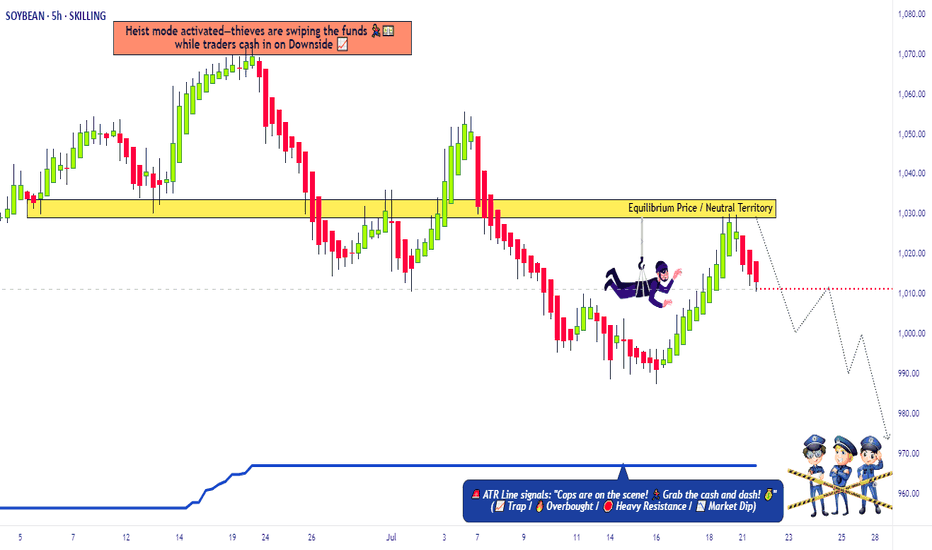

SoyBeans Price Reversal – Time to Swipe Bearish Profits🔓 Operation SoyBeans: Vault Breach Underway! 💼🌾

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Calling All Market Bandits, Scalping Buccaneers & Swinging Looters 🕵️♂️💰💣

We've marked our next robbery target—the "SoyBeans" Commodities CFD Market.

This isn’t just a trade, it’s an orchestrated heist built off Thief Trading intelligence: a mix of technical traps, fundamental cues, and criminal market psychology. 🧠💸

🔎 🎯 Entry Point - Where the Safe Cracks Open:

The vault is wide open—grab bearish loot at any price!

But for maximum stealth, layer in buy limit orders on the pullback using the 15m or 30m timeframe near swing highs/lows.

(We thieves call this: DCA under the radar.) 🕳️📉

🛡️ 🚨Stop Loss - Our Escape Hatch:

Set SL at the nearest 4H candle wick swing high (1040.00).

Customize it based on your loot size (lot size), order count, & risk appetite.

A smart thief knows when to vanish! 🏃♂️💨

🏁 💰Target - The Vault Cash-Out Point:

Main Heist Target: 970.00

Or exit early if the cops (volatility) show up! 🚔🎯

💡 Scalper’s Note - Quick Grab & Dash:

If you’ve got a heavy bag 💼💸, scalp short aggressively.

If not, roll with the swing crew—use trailing SLs to lock the loot and flee clean. 💨📦

📉 Thief Insight – Why We're Robbing This Vault:

"SoyBeans" showing bearish breakdowns due to:

📰 COT Positioning

📦 Inventory & Storage Data

🕰️ Seasonal Weakness

💭 Sentiment Drift

🔗 Intermarket Signals

Get the full scoop—go dig deeper into your own thief intelligence sources. 📚🕵️♂️

⚠️ Stay Alert – Market Mayhem Incoming!

News drops = surveillance upgrades. Avoid new trades during major releases.

Protect running loot with tight trailing SLs—guard your stolen goods! 🛑🗞️📉

❤️🔥 Show Some Love to the Robbery Crew!

💥Smash that BOOST button💥 to fuel the Thief Army.

Together, we rob smarter. 💰🚀

🔔 Stay Tuned, Looters:

Another heist is being planned. Don't miss the next setup.

Money is out there… we just have to take it the thief way. 🧠💎

📜 Disclaimer:

This plan is for chart criminals in training 📉🕵️♂️ – not personalized financial advice.

Always assess your own risks before raiding any market vault.

SOYBEANS

Soybean Breakout – Time to Steal Profits!🚨 "SOYBEAN HEIST ALERT: Bullish Loot Ahead! 🎯💰 (Thief Trading Strategy)"

🌟 Greetings, Market Pirates & Profit Raiders! 🌟

"The vault is unlocked—time to plunder the 🌱🍃SOYBEAN CFD market! Here’s your master plan for a smooth heist."

🔎 TRADE SETUP (Thief Edition)

Entry 📈: "Buy the dip or chase the breakout—bullish momentum is ripe for stealing!"

Pro Tip: Use buy limits near 15-30min pullbacks (swing lows/highs) for optimal theft.

Stop Loss 🛑: "Hide your loot!" Set SL at nearest 4H swing low (1030.00). Adjust based on your risk appetite.

Target 🎯: 1085.0 — or escape early if bears ambush!

⚡ SCALPERS’ NOTE:

"Only long scalps allowed! Rich? Raid now. Poor? Join swing thieves & trail your SL!"

🔥 WHY SOYBEAN? (Bullish Catalysts)

Technicals + fundamentals align for a bullish heist.

Check: COT reports, seasonals, macro trends, and intermarket signals (links below 👇).

⚠️ WARNING: NEWS = VOLATILITY

Avoid new trades during major news.

Trailing SLs = your escape rope! Lock profits before the cops (bears) arrive.

💎 BOOST THIS HEIST!

"Smash 👍 LIKE, hit 🔔 FOLLOW, and share the loot! Your support fuels our next raid."

🎯 Final Tip: "Profit is yours—take it and vanish! 🏴☠️"

📢 Stay tuned for the next heist! "Market thieves never sleep…" 😉

Stealing from bears: soybean long setup!🚨 THE GREAT SOYBEAN HEIST: Bullish Raid Plan (Swing/Day Trade) 🏴☠️💸

🌟 ATTENTION, MARKET BANDITS & MONEY SNATCHERS! 🌟

(Hola! Oi! Bonjour! Salaam! Guten Tag!)

🔥 Using the ruthless Thief Trading Strategy (TA + FA), we’re executing a bullish raid on the SOYBEAN Commodities CFD Market! Time to steal profits from the bears before they wake up! 🥷💨

🎯 MASTER HEIST PLAN (BULLISH RAID)

📈 Entry Point (Buy Limit/Market):

"The vault is unlocked—grab the bullish loot at any price!"

🔹 *For precision heists, set buy limits near pullbacks (15M/30M).*

🔹 ALERT: Set price alerts to catch the perfect steal!

🛑 Stop Loss (Escape Route):

📌 Thief SL at nearest swing low (3H timeframe) – 1030.0

📌 Adjust SL based on your risk tolerance & position size.

🎯 Profit Target (Escape Before Bears Strike Back):

💥 1095.0 (or exit early if the trap snaps shut!)

🧲 Scalper’s Bonus:

Only scalp LONG!

Big wallets? Go all-in! Small wallets? Swing-trade the robbery!

Use trailing SL to lock profits and escape clean!

🌱 MARKET TREND: BULLISH (BEAR TRAP SET!)

Overbought? Maybe. But the real trap is where bearish robbers get slaughtered.

High risk = High reward—only for cold-blooded traders!

📡 FUNDAMENTAL INTEL (DON’T SKIP THIS!)

🔗 Full reports (COT, Macro, Seasonals, Sentiment, Intermarket Analysis) in our biio!

🚨 TRADING ALERT: NEWS = DANGER ZONE!

❌ Avoid new trades during news!

🔐 Use trailing stops to lock profits & escape alive!

💥 BOOST THIS HEIST! (HELP US ROB THE MARKET!)

🔥 Hit LIKE & FOLLOW to strengthen our robbery squad!

💰 More heists = More profits. Stay tuned for the next raid!

🐱👤 See you in the shadows, bandits! 🤑🚀

"SOYBEANS" Commodities CFD Market Bearish Heist (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🥔🍀🍃SOYBEAN🍃🥔🍀 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 1D timeframe (980.0) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1100.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🍀🍃SOYBEAN🍃🍀 Commodities CFD Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"SOYBEAN" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🥔🍀🍃SOYBEAN🍃🥔🍀 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 30mins timeframe (1015) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 1060 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join Day traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🥔🍀🍃"SOYBEAN"🍃🥔🍀Commodities CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.☝☝☝

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets and Overall outlook score..., go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"SoyBeans" Commodities CFD Market Robbery Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SoyBeans" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (975.0) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (1015.0) Swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 935.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🥔🍀🍃"SoyBeans" Commodities CFD Market Heist Plan is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"SOYBEAN" Commodities Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "SOYBEAN" Commodities Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (1045.00) then make your move - Bullish profits await!"

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (1020.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 1083.00 (or) Escape Before the Target

Final Target - 1130.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🌾"SOYBEAN" Commodities Market is currently experiencing a bullish trend,., driven by several key factors.

Market Overview

Current Price: 1036.00

30-Day High: 1080.00

30-Day Low: 980.00

30-Day Average: 1000.00

Previous Close Price: 1020.00

Change: 16.00

Percent Change: 1.57%

🍀Fundamental Analysis

Supply and Demand: Global soybean demand is expected to increase, driven by growing demand for soybean oil and meal.

Weather Trends: Weather conditions in major soybean-producing countries are expected to be favorable, potentially leading to increased production.

Inventory Levels: Global soybean inventory levels are expected to decrease, driven by growing demand and limited supply.

Trade Trends: Global soybean trade is expected to increase, driven by growing demand for soybean products.

🍀Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for soybeans, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for soybeans as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for soybeans.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

🍀COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 60%

Open Interest: 150,000 contracts

Commercial Traders (Companies):

Net Short Positions: 30%

Open Interest: 80,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 20,000 contracts

COT Ratio: 2.0 (indicating a bullish trend)

🍀Sentimental Outlook

Institutional Sentiment: 65% bullish, 35% bearish

Retail Sentiment: 60% bullish, 40% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +50.

🍀Next Move Prediction

Bullish Move: Potential upside to 1120.00-1150.00.

Target: 1150.00 (primary target), 1200.00 (secondary target)

Next Swing Target: 1250.00 (potential swing high)

Stop Loss: 980.00 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 114.00 vs potential loss of 57.00)

🍀Overall Outlook

The overall outlook for SOYBEAN is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global soybean demand, favorable weather trends, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected weather events.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

SOYBEAN CFD Commodity Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the SOYBEAN CFD Commodity market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated on the MA level breakout of 1050.00.

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Target 🎯: 1130.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Fundamental Outlook 📰🗞️

The SOYBEAN CFD is expected to move in a bullish direction.

REASONS FOR BULLISH TREND:

Weather Conditions: The weather conditions in the US and Brazil, the two largest soybean-producing countries, are expected to be favorable for soybean production. This will lead to a potential increase in supply, which will put upward pressure on prices.

Demand from China: China, the largest importer of soybeans, is expected to increase its imports of soybeans due to a shortage of domestic supply. This will lead to an increase in demand for soybeans, which will drive up prices.

US-China Trade Deal: The US and China have signed a trade deal, which includes an agreement to increase Chinese purchases of US agricultural products, including soybeans. This will lead to an increase in demand for soybeans, which will drive up prices.

Low Inventory Levels: The inventory levels of soybeans in the US are currently low, which will lead to an increase in prices as demand increases. When inventory levels are low, suppliers are less likely to offer discounts, and buyers are more likely to pay a premium to secure supplies.

Strong Export Demand: The export demand for soybeans is expected to remain strong, driven by demand from countries such as China, Mexico, and Japan. This will lead to an increase in demand for soybeans, which will drive up prices.

Production Costs: The production costs for soybeans are expected to increase due to higher costs for inputs such as seeds, fertilizers, and pesticides. This will lead to an increase in the cost of production, which will be passed on to consumers in the form of higher prices.

Government Policies: The US government has implemented policies to support soybean farmers, such as subsidies and tariffs. These policies will help to increase the profitability of soybean farming, which will lead to an increase in production and higher prices.

Market Sentiment: The market sentiment for soybeans is currently bullish, with many traders and investors expecting prices to rise. This will lead to an increase in demand for soybeans, which will drive up prices.

Technical Analysis: The technical analysis for soybeans is currently bullish, with the price trading above its 50-day and 200-day moving averages. This indicates that the trend is upward, and prices are likely to continue to rise.

Seasonal Trends: The seasonal trends for soybeans are currently bullish, with prices typically rising during the summer months due to strong demand from countries such as China and Mexico.

These fundamental points suggest that the SOYBEAN CFD is likely to move in a bullish direction, with prices expected to rise due to strong demand, low inventory levels, and favorable weather conditions.

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

SOYBEAN CFD Market Money Heist Plan on Bullish SideHallo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist SOYBEAN CFD Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low Point.

Stop Loss 🛑 : Recent Swing Low using 2h timeframe.

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

Soy Bean Cash CFD Bullish Side Money Heist PlanHola ola Robbers / Money Makers & Losers,

This is our master plan to Heist SOY BEAN Cash CFD Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 2h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

SOYBN/USD and NZD/CHF on watch for me today.SOYBN/USD:

• If price pushes up above our upper rayline, it does so impulsively a subsequent tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

NZD/CHF:

• If price impulses down below our rayline, it does so in a convincing manner and a subsequent tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD and EUR/GBP on watch for me today.SOYBN/USD:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/GBP:

• If price pushes up above our rayline, it does so impulsively a subsequent tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/GBP, USD/JPY, EUR/NZD and SOYBN/USD on watch for me today.EUR/GBP:

• If price pushes down to and ideally just below our lower rayline and it does so correctively, then I'll be looking to get long with a risk entry either after a phase line break, or just above a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/JPY:

• If price pushes down below the upper ascending trend line of our most recent piece of structure, it does so impulsively a subsequent tight flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/NZD:

• If price impulses up above our most recent high, it does so in a convincing manner and a tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD and EUR/USD on watch for me today.Good morning all,

so September really was pretty devoid of many decent trading opportunities where how I trade is concerned, but once again I ended the month in profit and that's largely because I value my capital and the longevity of my trading career too much to be jumping into average trades when the market doesn't provide anything which I know from my testing gives me a clear edge over the market. Yes, the market always makes opportunities available. In fact almost every morning I spot opportunities which might play out, but not ones (to reiterate the point) which give me a clear edge over the market and the latter is all I'm interested in. Basically if I have to think for more than a couple of seconds about whether a setup gives me my "edge" or not, meaning that the investment opportunity hasn't "smacked me in the face" then I simply move on to the next pair and I look for my edge there.

Remember! Success is not found in trading every opportunity you can find, most of the people who blow trading accounts are doing that. It's found in showing up, waiting patiently until a setup which meets your plan materialises and then simply executing accordingly and this is something that I intend to do until the end of time.

With the above in mind listed below is what I'll be looking for from the market this morning as always for your viewing, tonight I'll be selecting my 'Top 6' pairs and my 'Wildcards' for next week, tomorrow morning I'll be creating my Monday Forecast and then on Monday as always I will bring you that forecast.

Have a great day and a great weekend!

SOYBN/USD:

• If price pushes up, it does so impulsively a subsequent tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/USD:

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure and the last part of the move is corrective, then I'll be looking to get long with a risk entry either after a phase line break, or just above a one hour or a fifteen minute rejection from it.

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure and it does so impulsively, then I'll be waiting for a convincing impulse back up followed by a tight flag and then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD and EUR/USD on watch for me today.Good morning all,

so September really was pretty devoid of many decent trading opportunities where how I trade is concerned, but once again I ended the month in profit and that's largely because I value my capital and the longevity of my trading career too much to be jumping into average trades when the market doesn't provide anything which I know from my testing gives me a clear edge over the market. Yes, the market always makes opportunities available. In fact almost every morning I spot opportunities which might play out, but not ones (to reiterate the point) which give me a clear edge over the market and the latter is all I'm interested in. Basically if I have to think for more than a couple of seconds about whether a setup gives me my "edge" or not, meaning that the investment opportunity hasn't "smacked me in the face" then I simply move on to the next pair and I look for my edge there.

Remember! Success is not found in trading every opportunity you can find, most of the people who blow trading accounts are doing that. It's found in showing up, waiting patiently until a setup which meets your plan materialises and then simply executing accordingly and this is something that I intend to do until the end of time.

With the above in mind listed below is what I'll be looking for from the market this morning as always for your viewing, tonight I'll be selecting my 'Top 6' pairs and my 'Wildcards' for next week, tomorrow morning I'll be creating my Monday Forecast and then on Monday as always I will bring you that forecast.

Have a great day and a great weekend!

SOYBN/USD:

• If price pushes up, it does so impulsively a subsequent tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/USD:

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure and the last part of the move is corrective, then I'll be looking to get long with a risk entry either after a phase line break, or just above a one hour or a fifteen minute rejection from it.

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure and it does so impulsively, then I'll be waiting for a convincing impulse back up followed by a tight flag and then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/SGD and USD/CHF on watch for me today.Good morning all,

I hope you're doing well.

So yesterday I was eyeing up a risk entry within the tight flag that had formed on USD/CHF with the view of riding the bearish momentum to the downside which I believed would likely come into the market now that we'd potentially filled all of the buy and sell orders which were inflating the mid-price up, in part because an amendment that I made to my trading plan recently based on the testing that I've done is to try and avoid taking reduced risk entries on the break of tight flags when the lower trend line (if I'm looking to get short is sloping downwards) has a notable descending gradient to it. So I was sat with my deal ticket filled in, about to pull the trigger but the momentum came is so quickly that I didn't get chance to place my order. Had I been able to do so then I would have likely been running at around +2.75% profit for much of yesterday with just over +1% of it locked in. But I'm running a business and self-discipline is far more important to me than not missing out, as indiscipline is largely why many traders blow their trading accounts. So I was happy to stick to my plan and let this investment opportunity go without me, safe in the knowledge that trades are often like buses.

Sure enough, a little while later the investment opportunity which I was looking for from NZD/USD which I posted yesterday also presented itself and this time I was able to catch the risk entry that I was looking for from the top of the larger flag which had formed and once again, once the orders had been filled at the top of this flag the momentum to the downside kicked in almost immediately as I'd anticipated it might. However swap hours then came and with my stop loss now at break even I had to make a judgement call on whether to temporally put my 1% risk back on the table until the spread which can get pretty wild on NZD pairs had calmed down, which I was happy to do based on what the DXY, other NZD pairs and what other correlated pairs were showing me and once the Asian Session had started and the spread had calmed down I moved my stop loss back to break even. However during the early hours of this morning I was alas wicked out of my position to the pip, but looking at how price is moving it would appear that we're likely moving back up to the top of our lower time frame structure to form an even larger larger flag which I'll be considering getting short on once again most likely tomorrow.

So that's a break even trade on NZD/USD for me which Im very happy with which I'll finish documenting and journaling tomorrow and below as always is what I'll be looking for from the market today.

Have a great day!

SOYBN/USD:

• If price corrects and a tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/SGD:

• If price pushes down to and ideally just below our upper rayline and the last part of the move is corrective, then I'll be looking to get long with a risk entry either after a phase line break, or just above a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/SGD and USD/CHF on watch for me today.Good morning all,

I hope you're doing well.

So yesterday I was eyeing up a risk entry within the tight flag that had formed on USD/CHF with the view of riding the bearish momentum to the downside which I believed would likely come into the market now that we'd potentially filled all of the buy and sell orders which were inflating the mid-price up, in part because an amendment that I made to my trading plan recently based on the testing that I've done is to try and avoid taking reduced risk entries on the break of tight flags when the lower trend line (if I'm looking to get short is sloping downwards) has a notable descending gradient to it. So I was sat with my deal ticket filled in, about to pull the trigger but the momentum came is so quickly that I didn't get chance to place my order. Had I been able to do so then I would have likely been running at around +2.75% profit for much of yesterday with just over +1% of it locked in. But I'm running a business and self-discipline is far more important to me than not missing out, as indiscipline is largely why many traders blow their trading accounts. So I was happy to stick to my plan and let this investment opportunity go without me, safe in the knowledge that trades are often like buses.

Sure enough, a little while later the investment opportunity which I was looking for from NZD/USD which I posted yesterday also presented itself and this time I was able to catch the risk entry that I was looking for from the top of the larger flag which had formed and once again, once the orders had been filled at the top of this flag the momentum to the downside kicked in almost immediately as I'd anticipated it might. However swap hours then came and with my stop loss now at break even I had to make a judgement call on whether to temporally put my 1% risk back on the table until the spread which can get pretty wild on NZD pairs had calmed down, which I was happy to do based on what the DXY, other NZD pairs and what other correlated pairs were showing me and once the Asian Session had started and the spread had calmed down I moved my stop loss back to break even. However during the early hours of this morning I was alas wicked out of my position to the pip, but looking at how price is moving it would appear that we're likely moving back up to the top of our lower time frame structure to form an even larger larger flag which I'll be considering getting short on once again most likely tomorrow.

So that's a break even trade on NZD/USD for me which Im very happy with which I'll finish documenting and journaling tomorrow and below as always is what I'll be looking for from the market today.

Have a great day!

SOYBN/USD:

• If price corrects and a tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/SGD:

• If price pushes down to and ideally just below our upper rayline and the last part of the move is corrective, then I'll be looking to get long with a risk entry either after a phase line break, or just above a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/SGD and USD/CHF on watch for me today.Good morning all,

I hope you're doing well.

So yesterday I was eyeing up a risk entry within the tight flag that had formed on USD/CHF with the view of riding the bearish momentum to the downside which I believed would likely come into the market now that we'd potentially filled all of the buy and sell orders which were inflating the mid-price up, in part because an amendment that I made to my trading plan recently based on the testing that I've done is to try and avoid taking reduced risk entries on the break of tight flags when the lower trend line (if I'm looking to get short is sloping downwards) has a notable descending gradient to it. So I was sat with my deal ticket filled in, about to pull the trigger but the momentum came is so quickly that I didn't get chance to place my order. Had I been able to do so then I would have likely been running at around +2.75% profit for much of yesterday with just over +1% of it locked in. But I'm running a business and self-discipline is far more important to me than not missing out, as indiscipline is largely why many traders blow their trading accounts. So I was happy to stick to my plan and let this investment opportunity go without me, safe in the knowledge that trades are often like buses.

Sure enough, a little while later the investment opportunity which I was looking for from NZD/USD which I posted yesterday also presented itself and this time I was able to catch the risk entry that I was looking for from the top of the larger flag which had formed and once again, once the orders had been filled at the top of this flag the momentum to the downside kicked in almost immediately as I'd anticipated it might. However swap hours then came and with my stop loss now at break even I had to make a judgement call on whether to temporally put my 1% risk back on the table until the spread which can get pretty wild on NZD pairs had calmed down, which I was happy to do based on what the DXY, other NZD pairs and what other correlated pairs were showing me and once the Asian Session had started and the spread had calmed down I moved my stop loss back to break even. However during the early hours of this morning I was alas wicked out of my position to the pip, but looking at how price is moving it would appear that we're likely moving back up to the top of our lower time frame structure to form an even larger larger flag which I'll be considering getting short on once again most likely tomorrow.

So that's a break even trade on NZD/USD for me which Im very happy with which I'll finish documenting and journaling tomorrow and below as always is what I'll be looking for from the market today.

Have a great day!

SOYBN/USD:

• If price corrects and a tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/SGD:

• If price pushes down to and ideally just below our upper rayline and the last part of the move is corrective, then I'll be looking to get long with a risk entry either after a phase line break, or just above a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/SGD and USD/CHF on watch for me today.Good morning all,

I hope you're doing well.

So yesterday I was eyeing up a risk entry within the tight flag that had formed on USD/CHF with the view of riding the bearish momentum to the downside which I believed would likely come into the market now that we'd potentially filled all of the buy and sell orders which were inflating the mid-price up, in part because an amendment that I made to my trading plan recently based on the testing that I've done is to try and avoid taking reduced risk entries on the break of tight flags when the lower trend line (if I'm looking to get short is sloping downwards) has a notable descending gradient to it. So I was sat with my deal ticket filled in, about to pull the trigger but the momentum came is so quickly that I didn't get chance to place my order. Had I been able to do so then I would have likely been running at around +2.75% profit for much of yesterday with just over +1% of it locked in. But I'm running a business and self-discipline is far more important to me than not missing out, as indiscipline is largely why many traders blow their trading accounts. So I was happy to stick to my plan and let this investment opportunity go without me, safe in the knowledge that trades are often like buses.

Sure enough, a little while later the investment opportunity which I was looking for from NZD/USD which I posted yesterday also presented itself and this time I was able to catch the risk entry that I was looking for from the top of the larger flag which had formed and once again, once the orders had been filled at the top of this flag the momentum to the downside kicked in almost immediately as I'd anticipated it might. However swap hours then came and with my stop loss now at break even I had to make a judgement call on whether to temporally put my 1% risk back on the table until the spread which can get pretty wild on NZD pairs had calmed down, which I was happy to do based on what the DXY, other NZD pairs and what other correlated pairs were showing me and once the Asian Session had started and the spread had calmed down I moved my stop loss back to break even. However during the early hours of this morning I was alas wicked out of my position to the pip, but looking at how price is moving it would appear that we're likely moving back up to the top of our lower time frame structure to form an even larger larger flag which I'll be considering getting short on once again most likely tomorrow.

So that's a break even trade on NZD/USD for me which Im very happy with which I'll finish documenting and journaling tomorrow and below as always is what I'll be looking for from the market today.

Have a great day!

SOYBN/USD:

• If price corrects and a tight one hour flag forms, then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/SGD:

• If price pushes down to and ideally just below our upper rayline and the last part of the move is corrective, then I'll be looking to get long with a risk entry either after a phase line break, or just above a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/CHF, NZD/USD and EUR/AUD on watch for me today.Good morning all,

I hope you're well.

Experience has taught me not to fret when the market doesn't look great at least in terms of how I trade, because when some pairs do shape up the whole Forex market tends to shape up across the board and so it appears to be doing again at the moment. To the extent that I actually found it difficult to leave one or two pairs out of my Tuesday Forecast last night whilst I was creating it and difficult to decide which pair to swap to USD/SGD for this morning after I decided to remove this pair for my forecast due to how it had moved during the Asian Session and that's one of the many reasons why I always say that patience is one of the keys to trading.

With the above in mind I have four pairs on watch today for the first time in a little while and my entry requirements I've included for your viewing as per usual.

Have a great day!

SOYBN/USD:

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure, then regardless of how it does so I'll be waiting for a convincing impulse back up followed by a tight one hour flag and then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If price simply impulses up above our lower rayline, it does so impulsively and in a convincing manner and a subsequent tight one hour flag forms, then I'll again be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

NZD/USD:

• If price pushes up to and ideally just above our lower rayline and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/AUD:

• If price pushes up to and ideally just above the upper trend line of our most recent piece of structure and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/CHF, NZD/USD and EUR/AUD on watch for me today.Good morning all,

I hope you're well.

Experience has taught me not to fret when the market doesn't look great at least in terms of how I trade, because when some pairs do shape up the whole Forex market tends to shape up across the board and so it appears to be doing again at the moment. To the extent that I actually found it difficult to leave one or two pairs out of my Tuesday Forecast last night whilst I was creating it and difficult to decide which pair to swap to USD/SGD for this morning after I decided to remove this pair for my forecast due to how it had moved during the Asian Session and that's one of the many reasons why I always say that patience is one of the keys to trading.

With the above in mind I have four pairs on watch today for the first time in a little while and my entry requirements I've included for your viewing as per usual.

Have a great day!

SOYBN/USD:

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure, then regardless of how it does so I'll be waiting for a convincing impulse back up followed by a tight one hour flag and then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If price simply impulses up above our lower rayline, it does so impulsively and in a convincing manner and a subsequent tight one hour flag forms, then I'll again be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

NZD/USD:

• If price pushes up to and ideally just above our lower rayline and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/AUD:

• If price pushes up to and ideally just above the upper trend line of our most recent piece of structure and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/CHF, NZD/USD and EUR/AUD on watch for me today.Good morning all,

I hope you're well.

Experience has taught me not to fret when the market doesn't look great at least in terms of how I trade, because when some pairs do shape up the whole Forex market tends to shape up across the board and so it appears to be doing again at the moment. To the extent that I actually found it difficult to leave one or two pairs out of my Tuesday Forecast last night whilst I was creating it and difficult to decide which pair to swap to USD/SGD for this morning after I decided to remove this pair for my forecast due to how it had moved during the Asian Session and that's one of the many reasons why I always say that patience is one of the keys to trading.

With the above in mind I have four pairs on watch today for the first time in a little while and my entry requirements I've included for your viewing as per usual.

Have a great day!

SOYBN/USD:

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure, then regardless of how it does so I'll be waiting for a convincing impulse back up followed by a tight one hour flag and then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If price simply impulses up above our lower rayline, it does so impulsively and in a convincing manner and a subsequent tight one hour flag forms, then I'll again be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

NZD/USD:

• If price pushes up to and ideally just above our lower rayline and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/AUD:

• If price pushes up to and ideally just above the upper trend line of our most recent piece of structure and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

SOYBN/USD, USD/CHF, NZD/USD and EUR/AUD on watch for me today.Good morning all,

I hope you're well.

Experience has taught me not to fret when the market doesn't look great at least in terms of how I trade, because when some pairs do shape up the whole Forex market tends to shape up across the board and so it appears to be doing again at the moment. To the extent that I actually found it difficult to leave one or two pairs out of my Tuesday Forecast last night whilst I was creating it and difficult to decide which pair to swap to USD/SGD for this morning after I decided to remove this pair for my forecast due to how it had moved during the Asian Session and that's one of the many reasons why I always say that patience is one of the keys to trading.

With the above in mind I have four pairs on watch today for the first time in a little while and my entry requirements I've included for your viewing as per usual.

Have a great day!

SOYBN/USD:

• If price pushes down to and ideally just below the lower trend line of our most recent piece of structure, then regardless of how it does so I'll be waiting for a convincing impulse back up followed by a tight one hour flag and then I'll be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If price simply impulses up above our lower rayline, it does so impulsively and in a convincing manner and a subsequent tight one hour flag forms, then I'll again be looking to get long with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

USD/CHF:

• If price corrects and a tight one hour flag forms, then I'll be looking to get short with either a reduced risk entry on the break of the flag or a risk entry within it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

NZD/USD:

• If price pushes up to and ideally just above our lower rayline and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.

EUR/AUD:

• If price pushes up to and ideally just above the upper trend line of our most recent piece of structure and the last part of the move is corrective, then I'll be looking to get short with a risk entry either after a phase line break, or just below a one hour or a fifteen minute rejection from it.

• If my entry requirements are not met then I will simply wait until another setup which meets my plan materialises.

• If there's any ambiguity then I will not place a trade on this pair.