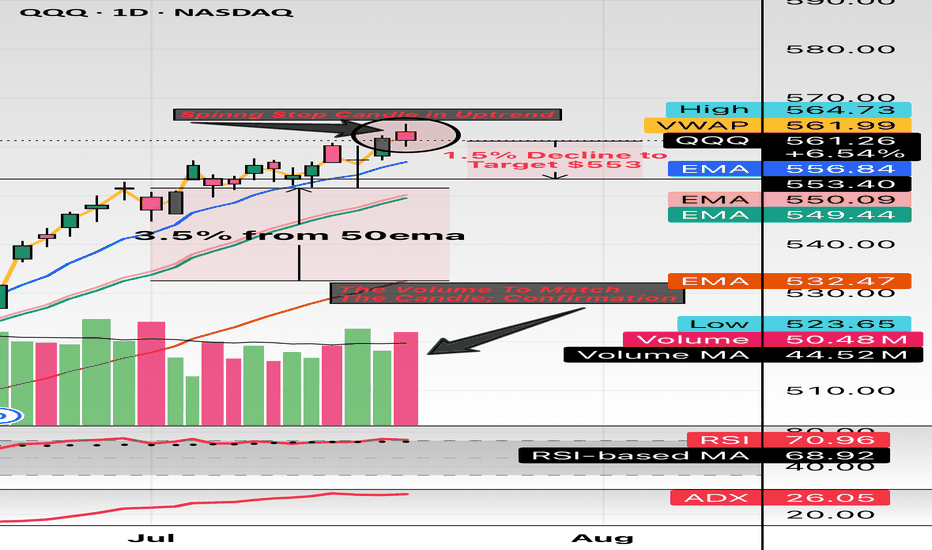

$QQQ this might the spot. Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY.

Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop candle and has volume to match. These candles usually take place (green or red) in downtrends or uptrends and provide pivotal indication. The market has major earnings this week (07/21/2025 to 07/25/2025) with names like Google, Tesla, General Dynamics, Verizon, Domino’s And so forth.

This week could be a catalyst to see some great volatility. I believe staying 3% from moving averages so I have noted 3.5% from the 50EMA and revisiting the 20EMA and 21EMA in the low $550 area. My target is $553 which is only a 1.4% move which can happen in one session in this environment while staying 3.5% above the 50EMA.

My trade idea will be $553p for 07/25/2025. Good luck!

WSL

Spinning Top

#SUIUSDT #1D (Bitget Futures) Rising wedge near breakdownSui got drained from Cetus LP and is about to print a spinning top candle on daily.

A retracement down towards 100EMA / descending trendline support seems likely.

⚡️⚡️ #SUI/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Short)

Leverage: Isolated (4.0X)

Amount: 4.8%

Current Price:

3.9642

Entry Zone:

3.9947 - 4.2035

Take-Profit Targets:

1) 3.5901

1) 3.2068

1) 2.8235

Stop Targets:

1) 4.5250

Published By: @Zblaba

CRYPTOCAP:SUI BITGET:SUIUSDT.P #1D #SuiNetwork #L2 sui.io

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +49.7% | +87.1% | +124.5%

Possible Loss= -41.6%

Estimated Gaintime= 1-2 months

$GLD - bullish momentum soon to stallHello, I was bullish on AMEX:GLD for a bit and now examining the charts, multiple frames, this may be setting up for a good short. If geopolitics and tariff talks deescalate then this should cool off. The Elliot wave placed indicates some time for a correction/pull back on this hot commodity and the candle on the Daily from Friday is a spinning stop doji which can indicate reversal in an uptrend. Also, we have so many gaps up that happened in 3 day span, crazy actually. I labeled areas of targets to fill these gaps. Expecting a retracement to $280.

WSL.

How Can You Use a Spinning Top Candlestick Pattern in Trading?How Can You Use a Spinning Top Candlestick Pattern in Trading?

The spinning top candle is a key tool in technical analysis, highlighting moments of market indecision. This article explores what spinning tops represent, how they differ from similar patterns, and how traders can interpret them to refine their strategies across various market conditions.

What Does a Spinning Top Candlestick Mean?

A spinning top is a candlestick pattern frequently used in technical analysis. It consists of one candle with a small body and long upper and lower shadows of approximately equal length. The candle’s body symbolises the discrepancy between the opening and closing prices during a specified time period, while the shadows indicate that volatility was high and neither bulls nor bears could take control of the market.

This pattern signifies market indecision, where neither buyers nor sellers have gained dominance. It suggests a state of equilibrium between supply and demand, with the price oscillating within a narrow range. The spinning top may indicate continued sideways movement, particularly if it appears within an established range. However, if it forms after a bullish or bearish trend, it could signal a potential price reversal. Traders always look for additional signals from confirming patterns or indicators to determine the possible market direction.

It’s important to note that the spinning top candle is neutral and can be either bullish or bearish depending on its context within the price chart. The colour of the candle is not important.

Spinning Top vs Doji

Doji and spinning top candlesticks can be confused as they have similar characteristics. However, the latter has a small body and upper and lower shadows of approximately equal lengths. It indicates market indecision, suggesting a balance between buyers and sellers without a clear dominant force. Traders interpret it as a potential reversal signal, reflecting a possible change in the prevailing trend.

The doji candlestick, on the other hand, has a small body, where the opening and closing prices are very close or equal, resulting in a cross-like shape. If it’s a long-legged doji, it may also have long upper and lower shadows. A doji candle also represents market indecision but with a focus on the relationship between the opening and closing prices. Doji patterns indicate that buyers and sellers are in equilibrium, and a potential trend reversal or continuation may occur.

How Do Traders Use the Spinning Top Pattern?

Traders often incorporate the spinning top candle pattern into their analysis as a way to interpret moments of market indecision. Whether the pattern appears during a trend or at key turning points, its context plays a significant role in shaping trading decisions.

In the Middle of a Trend

When a spinning top forms in the middle of an ongoing trend, traders often view it as a signal of potential market hesitation. This indecision can indicate a pause in momentum, suggesting either a continuation of the trend or the possibility of a reversal.

Entry

In such cases, traders typically wait for confirmation of the next price move. A break above the high of the spinning top may signal the trend will continue upward, while a break below the low could suggest the trend may move down. Observing how subsequent candles interact with the spinning top can help a trader gauge the market’s intentions.

Take Profit

Profit targets might be aligned with key price levels visible on the chart, such as recent highs or lows. For traders expecting trend continuation, these targets might extend further, while those anticipating a reversal might aim for closer levels.

Stop Loss

Stop-loss orders might be set in accordance with the risk-reward ratio. This placement helps account for the pattern's characteristic volatility while potentially protecting against unexpected movements.

At the Top or Bottom of a Trend

When a spinning top forms at a significant peak or trough, it often draws attention as a potential reversal signal. This appearance may reflect market uncertainty after a prolonged uptrend or downtrend.

Entry

Confirmation from subsequent price action is critical. Traders typically observe if the price breaks above the candle (bullish spinning top) or below the candle (bearish spinning top) to determine the likelihood of a reversal.

Take Profit

Targets could be set at major support or resistance zones. A trader expecting a reversal may look for levels reached during the previous trend.

Stop Loss

Stops could be placed in accordance with the risk-reward ratio, allowing for the volatility often present at trend-turning points while potentially mitigating losses.

Remember, trading decisions should not solely rely on this formation. It's crucial to consider additional technical indicators, market trends, and risk management principles when executing trades.

Live Example

In the EURUSD chart above, the red spinning top candle appears at the bottom of a downtrend. A trader went long on the closing of the bullish candle that followed the spinning top. A take-profit target was placed at the closest resistance level, and a stop-loss was placed below the low of the spinning top candlestick.

There is another bearish spinning top candlestick pattern on the right. It formed in a solid downtrend; therefore, a trader could use it as a signal of a trend continuation and open a sell position after the next candle closed below the lower shadow of the spinning top candle.

A Spinning Top Candle: Benefits and Drawbacks

The spinning top candlestick pattern offers valuable insights into market indecision, but like any tool in technical analysis, it has its strengths and limitations. Understanding these might help traders use it more effectively.

Benefits

- Identifies Market Indecision: Highlights moments where neither buyers nor sellers dominate, providing a clue about potential price reversals or continuations.

- Versatile Across Trends and Markets: Can signal price consolidation, continuation, or reversal depending on its context. It’s also possible to use the spinning top across stocks, currencies, and commodities.

- Quick Visual Insight: The distinctive shape makes it easy to spot on charts without extensive analysis.

Drawbacks

- Requires Confirmation: On its own, the pattern lacks particular signals, needing additional indicators or price action for confirmation.

- Context-Dependent: Its reliability depends heavily on where it forms in the trend, making it less useful in isolation.

- Prone to False Signals: Market noise can produce spinning tops that do not lead to meaningful movements, increasing the risk of misinterpretation.

Takeaway

The spinning top candlestick reflects market indecision and suggests a potential reversal or consolidation. Traders use this pattern as a tool to identify areas of uncertainty in the market. Therefore, it's important to consider the spinning top pattern within the broader context and get confirmation from other analysis tools.

If you want to test your spinning top candlestick trading strategy or apply it to a live chart, open an FXOpen account and start trading with tight spreads from 0.0 pips and low commissions from $1.50. Good luck!

FAQ

What Is a Black Spinning Top?

A black (red) spinning top is a variation of the spinning top candlestick pattern with a small body and equal-length shadows. This is different from the white (green) spinning top, as its body indicates a lower closing price. Traders analyse its context, technical factors, and confirmation from other indicators to interpret its significance.

What Is a Spinning Top Candlestick?

A spinning top candle meaning refers to a pattern characterised by a small body and long upper and lower shadows of roughly equal length. It reflects market indecision, where neither buyers nor sellers hold a clear advantage, and is often used in technical analysis to assess potential trend reversals or consolidations.

Is the Spinning Top Bullish or Bearish?

The spinning top candlestick pattern is neutral by nature. Its significance depends on the context within the price chart. When it appears at the end of an uptrend, it may signal a bearish sentiment, while at the end of a downtrend, it can indicate a potential bullish reversal.

What Does a Spinning Top Candle Indicate?

This pattern indicates a period of indecision and balance between buying and selling pressure. Depending on its position within a trend, it can signal consolidation, continuation, or a reversal in price direction.

What Is the Spinning Top Rule?

There is no fixed "rule" for spinning top trading. Traders typically look for confirmation from subsequent price movements or other technical indicators to decide on a course of action.

Is Spinning Top a Doji?

Although similar, spinning tops and doji candles differ. A spinning top has a small body with visible discrepancies between opening and closing prices, whereas a doji’s body is almost non-existent.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

$COIN Spinning Stop Candle in Downtrend; ReversalWe have 7 days of straight beating, assault, slaughter and murder. Do I think this thing reverses 10 fold? No but do I expect a bounce into the mid 220’s? Yes. RSI is relatively low (sold) for its name, it fundamentally smashed earnings and the candle here that closed on the daily is known as a spinning stop with a green closure. Expect a volatile move soon - tomorrow or and into Friday. NASDAQ:MSTR held up well today. This is always a craps shoot, no matter the trade, no matter the look of the chart and all the indicators we use. It just creates an edge. Good luck. I’m going to look at calls here for a bounce.

Wall Street Loser.

GICRE - Bullish Consolidation with VolumesNSE: GICRE is closing with a bullish consolidation candle supported with volumes.

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been moving along the horizontal support for the past few days which is indicating demand.

One can look for a 8% to 12% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

1W BTC Candlestick and Wave AnalysisI continue to be bearish and, by all my logic and knowledge, think that this market has been heavily manipulated since the Genesis bankruptcy.

Just think about it. The moment when the biggest crypto lender needs to liquidate their assets, the price goes up.

Also, if you follow the social metric, you know that creators of the crypto content are struggling to get new views.

And then, we have Elon changing the Twitter logo and pumping the DOGE, and the last time he did it, he pumped and dumped it for a BTC, which no one seems to remember or even realize.

But let's bring some chart analysis into it.

We first need to consider a gap in the VPVR on the right.

This is the chart of almost a year's worth of weekly candles, and that gap means that the price shot up without significant volume to create support anywhere above 25k.

Next, we have three weeks of consolidation, shown by long-legged Doji and two spinning top candle patterns.

The last week was bullish. It retested the upper Bollinger band, and as we can see, this one is bearish, which means it got rejected, but keep in mind this one has yet to close.

Last but not least, we can see a ribbon closing to a reversal on the ribbon in the waves indicator.

If you reduce the timeframe to 5D, it has already painted the local top.

Supported by the fact that the grey wave, which indicates the aggression or the speed of trading if you like, is approaching the zero line, which means the trend is reversed from bullish to bearish, excluding the fact that everything in me screams: "BUY," I will not do it.

I cannot predict the manipulation though I can see it and react to it thanks to my indicator, so my conclusion is: "Do your homework. This one is mine."

TQQQ Short Back To $17I think we are over bought! Prices have halted with a spinning top doji having formed and a candle after to confirm a possible pullback. We have room to drop back to the high volume node at $17 where smart money will make the next decision on direction. Not financial advice , DYOR

TATACOMM - Spinning Top with Volume SpikeNSE: TATACOMM is closing with a spinning top candle supported with high volumes

Today's volumes and candlestick formation indicates strong demand and stock should move to previous swing highs in the coming days.

The stock has been consolidating for the past few days which is indicating demand.

One can look for a 8% to 11% gain on deployed capital in this swing trade.

The view is to be discarded in the event of the stock breaking previous swing low.

#NSEindia #Trading #StockMarketindia #Tradingview #SwingTrade

TSLA: Bullseye (again)! Next Key Points to watch [UPDATED].• In our previous post, when TSLA was around $195 I set a target around $179 - $177, if a top sign appears. It happens that TSLA did a Spinning Top, and it dropped sharply afterwards. Now it is below our original target – the link to my previous public analysis is below this post, as usual;

• Now, TSLA is just bearish, and so far there’s not a single bullish sign indicating a bottom;

• If TSLA reacts and closes above the $177 today, it might bounce to higher levels, like the 21 ema, or even to the $198 again;

• In the lack of bullish reaction, we can assume that it’ll seek the gap at $170;

• TSLA has been a very easy stock to trade, as its movements are all technical and precise. For now, let’s pay attention to these key points. I’ll keep you updated on this, as usual.

Remember to follow me to keep in touch with my daily analyses!

SPX: Be aware of this KEY POINT! Is this a bottom?• The index did exactly what we described yesterday, as we nailed another support level on the index, at 4,028 (it hit 4,026, but we aren’t that perfectionists). The link to my previous analysis is below this post, as usual;

• Now the index is trying to react, and the 4,028 is just where the 21 ema is (1h chart);

• It is losing strength, but if it closes above the 38.2% retracement, it might bounce a little bit more;

• However, if it loses our dual support level made by the 4,028 + 21 ema, then it’ll probably seek the next retracements;

• The 61.8% is the last one, and only if the index loses it we might see a sharper correction in the daily chart, to its 21 ema;

• Speaking of daily chart, it seems it triggered a Spinning Top candlestick pattern, which might bring more correction ahead;

• For now, let’s pay attention to the dual-support level in the 1h chart, as it all depends on how it’ll react around this area today. I’ll keep you updated on this.

Remember to follow me to keep in touch with my daily analyses!

USD/CHF How To Trade Accumulating Pair With Spinning TopsThis Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

SPX Gap Fill Play!SPX has 2 gaps on the daily chart. One gap occurred June 10, 2022 and the other on June 13, 2022.

On June 15, 2022 SPX closed the day with a spinning top.

My plan is to take SPX to the upside after it breaks 3838.51. However, should it break below 3722.08, I will take it to the downside. I have an alert set at 3838.51 with the expectation of a gap fill to approximately 3900.

Please reference the screenshots of the SPX daily chart below.

*This is not financial advice.

Peace,

MrALtrades00

Algorand Short Scenario $ALGO's last two local highs both saw spinning top candles on the daily chart. Each realizing approx 20% retracement that followed the daily candle close over about 1.5 weeks.

Today, ALGO is forming another spinning top. If the trend continues, this gives a short-term price target of $0.67 by end of March.

SPY- Bearish- UpdateJust posting a quick update as the SPY is looking even more bearish after closing on Friday with a spinning top reversal pattern on the weekly timeframe- the markets have been overextended for quite some time, technicals are bearish on almost every timeframe- Some FIB levels and RSI-based supply and demand zones to keep an eye on-

- Bearish Megaphone Formed

- Bearish ABCD Harmonic Pattern Formed

- Spinning Top Candlestick Pattern Formed on the Weekly Timeframe (Bearish Reversal Pattern, See Attached Chart Below)

- Bearish Butterfly Harmonic Pattern Also Formed on the 4-Hour Timeframe (Not Pictured)

- Buyer Volume Drying Up

- Bearish Hidden divergence on the RSI - Also way in Overbought Territory

Weekly Timeframe

Previously Charted

Both Daily and 4H is giving a Bullish Move for GBPUSD... At the break-out below the Key Support area, price did a temporary sell off with a 50.2pip. Looking closely to the Bullish candle building up, a spinning top was created with a Bullish Candle after that and this indicates a potential and a high probability entry.

SPY- Bearish Reversal - UpdateSPY looking very bearish here, frankly, the markets have been overextended for quite some time and all technicals are bearish on almost every timeframe- Some FIB levels and RSI-based supply and demand zones to keep an eye on-

- Bearish ABCD Harmonic Pattern Formed

- Spinning Top Candlestick Pattern (Reversal Pattern, Bearish in This Case)

- Bearish Butterfly Harmonic Pattern Also Formed (See Attached Chart)

- Buyer Volume Drying Up

- RSI way in Overbought Territory

- MACD Death Cross on the 4-Hour

Previously Charted

SPX: When will it drop again?Hello traders and investors! Let’s see how the SPX is doing today!

It seems we see a bearish sign on the SPX, indicating a possible top (spinning top?), but I wouldn’t be too excited about it. After all, the index already did a similar pattern last Tuesday (it even more bearish, as it was a shooting star), and it was just a bear trap, as we thought.

What’s more, it is always important to analyze the hourly chart before any conclusion.

In the 1h chart, we don’t see any bearish structure yet, and we only see a healthy bull trend. As long as the index keeps doing higher highs/lows, the trend won’t reverse.

As stated by the 1st tenet of the Dow Theory: Trends persist until a clear reversal occurs . So far, I see no clear reversal. We have two support levels to keep our eyes on: The 21 ema, and the 4,567. If the index loses both supports, probably we’ll see some pullback in the daily chart.

For now, let’s just follow it closely, and if you liked this analysis, remember to follow me to keep in touch with my daily updates on stocks and indices. Also, support this idea if it helped you!

Have a good day.

US30 has been a steady uptrend, insight on scenarios to expect.This Indices has been on a steady uptrend, we have seen a clear break-out, retest and continuation. From the chart we have identified that the price is currently trading in a channel up, a successful to buy to the upper trend-line acting as a RESISTANCE if we can see a rejection with spinning top and or a Bearish Engulfing at this trend-line acting as RESISTANCE area, there is possibility of selling to the SUPPORT AREA @ 35769.7

SPX: Another RECORD HIGH! But, what if it starts dropping?Hello traders and investors! Let’s see how the SPX is doing today!

The index is going up nicely, but the candlestick in the daily chart looks enigmatic, as it is almost a Doji. The long shadow above the daily candlestick is annoying for sure, and kind of ruins the bullish momentum.

Since October 13, it seems the index deserves a pullback to the 21 ema again, at least, but we don’t see any meaningful weakness sign. Even if it closes doing a Doji, a Shooting Star, or a possible Spinning Top candlestick pattern, we be aware of the fact that the trend is clearly bullish in the 1h chart too:

As long as we don’t see any bearish confirmation here, and a sequence of lower highs/lows, the index won’t reverse in the daily chart. The 21 ema is pointing up, and it is working as a nice support as well.

This makes me wonder if a bearish candlestick pattern in the daily would be another bear trap – just a pullback to the 21 ema in the 1h chart. That’s why I prefer to use the 1h chart as a main guide for now. If it drops, ok, we have many support levels to work with, and probably the 21 ema in the daily chart will be our best indicator for now.

As some of you have been pointing out, a pullback would be great, and many other stocks would probably give us buy signs. Now I think it is the time to just hold some positions, instead of buying like crazy, and wait for more signs on the index.

If you liked this analysis, remember to follow me to keep in touch with my daily updates on stocks and indices. What’s more, support this idea if you liked it!

Have a good day.

$BTCM DailyIn the short term, may see more downside before next push up. Overall longer term Bias is bullish, however slightly over bought and bearish spinning top showing market uncertainty on Friday's close. Hoping for a little dip to add to my Oct $12.50 call position. Watching Ripster EMA clouds as support.