SPY 0DTE Bearish Setup – Max Pain in Play (Aug 7)## ⚠️ SPY 0DTE Bearish Setup – Max Pain in Play (Aug 7)

**Low-Conviction Market = Short-Term Put Opportunity?**

### 🧠 Summary of Consensus:

All major models (Grok, Gemini, Claude, Llama, DeepSeek) flag the **lack of bullish momentum**.

💡 **Key Bearish Signals**:

* 📉 Price below VWAP

* 📊 Weak volume

* 📉 RSI & flow: neutral to bearish

* 🎯 Max pain hovering near current price

---

### 🤖 AI Model Breakdown:

| Model | Bias | Action |

| -------------- | ------------------- | ---------------------------- |

| Grok / Gemini | 🔻 Weak Bearish | No trade (wait for clarity) |

| Claude / Llama | 🔻 Moderate Bearish | Buy PUT at \$630 |

| DeepSeek | ⚖️ Mixed Bearish | Monitor – no high-conviction |

🧭 **Consensus Direction**: **Weak Bearish**

---

### 🔧 Trade Setup (0DTE)

| Metric | Value |

| ---------------- | ------------- |

| 🎯 Instrument | SPY |

| 🔀 Direction | PUT (SHORT) |

| 💵 Entry Price | 0.78 |

| 💣 Strike Price | 630.00 |

| 🛑 Stop Loss | 0.39 |

| 🎯 Profit Target | 1.56 |

| 📅 Expiry | Aug 07 (0DTE) |

| ⏰ Entry Timing | Market Open |

| 📈 Confidence | 60% |

📊 **Risk/Reward**: 1:2

📉 **Time Decay Alert**: Tight stop-loss due to fast 0DTE decay.

---

### ⚠️ Key Watchouts:

* 📈 Reclaiming VWAP = **exit immediately**

* 🔊 Sudden volume spike = momentum shift risk

* 🧯 Keep position size small – this is a **scalp**, not a swing

---

### 🧠 Final Take:

> If SPY stays pinned below VWAP & max pain remains, this **0DTE put could print**. But discipline is everything — tight stop, tight leash. ⚔️

---

🧠 **Follow for daily AI-backed earnings & SPY plays**

📉 **Not financial advice – manage risk like a pro**

Spyidea

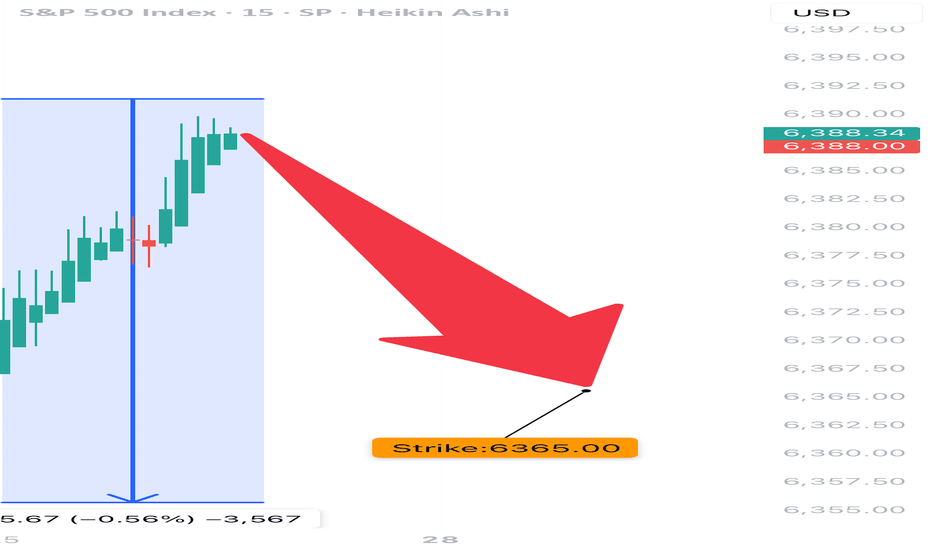

SPX 0DTE TRADE IDEA – JULY 25, 2025

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

SPY Breakout Watch: Triangle Pressure Builds Above 590SPY has surged in a strong V-shaped recovery from the March low of ~480 to testing major resistance around 595–600. The daily chart shows sustained higher highs and higher lows, but price now stalls at a key supply zone with multiple doji candles—signaling indecision. A rising trendline provides strong support near 570.

Zooming into the 60-minute chart, SPY forms an ascending triangle with flat resistance at 590 and rising support from 584. Volume contraction suggests accumulation, priming a potential breakout. A 60-min close above 590 targets 596, with a stop under 588.

On the 15-minute timeframe, bull-flags form frequently after morning gaps, with breakouts typically launching 4–5 points higher. VWAP and the 20-MA converge near 588.5, making it an ideal pullback entry zone.

Strategy for May 19–23:

Long on a clean breakout above 590 (target: 594–596)

Stop under 587.5–588

Caution if daily closes below 570

Expect early-week upside tests of 590–594, followed by a potential breakout toward 595–600. If a high-volume rejection occurs near that zone, a quick scalp-short may be in play.

SPY in Focus: Tactical Day Trading Amid a Bullish RecoveryAs of early May, SPY consolidates around $560–$570, testing former support-turned-resistance.

On the daily chart, the market is pausing after a rapid rally, with $610 as major resistance and $540–$485 as key support. The 1-hour chart reflects a solid uptrend with recent consolidation between $555–$568, while the 15-minute chart shows intraday weakness with critical support at $560.

Three trading strategies emerge: (1) Bullish breakout, buying above $564–$568 with targets up to $580;

(2) Bearish breakdown, shorting below $560 with downside to $545; and

(3) Range trading, buying/selling within $558–$568 using tight stops. Confirmation via volume and candlestick patterns (e.g., engulfing or hammer) is essential.

Short-term bias is bullish, but with caution—if SPY holds $560, it could retest $570 or break higher. A drop below $556 invalidates the bullish outlook.

MyMI After-Hours Update: S&P 500 Potential Pullback?As the White House proposes 25% Tariffs on Steel and Aluminum imported to the US, and with the current resistance we're seeing around the $6069 Price Level, we're now looking for a potential pullback as more import duties are to be included along with Steel and Aluminum come Tuesday / Wednesday of this week.

If we do see a pullback, we're looking to see if it break support on the 50% Retracement and even further below are the $6021 Price Levels, but even more so, the $5960s.

Going to be an interesting one to watch! Stay connected by registering your FREE account on our website to access even more resources and tools to improve managing your financials and investments.

LINK IN BIO!

How to PREDICT MARKETS! Tops and BottomsIn this video, I go over the following in great detail:

Predicting Markets with Williams %R, RSI, and MACD

Predicting market movements can be challenging, but combining the Williams %R, Relative Strength Index (RSI), and Moving Average Convergence/Divergence (MACD) indicators can provide powerful insights for traders.

Williams %R measures the current closing price relative to the high-low range over a specific period, helping identify overbought or oversold conditions. RSI gauges the speed and change of price movements, also indicating overbought or oversold levels. MACD analyzes the relationship between two moving averages of a security's price, identifying potential buy or sell signals.

By using these three indicators together, traders can:

Confirm Trends: When all three indicators align, it strengthens the signal for a potential trend continuation or reversal.

Identify Entry and Exit Points: Overbought or oversold signals from these indicators can help pinpoint optimal entry and exit points.

Reduce False Signals: Combining multiple indicators can help filter out false signals, increasing the reliability of predictions.

Comprehensive Technical Analysis: SPX 10-Minute ChartThis SPX 10-minute chart shows a clear intraday shift from a bearish to a bullish trend, accompanied by multiple technical signals. Let’s break down the analysis across different technical components:

1. Trend Analysis:

Initial Downtrend: The session started with bearish momentum as indicated by Put Signals and declining price action. The lower lows created a brief bearish trend that ended with a strong reversal.

Bullish Reversal: The reversal is confirmed by a series of Call Signals after a strong bullish breakout from the previous consolidation zone. The price broke above a significant resistance level around 5,731.94, leading to a steady uptrend.

2. Moving Averages:

Short-Term Moving Average (Orange Line):

This acts as immediate support during the bullish run. The price consistently stays above this line, indicating short-term bullish strength.

The slope of the moving average is steep, reflecting increasing bullish momentum.

Mid-Term Moving Average (Blue Line):

Positioned further below, the blue moving average provides a broader support level. This indicates that the medium-term trend remains supportive of the upward move, showing a well-established bullish context.

3. Heikin Ashi Candles:

Bullish Momentum: The Heikin Ashi candles display a strong bullish pattern with several consecutive yellow candles and minimal lower wicks, indicating reduced volatility on the downside.

Temporary Pullback: A few red candles appear, marking brief consolidation but not a trend reversal. The continuation of yellow candles afterward confirms sustained bullish pressure.

4. Key Signals and Levels:

Entry Long: A long entry signal is observed after the breakout around 5,731.94, which was an excellent point for entering the bullish trade.

Exit Long: The Exit Long signal near 5,776.76 suggests taking profits after the bullish move. This level now serves as short-term resistance.

Support Levels:

Immediate Support: 5,755.43 – A pullback to this level would still align with the bullish structure as long as it holds.

Major Support: 5,731.94 – This level marks the breakout point, acting as a strong floor for further bullish moves.

5. Volume and Momentum:

Although volume is not displayed, typically such strong moves (as indicated by Heikin Ashi and moving averages) are accompanied by rising volume.

Momentum: Bullish momentum remains high, supported by consistent upward price movement and the sustained hold above the moving averages.

6. Resistance and Future Outlook:

Immediate Resistance: The price is facing resistance at 5,776.76. A break above this could open the path to higher levels, potentially testing psychological levels like 5,800.

Continuation or Pullback: If the price breaks above 5,776, we can expect a continuation of the uptrend. However, a failure at this resistance might lead to a short-term pullback to 5,755 or even 5,731.

Conclusion:

The chart reflects a strong bullish reversal with clear signals of upward momentum. Traders should watch the 5,776 level for a breakout confirmation or potential pullback to the key support levels at 5,755 and 5,731. Maintaining the trend above the orange and blue moving averages will be crucial for sustained bullish movement.

SPY: 2007 vs. 2024 Rate Cut CyclesEconomic Indicators Comparison (2007 vs. 2024):

In both 2007 and 2024, several key economic indicators show notable similarities, suggesting the market faces comparable macroeconomic challenges:

Unemployment Rate (September 2007: 4.7%; September 2024: 4.2%)

US Inflation Rate YoY (September 2007: 2.5%; September 2024: 2.5%)

US Housing Starts (September 2007: 1.238M; September 2024: 1.235M)

US Leading Economic Activity (September 2007: 100.4; September 2024: 100.4)

US Existing Home Sales (September 2007: 4.5M; September 2024: 3.95M)

These parallels reinforce the notion that the 2024 market may experience similar stress as 2007 unless significant positive economic developments occur.

Overview:

The charts and additional data provided give a compelling comparison of two major market cycles: 2007 and 2024. Both cycles show striking similarities in market behavior, particularly surrounding the first rate cuts by the Federal Reserve. We see a top in the S&P 500 (SPX) in July of both years, followed by corrections, recoveries, and rate cuts in September.

2007 Market Behavior:

July 17, 2007 - SPX Tops: The S&P 500 peaked in mid-July 2007, reaching new highs as the economy, on the surface, seemed stable.

-9.5% Correction: Shortly after the top, the market corrected, declining by 9.5% in response to growing concerns about the subprime mortgage crisis.

Full Recovery: The market briefly recovered as investors expected the Federal Reserve to step in with supportive policies.

September 18, 2007 - First Rate Cut: The Federal Reserve cut rates for the first time in September 2007, sparking optimism that monetary easing could prevent further economic deterioration.

Market Collapse: Despite the rate cuts, the crisis deepened, leading to a full-scale market collapse as the global financial crisis unfolded.

2024 Market Behavior (So Far):

July 17, 2024 - SPX Tops: Once again, we see the S&P 500 peak in mid-July 2024, a period marked by inflation concerns and economic uncertainty.

-8.6% Correction: Similar to 2007, the market corrected by 8.6%, driven by fears of a potential economic slowdown and the anticipation of monetary policy adjustments.

Full Recovery: The market saw a brief recovery, as investors anticipated rate cuts to alleviate economic pressures.

September 18, 2024 - First Rate Cut: The Federal Reserve cut rates on September 18, 2024, echoing the 2007 scenario. However, whether the market will collapse, stabilize, or recover remains to be seen.

Comparative Analysis:

Topping Patterns: Both 2007 and 2024 show a clear topping pattern in July, followed by sharp corrections and subsequent rate cuts in September. This parallel highlights the cyclical nature of market reactions to monetary policy.

Rate Cut Effects: Historically, the first rate cut has not always led to an immediate market recovery. In 2007, despite initial optimism, the market eventually collapsed as the underlying economic problems, specifically the subprime crisis, worsened. The question now is whether the 2024 market will follow the same path, especially considering ongoing inflation and potential economic stagnation.

Key Observations:

Corrections and Recoveries: Both markets experienced similar corrections post-top. The 8.6% correction in 2024 mirrors the 9.5% drop in 2007, showing that investor sentiment and market behavior can repeat under similar macroeconomic pressures.

Rate Cut Timing: In both years, rate cuts followed periods of market instability, with the hope that monetary easing would stabilize the economy. However, uncertainty looms in 2024, as it is yet unclear whether these cuts will prevent a deeper recession or lead to further volatility.

Potential for Market Collapse in 2024: While the 2007 market collapse was driven by the subprime mortgage crisis, the 2024 market faces different challenges, such as inflationary pressures, geopolitical instability, and evolving global trade dynamics. There remains a risk that the 2024 market could experience a sharp downturn if these issues worsen.

Is this the Beginning of the Flip? Just KiddingFrom what we can see it appears that we are just at the beginning of a bear move here and that might be quite an aggressive move. pay attention to the $550 level here and if we stay at that or below it, we should a steep curve to the bears in the next few days here.

SPY 10-Minute Chart Analysis - September 3, 2024AMEX:SPY The SPY has been trading in a well-defined range over the past few sessions, bouncing between support and resistance levels like a pinball. Right now, we’re seeing a key moment where SPY is testing the lower boundary of its trading range.

Current Setup:

Resistance Zone: The upper boundary around 5,641 has consistently acted as a ceiling for SPY. Every time the price reaches this level, it gets knocked back down, indicating strong selling pressure.

Support Zone: On the other end, the support around 5,560 has held up well, with buyers stepping in to defend this level each time it’s been tested. SPY is currently hovering just above this support zone, which could be a critical area to watch.

What’s Happening Now:

SPY is testing the lower end of the range, around 5,573.91, after a sharp drop from the resistance. The price is attempting to bounce, but the question is whether this support will hold, or if we’re looking at a potential breakdown.

Key Levels to Watch:

Break Above: If SPY can gather enough momentum to push back towards the 5,641 resistance and break through it, we could see a significant move to the upside. This would signal that buyers have regained control.

Break Below: On the flip side, if SPY fails to hold above the 5,560 support, we might see a more extended decline, potentially opening the door to lower levels.

Summary: SPY is at a crucial juncture. The battle between buyers and sellers is heating up as the price hovers near the lower support of the range. Traders should keep a close eye on these levels, as a break in either direction could dictate the next significant move for SPY. Stay alert and be ready to act depending on how the market reacts in the coming sessions.

SPY 2-Hour Chart Analysis - August 28, 2024Double Trouble is the name of the game here, and it’s no joke. As you can see SPY just dipped below a critical support level, and things could get tricky if buyers don’t step in soon.

What’s Happening?

SPY has been bouncing around within a tight range for the past few days, but today’s action saw it break below the 554.93 support level (highlighted by the yellow dashed line). This level has been key in holding the price up, and now that it’s breached, we could be in for a rough ride.

Why Double Trouble?

Here I am referring to the fact that SPY is now stuck between two crucial zones: the broken support around 554.93 and the next significant support level down near 551.00. If the price falls to this lower support, we could see even more downward pressure, potentially leading to a deeper sell-off.

Key Levels to Watch:

Resistance: Look for potential resistance to form around the 554.93 level now that it’s broken. If SPY can reclaim this level, it might signal a reversal, but if not, the bears could stay in control.

Support: The next big support is down near 551.00. If SPY continues to fall, this is the level that needs to hold to prevent further losses.

What’s Next?

We’re at a pivotal point. A break back above 554.93 could give bulls a lifeline, but if SPY continues to slide, the 551.00 level will be the last line of support before more significant downside risk comes into play.

Stay cautious and keep an eye on these critical levels as we head into the next trading sessions. I am starting to believe that market is in a delicate position, and how it reacts here will set the tone for the days to come.

SPY Analysis Across Multiple Timeframes | AugustLike we have seen from the video above lets have some talks on these timeframes and see whar the analysis says.

Weekly Timeframe:

SPY is currently hovering around 533.27, which is near the top of its long-term uptrend. We’ve seen a slight pullback from the recent highs, which isn’t surprising given how strong the rally has been. If the pullback deepens, keep an eye on 523.97 as the first line of support. Should the price drop further, 514.09 could come into play as a stronger support. On the upside, breaking through 547.04 would signal the continuation of the bullish trend.

Daily Timeframe:

On the daily chart, SPY has pulled back to around 504.45 after a solid run-up. The recent bounce suggests that buyers are stepping in, but the next challenge lies at 515.13. If SPY can clear that hurdle, it might aim for the 524.99 area. However, if the pullback resumes, 503.45 is the first support level to watch. A break below that could see SPY testing 493.41.

30-Minute Timeframe:

Zooming into the 30-minute chart, SPY is in a bit of a holding pattern around 543.41. This sideways action indicates that the market is catching its breath after recent volatility. If SPY can break above 546.64, we might see a short-term rally toward the 550 level, which also happens to be a psychological barrier. On the flip side, if the consolidation breaks down, watch for support around 544.88 and 538.97.

Now what?

Again, note that SPY is at a critical juncture across all timeframes. Whether you're trading intraday or looking at the bigger picture, these levels are key to watch. We’re seeing some consolidation right now, but whichever direction SPY breaks, it could lead to a significant move. Stay nimble and watch those levels closely!