Sp1

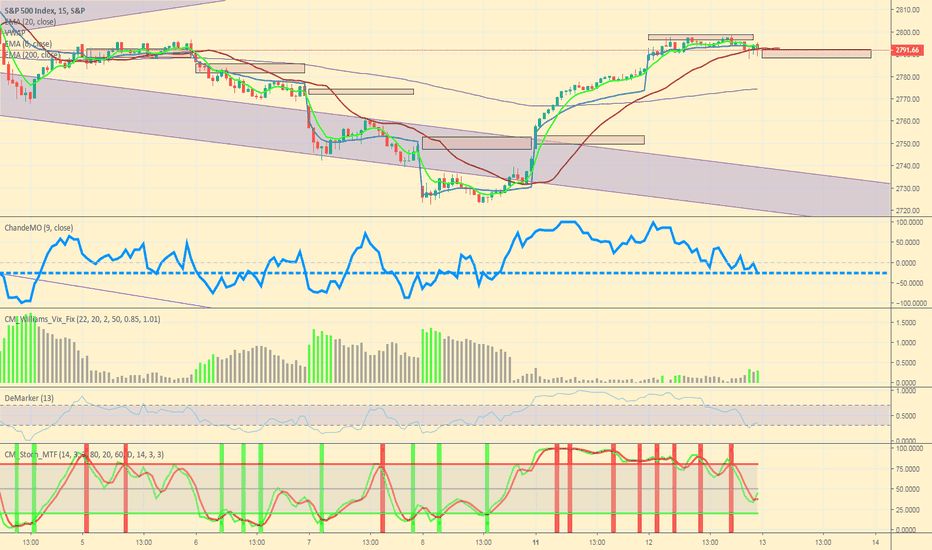

Bulls and Bears zone for 04-04-2019Yesterday's RTH trading pattern was opposite of Tuesday's. Market has been sideways during overnight session. I suppose, we might see a test of overnight session high before any sell off. Since there is no significant economic news today during RTH, it might end up being a range day.

Bulls and Bears zone for 04-03-2019Market sold off 50% of its range during last 30 minutes of yesterday's RTH which is not good for bulls. However, market did rally during overnight session. Perhaps market will test overnight high before deciding on direction.

Keep in mind that US:ADP Employment Report released this morning was below consensus.

Following reports which could impact the market are due as follows:

USA US:PMI Services Index

9:45 AM ET

USA US:ISM Non-Mfg Index

10:00 AM ET

Bulls and Bears zone for April 1, 2019Market has rallied during overnight session. Therefore, it will open gap up. It will probably come down and test 50 MA and maybe 200 MA before any rally.

There are few economic reports due which could move the market as follows:

US :PMI Manufacturing Index at 9:45 AM ET

US:Business Inventories 10:00 AM ET

US:ISM Mfg Index 10:00 AM ET

US:Construction Spending 10:00 AM ET

Bulls and Bears zone for 03-27-2019Yesterday market tried to rally then sold off and closed off the highs. Currently, market is trading around yesterday's close which is not a good sign for Bulls.

United States : EIA Petroleum Status Report comes out around 10:30 am EST. It can help determine the direction of inflation. In the U.S., consumer prices stabilizes whenever oil prices have fallen, but have accelerated when oil prices have risen.

Bulls and Bears Zone for 03-26-2019Yesterday market closed positive for the day. Even though market sold off overnight, but it started to rally this morning. It seems market will open gap up, will it close the gap and rally or vice versa. Time will tell.

US consumer confidence report is due at 10 am EST.

Bulls and Bears Zone for 03-19-2019Even though, market closed up yesterday but it was within a range. Overnight session was same except market started to rally in the morning. It would be a good idea to keep an eye on 200 ma.

Couple of reports to be released today that are important since two-third of our GDP is based on consumer spending.

1)US Redbook which compares retail sales at 8:55 am ET

2) US Factory orders of durable and non durable goods at 10 am ET