Shanghai Composite Index (SSE) To Hit 6,124 First, Then 8,660SSE had a rally from 2005 to 2007 establishing the all-time high of CNY 6,124.

After that, the price had built a weird corrective structure with ups and downs fading in magnitude over a very long period of time.

It took 17 years to complete the giant contracting triangle (white ABCDE marks).

The pattern was broken to the upside this summer.

This is the first harbinger of possible reversal and potential rally.

The confirmation we wait is the breakup of the peak of wave D beyond CNY 3,724

The conservative target for the upcoming rally is located at the all-time high of CNY 6,124

The ultimate target is set at the equal distance of blue wave (A) in blue wave (C) at CNY 8,660

Ssec

THE MOST Bullish chart you will see today!Is of the Shanghai composite.

A beautiful HVF is nearing pattern triggering,.

Early accumulation is probably warranted!

Isn't now the most bearish FUD, over the Chinese economic miracle you have ever seen in a lifetime.

The chart is telling a different story of consolidation of its extreme growth and continuation of it's remarkable rise.

A quadrupling on the index means some of the underling securities will yield life changing gains.

I haven't done any due diligence on individual names

But an #ETF to keep an eye on is #KWEB

Which is a basket of Chinese internet stocks.

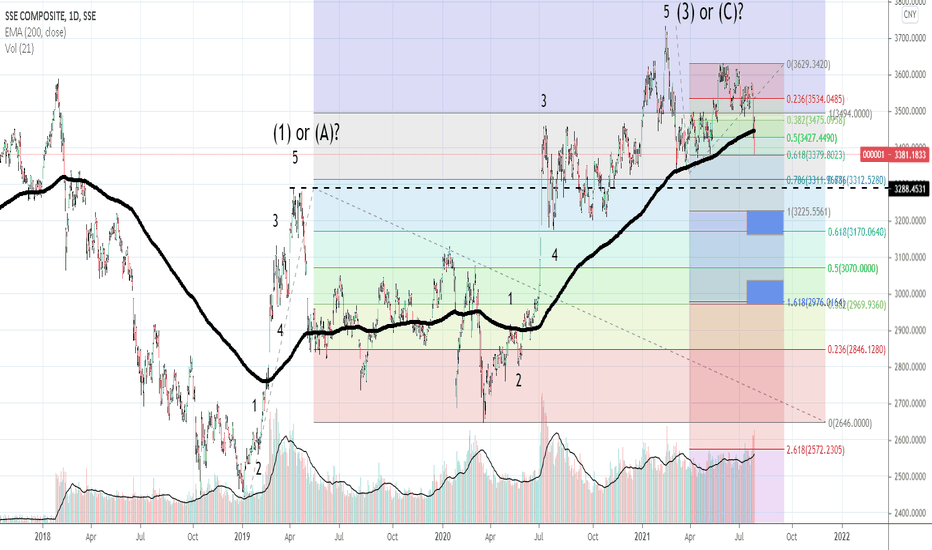

Shanghai SSE sharp bearishness and key level 3288.45Thanks for viewing.

I'm not a trader in SSE, or an investor.

General bullishness since December 2018 has recently been met with some strong resistance and selling pressure. Apart from finding myself here after reading the news today, where the commentator predicted more "risk" in the market, I don' really track this index.

I'm not a follower of the fundamentals of the market, but have some geopolitical insight. Whatever government intervention caused the sell-off, these are the technicals as I see them.

RSI: ~35 which is "oversold" but that can always go lower... or even stay at similar levels while the price grinds lower. No bullish divergence present on daily scale.

MACD: daily histogram shows below the zero line and in a steep downtrend. The moving averages have crossed over to the downside and are still diverging (converging would mean a slowing in the trend direction.

I am using Elliot Wave (which a lot of people don't really use for whatever reason) and there is a very clear support level that has to hold if your view is for continued bullishness: It is the 3288.45 level. If this level doesn't hold then the 18 month general bull-trend is over for a while. I put a couple of blue boxes as possible near-term support - even if that 3288 level is cracked, but unless you are trained to catch knives....

Either we are in a larger bullish market and this is a small (albeit very sharp correction), or there is a more extensive downwards correction underway. Personally, I wouldn't hang around to find out as the market seems to look corrective (downwards) in nature on the weekly time-frame as well.

If all the news and stories pumped out of China are true in the last 20 years... this isn't reflected in their stock market price trend. That said, the general trend - minus some massive run-ups seems to be slow and steady and there is some multi-year trend-line support at around 2800.

Let's see I guess. Best of luck and look after those funds.

SSE China bottomed@2863;may retest it before an abc to 3500SSE china composite index may have already bottomed at 2863.65 in April. It is now at my yellow pivot zone. It may go back down to retest the low.

2888 is a very impt FIBO level, exactly @0.786 retracement & is also coinciding with exactly 0.236 of my Fibo strategy on 2 separate retracements.

It is highly probable that SSEC may rally on early June. It may reach 3300 in early August before a long consolidation above the yellow pivot zone before another rally in early Nov2022 reaching as high as 3500

In 1Q2023. (A zigzag move)

If we see the Macro view in weekly Chart, SSEC actually finished wave 2 in 2005 at 1008.60. From there it zoomed up to 6124 ATH in Oct2007 just before the 2008 crash. From these 2 points it is actually making a very big wedge that is the big & long wave 4. The apex of this wedge has a definite destination. GUESS WHERE: exactly at 3500! It will whipsaw above & below the 3300 to 3500 zone for a while. It may reach as high as 3740 to 4000 before it finally breaks out of this BIG WEDGE to start the final wave 5.

Time to shine after zero-covid accomplishment.

Not trading advice

CHINA: End of a 17 Year Consolidation - Epic Breakout next?

Regardless of your political bias, here's the bullish case

- Pandemic, regulatory clampdown, China-fear mongering has driven stocks down

- Broke down from pennant in April 2022 but recovered and closed within pennant - bear trap?

- Structural shift in new world order (see Ray Dahlio's animated explanation www.youtube.com)

- Curious timing where the major investment banks have gotten majority control of their China business in 2020

- US coming to an end of a 40 year major cycle and a 90 year mega cycle - have printed money out of their problems for the last decade or more. End of low interest rate environment. Funds have to flow somewhere!

SSE Composite Index Probabilities Retracement HigherChina commerce ministry says production of auto, auto parts have fully resumed. China continues the narrative that they are back up and running. It should lift off some pain from the market and we probably have some retracement upward if market players are optimistic.

𝗡𝗲𝘄 𝗖𝗵𝗮𝗿𝘁: $SSEC Daily (or $SHCOMP). Hitting resistanceConfluence of resistance here. Worth watching to see if straight-line DCB continues and #PBOC liquidity pumps remain effective

Shanghai Due for a Bounce - Trump giving a break?Shanghai Due for a Bounce - Trump giving a break? BRICS meetings