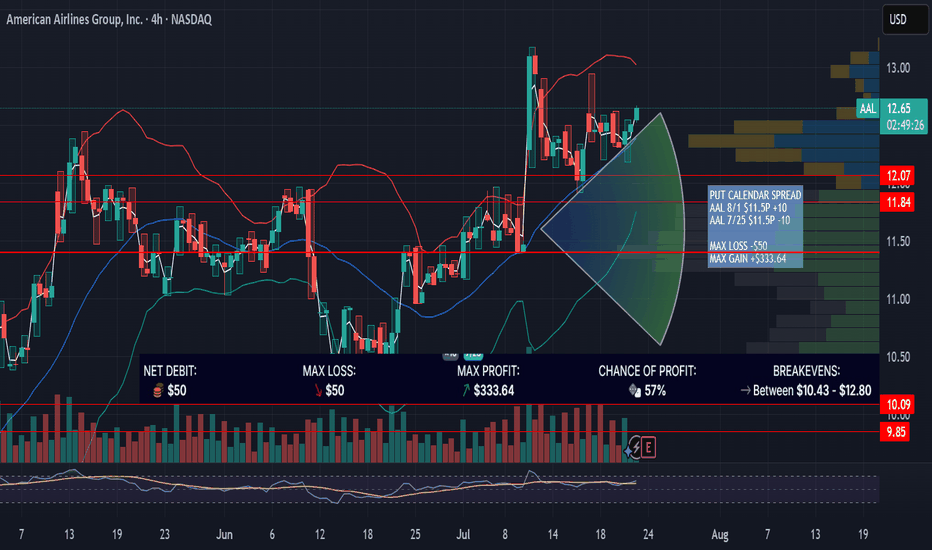

AAL PUT CALENDAR SPREAD / EARNINGSAAL is up 11% since 7/9/25 with a gap up riding on earnings of its competitor DAL. AAL earnings are in the morning on 7/24/25. Looking for a "sell the news" event with a good risk/reward options trade. This trade is designed for price to settle near the high volume node at $11.50 near expiration on 7/25/25.

PUT CALENDAR SPREAD

AAL 8/1 $11.5P +10

AAL 7/25 $11.5P -10

MAX LOSS -$50

MAX GAIN +$333.64

Spreads

DJT stock: Dead cat rebound or wave of support?Trump Media & Technology Group Corp's stock surged following news of an attempted assassination on major shareholder Donald Trump at a political rally on Sunday.

Given the fervent nature of Trump's supporters, it's plausible that voters could turn to their wallets before casting ballots in November as the presidential race heats up. Drawing parallels to the recent activity surrounding the GameStop stock, a meme rally cannot be entirely ruled out, potentially presenting a lucrative opportunity for speculators.

For this scenario to materialize, high trading volumes in the stock need to persist. The average trading volume over the past two weeks is around 10 million shares. If today's activity surpasses this figure, it could indicate sustained interest in the stock following yesterday's massive gap up and record trading volume.

Although DJT stock closed $6 lower than its opening price, it currently hovers around the crucial $40 level. If the bulls can maintain the price above this level before today's close, it could signal a further bullish trend. Conversely, if the price were to fall below the $40 mark, we might see the stock trading at its early July levels of $30.

This trade is highly speculative, and while the current political climate could easily add more fuel to the fire, it's crucial to monitor the fundamentals. DJT reported a loss for Q1, but with Q2 earnings around the corner, investors should stay vigilant. Call spreads with 30-40 DTE (shortly before Q2 earnings report) might be an interesting play here regardless of the direction you're betting on.

What is Spread in Trading | Everything You Need to Know

Hey traders,

It turned out that many newbie traders completely neglect spreads in their trading.

In this post, we will discuss what is the market spread and how it can occasionally spoil a seemingly good trade.

💱No matter what financial instrument we trade, in order to buy the asset we need to have a counterpart that is willing to sell it to us and vice versa, if we want to sell the asset, we need to have someone to sell it to.

The market provides a convenient exchange between buyers and sellers. The asset price is determined by a current supply and demand.

However, even the most liquid markets have two prices: bid and ask.

🙋♂️ Ask price represents the lowest price the market participants are willing to sell the asset to you, while 🙇♂️ bid price shows the highest price the market participants are willing to buy the asset from you.

Here is how bid and ask prices look like.

Bid and ask price are almost never equal. The difference between them is called the spread .

📈The spread size depends on liquidity of the market.

📍Higher liquidity implies bigger trading volumes and greater number of market participants, making it easier for them to make an exchange.

On such markets we see lower spreads.

📍From the other side, less liquid markets are categorized with low trading volumes, making it harder for the market participants to find a counterpart for the exchange.

On such market, spreads are usually high.

For example, current EURUSD price is 1.0249 / 1.0269.

Bid price is 1.0249 - you open short position on that price.

Ask price is 1.0269 - you open long position on that price.

The spread is 2 pips.

❗️Spreads must always be considered in a calculation of a risk to reward ratio for the trade. For scalpers and day traders, higher than usual spread may spoil a seemingly good trade.

Always check spreads before you open the trade.

Check how the spread is displayed in the trading terminal.

In 2020, for example, we saw unusually high spreads on Gold during UK/NY trading sessions. Spreads were so high that I did not manage to open a trade for a couple of days.

Not considering spreads in such a situation would cost you a lot of money.

Do you consider spread when you trade?🤓

Trading on Holidays: Liquidity and Spreads

When trading forex, it's essential to check spreads, especially during holidays.

Trading forex during holidays can be a bit more challenging due to reduced liquidity in the market.

Liquidity refers to the ease with which assets can be bought or sold without causing a significant change in price. During holidays, liquidity can be lower as many traders and financial institutions take time off, leading to fewer participants in the market.

Lower liquidity can directly impact the spread, which is the difference between the bid and ask price of a currency pair. In times of reduced liquidity, spreads tend to widen, meaning the difference between the buying and selling price of a currency pair increases. This can lead to higher trading costs for traders, as wider spreads require a larger price movement in the underlying asset before a trade becomes profitable.

It's essential for traders to be aware of these potential spread increases during holidays to avoid unexpected trading costs.

Additionally, wider spreads can also lead to slippage , where a trade is executed at a different price than expected. This can further impact trading results, especially during fast-moving markets with low liquidity.

Therefore, checking spreads during holidays is crucial for forex traders to anticipate potential increases in trading costs and adjust their trading strategies accordingly.

On TradingView, you can check the spreads in the top left corner. There you can find bid, ask prices and the spread between them.

It's important to factor in the impact of wider spreads on profitability and risk management when trading during these periods. By staying informed about spread changes during holidays, traders can make more informed decisions and better navigate the challenges of lower liquidity in the forex market.

❤️Please, support my work with like, thank you!❤️

Quality is back in focus, amidst the banking turmoilHistory never repeats itself, but it often does rhyme. The recent collapse of Silicon Valley Bank (SVB) and Signature Bank in the US and the forced takeover of Credit Suisse by rival UBS have triggered concerns of contagion across the global financial system. The current stress in the banking sector is reminiscent of the 2008 financial crisis. However, unlike the 2008 financial crisis, uncertainty is not centred on the quality of assets on bank balance sheets but instead on the potential for deposit flight.

Tough ride for Banks ahead

US regional banks have witnessed significant deposit outflows which, combined with unrealised losses on their security holdings, have seen banks consuming their liquid assets as a very fast pace. In turn, sentiment towards European banks has deteriorated. This is evident in the widening of debt risk premia, making it more expensive for banks to fund their operations. It’s important to note that banks were already tightening lending standards prior to recent events. So, lending conditions are likely to tighten further as deposits shrink at small and regional US banks and regulators respond to the new risk environment. The turn of events in the banking sector have led to higher uncertainty which is likely to be reflected in higher volatility in credit markets. So far, the impact on other sectors has been fairly contained, but a further deterioration of bank credit quality could drag other industries lower as well. We are still in the early innings, so the range of repercussions remains wide.

Traditional defensive sectors offer more protection in prior weakening credit cycles

On analysing the impact of a further rise (by 200Bps) in credit spreads on US and European debt (highlighted by the dark blue bars) we found that not all equity sectors will be impacted equally on the downside. In fact, traditional defensive sectors like utilities, consumer staples and healthcare could offer some protection in comparison to cyclical sectors such as banks, energy and real estate.

Since March 8, 2023, the steepest price corrections have been centred around the banking and commodity related sectors such as energy and materials, while technology, healthcare, consumer staples and utilities have managed to escape the rout illustrated by the grey bars. The historical sector performance (in the light blue bars) during Eurozone debt crisis (the second half of 2011), confirm a similar pattern whereby the traditional defensive sectors tend to shield investors when spreads widen.

Europe earnings hold forth despite the banking turmoil

Interestingly despite the recent banking turmoil, the global earnings revision ratio continued to show resilience in March. Europe stood out as the only region with more upgrades than downgrades. Earnings remain the key driver of equity market performance. Europe has clearly gotten off to a strong start and it will be interesting to see if European earnings expectations can hold up as credit conditions deteriorate.

Within Europe we analysed the sectors that were most exposed to the banking stress. By observing the beta of the sectors in the EuroStoxx 600 Index relative to regional banking spreads, we found that real estate, financials, industrials, materials, and energy were most exposed on the downside to the high banking stress. On the contrary, consumer staples, information technology, utilities and healthcare showed more resilience.

When the going gets tough, quality gets going

Investors should focus on companies with strong balance sheets which we often tend to find within the quality factor. Quality stocks, characterised by a higher earnings yield compared to its dividend yield alongside higher return on equity (ROE) and return on assets (ROA), would offer a higher margin of safety in periods of higher volatility.

Conclusion

While central banks in US, Europe and UK continued their hawkish stance at their most recent policy-setting meetings, the evolving banking crisis could alter the path for monetary policy ahead. Chair Powell conceded that tightening financial conditions could have the same impact as another quarter point rate hike or more from the Fed.

Given the rising concerns on the risk of banking industry contagion, shrinking corporate profits and central bank policy ahead we continue to believe that positioning your equity exposure towards the quality factor would be prudent.

5 ways to play the current macro environmentWhy We Rallied

It's been a strong few months for the S&P 500, which is up about 13% from the October lows. There were five reasons for the rally:

1) P/E ratios got attractive, especially for small-to-mid caps.

2) Inflation peaked, which historically has sometimes marked the bottom for stocks.

3) Global liquidity turned upward. Every major bond market was pricing a central bank pivot, and the big central banks (particularly Japan and China) added about $1 trillion to their balance sheets.

4) Economic data remained surprisingly strong, which raised hopes of a "soft landing."

5) Possibly there was a bit of forced buying due to a "short squeeze."

Why the Rally Is Probably Over

However, I believe we've now reached an inflection point where these tailwinds will turn into headwinds.

1) The S&P 500 and Russell 2000 P/E ratios are once again looking high (although S&P 400 and S&P 600 still look cheap). (See this report from Ed Yardeni.)

2) Inflation is no longer surprising to the downside. The last couple prints have been exactly in line with forecasts, and leading indicators of inflation have been creeping back up. See, for instance, this chart of service sector wages, this chart of copper prices, and this Goldman Sachs forecast of crude oil prices. This is partly because of the global liquidity boost and continued deficit spending , and it's partly because of China ending its Covid-zero policy and reopening its economy. (China is the largest importer of crude and the second-largest importer of liquified natural gas in the world.)

3) With inflation set to stay high, liquidity has tightened a lot. The market is no longer pricing a Fed pivot , and analysts suggest the central bank liquidity boost may be over . Stocks have now gotten significantly higher than liquidity measures would predict , which suggests they may need to come down a little.

4) Economic data are deteriorating. Leading indicators have been pointing toward recession for months , but consumer savings and a glut of job openings have helped delay it. We're definitely starting to see weakness, though. Credit card debt has soared to an all-time high , we're seeing more late payments , and the housing market is cooling off fast , with inventories of unused construction materials piling up . We've seen "soft landing" hype before: in 2000 and 2007 , just before those recessions hit. Unless the Fed pivots immediately, it's probably not "different this time."

5) The short squeeze is over for large cap tech, with most of the shorts already forced out.

Five Ideas for How to Reposition

How to trade a coming recession?

1) The obvious trade is long bonds, short stocks. Bond market valuations are very attractive relative to stocks, with bond yields only a little below the S&P 500's earnings yield, and bond markets having perhaps gotten too hawkish relative to policy rates. Given the historical correlation between 10-year yields and S&P 500 valuations, the gap that has opened between them may imply an opportunity for a statistical arb. Either stock valuations should drop or bond yields should rise. Historically, in a recessionary environment, the bond market has tended to recover first, and the stock market second. So now would be the time to long those bonds.

However , it should be noted that this recessionary environment is an unusual one in a lot of ways. Stocks have already sold off a lot, and valuations are pretty mixed. Bonds should perform well if we get a deflationary recession that allows to Fed to lower rates, but a stagflationary recession might force the Fed to keep rates high even as the economy stumbles. Thus, it may be worth getting a little more specific with our trade. Here are some other ideas:

2) Long investment-grade bonds, short high-yield bonds. If recession is coming, then high-yield spreads are probably way too low . It's possible that high-yield bond rates will rise even as investment-grade, Treasury, and policy rates fall.

3) Long high-quality small- and mid-caps, short low-quality large caps. In my opinion, large cap tech is still way too crowded. I wouldn't want to short Microsoft right now, given the success of Bing AI. But I'd be willing to take a swing at Amazon, Apple, and Netflix as long as I could balance the risk by longing some cheap, quality smalls and mids on the other side. In my opinion, the size factor is ripe for disruption. If you'd asked me two years ago, I would have said that AI would most benefit large cap tech. Now I think it will most benefit smalls. What changed between now and then is that AI went from being the exclusive domain of big companies to being publicly available at shockingly low cost. This happened way faster than I ever would have guessed, and you better believe that small, agile companies will capitalize on the opportunities provided by access to AI!

4) Long cash to buy the dip on energy stocks. Energy historically has struggled in a recession, so it's quite likely that energy stocks will see some downside soon. However, the current free cash flow yield on energy stocks is quite high , and the sector trades at 10x forward P/E . Meanwhile, investment in the sector is still much too low . I believe there will be a decade-long structural bull market in energy due to constrained supply, but that there will probably be some recessionary pain first. Meanwhile, money market funds offer a really high return on cash. My Fidelity money market is giving me almost 4%. Ain't nothing wrong with just collecting that money market rate and waiting for energy stocks to dip for the buy and hold.

With retail investor inflows at an all-time high , I believe the current market environment offers a good opportunity for savvy bears to execute some well-constructed long-short trades. If you look at how the smart money is positioned, it's pretty much the opposite of retail positioning here. There will be a time to get bullish on US large cap stocks, but we probably need to see some weakening of coincident economic indicators like employment first. (Stocks tend to do best when unemployment rates are high .) Remember, market positioning beats market timing, but ideally you could do a little of both!

Thanks for reading, and please share your ideas in the comments below!

💡 SPX 0DTE Trading - Nov 28’22 4025/4030 Bear Call Spread💡 SPX 0DTE Trading - Nov 28’22 4025/4030 Bear Call Spread

Credit Received: $95

The equity net short positioning is gone, but we are far from a meaningful net long. Skew has caught a bid (put demand > call demand) lately as participants have closed out equity shorts. The increase in skew suggests people are switching into hedging the downside via puts, instead of running delta 1 shorts (short stock).

In other words, in the case of a negative catalyst participant hedging may pressure markets lower and would quickly bid implied volatility. There may be a grab for some protection in the AM as participants await new data on 11/30.

Ultimately we continue to view $4,000 as fair value due to balanced gamma (calls + puts) tied to that strike and this may invoke mean reversion activity today.

If I am wrong on direction and the market rallies in the AM, I will simply convert to a butterfly. $4025 is our upside pin forecast.

Corporate Credit Conditions Part 1Since credit has far greater potential to create systemic issues than does equity, corporate credit conditions are much more important to the Federal Reserve (Fed) than changes in equity prices. If you have interest in macro, monitoring and understanding the basics of corporate credit is a must have skill. If there is any one thing that might actually cause a Fed pivot, it is disfunction in this market.

There is a significant amount of current commentary around the sharply higher all-in-yields of high yield (HY) and investment grade (IG) corporate debt. In most cases the pieces conflate extreme price weakness in the large credit ETFs (HYG & LQD) with credit distress. Most pieces seem to conclude that the declines are linked to declines in credit quality and highlight financing problems in the sector. Most of that commentary suffers from a misunderstanding of the relationship between credit and Treasury spreads, what the price declines/yield increases are communicating about macro conditions, and how vulnerable companies, particularly IG companies, are being forced to refinance into a higher rate environment.

In February 2022 I published a piece on credit conditions that covered using the TradingView platform to monitor secondary market credit spreads and conditions, why the declines in most credit ETFs had nothing to do with credit quality, and the basics of monitoring credit on the platform. That piece is linked below.

The short course: 1) Corporates trade at a yield spread to treasuries. The spread compensates the corporate debt investor for the higher risk of default. 2) If Treasury yields rise, their dollar price declines. Since corporates trade at a yield spread to treasuries, if treasury yields rise, so do corporate yields (prices decline). 3) Since corporate spreads are generally far less volatile than Treasury yields, in most time periods, corporate total returns are driven by changes in Treasury yields rather than changes in corporate spreads. 4) The lower the credit quality, the wider the spread or default compensation. For instance, BBB rated corporates have more credit risk and thus more spread/yield above Treasuries than A rated bonds, 6.27 verses 5.65%. The difference of 62 basis points is the markets compensation (risk premium) for owning the riskier bond.

The chart is a weekly chart of the option adjusted spread (OAS) of the ICE BofA Corporate Index back to the 1997 index inception. OAS is the standard way of assessing the credit spread compensation over and above the Treasury rate. The higher the OAS, the more compensation the investor receives. The bands are plotted 1 and 2 standard deviations above and below the from inception date median value. The large spikes higher in 2008 and 2020 are the great financial crisis and the pandemic. Spread compensation is only now back to the long term median. This after spending most of the last decade trading nearly a standard deviation rich to the long term median. I view this as the residual of the Feds QE translating to richer than normal asset prices.

In short, there is no evidence of credit distress in the broad IG market. There is also, at least in this chart, no compelling value argument to be made. However, credit spread is only part of the equation. Remember that corporate total returns are more a function of changes in base or treasury rates than in changes in corporate spreads.

In the next installment we will focus on the IG and HY markets in detail, some fundamental observations and finally, the correlation between rates and the major credit ETFs.

And finally, many of the topics and techniques discussed in this post are part of the CMT Associations Chartered Market Technician’s curriculum.

Good Trading:

Stewart Taylor, CMT

Chartered Market Technician

Taylor Financial Communications

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

A Minsky Moment is ComingThe economy has been going into the toilet for a while now. All the NBER coincident indicators are trending down to 0% growth. Some leading macro indicators have actually flashed negative. Housing volume is crushed, the treasury has started pricing in recessionary conditions while the credit market has been twiddling their thumbs expecting a soft landing (even bitcoin foolishly climbed to 25k on distorted hope, and some think that's going to happen again because of Elliot Waves and Fibonacci, the prophets of TradingView). But that is now changing, with the biggest drop still to come, and lessons will be taught all around.

We will probably have mass layoffs in Q4, based on the condition of deteriorating employment. The non-farm payroll survey, which does not survey households, is still downtrending in spite of double or even triple counting people holding two or three jobs as two or three employed. Household survey is dropping. People are starting to work less hours, which means there is trouble ahead for employment and the soft landing narrative.

We are still waiting for that turning point where the credit market and broad economy realizes a recession is unavoidable. And now, over the weekend, retail finally gets a headline it can work with: Bed Bath and Beyond CEO jumps to his death. I'm not going to short this index, its still too risky and I will keep my existing crypto shorts while rolling over everything else into USD and TLT; but I can see why one would short it. Things are rapidly coming to their crescendo, and the credit market will resume pricing in reality soon, if not on Tuesday.

2022: SPY woke up after labor day, wearing white, and chose violence.

Happy trading, fart knockers.

What is Spread in Trading | Trading Basics 📚

Hey traders,

It turned out that many newbie traders completely neglect spreads in their trading.

In this post, we will discuss what is the market spread and how it can occasionally spoil a seemingly good trade.

💱No matter what financial instrument we trade, in order to buy the asset we need to have a counterpart that is willing to sell it to us and vice versa, if we want to sell the asset, we need to have someone to sell it to.

The market provides a convenient exchange between buyers and sellers. The asset price is determined by a current supply and demand.

However, even the most liquid markets have two prices: bid and ask.

🙋♂️Ask price represents the lowest price the market participants are willing to sell the asset to you, while 🙇♂️bid price shows the highest price the market participants are willing to buy the asset from you.

Bid and ask price are almost never equal. The difference between them is called the spread.

📈The spread size depends on liquidity of the market.

📍Higher liquidity implies bigger trading volumes and greater number of market participants, making it easier for them to make an exchange.

On such markets we see lower spreads.

📍From the other side, less liquid markets are categorized with low trading volumes, making it harder for the market participants to find a counterpart for the exchange.

On such market, spreads are usually high.

For example, current EURUSD price is 1.0249 / 1.0269.

Bid price is 1.0249 - you open short position on that price.

Ask price is 1.0269 - you open long position on that price.

The spread is 2 pips.

❗️Spreads must always be considered in a calculation of a risk to reward ratio for the trade. For scalpers and day traders, higher than usual spread may spoil a seemingly good trade.

Always check spreads before you open the trade.

In 2020, for example, we saw unusually high spreads on Gold during UK/NY trading sessions. Spreads were so high that I did not manage to open a trade for a couple of days.

Not considering spreads in such a situation would cost you a lot of money.

Do you consider spread when you trade?🤓

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Trying to understand spreads betterNeed help understanding these spread futures charts. The daily time frame and the hourly time frames show different prices. In the picture I drew a ray going across at 961, on the daily you can see may 18th it hit the ray, on the hourly it did not. So which one was right? I have been wanting to put alerts on here, but the alerts are going off all over the place, I cant tell whats real and whats not.

Macroeconomic: Long Bonds/Stocks, Short GoldGold bug's biggest complaint is ALWAYS manipulation of Gold prices... Enter: exhibit 1.

This is the spread between Bonds and Gold, and it has reached maturity and should reverse from here IMHO.

With yields at 3%, banks will enter the bond market en masse, hedging that position with a short on Gold.

With yields finally attractive, the US DX will also continue to rally which will be good for both bonds and stocks.

For Gold, here you can see the EW justification for a return to lower levels as part of a 4th wave (before eventually making new highs).

Then a zoom in on the current breakdown:

I think a short position in Gold is justified, as well as long Stocks. The bottom in Bonds has not yet shown itself but could be any minute or day IMHO.

I think the biggest risk to this macroeconomic analysis is that we will see a deflation across multiple assets as a result of rising rates, which will be apparent if stocks don’t rally and bonds continue lower.

Continuous Corn SpreadsWhen carry out stocks are plentiful and the market structure is more definable, spreads seem easy to manage.

In the current domestic and world market structure of strong demand and less supply, it seems that trying to add value to hedges with capturing carry may be more of a risk play.

It is wise to manage the risks we know and the risks we can.

Carry Spreads have their limits, Inverse markets have no Rules

Continuous Bean SpreadsWhen carry out stocks are plentiful and the market structure is more definable, spreads seem easy to manage.

In the current domestic and world market structure of strong demand and less supply, it seems that trying to add value to hedges with capturing carry may be more of a risk play.

It is wise to manage the risks we know and the risks we can.

Carry Spreads have their limits, Inverse markets have no Rules

IWM 180/175 SpreadThis idea is related to my earlier idea. Check it out there for logic as the logic for this trade was essentially the same. In addition to the logic:

1. The return profile was there 10% Return on Margin

2. Appropriate Delta

3. Lovely Cushion / Level for the trade.

See linked idea for technical logic

TLT Call Credit Spread 149/152 call credit spread - Filled for 0.36 - >10% Return on Margin

I believe that the 20 years will continue downwards with rate hikes. As such I have setup this call spread to take advantage of the downward move. This position was opened on Jan 11th but I just got around to posting. See blue vert line for entry date Candle.

Additional premium was collected due to selling on a up day, entry now can be had for a similar credit if not more.

QQQ Put Credit SpreadI believe tech will remain strong, and this trade also has a large margin of error.

Opened for a 0.40 Credit.

Looking at the chart, this trade lines up perfectly with a support zone, in addition QQQ is still trending upwards on a quarterly basis. This is a bit of a reversion trade in the sense that I am taking advantage of the pullback to collect adequate premium at a low delta short strike ( 0.14 or 1.4 STD).

This trade in combination with the XLE trade from yesterday has shifted my portfolio from Delta neutral to a small long market bias.

Substitution Spreads Can Identify ValueMarket structure is the various puzzle pieces that can reveal valuable clues about the path of least resistance of prices. Fundamental analysis involves pouring through supply and demand data to forecast price direction. However, market structure can simplify the process as each jigsaw puzzle piece will complete an emerging picture. Market structure reflects price relationships that develop over time. Each commodity has idiosyncratic supply and demand characteristics. Price differentials in intra or intercommodity spreads can assist market participants in arriving at high-odds directional forecasts.

Substitution spreads are another part of market structure

The platinum versus gold spread- Financial substitution leads to value assumptions

Oil, coal, and natural gas- Energy substitutes can reveal clues

Think outside the box when analyzing a commodity- It’s all about choices

Over the past weeks, we have looked at how processing spreads provide clues about the supply and demand side of a commodity’s fundamental equation. We looked at term structure, backwardation, and contango and how price differentials for one delivery date versus another are real-time indicators of deficit or glut conditions. Location spreads shed light on the price of a commodity in one region versus another, while quality spreads tell us how different compositions or sizes can influence prices compared to benchmarks and put upward or downward pressure on futures prices.

Those spreads are all intra-commodity spreads. This week, we will investigate how inter-commodity spreads play a role in price direction. Substitution spreads reflect the price of one commodity versus another when they can serve the same or similar purposes when prices dictate.

Substitution spreads are another part of market structure

Markets reflect the crowd’s wisdom. Crowds tend to be wise consumers; they search for value and the best deal. When the price of a commodity rises to a level where a substitute makes more economic sense, many consumers will alter their buying behavior. Think of a trip to the supermarket. When shoppers plan to make a juicy steak for dinner and find out that a pork chop is a far better economic choice, they often choose pork over beef.

I like to call the live cattle versus lean hog futures spread the what’s for dinner spread, and it is an inter-commodity, substitution spread.

The quarterly chart of the price of live cattle futures divided by lean hogs shows that while the spread has an upward bias, the long-term average or pivot point is around the 1.40:1 level or 1.4 pounds of pork value in each pound of beef value. When the spread is above 1.4:1, pork is a wiser economic choice for consumers; when below the mean, beef is the optimal choice. While the spread can diverge from the midpoint, it has tended to revert to the norm since the turn of this century.

The chart of the June 2022 live cattle lean hog spread shows the relationship is right around the long-term average, indicating that beef and hog prices are at a long-term “fair value” level.

The beef versus pork spread is an inter-commodity barometer for consumer behavior. Meanwhile, the corn-soybean inter-commodity spread can serve as a guide for producer behavior.

The chart of the price of nearby soybean futures divided by corn futures shows that the pivot point dating back to the late 1960s is around the 2.4 bushels of corn value for each bushel of soybean value. Farmers are business people who work each crop year to create the optimal return on their acreage. Many can plant either corn or beans on their land. They grow the crop that offers the best return. When the corn-bean ratio spread is above 2.4:1, soybeans tend to provide the best financial result; when below the pivot point, corn is the more profitable choice.

The corn-bean relationship is most useful when looking at new crop futures before and at the beginning of the annual planting season.

The chart of the price of new crop November 2022 soybean futures divided by new crop December 2022 corn futures illustrates at below 2.26:1, on November 12, 2021, farmers are more likely to plant corn than beans as the coarse grain is more expensive and offers a better historic return than the oilseed.

The meat and grain inter-commodity spreads are guides. Many other factors could influence the levels, which are additional variables in the calculus of analyzing commodity prices. For example, a pork shortage in China because of disease could lift pork prices, or an outbreak that impacts cattle could do the same to beef. Since corn is the primary input in producing US ethanol, the shift in US energy policy could shift the corn-bean spread for fundamental reasons. However, these types of spreads that measure current price relationships versus historical means can be a helpful tool that may validate other assumptions.

The platinum versus gold spread- Financial substitution leads to value assumptions

In the world of precious metals, platinum and gold have far different supply and demand characteristics, but the two precious metals share some similarities. Platinum and gold have industrial applications, while they also have financial properties as means of exchange and stores of wealth for investors.

It is a challenge to label the price of any commodity cheap or expensive because the current market price is always the correct price as it is the level where buyers and sellers meet in a transparent market, the exchange. However, comparing the price of gold to platinum allows us to use the terms cheap and expensive on a historical basis.

The chart of the nearby platinum futures price minus the nearby gold futures price dating back to the early 1970s shows that from 1974 through 2014, platinum mostly traded at a premium to gold. While the spread has been as high as over a $1,000 premium for platinum to as low as a $1,000 discount to gold over the period, over the past 47 years, platinum has traded at a premium to gold nearly 85% of the time. It has only been over the recent seven years, since 2014, that platinum has been lower than the yellow metal. Many factors can explain platinum’s weakness versus gold, but on a historical basis, platinum is historically inexpensive compared to its precious yellow cousin.

At a $780 discount for platinum compared to gold, some investors have been stockpiling platinum because the inter-commodity spreads reflect compelling historical value for the metal.

Oil, coal, and natural gas- Energy substitutes can reveal clues

Energy prices can be highly volatile. While the world moves to address climate change by reducing the production and consumption of fossil fuels in favor of alternative renewable energy sources, hydrocarbons continue to power the world. When it comes to electricity production, power generation can come from many different sources. The world may be moving towards solar, wind, hydroelectric, and nuclear generations, but oil, gas, and coal continue to be significant energy sources.

Coal has been a four-letter word for many years, and many mining companies abandoned coal mining. The recent surge in oil and gas prices caused an almost perfect bullish storm in the coal market. Low supply levels and rising demand pushed prices to record highs in October.

The chart of thermal coal for delivery in Rotterdam, the Netherlands, shows the rise to a high of $280 per ton in October 2021, surpassing the 2008 $224 previous high. The spike higher in coal was a function of rising oil and gas prices, which is the essence of the inter-commodity spread within the fossil fuel sector.

Crude oil and natural gas are highly volatile commodities. There is always the potential for substitution when prices diverge from historical means.

The quarterly chart of the price of nearby NYMEX crude oil futures divided by the price of nearby NYMEX natural gas futures shows that the average of the high and the low since 1990, when natural gas futures began trading, is around the 20-25:1 of the natural gas price measured against the crude oil price. Below that band, natural gas tends to be historically expensive, while above the average level, crude oil becomes historically expensive compared to gas.

The daily chart of the relationship in the December futures contracts shows below the 17:1 level; natural gas is cheaper than oil based on the historical relationship over more than three decades.

Think outside the box when analyzing a commodity- It’s all about choices

Inter-commodity or substitutions spreads create a basis for comparison. Many other factors can explain deviations from historical norms but understanding and comparing the current levels to history is a valuable tool that can lead to a more robust level of analysis.

On their own, substitution spreads are insufficient to make conclusive trading or investing decisions as deviations can last for years or even decades, moving pivot points higher or lower. However, used in conjunction with processing spreads, term structure, location, and quality spreads, they are another puzzle piece that can reveal and validate assumptions about the path of least resistance for a commodity’s price.

I will be off next week but will return on Monday, November 29, with the final piece in this series and the final piece of the puzzle, the power of the crowd.

---

Sign up for our Monday Night Call using the link below. You can also sign up to receive these articles early using the other link provided below.

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

Market Maker Sweet Spot CalculationsIWM Market Maker Sweet Spot Calculations

NOVEMBER 2, 2021

How do we get to the Sweet Spot

Derived from the amount of OPEN INTERESTS multiplied with 100 shares per contract times mid price gives us a good estimate what money is at stake and where the Market Maker will make the most money, or better said will lose the least! This is the spot where the market maker wants to be every Friday when there is Option Payday.

The further text will not fit here since this introducing broker has no money to implement a nice editor or allows content provider to publish content without paying. Also for violating their rules some of my blogs got hidden. You will find me on Twatter.