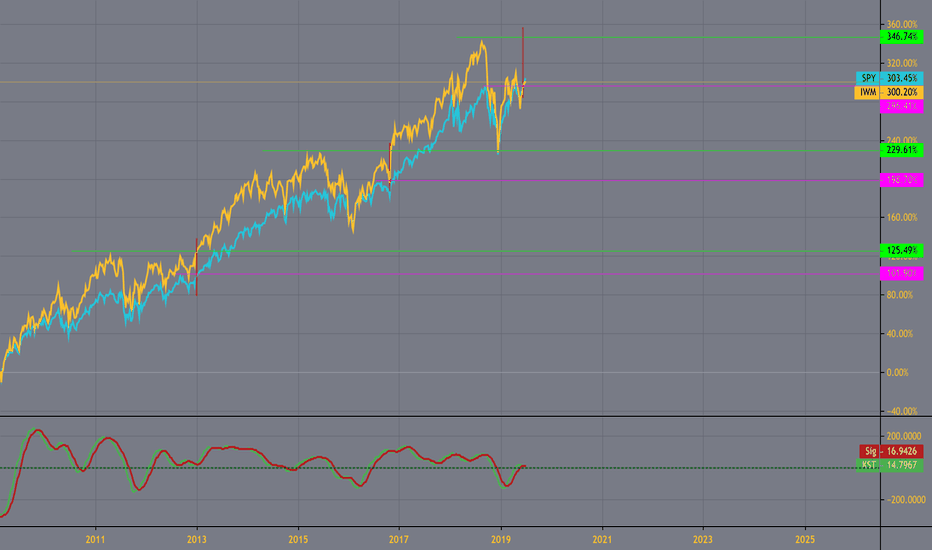

Houston- we have a problem.... iwm vs spyIWM has been the spy's faithful partner up chart since 2009. This run is different. I think we may be destined for failure.. until iwm can muster the strength to breaks its trend.

Suppose there's 2 possibilities here. either spy's gonna retreat, or iwm needs to make up some ground.. has a large distance to make a new high. Given circumstances i think retreat makes most sense.

Caution is warranted given conditions and charts history....

GOOD LUCK THIS WEEK!

SPXU

investors gonna fall for it? nothing new since december.. ATH?Market loves it when trump claims a victory.. but how many times will we fall for same news? Last time the tweet news did not make sustainable rally. seems like nothing new here. Why would we break highs and continue up?

Maybe..

There's some lines showing possible lack of confidence. We'll see how the cpu's play it. Trying to keep stance balanced. But im leaning more towards a decline in July than big rally. I know, I know July is the best month, the greatest month.... we'll see.

SPY- Quick DrawWhat is on the chart Is what I am looking at currently.

I guess my Bull Trap post from 8 days or so ago was correct. See attached. I think I was the first one to openly claim that It will be a bull trap. Now of course that is confirmed. The tell was the volume and lack of impulsiveness upon its first 10 min after breaking 282 (2 weeks ago)

20 likes and I'll keep this post up to date minute by minute.

SPX Weekly Candles Signal a Turn to Bottom of Channel!The S&P 500 has been in a bullish channel since 2009. The 200 day moving average has stayed within this range. Last week's rejection at the top of the channel paired with a bearish hammer signals a reversal. There is a potential for this to be a bear trap, so keep an eye on weekly closes.

A likely scenario is we revisit the top of the channel around 2840 and get slammed down to the 200 DMA. Re-evaluate your SPX shorts here, (2750). If the 200 DMA breaks down there is a chance we will fall to the bottom of the channel, (2440).

This is still a bullish trend. If we break below this channel the bear market will be confirmed.

This is not financial advice. Do your own research.

-Whistle

SPY- Broadsword calling DannyboySorry, I haven't updated in two days I've been stricken by a terrible case of the flu.

Ascending Broadening Wedge Pattern, for about 10 days.

These are distributive in nature and usually end up in selling down, especially when they are ascending (expanding to the upside)

We broke MAJOR resistance at 281 right?

Yes we did, but after two weeks have yet to have done anything impulsively. We should have had an impulse within the first few minutes or seconds of breaking out of the major resistance. The fact that we got above a major level without impulsing or having aggressive buy volume come in is a big red flag. This further points to a potential Bull Trap (as my last post was titled)

A bull trap is confirmed once we break back below that same 'major resistance' at about 281; or, once we break the horizontal bottom of this current broadening ascending wedge pattern 280.23. Also, keep your eye on a break of the blue channel I have drawn. This is a nice set up for a triple confirmation of a breakdown and to make it easy you could just say 280 is the major level that I am watching.

We do finally have significant bearish divergence now that we have had a high (Feb 25) and then a higher high (March 18 & Yesterday). The yellow line on the RSI shows the divergence.

Nasdaq and SPY are the only areas of the market that have continued higher since Feb 25!!!!!!!

Dow Jones (DJI) has not made higher highs in the last two weeks

Midcaps (MDY) have not made higher highs in the last two weeks

Russell 2k (IWM) has not made higher highs in the last two weeks

And many many other indicies.

QQQ- has increased in value but it has not broken any sturcture. QQQ is a nasdaq composite that is overall down except for the FAANG stocks which have been the lionshare of QQQ's upwardmovement as they are a flight to safety (reference: Right Side of the Chart video 1 or 2 days ago)

SPY - has broken structure but has not done so impulsivly strongly implying a bull trap (ref: last analysis, titled, "bull trap?")

I will provide updates to this analysis on the DJI, MDY, IWM for you to see what I am talking about for thier big picture weakness, in about 2 hours when I return.

No trade to make short until 280 is broken with stops above that level and or the highs.

: ) happy trading.

I have to run-I was in a bit of a rush- if i forgot somehthing I will update this analysis.

SPY-Bull Trap?So far it looks like a nice rejection on the perfect opportunity to make a breakout. This market is really trying to trick everyone.. C'est la vie.

My previous post had the multiple updates, and I included a particular moment when we wicked down, but were bought back up while near the Red Danger zone. This was the area that needed to hold on the small timeframes, and the wick didn't have strong volume coming in. You can see from the last update on my last post, that this is what tipped my hat to knowing this thing will probably crumble. (Please see related Idea below and scroll to the bottom of the many updates) Now we have support coming in at 281, once that breaks the markets will deflate. I can see us staying within a range for the next few weeks between 271.5 - 281. This could last for who knows how long.. 2 months ... 2 weeks... 2 days. I am not sure.

On the smaller time frames, we see a nice volume bar coming in when we hit 281, this will be our local bottom and a great place to use for entries or exits as the volume confirms its significance.

The rejection of the breakout today has not been confirmed, but will be confirmed if we close the day below the highs, and more specifically I like the 281 level for now. Until that breaks expect more chop.

After that breaks next major support will be our Larger Time Frame Ranges of 282-271.5.

Give a like if you want more minute by minute updates.

SPY- Bounce complete?My post Friday, warned of a bounce coming soon and it mentioned covering shorter term trades. Please refer to the attached "related idea" at the bottom.

Now we have gotten a nice little bounce, it already looks like it's trying to top to me. It could top here or surge higher to 279.30 or 281. But regardless wherever it does top it will be the next best place to get out into the safety of cash (or short) if you hadn't done so already last week.

If we make it all the way back up to the top at 281 area then I would be cautious of a break above that horizontal level, if that happens then we could see a retest of the yearly highs. This is an unlikely scenario in my opinion, but anything could happen, which is why closing out of shorts or re-entering the market long, if we do break 281 would be responsible for managing risk.

My analysis tells me that the odds are; we have just put in the last high point this market will see in a long time. Watch for the reversal by breaking this flag's support line, and then expect things to fall apart. This flag is ascending in nature, which leads to an impulsive break down if we break the support.

30 minutes until the market closes, so we will get to see which way this thing goes pretty soon.

SPY- How many measured moves can you find? Trade idea cover short term exp shorts fairly soon.

A little fun with taking measured moves from various 'h' patterns and Bear Flags. I see 3 different measured moves and they have very strong confluence with the 271.50 area.

We also have some Support Lines coming into the same area. One of which is quite important (purple) as it is part of my large flag consolidation pattern. And the other is a fairly strong horizontal support.

Also, most all of the larger timeframe stochastics have come down into the oversold areas.

This does not mean that we have to hit that target of 271.50 before a bounce up... It could just as easily turn from right here, and get a rally up. My plan only includes closing some shorter term short contracts at the 270.50 area or before.

SPY & the infamous "h"Beware of the 'h" patterns in downtrends.

Entry is at break of the bottom of the 'h' horizontal support.

This may break down, but then consolidate more sideways, maybe even attempt more bounce around action, for a prolonged consolidation here at the top. Of course, it could waterfall sell off... We don't know.

GL HF GG

* with only a half hour left of trading this could get propped up and not break today, yet the horizontal trade entry is still valid.

SPY into the crystal ballAll I can say is, what a Bounce! Well done Mr. President and institutions for keeping the Bears honest, btw: shout out to the real Mr. P! Unfortunately, you cannot prop up a market forever, and nature’s course will always find a way. I believe from this point on you can expect the market to be in a perpetual downtrend with lower highs and lower lows over the long term (next few years). I am not predicting a 'fell swoop' quick crash starting tomorrow, but more of an orderly sell-off until towards the end of the market cycle when everyone pushes the panic button together. You can see from the last two crashes how they behaved in this manner. Note: this trade idea is for a long term trading/investing. It is not guaranteeing that we will start the steep selling this week, although we certainly could. We could even stay at this level for a month; we don't really know but I would say better safe than sorry, establish your shorts and manage risk off of the 282 major horizontal resistance.

This market is about 6% overextended from where it "should" have turned around, based upon technical’s and their highest probabilities being at 262 reversal. I say "should" because there are no should's in the market, just what the price action does, and that is the only absolute truth. This is great for people who have been long up until this point. In a bear market, those gains can be taken out very quickly as we have seen 2 years of gains taken out in one month time (Dec 3- Dec 25 -16.6%) ...C'est la vie #BearMktLife

Fundamentals

I am not in a camp of looking at recent changes to influence these markets' fundamentals. These markets fundamentals are much more long term and lagging then people realize. These started 10 years ago after our last crash and how we have fiscally operated this country since then, during the 'biggest bull run in history'. Quantitative easing, Excessive Fed printing, bailouts, and 0% Fed interest for 9 years, etc etc. This market will not be saved from any of the following: trade deals with China, or how Powell "acts" at any given press conference, Government shutting down or reopening, Korea, AT&T merger, x, y, z... blah bla-blah. BTW- Re: China trade deals may conclude soon, which could provide initial strength as the deals are being put together and finalized. This could spike price up initially. But I am still of the camp that, "buy the hype sell the news" is prevalent human psychology. When an Unknown becomes a Known, the mystery is taken out of the market, and the only thing left to do is sell. Be careful of that one.

BTW- Fed and Trump are enemies.. Remember that.

Technicals

The tops that were put in during September, printed an RSI level that had only been achieved 3 other times in the history of the stock market, one of which was just before the great depression crash, the other two, strangely enough, were actually quite uneventful: 1929, 1955, 1996.

We have bearish divergences on the 4-hour chart: this officially happened today and started Feb 25th.

We have volume steadily decreasing since the inception of this bounce, still showing us the signature of indecision & reversal, as price goes higher on decreasing volume.

Our weekly stochastic is in the oversold area, I should have been watching this indicator more in the recent past, as opposed to the daily stochastic.

We have a nice clear ascending wedge in the white wedge pattern; we have finally broken this pattern.

Our Next horizontal support is at 275 its break if you missed the top and want to wait for confirmation then that is a level to consider

Candle: today we are creating a bearish engulfing candle: typically reversal

The above trades had very clear technical confluence and great places to manage risk off of. They have been my bigs trades up until this point, and have been majorly successful. This is number 3 on the chart because it is the 3rd BIG trade to take. As with the other trades, the importance of this area can only be seen as significant once enough time has passed as well as your opportunity.

_________________________________________________________________________________________________________________________________________________________________________

In the past 6 months of watching these markets closely, I had identified and posted some very high-quality trades listed on this chart, represented by 1 & 2 on the chart and linked below respectively.

*Please See the attached "Related Ideas" at the bottom for a walkthrough highlighting the past 6 months of this market accompanied by my analysis*

The above trades had very clear technical confluence and great places to manage risk off of. They have been my bigs trades up until this point, and have been majorly successful. This is number 3 on the chart because it is the 3rd BIG trade to take. As with the other trades, the importance of this area can only be seen as significant once enough time has passed as well as your opportunity.

The idea is this: we could be looking at the first bear market rally of this new bear market, which would essentially make "whatever area it tops at" the last high before a market crash/bear market. The technicals I am using today are more about market cycles and their behavior more than a certain trade set up. Since we are breaking down out of support @278.65 we could assume that a "local" top has been put in. We cannot say for certain if it is the ultimate top for the next few years or not as that requires a crystal ball. But I would say that the probabilities are highly stacked in favor of this being just that. The final top of a long arduous bear crash, with stops set just above these highs to manage your risk. If my final target at 157 is hit then this trade would have a risk to reward of 1:22 (1.8% Risk for 44% Gain). If you are using long term SQQQ options then the expected profit will be around 20x of your account from here to the final destination. If you want to close out of any shorter term contracts at our double bottom (235) in approx 3 months for a 5x on your account, then that could be wise. Then you would wait for that level to rebreak before reentry. After 235 breaks eventually we will look to close some positions within the 2015-2017 consolidation levels 212-185. From our current levels, if we get above 282 then you can close out of your short positions with a minimal loss, and look for a reentry higher possibly 286. If we break the all-time highs at 294 and live above them for a few weeks to a month, then we can assume that the bear market will not ensue and that I was in fact terribly wrong on this enormous trade plan.

It's as easy as 1, 2, 3.

Happy Trading Friends,

PipMiester

Please look at my related ideas attached below: very relevant information.

The ideas with "Historic" in the title were not meant to be public ideas, but I decided to make them publically available for this post.

Btw: Cudos to you tradingview bears over the past 6 months.

Shout out to Krown- I would be much less than half the trader I am today without your guidance that you graciously offer for free daily.

*This is not financial advice, as I am not a financial advisor. I am not registered with any agency and all assets traded have maximum loss potential. The information presented is for educational purposes only highlighting the differences between market cycles.

Topping pattern/candles starting to form as expected...SPY Stock market showing signs of reversing but still needs several more days to form top. But who will lead the decline and next rally? DOW or NASDAQ?

Here is an article talking about it.

SP:SPX AMEX:SPXS AMEX:SPXU NASDAQ:QQQ SQQQ AMEX:DIA SDOW UDOW