SPX - Are you catching the rotation trends? SPX is still holding very bullish price action. Technicals are pointing towards higher price and todays inside consolidation day certainly helps digest recent gains.

Along with the flat indices market session, we did observe some massive capital rotation trends.

Financials saw a pretty strong down move across the board. JPM / BAC / C all saw large outflows. We were positioned on the short side of financials and took profits on JPM puts.

Even with the big selloff in financials, SPX held up surprisingly well.

Capital simply rotated instead of outright leaving the market. Bullish Signal.

Technology, Energy, Materials, Health care, Transports all saw capital inflow trends.

Rotation into under preforming sectors is a sign that markets could be staging another healthy leg up.

We still have an upside target over 6300 on SPX.

SOXX

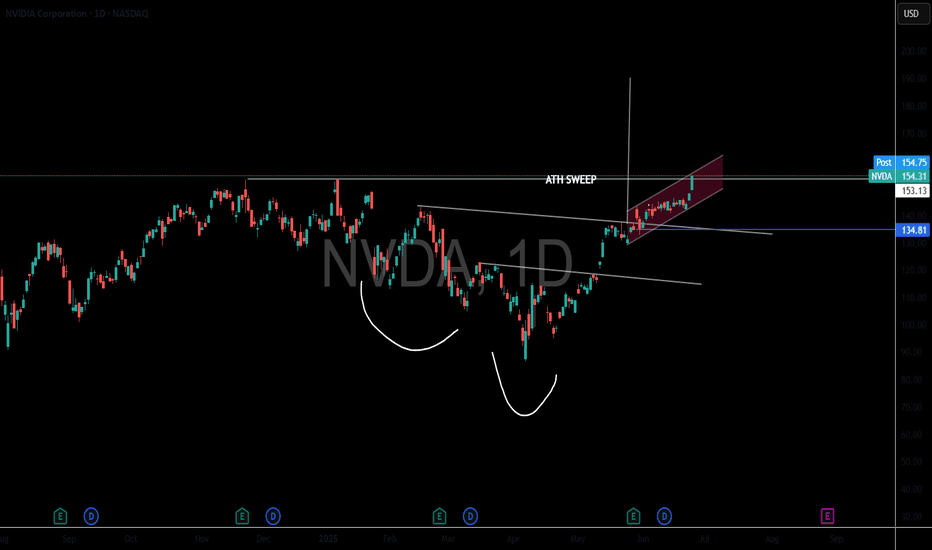

Nvidia & Nasdaq History - What you need to know!Record-high share price: NVDA hit a new all-time high as U.S. stock markets rallied and Wall Street analysts forecast continued upside

Nvidia is pushing towards the first ever $4 Trillion market cap.

Today it surpassed MSFT as the largest company in the world closing up over 4% on the session.

Micron earnings are adding extra fuel to the fire for semi conductors.

Short term picture for semis - they're very extended and need some consolidation.

Micron earnings: Revenue: $8.05 billion, up ~38% YoY, beating the ~$7.89 billion consensus

Data‑center revenue: Tripled YoY, powered by surging demand for high‑bandwidth memory (HBM)

HBM sales: Exceeded $1 billion, growing over 50% sequentially

Strong margin and revenue beat; robust cash flow (~$857 million free cash flow) with a solid balance sheet ($9.6 billion in liquidity)

OKTA - DAY TRADE IDEAOKTA is setting up for a day trade scalp long...perhaps an aggressive swing trade as well. The day trade is a much higher probability of success around the $98.50-$99.30

Okta's stock has seen some volatility recently. After a strong rally earlier this year, it pulled back following cautious guidance from the company. Despite beating expectations on sales and earnings for Q1 fiscal 2026, investors were concerned about slowing growth, leading to a 14.6% drop in its stock price.

Okta reported $688 million in revenue, a 12% year-over-year increase, and positive free cash flow of $238 million, but its GAAP earnings were significantly lower than its adjusted earnings. The company maintained its full-year revenue forecast of $2.85 billion to $2.86 billion, reflecting 9% to 10% growth, but analysts tempered their optimism due to macroeconomic uncertainties.

Technicals

- Multiyear Support

- 50 % Fib Retrace

- Upsloping Trendline

- Positive Divergence building on 1/ 4 hour chart.

SPX Bullish Patterns Emerging ahead of NVIDIA EarningsThe SP:SPX has taken out some major pivots and recaptured the ever so important daily 200 MA.

across multiple time frames some very interesting bullish patterns are emerging.

All eyes will be in NASDAQ:NVDA earnings tonight after the bell.

If NVIDIA beats and guides it will breakout of an epic bull flag pattern that will likely casue this market to trend to new All time highs.

Probabilities from a technical pattern standpoint are pointing towards higher price action.

We have already broken out and back tested key support levels and the buying is clearly being observed.

We remain net long with positions already in profit.

Bullish Semiconductors? SOXX The semiconductors NASDAQ:SOXX definitely tend to lead the market In bull rallies. I still think this saying will hold true for several years.

The NASDAQ:SOXX is flirting with some pretty decent resistance. This would be a perfect spot for sellers to exit and price action to digest recent gains.

If the chart plays out like I think it will, we should have a decent pullback in this area which could create an epic inverse head right shoulder. This pattern would be a very bullish setup that could take us into new All Time Highs in 2026.

This is a weekly pattern so allow the chart some tike to play out.

$INTC Nice Long Base – Ready to Breakout?NASDAQ:INTC oh how the mighty fall from grace. But so much for nostalgia. INTC has been basing since August 2024 for over 6 months. It looks like it has support around $19. It has tried to get moving a few times but no go.

Today it has tested both the longer term and shorter-term downtrend lines (DTL). It is testing today on the news that JD VANCE said AI will be built in the US. I have tried this name before and have been stopped out for a small loss. I have an alert set on the long term DTL. Should that trigger, I will want a convincing close above it. Looks to me, risk is well defined with a stop under $19. At current price that is about an 11% Stop Loss. Too much for me, so I would go to a lower timeframe to see if there is a better Risk Reward stop. All TBD.

I am only posting this because I like the longer base and thought you might want it on your watchlist as well.

This is my idea, if you like it, make it your own to fit “your” trading plan.

Oh no! SHORT TERM BEARISH- BACK TO 116 AT LEAST. $NVDA SELL NOW!A dead cat bounce refers to a temporary, short-lived recovery in the price of a falling stock. The term comes from the notion that even a dead cat will bounce if it falls from a great height. It is also commonly used to describe any situation where something experiences a brief comeback during or after a significant decline. This phenomenon is sometimes called a "sucker rally."

- Breakdown of the rising wedge pattern.

- SMA 20 & 50 are coming down

- Tariff wars with China and other countries

- Deepseek Shock/ Tech Shocks aka Al Black Monday on

- High inflation (Fed NOT "in a hurry" to push more rate cuts)

- Volume is decresing while price is increasing too fast.

- NASDAQ:SOXX shows weakness

Hopefully, NVDA holds at $116. Otherwise, it might gap down to fill at $95.

Advise selling now and purchasing again at a lower price.

$AMD GAP FILL 138 & 160A stock gap occurs when there's a significant jump in a stock's price after market closure, typically driven by some news. When this gap is filled, it indicates that the stock's price has reverted to its pre-gap, or "normal," level. This common occurrence happens as the price stabilizes after the initial rush of buying and trading sparked by the news subsides.

Exhaustion gaps are usually the most likely to be filled because they indicate the end of a price trend.

BUY NOW

According to 30 Wall Street analysts who provided 12-month price targets for Advanced Micro Devices over the past three months, the average price target is $182.18. The high forecast is $220.00, and the low forecast is $145.00. This average price target indicates a 46.14% change from the last price of $124.60 (as of 12/23/2024)

NASDAQ:AMD 's growing presence in the markets for central processing units (CPUs) and graphics processing units (GPUs) is poised to drive significant stock gains. We foresee a robust outlook for the semiconductor specialist's Epyc CPUs in the server and data center segment, as well as strong performance from the company's M1350 and M1400 GPUs.

+ NASDAQ:AMD net profit YoY grew by 777.88% which is 633.31% above its peer average

+ NASDAQ:AMD revenue has grown by 17.57% YoY from Q3 2023 to Q3 2024

+ NYSE:MD EPS is forecasted to grow by 41.26% YoY from Q4 2023 to Q4 2024

+ NASDAQ:AMD has a lower debt to equity ratio (3.02%) compared to its peer average (33.87%)

+ NASDAQ:AMD 's debt to equity ratio has reduced from 40.07% to 3.02% over the past 5 year

Is $AMD a massive buy opportunity for 2025?Is NASDAQ:AMD a massive buy opportunity for 2025?

AMD is doing great financially/fundamentally with chips that is 2nd to NVDA. In addition, their data center revenues are growing exponentially.

It is a probably a great buying opportunity here at $121 going into 2025.

Market near Top. SOXX is showing weakness.So first off, I am expecting a recession to begin in the next year.

I know, people have been saying this for years and I've been laughing at them for years. So many idiots thought that a recession begins once the yield curve inverts lol.

Well there's several things I've been watching for a recession: new home sales, unemployment claims, leading economic index (LEI), etc.

One of the last signs before a recession, believe it or not, is the SPX making a new high.

And we finally got NFP under +50k.

I don't think SPX will go much higher than 6100. And if you look at SOXX, an index of semiconductor stocks, it is actually below the 200-day simple moving average (sma). This seems to have escaped a lot of people's attention. I am watching to see if it breaks below October's low of 216.56.

Is NVDA the catalyst for the market?NVDA just had a bearish crossover of the 20 & 50 MA (Daily chart)

Last time we saw this bearish moving average formation was in early August.

NVDA proceeded to fall sharply in the coming days.

All eyes on the market leader. All eyes on the QQQ.

Will the Q’s be the demise of SPY?

If Nvidia sees anymore weakness you can be sure it will have other semis following suit.

Risk to reward in the near term is clear.

Is SMCI a buy? SMCI has lagged NVDA and many other semis.

Were now approaching a critical area...its make or break!

positive Daily divergence provides some hopes that were close to a near term bounce however after today semiconductor selloff the whole complex was shattered.

The fact that SMCI remained green while NVDA was down 10% should be a small win in itself...

The question is can it hold and build on this?

I do think its better positioned for a long than most semis.

No confirmed technical breakdown has occurred yet

Short NVDA for a little +33%...This trade is purely psychological revenge...

Long AAPL and TSLA, short NVDA haha

NVIDIA's (NVDA) Stock Expected to Plummet to $82 Post Q2 Earnings

1. Overestimated AI Chip Demand

2. Data Center Growth Slowing Down

3. Vulnerabilities in the Gaming Sector

5. Product Innovation Fatigue

6. Supply Chain Vulnerabilities

Intel Corporation (INTC) Stock: A Investment Opportunity ?Intel Corporation's recent earnings report has raised some concerns, but there are several reasons to remain optimistic about INTC stock.

Despite a challenging Q2, Intel is strategically shifting production to its high-volume plant in Ireland, positioning itself for long-term gains.

The company's focus on cutting-edge chip manufacturing and AI advancements highlights its commitment to innovation.

Moreover, Intel's diverse portfolio, including the promising Gaudi AI products, provides a solid foundation for future growth.

With strategic cost-cutting measures and a strong financial position, Intel is poised to rebound and deliver value to its investors.

TSLA / NVIDIA / INTC - The rotation trade?TSLA has been upderperfing the market, but is now showing some signs of potential life since Elon musks pay package was approved.

A bullish breakout pattern is on watch.

NASDAQ:INTC looks ready for a bullish move. Just like NASDAQ:ADBE & NASDAQ:TSLA popped on earnings, it looks like NASDAQ:INTC could be the next oversold S&P500 stock to bounce.

If we see any weakness in NASDAQ:NVDA we may see capital rotate into other cheaper semis.

S&P500 setting nee ATH.

SMCI Critical level IncomingSMCI saw a nasty down move today with the market.

Semiconductors led the downside move today.

It seems massive amount of capital rotated out of the market today.

This low float volume stock can unwind in a sharp way if this support is breached.

Remember dip buyers will likely start to accumulate as semis are coming from All time high bull market.

Everyone is watching the potential head & shoulder pattern that could trigger with more weakness.