S&P500 Accumulation almost over. New rally begins.The S&P500 index (SPX) has been trading within a 3-month Channel Up pattern, within which, it's been replicating almost the same structure. This involves an aggressive Bullish Leg Phase (dotted Channel Up), followed by a correction/ Accumulation Phase (blue Channels), which eventually leads to the new Bullish Leg.

The 1D RSI fractals among those patterns are similar and right now it seems that we are about to complete the latest Accumulation Phase. Having completed a 1D Golden Cross 2 weeks ago, the time-frame looks more bullish than ever and as long as the 1D MA50 (blue trend-line) holds, we expect at least a +5.68% rise (the minimum of the previous Bullish Legs), targeting 6550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Standardandpoors

Equity Markets Ahead of the US Inflation ReportEquity Markets Ahead of the US Inflation Report

Today at 15:30 GMT+3, the US inflation report (Consumer Price Index, or CPI) is scheduled for release. According to ForexFactory, analysts expect the inflation rate to rise from 2.4% to 2.6%.

The actual figures will provide market participants with grounds to debate not only the likelihood of a Federal Reserve rate cut, but also the evolving tensions between Donald Trump and Jerome Powell.

Should the report deliver any surprises, it will almost certainly trigger heightened volatility across the equity markets. For now, however, investors are seemingly optimistic about the upcoming fundamental data — especially given the commencement of Q2 earnings season, which lends additional weight to today’s macroeconomic indicators.

Technical Analysis of the S&P 500 Chart

The S&P 500 chart (US SPX 500 mini on FXOpen) shows the index fluctuating within a range defined by support at 6,222 and resistance at 6,290.

The upward impulses (as indicated by arrows) suggest that:

→ current market optimism, combined with the CPI release, may lead to a bullish breakout above resistance and the establishment of a new all-time high;

→ in a broader context, such a breakout could be interpreted as a continuation of the rally that began in April, following a period of consolidation between the aforementioned levels.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

S&P500: Once it breaks the 1W MA50, it doesn't look back.S&P500 has turned overbought on its 1D technical outlook (RSI = 75.570, MACD = 96.940, ADX = 23.950) and rightly so as it is extending the rally after crossing above the 1W MA50. The Channel Up since late 2011 shows that when the index crosses above its 1W MA50, it tends to spend a notable time over it (and every contact is a buy opportunity), with the most recent example being the March 2023 - December 2024 period. The shortest such period has been in 2019, which was suddently disrupted by the black Swan event of COVID. We may have gotten out of a similar situation as Trump's tariffs disrupted the uptrend earlier this year with a huge, unexpected correction. There 1W MA200 supported and this brings us to a new 'above the 1W MA50 bullish phase', which even if it is as short as 2019, it can still target 7,000.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Stock Markets Rebound Following Trump’s Ceasefire AnnouncementStock Markets Rebound Following Trump’s Ceasefire Announcement

Last night, U.S. President Donald Trump made a social media post announcing a ceasefire agreement between Iran and Israel. According to his own words, the ceasefire is set to last “forever.” This announcement triggered a sharp bullish impulse (indicated by the blue arrow) on the S&P 500 index chart (US SPX 500 mini on FXOpen), pushing the price to a new high above the 6074 level.

Just yesterday, traders feared that the United States could be drawn into yet another costly war following bomber strikes on Iran’s nuclear facilities. However, today the stock markets are recovering, signalling growing optimism and a waning of fears over a major escalation of the conflict.

Technical Analysis of the S&P 500 Chart

When analysing the S&P 500 index chart (US SPX 500 mini on FXOpen) seven days ago, we identified an ascending channel. The angle of the trend remains relevant, while the width of the channel has expanded due to the downward movement caused by tensions in the Middle East.

Notably:

→ the price marked the lower boundary of the channel as well as the internal lines (shown by black dots) dividing the channel into quarters;

→ the latest bullish impulse suggests that the upward trend is resuming after breaking out of the correction phase (indicated by red lines).

It is possible that in the near future, the S&P 500 index (US SPX 500 mini on FXOpen) could reach the median line of the channel. There, the price may consolidate, reflecting a balance between buyers and sellers—particularly if the peace in the Middle East proves to be lasting.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

S&P500: Targeting 7,000 by the end of the year.S&P500 is bullish on its 1D technical outlook (RSI = 64.729, MACD = 100.990, ADX = 19.772) as it is extending the bullish wave started on the April 7th bottom. The long term formation is a Bullish Megaphone and the previous bullish wave peaked after a +48.33% rise. With the 1W RSI pattern almost identical as then, we remain bullish on SPX, TP = 7,000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P500 No signs of stopping here. Can hit 6900 before years end.The S&P500 index (SPX) has turned the 1W MA50 (blue trend-line) into Support, successfully testing it and holding and is now going for the All Time High Resistance test. Based on its 1W RSI structure and candle action, it resembles the previous times since 2023 that after a quick consolidation, it broke upwards again aggressively.

As you can see, both of those Bullish Legs that started on the 2023 Higher Lows trend-line, hit at least their 1.618 Fibonacci extension before a new 3-week red pull-back. In the case of 2024, even the 2.0 Fib ext got hit a little later.

As a result, we expect to see at least 6900 (Fib 1.618) before the end of 2025, with the good case scenario (Fib 2.0) going as high as 7500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

S&P500: Inverse Head and Shoulders set to extend Apr-May rally.The S&P500 is bullish on its 1D technical outlook (RSI = 58.868, MACD = 85.480, ADX = 31.901) as it maintains a steady Channel Up pattern and just formed the first 1H Golden Cross in a month. Technically this is forming the Right Shoulder of an Inverse Head and Shoulders pattern, typically a bullish reversal formation, which not surprisingly was last seen in April when the Channel Up started and was completed with the previous 1H Golden Cross on April 24th. The result was a bullish extension fo rht 1.618 Fibonacci level. We're bullish on this, TP = 6,150.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P 500 Falls Following Downgrade of US Credit RatingS&P 500 Falls Following Downgrade of US Credit Rating

On Friday, 16 May, after markets had closed, Moody’s Ratings announced a downgrade of the long-term sovereign credit rating of the United States from the highest level of Aaa to Aa1. The key reasons cited by Moody’s were the rising national debt and interest payments, as well as expectations of a further increase in the budget deficit. Notably:

→ The downgrade was hardly a surprise. A similar move was made by Standard & Poor’s back in 2011, while Fitch Ratings followed suit in August 2023.

→ The official response may be seen as reassuring for market participants. US Treasury Secretary Scott Bessent played down concerns about the downgrade in an interview with NBC News, calling credit ratings “lagging indicators” and placing the blame on the previous administration.

→ Despite the downgrade, Moody’s acknowledged the US dollar’s role as the world’s reserve currency and stated that the United States “retains exceptional credit strengths, such as the size, resilience, and dynamism of its economy.”

Stock Market Reaction

The announcement triggered a negative market reaction, reflected in falling prices during Monday morning’s opening session. E-mini S&P 500 futures (US SPX 500 mini on FXOpen) retreated, as indicated by the arrow on the chart, pulling back from the highs reached by Friday’s close.

Last week, we pointed out signs of slowing momentum in the S&P 500 rally. Could the decline continue further?

Technical Analysis of the S&P 500 Chart

By drawing lines A, B, and C through the May rally peaks, we can observe a gradual flattening of the slope — suggesting that the bulls are losing momentum and confidence.

The price is currently trading between local lines C and C1, but it is reasonable to assume that the opening of the US session may bring renewed bearish pressure — potentially pushing the price lower, towards the bottom boundary of the broader upward channel (marked in blue).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

S&P 500 Index May Lose Upward MomentumS&P 500 Index May Lose Upward Momentum

Yesterday’s inflation data release held no major surprises, as the actual Consumer Price Index (CPI) figures came in close to analysts’ forecasts.

According to Forex Factory:

→ Annual CPI: actual = 2.3%, forecast = 2.4%, previous = 2.4%;

→ Monthly Core CPI: actual = 0.2%, forecast = 0.3%, previous = 0.1%.

Overall, stock indices rose yesterday, but according to media reports, this momentum may begin to slow in the near future:

→ UBS analysts downgraded their rating on US equities from “attractive” to “neutral” following the recovery from early April lows;

→ Goldman Sachs analysts believe that the US stock market rally could stall at current levels. In their view, the S&P 500 (US SPX 500 mini on FXOpen) is likely to reach 5900 over the next three months.

Technical Analysis of the E-Mini S&P 500 Chart

The chart provides more reasons to suggest that the current pace of growth may begin to slow.

Firstly, the index has entered a broad range between 5800 and 6120, where it spent a prolonged period during late 2024 and early 2025. This is a zone (highlighted in purple) where supply and demand previously reached a stable equilibrium — and similar balance could potentially emerge again.

Secondly:

→ the slope of the current upward channel (marked in black) appears excessively steep;

→ the RSI indicator points to a divergence;

→ the psychological level of 6000 may act as resistance.

Given the above, special attention should be paid to the scenario in which the S&P 500 (US SPX 500 mini on FXOpen) forms a short-term correction before the end of the month.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stock Markets Consolidate Ahead of the HolidaysStock Markets Consolidate Ahead of the Holidays

A lull is expected on the financial markets today due to a shortened trading week related to the Easter holiday celebrations.

It is reasonable to assume that traders will get a “breather” after a news-heavy April, which caused a volatile “shakeout” in the stock markets.

US Stock Markets

On Wednesday, Federal Reserve Chair Jerome Powell was both cautious and somewhat aggressive in his forecasts regarding US monetary policy, stating that Trump’s tariffs could delay the achievement of inflation targets.

In response, US President Donald Trump accused Powell of “playing politics”, hinting at his possible dismissal.

European Stock Markets

On Thursday, the ECB cut interest rates for the seventh time in the past 12 months, and European Central Bank President Christine Lagarde left the door open for further easing.

Analysts had expected a rate cut from 2.65% to 2.40%, so the financial markets reacted relatively calmly to the ECB’s decision.

Technical Analysis of the S&P 500 Chart (US SPX 500 mini on FXOpen)

On the charts of European and US stock indices today, a narrowing triangle pattern is forming, indicating a balance between supply and demand — in other words, price is more efficiently factoring in all influencing elements.

On the S&P 500 chart (US SPX 500 mini on FXOpen), the triangle is highlighted in grey. The ADX and ATR indicators are trending downwards, which underlines signs of consolidation.

From a bearish perspective, the market is in a downtrend (marked by the red trend channel) — but from a bullish point of view, price is in the upper half of the channel.

Although the situation appears “reassuring”, the long weekend may bring a string of high-impact statements from the White House, which could disrupt the balance and lead to a breakout from the triangle.

It is not out of the question that the bulls may seize the initiative and challenge the upper boundary of the channel in an attempt to lay the groundwork for an upward trend (shown in blue lines).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

S&P500: Trump's 90-day tariff pause just saved the day??S&P500 is having so far a +9.50% rise from today's low as even though Trump announced a 125% raise to China tariffs, he lowered and paused tariffs for 90 days to all countries that contacted the U.S. for negotiation. The 1D technical outlook is about to get neutral (RSI = 42.537, MACD = -181.510, ADX = 39.036) as the rebound is taking place at the HL bottom of the Bullish Megaphone, while the 1W MA200 stayed intact.

A similar Megaphone was last seen during the previous 2018 Trade War and was completed with the COVID crash that started an abnormal rally to new ATH to correct the equally abnormal crash. Needless to say, it was based on quick rate cuts but the situation isn't all that different today. Trump's stance towards negotiating, coupled with highly anticipated rate cuts, can deliver an equally abnormal rally now.

The previous HH of the Bullish Megaphone hit the 2.0 Fibonacci extension. This time if the rally extends to the end of the year, targeting the 1.5 - 1.618 Fibonacci Zone would be considered fair (TP = 6,900).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P 500 Index Hits 2025 Low Following Trump's TariffS&P 500 Index Hits 2025 Low Following Trump's Tariff Announcement

As shown on the S&P 500 Index (US SPX 500 mini on FXOpen) chart, the benchmark US stock index dropped below 5,450 points for the first time in 2025. This decline reflects the US stock market’s reaction to the tariffs imposed by the White House on international trade.

According to Reuters:

→ President Donald Trump announced a 10% tariff on most goods imported into the United States, with Asian countries being hit the hardest.

→ This move escalates the global trade war. "The consequences will be devastating for millions of people worldwide," said European Commission President Ursula von der Leyen, adding that the 27-member EU bloc is preparing to retaliate if negotiations with Washington fail.

Financial Markets’ Reaction to Trump’s Tariffs

→ Stock markets in Beijing and Tokyo fell to multi-month lows.

→ Gold hit a new all-time high, surpassing $3,160.

→ The US dollar weakened against other major currencies.

The S&P 500 Index (US SPX 500 mini on FXOpen) is now trading at levels last seen in September 2024, before Trump's election victory.

Investor sentiment appears to have turned bearish, with growing concerns over the impact of Trump's tariffs, as fears mount that they could slow down the US economy and fuel inflation.

Technical Analysis of the S&P 500 Index (US SPX 500 mini on FXOpen)

The bearish momentum seen yesterday signals a continued correction, which we first identified in our 17 March analysis.

At that time, we mapped out a rising channel (blue) that began in 2024, suggesting that selling pressure might ease near its lower boundary. However, Trump's policy decision has reinforced bearish confidence, and now the price may continue fluctuating within the two downward-sloping red lines. This suggests that the long-term blue growth channel is losing its relevance.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

S&P500: Recovery has started and the next stop is the 1D MA50.S&P500 is marginally neutral on its 1D technical outlook (RSI = 45.213, MACD = -61.280, ADX = 30.163) as it's recovered from Friday's bearish sentiment and already crossed above the 0.236 Fibonacci level. This rebound made Monday's low a Double Bottom and since the 1D RSI is on a HL bullish divergence, we expect a strong 1 month rally to start. The first target is the 1D MA50 slightly over the 0.5 Fib mark (TP1 = 5,835) and after a small correction, the 0.786 Fib (TP2 = 6,000), which is also the top of the 5 month Bull Flag.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

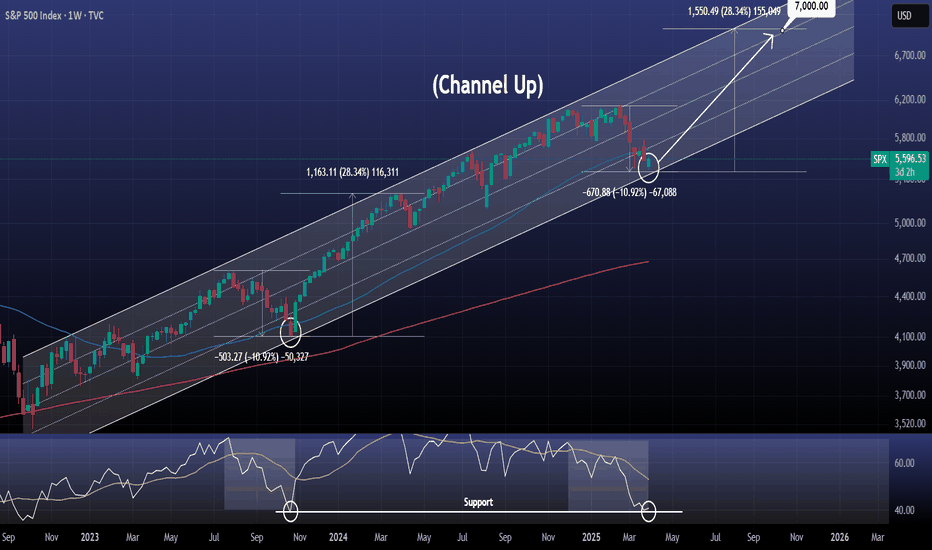

S&P500 Last time it made that bottom was 18 months ago.S&P500 / US500 is trading inside a multi year Channel Up that goes back to October 2022.

The index almost hit the Channel bottom this week and immediately we see a rebound attempt.

It may be under the 1week MA50 but this is not disastrous as the patterns last bottom was formed exactly under it on October 23rd 2023, 18 months ago.

On top of that, the 1week RSI was exactly where it is now, on the 40.00 Support, bearish enough to call for a long term buy.

In addition, the both bearish waved leading to both bottoms were almost -11%. This high symmetry potential suggests that the bullish wave that will follow may be of a similar +28.34% rise.

This is a unique opportunity to buy and target 7000.

Follow us, like the idea and leave a comment below!!

S&P500: Recovered the 1W MA50. Best buy opportunity of 2025.The S&P500 is marginally neutral on its 1D technical outlook (RSI = 47.606, MACD = -47.070, ADX = 35.637) as it is in the process of recovery from the previous oversold condition. What the index did recover however, and which is a massive buy signal, is the 1W MA50. Technically this trendline held two weeks ago, despite marginally crossing under it, and provided the basis for a new long term bottom. Basically it is the exact same pattern as the October 23rd 2023 bottom, which was also a HL on the 3 year Channel Up, declined also by -11% and the 1W RSI was almost on the same level as today's low (the S1 level).

Every bullish wave inside this 3 year pattern hit at least the 2.0 Fibonacci extension. Given that this bottom was made on the 0.618 Channel Fib level, like both of the last two HL (Aug 5th 2024, April 15th 2024), we expect a test of the Channel's top by the end of the year. A TP = 6,700 would still be under the 2.0 Fib extension and that's out long term target.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P 500 Analysis: Markets Start the Week on a Positive NoteS&P 500 Analysis: Markets Start the Week on a Positive Note

A week ago, while analysing the S&P 500 index chart (US SPX 500 mini on FXOpen), we noted that the market had officially entered a correction phase, as the price had declined more than 10% from its February 19 peak. This drop was driven by mounting uncertainty over the potential economic damage caused by the Trump administration’s tariff policies in international trade.

However, this morning, markets are showing signs of optimism following reassuring statements from officials over the weekend.

According to Reuters:

→ Trump announced plans to hold talks with Chinese President Xi Jinping, while the U.S. Trade Representative is set to meet his Chinese counterpart this week.

→ The European Union has taken a conciliatory stance, delaying its initial countermeasures against the U.S. until mid-April.

As a result, sentiment appears to have shifted towards optimism, with the S&P 500 index (US SPX 500 mini on FXOpen) trading approximately 4% above this month’s low.

Technical Analysis of the S&P 500 Index (US SPX 500 mini on FXOpen)

As noted on 17 March:

→ The price is forming an ascending channel (marked in blue).

→ The fact that the price has reached the lower boundary of the channel suggests that bearish momentum may be fading.

Currently, we are witnessing an attempt at a bullish reversal from the channel’s lower boundary.

From a bearish perspective, resistance may emerge around the 5750 level, where the price has previously reacted (as indicated by the arrows).

From a bullish perspective:

→ Bears have lost control of the 5600 level.

→ A bullish gap at the start of the week indicates a significant shift in market sentiment. If positive news continues to emerge throughout the week, the S&P 500 index (US SPX 500 mini on FXOpen) could attempt a rise towards the median of the identified channel.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

S&P500 1week MA50 test is the last before the Cycle tops.S&P500 / US500 tested this week its 1week MA50 successfully as the price almost touched it and rebounded.

We have seen this kind of behavior in the last 9-12 months before a Bull Cycle tops.

In fact with the 1week RSI trending downwards on a bearish divergence, today's price action looks more similar to the October 13 2014 1week MA50 fakeout, which was breached marginally but rebounded immediately.

Based on that, a 6500 Cycle Top target by October 2025 is very much realistic.

Follow us, like the idea and leave a comment below!!

S&P500: Potential Channel Up rebound on the 1D MA200.S&P500 is bearish on its 1D technical outlook (RSI = 34.564, MACD = -60.140, ADX = 38.870) as it unfolded the bearish wave of the long term Channel Up. The sequence has hit its 1D MA200 though, which is the major Support on this timeframe and being also the bottom of the Channel Up, we should be expecting a rebound. The first bearish wave of the Channel Up surpassed the 1.382 Fibonacci extension, so that is a valid technical target. The trade is long, TP = 6,300.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P500 Channel Up testing its bottom.S&P500 is trading inside a Channel Up that just hit its MA200 (4h).

This is a strong short term buy opportunity for the next bullish leg.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 6200 (+3.29% rise like the previous bullish leg).

Tips:

1. The RSI (4h) got oversold. The last 3 times this happened, the price immediately rebounded.

Please like, follow and comment!!

S&P500 Channel Up priced a bottom. Buy.S&P500 / US500 is trading inside a 20 day Channel Up.

The price hit today the 1hour MA200, while the 1hour RSI breached the oversold limit and rebounded.

The two times this happened before, it was a signal that the Channel Up has formed a bottom.

The bullish waves that followed, rose by at least +2.00%.

Buy and target 6200 as the new higher high of the Channel.

Follow us, like the idea and leave a comment below!!

S&P500: Neutral on 1D shows enormous upside potential.S&P500 is neutral on its 1D technical outlook (RSI = 53.735, MACD = 16.510, ADX = 17.690) as it just crossed over the 1D MA50 again and after a 1D MA100 rebound remains relatively low inside the Channel Up pattern. The 1D RSI is also bouncing on the S1 level, where the September 6th 2024 bullish wave originated and reached the 1.786 Fibonacci extension. That is an excellent technical level for the next HH (TP = 6,300).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P500: Be careful of this 4H Golden Cross.S&P500 is on a very healthy bullish 1D technical outlook (RSI = 61.261, MACD = -3.250, ADX = 30.268) and on 4H it is about to form the first Golden Cross since August 21st 2024. During these 5 months, the trend has been heavily bullish but the 4H Golden Cross only managed one last High before the price corrected again to the 1D MA100. The 4H RSI indicates that we might technically be at the start of this final High pricing. For now we will stay bullish (TP = 6,165) but after that, we will only buy again on the 1D MA100.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

S&P500 bottomed on its Falling Wedge. Strong short term upside. S&P500 / SPX is trading inside a Falling Wedge since the November 19th low and today hit the pattern's bottom.

This has coincided with the 4hour RSI hitting the 30.00 oversold limit.

Every time this has take place, the price rebounded to at least its 0.786 Fibonacci and the 4hour MA200.

This time the 0.786 Fib is very close to the top of the Falling Wedge but we can technically target the 4hour MA200 a little lower at 5950.

Follow us, like the idea and leave a comment below!!