10-09-2019 Another possible GBP cenario- Just another idea-GBP is currently at a very important level. -61% of fib -

It is obviously trending downward, but the sentiment on this pair is still very bullish.

74% of GBP traders at net long according to IG sentiment data. The trend usually goes against the sentiment, but sometimes it works.

If the Cable holds a current level and bounces from here, we may see a complete ABCD cycle before the Brexit. -Point "D" meets absolute downtrend line colored in red-

Sterling

10-08-2019 GBP/USD short opp - GBP's downtrend has started but we may see a small upward retracement.

It is possible to retrace 1.224XX level and continue to trend downward.

SL above the red trendline, the target is 78% fib level of the entire cycle(September resistance)

This is low hanging fruit setup.

GBPJPY ShortAfter a few days in that "indecision box" as I call it, the price has broken down, retested, failed, and will more than likely continue downwards. Not many people use the 180m chart but I find in quite useful on this pair in conjunction with the 200EMA and as you can see, the price respects the 200EMA quite well. Only thing that could completely derail this analysis is out of the blue Brexit headlines so stay vigilant on this trade.

Good luck!

Monday plan GBPJPYThe 20-day ADR was missed on Thursday and Friday. Moreover, the 20-week AWR was missed as well (both upside and downside). Price expansion is much expected next week. I am still bearish GBPJPY hence I am looking for bull traps at the levels I have illustrated on the chart

Expect updates in the trading days next week in reference to this post.

Navigating the Bias Shift : GBPJPY 27/9I am intraday bearish bias for Sterling today (both technical and fundamental rationale). I have marked levels that, if reached, will wait for a bearish signal. Price could go further down without tapping in these levels, which I would not chase. Let the price comes to me.

The daily range yesterday was small compared to the 120 pips 20-day ADR so I am expecting a price expansion today between 130-150 pips.

There are no risk events for the U.K and Japan

Update : GBPJPY PlanI don't need to do hindsight analysis/review of this pair (any pair really). I can say this though.. that stop hunt during a risk event? "experts" in the media claims the spike was a headline reaction . The fact that Sterling was BID literally 5 minutes before the confirmation of the supreme court it was claimed by the media experts that it's due to "buy the rumour, sell the fact"

I see in a different angle though. LIQUIDITY RUN. Buy Stops stacked just around Monday's high (obvious level hence banks use it against us/for them). The bank made a liquidity run/stop hunt. From that hunt, now the range have been formed, setting up traps for breakout traders or range traders.

Technically I am still bullish on Sterling. I don't have a rationale based on sentiment/fundamental analysis apart from Sterling is almost all about Brexit nowadays so I gather from yesterday's supreme court decision, sterling is bid right now I guess? I wont allow it to confuse me because my SOP is clear, if there is no clear sentiment/fundamental analysis based bias, I just rely on what the charts telling me

I am looking at the liquidity pool (marked in the chart) and if price goes there the low of the week formed, I will look to Long GBPJPY (and other GBP pairs)

Update: GBP/CAD - 1000 Pips Achieved (More to Go)*Yellow = 200 EMA | Blue = 100 EMA

This update is for OANDA:GBPCAD . I predicted (accurately) that price would find support at ~1.58165 , and it successfully rebounded off of this is level and has found resistance at ~1.65918 . We currently pushing off this resistance level and first found support around mid-August.

The close on Friday (Sept 20th) is critical because it is a strong bearish candle with a relatively large tail looking similar to a bearish hammer pattern. This is printing on a resistance level which is both horizontal and diagonal. The horizontal is the standard resistance at ~1.65918, but the diagonal is a trendline drawn from peaks in Mid-January 2016, Mid-March 2018, and late December 2018. On top of that, price is attempting to cross the 100 EMA which can act as additional resistance.

What to look for?:

a) Tenkan-Sen and Kijun-Sen are on the rise along with a Kumo Flip. This is clearly bullish and could mean any resistance OANDA:GBPCAD is facing is minimal, and these 2 moving averages (Conversion and Base) could act as support on a retracement.

b) Keep an eye on Fib Levels for support on a retracement specifically 0.382 and 0.5 - These levels have been used as support for retracements off this support in the past (January and September 2017).

c) RSI(14) shows that this pair is still not overbought and could easily continue upward which moves in confluence with other factors which indicates only minor resistance.

Good luck Traders!

GBP Update - Temporary exhaustion? Quick update on GBP pairs.

It's rallied into some key resistance levels on my charts. This could potentially signify exhaustion and lead to speculative selling/profit-taking in the very short term.

Keep a watch on the formation of this daily candle, if it posts some kind of inverted hammer or outside day, then I may look to sell some GBP pairs next week in anticipation of a correction.

There are political risks to trading GBP as we edge closer to the Brexit deadline. The rhetoric seems to be improving, although there has been no breakthrough in discussions just yet.

Overview of GBPUSD - VideoA quick overview of my current position on GBPUSD.

Looking at GBP on the whole, I think there is the possibility for more upside and continued momentum.

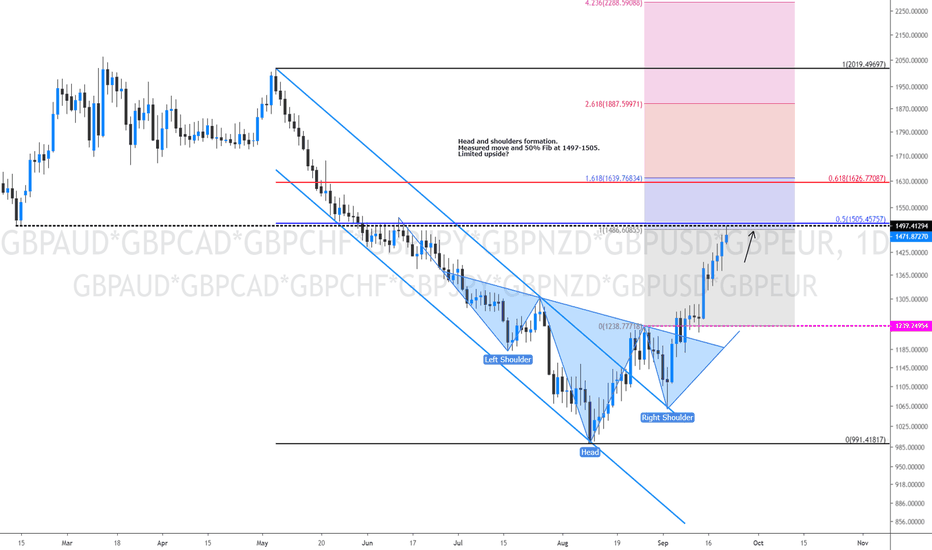

(Here is the code for the basket I use GBPAUD*GBPCAD*GBPCHF*GBPJPY*GBPNZD*GBPUSD*GBPEUR)

GBPUSD still looks good to me but it looks like we are about to see a consolidation/correction in the very short term.

Watching for now, but will be looking to buy on dips.

Trading Plan Update for GBPJPY The BeastReferring to the this post 2 days ago :

The daily range for yesterday was 100 pips roughly whilst the 20-day ADR was 130. I would consider it a hit. Today's 20-day ADR is 132 pips and I expect this will be reached today and hopefully to the downside. I am still bullish the Sterling and I am looking at liquidity pool at 134.600-134.500 and 134.00 price levels.

There was a valid bullish signal on Tuesday but I missed that signal. That signal formed an accumulation zone which creates another "liquidity plot" around 134.500-134.00.

If price enters in one of these price zones, that will activate my bullish mode and will look for bullish activation.

There is a risk event for UK and Japan today but either I don't expect anything significant.