Spacex

EVERYONE IS BEARISH & 90% WILL LOSE MONEY (Elon Musk - tesla) Everyone is shorting tesla when we just started a parabolic run!

Human psychology 101 fight the trend... this is clearly bullish and everyone is bearish

New paradigm is incoming!

The first sell-off just happened

Not much more to say here other than I am loading more USD from my bank to buy more Tesla :)

Stay profitable

Spce is going for a crash landing?Our last TA on SPCE was pretty acurate we got a bounce just above our target with just .20cents off. I'm always a follower of trading range lines or highs lows in predicting pull backs. As of now at closing we are at $26.50 with the low of $25.71, which is marketed on this graph since aftermarket price movement isn't shown due to low volume, yet we all know SPCE has bubblish volume. As of now we can hold off on SPCE until we get bullish movement, but what caused this drop?

1. SPCE was in a microbubble with Bullshit expectations.

2. The EPS was off by a Shit load and anyone could have seen this coming, besides the people getting behind the hype.

3. Corona ingeneral has had affect on the market after it spread to Europe and recently theres a case in California.

What's next for SPCE? well its the market bubble graph and as of now we could say we are in Anxiety since the bounce was Complacency. We could honestly see a sub $10 SPCE with we knowing SPCE won't beable to make any money even raising the price will just hurt the company itself. They need development like SpaceX with inovation on its Rockets. SpaceX has reuseable rockets.

Next target is our trading range of $19.06-$24.25. You can see past TA which hasn't change

TESLA REVERSAL - KEY ZONE PROVIDES BULL CASE SCENARIORSI & Stochastic are showing that TSLA is very oversold.

Extremely high support at ~$180 is within reach and is the key area for a reversal.

Long term uptrend line is also within reach and shows confluence with the key support level of $180.

LONG TSLA within the $180-190 region.

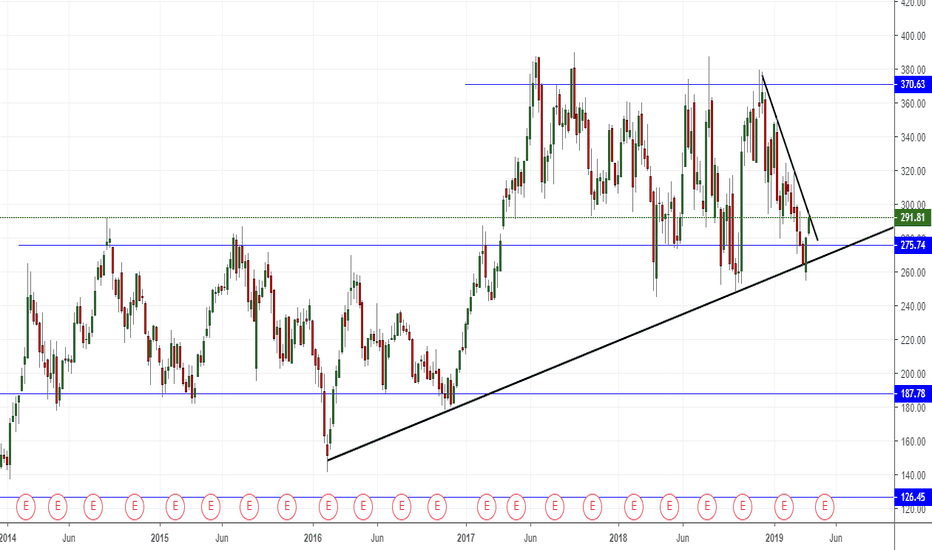

TESLA (TSLA) WEEKLY TIMEFRAME LONG The price chart for Tesla seems to be stuck in a range ever since price broke the 275.74 level, which had previously acted as resistance and now is support. The current resistance is at the 370.63 level and history shows that whenever price gets stuck in a loop (range), the support normally holds at least for three touches. Hence, now price has actually bounced off the 275.74 support level and we expect it to creep towards the 370.63 resistance level before we can see if the level holds or price breaks through and continues on a bull run. A trendline on the weekly timeframe also confirms the bullish momentum, as prices have already tested it four times, giving a pretty clear confirmation that the trendline holds.

For those traders who might have missed this trade, a good place to enter a trade would be on the breakout of the counter-trendline which can be drawn on the lower highs on the daily timeframe. We just hope that Elon Musk is not caught smoking a joint again or rambling nonsense on Twitter.

TESLA (TSLA) WEEKLY TIMEFRAME LONGThe price chart for Tesla seems to be stuck in a range ever since price broke the 275.74 level, which had previously acted as resistance and now is support. The current resistance is at the 370.63 level and history shows that whenever price gets stuck in a loop (range), the support normally holds at least for three touches. Hence, now price has actually bounced off the 275.74 support level and we expect it to creep towards the 370.63 resistance level before we can see if the level holds or price breaks through and continues on a bull run. A trendline on the weekly timeframe also confirms the bullish momentum, as prices have already tested it four times, giving a pretty clear confirmation that the trendline holds.

For those traders who might have missed this trade, a good place to enter a trade would be on the breakout of the counter-trendline which can be drawn on the lower highs on the daily timeframe. We just hope that Elon Musk is not caught smoking a joint again or rambling nonsense on Twitter.

TESLA ... LONG TERM ONLY ... TESLA is trading in an ascending triangle for so long, but it's getting too much attention from NSC and MEDIA. About their policies and future. still, consumer report shows us that TESLA OWNERS are very happy with their product and in the next few years it's the only company that's going to dominate the EVs industry. so I think in long term its good to go long.

Tesla INC, TSLA, Possible levels for safer entry!keeping it simple.

We have the weekly chart showing a slow but bearish momentum.

I know its having a little rise right now, but thats more or so seen on the daily chart or less.

There are a few weak and bearish indicators on the weekly as well.

I placed a decent buy area of possible pull back and testing of lower levels before the next rise to my sell zone above.

I wouldnt get into the trade until lower levels are retested one last time, to be extra safe.

I am not currently holding any TSLA

Check out my other charts that have been very accurate to date, with many having 50% to 500% gains!

Happy trading, debating and speculating!

Consistent, Cyclical Winner & A Fun "Show Me" Story (PT: $12.80)Iridium has reported well the last couple of quarters. The biggest story and "show me" aspect of it is its Constellation Network rollout that will be completed this year. This month, 55/75 satellites will now have been launched and in orbit with help from SpaceX (an amazing partner with a healthy record). There's little reason to believe they won't meet their goals this year, as guidance has remained the same.

This stability has allowed IRDM to step up slowly, but surely into different cyclical levels, where some modest gains can be made. Last year, when a 20/75 satellites were launched, IRDM was sitting between $10 and $11, only to shoot up into the $11 to $12 range as more satellites and guidance were maintained and stable. This trend has continued this year with an easy ceiling of $12.80 to hit. Anything around $11.25 was a good buy and has come up 5 times. No doubt it will continue after this most recent one. The stock has stayed above its 200 MA with little problems. Look for another opportunity in the near future, with a potential to sell again in June/July.