Spx500short

I am no Bear, I am Death.I spent a lot of time trying to frame this for everyone so I hope you all gain some more perspective from this.

How low will we go? I'm pretty sure the game of musical chairs is over...

Hope you're not planning on the housing market going up forever either...

I don't know how this is gonna play out but I'd suggest diversifying your assets. It is most likely that multiple systems will fail in this next crash and we'll be unable to save them just by injecting capital.

I'd say best case scenario is a -50% drop but that is so unlikely.

-75% to -90% is more likely IMO

Not Financial Advice. Just what I see.

CREEPYUmmm Guys....

Guys!!

No seriously! Guys!!

Alright I'm out. GoodBye.

Clearly the (tech bubble + housing bubble) formed a flat pattern and we just went up and retested the lower boundary......ummm....... Bye Bye.

Everything is lining up to where it makes unbelievable sense that the market will crash soon.

PREPARE FOR THE 3RD DEGREE DEVIATION TO THE DOWNSIDE.

Similarly to the Pandemic this is a ***Once in a Lifetime Correction***

I fully see that we are in the 4th Turning, the Saeculum is turning and we are entering a new phase of our world.

My advice is just long volatility and stocks that you love and don't mind if they bleed money for the next couple years. Hold good balance sheets and companies that are currently making a profit. Stay away from companies that are relying on future earnings growth.

S&P500 definitely entered into the bear market!Hello, everyone!

2.5 months ago I told you that the S&P500 crash is incoming (Linked article into description). I marked the signal bar on the chart with the arrow. Now the bear market is confirmed because the bearish divergence on the 1W chart leads to the red candles on the impulse system. Nevertheless I expect now the technical bounce to $4600 because the $4300 is the strong support and we have already seen the buyers reaction, after that I expect the steep decrease to the $4150, $3700 and the $3200. The last one is possibly going to be the bear market bottom, but we will see. S&P500 will definitely not set the new ATH during next year.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions at the real market.

S&P 500 (SPX) | The best target to fall🎯Hello traders, S&P 500 in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

This index also forms the main waves 1, 2 and 3, and according to the conditions we had in mind for starting wave 4, wave 4 has started.

Breaking the trend line was necessary to start wave 4.

This wave probably has a deeper correction compared to wave 2, and this correction will be in the form of a zigzag due to its sharpness at the beginning, and the target of this zigzag is around Fibo 0.50.

If the end of the main 3 wave is broken, the correction will change structurally.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

S&P 500 (SPX) | Bulls are BackS&P 500 (SPX) has been in bullish trend since March of 2020. It has been following bullish parallel channel by heart.

Recently it has broken the trendline but found a good support at Fib Level 0.236.

We are expecting bulls to be active again as they were little tired with almost 2 years of trend.

This support zone will be important level and bounce is expected from here to atleast recent high and if broken to ALL TIME HIGHS.

Trade your levels accordingly.

Don't forget to share your valuable feedback in comment section.

Check our other Forex and Crypto Setup on Profile.

Saturn Squared Uranus SPX2022 is most likely the start of the great depression. We may see a few more relief bounces before the decent happens after major planetary conjunctions finalize their alignments through March 21st, or again in September-November.

Twenty year cycles are powerful cycles. Saturn and Uranus alignments are very informative.

SPX GANN Scenariosyou may heard about the hyper inflation, end of the Super elliot cycle structure that comes to end, 2022 crash, news....

well basically this analyze focus on bearish Scenario, if price exceeded the gann will invalidated.

gann is easy if we know how to use it, its easy because we dont need to do anything, magical numbers do it for us.

SP500- We can have a bounce, but the outlook is bearishIn my previous SP500 analysis I said that I expect a break under the channel's support and that my target is the 4250 zone.

At this moment we have this break and we are halfway to my target. A bounce now is not out of the question, but this (in my opinion) doesn't represent the resumption of the uptrend, but just a corrective rally.

Bears can look to sell rallies around 4500 and slightly above and only SP500 back above 4700 would put a pause in this bearish scenario.

Things are looking even worst on the weekly chart:

SP500 has started the year with a strong bearish engulfing and all 3 weekly candles this year are read, with a very strong one last week

I would be surprised at all to see SP500 trading under 4k in the half part of the year

Good luck trading SP500!

Mihai Iacob

BIG DUMP INCOMING?SPX is going higher and higher but the chart is flashing really bad bearish signal that in history always preceded a really bad dump in the market.

We are having a bearish divergence on the monthly and this has always predicted a dump between 20 and 50% of the price.

Is this gonna happen again?

Also if you look at the daily the chart looks like a blow off top.

Let's see what happen in the next days/weeks

SPX Going short..Don't forget to click on the Follow button for more daily detailed analysis, Also if you have any questions, please do ask them!

Here we have our SPX chart.

The current Rally is losing steam as we enter previous resistance zones.

We are looking on the short side as price has hit our long targets.

Exit is noted at the eclipse symbol.

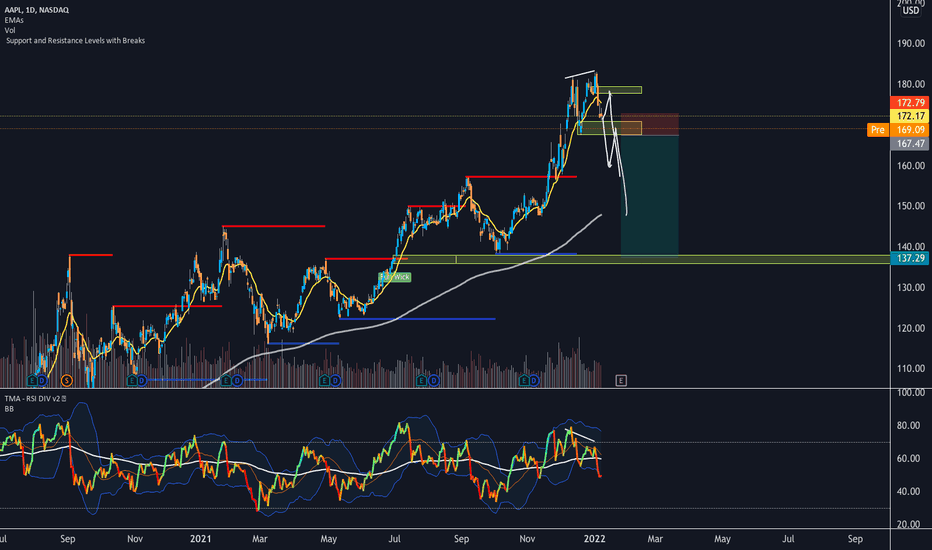

MONDAY LIVE: SPX500, EURUSD, USDCAD and APPLEHi Traders,

This is my view for this week on:

- SPX500

- EURUSD

- USDCAD

- APPLE

(I’ve just shared my fully explained 81strategy on Tube)

I remind you that this is only a forecast based on what current data are.

Therefore the following signal will be activated only if specific rules are strictly respected.

If you follow my strategy you will be able to identify the right filters and triggers to enter correctly the market and avoid fake signals.

I really hope you liked this video and I would like to know what do you think about this analysis, so please use the comment section below this video to give me your point of view.

Thank You

———————————

Pit from Trading Kitchen

SP500- Bearish Engulfing announce correction?In yesterday's Nasdaq100 analysis I said that I expect a drop for the index and 14k is my first target. Things are not different for SP500, here also expecting the price to drop.

Also, SP500 has started the year badly, with a bearish engulfing weekly candle and, although the price structure is not so bearish like in Nasdaq's case, a drop is probable here also.

4600 is trend line support, that kept the price elevated for more than a year now, and a break here would increase chances for a drop to 4250-4300 horizontal support.

In bearish this index too and I will look to sell rallies.

A new ATH would delay this scenario.

S&P 500 (SPX) | Best point for sell🎯Hello traders, S&P 500 in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

In indicators, the ratio of waves to each other is either too low or too high.

In this wave, wave 1 is formed and wave 2 has modified wave 1 relatively little.

Wave 3 then forms its microwave trend in a relatively normal state on a line and is in its last microwave.

Wave 5 The last microwave, wave 3 is not complete and this wave is on Fibo 0.50 compared to its microwaves and is not in a good position compared to the waves of the main wave 3 and it is better to return from the point after completing the waves to Fibo 0.38 Do a quick move.

Also, waves 3 and 4 of wave 5 of wave 3 form a harmonious pattern, and if this pattern is correct and we break the red circle and the downward trend line, we will have a heavy downward trend.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

S&P 500 (SPX) | Best point for sell🎯Hello traders, S&P 500 in daily timeframe , this analysis has been prepared in daily timeframe but has been published for a better view in 2 day timeframe.

In the indicators, because the movements of the waves are always upward and its corrections are very short compared to the forward movement that is done, no relation between the waves can be detected.

Therefore, we consider the beginning of new waves after the biggest correction in terms of time.

After the largest correction, we counted an almost normal wave 1 and a not-so-excellent wave 2, and considered the rest of the waves to be related to wave 3, and it was only in this scenario that we were able to make a connection between the waves.

Wave 3 is probably made up of 1, 2, 3, and 4 microwaves, and now we are inside wave 5.

In the previous analysis, we said that if the end of the previous wave is broken, the motion will be different and so on.

From wave 5, this ascent is related to microwave 5, which according to Fibo must end before 4900 and start the correction by breaking the black trend line.

If the price moves more than the specified targets, this count should be doubted.

🙏If you have an idea that helps me provide a better analysis, I will be happy to write in the comments🙏

❤️Please, support this idea with a like and comment!❤️

SPX looking weakAlthough the S&P 500 has been pushing hard for the last year, I think the omicron shakeout has brought a new short term correction.

I have laid out the wave count in the chart. This was the 5 wave cycles of the intermediate wave 5 of the primary wave 3 (not highlighted here). This is also been confirmed by the EW channel drawn in the chart. I expect S&P to finish this correction when it hits 4330. However before dip further there will be a relief bounce which will create a lower high at around 4700. Then after hitting the resistance we will have wave C which will bring extreme fear in the market to terminate at 4300. There the sentiment will be rock bottom, However, it will hide great opportunity for the grab pushing the S&P to new highs in q1 and 2 of 2022.

I drew two different scenarios for this.

Why do I care about S&P? Because it directly affects the crypto market.

FOLLOW ME, SHARE, LIKE AND COMMENT