BTCUSDT Head and Shoulders|Volume Climax|Neck Line Retest Entry Evening Traders,

Today’s technical analysis – BTCUSDT – breaking its heads and shoulders pattern with a technical target situated at around $6100.

Points to consider,

- Trend Bearish (Neckline breached)

- Rising Wedge broke with a retest

- Structural support holding true

- RSI below 50 (Not officially oversold)

- Stochastics below 50 (Sell pressure evident)

- Volume climax node evident

BTCUSDT has broken its neckline with conviction confirming the head and shoulders pattern, a retest is likely for a short entry.

The macro rising wedge support line broke with a bearish retest, putting in BTC’s right shoulder and continuing the overall lower high projection.

Structural support is currently holding true, a retracement back to the neckline is probable which is in confluence with the .382 Fibonacci.

The RSI is below 50 but not oversold, recovery is probable as price is testing a key support. The stochastics on the other hand is also below 50. Sell pressure is still evident and there is momentum stored to the downside.

An evident volume climax node has been printed, sign that a temporary bottom may be in, price is trying to find its equilibrium before another probable impulse move.

Overall, in my opinion, the macro trend is bearish; BTC just broke out of a bearish pattern, the head and shoulders. Retest and confirmation of the neckline is on the cards which will allow for a short entry.

What are your thoughts?

Please leave a like and comment,

And remember,

“If I hadn’t made money some of the time I might have acquired market wisdom quicker.”

Jesse Livermore

Stochastic Oscillator

ETHBTC Bull Flag| S/R Flip| Support Confluence| Pull Back Entry Evening Traders,

Today’s Analysis – ETHBTC – forming a potential bull flag above a key level, volume influx is needed for confirmation,

Points to consider,

- Trend bullish

- Confirmation of S/R Flip

- Bull Flag confluence ( .382 Fibonacci)

- RSI neutral

- Stochastics above 50

- Volume declining

ETHBTC's trend has been bullish, breaching a very key level with consolidation above structural resistance. A bull flag is likely forming, will be valid as long as the .382 Fibonacci holds which is in confluence with the now probable support upon a retest (S/R Flip).

The RSI is quite neutral sitting at 50; it does have a higher low projection using the trend line as a guide. Stochastics on the other hand is trading just above 50, indicating buy pressure coming in.

Volume is clearly low, an influx will be needed for a confirmation if a true bull flag and a continuation in the trend.

Overall, in my opinion, the .382 Fibonacci needs to hold which is aligned with the S/R flip. The technical target of the bull flag is aligned with local resistance.

What are your thoughts?

Please leave a like and comment,

And remember,

“I know from experience that nobody can give me a tip or a series of tips that will make more money for me than my own judgement.” - Jesse Livermore

USDCAD Descending Triangle| Low Volume| Structural Support|Apex Evening Traders,

Today’s Technical Analysis – USDCAD – in a probable descending triangle formation, support and resistances are converging thus a breakout is imminent.

Points to consider,

- Trend bearish – consecutive lower highs

- Clear resistance line to breach

- Structural support being tested

- RSI diverging from price

- Stochastics projected down

- Volume Cleary declining

USDCAD’s immediate trend is bearish after putting in a local top – coincided from a break of key structural resistance in the lower regions of the chart. A break and close of this clear resistance line will negate the overall bearish formation.

Structural support is being tested, holding true, forming a bullish divergence, the RSI is putting in higher lows whilst price puts in lower lows. This is a sign that price might have strength to retest resistance again.

The stochastics is currently projected down, coinciding with the lower high projection; momentum is stored to the downside.

The volume is clearly declining, indication that an impulse move is imminent especially as price trades close to its apex.

Overall, in my opinion, USDCAD will have a breakout as support and resistances converge. A break down is more probable due to the bearish nature of the trend and formation.

What are your thoughts?

Please leave a like and comment,

And remember – Jesse Livermore once said,

“It took me five years to learn to play the game intelligently enough to make big money when I was right.”

EURUSD Multi Month Resistance| Volume Climax| ApexEvening Traders,

Today’s Technical analysis will focus on EURUSD pairings, a clear monthly resistance pushing price down while support holding true – price is nearing its APEX.

Points to consider,

- Trend bearish (consecutive lower highs)

- Multi-Month Resistance line respected

- Structural support tested

- RSI neutral

- Stochastics in the lower regions

- Volume climax evident

EURUSD trend has been bearish over an extended period of time – putting in consecutive lower highs as price respects its multi-month resistance line. A break of this resistance line will allow structural support to hold true.

Price is travelling into its apex, - a breakout is imminent.

The RSI is below 50, quite neutral, no clear divergences have been set, previous divergence played out bullish at structural support. Stochastics on the other hand is in the lower regions; momentum is stored for an upside move.

Volume climax nodes are evident, sign of seller exhaustion, temporary bottom is in until price finds its equilibrium which will coincide with the apex.

Overall, in my opinion, EURUSD will have a break in the coming years as support and resistance levels converge. A break of multi month resistance will likely push EURUSD in to its local resistance.

What are your thoughts?

Please leave a like and comment,

And remember,

" Only enter a trade after the action of the market confirms your opinion and then enter promptly" - Jesse Livermore

ONTBTC Double Bottom| S/R Flip| Pull Back Entry Evening Traders,

Today’s technical analysis will focus on ONT/BTC, breaking a key level with conviction; an S/R flip retest is likely for a trade entry.

Points to consider,

- Resistance breached

- S/R flip for confirmation

- 200 EMA immediate resistance

- 21 MA confluence (upon S/R Flip Retest)

- RSI in overbought

- Stochastics in upper regions

- Increasing bull volume nodes

ONTBTC has broken an important level with candle closes above; price was consolidating under resistance giving a sign of increasing buy pressure. A Support/ Resistance flip is probable for a confirmation of the now support.

The 200 EMA is current resistance (candle has not closed above it), price is likely to respect it initiating a rejection. The 21 MA on the other hand is likely to be in confluence with the S/R flip retest if price retraces (it is likely to align).

The RSI is in overbought conditions, sign that the current impulse move is overextended. While the stochastics is in the upper regions, can stay trading here for a while however stored momentum to the downside.

Increasing bull volume nodes are evident, can be interpreted as a sign that buy pressure will continue to test upper regions.

Overall, in my opinion, ONTBTC has breached a key level; a retest is highly probable to confirm an S/R flip – allowing for a pullback entry.

What are your thoughts?

Please leave a like and comment,

And remember,

“Whenever I have had the patience to wait for the market to arrive at what I call a Pivotal Point before I started to trade; I have always made money in my operations.” - Jesse Livermore

MATIC Symmetrical Triangle|Resistance confluence|Volume ClimaxEvening Traders,

Today’s technical analysis will focus on MATICBTC, breaking out of a symmetrical triangle with strong bull volume, currently facing resistance from the 200 EMA.

Points to consider,

- Macro trend bearish

- True pattern breakout

- 200 EMA is local resistance

- Retest of local support probable

- RSI in overbought region

- Stochastics in upper region

- Volume climax evident

MATIC’s overall trend is still bearish with consecutive lower highs in place; it must break and consolidate above the .382 Fibonacci to establish a new higher high.

A true breakout of the symmetrical triangle came to fruition with strong convincing bull volume. This volume must sustain for further upside momentum.

The 200 EMA is currently local resistance, MATIC is likely to retrace from this level back for a retest of local support. The local support aligns with the .618 Fibonacci drawn from the 200 EMA resistance.

The RSI is currently in overbought conditions, a return to neutral territory is probable if a retrace comes to fruition. Stochastics on the other hand is floating in the upper regions with lots of stored momentum to the downside.

A volume climax node is evident; engulfing all previous nodes, bull volume follow through is needed to break resistance confluence.

Overall, in my opinion, MATICBTC is likely to come and retest local support; this will allow the RSI to cool off before the next impulse move back and above the 200 EMA.

What are your thoughts?

Please leave a like and comment,

And remember,

“Sheer will and determination is no substitute for something that actually works.” – Jason Klatt

BCHBTC Low Volume|Bearish Pennant|Apex| Breakout imminent Evening Traders,

Today’s technical analysis will be on BCHBTC, trading very close to its apex with a breakout being imminent.

Points to consider,

- Local Trend bearish

- Price trading near apex

- RSI testing support

- Stochastics projected down

- Volume extremely low

- Local support - .50 Fibonacci

BCHBTC’s local trend has been bearish, consecutive lower highs evident; this can be considered as a bearish pennant, a continuation pattern.

Price is coiling up near its apex, support and resistances are converging, decision time is upon fruition.

The RSI is testing its support; break will highly coincide with further downside momentum, similar case with the stochastics that’s already projecting down.

The volume is clearly below average, this signals a breakout being imminent from this current formation.

A break bearish needs to close below the .50 Fibonacci Level, this will confirm continuation in the trend, as local support is breached.

Overall, in my opinion, BCHBTC is upon a break, this current formation can be regarded as a bearish pennant as the trend is clearly making consecutive lower highs.

What are your thoughts?

Please leave a like and comment,

And remember,

Timing, perseverance, and ten years of trying will eventually make you look like an overnight success. – Biz Stone

GBPUSD Structural Resistance| Lower lows| Oversold Bounce Evening Traders!

Today’s Technical Analysis will be on a currency pair - GBPUSD, with a strong oversold bounce, now left trading within a small range.

Points to consider,

- Macro trend bearish

- Structural resistance confluence

- Support confluence

- RSI testing resistance

- Stochastics in lower regions

- Volume influx evident

GBPUSD has been establishing consecutive lower lows as presented by the down sloping trend line. Structural resistance is in confluence with the .618 Fibonacci, a test of this level will likely increase sell pressure, confirming an S/R flip.

Support is also in confluence – with an oversold bounce, buy pressure is evident with long wicks, the 1.14 Fibonacci Extension is in clean confluence with the down sloping trend line.

The RSI is testing resistance; a break will coincide with price testing structural resistance. Stochastics on the other hand is in lower regions, can stay trading here for a while, however lots of stored momentum to the upside.

Volume influx is evident, engulfing all previous nodes, further volatility is likely after leaving the .382 and the .50 Fibonacci range.

Overall, in my opinion, GBPUSD may trade in a range before the next volatile move. Due to the macro economic situation it is likely to test lower Fibonacci extension levels.

What are your thoughts?

Please leave a like and comment,

And remember,

“Don’t blindly follow someone, follow market and try to hear what it is telling you.” ― Jaymin Shah

The Different Ways To Trade The StochasticsCryptohopper Newsletter

The market has been very volatile over the past month with Bitcoin crashing 65% to 3,800$ . The price has since made an astonishing 80% recovery in one week from March 13th until the 20th. Following the recovery to almost 7,000$; the price has continued to range between 6,900$ and 5,600$. During the crash, many traders have attempted to buy the dip, just to see it dip even lower. Today we will explore how you could mitigate this risk by using stochastics with region crossover.

Without further due, let’s get into how you could have traded this past month by using the normal stochastics and the stochastics with region crossovers.

Different stochastic strategies

There are many different ways to use stochastics. Today we will explore 2 of them, along with their advantages and disadvantages:

Stochastics oversold: This strategy involves getting into a position when the stochastics drop below 20.

This strategy works better when the broader trend is in your favor, as it is expected for the price drops to be shortlived and to continue moving higher. The advantage of this is that you will be getting in at the lower prices in an uptrend.

This strategy can be very dangerous during a market crash though, or when the price is bearish in general as you will be getting in the trade, while the price will continue to drop further . This can be seen very well in the first three trades where the price continued to drop lower even though the stochastics were already oversold.

Stochastics with region crossover: This strategy involves getting into a position once the value of the asset in question rises again above 20.

This strategy can work very well in a downtrend but also in an uptrend depending on the severity of the pullback. In a downtrend, this strategy increases the probability that you are entering the trade only when the momentum is back in your favor. This can be seen by the first three entries in the graph where the buy point was 7%, 8%, and 16% lower than with the oversold strategy

In an uptrend, if the pullback is very large then this strategy will again ensure that the price will not continue [/b its descent once you enter. However, if the pullbacks are not very severe, then you will enter at a worse price point.

Overall the stochastics with region crossovers is more conservative and can lead to higher profits when the markets are volatile, as it is the case right now. Join us at Cryptohopper, where you can automate both of these strategies along with many others!

EOSUSD Trend Line Respected| Local Resistance Confluences Evening Traders!

Today’s analysis will focus on EOSUSD which has been in a defined downtrend, currently testing a key resistance area that has multiple confluences.

Points to consider,

- Bear Trend – Consecutive lower highs

- Resistance confluences (21 EMA, local resistance. .236 Fibonacci)

- Define down sloping trend line

- RSI testing resistance

- Stochastics neutral

- Low volume – influx imminent

EOSUSD has put in consecutive lower highs; price is currently testing local resistance that is accompanied with multiple confluences. In this area the .236 Fibonacci and the 21 EMA in convergence are giving clear sell pressure.

The down sloping trend line has been respected with multiple touches; a rejection from current local resistance will likely mean another retest of the trend line.

The RSI is testing median resistance, coming out of oversold conditions – quite neutral at current given time. Stochastics is also neutral, has stored momentum in both directions.

EOSUSD has clear dry volume with a recent bull pump failure; an influx will be imminent. This will be in conjunction with price direction.

Overall, in my opinion, EOSUSD needs to break resistance confluence with multiple higher lows to establish a trend change. However a rejection here will be in confluence with a volume spike, leading to a probable retest of the lower trend line.

What are your thoughts?

Please leave a like and comment,

And remember,

“Never let a win go to your head, or a loss to your heart.” – Chuck D.

REPBTC Broadening Wedge| Structural Resistance| 200 MAEvening Traders!

Today’s technical analysis will focus on REPBTC, in a valid broadening wedge formation with a failed partial raise at structural resistance.

Points to consider,

- Trend bearish – consecutive lower highs

- Structural resistance being tested

- 200 MA – local support

- RSI trading in a channel

- Stochastics in upper regions

- Irregular volume present

Augur is in a clear defined down trend on the macro scale and is travelling in a broadening wedge that will be confirmed with a break of its ascending support line.

The current local support is being established by the 200 MA, a break of this will be in confluence with a break of the broadening wedge.

Staunched structural resistance has been respected multiple times; it is in confluence with the .382 Fibonacci. A close above and consolidation will likely test the upper resistance line of the broadening wedge.

The RSI is in a clear channel, currently neutral, breaking this channel will dictate the direction of the price. Stochastics are currently in the upper regions, can stay trading here for an extended period of time, however lots of stored momentum to the downside.

Augur has irregular volume being present, common in broadening wedge patterns , an influx will be prevalent with a decisive break.

Overall, in my opinion, Augur needs to consolidate above structural resistance and create multiple higher lows to negate this pattern. A break of lower support line will however increase the likelihood of testing lower lows.

What are your thoughts?

Please leave a like and comment,

And remember,

“If you can learn to create a state of mind that is not affected by the market’s behaviour, the struggle will cease to exist.” – Mark Douglas

XMRBTC Triple Bottom| Down Trend Broken| Support ConfluenceEvening Traders,

Today’s Analysis will focus on XMRBTC which has broken a long term down trend, currently trading in a zone between support and resistance.

Points to consider,

- Daily trend change ( Triple bottom)

- Local support confluences

- Structural resistance respected

- RSI testing support

- Stochastics in upper regions

- Declining volume nodes

XMR has put in a probable triple bottom after breaking a strong lower high structure; the bottoming formation will ONLY be confirmed with consecutive higher lows above structural resistance.

The structural resistance has been respected multiple times; XMR is likely to trade within the range between support and resistance. Local support has viable confluences indicating a true trade location. The .386 Fibonacci needs to hold true to establish a higher low on the daily. Local support and the 21 EMA being in confluence put a strong emphasis on the level being a strong support zone.

The RSI is testing support, currently quite neutral whilst the stochastics trades in the upper regions. It can stay trading here for a while, however does have stored momentum to the downside.

The volume nodes are below average; this again indicates that XMR is likely to trade within the support and resistance region before an impulsive move.

Overall, in my opinion, XMR needs to break structural resistance in order to establish consecutive higher lows. This will confirm the daily trend change and the bottoming formation. Currently is may stay trading within this range for a while as volume continues to decline.

What are your thoughts?

Please leave a like and comment,

And remember,

“The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.” – Jesse Livermore

LINKBTC Key Levels| 200 DMA&DEMA | Low Volume Evening Traders,

Today’s Technical Analysis will focus on LINKBTC holding local support as the 200 DMA and DEMA approach – historically being pivot points.

Points to consider,

- Trend bullish – Consecutive higher lows

- Local support holding

- Resistant to break for continuation

- RSI in lower regions (Flat)

- Stochastics in lower regions (Flat)

- Volume below average

LINK’s trend has been bullish with consecutive higher lows being established with impulsive bull moves. Current local support is being held with the 200 DMA and DEMA approaching, historically being pivot points. A break of these technical indicators will break the higher low projection for LINK.

A break and close above resistance will continue the bullish bias, LINK will then likely take out highs and enter a blue sky breakout.

The RSI is in lower regions, has been trading flat and will remain flat until a decisive move. Stochastics is also flat in the lower regions, can stay trading here for an extended period of time with lots of stored momentum to the upside.

The volume nodes are well below average, sign that a decisive move is imminent from current technical trade location.

Overall, in my opinion, LINKBTC is holding a key support; the 200 DMA and DEMA are approaching and historically have been pivot points leading into impulsive bull moves. A close below however will greatly increase LINK’s probability of testing structural support which is in confluence with the 1.414 Fibonacci Extension.

What are your thoughts?

Please leave a like and comment,

And remember,

“The expectation that you bring with you in trading is often the greatest obstacle you will encounter.”

― Yvan Byeajee

BHP Key 200 WMA| Oversold RSI| Volume Climax Evening Traders,

Today’s analysis will focus on BHP, sellers are in complete control after breaking key technical levels. It has been rejected at a technical point that will dictate the overall trend in the coming weeks and months.

Points to consider,

- Strong bear break

- 200 WMA – Current resistance

- Local support respected - .618 Fibonacci in confluence

- RSI coming of oversold

- Stochastics in lower regions

- Volume climax evident

The trend is bearish for BHP, breaking key technical levels in the recent sell off. The 200 WMA is a vital level for the overall trend, current acting as resistance.

Local support is in confluence with the .618 Fibonacci, breaking this level will target the 2.618 Fibonacci Extension.

The RSI is currently extremely oversold; this is considered to be an oversold bounce if it recovers to neutral territory. Stochastics is in lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside.

Volume climax is evident; this suggests that the temporary bottom may be in. If BHP puts in a lower high, it will increase the chances taking local support out.

Overall, in my opinion, BHP has a clear level, 200 WMA, a break will increase the bullish bias as the .618 will hold true. A rejection will increase the bearish outlook, thus the first target being the 2.618 Fibonacci Extension.

What are your thoughts?

Please leave a like and comment,

And remember,

“Trading mastery is a state of complete acceptance of probability, not a state of fight it.”

― Yvan Byeajee

BNBUSDT Bear Flag| Low Volume| Structural Resistance Evening Traders,

Today’s Analysis will focus on BNBUSDT, forming a bear flag under structural resistance, a confirmation will likely test structural support.

Points to consider,

- Trend Bearish

- Structural resistance being tested

- Structural support likely target

- RSI lower high projection

- Stochastics in upper regions

- Volume below average

BNB’s trend has been putting in consecutive lower highs, currently forming a bearish continuation pattern at a key trade location. Structural resistance is in confluence with the 21 EMA and the 1.414 Fibonacci Extension, BNB is likely to get rejected.

The RSI is in a lower high projection, currently trading at a neutral level. The stochastics on the other hand is in the upper regions, can stay trading here for an extended period of time, however lots of stored momentum to the downside.

Volume is declining, an impulse move is imminent at this key technical level, if bear volume arises, this will be in conjunction with the confirmation of the bear flag.

Overall, in my opinion, BNB is trading at a very key level, resistance is very strong and there is a valid bear flag. BNB has a high probability of breaking down bearish, continuing the overall bear trend.

What are your thoughts?

Please leave a like and comment,

And remember,

“In trading, everything works sometimes and nothing works always.”

UBER Oversold Bounce| Structural Resistance| .50 Fibonacci Evening Traders,

Today’s Technical Analysis will focus on UBER, with an insane oversold bounce, over 100% gain, currently testing a key resistance that will dictate the overall macro trend.

Points to consider,

- Oversold bounce still in fruition

- Structural resistance in confluence

- Stochastics projected up

- RSI hitting resistance

- Noticeable bull volume nodes

- Daily lower high likely

UBER is currently in an oversold bounce, testing a key structural resistance that is in confluence with the .50 Fibonacci level.

The stochastics is projected up, still has more stored momentum to the upside whilst the RSI is testing its resistance. It is likely to break in conjunction with the upside momentum of the stochastics.

There are noticeable bull volume nodes, driving the oversold bounce, this must sustain if structural resistance is to be broken.

Overall, in my opinion, UBER is testing a critical level on the macro timeframe. A rejection will be in favour of the bears, putting in lower high. A break and consolidation however, will increase the likelihood of testing upper level, thus changing the macro structure.

What are your thoughts?

Please leave a like and comment,

And remember,

“In order to succeed, you first have to be willing to experience failure.”

― Yvan Byeajee

Silver Weekly Resistance| Oversold bounce|Macro Structure Evening Traders!,

Today’s update will be on Silver, which has breached an important weekly support, now potential resistance upon a retest.

Points to consider,

- Trend bearish (lower highs)

- Back test of Support likely

- RSI in oversold conditions

- Stochastics in lower regions

- Volume climax evident

- VPVR currently flat

Silvers overall trend has been putting in consecutive lower highs, it broke a major high timeframe support with a gap open. Back test of this support will confirm a bearish retest, which will be extremely bearish.

The RSI is in oversold conditions, leading silver to a probable oversold bounce into weekly resistance. Stochastics is in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the

upside.

Volume climax is evident, with above average nodes, sign that a temporary bottom may be in. The VPVR is currently flat, this is within the open gap region where silver is likely to fill for a retest.

Overall, in my opinion, Silvers oversold bounce is probable for a retest of weekly resistance; a rejection will be very bearish for the overall macro structure.

What are your thoughts?

Please leave a like and comment,

And remember,

Timing, perseverance, and ten years of trying will eventually make you look like an overnight success. – Biz Stone

ETHUSD Range Median| Local Trend| $100 Psychological LevelEvening Traders,

Today’s Technical analysis will focus on distinctive levels on ETHUSD, currently holding its local trend line, a break will likely send it to lower support ($100 psychological level).

Points to consider,

- Trend bearish

- Local trend being tested

- Confirmed bearish retest

- RSI testing support

- Stochastics in lower high projection

- Clear decline in volume

ETHUSD’s immediate trend has been bearish with consecutive lower highs in projection; a break down will establish yet another lower high.

The local trend line is being tested; this is at range median between structural resistance and $100 Psychological support. A re-test of the psychological support will increase if this trend line does not hold.

ETHUSD has had a confirmed bearish retest with a wick, this signals strong sell pressure coming in. The RSI is currently testing support; a break of this level will be in synch with a break of the local trend line.

The Stochastics is currently trading in a lower high projection, still with stored momentum to the downside. ETHUSD also has clear declining volume; this signals an influx being probable, especially when testing key pivot levels.

Overall, in my opinion, if the local trend line breaks, ETHUSD is likely to re-test the $100 psychological level, if buy pressure fails to come in, then this gives us a short opportunity.

What are your thoughts?

Please leave a like and comment,

And remember,

“Amateurs think about how much money they can make. Professionals think about how much money they could lose.” – Jack Schwager

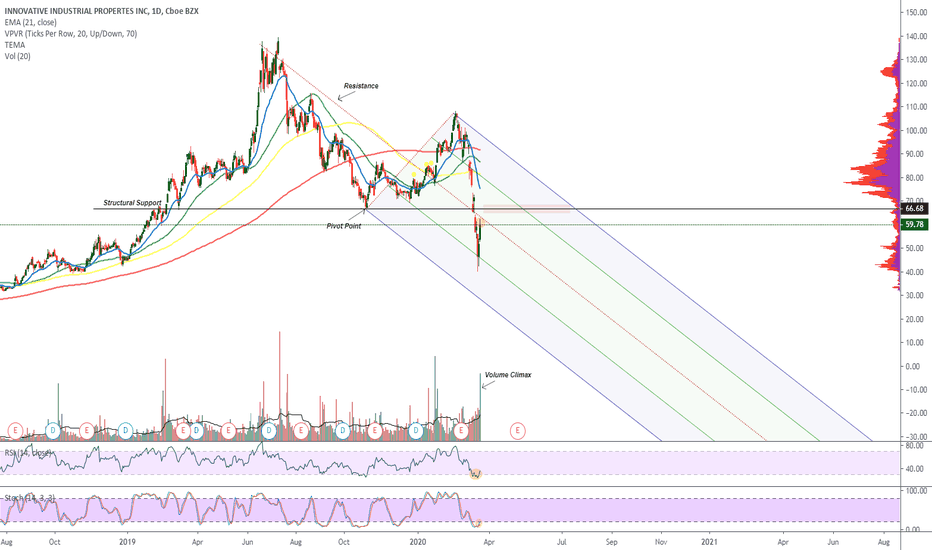

IIPR Pivot Points |Oversold Bounce| Structural Support Evening Traders,

Today’s analysis will be on IIPR, breaching structural support and currently is testing pitchforks median line (resistance)

Points to consider,

- Bearish trend, consecutive lower highs

- Median line tested

- Structural support breached

- RSI recovering from oversold

- Stochastics in lower regions

- Volume climax evident

IIPR’s overall trend is bearish, putting in consecutive lower highs on the macro timeframe. Current resistance is being tested (Median line), it is important to break this level in order to test previous support.

The Structural support breached is a major level to close above; a retest and failure will confirm a bearish retest.

RSI is recovering from oversold conditions, this has lead price to an oversold bounce. Stochastics on the other hand is trading in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside.

Volume climax is evident, which puts emphasis on a temporary bottom, this will get taken out if a bearish retest is confirmed.

Overall, in my opinion, IIPR must break and close above structural resistance, failure will be very bearish.

What are your thoughts?

Please leave a like and comment,

And remember,

“You have power over how you'll respond to uncertainty.”

― Yvan Byeajee

I'm Starting to See a Patern Here (DOW JONES DROP INCOMING)The Dow has tested the blue resistance line (around 19,000-19,200) about 7 times throughout the last week. The Stoch RSI is also showing it is not oversold yet. In addition, you can see the pattern of a big drop, a small gain, a big drop, a small gain, and so on. We just had the small gain and I think another big drop is coming on Monday. However, if it decides that after 7 times of hitting a resistance to rebound off of it, this could be the bottom of the recession (I think this is highly unlikely and has a 5% chance of actually happening).

GUESS Key Level Broken| Bearish Retest| Volume Climax Evening Traders,

Today’s technical analysis will be on GUESS, breaking major structural support and confirming a bearish retest,

Points to consider,

- Bear Trend (consecutive lower highs)

- Structural support breached

- Confirmed S/R Flip

- RSI oversold

- Stochastics in lower regions

- Volume climax evident

GUESS has been in an established bear trend with consecutive lower highs, a new local low has been confirmed with its recent wick down.

Weekly structural support has been breached; this is a high timeframe support, broken with convincing volume with a confirmed bearish retest. Bulls were not able to break above the now resistance – confirming the S/R flip.

RSI is currently oversold; a reversion back to neutral territory is highly probable. The stochastics on the other hand is in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the

upside.

Volume climax is evident, signalling a temporary bottom is in; however this is likely to change due to the confirmed S/R flip.

Overall, in my opinion, Guess is likely to test lower lows upon breaking key structural support. This is also combined with the greater economic situation; the retail sector is largely hit.

What are your thoughts?

Please leave a like and comment,

And remember,

“Don't blindly follow someone, follow market and try to hear what it is telling you.” ― Jaymin Shah

AUSUSD 1998 Lows| Volume Climax| Technical Level Evening Traders,

Today’s analysis will be on the Australian dollar, taking a hit after breaking local support. Currently it’s trading at a pivot point that needs to be defended by the bulls.

Points to consider,

- Consecutive lower highs

- Local support breached

- 1998 Lows tested

- Volume climax evident

- RSI oversold

- Stochastics in lower region

The Australian dollar has been putting in consecutive lower highs, a clear defined down trend on the monthly time frame.

Local support was breached earlier this year, posting a 17% loss; it has officially tested its 1998 lows. This area is a strong trade location, pivot point, where a bounce was expected.

The RSI is officially oversold; a return to neutral territory is imminent. Stochastics on the other hand is trading in the lower regions, can maintain here for an extended period of time, however lots of stored momentum to the upside.

There is evident volume climax, signally seller exhaustion, allowing bulls to defend promptly.

Overall, in my opinion, a relief rally is probable from such oversold conditions, this really all depends on the current macro situation.

What are your thoughts?

Please leave a like and comment,

And remember,

“Opportunities come infrequently. When it rains gold put out a bucket not a thimble.” – Warren Buffet