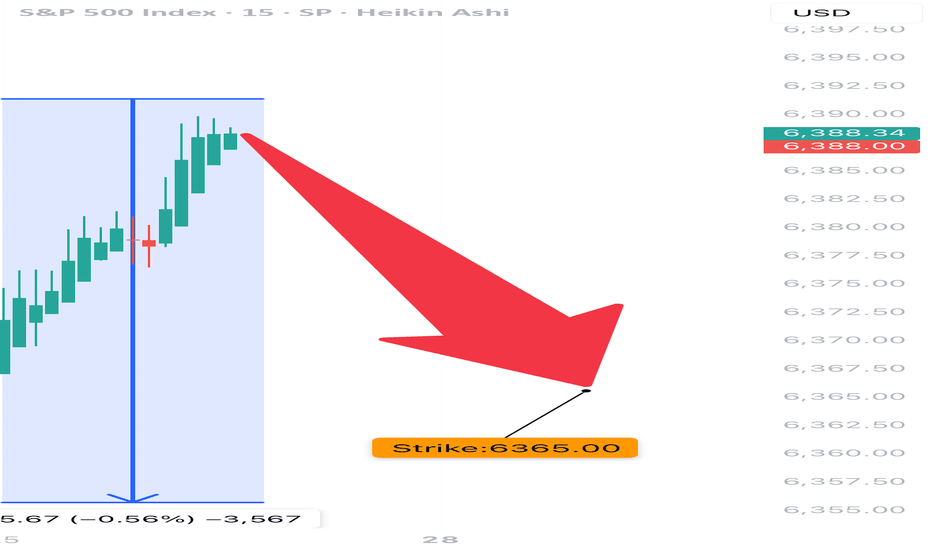

SPX 0DTE TRADE IDEA – JULY 25, 2025

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

Spyshorts

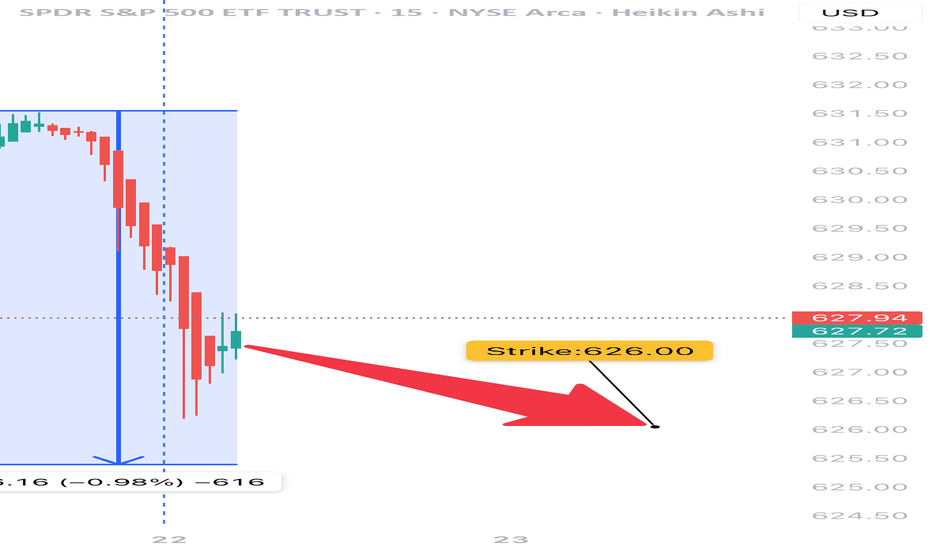

SPY Options Analysis Summary (2025-07-22)

🔻 AMEX:SPY Weak Bearish Put Setup (0DTE) – 07/22/25

All models agree: price is weak, momentum is limp, and VWAP is above.

But conviction? Not unanimous. High-risk, high-reward 0DTE scalpers only.

⸻

📉 Trade Setup

• 🟥 Direction: PUT

• 🎯 Strike: $626.00

• 💵 Entry: $0.57

• 💰 Target: $1.70 (+200%)

• 🛑 Stop: $0.28 (–50%)

• 📅 Expiry: Today (0DTE)

• ⚖️ Confidence: 65%

• ⏰ Entry Timing: Market Open

⸻

🧠 Multi-AI Consensus

Model Bias Action

Grok/xAI Weak Bearish ⚠️ No Trade

Claude Weak Bearish ⚠️ No Trade

Gemini Bearish ✅ $627 Put

Llama Moderately Bearish ⚠️ Conservative Put

DeepSeek Bearish ✅ $626 Put

🔹 VWAP < Price = Bearish bias

🔹 RSI = Neutral → watch for fakeouts

🔹 VIX favorable (<22)

🔹 Volume = weak = risk of whipsaw

⸻

⚠️ Risk Notes

• Bounce risk off session lows is real

• Lack of momentum may cause theta burn

• Best for scalpers who react fast — not a swing trade

• No conviction = smaller size, tighter leash

⸻

📢 Tagline (for virality):

“ AMEX:SPY is limping, not bleeding. But if it breaks, 200% comes fast. 0DTE scalpers: this is your window.” 💣

Michael Burry Executes Massive Short of SPY and QQQIntroduction:

In recent news, renowned investor Michael Burry has made waves by executing a massive short of the SPY (S&P 500 ETF) and QQQ (Nasdaq 100 ETF). Burry's move has garnered significant attention, raising concerns about the future performance of these major USA stock market ETFs. This article aims to provide traders with a cautious analysis of the situation and present a call to action for those considering shorting these ETFs.

The Burry Effect:

Michael Burry, famously known for his accurate prediction of the 2008 financial crisis, made a bold move again. By shorting the SPY and QQQ, Burry is signaling his belief that the current market conditions may be overvalued or potentially face a correction. Traders should take note of his historical accuracy and consider the implications of his actions.

Understanding the Risks:

Understanding the associated risks is crucial to approach any investment decision thoroughly. Shorting ETFs like SPY and QQQ involves betting against the market's overall performance, which can be highly volatile and unpredictable. While Burry's track record is impressive, conducting independent research and analysis is essential before making investment decisions.

Considerations for Shorting:

1. Diversification: Traders should ensure their portfolios are well-diversified, spreading risk across various asset classes and sectors. Shorting ETFs like SPY and QQQ should be considered a strategic move within a broader investment strategy.

2. Risk Management: A clear risk management plan is crucial when shorting major market ETFs. Setting stop-loss orders and regularly monitoring positions can help mitigate potential losses.

3. Expert Advice: Consult with financial advisors or professionals specializing in shorting strategies. Their expertise can provide valuable insights and guidance tailored to individual trading goals and risk tolerance.

Call-to-Action: Proceed with Caution

Considering Michael Burry's recent shorting activity, traders are encouraged to proceed cautiously when contemplating short positions on SPY and QQQ. While Burry's reputation for accurate predictions is noteworthy, conducting thorough research and analysis is imperative, and assessing the potential risks and rewards associated with such trades is imperative.

Ultimately, the decision to short these significant USA stock market ETFs should be based on an individual's risk appetite, investment strategy, and market outlook. Traders should carefully weigh the potential benefits against the inherent risks, seek professional advice, and consider alternative investment options.

Conclusion:

Michael Burry's massive short of SPY and QQQ has undoubtedly sparked interest and raised questions among traders. However, it is crucial to approach such investment decisions and conduct thorough research cautiously. By considering the risks, diversifying portfolios, and seeking expert advice, traders can make informed choices that align with their individual trading goals. Remember, shorting major ETFs is a complex strategy that requires careful consideration and may only be suitable for some.

SPY - bearish - pitchfork analysisOn the weekly chart SPY is close to some resistance pitchfork lines and the RSI is approximately in divergence with the price (the price high although lower then the earlier high it's still high relative to how the RSI high is in relation to the earlier one). On the daily chart the price is close to resistance pitchfork lines and the the RSI reached a resistance pitchfork line.

Will history repeat itself? Party until Jan 25thPlease do your DD this is not a financial advice.

The current market crash and bounce seems to be rhyming with the 2000 crash. If you saw my AAPL(attached below) idea, you will see that I believe this is the case and we are going through 2000 crash and eventually 2008 (in about 8 years) deleveraging again. With the CPI and unemployment data out of the way, there is no major event to wait for until earnings; starting with Tesla on the 25th which I think will would start the next downturn in markets if it hasn't started by then.

The two ways this plays out. Both are badHey there friends!

As you can see, I have two resistance trendlines plotted. Both historically have been respected very reasonably. On top of this, id like to mention that my software that signals weakness in the market has been triggered. Although it doesnt 100% predict the absolute top, it does show where weakness is and you can see how it has preformed in the past. With this said, as we test the first of the 2 trendline resistances of this massive megaphone AND test the resistance trendline of the ascending channel, I expect some kind of retrace.

The target would be assumed to be the bottom of the ascending channel, which would be 3836. From there we will see one of two things. Either a breakout of the ascending channel or a bounce from the support line to send us up to test the second of the resistance trendlines in the descending megaphone. If we bounce, im certain it will also test the resistance trendline of the ascending channel. This would line up to be on December 1st with a target of about 4110.

If instead we breakout of the ascending channel when we head down, the target would be 3300 based purely on TA of the ascending channel. But i would like to mention that whenever we find a top, we reject -16.50% in 45 days (this has happened the last two times)

If we go based on that the target would be more like 3200.

Stay fluid friends. Were in for a volatile time

SPXU INVERSE ETF TRADING IDEA FOR FOMC MEETING 3/16/22This is my trading strategy for March 16th, 2022 on the next FOMC meeting. Using inverse 3 x etf is like doing options without options. They track opposite of whatever it is they track. In this case the SPXU does the exact opposite of the SPY S&P 500 ETF .. The spy tracks the S&P 500 markets.

So I'm setting up a position on morning opening day of March 16th, Wednesday with $6,660 position anticipating a 5-8% return x 3x since the SPXU is a 3 x inverse..

Be very careful using 3x inverse or any inverse etf . YOU HAVE TO WATCH THEM LIKE A HAWK. They are not meant for long term or swing trade. They are for 1 day intra day only and can be very dangerous if you don't use them properly. They can also make you quick FAST money , BUT YOU CAN ALSO LOOSE ALL YOUR MONEY IN 1 DAY, if you DON'T KNOW what you are doing..

This is what I am doing. I am not giving trading advice. I simply share some of my trading ideas here...

PS.Disclaimer

I’m not a certified financial planner/advisor, a certified financial analyst, an economist, a CPA , an accountant, or a lawyer. I’m not a finance professional through formal education. The contents on this TA,( Technical Analysis ) site are for informational purposes only and do not constitute financial, investment, trading, accounting, or legal advice. I can’t promise that the information shared on my posts is appropriate for you or anyone else. By using or reading this technical analysis you agree to hold me harmless from any ramifications, financial or otherwise, that occur to you as a result of acting on information found on this analysis, post or newsletter.

SPY BIG SHORT,,? -20~30% I hope that never happens. If it reaches a high point within 2-3 weeks. What will happen to the Nasdaq? Do you know about the rate T of stock prices. There is a speed in the stock price tends to rise and fall at a time. Even if the index reaches a high point, it waits for friends who have not yet reached it, and then falls with their hands in their hands. Let's all be honest. The current stock market is not healthy. Bubbles exist. Inflation has the chance to be persistent. We feel it as skin. Let's not fight the FED. Let's avoid the fight. Fed does not protect your assets. A big drop is expected. Once again. I hope not. I recommend reducing technology shares and increasing banking or non-technical shares within a few weeks.

SP500 - SHORT; Nothing but Shorts (SELL!!) here!A ~25% decline from here should be rather quick and uneventful. However, such a decline is likely to be just the first leg on a long road to a full ~70% decline by the end of this full cycle. - Which would be nothing more than a garden variety return to the Historic Norm ! The same goes for all US Indexes and those who are historically informed (or reviewed the evidence, presented in virtually every single recent post) should not be surprised at all.

The Carry Trade Currencies - and equivalents relative to the VIX post;

$SPY July 1st Decision Point - Calls or Puts?SPY Market Breakdown - July 1st, 2020

1H chart of SPY update from previous post, looks like it's fighting to regain this upwards channel it was trending in for the last few months.

I said last post that we were losing steam and if we keep getting more and more 2nd wave corona news I could see $280 puts.

Well no bias here, saw JP on Bloomberg news this morning wearing a face mask talking about how he's printing more money to save the economy and 2nd stimulus round.

Shoutout the homie mike turtle bloomberg

We are faced with 2 scenarios now, at a critical decision moment for the SPY

Scenario 1 - Bullish Case, the price keeps slowly grinding back up and regains this upwards channel before making a move towards $320 resistance level

Scenario 2 - Bearish Case, the price rejects off this trend and bleeds sideways until hitting $302 & $294 respectively

Not giving exact entry/exit points because you as traders also need to chart this out by yourselves and make your own decision. If I just tell you the answer everytime, you will never learn how to actually trade. As always please do your own research, I am not a financial advisor.