S&P500 Next Key Levels I will be waiting to see if we get some short term buying before continuing down to $5,200 levels.

Waiting for price to reach the $5,800 area and anticipating a strong rejection to continue the bearish trend.

After confirmation of the rejection, I will be looking for simple lower lows, lower highs before entering a sell, preferably around the $5,600 mark.

What are your thoughts on the AMEX:SPY and the THINKMARKETS:USDINDEX in general?

S&P 500 (SPX500)

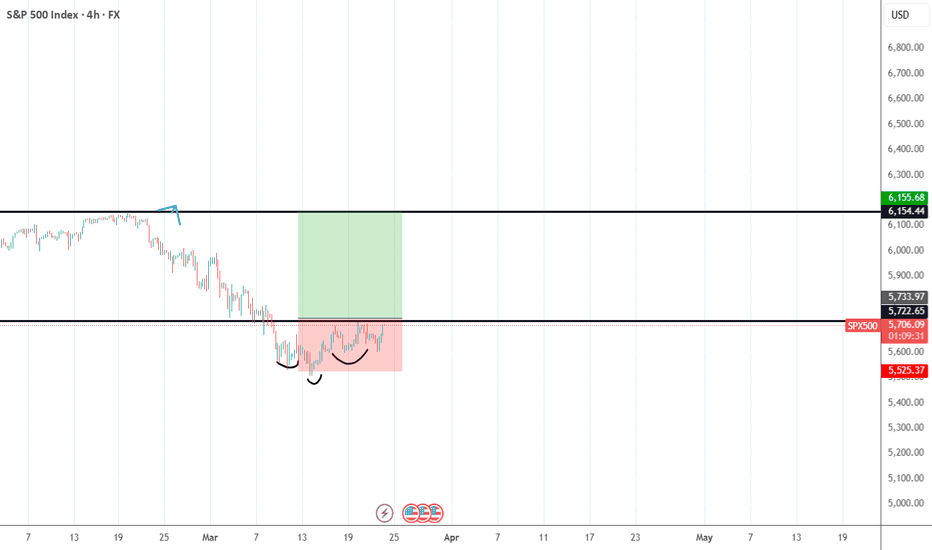

BUY SPX500SPX500 Trade Idea: Bullish Continuation Setup

Market Overview

The SPX500 has shown strong bullish momentum, and a continuation of this trend is likely if price holds above the 5,772-support area. A confirmed breakout from this level could provide an ideal buying opportunity.

Trade Setup

Entry: Buy at 5,733 (waiting for confirmation at key support)

Stop Loss (SL): 5,525 (below strong support zone)

Take Profit (TP): 6,154 (next key resistance level)

Analysis & Rationale

✅ Bullish Trend Continuation – Price action suggests strong momentum, favoring further upside.

✅ Key Support at 5,772 – A breakout above this level will confirm bullish strength.

✅ Favorable Risk-to-Reward Ratio – Well-defined SL and TP provide a balanced strategy.

Trading Plan & Execution

Wait for confirmation at 5,772 before entering.

If price holds, execute a buy order at 5,733.

Set SL at 5,525 to limit downside risk.

Take profit at 6,154, adjusting the stop-loss accordingly if price gains momentum.

This trade setup follows the bullish market structure, providing an opportunity to capitalize on SPX500’s continued upside potential. However, monitor economic data and global market sentiment for any shifts in trend.

📌 Risk Disclaimer: Always implement proper risk management and adjust your strategy as market conditions evolve.

Trading Is Not Gambling: Become A Better Trader Part III'm so thankful the admins at Tradingview selected my first Trading Is Not Gambling video for their Editor's Pick section. What an honor.

I put together this video to try to teach all the new followers how to use analysis to try to plan trade actions and to attempt to minimize risks.

Within this video, I try to teach you to explore the best opportunities based on strong research/analysis skills and to learn to wait for the best opportunities for profits.

Trading is very similar to hunting or trying to hit a baseball... you have to WAIT for the best opportunity, then make a decision on how to execute for the best results.

Trust me, if trading was easy, everyone would be making millions and no one would be trying to find the best trade solutions.

In my opinion, the best solution is to learn the skills to try to develop the best consistent outcomes. And that is what I'm trying to teach you in this video.

I look forward to your comments and suggestions.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Weekly Market Forecast SP500 NASDAQ DOW: Short Term BUYS!In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures for the week of March 24 - 28th. We'll determine the bias for the upcoming week, and look for the best potential setups.

The equity markets have been choppy lately, but this week may be different. The economic calendar shows a smooth week ahead, as there are no NFP, FOMC, or similarly volatile news ahead to potentially reverse a market out of the blue. The indices show potential to break consolidation and move upwards. So we wait until there are definitive market structure shifts to occur, acting as confirmations.

Only then do we pounce!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Trendline Broken – Is the Bull Run in Trouble?The S&P 500 index is currently exhibiting a critical technical structure. After forming a series of Higher Highs (HH) and Higher Lows (HL) within a well-respected rising trendline, the price recently made an All-Time High (ATH) but has since shown signs of weakness. The trendline, which has acted as a dynamic resistance multiple times, has now been broken.

At present, the price is retesting the key horizontal support zone and the 200 EMA after the breakdown. This retest is crucial—a rejection here could confirm a bearish shift, potentially leading to lower levels near the next key support zone. Additionally, the RSI is displaying a bearish divergence, signaling weakening momentum despite recent highs.

Key Takeaway:

Watch for confirmation at the retest zone. A rejection may signal a deeper correction, while a reclaim of the trendline and 200 EMA could reestablish the bullish structure. Risk management is key at these pivotal levels.

S&P500 The Week Ahead 24th March '25S&P500 bearish & oversold, the key trading level is at 5766

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

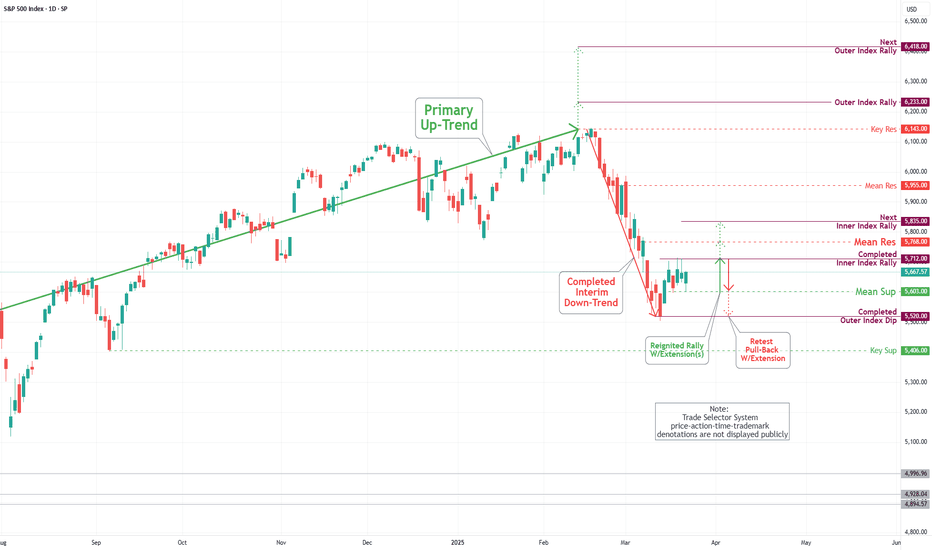

S&P 500 Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

During the course of this week's trading session, the S&P 500 achieved the designated target for the Inner Index Rally at 5576, which occurred midweek. This target was accompanied by considerable volatility, ultimately hindering upward movement. On the week's final trading day, the index experienced a notable decline, resulting in a significant drop that reached our critical target, Mean Support, at 5603.

Consequently, the index is now poised to target a retest of the Inner Index Rally level 5712, with a subsequent potential target identified at the Mean Resistance level 5840. It is essential to consider that upon reaching the Inner Index Rally target of 5712, a decrease in the current price level is anticipated, which may lead to a retest of the Mean Support at 5601. Furthermore, an extended decline is possible to revisit the completed Outer Index Dip at 5520 before the resumption of an upward rally.

S&P500 INTRADAY Bearish oversold bounce back Key Support and Resistance Levels

Resistance Level 1: 5714

Resistance Level 2: 5770

Resistance Level 3: 5872-5920

Support Level 1: 5500

Support Level 2: 5387

Support Level 3: 5254

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

German $DAX ($EWG) Topping Out?Originally posted on 3/12, but blocked b/c I referenced my X account. Looks like a bearish move could be materializing alongside broader risk asset weakness:

Is the XETR:DAX topping out? Monthly RSI @ 80+ w/ weekly nosing over and daily bearish divergences observable. Index high from 3/6 coincided with the 261.8% Fibonacci extension of the 11/2021-10/2022 uptrend correction.

Confirmation short setup could materialize $FDAX closes below pivot low of the 1D uptrend (22226), bounces off of short-term demand (ex: 22142-21691, and trades into supply ≥ 22226. This scenario is speculative - the market needs to show its hand.

Presently, DAX is up > 1.5% alongside US stocks, which dipped into intermediate-term demand and benefited from softer-than-expected CPI prints. However, DAX (and domestic) bulls haven't proven anything yet. Unless buyers manage to push the DAX higher - initially above 22900 and secondarily through 23000-23200 - on accelerating momentum, risk remains to the downside (IMO). German stocks have been global relative strength leaders as of late, so if they do correct, other equity indexes may retreat in tandem.

Long-term charts for US indices ( SP:SPX , NASDAQ:NDX , TVC:RUT ) look more bearish vs. bullish (I still have some shorts on), though a near-term recovery is plausible. If domestic equities do trade lower, selling could materialize in Asian and European markets. Use LTF charts to monitor price action/manage risk and splice into shorts if German stocks AMEX:EWG start to crack.

My $0.02. Feedback welcome.

Jon

SPX500 2nd Leg Down? 21 Mar 2025

Yesterday's candlestick closed as a bull bar in its lower half with a long tail above.

In yesterday's report, we said traders would see if the bulls could create a strong retest of yesterday's (Mar 19) high followed by a breakout above. Or if the retest would lack follow-through buying, stalling around or slightly above yesterday's high area.

The market formed a retest of the March 19 high, but stalled and formed a lower high.

We said the move while strong, likely was simply a bull leg and a buy vacuum test of the trading range high. If true, sellers would emerge near the trading range high, which was the case. (Please refer to the tagged post)

The bulls want the market to form a 2 legged sideways to up pullback.

The pullback is currently underway but has a lot of overlapping candlesticks. The bulls are not yet as strong as they hope to be.

They need to create credible buying pressure - consecutive bull bars closing near their highs to increase the odds of testing the 20-day EMA or the January 13 low.

For today, the market may open lower today. If the market continues down, they hope the March 18 low will act as support, forming a small double bottom bull flag.

The bears see any pullback as minor. They expect at least a small second leg sideways to down to retest the Mar 13 low after the pullback phase.

The 9-bar bear microchannel on the daily chart and the 4-bar bear microchannel on the weekly chart increase the odds that the first pullback (current pullback) would be minor and not lead to a reversal up.

They hope the leg to retest the March 13 low will begin soon. They must create strong bear bars with follow-through selling to increase the odds of another leg down.

The prior climactic selloff and parabolic wedge increase the odds of a pullback which is underway.

Traders will see the strength of the pullback. If it is strong (consecutive bull bars closing near their highs), they may look for a retest of the breakout point - Jan 13 low.

If the pullback lacks follow-through buying (overlapping candlesticks, doji bars, bear bars, long tails above bars), the odds of another leg down AFTER the pullback phase increase.

So far, the pullback has a lot of overlapping candlesticks which indicates that the bulls are not yet as strong as they hope to be.

For now, traders will see if the bears can create a strong bear bar today.

Or will the market open lower but lack follow-through selling, like yesterday?

I will update again later today.

SPY/QQQ Plan Your Trade for 3-21-25 : BreakAway PatternToday's Breakaway pattern may show up in the form of an Island Top or break-away to the upside if my analysis is correct.

I see the markets stalling over the past few days, potentially setting up a "last breakaway" type of pattern today.

I've highlighted how these "last" patterns work where price sets up a peak or trough (in this case a peak) as a last/exhaustion move and how this move can sometimes be very aggressive.

I urge traders to stay cautious today as we are moving into a MAJOR REVERSAL weekend.

I believe the markets will suddenly change direction next week (early) and will move back into downward trending by March 25-26.

Gold and Silver may rally today if the markets move into that Exhaustion Peak pattern. Keep an eye out for Gold/Silver/Bitcoin to potentially rally today and into early next week.

Overall, traders should stay very cautious as we move into next week's peak/top/rollover.

Don't get too aggressive trying to prepare for the rollover or any potential upside move over the next 3-5+ days.

Let the markets show us what and when we need to be aggressive.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade For 3-20-25 : Flat-Down PatternToday's SPY Cycle pattern suggests the SPY/QQQ will stay somewhat muted in trading range today.

I still believe the SPY/QQQ are in a moderate melt-up type of trend - attempting to reach a peak near the end of this week or early next week (see the patterns for March 24, 25, 26).

Even though I believe we are struggling to try to move higher, I do believe any failure of the SPY to move above the 0.382 Fibonacci retracement level would be a technical failure related to the breadth of this pullback.

Thus, I believe the markets have at least one more attempt to try to move higher over the next 5+ days before topping and rolling over into a broader downtrend.

Gold and Silver moved solidly lower this morning - almost like a Panic type of selling. I believe this is related to the Flat-Down pattern and I believe Gold/Silver will recover fairly quickly. I do believe this is a huge opportunity for Gold/Silver over the next 30+ days. I believe Gold will attempt to move above $3500-3600 before the end of April.

BTCUSD rolled higher yesterday by more than $4000 - just like I predicted.

Incredible.

And, that is another reason why I believe the SPY/QQQ have more room to the upside than we are seeing right now.

Remember this is a trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SP500 (E-mini Futures) - Decision TimeBigger Picture SP500 Futures Update - Decision Time

- Powell (FED) ruled out a recession in todays FOMC Press Conference (Bullish)

- Powell announced drastically slow down QT beginning next month (Extremely bullish for risk assets)

- The Asian and European stock market indices are still showing strength forming new ATHs week by week.

SPY rally done soon?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. I am expecting the market to end its recent rally this week. The current rarely would be about a week in length depending when it began for individual stocks. The rally has done a few important things with its slow and prolonged upward movement, mainly prevents a wave 3 signal from occurring during the next decline.

My wave 3 indicator tends to signal wave 3s and 3 of 3s. See my scripts for the specifics of the indicator. If the market had a short wave 4 up and then a sharp or prolonged drop during wave 5, a new wave 3 signal would occur which violates the currently placed Minor wave 3 (yellow 3). Allowing separation from the current wave 3 signal enables wave 5 to drop quick or slow.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

Specifically for SPY, Minor wave 3 was longer than wave 1, which does not place a maximum length on wave 5. Assuming wave 4 ends on Thursday or Friday, Minor wave 5 could be a week or longer. In that time, at the very least it should drop below wave 3's bottom of 549.68. Using some basic movement extensions, it will likely go lower. The 5 wave lower pattern for this fifth wave is hypothetical, but a bottom could occur between 525-538. Once we bottom, we should see another rally over a few weeks. I will forecast what that could look like as Intermediate wave 1 nears its end.

Another possibility that could play out is we rally through the weekend. In this case Intermediate wave 1 possibly ended at the current Minor 3 bottom. This would mean we are in Intermediate wave 2 now. I will evaluate this solution if the rally continues next week.

Sharp reversal in US marketsAmid market volatility and uncertainty, US stock indices experienced a sharp decline last week. The Dow Jones Index (#DJI30) fell by 3.5%, the S&P 500 (#SP500) dropped by 4.1%, and the Nasdaq-100 (#NQ100) lost 5.5%.

Investors reacted nervously to new economic data, including rising inflation and expectations of interest rate hikes, leading to a sell-off in stocks and a decline in key indices. The drop was particularly significant in the technology and consumer sectors, where companies like Apple and Tesla lost around 6-7% of their value.

However, starting March 13, 2025, the indices began to recover: #DJI30 gained 2.3%, #SP500 rose by 2.5%, and #NQ100 increased by 3.1%.

The recent rebound in US stock indices has been driven by several factors that restored investor confidence. Let’s take a closer look at the main reasons:

• Improvement in unemployment data: Labor market statistics played a crucial role in the market recovery. The US unemployment rate fell to 3.4% in February 2025, marking a record low in recent decades. This indicates strong employment levels and economic resilience, boosting investor optimism and supporting stock market growth.

• Stabilization of inflation and interest rate expectations: Although inflation in the US remains high, recent data showed a slowdown in its growth. Reduced inflationary pressure gave investors hope that the Federal Reserve (Fed) might slow down the pace of interest rate hikes. This was perceived as a sign of potential economic stabilization, positively impacting stock indices.

• Growth in consumer spending: One of the key drivers of the recent market recovery has been the increase in consumer spending. In Q1 2025, consumer demand in the US showed strong performance, serving as an essential indicator of economic activity. Increased spending on goods and services supports business stability and enhances corporate revenues, which, in turn, stimulates stock growth.

• Absence of new geopolitical risks: In recent weeks, there have been no major geopolitical crises or new threats on the international stage. This helped financial markets stabilize, as investors could focus on economic data and corporate earnings reports, contributing to stock index growth.

• Positive corporate earnings reports:

• #Microsoft (MSFT): Microsoft shares rose by 4.2% after reporting strong quarterly results, driven by growth in cloud services and software revenue.

• #Google (GOOGL): Alphabet’s stock increased by 3.7% due to higher advertising revenue and improved forecasts for upcoming quarters.

• #Apple (AAPL): Apple shares climbed 2.9%, supported by strong sales of new products and rising revenue from services.

• #Tesla (TSLA): Tesla stock surged 5.6%, fueled by strong electric vehicle sales growth and optimistic profit projections for the next quarter.

These companies demonstrated significant growth on the back of improved financial performance, strengthening investor confidence and aiding the stock market’s recovery amid volatility.

So despite last week’s market downturn, the current situation in the US stock market signals a potential recovery and a more positive trend in the coming weeks.

Possible rise from the bottom of the long-term ascending channelGiven the recent emotional decline in the Dow Jones and S&P500 due to Trump's tariff policy, the S&P500 is expected to make an upward correction from the bottom of its confirmed ascending channel. The stop loss is equivalent to the closing of the 4-hour candle below today's last low, with a target of 5900 in the final step.

Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

S&P500 INTRADAY awaits Fed’s decision and press conferenceThe US Federal Reserve will announce its interest rate decision and release the monetary policy statement on Wednesday at 18:00 GMT, followed by a press conference from Chairman Jerome Powell at 18:30 GMT.

Recent weak economic data from the US, along with new tariffs announced by President Donald Trump, have raised concerns about a possible recession. Despite this, the Fed is expected to keep interest rates unchanged for the second meeting in a row.

The updated Summary of Economic Projections (SEP) could provide important insights into the Fed’s future plans. However, the stock market remains wary that the Fed might not take a dovish enough stance. Inflation remains high, and tariffs could push prices even higher, making the central bank cautious about easing policy.

Key Support and Resistance Levels

Resistance Level 1: 5714

Resistance Level 2: 5770

Resistance Level 3: 5872-5920

Support Level 1: 5500

Support Level 2: 5387

Support Level 3: 5254

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SPY/QQQ Plan Your Trade For 3-19-25 : Top PatternToday's Top pattern suggests the SPY/QQQ will attempt to rally up to resistance, then form a peak/top in price, and then roll over a bit.

After yesterday's fairly consolidated price range, I believe the SPY/QQQ may rally through most of the day and move into the topping pattern near the end of today's trading day.

Overall, I believe the markets are still rolling into the Excess Phase Peak consolidation phase and that means traders need to prepare for extreme price volatility.

What is interesting is how BTCUSD is trying to rally a bit, but not finding upward momentum.

As I stated in today's video, I believe a fairly big move upward, possibly $3000 or more, in BTCUSD could happen between now and the end of this week.

This would be a perfect upward price advance into resistance that could correlate with a move h higher in the SPY/QQQ - targeting the upper level of the Consolidation Phase.

Gold and Silver have reached a "pause" level. I believe Gold and Silver will only pause for 48 to 96 hours before attempting to break higher. So, metals will still attempt to break higher into late March 2025.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPX cycle tell me we are in a bear market this yearThe cycles and the crosses are clones, therefore not exact fit.It doesn't look like a correction when I look at the cycles and pattern. I am more convinced that it is going to be a bear market in USA not just on technical but even on fundamentals:

China has just finished a recession and will grow with higher cost of production, unlike 2000-2015. Market and Fed is under illusion that inflation will come down to 2% (Thank chinese cheap goods for that before covid, but not now and going forward). Higher cost of chinese goods and trump tariff are sure to jack up inflation to 4%+ this year in my opinion. People are addicted to low interest rate since 2000's, but historically they ware always higher at 6% mean.

Any rallies would be temporary

S&P 500 E-mini Futures VWAP Breakout Strategy Sharing a solid intraday idea for you all – something I’ve been running on the S&P 500 E-mini Futures (30-min chart) lately, and it’s been delivering clean setups.

VWAP Breakout Play

I’m focusing on simple VWAP-based breakouts. Here’s the breakdown:

The setup:

• Wait for price to break above or below the VWAP with strong momentum (big candles + solid volume).

• I always confirm with a momentum indicator like MACD or RSI to filter out the noise.

Entries:

• Breakout Long: When price pushes above VWAP + momentum aligns.

• Breakout Short: When price dumps below VWAP + momentum confirmation.

Exits & Stops:

• Scale out at session highs/lows or key pivots.

• Stop-loss goes just beyond VWAP to keep the risk tight.

• If momentum fades, I’m out.

Why I like it:

VWAP attracts institutional flow, and combining it with momentum gives this strategy a solid edge, especially around U.S. session opens when volatility kicks in.

Give it a try and tweak it to your liking!