Stellar breach of falling wedgeBreach of falling wedge may lead to upsides, prices often drop out of falling wedges to the downside, this is a good time to add to your position if faith is kept in the falling wedge.

Stellardollar

STRBTC Falling wedgeStellar is in a falling wedge pattern, breach of the bottom of the falling wedge may signal an immediate upside.

XLMUSD formed bullish Crab | A long opportunityPriceline of XLM / US Dollar cryptocurrency has formed a bullish Shark pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this area.

I have used Fibonacci sequence to set the targets:

Buy between: 0.052774 to 0.051811

Sell between: 0.053524 to 0.055333

Regards,

Atif Akbar (moon333)

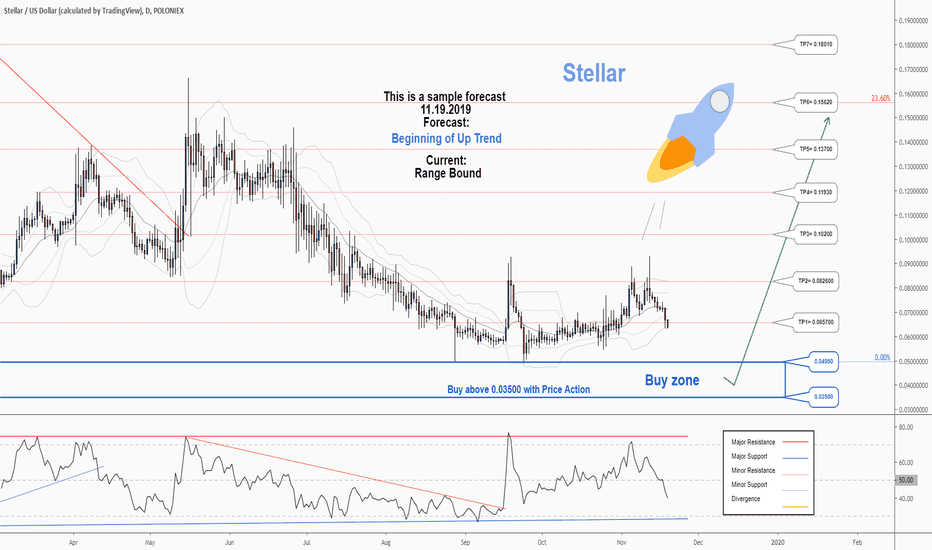

There is a trading opportunity to buy in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 40.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.04950000 to 0.03500000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.04950000)

Ending of entry zone (0.03500000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.06570000

TP2= @ 0.08260000

TP3= @ 0.10200000

TP4= @ 0.11930000

TP5= @ 0.13700000

TP6= @ 0.15620000

TP7= @ 0.18010000

TP8= @ 0.22210000

TP9= @ 0.27550000

TP10= @ 0.32880000

TP11= Free

There is a trading opportunity to buy in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 40.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.04950000 to 0.03500000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.04950000)

Ending of entry zone (0.03500000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.06570000

TP2= @ 0.08260000

TP3= @ 0.10200000

TP4= @ 0.11930000

TP5= @ 0.13700000

TP6= @ 0.15620000

TP7= @ 0.18010000

TP8= @ 0.22210000

TP9= @ 0.27550000

TP10= @ 0.32880000

TP11= Free

XLMUSD formed bullish Cypher | A log opportunityPriceline of XLM / US Dollar cryptocurrency has formed a bullish Cypher pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this area.

I have used Fibonacci sequence to set the targets:

Buy between: 0.078361 to 0.077317

Sell between: 0.079354 to 0.081503

Regards,

Atif Akbar (moon333)

The BAT Always Pushed The Stellar To Achieve Highest Price EverThe XLM token started with the opening price of $0.002251 in Jan 2017 as per Kraken exchange and reached at $0.06700 within 4 months on May 2017 that was more than 2,876% huge bullish move which brought the Stellar in lime light and in a very short period of time the token came among the top cryptocurrenices list.

The market cap was increased from 17,173,226 to 585,609,334 which was more than 3310% difference.

Then after May 2017 to July 2017 the XLM faced strong bearish trend and the price action dropped from $0.067 to $0.0122 and that was a really huge loss of more than 81%.

For more than 3 months this bearish trend was continued and on week chart every candle stick was being closed lower than the previous candle stick and the people were expecting more worst situation for future.

Upto July 2017 the Stellar was not as that much older that the traders would get signals from different indicators on week chart even the first exponential moving average with time period of 20 was appeared in May 2017.

The Nature's Role:

But in the meanwhile the nature was playing its role and the supply and demand of traders formed a harmonic pattern that was a bullish BAT harmonic pattern. After initial leg which was from Mar 2017 to May 2017 the B leg was retraced upto 0.50 Fibonacci and B to C leg projected between 0.382 to 0.886 Fibonacci and this was the projection of A to B leg as exactly required for BAT. Then the last C to D leg retraced between 0.786 to 0.886 and this was the potential reversal zone as per bullish BAT, then from July to Aug 2017 the consolidation period started and the price action moved sideways. Then in all of a sudden the exponential moving average 10 which was likely to cross down the EMA 20 to form a death cross, moved aggressively up and in very next week the price action hit the 51 cents which is the all time high sofar by Lumens.

This time the Stellar is making almost similar move and this move is more broader than the previous move of 2017, and we also have more indicators and moving averages available to measure the priceline moves.

After Feb 2018 we had a strong bear move which leaded more than 69% loss then in the month of April 2018 the bulls took the charge again and brought the XLM price upto $0.46200 and recovered more than 59% loss but this move was not for making another high therefore after hitting the $0.46200 the bears took the charge again and leaded the price action upto $0.052 in Sep 2019 which was more than 89% loss from the highest ever price of $0.5100.

1st sign of breakout:

Since Feb 2018 the price action was moving within a pennant and after a year on Feb 2018 the priceline hit the second time on pennant support and this hit produced a bounce which leaded the price to hit the resistance of pennant and broke out on May 2019, during this the exponential moving average 10 was likely to cross up the EMA 20 but could not make this golden cross then a price correction period started which leaded the price again down upto $0.0542, this time the RSI went in oversold zone and now the EMA 10 is again moving up to make another attempt to form a golden cross with EMA 20 if this golden cross will be successfully formed then it can again lead the price action for all time high as it took place in Aug 2017. We have the MACD strong bullish.

Stochastic upto month chart has given bull cross.

The Nature Is Again Playing Its Role:

Again the buying and selling trend from the humans has given the price action some certain directions and the Stellar has formed again a very big natural bullish BAT pattern on month chart.

After initial leg the A to B leg is almost retraced upto 0.50 Fibonacci and B to C leg is moved the projection area of A to B leg between 0.382 to 0.886 Fibonacci and now again the last leg is retraced between 0.786 upto 0.886 Fibonacci And this time the Stellar price is again entered in potential reversal zone of BAT like it was in July 2017 and now we can expect another very strong bullish divergence which can lead the price action to achieve higher than the previous high 51 cents.

Even though this move can lead to the highest ever price in the history of XLM but realistically we can sell between 0.382 ot 0.786 Fibonacci projection of A to D leg, so the targets can be as below:

Buy between: $0.110241 to $0.059381

Sell between: $0.231517 to $0.413568

Regards,

Atif Akbar (moon333)

XLMUSD forming bullish BAT | Upto 22% expectedThe priceline of XLM / US Dollar cryptocurrency is forming last leg of bullish BAT pattern and soon it will be entered in potential reversal zone insha Allah.

This PRZ area should be used as stop loss in case of complete candle stick closes below this zone.

I have used Fibonacci sequence to set the targets:

Buy between: 0.072350 to 0.070104

Sell between: 0.077704 to 0.085743

Regards,

Atif Akbar (moon333)

There is a possibility for the beginning of an uptrend in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.04950000 to 0.03500000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.04950000)

Ending of entry zone (0.03500000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.07100000

TP2= @ 0.08500000

TP3= @ 0.10200000

TP4= @ 0.11930000

TP5= @ 0.13700000

TP6= @ 0.15620000

TP7= @ 0.18010000

TP8= @ 0.22210000

TP9= @ 0.27550000

TP10= @ 0.32880000

TP11= Free

There is a possibility for the beginning of an uptrend in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 43.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.04950000 to 0.03500000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.04950000)

Ending of entry zone (0.03500000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.07100000

TP2= @ 0.08500000

TP3= @ 0.10200000

TP4= @ 0.11930000

TP5= @ 0.13700000

TP6= @ 0.15620000

TP7= @ 0.18010000

TP8= @ 0.22210000

TP9= @ 0.27550000

TP10= @ 0.32880000

TP11= Free

XLMUSD formed bullish Gartley | A buying opportunityPriceline of XLM / US Dollar cryptocurrency has formed a bullish Gartley pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this area.

I have used Fibonacci sequence to set the targets:

Buy between: 0.05884816 to 0.05789023

Sell between: 0.05960227 to 0.06141290

Regards,

Atif Akbar (moon333)

XLMUSD has formed a bullish BAT | Upto 596% possibilityPriceline of XLM / US Dollar has formed a bullish BAT pattern and entered in potential reversal zone and ready to hit the sell targets soon insha Allah.

But the volume profile is still showing the traders interest below the PRZ area even the POC of volume profile is also below the potential reversal zone, therefore I would suggest for secure trade we can wait for stochastic to give bull cross and for the MACD to turn weak bearish from strong bearish atleast upto 2 week chart and also use the potential reversal zone as stop loss (In case the candle stick will be completely closed below the potential reversal zone).

I have used Fibonacci sequence to set the targets:

Buy between: 0.110241 to 0.059381

Sell between: 0.231517 to 0.413568

Enjoy your profits and Regards,

Atif Akbar (moon333)

There is a possibility for the beginning of an uptrend in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

.The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 39.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.08495 to 0.07211). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.08495)

Ending of entry zone (0.07211)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.10213

TP2= @ 0.11930

TP3= @ 0.13400

TP4= @ 0.14993

TP5= @ 0.17345

TP6= @ 0.20730

TP7= @ 0.23610

TP8= @ 0.28670

TP9= @ 0.33745

TP10= Free

There is a possibility for the beginning of an uptrend in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

.The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 39.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.08495 to 0.07211). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.08495)

Ending of entry zone (0.07211)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.10213

TP2= @ 0.11930

TP3= @ 0.13400

TP4= @ 0.14993

TP5= @ 0.17345

TP6= @ 0.20730

TP7= @ 0.23610

TP8= @ 0.28670

TP9= @ 0.33745

TP10= Free

There is a trading opportunity to buy in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 46.

. While the RSI downtrend and the price downtrend in the daily chart are not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.09934000 to 0.08942000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.09934000)

Ending of entry zone (0.08942000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.11930000

TP2= @ 0.13400000

TP3= @ 0.14770000

TP4= @ 0.17342000

TP5= @ 0.18912000

TP6= @ 0.20730000

TP7= @ 0.23610000

TP8= @ 0.28670000

TP9= @ 0.33745000

TP10= Free

There is a trading opportunity to buy in STRUSDTechnical analysis:

. Stellar/Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 46.

. While the RSI downtrend and the price downtrend in the daily chart are not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.09934000 to 0.08942000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.09934000)

Ending of entry zone (0.08942000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.11930000

TP2= @ 0.13400000

TP3= @ 0.14770000

TP4= @ 0.17342000

TP5= @ 0.18912000

TP6= @ 0.20730000

TP7= @ 0.23610000

TP8= @ 0.28670000

TP9= @ 0.33745000

TP10= Free

There is a possibility for the beginning of an uptrend in STRUSDTechnical analysis:

. STELLAR/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 38.

. While the RSI downtrend and the price downtrend in the daily chart are not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.09934000 to 0.08942000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.09934000)

Ending of entry zone (0.08942000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.11080000

TP2= @ 0.11930000

TP3= @ 0.13807000

TP4= @ 0.17342000

TP5= @ 0.18912000

TP6= @ 0.20730000

TP7= @ 0.23610000

TP8= @ 0.28670000

TP9= @ 0.33745000

TP10= Free

There is a possibility for the beginning of an uptrend in STRUSDTechnical analysis:

. STELLAR/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 38.

. While the RSI downtrend and the price downtrend in the daily chart are not broken, bearish wave in price would continue.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.09934000 to 0.08942000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.09934000)

Ending of entry zone (0.08942000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.11080000

TP2= @ 0.11930000

TP3= @ 0.13807000

TP4= @ 0.17342000

TP5= @ 0.18912000

TP6= @ 0.20730000

TP7= @ 0.23610000

TP8= @ 0.28670000

TP9= @ 0.33745000

TP10= Free

A trading opportunity to buy in STRUSDTechnical analysis:

. STELLAR/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 69.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.11789000 to 0.09560000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.11789000)

Ending of entry zone (0.09560000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.14580000

TP2= @ 0.17342000

TP3= @ 0.18912000

TP4= @ 0.20730000

TP5= @ 0.23601000

TP6= @ 0.25526000

TP7= @ 0.28668000

TP8= @ 0.33745000

TP9= @ 0.40960000

TP10= @ 0.50150000

TP11= Free

A trading opportunity to buy in STRUSDTechnical analysis:

. STELLAR/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 69.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.11789000 to 0.09560000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.11789000)

Ending of entry zone (0.09560000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.14580000

TP2= @ 0.17342000

TP3= @ 0.18912000

TP4= @ 0.20730000

TP5= @ 0.23601000

TP6= @ 0.25526000

TP7= @ 0.28668000

TP8= @ 0.33745000

TP9= @ 0.40960000

TP10= @ 0.50150000

TP11= Free

A trading opportunity to buy in STRUSDTechnical analysis:

. STELLAR/DOLLAR is in a range bound and the resumption of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 66.

. The RSI and the price downtrend in the daily chart are broken, so the probability of the beginning of uptrend is increased.

Trading suggestion:

. If you missed our first HUNT, you have a second chance to buy above the suggested support zone.

. There is still a possibility of temporary retracement to suggested support zone (0.23 to 0.18). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.23)

Ending of entry zone (0.18)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

New Take Profits:

TP1= @ 0.31

TP2= @ 0.40

TP3= @ 0.46

TP4= @ 0.66

TP5= @ 0.74

TP6= @ 0.96

TP7= Free

We opened 7 BUY trade(s) @ 0.18415803(day close price) based on a reversal candle ( Hammer ) at 07.12.2018 in our suggested support zone (0.23 to 0.18).

Total Profit: 75022783

Closed trade(s): 12584197 Profit

Open trade(s): 62438586 Profit

Closed Profit:

TP1 @ 0.31 touched at 03.21.2018 with 12584197 Profit.

Open Profit:

Profit for one trade is 0.28822234(current price) - 0.18415803(open price) = 10406431

6 trade(s) still open, therefore total profit for open trade(s) is 10406431 x 6 = 62438586

All SLs moved to Break-even point.