S&P500: Recovered the 1W MA50. Best buy opportunity of 2025.The S&P500 is marginally neutral on its 1D technical outlook (RSI = 47.606, MACD = -47.070, ADX = 35.637) as it is in the process of recovery from the previous oversold condition. What the index did recover however, and which is a massive buy signal, is the 1W MA50. Technically this trendline held two weeks ago, despite marginally crossing under it, and provided the basis for a new long term bottom. Basically it is the exact same pattern as the October 23rd 2023 bottom, which was also a HL on the 3 year Channel Up, declined also by -11% and the 1W RSI was almost on the same level as today's low (the S1 level).

Every bullish wave inside this 3 year pattern hit at least the 2.0 Fibonacci extension. Given that this bottom was made on the 0.618 Channel Fib level, like both of the last two HL (Aug 5th 2024, April 15th 2024), we expect a test of the Channel's top by the end of the year. A TP = 6,700 would still be under the 2.0 Fib extension and that's out long term target.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

SPX (S&P 500 Index)

SPX Stalls at Resistance - Here's What I’m Watching SPX Stalls at Resistance - Here's What I’m Watching | SPX Analysis 26 Mar 2025

You know that scene in every action movie where someone’s finger hovers over the big red button… and they don’t press it?

That’s me right now.

Because once again, sitting back and waiting for a cleaner entry zone is paying off. SPX tagged the upper Bollinger Band – like a polite tap on the shoulder – but hasn’t turned with any conviction.

No pulse bars. No reversal. Just a stall.

And that, my friend, is where we earn our edge – not by reacting early, but by knowing when not to act at all.

---

Deeper Dive Analysis:

Markets don’t always reward the busy. Sometimes, the biggest wins come from doing… nothing.

And today is one of those days.

📍 SPX tagged the upper Bollinger Band

⏸️ But instead of turning sharply, price paused

🚫 No bearish pulse bars yet – which means no confirmed reversal

We’re in “hover mode”.

Which, translated to trader speak, means:

"Don’t be clever. Just wait."

🎯 I’m staying bullish above 5700

🧭 But I’m not placing blind trades just to feel productive.

If price breaks and holds above 5700, I’ll consider scaling in for a bullish continuation.

If we slip back below 5700, I’ll reassess for bearish setups and pulse bar confirmation. But until then? My finger’s off the button.

Why? Because I know this pattern.

The tag-with-no-turn often just means we’re not done yet. The trend might still have gas in the tank, or it’s winding up for a more dramatic move later.

Either way, I’m not front-running it.

And honestly? Watching others flinch and overtrade while I sip tea and wait is one of life’s great pleasures. 😎

---

Fun Fact

📢 In 2006, someone accidentally sold 610,000 shares of a stock instead of 1.

💡 This infamous “fat-finger trade” cost Mizuho Securities $225 million in one afternoon — and became one of the most expensive typos in trading history.

Moral of the story?

In trading – as in typing – sometimes doing nothing is smarter than doing something fast.

Nightly $SPY / $SPX Scenarios for March 26, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸📉 Consumer Confidence Hits Four-Year Low: The Conference Board reported that the Consumer Confidence Index fell to 92.9 in March, marking the fourth consecutive monthly decline and reaching its lowest level since January 2021. Rising concerns over tariffs and inflation are major contributors to this decline.

🇺🇸🏠 New Home Sales Rebound: New home sales increased by 1.8% in February to a seasonally adjusted annual rate of 676,000 units, slightly below the forecasted 679,000. The median sales price decreased by 1.5% to $414,500 from a year earlier, indicating potential affordability improvements in the housing market.

📊 Key Data Releases 📊

📅 Wednesday, March 26:

🛠️ Durable Goods Orders (8:30 AM ET):

Forecast: -1.0%

Previous: 3.2%

Reflects new orders placed with domestic manufacturers for long-lasting goods, indicating manufacturing activity.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$760

Sleep: Bad Overall health: drained

Daily Trade Recap based on VX Algo System

9:50 AM VXAlgo ES 48M Sell Signal ( didn't work that well)

10:10 AM VXAlgo ES 10M Buy signal (Double Signal) :check:

12:47 PM VXAlgo ES 10M Buy signal (Double Signal) :check:

3:30PM doji trade + expecting 48m to flip up

Market stalled a it today as expected because we ran up a lot yesterday,

We did go a bit higher but not much up from yesterday's high.

Overall decent range day if you trade the 1 min MOB.

potential next target of 8000 for SPXAnalysis of the Chart:

Bull Run Identified:

Two bullish trends are highlighted after 10% corrections.

After each pullback of ~10%, the market resumed its upward trajectory.

Correction Zones:

First correction (~10.29%) occurred in mid-2023.

Second correction (~10.27%) happened recently in early 2025.

These corrections are typical in bull markets, indicating healthy price consolidations before further upside.

Next Target:

The chart suggests a potential next target of 8000 for SPX.

This implies a continued bullish trend and significant upside.

Conclusion:

The S&P 500 has experienced multiple bull runs after 10% corrections, indicating a strong uptrend.

If historical patterns repeat, the market could move towards 8000, provided macroeconomic conditions remain supportive.

Bear Slippers Off. Bull Boots Laced.Bear Slippers Off. Bull Boots Laced. | SPX Analysis 25 Mar 2025

The tide turned Monday, and for once, the charts didn’t just mutter vaguely in Morse code – they actually gave us something to work with.

After weeks of grindy, gummy-bear movement, SPX finally flashed a bullish signal. The classic breakout-pullback has shown itself on the 30-minute timeframe, and the daily chart has joined the party with a sharp reversal, flipping us right back into the prior range.

Let’s just say this… not rolling those final bear swings? Smartest decision I didn’t overthink. I just wanted to stop the bleeding. Turns out, it also kept me out of harm’s way.

Now, with the bear slippers safely tucked back into the winter cupboard, I’m eyeing the bull setups. But as always – I’m not jumping just yet…

---

Deeper Dive Analysis:

Monday brought a much-needed shakeup – not the kind that rattles your coffee mug off the desk, but the kind that whispers: “Something’s changed…”

And it has.

The 30-minute chart formed a clean breakout-pullback, the kind you could frame on the wall and call “textbook.”

The daily chart? We’ve got a bullish reversal pattern that’s pushing price back into the old range.

That means my bearish bias has officially flipped.

Goodbye bear slippers. Hello, Bull Boots.

Let’s talk about those bears for a moment…

Last week’s trades didn’t go to plan. Friday’s rally chewed them up, and instead of rolling endlessly like a gambler doubling down, I did what needed to be done: closed them. Cleared the head. Took the "L".

And now, I’m glad I did.

Sometimes, the best trade is no trade. Or at least, no new pain.

During my Fast Forward mentorship call, we did our usual morning deep dive.

We looked at:

The GEX flip (Gamma Exposure momentum line)

Intraday call wall pressure

And the speculative cap at 5765 for the high of day

With that info, I made the call to delay my bull swing entry. Why chase a top when the market’s whispering “pullback pending”? I’d rather find a smarter entry… with more meat on the bone.

So what now?

Bias is bullish

5765 & 5805 = overhead friction

Waiting for a deeper pullback before entering long - Ideally 5720

My trigger’s locked. My chart’s marked. Now I wait.

And if that pullback doesn’t come?

Fine. I’ll let it go and re-evaluate. No FOMO. No flinching.

The plan is simple: Trade with the setup, not the hype.

--

Fun Fact

Benjamin Graham once said, “In the short run, the market is a voting machine. In the long run, it is a weighing machine.”

But he never accounted for meme stocks, social media panic, and Reddit-fuelled rocket ships.

Today, it often feels like the market's a slot machine with a Twitter feed.

Still – patterns like breakout-pullbacks?

They’re timeless, regardless of the noise.

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$650

Sleep: 🆗 Overall health: feeling drained today.

Health wise, Feeling really tired today, might need to really add red light therapy to my morning process.

Daily Trade Recap based on VX Algo System

11:39 AM VXAlgo NQ 48M Sell Signal (took mes but got stopped out)

12:26 PM VXAlgo ES 48M Sell Signal +NQ 48 sell (made money)

1:30 PM VXAlgo ES 10M Buy signal (avg down at support & made money)

In regards to the market today, we broke over the 48 min resistance yesterday night when market opened and it pushed us into bullish zone,

naturally when market is in bullish zones, it can push hard so you just have to sit back and watch if you missed the entry.

Which was what I did and just waited until we get a sell signal.

Dow Jones on the weekly chartAs you can see, due to recent economic news and Trump's economic approaches, we have unfortunately witnessed a decline in major indices, including the Dow Jones. We are currently at the last available support level, which is the bottom of the Dow Jones long-term channel, and we need to see how it reacts to this level in tomorrow's news and the CPI release.

Breaking: SPX6900 ($SPX) Surged 21% Today The price of SPX6900 ( SP:SPX ) surged Nearly 25% today amidst breakout of a falling wedge.

Created on the Ethereum blockchain, SPX6900 is an advanced blockchain cryptography token coin capable of limitless possibilities and scientific utilization. With a growing momentum and hardworking community the coin seems to be a contender in the incoming bullrun speculated by traders.

As of the time of writing, SP:SPX is up 16.35% trading in tandem with the 1-month high axis. a break above that point could signal a trend continuation to the $0.70 - $0.80 pivot.

Similarly, should SP:SPX cool-off, immediate consolidation point resides in the 38.2% Fibonacci retracement point.

SPX6900 Price Live Data

The live SPX6900 price today is $0.616856 USD with a 24-hour trading volume of $45,031,583 USD. SPX6900 is up 21.61% in the last 24 hours, with a live market cap of $574,288,459 USD. It has a circulating supply of 930,993,090 SPX coins and a max. supply of 1,000,000,000 SPX coins.

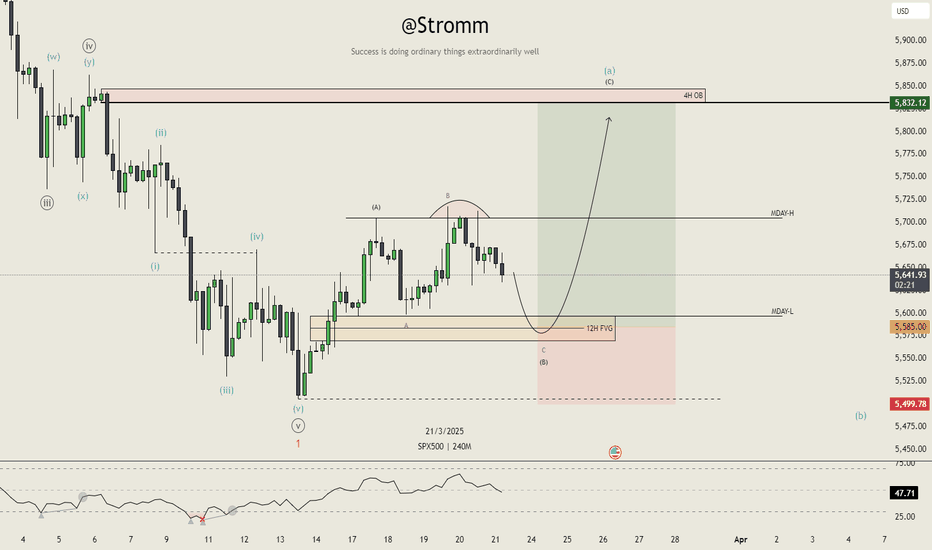

S&P 500 Setting Up for a Breakout – But Not Before One More TrapAs I’ve said before, the FOREXCOM:SPX500 is a key reference for my crypto trading . That’s why I sat down and took a closer look at the chart – and I’m now ready to place a limit order , based on what I’m seeing.

I believe we’re still in a correction phase , and it’s far from over . However, I think it’s realistic that we’ll see a move toward $5,832 next week . Before that happens, I expect either today’s Monday Low or next week’s Previous Weekly Low to get swept, ideally triggering a dip into the 12-hour Fair Value Gap just below.

That’s where I see my entry zone forming. It’s also the exact area where Wave B overshoots the starting point of Wave ABC, making it a clean Flat correction pattern, with Wave C completing to the downside before we get a solid move upward.

I’m setting my stop-loss below the $5,500 low. If this setup plays out, I expect the S&P to push toward $5,832 , and after that, I’m anticipating a larger correction that could take the index back down to $5,500 or even $5,450 over the coming weeks.

Timing remains unclear for that move after, but the structure is here , and I’m looking forward to seeing how it plays out.

Looking for a minimum of ES 5850In the days to come our initial pattern off the recent has the high probability to get into the 5850 area.

Here I will be looking for a pullback.

If this pullback can be viewed as corrective in it's structure then I expect the subdivisions and pathway on my ES4Hr chart should follow suit. However, if the pullback turns out to be impulsive, I will be looking for follow through for either Minor B having completed early, or the alternate wave (iv). If that sort of price action were to materialize, it's Friday's low of 5651.25 that must support any drop if we're to continue to subdivide higher and have this minor B take more time.

S&P nearing the 38% retracement and flag top! Intraday Update: The S&P futures are up today following possible tariff news being factored in from some weekend headlines about "targeted reciprocal tariffs" for April 2nd, which is allowing for the S&P to near the 38% retracement which would be the top of the beer flag pattern and setup.

Why I Took the L (and Feel Great About It)Why I Took the L (and Feel Great About It) | SPX Analysis 24 Mar 2025

The markets are meandering again, and I’m starting to feel like a one-man tribute band for “Brimful of Asha” on repeat. Another grindy week, another re-run of the up-a-bit, down-a-bit SPX drama.

Today’s vibe? Picture those magnificent men in their flying machines… looping up diddely up-up and down diddely down-down with zero destination in sight.

The overnight futures opened with some energy - but landed us smack back into the call wall zone at 5700/5720. Meanwhile, the Bollinger Bands are pinching tighter than my jeans post-Christmas, confirming what we already know: this market’s stuck in a range.

But here's the thing… I’m not stressing it. I’ve seen this dance before. And I know exactly what I’m waiting for.

---

Deeper Dive Analysis:

Another week, another range, and here I am again – sipping coffee, muttering to myself like a budget oracle, watching SPX push a few points higher and thinking… "Didn’t we just do this yesterday?"

The overnight futures gapped higher, but the market basically landed us right back into the same call wall we’ve been dancing with all week – 5700/5720. It’s like déjà vu… but with less excitement.

And don’t even get me started on the Bollinger Bands. They’re pinching so tightly now you could use them as a tourniquet. Yes, we’re consolidating. Yes, we already knew that. But now it’s like the market is actively mocking us.

🎯 So what’s changed? Nothing.

The plan remains exactly the same:

Wait for a breakout-pullback – either direction.

Don’t force trades.

Stay sharp, but don’t get twitchy.

Friday’s rally? It messed with the last of my bear swings, and instead of dragging the positions out like a bad soap opera, I just let them expire and took the loss. Not because I had to. But because they were irritating me.

Sometimes, the smartest move is not about managing the trade – it’s about managing the trader. I cleared the decks, reset the headspace, and now I’m ready for what comes next.

So here we are:

Bullish trigger is still 5720+

Bearish trigger stays below 5605

Everything in between is just noise.

And yeah, I’m still leaning bearish, but I’m not forcing it. We’ve seen this pattern before – the grind, the stall, the fakeout. And when the real move comes? That’s when I’ll strike.

Until then, it’s back to the charts, back to the tea, and back to waiting with the quiet smugness of someone who knows patience pays better than panic.

Let’s see if today delivers… or if we’re just rolling the same episode again.

---

Fun Fact

📢 In 1997, when the VIX dropped below 10, traders called it "nap time."

The market stayed so calm for so long, many option traders took part-time jobs just to stay busy - including one notorious story of a floor trader who moonlighted as a nightclub bouncer.

💡Lesson? When volatility vanishes, don’t force action – prepare for the return of chaos.

S&P500 Next Key Levels I will be waiting to see if we get some short term buying before continuing down to $5,200 levels.

Waiting for price to reach the $5,800 area and anticipating a strong rejection to continue the bearish trend.

After confirmation of the rejection, I will be looking for simple lower lows, lower highs before entering a sell, preferably around the $5,600 mark.

What are your thoughts on the AMEX:SPY and the THINKMARKETS:USDINDEX in general?

SPX: uncertainty holdsAnother relatively mixed trading week for US equities. The most important weekly event was certainly the FOMC meeting, where the Fed decided to hold interest rates unchanged for one more time. Important input was that the Fed is still on the track of two rate cuts during the course of the year, which modestly supported positive market sentiment. Still, uncertainties regarding decisions of the US Administration, specially related to trade tariffs are leaving the mark for precaution among market participants. Along with the trade tariffs, consultant companies like Accenture are affected by the DOGE cuts in spending and whose shares suffered a 7,3% drop in value.

The S&P 500 was traded higher by 0,5% on a weekly level. However, uncertainty is still evident in the index moves. The highest weekly level was 5.710, while the index closed the week at the level of 5.667. Companies are starting to bring up their estimates regarding future earnings. Currently, some of them noted expectations that trade tariffs will impact their future sales, planning of capital spending and jobs. As long as uncertainty holds on the market, the prices of stocks will be in a volatile mood. In this sense, it should not be expected to see some exponential moves in the S&P 500, like it was during the previous two years.

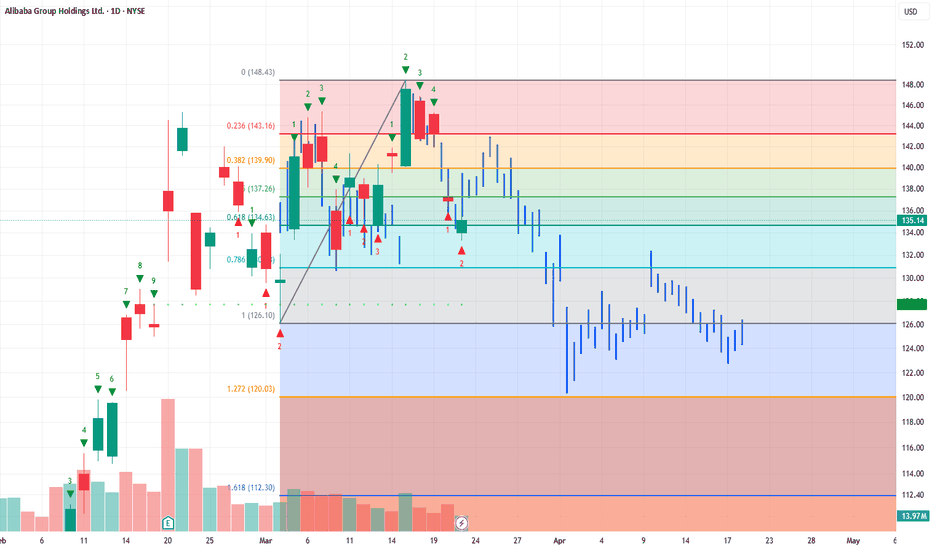

$BABA on its way to $120s into AprilI would honestly be surprised if it doesnt gap down this Monday before the open. The weekly imo, looks like a mess atm and could gap into $120s easy. If it doesn't, I would expect some consolidation for a fall into the First week of April. We're right at the golden pocket retrace at the .618, very common retracement level, if we look at Fibs with a bearish perspective and measure a retrace back to the lower golden pocket at 1.61 fib from highs, $112.30 would be my ultimate target if we can break $126. $126 opens the flood gates to our ultimate target at $112.

Combined US Indexes - Time to make a Lower HighFrom the last time, the Combined US equity indexes did keep into the Extension Zone (EZ) as marked out. This Zone is defined from the lowest point of the TD Setup and the range is determined by the range of the candle that has the lowest point, this case being Candle 9 (4 March).

So after the expected two week in the EZ, we see an indication of the week ahead to continue the Sell Setup and break out of the EZ for the week, at least from mid-week where it would be candle 9.

According to TD rules, this Sell setup is NOT bullish, and can be expected to turn further down from resistance (Orange Line). This orange line is determined from the weekly chart where there is an ongoing TD Buy Setup (bearish) that needs to be kept intact for the trend to continue.

So, based on the techincals, the combined US equities may be seeing a last week of bullishness which goes through the yellow ellipse, then face strong resistance and continue the main Bearish trend (as depicted by the prevailing Buy Setup (20Feb to 4Mar). Noted that the main trend changed to Bear once the TDST was broken down on 3Mar.

Here are very good live examples for those keen on (Thomas) Demark indicators; watch and wait for it to develop...

BRIEFING Week #12 : Alt-Season might be coming soonHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil