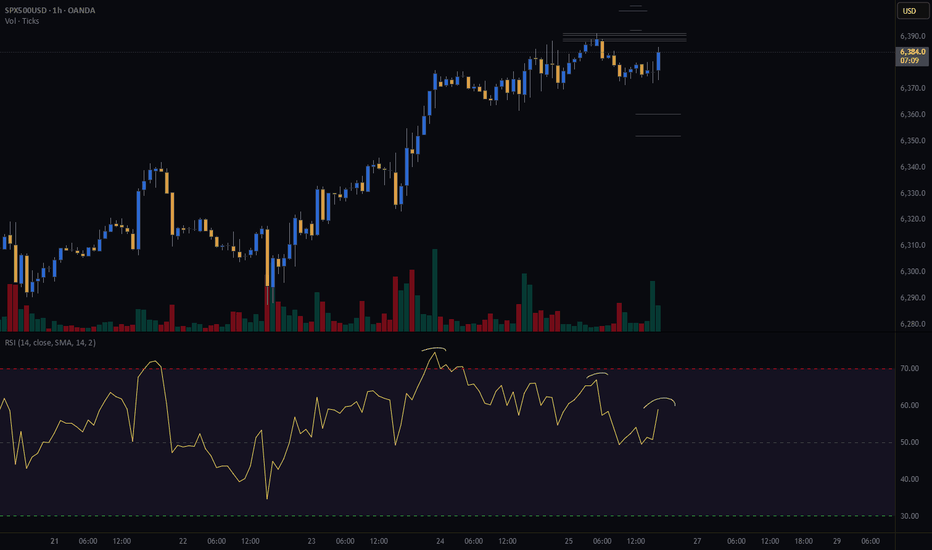

Spxshort

S&P500 (CASH500) (SPX500) SHORT - Head and shoulders 30minRisk/reward = 3.3

Entry price = 6314.8

Stop loss price = 6318.4

Take profit level 1 (50%) = 6301.3

Take profit level 2 (50%) = 6297.5

Waiting on validation from a few other variables.

For example, waiting for the current 30min candle to close in range.

Letssss goooooo

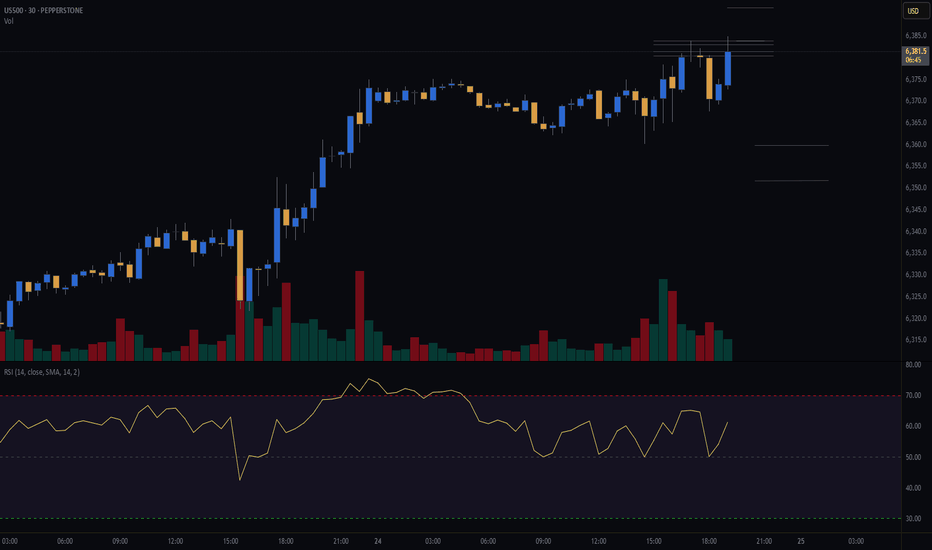

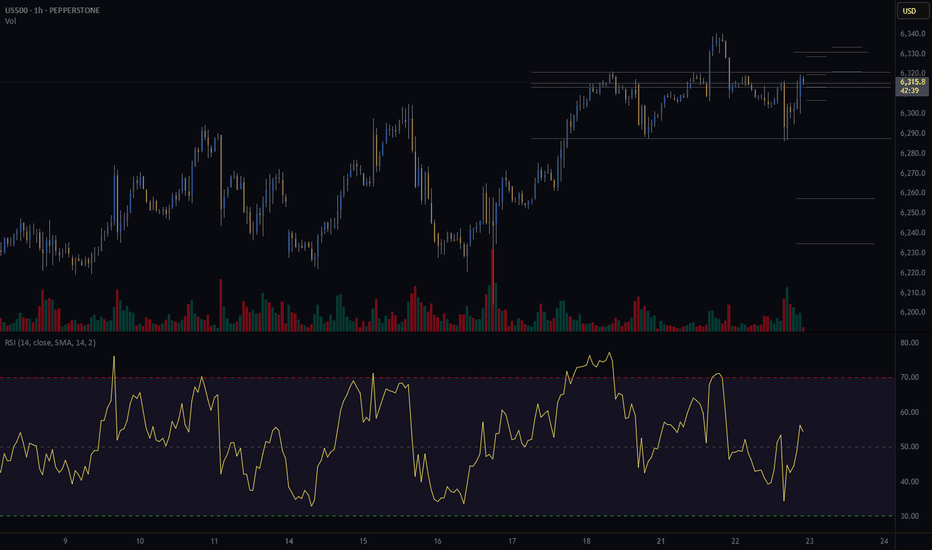

S&P 500 (CASH500) Short - Head and shoulders H1Potential short on S&P 500.

Risk/reward = 3.4

Entry = 6264.9

Stop loss = 6280.3

TP level 1 = 6221.7 (50%)

TP level 2 = 6200.5 (50%)

Need current candle to close back in range at 10.00 for all variables to be met.

Volume exception applied since current candle is the open of European markets.

Little Rest For SPXI think the SPX structure is more prone to bearishness. There is a structure that will probably move quickly in one direction. I don't think a good structure has been formed for a bottom. And the rise does not seem very strong. For this reason, I expect an increase after the first fall.

Since this situation will probably reflect on crypto, my bearish contracts are still in place. But I am thinking of buying a bullish contract until the FOMC time.

SELL SPX FROM 4100 OR 4000 AND TP ON 3800 AND WAIT Patience !! Time to Sell or Wait to 4100 anyways Going back to 3800 TP and wait for second confirmation Going back to 3200 !!!

stay Profitable

do not add to losers

add to winners

do not over leverage

do not open many positions

only trade what you know

dot get sentimental with trades . close it if did not work !!!

HAVE A GOOD WEEKEND !!!

SEE YOU GUYS ON PROFIT FRIDAYS !!!

SHORT NVIDIA for a 15% Profit Target from yesterdays close...**NIVIDA** Failed to create a new High and Broke Support in yesterdays session on higher Volume circled below, see the stock falling at least another 15% from here dragging the S&P index with it, first target would be $110 with stop loss placed above all time high $152.90 ...

S&P 500 Index (SPX) Analysis: Key Levels and Expectations.SP:SPX My Take:

Looking at the 4-hour chart of the S&P 500 Index, it's clear that we're approaching a critical juncture. The price recently rallied up to the $5,630 - $5,655 resistance zone, which has been a significant barrier in the past. However, this level has proven to be tough for the bulls to break through, and we're now seeing signs of potential exhaustion.

Key Levels:

Resistance:

$5,620 - $5,630: This is the zone where the price is currently facing resistance. It’s a crucial area to watch because a failure to break above it could result in a pullback.

Support:

$5,480 - $5,440: If we see a rejection from the current resistance, I'm expecting the price to retrace towards this support zone. This area has acted as a strong floor in the past, and it's likely where buyers might step in again.

Trendline Support:

The upward trendline, originating from the lows earlier this year, is still intact. This trendline could provide additional support around the $5,280 level if the price breaks through the aforementioned support zone.

Expectations:

Pullback Potential:

Given the current price action, I wouldn’t be surprised to see a pullback from this resistance zone. The first area I'll be watching for potential support is the $5,480 - $5,440 zone. A break below this could bring us down to test the trendline around $5,280.

Continuation of the Uptrend:

If the bulls manage to push through the $5,620 - $5,630 resistance zone, we could see a continuation of the uptrend with a possible target towards $5,700 and beyond. But for now, I’m leaning towards the possibility of a short-term pullback before any further upside.

Food for Thoughts:

Right now, I’m closely watching how the price reacts around this resistance zone. A pullback could offer a good buying opportunity, especially if it holds above the $5,480 - $5,440 support area. On the other hand, a strong breakout above $5,630 would signal that the bulls are in control and could push the market to new highs.

Stay tuned for more updates as the situation develops! Happy Trading from Deno Trading!

US100 + S&P 500 WEEKLY MULTI TF ANALYSISHELLO TRADERS

Hope everyone is doing great

📌 A look at NAS 100 & S&P500 from HTF - MULTI TIME-FRAME ANALYSIS

NAS100 WEEKLY TF

* 2 WEEKS bullish run delivering from the +OB On the NAS100 & S&P500 from the weekly.

* We are opening bullish on the weekly signalling strong signs of cont.

* But with (PO3) possible breather on the index's to see some reversal.

* with a -FVG & -OB looking for a small reversal but momentum strength brings doubts or some skeptism.

* Because The weekly & daily TF show we are still trading in BULLISH conditions on the NAS100 & S&P500.

NAS100 & S&P500 DAILY TF

* It becomes interesting on the Daily as we see an SMT on NAS & the S&P.

* S&P 500 is mitigating the POI -FVG.

* As NAS100 Is just shy of this PD ARRAY.

* Opening bullish i am looking for some rejection to confirm this SMT.

*WITH (PO3) RULES

Either than that as we drop to the 4H

* still bullish on NAS100 Trend cont. favoured until otherwise price shows some significant bearish move.

SENTIMENTS THE SAME ON THE S&P500

* Looking for reversal patens other wise continuation of the move.

1H TF

* Sentiment remains, remain bullish unless otherwise.

* Probably be looking for short OPPORTUNITIES otherwise .

* We will see what does the market dish.

🤷♂️😉🐻📉🐮📈

HOPE YOU ENJOYED THIS OUT LOOK, SHARE YOUR PLAN BELOW,🚀 & LETS TAKE SOME WINS THIS WEEK.

SEE YOU ON THE CHARTS.

IF THIS IDEA ASSISTS IN ANY WAY OR IF YOU ENJOYED THIS ONE

SMASH THAT 🚀 & LEAVE A COMMENT.

ALWAYS APPRECIATED

____________________________________________________________________________________________________________________

* Kindly follow your entry rules on entries & stops. |* Some of The idea's may be predictive yet are not financial advice or signals. | *Trading plans can change at anytime reactive to the market. | * Many stars must align with the plan before executing the trade, kindly follow your rules & RISK MANAGEMENT.

_____________________________________________________________________________________________________________________

| * ENTRY & SL -KINDLY FOLLOW YOUR RULES | * RISK-MANAGEMENT | *PERIOD - I TAKE MY TRADES ON A INTRA DAY SESSIONS BASIS THIS IS NOT FINACIAL ADVICE TO EXCECUTE ❤

LOVELY TRADING WEEK TO YOU!

The doomsday retracementWow, what a week it has been. SPX down 3.5% and up 2.5% the day after.

My thought is this backtrack is going to be the biggest retracement for the drop, just like we saw on bitcoin. APPL seems to have DOJ issues, NVIDIA chip issues in Taiwan... all seems to be lining up for potential lower for longer. My only buy this year will be TSLA. More on that.

Goldilocks is not going to bring us back to pre-pandemic levels, rate cuts are not going to save the market. The narrative has already changed on July 17th when Trump said he didn't want to invade Taiwan, good luck buying after august.

S&P weekly consolidation in progressAt the end of last week, sellers confirmed weekly consolidation by closing below the previous week's low. From now on, bears have control over the price on the weekly timeframe. We should monitor the progression of weekly lows and highs to see when things start to shift, but until then, we should trust the sellers.

It is also notable that if we look at the futures chart ( CME_MINI:ES1! ), we can see that buyers were unable to close above the previous day's high for the last 10 trading days. If buyers want to regain control, this will be their first objective.

Please note that the price is currently positioned near the previous month's low, which can provide an intermediate support level. If you’re planning to short the market, it is better to wait for a pullback or for a breakout with retest.

Finally, if weekly consolidation will convert into monthly consolidation it will be a major win for bears.

Disclaimer

I don't give trading or investing advice, just sharing my thoughts.

Have we found the top of S&P at 5110? The month of February saw an incredible bull run up to 5110.

The high was created on the 29th of February and as of March 1st, the high has not been broken. There is bearish divergence on D1 and H4.

The upward channel is at the risk of being broken after 2 months.

We have taken a short position at 5104 with a stop loss at 5150 and a reward of 4750.

Good luck!

Liquidity sources are drying upOn Friday, the S&P 500 in the last part of the session began to fall with some force. And today, we have seen that it has fallen and opened below the support zone at 4.998

The question we have to ask ourselves is: What does this mean? Does it mean it will continue to fall? Has a roof formed?

Last Friday, the options contracts expired. This meant the disappearance of the gamma, and meant the disappearance of a source of liquidity, that is, the money coming from the dealers to cover the positions they had open.

That money has disappeared, therefore, we must consider that a source of liquidity is missing.

Until we see how the gamma is situated, at what levels it stabilizes and what the behavior of investors is in the options market, it is reasonable to think that we will witness temporary fragility at least during the first days of this week.

And what does the chart tell us?

This morning it has pierced the support in the 4.998 zone. This is a symptom of weakness, of short-term fragility.

What 2 options are there?

If it now rebounds and is not able to exceed the 5.000 level, it will most likely deploy a new downward leg.

And if it rebounds, and moves sideways above 5.000, it is most likely that the price will try to return to the high zone.

Now, 5.050 is a wall. It was already before the expiration of the options contracts, and it is even more so now. Therefore, maximum rise is in the 5.050 zone.

If it fails to break above 5.000, we have support between 4.941 and 4.922

As long as the S&P 500 remains above that level, I will maintain a bullish bias.