$SSE has broken out of the key trendline

Hello LSE:SSE community,

Since the launch of SorooshX - an innovative Web3 crypto exchange and SocialFi platform - its native token (SSE) has surged over 400% in recent months before undergoing a healthy market correction. The token shows a strong correlation with Bitcoin's long-term trends, and with the project's continued development and fundamental upgrades, SSE could reach higher levels after this consolidation phase.

Key Upcoming Updates for SSE:

- New exchange listings to improve liquidity

- Smart contract upgrades for features like trading fees, collateral, and staking, enhancing SSE's on-chain utility

Price Analysis:

The key resistance levels to watch are $0.0025 - $0.0030, with a potential retest. For high-potential projects like SorooshX, a DCA (Dollar-Cost Averaging) strategy is recommended.

Disclaimer: Cryptocurrency investments are high-risk. Always manage your capital wisely and trade responsibly.

Good luck with your trades!

SSE

Pinduoduo $220PDD has a lot of potential to rise to $220 and above. China has been battered and this stock trades with a 12 PE ratio. That's about as cheap of a stock with revenue growth like this you're going to find.

The CSI 300 index has finished it's 2022 correction and is in a uptrend likely supporting PDD rising.

Good luck!

SSE is heading for 100X in the BullrunThe #SSE token, one of the most innovative AI and Web3 projects in the market, is the native token of the Soroosh Smart Ecosystem. It is utilized for staking, transaction fees, and trading on the #SorooshX exchange, as well as for payment methods, mining, and advertising services within the platform.

Over the past three months, SSE has experienced over 450% growth and has established a remarkable weekly support level.

The new version of the Soroosh app is set to be released soon. This version will include a professional #SocialFi, spot and futures trading, and an intelligent #signal platform, all of which will significantly increase SSE token circulation and lead to more token burning. These updates position SSE for substantial price growth.

Even before the launch of the SorooshX exchange, users have been actively buying and staking SSE tokens, with demand continuing to rise.

Mid-term and Long-term Targets:

• $0.01 - $0.05

• $0.10 - $0.30

• $0.50 - $1

🚀 Get ready for the next big move!

Shanghai Composite Index (SSE) To Hit 6,124 First, Then 8,660SSE had a rally from 2005 to 2007 establishing the all-time high of CNY 6,124.

After that, the price had built a weird corrective structure with ups and downs fading in magnitude over a very long period of time.

It took 17 years to complete the giant contracting triangle (white ABCDE marks).

The pattern was broken to the upside this summer.

This is the first harbinger of possible reversal and potential rally.

The confirmation we wait is the breakup of the peak of wave D beyond CNY 3,724

The conservative target for the upcoming rally is located at the all-time high of CNY 6,124

The ultimate target is set at the equal distance of blue wave (A) in blue wave (C) at CNY 8,660

Who Gets Rich in China's Market Rally?On September 24th, China announced an unprecedented fiscal stimulus, aiming to rescue its ailing economy. As soon as the news got out, China’s stock market staged a huge rally. The Shanghai Stock Exchange (SSE) index moved from below 2,800 on September 24th to close at 3,336.5 on September 30th, up 19% in a week. One-month return for the SSE and notable Chinese stocks are listed here:

• SSE: +17.5%

• Yonghui Supermarkets: +59.9%

• JD: +51.3%

• BABA: +32.5%

• BIDU: +25.5%

China's stock market is closed on October 1-7 to observe the National Day holiday. Social media is floating a lot of fairytales about who made a big fortune in the last week of September. Here are two of the stories:

The first one is about MINISO, a boutique Chinese department store chain with over 5,000 stores worldwide. It is listed on the NYSE under the stock symbol $MNSO. On September 23rd, MINISO announced that it would acquire 2.67 billion shares of troubled supermarket chain Yonghui Supermarkets (601933.SH), at RMB 2.25 per share.

The next day, China announced the stimulus package, and all stock prices shot up. On September 30th, Yonghui closed at RMB 3.63, up 1.38 yuan or 61.3% from a week ago. With the acquisition of 2.67 billion shares, MINISO stands to make a profit of RMB 3.68 billion, equivalent to US$200 million (at USD/RMB exchange rate of 7.09).

MINISO could sit on the nice profit for three months and do nothing. It does not have to remit payment for the acquisition until Q1 2025. Is this just good luck or what?

The second story is about Michael Burry of Scion Capital, a Wall Street outcast made famous by Michael Lewis’ bestseller, the Big Short, and the hit movie with the same title, with Christian Bale portraying Burry. Recent SEC filing shows that as of the end of Q2 2024, Scion’s largest stock holding is BABA, accounting for 22% of its fund. JD and BIDU are its fourth and fifth holding, respectively. Each is for about a 12.5% share.

For an unknown reason, the Big Short turned into a Big Long with nearly half of its investment concentrating on Chinese stocks. With a timing precision, Burry scooped them up cheap just before they popped. Is this superb stock picking skill, or just luck?

Would the China rally continue when the market resumes trading on Tuesday? Goldman Sachs just released a research note, saying: Unless China does QE now, the current market rally will crash and burn, and the economy will be a crater. If China does do QE, oil will soar, and gold and bitcoin will be orders of magnitude higher.

While this is presented as two alternative paths, there is only one way to go, in all practical purpose. After going all out last month with unprecedented fiscal stimulus, the Chinese government could not afford to see the stock market and the housing market to tank again. It really needs to finish the job by injecting financial stimulus into the economy. Now that the market sensation has already turned positive, government spending would trigger consumer spending as well as investment from the private sector. Such a multiplier effect could lift the Chinese economy higher.

Happy Trading!

Symmetrical Triangle Pattern Formed & Target.Wait for the Breakout, as it is Crucial in the Stock Market. Institutions and Professionals often Enter Trades based on PATTERNS & BREAKOUTS. After a Breakout, the Market significant BULLISH Trend.

I want to help people Make Profit all over the World throughout my entire life. Additionally, I am eager to Receive Money Worldwide because of my Potential.

TON goes to $10 ??? crucial area to hold !!!!Hey SSE community ,

As you have had many requests to chart the TON, today I will chart it for you

#TON has started a strong upward trend in the last two months and after each new high, it makes a trading box and after the box breaks, it goes to new high, which is expected to be the new high of $10 if the current box breaks.

Important support of TonCoin is the area of $5.8, which is both the bottom of the trading range and the upward trend line. If this support is lost, the 4.7 and 3.5 areas are demand zones for enter to the trade.

Matic is getting ready to new ATHHello SSE community

As you can see #MATIC in it's USDT pair is getting ready to retest the long-term dynamic support and if it holds that gonna be good entry point into matic for bull-run

Good points as entry trigger : 0.90 , 0.86

Enjoy and lucky with your investment

SSE is moving upward in the next 6 monthHello SSE community

According to the announcements and new fundamental news of the Soroosh Smart Ecosystem

Big update is coming for this project by the end of Q1 2024 and it will impact on the LSE:SSE token price in the next 6 - 9 months .

As you can see on the chart of #SSE in Bitmart and BingX , there is a crucial resistant to break at the area of 0.008 and potential entries are 0.0060 - 0.0065

My recommendation is buying step by step in several part in the area of values

Available targets in the next bull-cycle are 0.020 , 0.05 , 0.10 , 0.15 , 0.30

Good Luck guys

Polkadot is getting ready to moving upward Hello SSE community

As you can see in the chart, 3Dot in this USDT pair is consolidating the potential supporting area around 6 - 5.8 dollar which is my potential entry zone if the supporting area works well.

My potential targets for Dot in the next 3 months are 20 - 23 dollar

If you are looking for short position in the current market pay attention to the level of liquidity around $7.3 it could be hunted all shorts then continue to the correction.

Big thanks, Let's change the WEB3 world together

$SSE is on the way to reach 30 centsHello Guys,

I am going to analysis chart #SSE token in daily time frame As you can sse the volume is increasing in Bitmart and BingX and potential targets for 2024 are around the area of $0.15 - $0.30

The chart on Bitmart is not clean but in the BingX you can see the chart more reliable and analysis important levels.

According to the fundamental analysis, SSE is the utility token of Soroosh Smart Ecosystem and using as a payment method and Staking and transaction fee in SorooshApp.

So my forecasting is the team are developing the project fast and significant demand gonna be generated for the token according to the project roadmap.

Good Entry levels are around 0.0065 - 0.0080 and it could be growth more than 500% from this levels by the end of 2024

See you in the next technical analysis guys

XRP is getting ready to go to $1Hello SSE guys,

Ripple in the USDT pair has been create a triangle in the weekly time-frame and now it is ranging the supporting area around 0.65 to 0.55 cents.

If XRP broke out the weekly trend-line and triangle in the next days following targets are available : 0.77, 0.86, 0.92 cents

BNBUSDT is getting readt to pump to $500Hey #SSE community,

As you can see, BNB has broken its long-term weekly trendline and is currently stuck under a static resistance in area of 265 bucks.

In my opinion, after breaking this resistance, BNB can grow to the following targets in the next 9 months :

333 , 350 , 390 , 450 , 500

Do not forget do risk and liquidity management.

Shanghai Comp. (SSE) -> Please Pay AttentionMy name is Philip, I am a German swing-trader with 4+ years of trading experience and I only trade stocks , crypto , options and indices 🖥️

I only focus on the higher timeframes because this allows me to massively capitalize on the major market swings and cycles without getting caught up in the short term noise.

This is how you build real long term wealth!

In today's anaylsis I want to take a look at the bigger picture on Shanghai Composite.

The Shanghai Composite index is the leading index of China and has been trading in a long term symmetrical triangle for more than 15 years.

Considering the fact that SSE entered bullish into this triangle, I do expect a bullish breakout which could happen in the next 6-18 months and then I do expect a major move to the upside.

- - - - - - - - - - - - - - - - - - - -

I know that this is a quite simple trading approach but over the past 4 years I've realized that simplicity and consistency are much more important than any trading strategy.

Keep the long term vision🫡

SSE Composite Index WCA - Classic Rectangle Introduction:

Hello and thank you for taking the time to read my post. Today, we analyze the SSE Composite Index on the weekly scale, focusing on a classic price pattern called the "Rectangle Pattern." The SSE Composite Index is the most important stock index in China, excluding Hong Kong. It is a price index weighted by market capitalization and includes all public companies listed on the Shanghai Stock Exchange. The index is published by the China Securities Index Company. Analyzing an index helps enormously with top-down approaches, as it provides a broader perspective of the market and allows investors to gauge the overall sentiment before diving into individual stocks.

Rectangle Pattern:

The rectangle pattern is a chart pattern formed when the price of an asset moves between two parallel horizontal lines—representing support and resistance levels—over a period of time. In essence, it reflects a consolidation phase where the market is undecided about the direction of the trend.

Remember, this is just a brief introduction to the technical aspects of the rectangle pattern. As you delve deeper into this topic, you'll discover more nuances and practical applications that can enhance your trading strategies.

Additional Analysis:

On the SSE Composite Index chart, we can observe some fascinating insights. The general trend was downward until 25/04/2022, which changed with the formation of a hammer. Since then, the price has been bound within a range, which is depicted as a classic rectangle pattern. This pattern has been forming for 423 days, which is notable because the longer a pattern remains consistent, the higher the probability that the subsequent breakout will be volatile.

The support of the range is at 2890, while the resistance is at 3400. Currently, the price is above the 200 EMA, making a long entry more attractive. We will closely monitor the price pattern and wait for a break above 3400 while examining the sectors or stocks from the SSE Composite Index more closely. The next potential resistance after 3400 would be 3720.

Top-Down Approach Significance:

A top-down approach is a method that investors use to analyze the market, beginning with a broad overview and then narrowing down to individual stocks. This method helps investors identify the overall market sentiment and trends, allowing them to make more informed decisions when selecting stocks within specific sectors or industries. Analyzing the SSE Composite Index, as shown in this post, provides a valuable starting point for investors looking to employ a top-down approach in their decision-making process.

Conclusion:

The SSE Composite Index weekly chart showcases a classic Rectangle Pattern, reflecting a consolidation phase in the market. By closely monitoring the support and resistance levels, as well as the general trend, traders can be better prepared for any potential price action in the future. Utilizing a top-down approach enables investors to gain a broader perspective and make more informed decisions when selecting stocks. As always, it's essential to consider risk management and proper position sizing when trading based on chart patterns.

Please note that this analysis is not financial advice. Always do your own due diligence when investing or trading.

If you found this analysis helpful, please like, share, and follow for more updates. Happy trading!

Best regards,

Karim Subhieh

Chinese SSE300 Index ETF: Bearish Dragon with 1.618 TargetThis is an extension to the Bearish SSE50 setup that I posted not so long ago; I found a tradable US Listed ETF that tracks the movement of the SSE300 and the situation on this chart is pretty much the same as the one for the SSE50 where we are breaking a logarithmic trendline, the moving averages, and looking to make a minimum 61.8% retrace. However, I believe it will go much deeper and my targets will be the 88.6% retrace at $17.31 and then the 1.618 Fibonacci Extension below at $7.72

SSE (Shanghai stocks index ) probably “bottomed”. 28/Oct/22SSE ( Shanghai Stocks Exchange ) index probably now as “leading indicators” for world’s economic not US anymore..As its index “crashed / bottomed” much “earlier than US markets like its individuals stocks e.g BABA, Tencent, Xiaomi, NIO etc..

Shanghai Composite Index Macro TriangleOstensibly SSE in a macro triangle formation. In this scenario we typically find peaks at 786 relationship of one another, At times we find the last leg falls shy of the 786.

** Please not the idea conveys only a potential pattern and how it may complete, and is not intended as a projection of future price action which relies on many factors that patterns and charts cannot and often do not capture.

Chinese SSE 50 Index Bearish Dragon with 1.618 TargetThe top 50 stocks in the Shanghai Composite Index look to be collectively forming a Bearish Chinese Dragon which if it breaks down could very well send it straight down to the 1.618 Extension given that there's is only one little Support Zone Below us after the trendline is broken. Given this very great Potential Danger that is visible on the chart i will be Avoiding Investment into Chinese Assets in the foreseeable future.

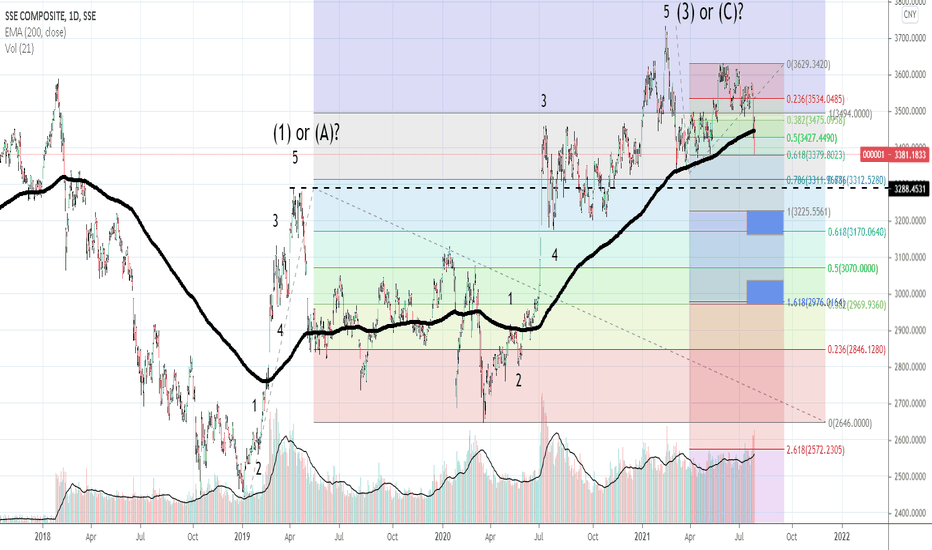

Shanghai SSE sharp bearishness and key level 3288.45Thanks for viewing.

I'm not a trader in SSE, or an investor.

General bullishness since December 2018 has recently been met with some strong resistance and selling pressure. Apart from finding myself here after reading the news today, where the commentator predicted more "risk" in the market, I don' really track this index.

I'm not a follower of the fundamentals of the market, but have some geopolitical insight. Whatever government intervention caused the sell-off, these are the technicals as I see them.

RSI: ~35 which is "oversold" but that can always go lower... or even stay at similar levels while the price grinds lower. No bullish divergence present on daily scale.

MACD: daily histogram shows below the zero line and in a steep downtrend. The moving averages have crossed over to the downside and are still diverging (converging would mean a slowing in the trend direction.

I am using Elliot Wave (which a lot of people don't really use for whatever reason) and there is a very clear support level that has to hold if your view is for continued bullishness: It is the 3288.45 level. If this level doesn't hold then the 18 month general bull-trend is over for a while. I put a couple of blue boxes as possible near-term support - even if that 3288 level is cracked, but unless you are trained to catch knives....

Either we are in a larger bullish market and this is a small (albeit very sharp correction), or there is a more extensive downwards correction underway. Personally, I wouldn't hang around to find out as the market seems to look corrective (downwards) in nature on the weekly time-frame as well.

If all the news and stories pumped out of China are true in the last 20 years... this isn't reflected in their stock market price trend. That said, the general trend - minus some massive run-ups seems to be slow and steady and there is some multi-year trend-line support at around 2800.

Let's see I guess. Best of luck and look after those funds.

China ETF GXC pre-launch testPreviously been highlighting China, particularly as Chian equites have been misunderstood, maligned, and assumed to have downside due to their tough COVID-19 strategies.

As expected, GXC launched with a gap up. However, this gap up did not translate further into a gap and run, but instead stalled. In view of the overall technical picture, it appears may have formed the last triangle pivot point.

Hence, the triangle has been adjusted accordingly, from previous.

The weekly chart has nice technicals with RPM and MACD crossing over upside. Would have preferred a more bullish candlestick for the week, but that did not happen.

The daily chart has a gap and stall, and this is likely to pan out with a retracement close and reopen the previous gap. Possibly to reconnect with the MA band, and then the real launch with a triangle breakout at the end of June. Path sketched out there.

Bullish but need some more baking time...