Bitcoin Adoption in El Salvador is HUGEWhile the majority of the companies in the survey pool were small businesses as they account for 71% of the respondents, 16% of them were large companies and 13% were medium scale businesses.

What this survey shows is that despite the litany of moves the government has made to drive its people towards Bitcoin, the level of adoption is still considerably low.

Despite the low adoption rate, President Nayib Bukele remains bullish on the flagship digital asset, and the country currently holds around 1,800 units of the coin.

El Salvador’s Bitcoin Bond plan hits a snag

El Salvador’s plan to build a Bitcoin city financed by a $111 billion Bitcoin bonds appears to have hit a snag as the country’s finance minister, Alejandro Zelaya, in a recent interview with a local TV station hinted that the ongoing war in Ukraine could impact the implementation of the bond.

The bond was first announced in November 2021, and it was revealed that half of the money generated from the bond sales would be spent on building infrastructure and geothermal energy-powered Bitcoin mining. The other half would be used to purchase Bitcoin for the country.

Station

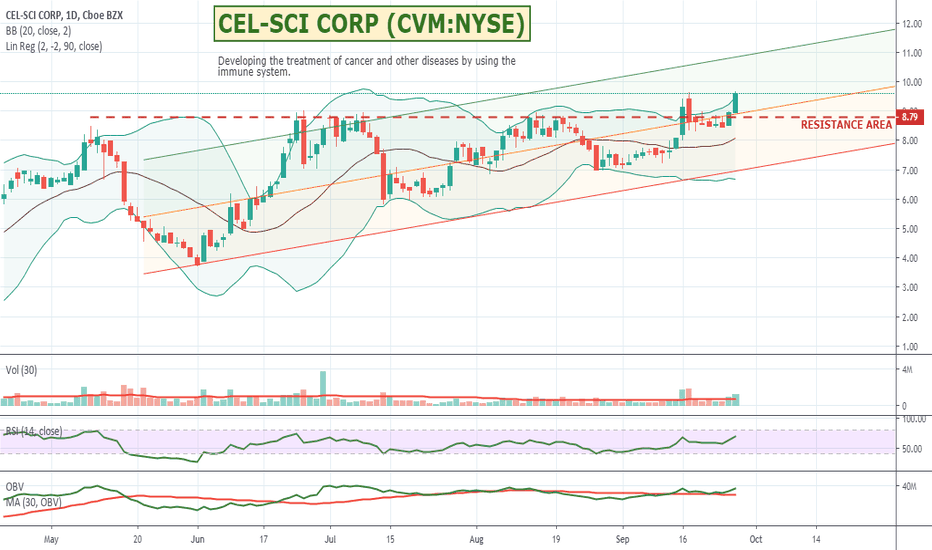

$CVM - CEL-SCI - Using the bodies immune system to fight cancersStill playing around with buying shares directly in Trading View via Trade Station and REALLY liking it so far. Super simple. Took a punt on CVM as it looks to have broken above a multiple resistance area, has broken above its upper bollinger band, has good volume, OBV is up, and the RSI is showing it has demand behind it and is still at fair value.

As for the company itself, I do like the idea of using the bodies own defence systems and turbo boosting them to fight cancers and other diseases. These "discovery" type stocks can however be highly volatile and can rocket or plummet on news.

You can see on the chart in the blue buy box I bought 100 @ $9.09 and they are now at $9.60 - and the green $58.48 in the box is how much I am up for the stock so far. You can also see that I have a sell stop (ie sell at market) if the stock hits $7 or below. This sell stop is easy to drag up and down, so I can have a look each day and very quickly visually check on say the 1 Day and 15 minute charts to see if I want to move it up or down. I can also very quickly flick between my moving averages views and my bollinger band views to see if I want to make it tighter or looser depending one whats happening in the market. Very cool. I like it :)

I don't have a take profit order in but that is also easily set and movable. Sometimes on these speculative type shares I might have a 15% take profit to capture any sudden rises before they pull back. For now I will monitor this one manually and move my stops as it progresses. Note that I will almost never move a stop down. They are there for a reason. Id prefer to take the $5 brokerage hit and get out and buy back in if one of my stops gets taken out.

CVM is also my mothers initials so fingers crossed this one rockets :) (<- Not a buy recommendation by any means :))

CEL-SCI Corporation is engaged in the research and development at developing the treatment of cancer and other diseases by using the immune system. The Company is focused on activating the immune system to fight cancer and infectious diseases. It operates through the segment of research and development of certain drugs and vaccines. It is focused on the development of Multikine (Leukocyte Interleukin, Injection), an investigational immunotherapy under development for treatment of certain head and neck cancers, and anal warts or cervical dysplasia in human immunodeficiency virus and human papillomavirus co-infected patients and Ligand Epitope Antigen Presentation System (L.E.A.P.S.) technology, with over two investigational therapies, LEAPS-H1N1-DC, a product candidate under development for treatment of pandemic influenza in hospitalized patients, and CEL-2000 and CEL-4000, vaccine product candidates under development for treatment of rheumatoid arthritis.

GBP/JPY potential patternGartley drawn in a best outcome scenario. 618 C was held so that makes me think we will have a reversal. PRZ is not that narrow and since its a Gartley pattern we shall be looking for the AB=CD to complete. Stop losses a few pips after the X, TG1 and TG2 are on fib levels and in the best case scenario we will have a trade with around 4:1 RR. Just stare at the chart it could be one of the great trades this year.

That's all, folks.