 and 1.122 regions.

On another hand, if you have long positions, you can TP near 1.15 or 1.122 regions.

Let's see.

DYODD, Our trade analysis may not suitable to intraday (or) short time frame trading.

Whatever method you use if you do not follow the proper rule of risk management, it will have detrimental effects on your account.

Feel Free to "Follow", press "LIKE" "Comment".

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Weekly Momentum Analysis On Major Pairs (Wk32/2019)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume, Macro view nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Very Bearish

Gold & Silver: Mixed/Neutral

XXX/JPY: Very Bearish

Stock Indexes: Very Bearish

BitCoin: Slight Bullish

Week 32 (5 Aug 2019)

Gold XAU/USD ($1.4K is Support & $.145K is Resistant) View On Gold XAU/USD (27 July 2019)

We will be having the FED item in the coming week and it is very likely that a 25bps rate cute is a given.

There are 2 major regions that I want you to take note.

Support: I am expecting $1,395 to $1,400 region to act as very good support. We can't be firm on the major pullback until the previously mentioned support is broken strongly.

Resistant: I am expecting $1,425 to $1,430 region to act as a very good resistant. The gold price shall not pass the region easily. Upon the rate announcement, the price may make a quick swing up above $1,450 just to have a pullback down in the near term.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

AUD/CAD (Need more clues to go long)View On AUD/CAD (30 July 2019)

It is under the established downtrend and the PA is bearish as well.

The only thing is it is at the swing support level.

So it is considered it is late to short. But if you are entering any long position, you will need to be extremely careful as the trend is not on your side.

If there is any pullback UP, I expect 0.916 will be strong resistant/TP.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

GBP/USD (The Bear trend is taking a pause)View On GBP/USD (5 July 2019)

Background: We are on the strong DOWNtrend for the past weeks and now it is pausing for a while. We MAY (or may not) see some sort of pullback.

If the swing back happens, 1.269 area will be a strong resistant region.

Target(s): Neutral. 1.269 is good resistant region.

SHTF: NA

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Weekly Momentum Analysis On Major Pairs (Wk31/2019)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume , Macro nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Very Bearish

Gold & Silver: Mixed/Weak

XXX/JPY: Very Bearish

Stock Indexes: Mixed/Weak

BitCoin: Slight Bearish

Week 31 (27 July 2019)

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

EUR/JPY (Do you want to live dangerously?)View On EUR/JPY (22 July 2019)

Back Ground: The market was hitting hard on EURJPY since last May. So, the current main trend is DOWN still.

Things to See: It is on the BIG sideway swing mode since the last June and we are seeing potential signs of bottoming.

Target(s): UP 122.14 (TP1), 123.1 (TP2)

SHTF: $119.2 is the last support.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

WTI Crude Oil (A little early to go LONG)View On WTI Oil (23 July 2019)

As we warned in the previous analysis, it could not break past $60 level and it is in the phase of pull-back.

I expect $51-$53 regions shall act as a strong base to prevent the price from going lower and eventually the Oil price shall start to rise the near future.

Let's see.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

EUR/USD (Watch the 1.110 region closely)Updated View On EUR/USD (25 July 2019)

Today we will have a series of High impact EURO items/news. High volatility on euro pairs is expected.

It was in the deep pull back on the recent days but I expect 1.110 is going to support/defend very well.

It is too early to turn bullish but it is getting late to be bearish as well. It is going to be fun.

Let's see.

DYODD, Our trade analysis may not suitable to intraday (or) short time frame trading.

Whatever method you use if you do not follow the proper rule of risk management, it will have detrimental effects on your account.

Feel Free to "Follow", press "LIKE" "Comment".

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

German Stock Index DAX (A minor pullback is in the making)Updated View On German Index (22 July 2019)

DAX is in the "potentially minor" pull back at the moment.

I expect the following support levels can stop the price from going lower. They are 12,200 and 12,080 region.

So, if you want to buy in, be patient and wait for a good set up to appear.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

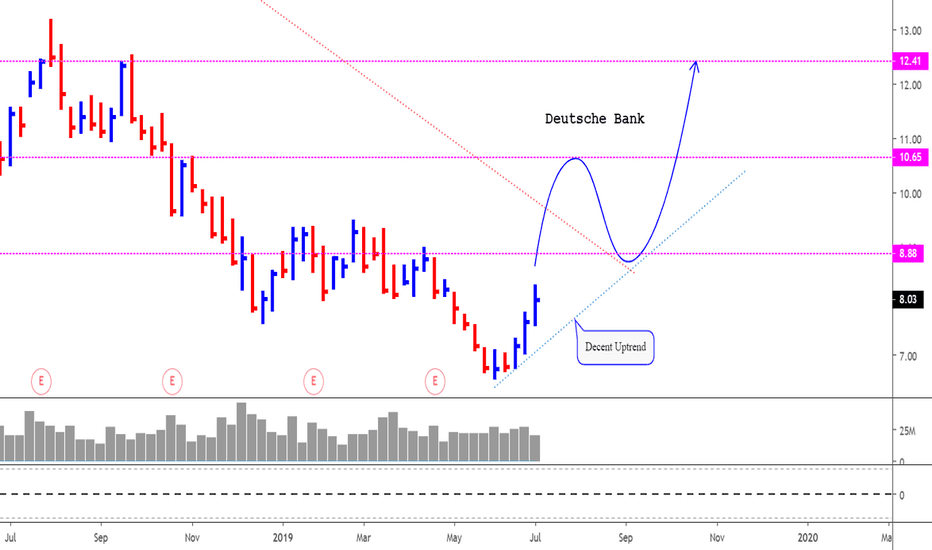

Deutsche Bank (DB) (The swing back UP is here to stay)View On Deutsche Bank (8 July 2019)

Apparently, the market seems to love the news of retrenchment.

Deutsche Bank (DB) is in the healthy midterm UPtrend for the recent weeks. I expect it will go to 8.88 regions easily soon.

So, it is better to stand on the LONG side now.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice.

We may (or) We may not take the trade. The risk of trading in securities markets can be substantial.

You should carefully consider if engaging in such activity is suitable to your own financial situation.

We, Sonicr Mastery dot com is not responsible for any liabilities arising from the result of your market involvement or individual trade activities.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Free Telegram FX/Stock analysis at your fingertip @ t.me/sonictraders

Follow our Trading View, @ bit.ly

Visit our Webby @ bit.ly

Like our FB @ bit.ly

Looking for a good broker? Go to cmc.mk

USD/CHF (Is the "Risk On" back?)View On USD/CHF (23 July 2019)

We have some bullish candles appeared in the past few days. Soon it has to break out from the DOWN trend (red dotted line) to show their seriousness on the bull side.

We are seeing some potential Bullishness in USD/CHF and It can go to 0.992 (TP1)/ 0.999 (TP2) region. All the best.

DYODD, Our trade analysis may not suitable to intraday (or) short time frame trading.

Whatever method you use if you do not follow the proper rule of risk management, it will have detrimental effects on your account.

Feel Free to "Follow", press "LIKE" "Comment".

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

AUD/USD (Watch that $0.695 to $0.7 region!)View On AUD/USD (24 July 2019)

First Thing First: It is in the retrace mood after hitting 0.708 resistant regions.

Back Ground: The PA is still very bearish and we may see some bull candle near 0.695 to 0.7 region.

Target(s): Neutral. If you want to long wait for a BULL candle to show up first.

SHTF: NA

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Gold XAU/USD (Aug 1st will be the Grand Finale)View On Gold XAU/USD (15 July 2019)

Gold had a nice BULL run in gold last June. It moved nearly +1,500 pips and it'd have burst a lot of stubborn traders' accounts with their short positions (You should be fine if you followed our previous analysis).

It reached up to $1,440 region in July and went into the sideways movement ever since.

Looking forward, I expect the "BIG RANGE BOUND" movement is here to stay.

It can go up higher but $1,425/$1,440/$1,450 regions will be the tough level to break up while $1,390/$1,381 will act as support regions too. So, get ready to take a profit once the above-mentioned levels are hit.

The whole market is expecting a rate cut on Aug 1st and the FED might have some tricks under its sleeve.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Weekly Momentum Analysis On Major Pairs (Wk30/2019)First Thing First: This analysis is for “general overview only” as it is solely based on price action. That’s why it is called momentum analysis in the first place. Support/Resistant, Volume, Macro nor any other factors are not used during write up. Refer to the individual pair analysis for a more comprehensive write up.

XXX/USD: Slight Bearish/Weak

Gold & Silver: Bullish

XXX/JPY: Mixed

Stock Indexes: Mixed

BitCoin: Very Bearish

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

GBP/CAD (Is the Short Covering rally about to take place?)View On GBP/CAD (16 July 2019)

Currently, We are in a prolonged established downtrend.

But the past few days the market seems to go into the sideway mode and it uses 1.63 as some sort of support.

Watch out 1.636 regions, if the price manages to break and stay above it, we may see some short covering rally. Let's see.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.