The Stock Market Decline Appears to be only in the US as of nowLast week on one of my member live videos I pointed out to the attendees that European markets were currently at, or very close to their All-Time highs...whereas in the US, we've entered the technical definition of a stock market correction...(down 10%). If you're so inclined to Google an economic calendar, it also appears the economic metrics like CPI, unemployment, etc... appear much better as well. There's an old adage in the markets.... "When the US sneezes, the global economy catches a cold" . However, at this very moment in time, the only thing that appears sick is the US. Maybe that changes with time. I suspect that will be the case...but in any event, one thing that is clear is that our stock market indices are signaling that whatever economic sickness is to be contracted, it will have originated here...in the United States.

That is certainly a new phenomenon.

For the past couple years I have been warning my members (and followers here on Trading View) of a long-term top in the stock markets. Week after week in my trading room, I have commented that I believe I have all constituent waves accounted for, to the best of my ability, to say with a high degree of confidence that a super-cycle wave (III) has topped .

What we have lacked is the price action to confirm that statement. This morning, I cannot tell you we have confirmation. That confirming probability only comes when price declines below the area of the wave 4 of one lesser degree. That area is outlined in the SPX daily chart entitled the "Must Hold Region". We are not there yet, nor do I think price makes a bee-line there in one shot. Therefore, I am NOT in panic mode this morning because I do believe we need a retrace higher and only that retracement's structure will inform us the higher probability of future price subdivisions....(higher or lower).

Panic is the necessary trader behavior needed to decline in such fashion as I believe a super cycle wave (IV) will start out. However personally, I do not think it's today. Futures are red this morning and closer to the recent lows than last week...the headlines surrounding the stock market appear very negative...but as of this morning, the MACD indicator on intraday charts is saying this type of sentiment is getting slightly weaker and NOT making new lows.

Therefore, I continue to maintain the price and technical indications tell me a minor B is either currently underway, or will be confirmed in the short term. Until those parameters get flipped, I'll reserve my panic (so to speak) for the c of (c) of intermediate (A) into the must hold region later this year... where it will probably be justified at that time.

Best to all,

Chris

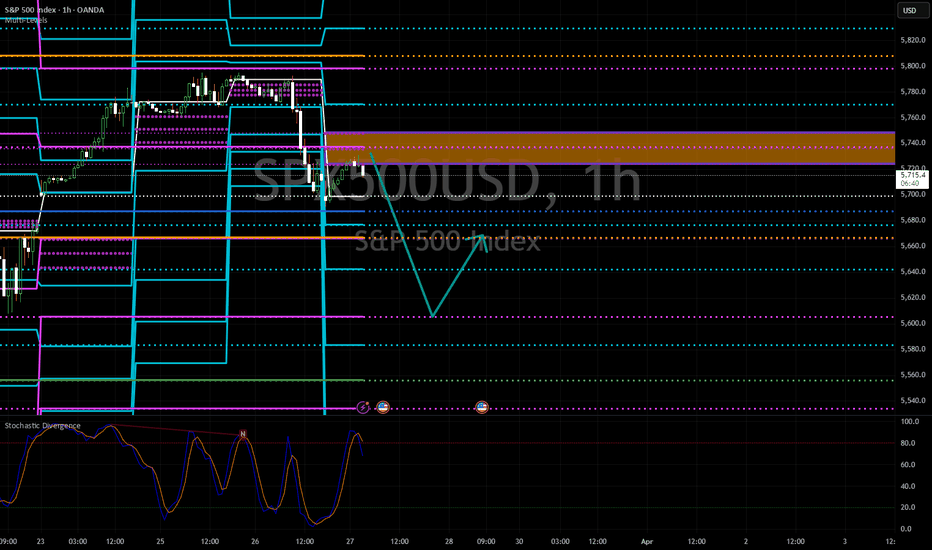

SPX (S&P 500 Index)

SPX: tariffs combined with inflationInflation expectations are on the rise again in the US. As markets are closely watching developments with trade tariffs, in combination with increasing inflation, the sentiment ended the week in a red zone. During the week, the S&P 500 was struggling to sustain a bit of positive sentiment, however, Friday's trading session brought back significant sell off of stocks. The week started at 5.780, but it ended at 5.580, losing 1,97% on Friday. In the last six weeks, the index spent five weeks in negative territory.

Tech companies were the ones that dragged the rest of the market to the downside. META and Amazon were down by 4,3%, Apple dropped by 2,66%, Tesla lost 3,51% in value. Trade tariffs are still a cloud which brings high uncertainty to the market. News reported that both Canada and the European Union are considering reciprocal measures as a response to the imposed US tariffs. The US Administration announced last week potential 25% tariffs on all car imports to the US. As long as this kind of trade war is in the open space, it could not be expected that the market would consolidate and stabilize. In this sense, further high volatility might be expected. In the week ahead, the NFP and unemployment data for March will be posted, so this would be a day to watch.

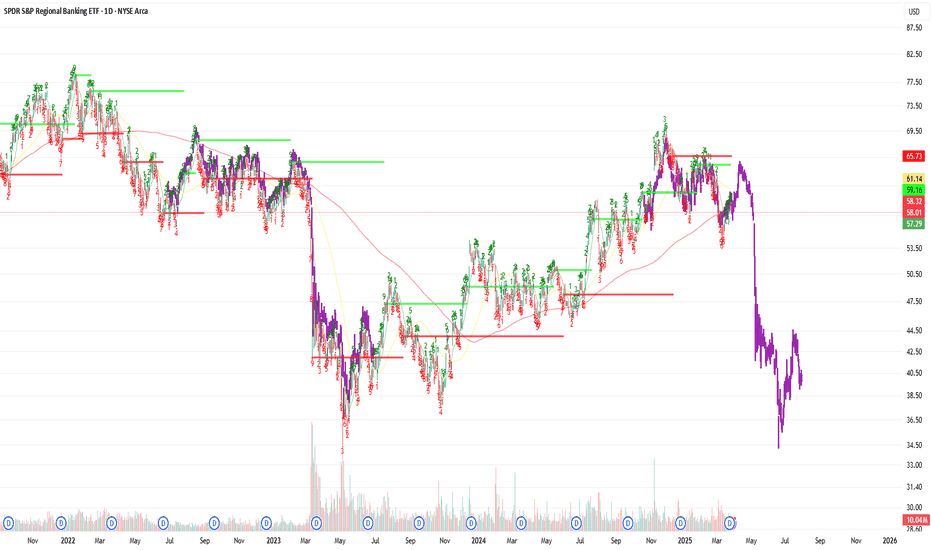

$KRE CRASH COMING ... Not yet tho..we'll find out..Regional Banks seem to be heading on a slippery path identical to the most previous crash pattern back when they needed all the loan Bailouts. Now that all the loans have stopped, I'm sure some banks may be heading towards loan restructuring perhaps, maybe defaults, I'm not sure honestly. I just know that the chart never lies and I've been watching and waiting for a long while. I predicted the first crash back then and I currently have no doubts with the current chart ahead of me. As always, I will do my best to provide the best insight possible into these speculations. Currently we have the Daily breaking trend and the bar count getting close to the previous 141 bars. The only difference is that we bounce off the 100% retracement. If we continue to lose the 1.27, we'll be headed for the 1.61..... updates soon.

Weekly $SPY / $SPX Scenarios for March 31 – April 4, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📈 Anticipated U.S. Jobs Report: The March employment data, set for release on Friday, April 4, is expected to show a slowdown in job growth, with forecasts predicting an increase of 140,000 nonfarm payrolls, down from 151,000 in February. The unemployment rate is projected to remain steady at 4.1%. This report will be closely monitored for signs of economic momentum and potential impacts on Federal Reserve policy.

🇺🇸💼 President Trump's Tariff Announcement: President Donald Trump is scheduled to unveil his "reciprocal tariffs" plan on Wednesday, April 2, dubbed "Liberation Day." The announcement is anticipated to include a 25% duty on imported vehicles, which could significantly impact the automotive industry and broader market sentiment. Investors are bracing for potential volatility in response to these trade policy developments.

🇺🇸📊 Manufacturing and Services Sector Updates: Key indicators for the manufacturing and services sectors are due this week. The ISM Manufacturing PMI, scheduled for Tuesday, April 1, is expected to show a slight contraction with a forecast of 49.5%, down from 50.3% in February. The ISM Services PMI, set for release on Thursday, April 3, is projected at 53.0%, indicating continued expansion but at a slower pace. These reports will provide insights into the health of these critical sectors.

MarketWatch

📊 Key Data Releases 📊

📅 Monday, March 31:

🏭 Chicago Business Barometer (PMI) (9:45 AM ET):

Forecast: 45.5

Previous: 43.6

Measures business conditions in the Chicago area, with readings below 50 indicating contraction.

📅 Tuesday, April 1:

🏗️ Construction Spending (10:00 AM ET):

Forecast: 0.3%

Previous: -0.2%

Indicates the total amount spent on construction projects, reflecting trends in the construction industry.

📄 Job Openings (10:00 AM ET):

Forecast: 7.7 million

Previous: 7.7 million

Provides insight into labor demand by measuring the number of job vacancies.

📅 Wednesday, April 2:

🏭 Factory Orders (10:00 AM ET):

Forecast: 0.6%

Previous: 1.7%

Reflects the dollar level of new orders for both durable and non-durable goods, indicating manufacturing demand.

📅 Thursday, April 3:

📉 Initial Jobless Claims (8:30 AM ET):

Forecast: 226,000

Previous: 224,000

Measures the number of individuals filing for unemployment benefits for the first time, providing insight into labor market conditions.

📊 Trade Balance (8:30 AM ET):

Forecast: -$123.0 billion

Previous: -$131.4 billion

Indicates the difference between exports and imports of goods and services, reflecting the nation's trade activity.

📅 Friday, April 4:

💵 Average Hourly Earnings (8:30 AM ET):

Forecast: 0.3%

Previous: 0.3%

Measures the change in earnings per hour for workers, indicating wage inflation.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

BRIEFING Week #13 : ETH offers perfect opportunityHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

TESLA is up 47X vs the SPX. Can it do another 6.9X?An extraordinary unicorn enterprise, or a collection of companies and intellectual properties, led by the most prominent CEO in the history of public companies.

TESLA and ELON are impossible to overlook, and this chart has kept many observers on the sidelines for over 14 years. In the initial 6 to 9 years, Wall Street analysts and commentators failed to grasp the bigger picture, focusing excessively on the balance sheet and evaluating the company merely as an automaker. They completely missed the groundbreaking technologies being developed and advanced.

Today, we stand on the brink of fully autonomous vehicles becoming commonplace, artificial intelligence integrating into our everyday lives, and affordable space exploration becoming a reality, not to mention the myriad of other innovative technologies emerging from this remarkable company.

Individuals often enjoy predicting market peaks and labeling stocks as overvalued.

However, this chart comparing Tesla to the S&P 500 indicates that the stock may be gearing up for another surge to new heights.

Picture 10 million robotaxis cruising through our streets.

Envision a fleet of vehicles that not only generates income but also undergoes upgrade cycles, in contrast to traditional cars that face maintenance cycles, and are bogged down by Human operator's.

This development is poised to significantly transform the self-hailing ride-sharing market and the food delivery sector, potentially eliminating the role of human drivers.

In fact, Uber could very well become Tesla's largest client!

SPY Price Projection: Mid-2025 TargetRevealing Market Trends: Logarithmic Regression Analysis Indicates Bullish Path for SPY

In the ever-evolving realm of financial analysis, the search for reliable predictions remains ongoing. Logarithmic scale regression analysis, coupled with potent indicators, has emerged as a promising tool for discerning trends, particularly regarding assets like the SPY.

This analysis delves into the utilization of logarithmic scale regression alongside two robust indicators, offering insights into the potential trajectory of the SPY's price movement. It's essential to note that the interpretations and predictions presented are based on my analysis alone and should not be construed as financial advice. As with any market analysis, uncertainties persist, and actual outcomes may diverge from projections.

Logarithmic scale regression accounts for the exponential nature of price movements, providing a nuanced perspective on long-term trends. When combined with indicators such as moving averages or momentum oscillators, the analysis gains depth, revealing not only the direction but also the strength of the trend.

After meticulous examination of historical data and the application of analytical tools, our analysis suggests a bullish trajectory for the SPY, with a projected price nearing 620 EUR by mid-2025. This projection implies a significant uptrend from the current date, with a potential increase of approximately 20% over the specified timeframe.

However, it's crucial to approach such forecasts with caution, recognizing the inherent risks associated with financial markets. While our analysis indicates a positive outlook, market conditions can change rapidly, leading to deviations from expected trends.

In summary, logarithmic scale regression analysis, supported by robust indicators, offers valuable insights into market trends and potential price movements. While our analysis suggests a bullish sentiment for the SPY, investors should conduct thorough research and seek professional advice before making investment decisions.

Disclaimer: The analysis provided is based on personal interpretation and should not be considered financial advice. Investing in financial markets carries risks, and actual outcomes may differ. Readers are encouraged to conduct their own research and consult with financial professionals before making investment decisions.

S&P 500 Technical Breakdown – Bearish Momentum Building?Looking at this SPX Daily Chart, we’re seeing some clear signs of weakness in the market.

🔹 Breakdown from the Rising Channel – After months of uptrend, SPX has broken below its previous rising channel, signaling potential downside ahead.

🔹 Failed Recovery Attempt – The recent bounce formed a bear flag (highlighted in brown), but today’s sharp drop indicates that the relief rally has been rejected.

🔹 Key Fibonacci Levels in Play –

The 0.382 Fib retracement was acting as support, but price has now slipped below it.

Next key level: The 0.5 Fib (around 5,550) and the 0.618 Fib (near 5,438) could act as crucial support zones.

A deeper retracement to 4,982 (0.786 Fib) isn't out of the question if selling pressure accelerates.

🔹 Moving Averages & Volume –

The price is now under the 200-day moving average (blue line), which is typically a bearish signal if confirmed.

Volume has been increasing on red days, hinting at stronger selling conviction.

🔹 Support & Resistance Zones –

Resistance: ~5,822 (recent bounce level) and ~6,097 (previous high)

Support: ~5,402 and ~4,982 if selling intensifies.

🚨 Final Thoughts: The technical structure is turning bearish, and if the S&P 500 doesn’t reclaim key levels soon, further downside could be on the horizon. Bulls need to step in fast to avoid a deeper correction.

My last warning To Donald Trump and Americansif you Attack Iran's infrastructure, America enters a shitty situation that will last for not years but for decades. you can fix the problem by supporting the Iran's King Reza Pahlavi and the people and the mullahs will be overthrown easily but you are Unknowingly doing it in a very wrong way, if you do it Stockholm syndrome will happen.

----

Price has ping on the channel edges. I hope it becomes just a simple correction but Americans ego is is in line with technicals.

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$537.50

Sleep: 8 hour, Overall health: Energized

As mentioned in our trade recap video yesterday, today was suppose to be really bearish and go down more,

However, the inflation report ended up being really bad and that just crashed the market all day.

I was expecting to see some bounces here and there along the way but it was just straight drill with no buyers in sight.

Daily Trade Recap based on VX Algo System

8:24 AM Market Structure flipped bearish on VX Algo X3! Look to STR at 1 min MOB or resistance.

11:10 AM VXAlgo NQ 10M Buy Signal

3:36 PM VXAlgo NQ 48M Buy Signal

S&P500 Huge retest of former Channel Down.S&P500 / US500 took a big hit today following the higher than expected PCE, causing a price rejection on the 4hour MA50.

So far however the drop stopped exactly at the top of the former Channel Down of February-March.

With the 4hour RSI on the same level as March 10th, if this level holds, it will be a huge retest buy signal and will start a new bullish wave.

Based on this, we'd expect the 1day MA50 to be targeted at 5,850.

Follow us, like the idea and leave a comment below!!

S&P to find buyers at current market price?US500 - Intraday

Closed the day little net changed.

An overnight negative theme in Equities has led to a lower open this morning.

Immediate signals are hard to interpret.

Bespoke resistance is located at 5853.

Bespoke support is located at 5536.

Dips continue to attract buyers.

We look to Buy at 5609 (stop at 5572)

Our profit targets will be 5719 and 5853

Resistance: 5719 / 5737 / 5853

Support: 5616 / 5607 / 5536

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nightly $SPY / $SPX Scenarios for March 28, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📊 Core PCE Inflation Data Release: The Personal Consumption Expenditures (PCE) Price Index for February is set to be released. Economists anticipate a 0.3% month-over-month increase and a 2.5% year-over-year growth, aligning with previous figures. As the Federal Reserve's preferred inflation gauge, this data could influence monetary policy decisions.

🇺🇸🛍️ Consumer Spending and Income Reports: February's personal income and spending reports are due, with forecasts indicating a 0.4% rise in personal income and a 0.5% increase in personal spending. These figures will provide insights into consumer behavior and economic momentum.

🇺🇸🏠 Pending Home Sales Data: The Pending Home Sales Index for February is scheduled for release, with expectations of a 2.0% increase, following a 1.0% rise in January. This index offers a forward-looking perspective on housing market activity.

📊 Key Data Releases 📊

📅 Friday, March 28:

💵 Personal Income (8:30 AM ET):

Forecast: +0.4%

Previous: +0.9%

Measures the change in income received from all sources by consumers.

🛍️ Personal Spending (8:30 AM ET):

Forecast: +0.5%

Previous: -0.2%

Tracks the change in the value of spending by consumers.

📈 PCE Price Index (8:30 AM ET):

Forecast: +0.3% month-over-month; +2.5% year-over-year

Previous: +0.3% month-over-month; +2.5% year-over-year

Reflects changes in the price of goods and services purchased by consumers.

🏠 Pending Home Sales Index (10:00 AM ET):

Forecast: +2.0%

Previous: +1.0%

Indicates the number of homes under contract to be sold but still awaiting the closing transaction.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

S&P500 Do you really want to bet against the market??We have done a number of multi-decade analyses on both S&P500 (SPX) and Dow Jones over the years. Especially in times of high volatility, such as the current ones amidst the tariff wars, the long-term macro-economic analysis always helps to keep the most objective perspective.

And as you see in the wide picture of SPX's 35-year Cycles, the current 3-month correction is nothing but a technical pull-back that justifies the rule. The 1M MA50 (blue trend-line) tends to be the main Support during the Bull Phase and then it breaks, the Bear Cycle starts that drops even below the 1M MA200 (orange trend-line).

Right now, assuming the current Cycle that started after the early 2009 Housing Crisis bottom, will be as long as the previous one at least, we are headed for the 0.5 Time Fibonacci level (blue) and are marginally above the 0.382 Horizontal Fibonacci level (black). This is the exact kind of behavior we had on the previous Cycle with the 1990 pull-back, which as expected approached the 1M MA50 and rebounded. In 1954, the index was again headed for the 0.5 Time Fib and was on the 0.382 Horizontal Fib.

It is obvious that the degree of symmetry among the Cycles is remarkable and as long as the 1M MA50 holds, any pull-back should historically be bought. As we head towards the 0.786 Time Fib though, the danger of staying in the market gets extremely high but as mentioned, a break below the 1M MA50 is the confirmed sell signal.

This shows that despite the recent volatility, buying is still heavily favored. Are you willing to bet against the market at this stage?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bull vs Bear: The 5700 FlipzoneBull vs Bear: The 5700 Flipzone | SPX Analysis 27 Mar 2025

Some days, the best trade is no trade at all.

It’s Thursday, the kettle’s on, the charts are up… and I’ve done absolutely bugger all from a trading perspective. Not out of laziness (though I do love a good sit-down), but because nothing’s screaming "go". And when nothing’s screaming, I don’t go running.

We’re smack-dab in the middle of the “flip zone” - right around 5700. The market’s pacing like a nervous cat, pretending to pick a direction, but mostly just knocking things off the shelf to keep us on our toes. And honestly? I’m good with it. Because when the market hesitates like this, it’s usually winding up for something worth waiting for.

Stick with me and I’ll show you how to turn “nothing happening” into “something smart”.

---

Deeper Dive Analysis:

Today felt a bit like turning up to a party early and realising no one’s there yet. Just me… and the punch bowl.

I’ve barely done a thing trade-wise. And I’m perfectly happy about it. Because when there’s no clear setup, the smartest thing you can do is absolutely nothing.

Here’s why:

The 5700 level continues to act like the social bouncer of this range - nobody gets through without a convincing ID. It’s the pivot point where bulls and bears are circling, eyeing each other like it’s a West Side Story dance-off.

Bear pulse bars? None yet. So while price has dribbled downward in that slow, lazy style, we’ve had no real confirmation of fresh bearish momentum.

Bull pulse bars? Not exactly punching through the ceiling either. For that, we need to see solid moves above 5720 and, ideally, a breakout-pullback pattern to load up a fresh bull swing.

What’s more interesting is the GEX (Gamma Exposure). This week’s setup highlights 5700 as the flip point, reinforcing what we’ve already seen in price behaviour. When the options market lines up with technicals, I start paying even more attention.

The ES futures chart (with overnight data) shows the same range boundaries a little more clearly. It’s painting a picture of compression. And as you know from experience, compression always precedes expansion.

I’ve said it before and I’ll say it again: patience pays.

We're in the eye of the storm - the kind where people get twitchy, traders get emotional, and portfolios get wrecked... unless you're working the system.

So here's the play:

No new bear trades until pulse bars form below 5700.

Bull trades only trigger on solid breaks above 5720.

Until then? Watch. Wait. Brew tea.

Because I’d rather miss the first 10 points of the move than get slapped for trying to be clever.

---

Fun Fact

There’s a stock ticker called YUM. Yes, really.

YUM Brands – owner of Taco Bell, KFC, and Pizza Hut – trades under the very appropriate ticker: YUM. Now that’s branding you can taste.

YUM Brands spun off from PepsiCo in 1997 and has since become a global fast food empire. With over 50,000 restaurants in more than 150 countries, it’s been gobbling up global market share like it’s a late-night snack. The ticker symbol “YUM” is one of Wall Street’s more deliciously accurate tickers – and proves that branding doesn’t stop at the menu. Fun fact: KFC was once known as “Kentucky Fried Chicken” until the name got a trim for health-conscious times. Go figure.

SPX500 H4 | Bullish uptrend to extend further?SPX500 is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 5,704.90 which is a pullback support.

Stop loss is at 5,590.00 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 5,848.75 which is an overlap resistance that aligns close to the 50.0% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

SPX: Bear Flag? On the 4hr or a bounce off the 1D trendline?Market has been in a funk. Trump announces 25% tariffs on auto imports. Surprised markets didn’t tank more in AH.

Gap filled on a lot of charts today (3/26/25). Wondering now, on the daily if it bounces off this purple trend with unemployment data and PCE Friday.

$KRE REGIONAL BANK Crash? Identical Setup to March 23'Identical Setup to 23' Regional Bank Crash. As always, not sure what the trigger will be, but I will do my best to keep everyone updated as usual. Target of $58 from $60s reached. I'll be expecting a bit more come June. Watch for the sideways movement and rally until then.