Straits Times Index (STI) Analysis 26 May 2020; Staying NeutralCurrently staying neutral for STI. It is trading below the range EQ of 2689.97 and has not been able to reclaim this. This is bearish, which means every bounce should be shorted.

However, it is trading above the Order Block (OB) EQ of 2517.52 – hanging by a thread. This is the critical point to look at: whether we reclaim this or lose this at monthly close.

When monthly closes in the next few days it will give us a clearer picture. There are 4 scenarios we need to contemplate:

1) (High Probability) Lose OB EQ of 2517.52 -> potential swing short. Take Profit (TP) 1 targeting the EQ of the OB below us at 2318.17.

2) (High Probability) Reclaim OB EQ of 2517.52 -> potential scalp long. Take Profit (TP) targeting the range EQ at 2689.97. Do not stay in this trade for too long. 1) Market structure has broken down on the high time-frame, 2) we are trading below range EQ, so this is a counter-trend move. Hop out of the trade if it is getting uncomfortable; don’t be too fixated on hitting the TP.

3) (Low Probability) Monthly close reclaims range EQ of 2689.97 -> Swing long position. TP1 targeting the EQ of the OB above range EQ at 2919.34.

4) (Very, very Low Probability) Monthly close sweeps range low of 1473.77. This is definitely a long term swing long. Doubt it will happen in the near future.

STI

STI - Singapore - poised to deliver 15 to 25% during next 10daysSTI finished a primary degree contracting triangle pattern that should initiate a long path upward from here. It seems to be tracing a 5 wave move up that will form a minor wave 1 pattern. Currently we should be beginning a minute impulse wave 3, the strongest of the impulse waves that should deliver from 14 to 24% returns up to the next 10-15 days. Price-to-book ratio also confirms the pattern. Time to catch it ! FOLLOW SKYLINEPRO TO GET UPDATES.

SPX500 or STI , which is better ?Volatility wise, you can see STI is more volatile with sharp spikes (orange) compared to SPX500.

And then the green zone where both are moving in a bullish channel. SPX500 has a much smoother ride. This is important as traders might get stopped out due to tight SL.

More importantly, when all indices have risen lately due to the Fed's generous money printing, SPX500 has retraced more than 35% while STI is at a miserable 10%.

The downside is investing in SPX500 requires one to use own cash whereas in STI, we can employ our CPF (401K) to invest.

Of course, we have the global giants like Amazon, Facebook, Apple, etc in SPX500 while STI contains mainly regional or state owned companies blue chips.

From a returns point of view, I will go for SPX500.

Straits Times Index (STI): Bullish Forecast

hey traders,

2550 is a major weekly structure level on STI.

just recently we saw its confirmed bullish breakout with a weekly candle close above that,

now the market is retesting the broken structure and I believe that bullish sentiment will proceed.

target levels are:

2700

2850

good luck!

OCBC - Rising wedge!Consider it a Rising wedge or a flag/pennant (on longer timeframe). Both in my view are bearish formations in current context. Look out for the breakdown of the wedge. Target should be recent low atleast.

However, I also see a cup and handle formation, therefore, bets off if the recent high is taken out and goes above the wedge formation.

Disclaimer: Not a recommendation to buy or sell.

SG DBS BREAKING DOWN DBS is very weak now. Having bounced off 25 twice in recent time, it failed to make higher highs, failed the 55EMA, and is likely to revisit 25.

MACD supportive of bearish bias.

Going for a bounce at 24.50, and to consolidate at 24 for deliberation of a possible major rally to 40.

Sunshine on STISunny Singapore is getting wet weather in the month of December. Lots of sales ongoing with the festive season - Christmas and year end sales.

The HK protests in some ways have contributed to a fair amount of Hong Kongers moving to Singapore and even business owners parking their funds here.

www.cnbc.com

www.channelnewsasia.com

STI- NYSEVery simple:

If price breaches 66.32

enter trade: 68.32

exit trade: 80.05

stop loss: 63.00

Good Luck,

Yanlord - Adam and Eve reversal (bullish reversal)Adam and Eve is another of my favourite bullish reversal pattern. Yanloard broke above the neckline at 1.35 on 11 Feb and has been consolidating between 1.36 to 1.42 for the past week. The consolidation looks to be a bull flag and I am expecting it would be able to reach a price target of around 1.50 (hmm, just a small profit for now as the adam and eve formation was "shallow").

APAC Realty - Possible Bull Trend underway Apac Realty was in a decline for almost 8 months before hitting bottom in Nov 2018. It then flattens out and formed a base over the next 3 months before rising sharply on 12 Feb 4 days ago. This could signal the start of a new bull trend. There is an immediate resistence at 0.585, should there be a pullback towards 0.51 and starts to rebound from there, it would be an opportunity to stake at low risk with mid term price profit of 0.75. (profit targest are just a guide, trail and protect your profits should the stock rise in our favour!).

OUE - Inverted Head & Shoulders (Bullish Reversal Pattern)OUE formed an inverted Head and Shoulders over the last 6 months (with a sloping neckline). It broke the neckline at 1.50 two weeks ago with higher volume but consolidated in a small range until it took another step up on 15 Feb. It looks on track to a projected target of at least 1.70 with an inital stop loss placed a couple of ticks below 1.50.

Straits Times Index (Daily Chart) - Where is the Bottom?Since our last predictions on the Straits Times Index, the price has continued to fall from 3300 to 3000, and then below it.

At this rate of decline, is there any support or bottom in sight?

I generally do not like to do projections, because most projections are just guesses.

The best way to know is to observe the price as it moves, then you will know when it has likely bottomed.

And for now, it still looks like it can continue to fall.

So i will stay bearish and continue to monitor.

Straits Times Index (Daily Chart) - Very BearishSince my last call to short (on my blog and during my events), the STI has fallen about 5.5%, and has corrected 13.3% from the highs.

This is the reason why I am bearish on Singapore stocks and have liquidated my portfolio a long time ago to focus on the US markets.

I have a feeling price will continue falling until the 3000 support level. I will be watching to see once it reaches there.

STI - Not time to buy yet, but selling isn't a good idea too!As the trade war between US and China intensifies, general markets in Asia get the ripple effect too.

STI has dropped around 5.40% and is now trading around 3300 region.

If you're feeling worried because of this drop, you better be.

If you're feeling happy because now you think you can buy at a cheaper price, you better don't.

Now, why do we say so?

If you're feeling worried and uneasy because of the drop, it just shows that (1) you do not have a proper investment/trading plan to start with, and (2) you do not have the right risk management plan in place. And that's the exact reason why you should be worried.

If you're feeling excited to hop onto a trade or invest now, hold your horses. The time isn't right yet. Be patient. Wait for at least a sign of price bouncing before entering :)

Our bias remains to the upside for the general equities market at the moment. Our macro analysis is still showing room for the markets to rally. Perhaps for the last wave up between 2018 to 2019.

After that, we might eventually see the long-waited "clearance sales" in the equities market. When that happen, it will be a shopping spree for many well-prepared traders and investors.

*Disclaimer - This analysis alone DOES NOT warrant a buy or sell trade immediately. Before you enter any trade in the financial market, it is very important that you have a proper trading plan and risk management approach.

The sharing of this idea is neither necessarily indicative of nor a guarantee of future performance or success.

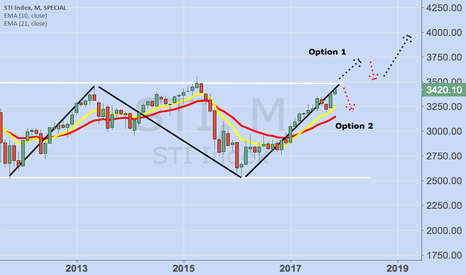

STI Index 2 Options as we come to the crossroads soon.

Option 1 : Breakout and pullback and head northwards to 4000+ price level

Option 2 : Breakdown as per previous 2 attempts

Analysts are expecting a breakout of 3500 , read news here

www.todayonline.com

I do not trade this index but use it as a barometer for overall stock performance and dive down into individual companies. Singapore is an important global financial hub and its stock performance is a good guide to the overall economy globally as well. US has always been an influence to its performance so watching US market will provide deeper insights into the various emerging markets performance.

STI - A retracement or a reversal?The first half of 2017 has been a good run for the Singapore stock market - Straits Times Index (STI), gaining over 300 points.

However, we believe that a retracement or a reversal to the downside is imminent. The question is are we gonna see a retracement or a reversal?

Retracement

Price moves correctively, usually taking a longer period of time, and does not move much in terms of price.

Reversal

Price moves impulsively, usually taking a shorter period of time, and moves strongly in terms of price.

Knowing what constitute a retracement and a reversal is essential in knowing how to plan your trades.

1) If we see a correctively move lower towards 3077 area, it will present us a good opportunity to look for one more move to the upside towards 3360 area.

2) If we see an impulsively move lower breaking the trend line, we can expect price to move lower potentially towards 2901 area. If this happens, it will present us a good selling opportunity targeting 2901.

Based on our Elliott Wave analysis, with the current price development, we are expecting the 1st scenario to have a higher probability of happening.

Even if you are not trading the stock index, understanding and monitoring the equities market can provide us with the current market risk environment, and thus provide us with trading opportunities in the currency market too.

Straits Times Index (STI) - tracking the Singapore Stock IndexI was conducting a talk at a local Stock Broking house. Really appreciate the invitation to speak to a group of enthusiastic participants. The participants and I were looking at the STI, stock indices for Singapore.

There is a bearish Bat pattern completing much higher at around 3430. However there is an AB=CD pattern completing now at 3145/50. This is also at a support level back in Oct 2014. This gives me a slight bearish bias at this moment before it can continue higher.