Trump Delays Tariffs for 90 Days. The S&P 500 Rebounds SharplyTrump Delays Tariffs for 90 Days. The S&P 500 Rebounds Sharply

As shown in the chart of the S&P 500 (US SPX 500 mini on FXOpen), the index is currently trading near the 5,500 level.

This result is highly encouraging, considering that as recently as yesterday morning, the index was hovering around 4,900.

Why Have Stocks Risen?

The strong rebound seen yesterday evening was triggered by a statement from the US President — he announced a 90-day delay in the implementation of wide-ranging global trade tariffs, which had originally been unveiled on 2 April and led to a sharp drop in the index (as indicated by the arrow).

However, this does not apply to China, for which tariffs were not delayed but increased. "Due to the lack of respect China has shown towards global markets, I am raising the tariff imposed on China by the United States of America to 125%, effective immediately," said Donald Trump, according to media reports.

Overall, US stock markets responded positively to the news, and Goldman Sachs economists have withdrawn their US recession forecasts.

Technical Analysis of the S&P 500 Chart (US SPX 500 mini on FXOpen)

Despite yesterday’s sharp rebound, the stock market remains in a downtrend (as indicated by the red channel).

From a bullish perspective:

→ A Double Bottom pattern (A–B) has formed around the 4,900 level;

→ Price has moved into the upper half of the channel.

From a bearish perspective:

→ Bulls must overcome key resistance near the psychological 5,000 level;

→ While tariffs have been delayed, they have not been cancelled. As such, the risk of an escalating trade war is likely to continue putting pressure on the S&P 500 index (US SPX 500 mini on FXOpen) in the coming months.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Sp500forecast

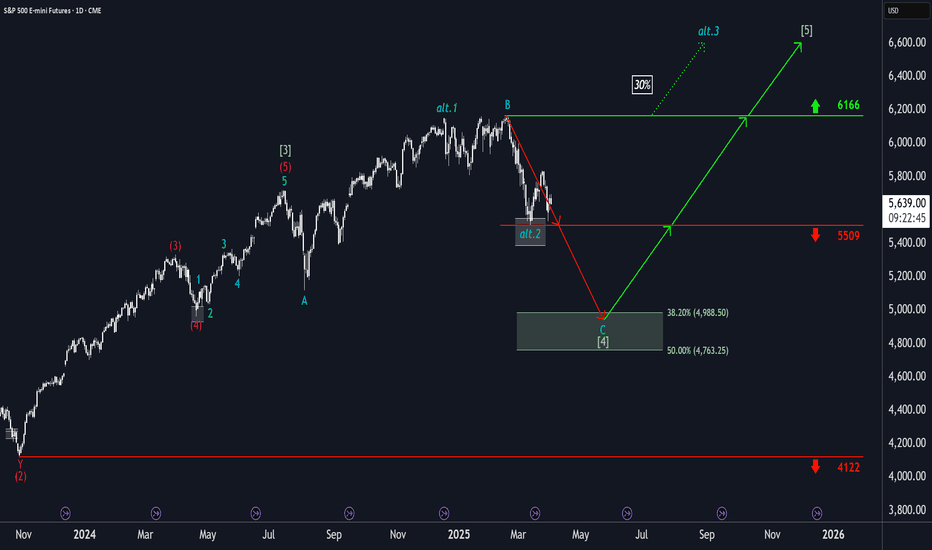

S&P500: Persistent SupportThe S&P 500 continued its recovery following its reaction to the support at 5509 points. However, in our primary scenario, we expect the index to fall below this mark to ultimately complete wave in green within our color-matched Target Zone (coordinates: 4988 points – 4763 points). Within this range, there are entry opportunities for long positions, which could be hedged with a stop 1% below the Zone’s lower boundary. Once the corrective movement has reached its low, the final upward movement of the green wave structure should commence. In the process, the index should gain significantly and reach the high of wave above the resistance at 6166 points. If this mark is surpassed prematurely, our alternative scenario with a 30% probability will come into play.

S&P500: Days of DecisionHovering near the 6,000 points mark, the S&P 500 enters the second half of the week at a critical juncture. The next few trading sessions will determine whether the index will push directly to new record highs or first undergo a more extended correction. In our primary scenario, the S&P should continue selling off to settle the turquoise wave 2’s low within the corresponding long Target Zone between 5,667 and 5,389 points. Only from there should the next turquoise impulse wave 3 take over, driving the index to new all-time highs beyond the resistance at 6,365 points. If the S&P immediately resumes its upward trajectory, it might break past 6,365 points without delay. In this 38% likely alternative scenario, the index would bypass the turquoise Target Zone and significantly extend the green impulse wave alt. . Primarily, we consider the green wave as already complete.

M.A.G.A's STORYTAIL (SP500)If I can reach the stars, pull one down for you

Shine it on my heart so you could see the truth

That this love I have inside is everything it seems

But for now I find, it's only in my dreams

And I can change the world

I will be the sunlight in your universe

You would think my love was really something good

Baby, if I could change the world

If I could be king, even for a day

I'd take you as my queen, I'd have it no other way

And our love would rule in this kingdom we have made

'Till then, I'd be a fool wishing for the day

And I can change the world

I would be the sunlight in your universe

You would think my love was really something good

Baby, if I could change the world

Baby, if I could change the world

I could change the world

I would be the sunlight in your universe

You would think my love was really something good

Baby, if I could change the world

Baby, if I could change the world

Baby, if I could change the world

Eric Clapton

SP500 - detailed wave countHow Trump's tariff, economic plans could shake the US dollar

Reports indicate President-elect Donald Trump may declare a national economic emergency to enact controversial tariff policies under the International Economic Emergency Powers Act (IEEPA). Despite criticisms, Trump remains committed to his proposed economic measures.

Yahoo Finance reporter Alexandra Canal examines how the US dollar (DX=F, DX-Y.NYB) might respond to Trump's tariff plans and overall economic agenda, inversely causing a reaction in S&P 500 (^GSPC) earnings growth.

To watch more expert insights and analysis on the latest market action, check out more Asking for a Trend here.

This post was written by Angel Smith

S&P500: Strong SurgeOn Friday, a strong surge propelled the S&P500 upward, so the index is beginning the new week at distinctly higher levels. Still, in our primary scenario, we anticipate a significant sell-off during the turquoise wave 2, which should drive the S&P down into our turquoise Target Zone between 5616 and 5368 points. In this range, the turquoise impulsive wave 3 should start and deliver a robust upward movement beyond the resistance at 6169 points. However, there is a 36% chance that the index will reverse upward prematurely and surpass the resistance at 6169 points earlier during an alternative blue five-wave structure.

S&P500: More Upward Potential!We still ascribe more upward potential to the S&P’s turquoise wave B – up to the resistance at 6088 points. At this level, we expect a transition into the same-colored wave C, which should push the index down into our green Target Zone between 5110 and 4921 points. Within this Zone, the larger wave should find its final low, which should provide potential entry points for long positions. A stop-loss can be set 1% below this Zone for risk management. However, if the index surpasses the 6088 points mark directly, our alternative scenario (probability: 38%) will come into play: it suggests that the wave low is already in place.

Is SP500 strike to cover crisisDear All,

This is SP500 to GDP Ratio chart which is show us maybe we should ready for another crisis. If you compare this chart to Will500PR to GDP Ratio I have published before you can clearly see negative bearish divergence between these two that means total public traded shares do not touched higher top but SP500 index reaches higher rates; So its obvious to see a sharp shrinkage as soon as possible. See if FED can cover it by soft landing or not?

SPX Bounce Target ReachedTen days ago, I wrote about a correction of the SPX back the red support zone. Now the time has come to talk about what could happen next.

The correction didn't happen in the beautiful fashion i had forseen, but this still works. What i expected was a clear zigzag formation within this falling channel, but we broke the support trendline and reached the first real correction target. After that, the price shot back in the channel.

From here, it is most likely that the price will go sideways, maybe in a fashion where it will touch the resistance line once again, or that the SPX is will reach the lower level of this zone, whilst staying in the channel.

SPX: First Down Then UpIt looks like the SPX has topped out temporarily. This woudn't be too farfetched as the previous couple uptrends lasted for 34, 36, 21, 23, 40, and 33 days. Right now, we're looking at a top which has been formed after 28 days.

From the looks of it, its trying to form a falling channel. The properties of this pattern are:

- Declining parralel support and resistance lines

- Price oscilating between the support and resistance lines

- Bottom at an important support zone

- Going sideways after hitting the bottom, preferibly with a daily bullish divergence

I'm still bullish on the SPX for 2023, but for now i'm expecting a small correction.

S&P500 Is Likely To Go LowerThe SPX made a false breakout. A false breakout means that the price attempted to break out of a pattern, or break support/resistance. The attempt is successful for a short amount of time, before the price goes back to where it was. This usually is a reversal signal.

For now i'm staying bearish, untill the price goes sideways or manages to break the resistance of the channel.

SPX Daily TA Cautiously BullishSPXUSD daily guidance is cautiously bullish. Recommended ratio: 80% SPX, 20% Cash.

* GOLDEN CROSS WATCH . US December CPI came in 0.1% lower than in November (which saw a rise of 0.1% from October), whereas Core CPI came in 0.3% higher than in November (which saw a rise of 0.2% from October). The UofM Consumer Sentiment Index (Preliminary) for January is currently 64.6 , up from 59.7 in December. The current GDPNow US Q4 GDP estimate is 4.1% , up from 3.8% on 01/05/23.

It seems as though markets are pricing in a "turnaround in inflation", but with Russia/Ukraine and ongoing supply chain disruptions from China it is likely premature to make such an assessment. Additionally, CPI is conflated and this is largely because the cost of gas has been falling in recent months; this is due to to a combination of: weakening demand from China amidst record COVID cases and resulting lockdowns; a price cap on Russian oil; a dramatic slowing of travel in the winter season (US); and lingering effects of the US government tapping into the SPR. Russia deciding to ban oil exports to any organization or country supporting the $60 price cap begins on February 1st and the next OPEC meeting could result in a cut to production in effort to boost prices.

Cryptos are mixed. US Treasuries are up.

Key Upcoming Dates: US December PPI at 830AM EST 01/18; US December Retail Sales at 830AM EST 01/18; Next GDPNow US Q4 GDP Estimate 01/18; US Federal Reserve Beige Book at 2PM EST 01/18; US December Building Permits and Housing Starts at 830AM EST 01/19; US Federal Reserve Governor Lael Brainard (FOMC member) Speech at 1:15PM EST 01/19; US Federal Reserve Governor Christopher Waller (FOMC member) Speech at 1PM EST 01/20. *

Price is currently testing the 200MA at $4k as resistance. Volume remains Moderate (moderate) and has favored buyers for the last four sessions as Price trades in the Point of Control. Parabolic SAR flips bearish at $3810, this margin is mildly bearish. RSI is currently forming a soft peak at 61 as it approaches 68.42 resistance. Stochastic remains bullish and is currently trending sideways at max top (it can remain in this 'bullish autobahn' for a few sessions). MACD remains bullish and is currently trending up at 14.5 as it breaks above the uptrend line from March 2020, if it can sustain this momentum then it will likely test next resistance is at 33.08. ADX is currently trending up at 15 as Price continues to trend up, this is mildly bullish at the moment.

If Price is able to break above the 200MA with conviction, the next likely target is a retest of $4058 minor resistance . However, if Price is rejected here, it will likely test the 50AM at $3913 minor support . Mental Stop Loss: (two consecutive closes below) $3913 .

SPX Not Giving UpA small follow up for the bullish case of the SPX:

We're still in the resistance zone, located below the resistance line of the bigger falling channel we're in.

Now we've seen the first rejection of the upper part of the resistance zone, however, we just shot right back in. That is still bullish. Right now, the bullish case for the SPX is still in play, and im excited to see wether we can break the resistance.

I guess we'll get our answers within a couple fo weeks.

SPX Broke bullish Now What?In the last SPX post, I started to doubt my bearish scenario of the index, by saying that the price looks bullish on the short term. Now that we've seen a short term pump to the resistance, I wanted to give an update.

Right now, the upper level of the resistance zone has been touched. This begs the question: Are we going to see a break of this resistance zone. If that happens, I find it extremely likely that the resistance of the channel will break aswell.

However, since we're at a resistance level, we have to be cautious about the following events. Right now i'll switch from bullish to neutral, because I want to see whats going to happen next.

SPX Daily TA Neutral BullishSPXUSD daily guidance is neutral with a bullish bias. Recommended ratio: 52% SPX, 48% Cash.

* US New Residential Construction saw Building Permits for November down 11.2% from October to 1,342,000 and November Housing Starts down 0.5% from October to 1,427,000 . These numbers are reflective of an economy preparing for weakening demand as we head into 2023. US November Consumer Confidence spiked from 101.4 in November to 108.3 in December following two consecutive months of decline . This number is likely reflective of a lower CPI in November paired with expectations of continued lower inflation in 2023. Nike beat on both top and bottom 2023 Q2 estimates with its second best quarter of revenue growth in the past 10+ years , this is likely due to Black Friday sales and holiday shopping but is also reflective of a still strong US consumer. It was confirmed today by US Secretary of State Antony Blinken that the first transfer of the Patriot Air Defense System will be included in the most recent $1.85b aid package that the US will provide to Ukraine . Ukraine President Zelenskyy has also landed in the USA to meet with President Biden and deliver a speech to a joint session in Congress later tonight. Russia has previously declared that any Patriot Missiles supplied to Ukraine would immediately become legitimate targets of their armed forces attack .

US Equities, US Equity Futures, Energy, Agriculture, DXY, HSI and N100 are up. Cryptos are mixed. Metals, GBPUSD, EURUSD, JPYUSD, CNYUSD, NI225, VIX and US Treasurys are down.

Key Upcoming Dates: US Final Q3 GDP Estimate at 830am EST 12/22; US November PCE Index at 830am EST 12/23; UofM Consumer Sentiment Index at 10am EST 12/23. *

Price is currently testing the 50MA at $3875 as resistance. Volume is currently Low (high) and on track to favor buyers for a second consecutive session. Parabolic SAR flips bullish at $4045, this margin is neutral at the moment. RSI is currently testing the uptrend line from January 2022 at 46.5 as resistance. Stochastic crossed over bullish in today's session after retesting max bottom and is currently trending up at 11, the next resistance is at 17. MACD remains bearish and is currently testing -11.45 support. ADX is currently trending down at 13.6 as Price is attempting to defend support at the 50MA, this is mildly bearish at the moment.

If Price is to reclaim support of the 50MA it will have to close above $3875 as well as recapture support at $3913 minor support . However, if Price is rejected here at the 50MA, it will likely aim to retest the lower trendline of the descending channel from July 2021 at ~$3710 as support . Mental Stop Loss: (one close below) $3810.

SPX Daily TA Neutral BearishSPXUSD daily guidance is neutral with a bearish bias. Recommended ratio: 45% SPX, 55% Cash.

* The FOMC announced a 50bps rate hike today and adjusted their Dot Plot to reflect a 5.1% FFR in 2023 . Markets rallied prior to the announcement and then fell shortly after, though this could have been a short-squeeze, Equity and Crypto markets could see more downward pressure as investors return to Bonds; currently FFR futures traders are anticipating a 75bps rate hike on 02/01/23.

DXY, US Treasurys (mixed) and Natural Gas are up. US Equities, US Equity Futures, Cryptos, Commodities, GBPUSD, EURUSD, JPYUSD, CNYUSD, HSI, NI225, N100 and VIX are down.

Key Upcoming Dates: Next GDPNow US Q4 GDP estimate 12/15; US November New Residential Construction at 830am EST 12/20; US Final Q3 GDP Estimate at 830am EST 12/22; US November PCE Index at 830am EST 12/23; UofM Consumer Sentiment Index at 10am EST 12/23. *

Price is currently trending down at $3995 and is at risk of breaking below the uptrend line from 10/13 after being rejected by the 200MA at ~$4035 as resistance. Volume remains Moderate (high) and favored sellers for a second consecutive session; Price briefly touched the VP Point of Control at ~$3970. Parabolic SAR flips bearish at $3920, this margin is bearish at the moment. RSI is currently testing 52.68 as support after crossing above it to start the week. Stochastic remains bullish and is currently testing 43.62 resistance. MACD remains bearish and is currently at risk of denying a trough formation at 33.08 support; if it loses 33.08 support then the next support (minor) is at 10.73. ADX is currently trending up slightly at 16 as Price attempts to defend the uptrend line from 10/13, this is neutral at the moment.

If Price is able to bounce here and reclaim support of the uptrend line from 10/13 at ~$4032 (which coincides with the 200MA), it will have to break above $4058 minor resistance in order to retest the upper trendline of the descending channel from November 2021 at ~$4150 as resistance . However, if Price continues to break down here, it will likely retest $3913 minor support . Mental Stop Loss: (one close above) $4058.

SPX Daily TA Cautiously BearishSPXUSD daily guidance is cautiously bearish. Recommended ratio: 35% SPX, 65% Cash.

* BOUNCE WATCH . It's volatile week with investors preparing for another FFR hike (12/14) that is widely expected to be 50bps (with a chance at 75bps) as China continues to formally lax their Covid-Zero restrictions in major cities like Beijing where people with a negative PCR test result are now allowed to congregate in certain public places . This has investors torn over a China reopening rally and more flight from Risk-On assets to DXY and US Treasurys with further FFR hikes. Russia continues to bombard Ukrainian energy infrastructure as Russia prepares to ban the sale of Russian oil to buyers participating in the new $60 price cap imposed by the G7 yesterday . In the coming years it would be reasonable to expect more of a push toward renewables like Solar energy in response to the geopolitical factors that are causing oil prices to be unsustainably volatile.

VIX, Metals, Agriculture, NI225, GBPUSD, EURUSD and JPYUSD are up. DXY, US Treasurys, US Equities, US Equity Futures, Cryptos (mixed), Energy, CNYUSD and N100 are down.

Key Upcoming Dates: US November PPI 830am EST 12/09; US November CPI 830am EST 12/13; Last FOMC Rate Hike Announcement of 2022 at 2pm EST 12/14; US November New Residential Construction at 830am EST 12/20; US Final Q3 GDP Estimate at 830am EST 12/22; US November PCE Index at 830am EST 12/23; UofM Consumer Sentiment Index at 10am EST 12/23 .*

Price is currently trending down at $3954 as it approaches a $3913 minor support after being rejected by the 200MA (~$4058 minor resistance). Volume is currently Low (moderate) and on track to favor sellers for a second consecutive session if it closes today's session in the red. The VP Point of Control is at $3913 minor support. Parabolic SAR flips bullish at $4102, this margin is mildly bullish at the moment. RSI is currently trending down at 50 as it tests 52.68 support, the next support is the uptrend line from January 2022 at ~46. Stochastic remains bearish and is currently trending down at 28, the next support is at 17. MACD crossed over bearish in today's session and is currently trending down at 48 as it risks losing 55.35 minor support if it breaks down further. ADX is currently trending down at 18.53 as Price is also trending down, this is neutral at the moment.

If Price is able to bounce here then it will likely retest the 200MA at ~$4040 as resistance before potentially retesting $4058 minor resistance . However, if Price continues to break down here, it will likely retest $3913 minor support . Mental Stop Loss: (one close above) $4040 .

SPX Daily TA Cautiously BullishSPXUSD daily guidance is cautiously bullish. Recommended ratio: 65% SPX, 35% Cash .

* US EMPLOYMENT SITUATION WATCH . If Unemployment reports higher tomorrow (which with the amount of layoffs in corporate USA these days would be reasonable), this would signal that the FOMC's monetary policy is becoming increasingly effective and they will likely go ahead with their 50bps rate hike on 12/14. This may be considered bullish by markets but it would be prudent to expect for a bit of volatility tomorrow regardless. October's PCE Index was reported (6% vs 6.3% in September) at 12:45pm EST today , when it should've been reported at 830am EST today; why this happened, who knows? Why it (Core PCE) reflected exactly what Fed Chair Jerome Powell forecasted in his speech at the Brookings Institute yesterday, who knows? Powell (and the Fed) forecasted Core PCE dropping from 5.1% (5.2% revised) to 5%, that's exactly what was reported today. The 7th GDPNow US Q4 GDP estimate came in at 2.8% down from 4.3% on 11/23 .

Russia Foreign Minister Lavrov justified recent attacks on Ukrainian infrastructure as a means of defending Russia from "inherent risks" and condemned NATO and the USA for participating in the defense of Ukraine . France and the USA agreed to continue supporting Ukraine . Meanwhile, the Pentagon reported that China conducted more ballistic missile tests than the rest of the world combined in 2021 but that there are doubts regarding whether or not they can achieve their goals of becoming a military superpower by 2027 .

HSI, NI225, N100, GBPUSD, EURUSD, JPYUSD, CNYUSD, Energy, Agriculture and Metals were up today. DXY, US Treasurys, US Equities, US Equity Futures, Cryptos and VIX were down.

Key Upcoming Dates: November Employment Situation at 830am EST 12/02 ; US November PPI 830am EST 12/09; US November CPI 830am EST 12/13; Last FOMC Rate Hike Announcement of 2022 at 2pm EST 12/14; US November New Residential Construction at 830am EST 12/20; US Final Q3 GDP Estimate at 830am EST 12/22; US November PCE Index at 830am EST 12/23; UofM Consumer Sentiment Index at 10am EST 12/23. *

Price attempted to push higher in today's session and finished at $4076 after briefly testing the 200MA which coincided with $4058 minor support. Volume finished today's session Moderate (high) and favored sellers after favoring buyers in yesterday's session. Parabolic SAR flips bearish at $3938, this margin is neutral at the moment. RSI is currently trending down slightly at 62.5 after forming a soft peak at 63.5, the next support is at 52.68 and resistance at 68.42. Stochastic crossed over bullish in today's session after bouncing off of 68 support and is currently trending up at 83. MACD remains bullish after defying a bearish crossover and is currently trending up slightly at 62, it's still technically testing 55 minor resistance. ADX is currently trending up slightly at 21 as Price attempts to push higher, this is mildly bullish at the moment and would become bullish if it maintains this correlation over 25.

If Price is able to establish support at $4058 minor support then the next likely target is a retest of the upper trendline of the descending channel from November 2021 at around $4175 resistance (this would present a very critical resistance). However, if Price breaks down below $4058 minor support as well as the 200MA at $4048 as support , it will likely retest $3913 minor support. Mental SL: (one close below) $4032 .

SPX Daily TA Neutral BullishSPXUSD daily guidance is neutral with a bullish bias. Recommended ratio: 60% SPX, 40% Cash.

* October CPI rose 0.4%, the same increase as in September ; but what moved markets was that Core CPI rose 0.3% compared to 0.6% in September. Such an impulsive rally after one dovish CPI print is hardly sustainable in a bear market; however, if the UofM Sentiment Survey tomorrow is bullish and Russia renews their grain deal with Ukraine on 11/19, this rally may be able to continue into the PCE report on 12/01. Equities finished up in today's session and Equity Futures, Oil, Agriculture, DXY, Long-Term US Treasuries, HSI, NI225 and CNYUSD are up. Cryptos are correcting after many experienced a ~20% rally in today's session. VIX, Natural Gas, Gold, JPYUSD, GBPUSD and EURUSD are down. Russia ordered their citizens to evacuate Kherson City in anticipation of a Ukrainian shelling that would level the whole city, this of course is probably another False Flag operation because Ukraine likely has no interest in destroying their own infrastructure. Ukrainian military officials cast their doubts over such a retreat and think it's a ploy to lure Ukrainian soldiers into a central location to maximize inflicted damage.

Key Upcoming Dates: UofM November US Consumer Sentiment Survey at 10am EST 11/11; Fourth GDPNow Q4 GDP estimate 11/16; Russia/Ukraine Grain Deal Expiration on 11/19; 2nd Estimate of US Q3 GDP at 830am (EST) 11/30; October PCE Index at 830am EST 12/01; Last FOMC Rate Hike Announcement of 2022 at 2pm EST 12/14 . *

Price finished today's session trending up at $3956, it's still technically testing $3913 minor resistance and will need to close above it in tomorrow's session to help confirm bullishness; considering that Price appears to be legitimately breaking above the 50MA for the first time since 07/19, it may test it as support before continuing higher. Volume finished the session High (moderate) and obviously after a bullish CPI when inflation is the number one market focus, it favored buyers; Price is trading in the second largest supply/demand zone on the chart. Parabolic SAR flips bearish at $3700, this is mildly bearish at the moment. RSI is currently trending up at 60 with no signs of peak formation as it approaches a retest of $4058 minor resistance. Stochastic resisted a bearish crossover in Wednesday's session and is currently trending up at 60, it's still technically testing 48 minor resistance. MACD remains bullish after also resisting a bearish crossover in Wednesday's session and is currently trending up at 21 as it attempts to confirm a break above 11 minor resistance. ADX is currently beginning to form a trough at 17 as Price has been pushing higher, this is mildly bullish at the moment.

If Price is able to flip $3913 minor resistance to support then the next likely target is a retest of $4058 minor resistance . However, if Price breaks down below $3913 minor resistance , it will likely retest ~$3855 as support before potentially falling lower to test the 50MA as support at ~$3800 . Mental Stop Loss: (two consecutive closes below) $3913.