MSFT at Risk for More DownsideNASDAQ:MSFT needs to do a split. It doesn't have buybacks at this time. It is at risk of more downside until it hits prior lows. Support should kick in at the lows of prior rebound areas. The last earnings report was good. Percentage of Shares Held by Institutions ticked up this quarter.

Split

NVDA is below the split lows and the daily 50 SMA.NASDAQ:NVDA confirmed the daily 50 SMA down today, following the NASDAQ:SMH last week. NASDAQ:NVDA also lost the split lows in similar fashion to NASDAQ:AVGO last week. The weakness in semiconductors contributed to the sell-off in technology names today, which provided an excellent opportunity for shorts. Watch for any gap ups in technology names to get sold off and confirm the previous day's lows, which will confirm the short for further trades to the downside, as we enter a seasonally weak time for technology.

NVIDIA (NVDA) "disaster zone" temporarily Nvidia, on the news, people talking, I figured I would share this post with this chart indicator to give them a view of what this indicator would look like using it on Nvidia. The image appears to tell a story that the price is falling. For the moment there is a strong conviction that the price is going to decline. After a split, like with apple, the price does go through a period when investors leave because the price is no longer as expensive. Some people like expensive things and after a stock split the price is not as expensive. There are those superficial investors who only like expensive things.

(NVDA) nVidia "so close"Custom indicator to track volume against median levels diverting levels of highs and lows. Basically the indicator looks to measure something that offers a view of the direction of shares and whether the shares are pulling or pushing against the price of the stock, or crypto. In this case nVidia is running eerily close to the zero hline. The split is coming up and there will be 10x more shares. Even though the stock split shows definite signs of continued growth and future gains in mcap the timing is correlated as such. The image is on the week length because I couldn't fit the entire image one the day length of time with my computer. The purple line falls as the price gains. The purple line works against the movement of the graph chart in any sense of the word.

BKNG: Hidden Accumulation CuesThe big season for vacations starts this week as schools close, graduations begin, weddings increase, and families plan big vacations this year.

BKNG has had HFTs attempting to sell it down several times but it holds within a sideways trend still. This implies hidden accumulation.

If it breaks to the upside, then this sideways trend becomes support.

BKNG must do as all other high-priced stocks have done: do a big split to lower the share price to $100 - 300. When the Board does so, the stock has more potential for runs up rather than down.

$RIDE - 1:15 SplitNothing much to say here.

The situation with RIDE is the same as before. Foxconn decided to break their contract and not buy NASDAQ:RIDE at the price of $1.70 as previously agreed since the price of the stock had declined to $0.30. It seems the cost of business of just breaking contract was better for them than to actually go ahead and buy NASDAQ:RIDE shares for said price.

Lordstown / NASDAQ:RIDE had to finally implement a reverse split in order to bring their stock price back into compliance with Nasdaq's rules where a stock cannot be below the value of $1.00 for an extended amount of time. By reverse splitting, the price of the stock should go somewhere around $3.80.

OCC Memo:

-Lordstown Motors Corporation (RIDE) has announced a 1-for-15 reverse stock split. As a result of the reverse stock split, each RIDE Class A Common Share will be converted into the right to receive approximately 0.066667 (New) Lordstown Motors Corporation Class A Common Shares. The reverse stock split will become effective before the market open on May 24, 2023. Cash will be paid in lieu of fractional shares.

New Cusip: 54405Q209

Deliverables for Call/Put writers:

-The RIDE component of the RIDE1 deliverable will settle through National Securities Clearing Corporation(NSCC). OCC will delay settlement of the cash portion of the RIDE1 deliverable until the cash in lieu of fractional RIDE Shares is determined. Upon determination of the cash in lieu amount, OCC will require Put exercisers and Call assignees to deliver the appropriate cash amount.

TLDR if you wrote calls or puts, you're gonna have to have some cash in your account to deliver upon your new liabilities. I sold 1000 puts so i have something to pay here.

Technicals:

-The big wedge is coming to an end. Let's see what happens.

Fundamentals:

-Product is great, financials & backing are not great.

My opinion:

-The company is in a difficult place and has a higher chance of not making it than actually making it which is why the risk payoff on a possible reversal on this is extremely high. The risk of loss of your investment is also very high.

My positions:

-1000 calls, 1000 puts at the $0.50 strike with plans to sell that much more post split in the new chain.

What you should do:

-Probably nothing. The EV sector is a difficult place to invest in right now. You do you.

TSLA Split 2020 VS 2022Elon Cracks a Beer open on May 24 weekend in 2020.

MSM : Past performance is not an indication of future results.

Elon : Hold my Beer

The run up to TSLA splits are always exciting.

Who doesn’t want this stock?

If there is an after split rally like the other mega caps and TSLA in 2020 we should see this ascending triangle setup nicely for a run up to 1000+ before a pull back.

AMZN Amazon 20-for-1 Split on Monday, June 6AMZN Amazon was the last giant company which didn`t split its stock.

And the $2510 price was somehow prohibitive for retail investors.

The 20-for-1 Split will be more retail investor friendly and we could play some options at a decent price for AMZN.

Statistically we saw an increase in price of every company that did a stock split so far, so i expect the same for AMZN Amazon.

My price target is $2738 or its split equivalent by the end of next week.

I see an 11.30% upside from here.

Looking forward to read your opinion about it.

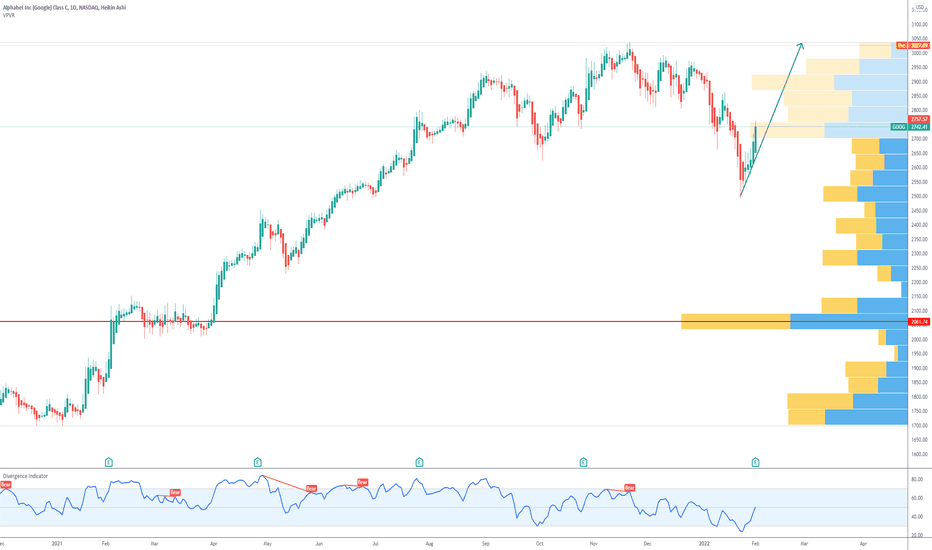

My HIGHEST CONVICTION trades of 2022 - Amazon and GoogleThis is the chart video for my Best of Us Investors production detailing why I put Amazon NASDAQ:AMZN and Google NASDAQ:GOOG as my highest conviction trades of 2022. The past tech stock splits of Apple NASDAQ:AAPL Tesla NASDAQ:TSLA and NVidia NASDAQ:NVDA inform my thesis going into these future splits.

AMZN just broke through a falling wedge (plus stock split)With AMZN pending 20-to-1 stock split this looks like a good bet right now. AMZN just broke through the top resistance of the falling wedge pattern. This is good short term and long term bet. Also if you like selling covered calls after the split AMZN will be a good stock for Covered Calls as it will be more affordable to buy in blocks of 100. If you buy 5 stocks today that will give you 100 after the split and you can sell a covered call. So buying in blocks of 5 is a good thing if you plan to sell covered calls.

Amazon 50 in 50Following Amazon stock NASDAQ:AMZN hitting the COVID low to ATH 50% Retracement on March 8th, 2022 prior to the split announcement I have been waiting for a pullback to enter on both the Retracement Level and in preparation for the pre-split (May 27th) rally I expect. Success will come from patience.

GOOG Alphabet Inc. 20-to-1 Stock SplitRuth Porat, Alphabet CFO: “The reason for the split is it makes our shares more accessible”

Alphabet Inc . 20-to-1 Stock Split on July 15 could lead to Alphabet’s listing on the Dow Jones Industrial Average , the indexs that holds 30 blue-chip companies.

And you all know how appealing were Apple , Tesla and Nvidia for retail investors after the stock splits!

My short term price target is the all time high, $3037.

Looking forward to read your opinion about it!

DELL Opportunity to Ride and Nice Push UPDell as you can see from COVID DIP March 17 2020 has been on a tear recently shedding VMWare to do it's own thing it allowed DELL to focus back on what it does best. As you can see it has been on a constant tear VERTICALLY. It will be facinating to see if it will keep this going or if it will break trend. To me basing on the indicators i would bank on it bouncing off the lower trend line and pushing to the top side as it normally has it has not had many breaks on the bottom trend line and it does to the top side circled in yellow. Pay attention to your indicators showing you neutral signs i would much rather wait for a good entry point on the Stochastic or RSI before throwing my money in the hat, but with the holidays it is a good bet to think they will run.

LONG AMZN

I AM NOT UNCERTAIN

AMZN has been moving sideways over more than 400 days now... It's time this monster wakesup....

It has good technical set up as well to play...

The trade idea in chart is just for educational purpose. Before playing anything contact your financial advisor..!!

NASDAQ:AMZN

Tesla breakout in mid august?If tesla is in a triangle and breaksout in mid August between 10-12 (note that last years stocksplit announcement was in 11 August.) then I would say Tesla would rapidly go up until the beginning of September and then drop again just like last year. That would mean my projection of $1400+ would be reached in 2 weeks which Tesla is know for having done before. Tesla follows the wyckoff pattern and has done a massive accumulation for many months now and will cause an even greater markup to distribute the bought shares by smart money at the top. Elon musk said that the company would perhaps have their company meeting in late July or early August which means that something could be decided then which could spark a move up.

This is not Financial advice only speculations.

Please comment any thoughts

PIXY - My Worst Nightmare - Down 96.64% - The KingIf anyone is new to stock market, beware of Back Split. I bought this stock years before and did NOT know what BACK split was. I thought all splits were good and happy when they announced back split. Now I am down 96.64%

SNCA Merger VotePer Delaware law the merger vote must have a majority of the shareholders agree, NOT just a majority of the shares voted, therefore not voting is the same as a NO vote

PLEASE SEND IN YOUR PROXY AND VOTE! Lost your proxy? Not sure if you had shares Feb 9th?' Call HERE:

The Proxy Advisory Group, LLC

18 East 41st Street, 20th Floor

New York, New York 10017

(212) 616-2181