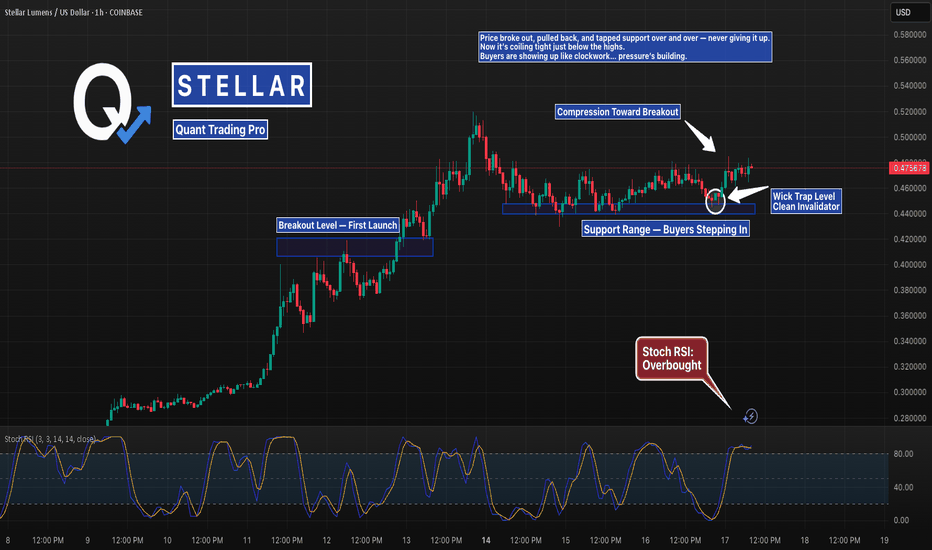

XLM Coiling at the Highs After Holding Support PerfectlyStellar broke out, then printed the cleanest support range you’ll find.

Wicks into demand, fast rejections, and now it’s compressing just under resistance.

If it breaks from here, there’s room to stretch.

But don’t forget — the longer it coils, the harder it snaps.

#XLM #StellarLumens #XLMUSD #SupportAndResistance #BreakoutSetup #CryptoCharts #TradingView #QuantTradingPro #BacktestEverything

Stellarlumens

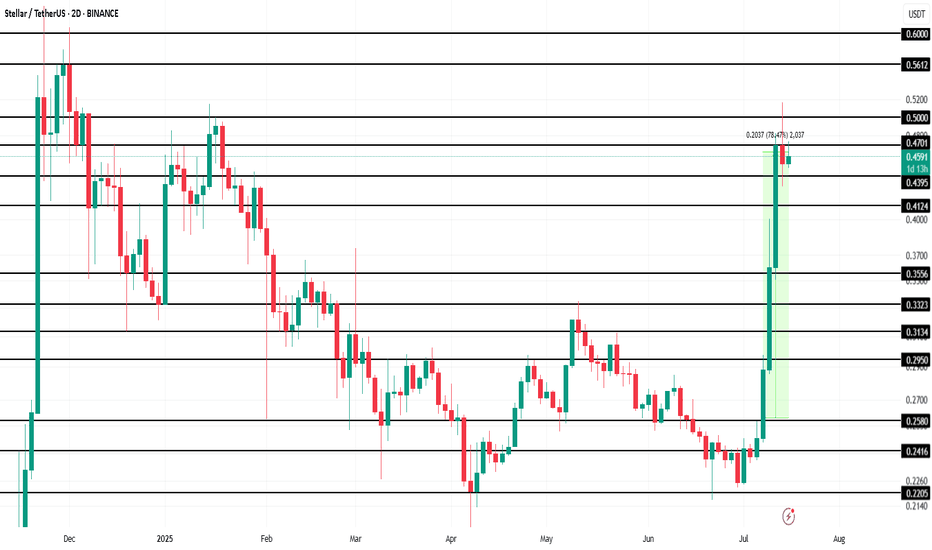

Stellar (XLM) Makes History Amid 78% Price Surge This WeekBINANCE:XLMUSDT is currently trading at $0.46, up 78.5% over the past week . However, the altcoin faces resistance at $0.47, a level it has struggled to breach in recent days. The ability to break this resistance is crucial for continued growth, as it will determine whether XLM can push higher.

BINANCE:XLMUSDT futures market activity has also surged, with Futures Open Interest hitting an all-time high of $520 million in the last 24 hours. This indicates that traders are increasingly interested in the asset's derivatives, which are capitalizing on its rise.

Given the strong sentiment from futures traders and the technical indicators, it is likely that BINANCE:XLMUSDT will push past the $0.47 resistance and target $0.50 in the coming days . A successful breakthrough could lead XLM toward its next target at $0.56, marking an eight-month high. This would signify continued strength for the asset.

However, if the broader market sentiment shifts or investors begin to sell their holdings, BINANCE:XLMUSDT could face a significant pullback. If the price falls below the key support levels of $0.43 and $0.41 , it could slide further to $0.35, which would invalidate the current bullish outlook.

XLM potentialXLM shows a great performance this cycle so far and it finally show some independency from XRP and lead without XRP getting pump.

Some might think it will go for ever, I am sorry to break your heart it won't be more than $70B market cap. best case scenarios.

Around $15B to $19B there will the first resistance.

1.618 fib in all timeframes will be the next, which will be $20B - $28 Market cap I think safe bet for final exit will be $53B market cap which is 350% from here.

Stellar Lumens Looks Ready for Blast-Off!There is a very similar trend happening with the technology of the internet and computing as what we’re seeing now with AI and crypto. The early accumulation cycle for Nvidia would have shaken out many investors simply because of how long it took before going parabolic. Stellar Lumens is showing the same pattern—but the wait could be over. I see a large parabolic run coming for Stellar Lumens very soon, one that could take us to new all-time highs and spark a mass adoption cycle similar to what happened with internet and computing technology.

As always, stay profitable.

- Dalin Anderson

XLM Crashes Below Key Support – Is a Reversal Near?XLM has broken its previous low, raising the question: where is the next major support zone? To determine this, we will focus on fibonacci, moving averages, and order blocks to find a high-probability bounce area for a potential long position.

🔍 Fibonacci Retracement – Locating the Next Support Level

Using the Fibonacci retracement tool from the low at $0.0757 to the high at $0.6374:

0.618 Fib Retracement → $0.2903 (Already Lost) ❌ Current Price: $0.248

Next Major Fib Level – 0.786 Retracement at $0.1959

Since the 0.786 Fib level is a key retracement point, we need further confluence factors to confirm its strength as a potential support zone.

🔗 Confluence Factors Strengthening the Support Zone ($0.1959 – $0.17179)

1:1 Trend-Based Fibonacci Extension

High: $0.6374

A: $0.3179

B: $0.515

1:1 extension aligns at $0.1902 → Strong confirmation near 0.786 Fib retracement ✅

Wave A-B Fibonacci Extension

1.618 Fib extension from wave A to B is at $0.1875 → Aligns with the 1:1 trend-based extension ✅

Daily Support Level at $0.1962

Sits almost exactly at the 0.786 retracement ($0.1959) ✅

21 EMA & 21 SMA for Moving Average Support

21 EMA at $0.20338

21 SMA at $0.17187

Order Block Between $0.2208 – $0.1964

Demand area aligns with the major support zone ✅

Key Takeaway:

A high-probability support zone is now identified between $0.1959 and $0.17179, with multiple confluences suggesting a strong potential bounce.

Trade Plan – Scaling Into a Long Position

Given the strong confluence at the support zone, the best approach is scaling into a long trade.

DCA Entry Strategy:

Start scaling in at $0.22, as an order block exists between $0.2208 – $0.1964

Main focus remains on the support zone ($0.1959 – $0.17179)

Stop Loss:

Below the 21 SMA ($0.17187) for invalidation

Take Profit Levels for Optimal R:R:

First TP at $0.25 → Resistance area

Next TP at $0.30 → Strong psychological & resistance level

R:R Approximation:

2:1 R:R for first TP ($0.25)

3:1+ R:R if targeting $0.30

High-Probability Support Zone Identified

✔ Multiple confluences confirm a strong support zone at $0.1959 – $0.17179

✔ Scaling into a long from $0.22 to $0.17179, with stop loss below the 21 SMA ($0.17187)

✔ Take profit levels set at $0.25 & $0.30 for a solid R:R trade

Alternative bullish scenario: A reclaim of lost key low at $2526 with rising volume could signal a long opportunity, only on confirmation.

💬 Will XLM bounce from this key support? Let me know your thoughts in the comments! 🚀🔥

XLMUSD - SHORT SETUPCoin: #XLM/USDT

Short Set-Up

Leverage: 5-10x

#XLM already breaked down the symmetrical triangle and looking bearish.

Entry: 0.278 - 0.284$(Enter partially)

Targets: 0.272 - 0.266 - 0.260 - 0.254 - 0.242 - 0.230$(Short term)

Stop-loss: 0.290$

Please support with a like/boost and follow for more useful crypto updates!

To Thine Own Shoe be True - $BTC's Other Foot is About to FallBitcoin’s Floor Must Be Lower – Chart Physics and Market Psychology at Work

In this video, I explain why Bitcoin has no choice but to find a lower floor, despite many traders believing the worst is behind us. While price is briefly going to appear to confirm support, this is just part of the process before it comes back down and breaks through it on the third test. The real focus here isn’t whether this level holds for another day or two—it’s about why Bitcoin must go lower before it can establish true support.

For a long time, Bitcoin has been floating over clear air with no real structural support. When price climbs too high without building a strong foundation, it eventually has to fall back down to fill the gaps. Right now, the market is in denial, desperately trying to hold Bitcoin in the $90,000 range, but this isn’t about what traders want—it’s about chart physics and liquidity. When there’s nothing left to hold the price up, it must seek a lower equilibrium.

Psychologically, traders don’t want to accept that Bitcoin might have to revisit $70,000 or lower to reset before moving higher. But markets don’t move based on hope—they move based on supply, demand, and liquidity positioning. Right now, there are no meaningful buyers willing to absorb the sell pressure at this level, which means Bitcoin has nowhere to go but down. Once it finally breaks through, it will likely move quickly, as there’s no real support structure beneath it.

Know thy shoe.

The shoe will find the ground.

(My sincerest apologies about the volume ladies and gentlemen. The problem which I thought I had corrected from a prior video still exists in this video. It is an issue I'm hoping Trading View can correct before too long on their end… The problem originated on my end, but there was nothing I can do after it was recorded, and I had to get this video up there - I believe it contains important time sensitive information…

Please try listening with the volume turned all the way up or perhaps with headphones until the problem can be corrected.

My system issue has been corrected for the future, but Trading View if you can, please tweak this on your end and amplify it. This video is extremely worthwhile..)

XLM UPDATE VIDEO UPDATE COMING SOON!XRP has hit a new all-time high, shifting its pattern to one previously seen in XLM—a topic I’ll cover in my upcoming XLM update in the next few days.

This development could have major implications for the future of both cryptocurrencies. While I see significant headwinds in the near term, I’m closely monitoring these patterns before releasing my next video.

Global markets are getting increasingly interesting, and I believe 2025 will be a pivotal year.

XLM - Will XLM Find Strength or Stumble?XLM has been in a downtrend for the past 10 days after rejecting from the 0.618 Fibonacci retracement resistance. The price action shows lower highs and lower lows with no significant volume, signaling a potential continuation of the trend. Let’s identify the key support and resistance zones and possible trade setups.

Support Zone

A strong support zone lies between $0.3725 and $0.3695 based on multiple confluences:

Monthly Level: At $0.3725

Anchored VWAP: From the very low, the VWAP aligns with the monthly level

Fibonacci Retracement: Drawing the fib retracement from the year’s low to the recent high, the 0.75 Fibonacci level lies at $0.3695

Resistance Zone

Key Level: Price data highlights $0.435 as a significant S/R zone

Fibonacci Retracement: The 0.618 Fibonacci retracement from the current wave aligns with the key level

Short Trade Setup

Entry: 0.618 Fibonacci retracement/key level at around $0.435

Stop Loss: Above the previous high

Take Profit: Target the support zone at round $0.3725

Risk-to-Reward (R:R): 4.5

Long Trade Setup (on confirmation)

Entry: Long position between the support zone of $0.3725 and $0.3695

Stop Loss: 3% SL

Take Profit: around 0.39/0.4

Risk-to-Reward (R:R): 2 or better

Stellar (XLM) Price Breakout Fuels 30% Surge Hopes

Stellar Lumens (XLM), the cryptocurrency designed to facilitate fast and low-cost cross-border payments, has recently shown signs of a potential breakout, sparking speculation about a significant price surge. After a period of relative stagnation, XLM has demonstrated renewed momentum, capturing the attention of traders and investors alike. This article delves into the factors contributing to this potential breakout, examines technical indicators, and explores whether a 30% surge is a realistic possibility.

Stellar’s core mission is to provide an efficient and inclusive financial ecosystem, particularly for underserved populations. It aims to streamline international transactions, making them faster, cheaper, and more accessible than traditional banking systems.1 This focus on real-world utility has always been a strong foundation for XLM, and recent developments suggest this utility is beginning to translate into market action.

Factors Driving the Potential Breakout:

Several factors contribute to the current bullish sentiment surrounding XLM:

• Increased Network Activity: A key indicator of a healthy blockchain network is its level of activity. Recent data suggests a significant uptick in transactions on the Stellar network. This increased usage indicates growing adoption and demonstrates the platform’s real-world utility. This increased activity could be attributed to new partnerships, integrations with existing financial institutions, or the organic growth of its user base.

• Growing Institutional Interest: While not as prominent as Bitcoin or Ethereum, Stellar has been quietly attracting institutional interest. Its focus on regulated financial services and its compliance-friendly approach make it an attractive option for institutions seeking to explore the potential of blockchain technology. Increased institutional involvement often translates to larger trading volumes and can significantly impact price action.

• Favorable Regulatory Landscape: The regulatory landscape for cryptocurrencies is constantly evolving. Positive regulatory developments, particularly those related to cross-border payments and digital assets, can create a favorable environment for projects like Stellar. Clearer regulations can foster greater confidence among investors and encourage wider adoption.

• Technical Indicators: From a technical analysis perspective, XLM has shown promising signs. Recent price action has seen XLM break through key resistance levels, suggesting a shift in momentum.2 Trading volume has also increased, further supporting the bullish narrative. Several technical indicators, such as moving averages and relative strength index (RSI), point towards a potential upward trend.

• Focus on Decentralized Finance (DeFi): While Stellar isn't primarily known for DeFi, the network has seen increasing development in this sector. The growth of DeFi applications on Stellar could attract new users and capital to the ecosystem, further driving demand for XLM.

Technical Analysis and Price Prediction:

Analyzing XLM's price charts reveals a potential breakout pattern. The price has been consolidating within a defined range for a period, and the recent break above this range suggests a potential shift towards an upward trend. This breakout is further supported by increased trading volume, indicating strong buying pressure.

Several technical indicators suggest a bullish outlook:

• Moving Averages: The price of XLM has crossed above key moving averages, such as the 50-day and 200-day moving averages, which are often interpreted as bullish signals.

• Relative Strength Index (RSI): The RSI, a momentum indicator, is showing increasing strength, indicating growing buying momentum.

• Volume: The increased trading volume accompanying the price breakout provides further confirmation of the bullish trend.

Based on these technical indicators and the current market momentum, a 30% surge is a plausible scenario. However, it’s crucial to remember that the cryptocurrency market is highly volatile, and price predictions are not guaranteed.3 Several factors could influence XLM’s price action, including overall market sentiment, regulatory developments, and competition from other cryptocurrencies.

Is a 30% Surge Realistic?

While the technical indicators and fundamental factors suggest a potential for significant price appreciation, a 30% surge should be considered a potential target rather than a certainty. The cryptocurrency market is known for its volatility, and unforeseen events can quickly change market sentiment.4

Conclusion:

Stellar’s XLM is showing promising signs of a potential breakout. Increased network activity, growing institutional interest, favorable regulatory developments, and positive technical indicators all contribute to the bullish sentiment. While a 30% surge is a realistic possibility based on current trends, investors should exercise caution and conduct thorough research before making any investment decisions. The cryptocurrency market is highly volatile,5 and it’s essential to manage risk effectively.6 However, the current momentum surrounding XLM suggests that the project is well-positioned for future growth and could offer significant potential for investors. The focus on real-world utility and the development of the Stellar ecosystem continue to be key factors to watch in the coming months.

XLM's Correction Complete? Targeting $1.10 with Strong MomentumContext and Recent Price Action

XLM has been one of the standout performers in recent months, showcasing impressive bullish momentum:

The November Surge: Starting from $0.084 in early November, XLM skyrocketed to a peak of $0.63 by the end of the month. This remarkable 613% rally highlights intense buying pressure and growing market interest.

The Correction: Following this explosive move, XLM entered a natural consolidation phase, retracing about 40% of its gains. This correction has formed a classic ABC pattern, with the price finding support at $0.35. Such retracements are common after parabolic moves and often set the stage for the next leg higher.

The Bullish Reversal: On Friday, December 13th, XLM has begun to show signs of renewed strength. After revisiting the $0.35 low, the price has rebounded to $0.43, forming a solid bullish engulfing candle on the 6-hour timeframe. This is a strong indication that buyers are regaining control.

Outlook and Target Projection

XLM's structure suggests the corrective phase is nearing its end, paving the way for the next impulse wave. Considering the prior momentum and market conditions, a price target of $1.10 is highly probable within the next 2 weeks.

Key Levels to Monitor

Entry Point:

Current price at $0.43 provides an attractive entry zone for buyers anticipating the next move higher.

Profit Targets:

$0.65 – Retest of the November high.

$1.10 – Extended target based on historical momentum and potential wave projections.

Stop Loss:

Below $0.35 – A breach of this support would invalidate the bullish thesis and could lead to further downside exploration.

Risk-to-Reward Analysis

With the price currently at $0.43:

Downside Risk: Stop loss at $0.35 results in a risk of ~18.6%.

Upside Potential: Targeting $1.10 offers a reward of ~155%.

This gives a compelling risk-to-reward ratio of approximately 8:1.

Conclusion

XLM's recent surge, healthy correction, and current bullish signals create an excellent opportunity for traders. With clear profit targets at $0.65 and $1.10, and a well-defined stop loss at $0.35, this setup offers a strong blend of technical reliability and favorable risk-to-reward dynamics. As XLM completes its consolidation, it seems poised to resume its upward momentum.

Let me know if you’d like further refinements!

XLM's Correction Complete? Targeting $1.10 with Strong MomentumContext and Recent Price Action

XLM has been one of the standout performers in recent months, showcasing impressive bullish momentum:

The November Surge: Starting from $0.084 in early November, XLM skyrocketed to a peak of $0.63 by the end of the month. This remarkable 613% rally highlights intense buying pressure and growing market interest.

The Correction: Following this explosive move, XLM entered a natural consolidation phase, retracing about 40% of its gains. This correction has formed a classic ABC pattern, with the price finding support at $0.35. Such retracements are common after parabolic moves and often set the stage for the next leg higher.

The Bullish Reversal: On Friday, December 13th, XLM has begun to show signs of renewed strength. After revisiting the $0.35 low, the price has rebounded to $0.43, forming a solid bullish engulfing candle on the 6-hour timeframe. This is a strong indication that buyers are regaining control.

Outlook and Target Projection

XLM's structure suggests the corrective phase is nearing its end, paving the way for the next impulse wave. Considering the prior momentum and market conditions, a price target of $1.10 is highly probable within the next 2 weeks.

Key Levels to Monitor

Entry Point:

Current price at $0.43 provides an attractive entry zone for buyers anticipating the next move higher.

Profit Targets:

$0.65 – Retest of the November high.

$1.10 – Extended target based on historical momentum and potential wave projections.

Stop Loss:

Below $0.35 – A breach of this support would invalidate the bullish thesis and could lead to further downside exploration.

Risk-to-Reward Analysis

With the price currently at $0.43:

Downside Risk: Stop loss at $0.35 results in a risk of ~18.6%.

Upside Potential: Targeting $1.10 offers a reward of ~155%.

This gives a compelling risk-to-reward ratio of approximately 8:1.

Conclusion

XLM's recent surge, healthy correction, and current bullish signals create an excellent opportunity for traders. With clear profit targets at $0.65 and $1.10, and a well-defined stop loss at $0.35, this setup offers a strong blend of technical reliability and favorable risk-to-reward dynamics. As XLM completes its consolidation, it seems poised to resume its upward momentum.

Let me know if you’d like further refinements!

More proof Goldencross works immediately in this phase of bullJust like the char I posted before this one, I’m posting this simply to lllustrate how the golden cross (orange line crossing above the blue line) immediately resulted in a very pivotal bullish pump that coincided with a major fulcrum point on the chart recently on multiple different charts. More times than not in the other market cycles, when a golden cross occurs it usually takes a few weeks afterwards to know whether that cross will have its desired outcome or instead end up being a fakeout but lately I’ve noticed multiple charts have seen an instantaneous pump on the exact day of the golden cross, which is making me think that once we enter the 2nd parabolic phase of a bull market that that is when you can anticipate a golden cross to have its immediate intended effect its suppose to have with much much higher probability than all the other market phases including even the 1st half of the bull market. Anyways I wanted to illustrate that hypothesis here with the XLM chart as you can clearly see it’s a text book example, and I will try to put a link below to the previous example where this occurred as wel a link to the total2 chart which will have its golden cross in the next 102 daily candles.l One major reason I want to illustrate this is because within the next 1-2 daily candle closes the Total2 (aka altcoin market) chart is going to have its golden cross and it is currently trying to confirm the breakout upward from a cp and handle pattern which is a huge fulcrum point for it. So should the trend of instantaneous golden cross pump effects occurring the same daily candle as the cross itself, this could clue us into exactly when the real full on alt season will be about to kick off (which if correct, will be ignited by a big confirmation breakout pump within the next 1-3 daily candles). *not financial advice*

XLM | STELLAR | Can XLM go HIGHER?All the bottom feeders are pumping - XRP, XLM and ADA. This goes to show to that if it can be traded, it will be traded.

I have some thoughts on this (the unpredictability of these coins) . As they do not follow traditional market patterns, it makes them very hard to read and harder to predict - this significantly increases the risks associated in trading these coins.

I will admit I did have some XRP this cycle - but not ADA or XLM. Looking at the char prior to the pump, it was a dead coin - and there was no reason to anticipate such a huge increase.

Yesterday's update on XRP here:

___________________________

BINANCE:XLMUSDT

Stellar (XLM) - Key Levels! Nov, 2024Key Support & Resistance Levels:

🟢Support Zone= $0.41 - $0.44

🔴Resistance Level= $0.537

⚠️Major Resistance= $0.637

If resistance levels are met and a candle close fails to break through them, there could be a short-term pullback or consolidation. Furthermore, if not, price action holds above the current support zone. Expect a further continuation to the downside in the short term.

‼️Next Line of Support if bulls fail to hold pressure against bears:

= $0.332

XLMUSD - Wave E of Wave (B) Looks Complete - Time To Go Short...In this video, I break down how the wave patterns, as interpreted through AriasWave, suggest that it's time to short this market.

When I notice over-the-top predictions and media hype, it only reinforces my belief that we've reached a short-term top in this cryptocurrency.

Here I provide a detailed wave analysis to support my bearish outlook, making it easy for you to follow along.

If prices begin to decline from here, you can expect to see continued corrections along the way that play out in a similar manner.

Be patient with XLMUSD, it's time will comeHello everyone,

today I choose to talk about XLM.

Many consider it a dead coin, since it did not make a new ATH in 2021. But I prefer trading with verified coins that have been around for long enough to establish patterns in their charts. And I trade based on these patterns.

This is a weekly chart of XLMUSD.

It is one of the sleepiest coins. But when it wakes up, it is a rocket.

How to read my chart:

- When XLM is in bull market, it respects 21 weekly EMA -> price action above it. (arrow up)

- When XLM is in bear market, it respects 21 weekly EMA -> price action below it.

- In accumulation, price action plays with 21 weekly EMA, goes above it then below, then again above it, and below... (rectangle)

Sure, this does not help, right. How could you know if we are still playing with 21 weekly EMA or is this cross above start of parabolic rise. Well, the answer lies in RSI.

XLM goes parabolic once weekly RSI crosses above 70 (circle). We are not there yet so I do not expect fireworks tomorrow. Remember, XLM is one of the last ALTs in the bull run to wake up, that is why its bull runs are so violent. Because once it wakes up it makes up for all the sleeping in matter of few weeks.

More info on XLM:

- XLM created its base (red line). It has respected it since 2018. It has touched it in 2023 and 2024.

- People think XLM slept through 2023 bull run and hence is dead. But the fact is that the 2023 bull run is still not over and XLM will mark the end of it with its parabolic run.

I have started to slopwly accumulate XLM with the money gained from BTC and other ALTs that have already surged.

XLM potential is from 5x to 15x. You choose and determine where you want to take profit. BUT MAKE SURE TO TAKE THE PROFIT!

And remember: If you buy low, you do not need coin to break ATH to make substantial amount of money. Buying price is much more important then selling price.

Good luck.

P.S. Check my other posts. If you find value in my ideas, boost and share them.

If you want to stay notified, follow me.

2 overlapping invh&s patterns on the weekly logchart for XLMThe inverse head and shoulders with the yellow neckline is the same one that is on the linear chart, however on the log chart you get a much higher target of around 44 cents. Reaching that target will also push price above a second bigger inverse head & shoulder neckline (in green) which once that one validates its breakout, it’ll have a full target of around 81 cents. Watch for the weekly 200ma(in blue) to hold support here if so not a bad place for an entry, if not retesting the yellow neckline or even throwin a wick or few back below it is not impossible and would create other good small entry opportunities as well. *not financial advice*