SPX 0DTE TRADE IDEA – JULY 25, 2025

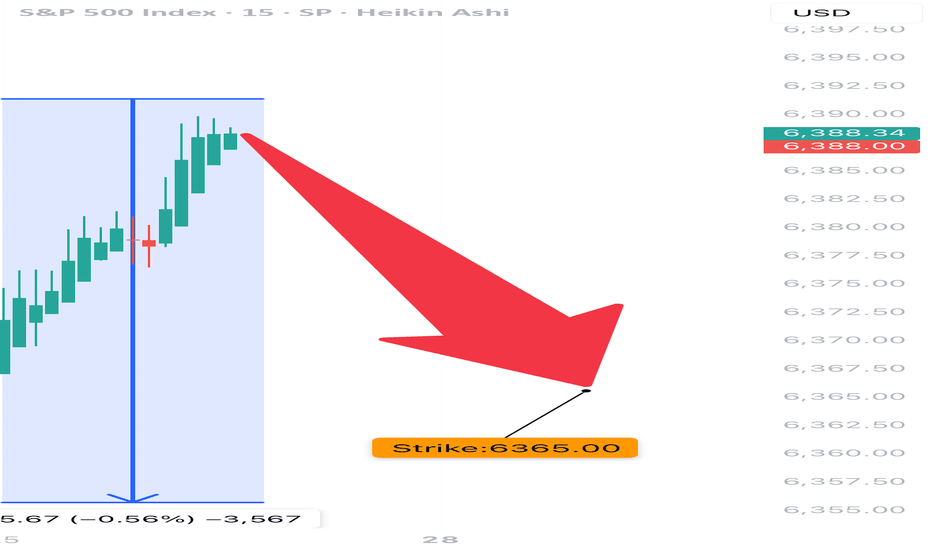

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

Spyoptions

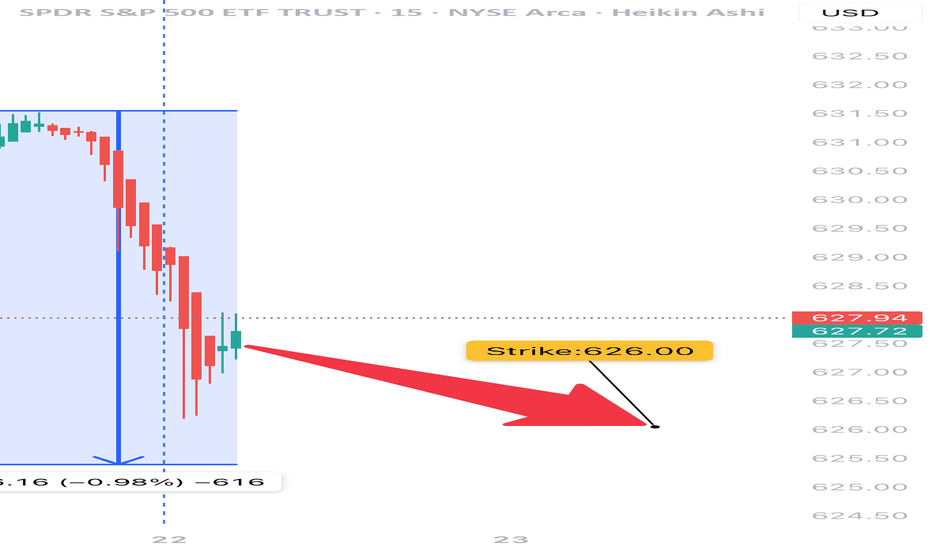

SPY Options Analysis Summary (2025-07-22)

🔻 AMEX:SPY Weak Bearish Put Setup (0DTE) – 07/22/25

All models agree: price is weak, momentum is limp, and VWAP is above.

But conviction? Not unanimous. High-risk, high-reward 0DTE scalpers only.

⸻

📉 Trade Setup

• 🟥 Direction: PUT

• 🎯 Strike: $626.00

• 💵 Entry: $0.57

• 💰 Target: $1.70 (+200%)

• 🛑 Stop: $0.28 (–50%)

• 📅 Expiry: Today (0DTE)

• ⚖️ Confidence: 65%

• ⏰ Entry Timing: Market Open

⸻

🧠 Multi-AI Consensus

Model Bias Action

Grok/xAI Weak Bearish ⚠️ No Trade

Claude Weak Bearish ⚠️ No Trade

Gemini Bearish ✅ $627 Put

Llama Moderately Bearish ⚠️ Conservative Put

DeepSeek Bearish ✅ $626 Put

🔹 VWAP < Price = Bearish bias

🔹 RSI = Neutral → watch for fakeouts

🔹 VIX favorable (<22)

🔹 Volume = weak = risk of whipsaw

⸻

⚠️ Risk Notes

• Bounce risk off session lows is real

• Lack of momentum may cause theta burn

• Best for scalpers who react fast — not a swing trade

• No conviction = smaller size, tighter leash

⸻

📢 Tagline (for virality):

“ AMEX:SPY is limping, not bleeding. But if it breaks, 200% comes fast. 0DTE scalpers: this is your window.” 💣

Rising wedge on SPY - Melt up? or Next leg down? Immediate Bias (Tomorrow):

Scenario 1 – Bullish Continuation (Low Probability unless there's a macro catalyst):

Breaks above ~$596–$598 cleanly

Retests that zone as support (watch 595.50 intraday)

Then targets:

600 psychological

604–608 upper resistance channel

Possible end-of-month blow-off top: 612–618

Scenario 2 – Pullback / Rejection (More Probable Setup):

Rejected at ~596–597 zone (which aligns with upper wedge resistance)

Breakdown below $590 intraday

Then targets:

587.80 EMA cluster (20/50)

If lost → 576.44 next EMA + demand level

Followed by major support at 565.87 / 563.43

🔥 Week Ahead Trade Plan (May 20–24)

✅ Bullish Possibility:

If NVDA earnings, FOMC minutes, or macro data surprise to the upside

Watch for breakout above the red wedge and hold above 600

Target range: 604 → 612 max upside

🚨 Bearish Scenario:

Wedge breakdown below ~$590

Momentum cracks down to:

587

576 (watch for bounce)

If panic selling → 565–563 (larger time frame buying zone)

Volume divergence and overbought EMAs support a potential cool-off.

📅 Monthly Projection (End of May):

If wedge breaks down → consolidation range between 563 – 587

If wedge breaks out → blow-off rally up to 612–620, but likely to fade quickly

Fed commentary and NVDA earnings on May 22 will be major catalysts

📌 Key Levels

Type Price Notes

Resistance (R3) 612–618 Final upside blow-off zone (channel top)

Resistance (R2) 604 Overhead channel line

Resistance (R1) 595–598 Wedge top + major resistance

Support (S1) 587 EMA cluster + strong local demand

Support (S2) 576 Clean structure + prior breakout

Support (S3) 565–563 Confluence of long-term EMAs + trendline

🎯 Trade Setups

📉 Bearish (Favored if no breakout tomorrow):

Short 595–597 with stop above 600

Targets: 587 → 576

Optional: Add below wedge break (~590)

📈 Bullish (Confirmation-based):

Break + retest of 597–600

Target: 604, then scale out at 612

Avoid front-running long unless you see volume + price close outside wedge

S&P500 $SPY | SPY’s All-Time High - Where to Next? | Feb23'25S&P500 AMEX:SPY | SPY’s All-Time High - Where to Next? | Feb23'25

AMEX:SPY BUY/LONG ZONE (GREEN): $597.50 - $613.23

AMEX:SPY DO NOT TRADE/DNT ZONE (WHITE): $584.88 - $597.50

AMEX:SPY SELL/SHORT ZONE (RED): $574.00 - $584.88

AMEX:SPY Trends:

AMEX:SPY Weekly Trend: Bullish

AMEX:SPY Daily Trend: Bullish

AMEX:SPY 4H Trend: Bullish

AMEX:SPY 1H Trend: Bearish

AMEX:SPY just reached a new all-time high! How did price get there?

AMEX:SPY experienced a small range between 602.45 – 604.00, followed by bearish momentum, leading to a 3% drop in price. However, bullish momentum quickly stepped in, pushing the price up before continuing downward again. This bearish trend was short-lived and appears to have formed a developing range rather than a sustained downtrend.

Shortly after, price broke back above 597.50, signaling the start of a new bullish trend. SPY then established a ranging pattern between 597.50 - 608.00 before ultimately breaking out to a new all-time high of 613.23. Despite the breakout, price action has now dropped back into the range between 597.50 - 608.00.

Where to next? Will SPY hold its new highs, or is this the start of a reversal?

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, sp500, s&p, fed, federalreserve, fedrate, AMEX:SPY , snp, snp500, usmarket, usmarkets, stockmarket, overallmarket, spyath, spyalltimehigh, all-time high, price action, bullish trend, bearish momentum, trading range, breakout, support and resistance, choppy market, untradable zone, stock market, technical analysis, market trends, price breakout, volatility, trend reversal, stock trading, SPY analysis, market momentum, trading strategy, sparros, sparrosexchange,

Time to Prepare | $SPY Options Bull & Bear Week 1 March 2025AMEX:SPY

Last week's AMEX:SPY $595 Put 3/10 ran for 66% from $480 up to $1,420.

The last two weeks, the market has suffered a controlled pullback. So far it has been cautious selling rather than outright panic. While fear has entered the market, it has yet to reach capitulation, where there would be significantly more potential downside. The key level to watch long-term is the 200SMA on the daily chart, currently at $568.45. This level, which hasn't been tested in 16 months, could signal a Stage 4 selloff, a more aggressive and potentially prolonged downward trend.

Here are this week's AMEX:SPY Options:

(15-30 minute candle closes for confirmation and stop-loss)

📜 $580 PUT 3/17

Entry: Breakdown and failed retest of $584.50

Target 🎯 : $580, $574, $571

📜 $590 CALL 3/17

Confirmed breakout over $584.50

Target 🎯 : $590, $591.50, $594

$SPY Bull & Bear Options to End FebruaryThe AMEX:SPY is at a crossroads as we close out February. We’ve had hotter-than expected inflation, talks of tariffs, promises of deregulation, China’s stimulus rollout, and Wall Street’s continuing “soft landing” narrative. This is a time to be cautious. Friday’s PCE inflation data could sway the Fed’s March rate decision. Midterm elections and tax cut debates are heating up. Regardless of the noise, the levels show us the way.

We are trading in the range of $591 to $600. For this week, we will be using support over $597 as the entry for calls and a rejection under $600 for puts.

Here are this week’s AMEX:SPY options:

(15-30 minute candles for confirmation and stop-loss)

📜 $595 PUT 3/10 or $591 3/11 (Cheaper, but higher risk)

Entry: Retest & rejection under $600

Target 🎯 : $595, $591.50, (Continuation: $587, $585)

📜 $603 CALL 3/11

Entry: Breakout & retest over $597.70

Target 🎯: $601, $603, $603.44, (Continuation: $606, $608)

$SPY Options - Bull & Bear | February Week 2We have been range bound the last three weeks. Sellers are starting to exhaust buyers more quickly than before. We are leaning bearish but confirmation is king. We use 15-30 minute candle closes for confirmation and stop-loss.

Should there be a significant pullback, $580 and $560 are major floors of support.

Here are our bull and bear options for this week:

$600 PUT 2/24

Entry: Confirmation of breakdown under $603.44 (OR harsh rejection at $606)

🎯Target: $600 ($603.44)

$608 CALL 2/24

Entry: Confirmation of breakout over $606

🎯Target: $607, $608

Here's how last week's options went:

📜 AMEX:SPY $605 Call 2/21

$500 → $770 (+54%)

📜 AMEX:SPY $605 Call 2/18

$350 → $645 (+84%)

Bull & Bear Top Options February Week 1AMEX:SPY

Weekly Options 2/4/2025

We are still trading in the same range as last week from $591 to $605. This week we will trade this same range using 15 to 30 minute candle closes for confirmation and stop-loss.

$605 Call 2/18 or 2/21

Entry: Breakout over $600, buy off retest

Targets🎯: $603, $605, $608

$595 Put 2/18 or 2/21

Entry: Breakdown under $600, buy off retest rejection

Targets🎯: $595, $593, $591

$SPY Options | Trump Week TwoAMEX:SPY

Fear and panic has spread in the market, but buyers ate it up by end of day (1/27). There is a gap from December 18th up to $603-$606. $603.44 is the key pivot for bulls and $591.54 for the bears.

For our weekly options trades, we use 15 or 30 minute candle closes for confirmation and stop-loss.

$603 CALL 2/11

Entry: Breakout/Hold Over $599.92

Targets🎯: $603.44, $606

$595 PUTS 2/11

Entry: Breakdown/Rejection Under $599.92 OR $603

Targets🎯: $595, $591.54

Trump Week 1 $SPY Options (Bull & Bear)AMEX:SPY

This week we are focusing on the range of $585 to $607.90 with our confirmation level at $599.44. We are using 15-30 minute candles closes for both confirmations and stop-losses. Best of luck!

Ranges: $585.81-$599.44-$607.90

$606 CALL 2/14

Entry: 15 minute close OVER $599.44 (Buy off retest)

Targets: $606, $607.90

$589 PUT 2/14

Entry: 15-minute close UNDER $599.44 (Buy off retest)

Targets: $589, $585.81

$SPY Weekly Options | Last Week's Put +185%AMEX:SPY

Our range is $570 to $589 with our entry pivot at $580. For these options, we use 15-30 minute candle CLOSES for confirmation and stop-loss.

📜 $585 CALL 1/27

Entry: Confirmation over $580

Target🎯: $584, $585, $589, $595

📜 $570 PUT 1/27

Entry: Confirmation below $580

Target🎯: $575, $570

Bull & Bear into the New Year | Week 1 2025 $SPY OptionsAMEX:SPY

Last week, our $585 PUT 1/13 was a killer, producing two daytrades that ran for 50% and 132%!

Here is what we are watching for this week:

We have reclaimed bullish trend and expect consolidation within this range from $584.59 to $607.45. Last two weeks have been low volume and profit taking. We are using this bullish trendline for confirmation using 15-30 minute candle closes.

$601 Call 1/24

Entry: Retest and hold of bullish trendline

Targets 🎯: $599, $601, $603, $608

$590 Put 1/24

Entry: Breakdown and failed retest of trendline

Targets 🎯: $590, $584.59

SPY Triple Bottom, Rally time?!AMEX:SPY SP:SPX

I'd really like us to end the week above $580 in order to have this either Double or Triple bottom friends!

I could see a flash crash down to fill the price GAP at $574.81 as well.

Either way from what I'm seeing on the TVC:VIX , Economic numbers, and the charts I believe we are getting close to a bottom friends.

Consolidate down to only the best names until we receive that confirmation. They did a fake out today and another FED putting FUD into the market didn't help with the GDP projection.

Not financial advice.

Bull & Bear New Year SPY OptionsAMEX:SPY

We see the indices having a tough January. Long-term trend is still intact. The 10-year yield is a benchmark for bulls/bears. It needs to be down to 4% (currently 4.5%). If it hits 5%, the pullback will intensify. There is a high floor of support on pullbacks, notably the 50SMA ($580) and 200SMA ($550). We are not thinking bear market. We are overextended.

$595 CALL 1/13

Entry: Breakdown under white trendline

Targets 🎯: $595, $598.67

$585 PUT 1/13

Entry: Breakdown under white trendline

Targets 🎯: $585, $583.56, $580

Best of luck to you all and a happy new year from all of us at Pennybois!

🥂🎆🥳

SPY Options: Bull & Bear (Week of December 16)AMEX:SPY

Short-term we are looking at a downside trade as we want RSI to cool off a bit. Key levels at $607 and our key pivot of $604.25 last week.

📜 $604 Put 12/31

Entry: Rejection and 15-min close UNDER $607, entry off retest of resistance

🎯 Targets: $604.25, $603.37

📜 $608 Call 12/31

Entry: Breakout and 15 min close OVER $607, entry off retest of support

🎯 Targets: $608, $608.50

Weekly SPY Options: Bull & Bear ScenariosWe are back after another banger week for SPY options. Last week's $605 Call 12/9 ran for 31.4%. This is how we are prepared for both sides!

📜 $604 CALL 12/16

Entry: Retest of $603.37 and 15-min close OVER

Target: $604, $605

Stop-loss: 15-min close UNDER $603.37

📜 $600 PUT 12/16

Entry: Breakdown and 15-min close UNDER $603.37

Target: $601.25, $598

Stop-loss: 15-min close OVER $603.37

AMEX:SPY

Bull & Bear Options for Week of 11/25 (184-210% Last Week)We are back after another banger week for SPY options. Last week's $590 Call 12/2 confirmed twice off $586 returning intraday gains of 48-67% on Tuesday & Wednesday and reaching highs on Monday 11/25 of 184-210%

Here are this week's options:

Range: $583-$598 ($590 mid-point)

$595 PUT 12/9

Entry: 15-min candle close BELOW $598.67

Targets: $595.50, White trendline

Stop: 15-min candle close ABOVE $598.67

$605 CALL 12/9

Entry: 15-min candle close ABOVE $598.67, 15-min retest and close ABOVE $598.67

Targets: $601, $605

Stop-loss: 15-min candle close UNDER $598.67

SPY S&P 500 ETF End of the Year Price Target If you haven`t bought the recent dip on SPY:

Now with Goldman Sachs lowering U.S. recession odds from 20% to 15% and raising their 2024 year-end S&P 500 target to 6000 from 5600, the outlook for the market appears increasingly optimistic.

The reduced recession risk suggests stronger economic stability, and the upward revision in the S&P target points to continued growth potential.

Given these factors, I agree that a year-end price target of 600 on SPY is achievable.

Comprehensive Technical Analysis: SPX 10-Minute ChartThis SPX 10-minute chart shows a clear intraday shift from a bearish to a bullish trend, accompanied by multiple technical signals. Let’s break down the analysis across different technical components:

1. Trend Analysis:

Initial Downtrend: The session started with bearish momentum as indicated by Put Signals and declining price action. The lower lows created a brief bearish trend that ended with a strong reversal.

Bullish Reversal: The reversal is confirmed by a series of Call Signals after a strong bullish breakout from the previous consolidation zone. The price broke above a significant resistance level around 5,731.94, leading to a steady uptrend.

2. Moving Averages:

Short-Term Moving Average (Orange Line):

This acts as immediate support during the bullish run. The price consistently stays above this line, indicating short-term bullish strength.

The slope of the moving average is steep, reflecting increasing bullish momentum.

Mid-Term Moving Average (Blue Line):

Positioned further below, the blue moving average provides a broader support level. This indicates that the medium-term trend remains supportive of the upward move, showing a well-established bullish context.

3. Heikin Ashi Candles:

Bullish Momentum: The Heikin Ashi candles display a strong bullish pattern with several consecutive yellow candles and minimal lower wicks, indicating reduced volatility on the downside.

Temporary Pullback: A few red candles appear, marking brief consolidation but not a trend reversal. The continuation of yellow candles afterward confirms sustained bullish pressure.

4. Key Signals and Levels:

Entry Long: A long entry signal is observed after the breakout around 5,731.94, which was an excellent point for entering the bullish trade.

Exit Long: The Exit Long signal near 5,776.76 suggests taking profits after the bullish move. This level now serves as short-term resistance.

Support Levels:

Immediate Support: 5,755.43 – A pullback to this level would still align with the bullish structure as long as it holds.

Major Support: 5,731.94 – This level marks the breakout point, acting as a strong floor for further bullish moves.

5. Volume and Momentum:

Although volume is not displayed, typically such strong moves (as indicated by Heikin Ashi and moving averages) are accompanied by rising volume.

Momentum: Bullish momentum remains high, supported by consistent upward price movement and the sustained hold above the moving averages.

6. Resistance and Future Outlook:

Immediate Resistance: The price is facing resistance at 5,776.76. A break above this could open the path to higher levels, potentially testing psychological levels like 5,800.

Continuation or Pullback: If the price breaks above 5,776, we can expect a continuation of the uptrend. However, a failure at this resistance might lead to a short-term pullback to 5,755 or even 5,731.

Conclusion:

The chart reflects a strong bullish reversal with clear signals of upward momentum. Traders should watch the 5,776 level for a breakout confirmation or potential pullback to the key support levels at 5,755 and 5,731. Maintaining the trend above the orange and blue moving averages will be crucial for sustained bullish movement.