GBPUSD Longer Term ShortAs per the video the pound has been in decline over the past years so am looking for longer term shorts. On the weekly price action looks toppy and there's a good risk reward potential for entering short now looking for a retracement to 50% or even further. Whether it will ever reach parity or simply bottom out and climb remains to be seen in the future.

Sterling

GBP/USD is in one-year highs - where is the next resistance?GBP/USD is in one-year highs - where is the next resistance?

In between 1.2867/85 lies a short term resistance line, the 55-month ma, the 200-weel ma and the 23.6% retracement of the entire move down from the 2007 peak. We recommend tightening up stops as we approach this tough zone as we would allow for some profit taking in this vicinity.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

GBPUSD BUY SETUPLooking to buy GBP against the green back in an area of support zone where market has tested the zone a few times already, Shorting doesn't make sense until the trend has indeed changed and reversed which so far is not the case so we will look to buy around 1.4080-1.4090 with stops under 1.4060 and targets @ 1.4180 & 1.4240

ORBEX: Pound Supported As MRP Vote Share Predicts Tory Win!In today’s market insights I talk about YouGov’s MRP (multi-level regression and post-stratification) poll and how predicting UK’s vote share with 93% accuracy in the past supports the British Pound!

Aside from politics potentially moving the UK markets today, we have important GDP data coming out from Canada too. And this is likely to affect loonie.

The recording explains what I am expecting in the short and also medium-term for both GBPUSD and USDCAD. Don't miss out on information that can help!

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

GBP Update - Temporary exhaustion? Quick update on GBP pairs.

It's rallied into some key resistance levels on my charts. This could potentially signify exhaustion and lead to speculative selling/profit-taking in the very short term.

Keep a watch on the formation of this daily candle, if it posts some kind of inverted hammer or outside day, then I may look to sell some GBP pairs next week in anticipation of a correction.

There are political risks to trading GBP as we edge closer to the Brexit deadline. The rhetoric seems to be improving, although there has been no breakthrough in discussions just yet.

Overview of GBPUSD - VideoA quick overview of my current position on GBPUSD.

Looking at GBP on the whole, I think there is the possibility for more upside and continued momentum.

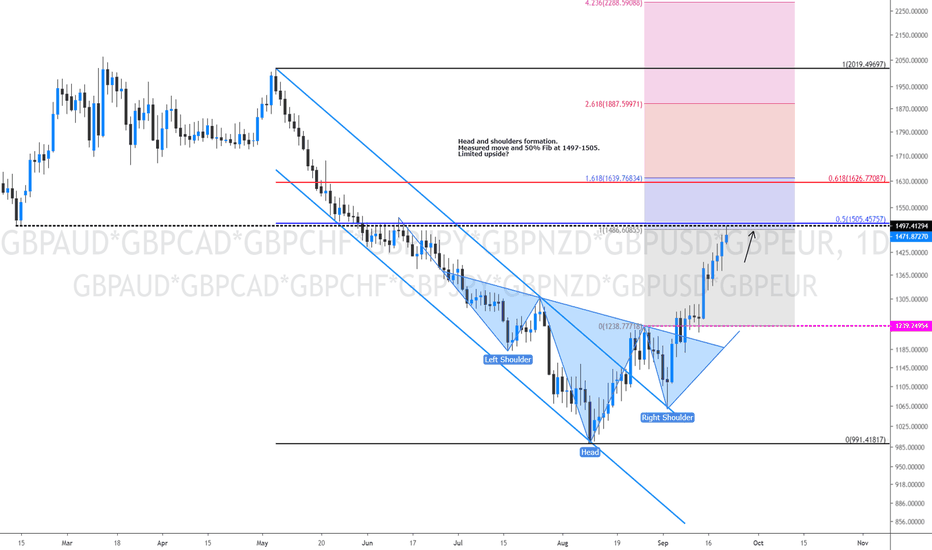

(Here is the code for the basket I use GBPAUD*GBPCAD*GBPCHF*GBPJPY*GBPNZD*GBPUSD*GBPEUR)

GBPUSD still looks good to me but it looks like we are about to see a consolidation/correction in the very short term.

Watching for now, but will be looking to buy on dips.

GBP - Signs of a bottom beginning to form?Looking at a basket of Sterling pairs on a variety of time-frames.

(You can add this to your own watchlists by copying this code: GBPAUD*GBPCAD*GBPCHF*GBPJPY*GBPNZD*GBPUSD*GBPEUR )

There appears to be some evidence of a bottom shaping on the 4-hour chart.

Expecting a bumpy ride with Sterling, but I believe the Risk/Reward is looking favourable in the short term.

We should see some more news from Brexit discussions over the next few hours.

Let's see what happens!

Hope you like the video - please give it a like if you do!

Good Luck.

Joe

GBP Macro news

The July UK government posted a budget surplus of £1.3bn compared with £3.5bn the previous year with the deficit for the first four months of fiscal 2019/20 increasing to £16.0bn from £10.0bn as spending increased and revenue growth slowed.

Sterling lost ground following comments by a French official that in view of Prime Minister Johnson’s comments on the Irish backstop, the baseline scenario now seemed to be a ‘no-deal’ Brexit and President Macron reiterated that the deal could not be re-opened. German Chancellor Merkel stated that as soon as there is a solution to the Irish border issue, there will be no need for the backstop. She also stated that a negotiated Brexit would be welcomed, but Germany is ready for all outcomes and challenged the UK government to find a solution to the Irish border within the next 30 days.

The comments failed to provide significant support with Sterling holding net losses on the day. EUR/GBP settled around 0.9140 with GBP/USD below 1.2150. A labour-market survey recorded the strongest increase in wage rises since 2008, but political tensions tended to dominate sentiment with GBP/USD around 1.2120 on Thursday.

GBP/CAD sets up >1000 Pip Play! *Yellow MA = 200 EMA | Blue MA = 100 EMA

In this video, I go over the approaching support level for OANDA:GBPCAD and the potential play to the top of the consolidation box set after the reversal we see from January 2016 - October 2016. A play from the support to resistance is well over 1000 pips and has two different opportunities:

1. We bounce off of more recent support

2. We bounce off of all-time low

I'm looking for both options to play to the top of the box and move price action within that same range again. This support is extremely strong and could lead to a very profitable play, especially since the RSI shows us the pair is oversold with bullish divergence, characteristics of previous plays in this zone. The resistance I outline is from old support and fib levels, but both this resistance and fib levels have been broken on previous bounces off the same support.

Good luck traders!

Triggered on GBPCHF - Video on why we bought this levelFX:GBPCHF , OANDA:GBPCHF , SAXO:GBPCHF

Here is a video on GBPCHF. We posted a buy idea on the pair this morning (see the related idea).

Just a quick run through on the reasoning behind it and why we thought it was a decent speculative trade to have a look at today.

Feel free to comment if you have any questions or would like to discuss anything.

Full details of the trade can be found on our wall or in the related idea link.

GBPUSD: Sterling could rule - get into this!Pound/Sterling may hold some surprises. I have spotted a major curve suggesting probability for the upside. Just don't expect it go go up in a nice smooth way. Brexit is likely to hold some favourable surprises for GBP/ pairs in the longer term. Into April, expect high volatility and trouble.

GBPUSD: People are asking the wrong questionI'm being asked by people (I didn't say on Tradingview), "Where is the pound going?" This is the wrong question and I explain why. 'The pound (sterling)' is not simply GBPUSD. In the screencast I show opportunities on different time frames.

Overall I conclude that (at this point in time), most significant trends are pointing for the south. That doesn't mean that people cannot go long or make profits from going long.

Review of sterling pairs - week ahead. I'm doing my home work and sharing. GBPEUR or EURGBP looks good for next week based on 6H time frames.

In fact nearly all Sterling pairs look favourable for trends south. That doesn't mean I'm shorting all next week.

This is not advice or predictions on what will happen.

Stalking Sterling for next week - as Brexit panic sets in. In the screncast I start off with GBPAUD on a weekly time frame and move on into much lower time frames across other pound-pairs.

The geopolical/macroeconomic picture for the UK with Brexit, creates uncertainty.

There are reliable reports of preparations for pharmaceutical stock piling, big push in logistics sector for storage of tinned food and firelighters and Whitehall preparing 'war games' scenarios. Such preparations would not be happening if there was no realistic probability of a hard Brexit.

The issue of course for us traders is not about Brexit as a politico-economic event. We need to be prepared to make some money out of it. Right? This is not a moral issue for me, but if it is for some traders, then avoid Pound pairs.

GBP/USD Cable Short- Brexit Causes Sterling Tumble or does USD?GBP/USD has Fallen Nearly 300+ pips Since Rejecting 1.4000. THis Pair has now seen quite a divergence between the moving Averages as the new Fed Chair Powell Preaches hawkish overtones about Fed Hikes and Market Exhuberance. WIll The Cable Fall Again to Post Brexit Levels Yet Again?

Looking at the chart techincally, we can see that the Weekly Ascneding Trendline is currently being tested as the pair consolidates around the weekly mid range level of 1.3750. A confirmed break below would indicate a potential short oppurtunity however lets not rule out any retracements as the pair has had a massive fall in the past few days!

Related Tickers AMEX:FXB TVC:DXY FX_IDC:GBPUSD