Sp500usd

**** Market Trading Strategy Idea SP500 ***Key Chart & Economic Insights:

- Current Market Position

- The S&P 500 is around $6000, showing positive momentum (+1.03%).

- Upward trend visible, indicating strong buying interest.

- Economic tailwinds support continued growth.

- Projected Price Movements

- 6800 USD: Key resistance level where selling pressure could emerge.

- Market pullback: A correction after 6800 may create a buyback opportunity.

- Recovery phase: Expected rebound toward 7000-7500 USD, another selling position.

- Economic Context: U.S. Manufacturing Boom & GDP Growth

- The United States is ramping up domestic production, boosting industrial output and reshoring manufacturing.

- This shift is fueling GDP growth, strengthening economic fundamentals and potentially sustaining bullish market momentum.

- Strong consumer spending & investment could drive stocks higher, aligning with the planned trade strategy.

Risk Management & Optimization:

- Entry & Exit Precision: Define stop-loss and take-profit levels.

- Momentum Confirmation: Ensure price action validates expected moves.

- Economic Indicators: Watch manufacturing & GDP data for trend validation.

If you want to refine this analysis or explore other scenarios, I'm here to dive deeper into key points! 🚀 Subscribe! TSXGanG

I hold a CCVM and MNC (Certificate of Competence to become a securities broker anywhere in Canada) and have been working as a trader for five years.

It’s a pleasure for me to help people optimize their trading strategies and make informed financial market decisions.

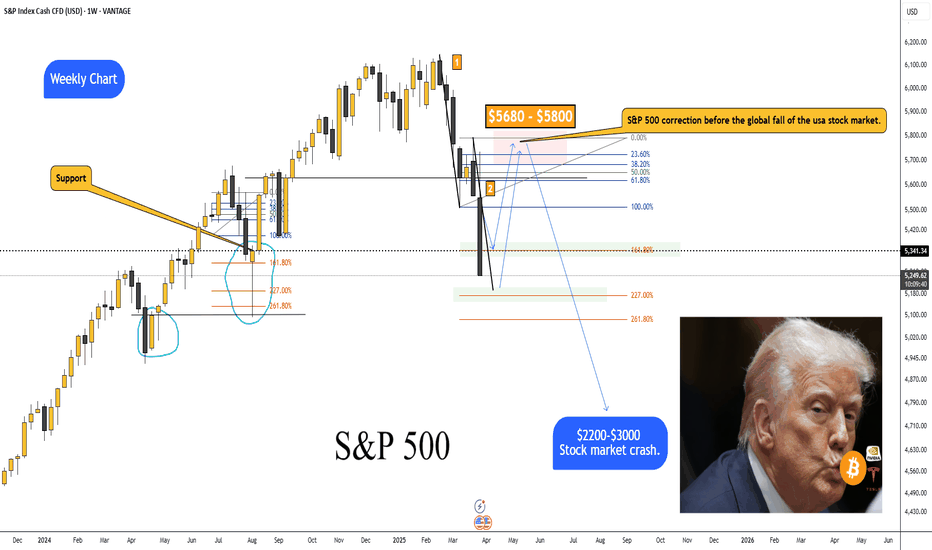

S&P 500 correction before the global fall.S&P 500 correction before the global fall of the usa stock market.

Hey traders! I’m sure many of you have noticed that after the introduction of retaliatory tariffs, the markets started getting pretty choppy.

The S&P 500 took a serious dive.

• On the weekly chart, I’ve marked a support level + the 161.8% Fibonacci level, where we might see a bounce back to the $5680–$5800 range.

• But from there, I think we could see the start of a major crash—both in equities and crypto—that could last 1–2 years.

• Based on my estimates, the S&P 500 could drop back to 2020–2021 levels, a wide range of 2200–3000.

• For Bitcoin, we’re talking around $5000; for Ethereum, $100–$300; and for Solana, $2–$12.

3D Chart:

3W Chart:

Real-world events that could tank the stock market this hard:

Global Recession: If major economies (US, China, EU) slide into a recession at the same time—think trade wars, rampant inflation, or a debt crisis—investors will dump risky assets like hot potatoes.

Trade War Escalation: Harsher tariffs between the US and China/EU could wreck supply chains, crush corporate earnings, and spark a full-on market panic.

Geopolitical Conflict: A big blow-up—like a full-scale war or crisis (say, Taiwan or the Middle East)—could send capital fleeing to safe havens (gold, bonds), while stocks and crypto get slaughtered.

Collapse of a Major Financial Player: If a big bank or hedge fund goes bust (Lehman Brothers 2.0-style) due to an overheated market or bad debt, it could trigger a domino effect.

Energy Crisis: A spike in oil/gas prices (from sanctions or conflicts, for example) could kneecap the economy and drag risk assets down with it.

Market Bubble Burst: If the current rally turns out to be a massive bubble (and plenty of folks think it is), its pop could pull indexes down all on its own.

Looming Wars: A potential Russia-Europe war starting as early as 2025, or an Iran-Israel conflict that drags in multiple nations, could destabilize global markets, spike energy prices, and send investors running for the exits.

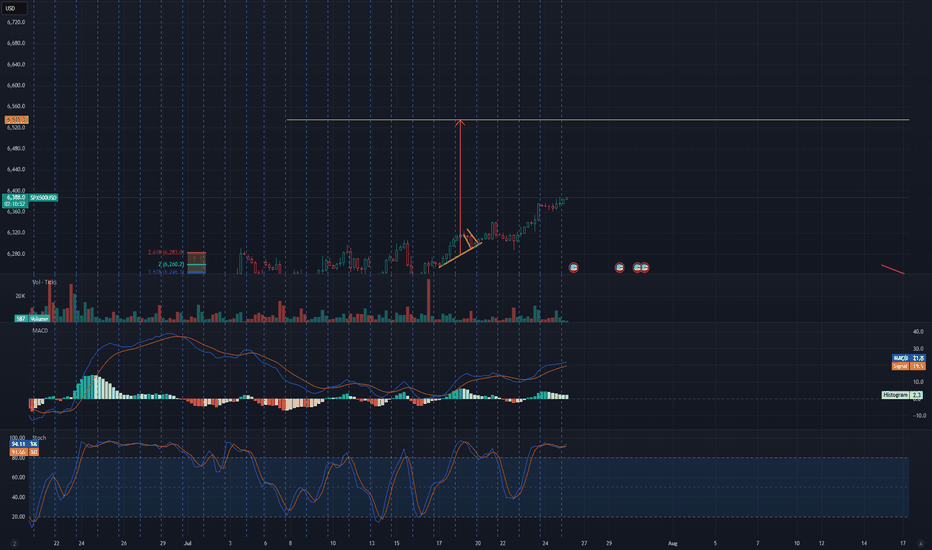

ES - Where to Join into the TrainThese two blue boxes are also very suitable for working with receivers.

Instead of getting lost in the low time interval, transactions can be taken by looking at the reactions when the price reaches these levels.

My Previous Ideas

DOGEUSDT.P | 4 Reward for 1 Risk much more if you hold it.

RENDERUSDT.P | HTF Accuracy

ETHUSDT.P | Accurate Buyer Zone Identification | High Risk Reward if you hold it.

BNBUSDT.P | Accurate Buyer Zone Identification | High Risk Reward if you hold it.

Bitcoin Dominance | Great Characteristic Detection and Accurate Analysis

SPX500The S&P 500 is showing a stair-step upward movement, primarily rebounding during non-active U.S. trading sessions. Key factors to watch:

- The market tends to recover when the U.S. session is closed, and corrects slightly when it reopens. This is due to residual selling pressure from retail investors during active hours.

- Strong resistance is seen around 5400 points, where previous declines started. A potential pullback to test support around 5100-5200 would create an ideal setup for a more robust rebound.

- Potential Iran-Israel conflict could create short-term volatility around August 12, potentially triggering a market pullback.

- Upcoming data on August 14 will influence market movements. Expected low inflation supports future rate cuts, providing a favorable environment for long-term growth.

S&P 500 ANALIYSIS !!S&P 500 Analysis

The S&P 500 has recently broken out of a "cup and handle" pattern, which is typically a bullish indicator. This breakout suggests a continuation of the upward trend, supported by the 21-day moving average that acts as a dynamic support level.

Cup and Handle Pattern: This pattern is characterized by a "cup" formation followed by a short consolidation period that forms a "handle." The breakout above the handle signals a bullish trend.

21-Day Moving Average: The S&P 500 is currently trading above the 21-day moving average, which acts as a support level and confirms the ongoing bullish momentum

Retest Above Breakout Level: The S&P 500 will likely retest the breakout level. A successful retest would further confirm the bullish trend.

CME Gap Considerations: There is a CME gap above the breakout level. Historically, such gaps tend to get filled, indicating potential short-term downward momentum before the uptrend resumes.

Monitor for a retest of the breakout level. If the price stays above this level, it confirms the bullish trend.

Keep an eye on the S&P 500 staying above the 21-day moving average. This will strengthen the uptrend.

Fill the Gap: Anticipate potential downward momentum to fill the CME gap. If this happens, it could present a buying opportunity if the price stays above key support levels

Breakout Below Support: If the S&P 500 breaks below the 21-day moving average and fails to recover, it could signal a reversal of the current trend.

The S&P 500 is in a strong bullish trend, confirmed by the breakout from the cup and handle pattern and support from the 21-day moving average. A retest of the breakout level and potential gap fill could bring short-term volatility, but as long as the price holds key support levels, the overall outlook remains positive.

Monitor the breakout level and 21-day moving average for potential retests.

Make sure any breakout or retest is accompanied by significant trading volume for confirmation.

Stay aware of macroeconomic news and updates that may impact market sentiment and the performance of the S&P 500.

Remember:-This is not a piece of financial advice. Stay tuned to us for further updates and analysis. Thank you!

SP500 H4 Projection Price is clearly in a bearish trend. Price also has fair value gab and unmitigated order block zone. So initiate short positions near the order block zone after finding a strong bearish price action structure. Analysis trend is invalid if the price breaks and closes above the trendline. Good Luck.

S&P500 - Long; For now ...This naturally rimes with the Nasdaq signals and with the overall global equities outlook.

Here, two opposing forces are the most significant factor;

1) The unfolding (and enduring!) USD strength - Downward pressure ;

2) The massive, continuously inbound (to US) capital flows , primarily from Europe - Upward pressure .

Driven by the rapidly unraveling globalization (driven by a Europe which the US decided to turn into a bonfire that is now clearly visible from Alpha-Centauri, and a China which is dying of old age as the demographic apocalypse is hitting hard this year - 2023), these fundamental forces will likely make this year one for the records - especially when it comes index (equities) trading.

Many, many trading opportunities to be expected, throughout this year, probably far more than in other periods.

Laissez le bon temp roule!! ...

Will the fifth wave be completed or is it wave X?Greetings, dear friends. I hope you are having a productive week.

I am happy to assist you in ensuring that all previous analyses are attached to each corresponding analysis. This will provide a comprehensive overview and help you make well-informed decisions. Please do not hesitate to let me know if there is anything else I can do to assist you further.

I want to share my market analysis ideas based on the Elliott Wave Principle with you.

I am a fan of this principle and follow all the rules and guidelines for analyzing the market.

However, please note that my ideas are based on my personal experience and may change over time.

If there is an error in my analysis, I am open to re-analyzing it from the beginning and learning from my mistakes.

It's important to understand that making an error in analysis is not a fault, but evading responsibility is.

No one can analyze financial markets with 100% accuracy, but it's remarkable how close we can get.

We analyze from multiple perspectives to consider all possibilities.

Let's mention a few opinions and ideas!

Based on mathematics.

I am still practicing to understand the Elliott Wave Principle better and hope to provide an even better analysis in the future.

Thank you for your continued support, and I look forward to our mutual success.

Best regards,

Mr. Nobody

Keep trying and never give up.

Good luck!

Where to from here on SPXI posted this chart few weeks ago as a follow up to my short to show the few paths SPX is going to take after it begins the descent and SPX has followed the one where I explained about a break of the channel into the deviation below. please refer links below the description to look at my previous posts on SPX short idea.

The only difference is that this happened a bit slower than I anticipated, which makes this drop out of the channel less likely to be a deviation now.

As you can see, we are bouncing from the Support zone as I had highlighted in my previous post.

Which brings us to the question of where we go from here.

On The Daily TF we have first hints of a reversal or a decent size bounce from here, we have bounced from a key support and ended the day with right candle stick on the daily, but we need one more day of price action to confirm the reversal. If we get another green day without breaching the low, we are likely to head up.

But if we zoom in to 4h TF things become clearer.

Let's Look at the following chart:

On Friday we broke structure to the upside on 4h and created a strong low at 4336. That number is not random , Will cover this in the next chart.

If we get a pull back and break higher than Fridays high, we will get a full Change of trend on 4h TF. Once we do, we should be able to break all the 4h strong highs until we meet the Daily Strong high at 4502 which is what I think will be hard to break and we will get a strong rejection from there. From there we can do one of the two things, either come back down create a double bottom and try again to break the daily high at 4500 and continue higher. If not, we will continue the daily trend by breaking 4336 low and head lower.

Now let's look at why the price bounced from 4336. The following chart has the answer. If you know VPA, then you know price moves in ranges, just like candle stick patterns are fractals, Ranges can act like fractals as well. In the chart you can see There are 3 ranges R1, R2 and R3 that formed on this uptrend. R3 is the larger range that encompasses R1 and R2 and 4336 is the VAL of this bigger range and as Per VPA theory , price in a range keeps roughly bouncing between VAH and VAL of the ranges .If you look at the VAH of R3 it coincides precisely with the Daily strong high at 4500 which gives us another confluence for a rejection there into the Daily OB shown in previous chart.

Finally, if throw regular old fibs and Gann Fan into the mix we get additional confluence for a rejection at the 4475-4500 region as shown in the chart below. 4475 region is a Gann resistance and 4475-4500 0.5 to 0.618 region of the retracement.

Some Projections:

If we do get a move like the one, I have explained, i.e. move to 4500 area and reject, we will have few patterns emerge like inverse H & S and cup and handle. I have highlighted the targets if they mature. But always remember all these patterns are pure manipulation by large institutions to trap retail traders, it possible that there is a fake out into the pattern where pa comes to lower 4300s and then reverses from there can creating yet another pattern a Double bottom, so only trade confirmations based on market structure change.

Happy Trading App!!!

S&P 500 Pushing to 6,000 after Wedge BreakFalling Wedge has formed with the S&P 500 since 1 July 2021.

We then recently had a breakout above 3,991 which confirmed upside to come.

With the strong Engulfing up candles, we can expect the price to soar in the next few weeks.

That is if the trend does hold and doesn't cause a fakeout.

Price>200

RSI>50

My first target is at 6,000.

SMC

Below the Falling Wedge, there is a clear sign of Sell Side Liquidity.

This is where Smart Money buys into positions (and sweeps liquidity) from traders who are long (get stopped) and for short traders who enter into their trades.

This causes the price to rocket up each time it touches this Order Block.

Now we'll need a strong catalyst for upside to continue. I am rooting for this one...

#SP500 Alternative #SPX #SPY #ES1! A less demanding and yet more robust looking alternative would be to drop expectation of ABC flat and replace it with WXY double zigzag.

This scenario popped up just now when I erased some of the previous drawings, zoomed out and tried thinking bigger and less anchored by the previous ideas.

S&P 500 Index Analyze !!!S&P 500 has been moving on Ascending Channel for about 12 years😱. S&P 500 had an Impulse wave with an Extended 3rd Wave . When wave 3 is extended , we can use from Elliott Wave Fibonacci Retracement and Extension Guidelines of extended waves :

🔅 If wave 3 is extended , waves 1 and 5 are often nearly equal in magnitude and duration.= This guideline is running correctly on my chart✅ = The end of the main wave 5 (Zone): 4505 until 4182

🔅If wave 3 is extended , then wave 4 often ends at the level of sub-wave 4 of 3 and is quite shallow (retraces 23.6% – 38.2% of wave 3). This guideline is running correctly on my chart✅

🔴 Heavy Resistance Zone : 5817 until 5348 .

S&P 500 Index Analyze Timeframe 2 Weeks ( Log Scale )

❗️ Note ❗️: I expect that S&P 500 would go down at least until the middle line of ascending Channel .

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy , this is just my idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

SP500 DECISION TIME. Lots of Bearish factors. But Inflation Top?$SP500

DECISION TIME.

The amount of resistance here is unreal. Must be a lot of stops right above $4200.

The chart looks bearish, but Inflation has Topped?..

Moment of Truth. Not the time to long, derisk or hold.

#SP500

Blue Trendline = Diagonal Resistance

Red Box = Resistance horizontal

Blue Trendline = Diagonal Resistance

Comment if you think we will break out / down.

S&P500 DROP TO 3500?.

S&P W1 3-9-22 DROP TO 3500 ?:

- Continued FED-tightening is bearish equities

- Recessionary circumstances (US & World) is bearish equities

- Strong(er) Dollar is not bullish equities

- Analysis based on Fib-Confluences:

- 3500 = 50% retrace of Covid-uptrend

- 3500 seems likely as downside target

- 3250 is 62% retrace of Covid-uptrend = 162% extension of recent upswing

- 3250 remains to be seen, but certainly doable this year

- Wave analysis perspective:

- AB = CD = 3500

.

SP500 Wave StructureThis is a follow up to my previous SPS500 analysis. Have a look at the idea mentioned below to check the wave structure on Daily Chart:

Currently we are in B wave which due to bullish sentiments in the market expanded above the start price of Wave A. Similar to NAS, I am anticipating the converging diagonals on SP as well while expecting the drop in prices by next week.