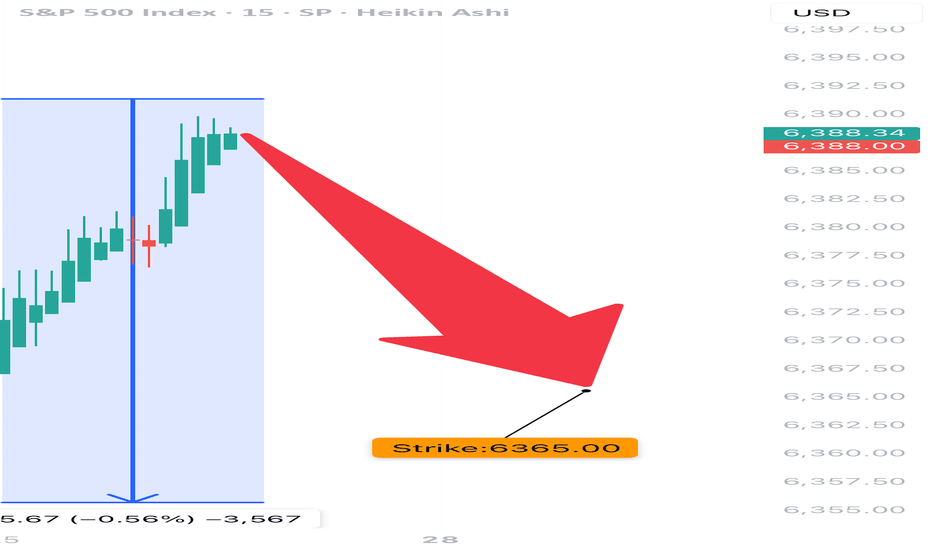

SPX 0DTE TRADE IDEA – JULY 25, 2025

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

Spyputs

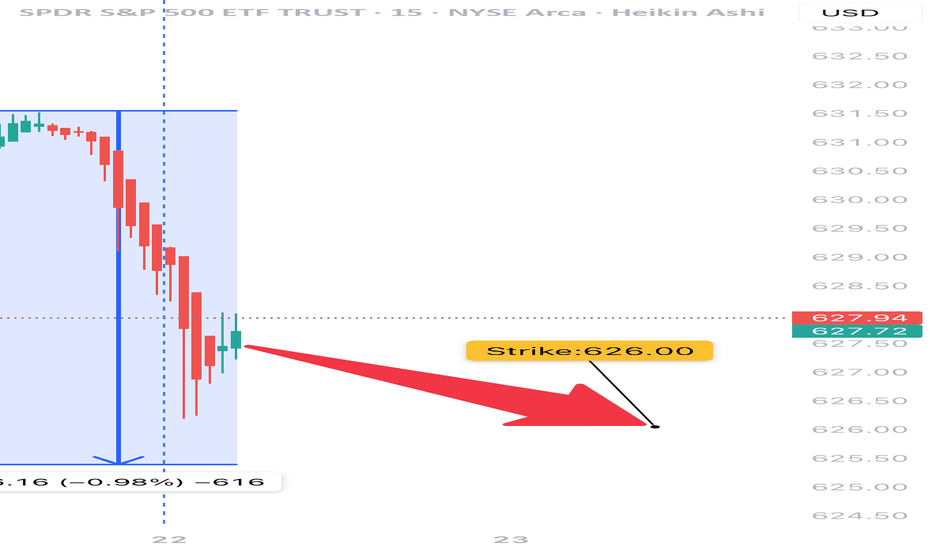

SPY Options Analysis Summary (2025-07-22)

🔻 AMEX:SPY Weak Bearish Put Setup (0DTE) – 07/22/25

All models agree: price is weak, momentum is limp, and VWAP is above.

But conviction? Not unanimous. High-risk, high-reward 0DTE scalpers only.

⸻

📉 Trade Setup

• 🟥 Direction: PUT

• 🎯 Strike: $626.00

• 💵 Entry: $0.57

• 💰 Target: $1.70 (+200%)

• 🛑 Stop: $0.28 (–50%)

• 📅 Expiry: Today (0DTE)

• ⚖️ Confidence: 65%

• ⏰ Entry Timing: Market Open

⸻

🧠 Multi-AI Consensus

Model Bias Action

Grok/xAI Weak Bearish ⚠️ No Trade

Claude Weak Bearish ⚠️ No Trade

Gemini Bearish ✅ $627 Put

Llama Moderately Bearish ⚠️ Conservative Put

DeepSeek Bearish ✅ $626 Put

🔹 VWAP < Price = Bearish bias

🔹 RSI = Neutral → watch for fakeouts

🔹 VIX favorable (<22)

🔹 Volume = weak = risk of whipsaw

⸻

⚠️ Risk Notes

• Bounce risk off session lows is real

• Lack of momentum may cause theta burn

• Best for scalpers who react fast — not a swing trade

• No conviction = smaller size, tighter leash

⸻

📢 Tagline (for virality):

“ AMEX:SPY is limping, not bleeding. But if it breaks, 200% comes fast. 0DTE scalpers: this is your window.” 💣

$SPY Market top playing outAs I've mentioned in my previous analysis, I believe we're at a market top (Despite Tom Lee calling for new highs).

There's nothing positive for markets looking forward, therefore I think markets will finally price in all of the raise hikes and the poor economy.

I think we may see one more high, however, if we do, I believe it'll result in a rug pull. I think the FOMC meeting tomorrow will largely be bullish for markets, but then after that, Thursday, Friday or into early next week, we'll see the market reverse.

I'm looking for the move to hit the targets laid out on the charts.

$412, $397 or $393 as the bottom. With hindsight, I think the move will mark the top of the market and we'll continue much lower. Bear market continuation targets shared here.

Let's see if it plays out.

ES EZ SHORTSES/SPY/SPX is currently in a consolidation pattern. The S&P tends to make a big move out of these consolidation patterns once they are given time to play-out. NOTE that these consolidation patterns CAN breakout in any direction AND/OR fake-out in either direction but, observing the weekly price action, Im banking on this pattern being bearish along with the fact that this stock is currently in a overall downtrend. I see the ES' falling to 3745 in less than 2 weeks.

R.I.P. The S&PAs you can see, History repeats itself. To my technical eye, The S&P is loosing momentum at a price of major resistance AND(+) a Major trend line where price has previously ended its bull rally to return to its overall bear market downtrend. Second possibility attached. I see The S&P returning to the 350's if not much much lower. Its divergent sister, the VIX is showing similar confluence because it is also at a price area of major lows where it has previously reversed overall direction longterm. I see The VIX returning to 34.32.

Small gambling put on the SPYJerome Powell gave good momentum in the market yesterday. I do not think this is enough to breakout of the bear trajectory. Market went emotional and soon reality will resurface. Inflation and interests are still high. Macro economics are not favourable. Money is still getting sucked out of the market. As time goes by, people have less money to invest because of higher prices. This is not really a pivot, interest rates are still expected to rise further. Maybe at a slower pace.. so what? Credit will still go more expensive. I went with a small gambling put on the SPY.

$SPY bulls in charge? maybe for now..$SPY momentum has been strong for the past few weeks. after the market switched gears to the upside after the government lifted off the covid restrictions this summer, and ok earnings in some of the big tech stocks couple weeks ago. i believe after the restrictions got lifted off, it helped the economy to get back on its feet. but despite the covid restriction being lit off, it created massive supply chain issues, and inflation. this is due to massive back log of the supplies that didn't get sold in the past 2 years because of the covid. Also, small businesses try to make up for the loss of profits during the pandemic.

here's my day trade price target for SPY on FRIDAY 08/15/22.

============================================================

For calls; buy above $429.17 and sell at 431.28 or above

For puts, buy below 426.49 and sell at 424.17 or below

============================================================

Welcome to this free technical analysis . ( mostly momentum play )

I am going to explain where I think this stock might possibly go the next day or week play and where I would look for trading opportunities for day trades or scalp play.

If you have any questions or suggestions on which stocks I should analyze, please leave a comment below.

If you enjoyed this analysis, I would appreciate it if you smashed that LIKE or BOOST button and maybe consider following my channel.

SPY Trade Idea (BULL TRAP)Here Im using the trend based fib ext.

SPY is currently at the June highs and the 1.618 Fib level.

Seeing deviation with price making a higher high and the RSI making a lower low on the 4HR. (Bearish)

In June fear turned to euphoria in an instant. Talks about the bear market being over started, just like it is now.

Spy fell out of an ascending channel after initially getting rejected from the 1.618. (Bearish)

In June it took about a week to finally sell off and bull market talks faded in the. background. I think we see a similar story in the next few days and weeks.

If you're bullish i would be patient, things dont go up in a straight line. The RSI on the daily is at levels not seen since March. VIX is on a strong support which has generally marked local tops. If you notice there has been 3 times we previously touched this support and every time has been a sell signal. Same goes with the top resistance, every time we touched resistance it marked a local bottom in the stock market as you can see with the red and green arrows.

In the coming weeks I am bearish on SPY and anticipate a retest of 390, a break below that and the next level is 380.

However coming off one of the best months in a long time the medium to long term future looks bright for the stock market.

We look to be forming a possible inverse head and shoulders pattern on higher time frames and if this is the case we should see strong support in the 380-390 range. (This is where Im swinging long if the market gives us these levels). I would also like to see VIX at resistance to further confirm the trade.

I wouldn't be surprised if VIX broke out of this wedge, and give us the 40+ everyone has been calling for which if in fact we do reach those levels on VIX i think that would be the max opportunity to go long on the market. We will cross that bridge when/if we get there.

Ill soon be posting ideas on individual stocks, let me know if you guys agree or disagree!

SPY S&P 500 Compared To 2008 - Will We Follow The Same Pattern?The daily chart for the S&P 500 looks eerily similar to the chart from the 2008 crash. We have already crossed below the VWMA 100 and VWMA 500 now which are both historically very supportive moving averages. I think it's very possible we chop around in this area for the next couple weeks while we wait for the VWMA 100 to cross below the VWMA 500, but if we can't stay supportive back above the VWMA 500, it will likely fall pretty hard. If it's anything like the 2008 crash, it should be a steep drop from here, but there are a lot of other factors at play so we will just have to wait and see.

The 2008 drop fell 56% from its high over about 510 days. If we perform the same this time, that would mean a drop to around $210 that would happen around the middle of 2023. Again this is just if we repeat the exact same thing statistically. $210 is also the low from the 2020 pandemic crash and a likely area for it to hold if it does make it down that far.

Something to note though is that when matching the two timeframe's chart patterns, the 2008 chart pattern took twice as long to play out. So with the bottom reaching a 56% drop over 510 days, it looks very extended and not very similar to the timeline from 2008. This makes me consider that if we do follow the pattern from 2008, it may happen in a shorter timeframe such as a year or so. This is purely speculative and obviously there are a lot of other things that factor into this, but I'm just comparing chart patterns here as possible outcomes.

We should see some good support in that purple cloud though on the way down. Those are the EMA 1000 and EMA 2000 which I are typically very strong support/resistance.

If we do follow the same pattern as 2008, I'm waiting for price to reclaim and stay supportive above the VWMA 100 before entering LEAP Calls when it rebounds. Then wait for price and the VWMA 100 to get back above the VWMA 500 for confirmation of another actual bull run to begin (but that could take 2+ years to happen again if this scenario plays out).

Drop your thoughts in the comments, I'm curious to hear what others have to say on this comparison.

Spy forecast Spy levels to watch for- the yellow 436.58 being the 0.5% fib on the fib speed resistance fan. and 423.63 being the 0.38% or (.25%)

440 is acting as resistance. if it breaks lets see if it can hold and go from there. could test 442-443 again.

for my opinion and im racing the clock on this 15min edit window.

if we dont breech and go lower we stay between 437-441.50 (short term/ like today maybe/ highly unlikely).

if we do go lower, which i think that is a good chance, it COULD eventually test those 432-430-428 levels then reassess from there.

doesnt mean it has too. its just until goes lower there isnt really any big things to say till then. or im tired from retyping this.

that also doesnt mean i think we HAVE to go there before ripping faces off to the top side. this market is very wild and honestly today will be very telling

$SPY oversold?? $SPY broke the previous support of 457 approaching below 430. in all time frame SPY is really bearish. but the RSI on 1hr and 4hr chart shows that its oversold.

oversold level doesn't mean it will bounce there. But the probability of short bounce is there. overall it seems the market is trying to deplete itself at the moment.

most of the stocks that is rallying from this market are the retailers and energy. basically there is probability that the market is going in cyclical rotation but I could be wrong..

Day trade or scalp target play: 01/24/22

Buy call above 444.44 sell at 450.93

Buy puts below 434.60 sell at 431.22

Hello everyone,

welcome to this free technical analysis . ( mostly momentum play )

I am going to explain where I think this stock is going to go over the next day or week play and where I would look for trading opportunities

for day trades or scalp play.

If you have any questions or suggestions which stock I should analyze, please leave a comment below.

If you enjoyed this analysis, I would definitely appreciate it, if you smash that LIKE button and maybe consider following my channel.

Thank you for stopping by and stay tune for more.

My technical analysis is not to be regarded as investment advice. but for general informational proposes only.

9/23 UPDATED BEAR THESIS $316-317 next stopKey points

The DXY may bounce on resistance as shown

Oil may bounce on support as shown

Bonds remain unchanged as shown

Need to gauge Asia's reaction from our sell off today for confirmation on tomorrows trade

For those that don't understand intermarket relationships. From left to right and can start at any point.

Currency ------> commodities -----------> bonds -----------> Equity -------> currency --------> commodities ---------> bonds -----------> equity.

Huge markets reacting to one another, all interconnected, all correlated globally.

Given the circumstances, Spy is sitting in no-mans land right now with a straight shot to 316-317, but given that the DXY and OIL is looking to bounce off support/resistance means its bullish for SPY(meaning a relief bounce is probable, but will only be able to tell at tomorrows open, we need to see how asian markets will react to our sell off today)

The Dollar had a textbook breakout to the upside. When the Dollar rises, equity falls.(not all the time). When Oil loses value ----> spy loses value)

My chart merely shows that OIL is near a support line and that Dollar is near a resistance = Probability of Spy having a relief bounce.

The Risk vs reward is still heavily favored to the bears.

My General view of SPY

In my philosophical view, humans tend to always need an "answer" for everything in life. Historically we created gods to explain the unexplainable. That's not to say that i am an atheist in my religious view, nor am i trying to make this a religious discussion, I'm purely commenting on human nature. We are a curious species and we learned to not take "no" or "i don't know" as an answer from a very early age of our ancestry.

If you look around you, it feels we "must" have an answer for everything in life, including the unexplainable (consciousness). Scientific people call it "coincidence", religious people call it a "miracle from god". To advance in our life we need to see these two groups of people from a third persons perspective, and understand both sides. It doesn't always have to be black or white, right or wrong. It's okay "not to know", as long as you are the path to enlightenment through spiritual or scientific, that's all that matters.

I am only a man, born into this world trying to make sense of something insensible for my time.

So why is my philosophical view important in the way that I trade? I see many traders nowadays pointing to the news as an "answer" for their directional bias in the markets. Trump said this, trump said that, markets go up, markets go down. The media business sells you the answers, and you buy them because its encoded in our ancestral genes to buy them. To reach a new level of consciousness, you would need to understand the words. " I am only a man, and too stupid of a species to understand anything but." We are a mere spec in the timeline of "(life?)".

My thesis is based purely on objective data with a technical analysis standpoint (sometimes with the exception of federal news.)

Before trying to understand the way that i trade, you would need to understand my philosophical standpoint, and to also assume that nowadays, there is a gap between the real economy and the stock market. The stock market ≠(does not equal) the economy. You would also need to understand the options market and that algorithms created by market makers are always trying to stay delta neutral hedging their positions. And finally the last thing you must understand is intermarket analysis to fully understand my trading view.

So if we can all come to the agreement that we are trading against algorithms, we could also say that we are trading against logic. In this case it is MUCH easier to trade against logic than against emotional traders because every move in the market is based on a formula instead of being based on a opinionated rational/irrational decision to sell or buy. Do I know the formula? No I don't, and that's okay. What i do know, is the results of the formula at work. Sometimes its easy to spot when live trading, sometimes it can only be spot with hindsight bias, sometimes the answer is never found, AND THATS O.K.

For example, i don't see where or why "2+2" is happening, but i keep seeing "4" as the answer.

So if we can all come to the agreement that we are trading against algorithms, we could also say that we are trading against logic. In this case it is MUCH easier to trade against logic than against emotional traders because every move in the market is based on a formula instead of being based on a opinion based rational/irrational decision to sell or buy.

TL;DR We are not trading based off psychology any longer, we are trading based off logic. (algorithms & formulas) My thesis is based purely on objective data with a technical standpoint (with the exception of federal news.)

AMEX:SPY

Multiple resistances/support areas for the S&P.

We have always respected the white resistance since the 2008 financial crisis. The solid green line in the middle is what i consider the "goldilocks" zone. A habitable zone in which "fair price" has been achieved in the context of the uptrend we are seeing since the 2008 financial crisis.

In conclusion, to not make my first post too long i will write some pointers in how i trade.

I trade Spx products vs volatility

I trade Spx products vs forex

I trade Spx products vs bonds

I trade Spx products vs commodities

I trade Spx products logically ( I heavily disagree with EWT methodology)

I trade Spx products using intermarket relationships

I use historical resistance/supports in all markets to gauge activity in what i'm trading.

As time goes on i will post many charts of what i wrote above, and too make things less confusing i will explain as i go.

SPY - Measuring Flag WarningThe $SPX sell-off from September 2nd highs, created a consolidation range (orange rectangle) from $330-340 approximately.

Making a measured move, with the consolidation constituting a half-way measuring flag structure (blue arrows).

100 exponential moving average is now the trend support, coincidental with June highs. Unfortunately, this is not a support trend historically market makers pay special attention to.

Bearish Development - CovidThis could provide a turn in the market to the bearish side. I created 2 quick scripts that compare the change in daily deaths to change in daily cases. On average there seems to be about a 10 day delay between a new uptick in cases followed by a new uptick in daily deaths.

Why did new cases stay the same and deaths went down?

The only reason I can possibly explain this is that the majority of new cases for awhile was the younger generation with a lower risk of death.

Why should I be worried now?

We've been consistently hitting new all time highs in cases for nearly 2 weeks now. New daily deaths are starting to climb and with a bit of a jump too. This next week will tell us if the new uptick in cases was due to a lot of false positive testing, or was the result of a lot of people contracting covid. If this is the case a MASSIVE uptick in hospitalizations and deaths will happen. Spy puts may be in the cards.

Get Your Puts In, This Rally Is Weak.Short and concise as all of my charts are. I believe in the methodology of coming up with a fundamental approach to reading the charts, and simply test these beliefs with TA to either confirm or reject the fundamentals. This late-week rally leading into the weekend has A LOT of stipulations involved which is why it is very difficult too identify a clear and concise move at the moment. Democrats in the US are working hard to push an additional stimulus bill to pass which has in the recent pass, caused markets to rise. Republicans are still not set and have not voted on this new bill. This is an extremely important note to remember here. Stimulus bills are good for corporations, which in turn yields positive returns in the overall market as sentiment rises. THIS IS NOT A LONG TERM ECONOMIC SOLUTION but it's apparent those in leadership roles are prioritizing keeping our markets propped up and I can easily foresee this new stimulus bill passing once the Republican party can add a few stipulations to the bill.

Putting the stimulus aside, short term charting is showing a very clear double top. In my previous chart, this was identified and successfully shorted down to the 50 fib retracement level. You can see my buy zone was set between $274-278 and I gotta say... It was perfect. That zone was a major support area and a subsequent bull rally followed. This was expected too! Not every bear rally is 2,000 days straight of red, we MUST have green days to leg down further. After-all, if there are no buyers, who is there to pick up your shares/options once you exit?

We're seeing:

Lower highs

Lower lows

RSI is also showing exhaustion

Major resistance is being hit currently

All things are leading and pointing to another leg down. Buying volume is very poor in this rally, thus showing a lack of positive sentiment in the current price point we're hanging around. Looking for what to watch? Volume will dictate which way we begin moving. I also implore you to take a close look at resistance and support zones. We did see a solid bounce from the 50 Fib level but I simply don't think we have enough upward momentum to re-test 61.8 again. If a leg down takes place next week or over the weekend, I can see us re-testing the 50 Fib level and that level failing, driving us down to new lows once again.

Level of risk: Moderate to High

Be very careful with staying up to date on the news and the impending stimulus bill. This will impact price action and will likely come after hours. If this bill stalls or doesn't get passed, that alone will be a catalyst for our next leg down.

Just be very careful during these low volume days and make sure to watch the Greeks if you decide to play options. I suspect if the stimulus passes, Monday will be quite green but watch that volume!

Bearish Outlook With Next Bounce Near $274-278Very simple chart. Things are going wild right now in the market and playing daily options may result in you getting burned. The Fed has shown with their unlimited QE that they are willing to do what's necessary to prop up our markets. That said, looking at the extremely low volume the past week, you can see everytime there is an influx in volume, the ticket begins trending down. I stated in a previous post how the resistance at $294 was going to be the turnaround point, although I will admit I didn't suspect the second double top to occur. That said, if you played had I mentioned with some long-dated Puts, you'd be swimming in cash right now.

This move down is a clear indication the .68 Fib level held as expected and the market is pulling back now. This will continue to happen until we reach the next support zone which is looking like won't come until we reach the .5 Fib retracement level. I will need to spend the day watching price movement to see if a buying opportunity will be present, but that will be the next buy-zone to watch for. If this leg down is a violent one, it's very much a possibility we dive through this zone with enormous volume.

For now, shorting to this area should be a relatively safe play to scalp some profit. Hope this chart gets more exposure than my last!