SPX approaching support, potential for a bounce!

SPX is expected to drop to 1st support at 2956.1 where it could potentially react off and up to 1st resistance at 3107.0.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.

SPXS

SPX approaching support, potential for a bounce!

SPX is expected to drop to 1st support at 2956.1 where it could potentially react off and up to 1st resistance at 3107.0.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.

SPX approaching support, potential for a bounce!

SPX is expected to drop to 1st support at 2956.1 where it could potentially react off and up to 1st resistance at 3105.3.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully

understand the risks.

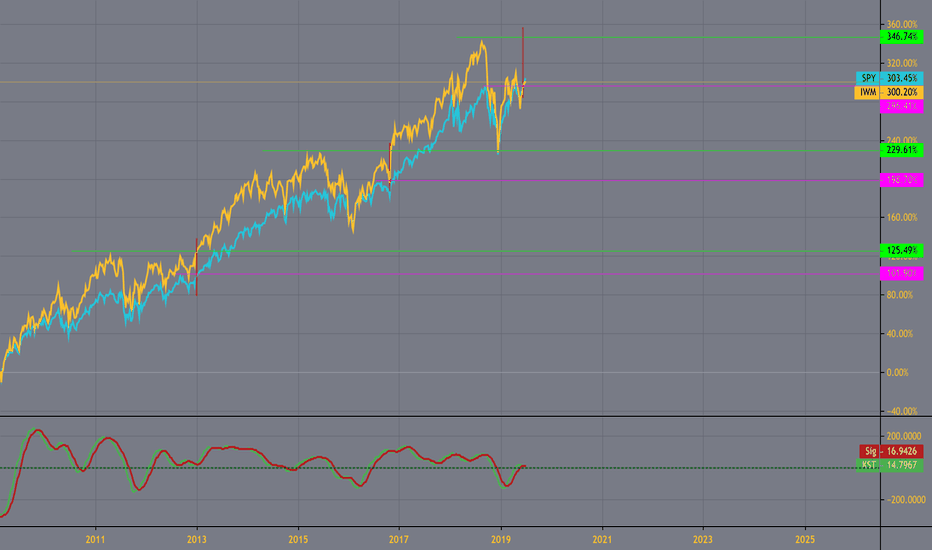

Houston- we have a problem.... iwm vs spyIWM has been the spy's faithful partner up chart since 2009. This run is different. I think we may be destined for failure.. until iwm can muster the strength to breaks its trend.

Suppose there's 2 possibilities here. either spy's gonna retreat, or iwm needs to make up some ground.. has a large distance to make a new high. Given circumstances i think retreat makes most sense.

Caution is warranted given conditions and charts history....

GOOD LUCK THIS WEEK!

xlf in a popular retreat zone. may be good hedge, or shortHeres some interesting spots on chart. xlf been lagging. similar to iwm.. which looked to be backing out of similar resistance zones.

May pickup some puts to add to my rally for nothing hedge.. Keep waiting to hear why we're back up here. fed rate that never changed? trump deals that never get made? earnings revisions everywhere.. so much debt.. etc

Seems this or iwm reacts stronger to downside, vs spy or vti.. Some may consider this a warning that there is downside risk mounting.. others on the trump train just see more money to harvest. Not sure where i stand. I guess id say im not convinced. But eager to see what happens.

investors gonna fall for it? nothing new since december.. ATH?Market loves it when trump claims a victory.. but how many times will we fall for same news? Last time the tweet news did not make sustainable rally. seems like nothing new here. Why would we break highs and continue up?

Maybe..

There's some lines showing possible lack of confidence. We'll see how the cpu's play it. Trying to keep stance balanced. But im leaning more towards a decline in July than big rally. I know, I know July is the best month, the greatest month.... we'll see.