LLKKFJumped back in lake after some good success with this 1 last month. I think we finally get the move back up to .45c then eventually .65c. The triangle I drew is subjective so can't be sure of the accuracy. Also the fact that after breaking from the triangle top Trend line lake just sells off back into the triangle. So be c careful here if you follow my idea because I read this a few ways.

1. Lake is way oversold and the trend is ready to bounce.

2. They have some catalysts ahead this month I believe they will report the lithium mining extraction results soon (DYOR)

3. This level has been proved as strong support thus far.

4. If a breakdown happens and Lake starts to head below .21c I will exit because those lower EMAs will likely be tested in this scenario.

5. Low volume so we need buyers to move this stock so the news about their extraction will likely be the catalyst.

GL guys.

Stockanalysis

Buy $CIG - NRPicks 07 MarCia Energetica Minas Gerais-Cemig, through its subsidiaries, participates in the generation, transmission, distribution and sale of energy in Brazil. As of December 31, 2019, the company operated 80 hydroelectric, thermoelectric and wind and solar plants with an installed capacity of 6,000 MW; 4,134 km transmission lines; and 335,421 km of distribution lines.

Risk rating agency Standard & Poor's (S&P) has raised its corporate ratings for Cemig, said the increase in ratings reflects our view that Cemig has kept its credit and liquidity metrics strong amid the pandemic. The company is close to filing its earnings report on March 31.

-Value

-P/S 0.79

-P/E 8.9

-P/B 1.04

-ROE 12.30%

Technical:

-Low levels of RSI - Oversold

-Price below MA50,MA100 andMA200

-Support at $2.04

Apple Stock - Head and Shoulders formation as Investors WaryHi,

AAPL daily chart has completed the formation of Head and Shoulders pattern and it is now breached. If the price goes up in the next few days and pull back on the line, it will confirm the drop. I am in the position of selling some of the portion until the next confirmation.

The drop should be contributed by the the plan of the technology titan to produce electric cars. It is seen as a big innovation as well as big investment to the company due to its reputation as having a penchant on being a disruptive company.

The production was started as a rumor. However, as the news on the company is in discussion with several suppliers to procure the lidar technology emerged, we can assume that the rumor might become reality. For information, Lidar Technology is used in self-driving vehicles.

Happy Trading!

$AITXArtificial Intelligence Technology Solutions Inc. focuses on the delivery of artificial intelligence and robotic solutions for operational, security, and monitoring needs. The company was formerly known as On The Move Systems Corp. and changed its name to Artificial Intelligence Technology Solutions Inc. in August 2018. Artificial Intelligence Technology Solutions Inc. was founded in 2016 is based in Reno, Nevada.

$50 MILLION REGISTERED DIRECT OFFERING case study$VISL ANNOUNCES $50 MILLION REGISTERED DIRECT OFFERING PRICED AT-THE-MARKET UNDER NASDAQ RULES

$VISL today announced that it has entered into a definitive agreement with institutional investors for the purchase and sale of 18,181,820 shares of its common stock and common stock warrants to purchase up to 9,090,910 shares of common stock at a combined purchase price of $2.75 per share in a registered direct offering.

The common stock warrants will be immediately exercisable, have an exercise price of $3.25 per share and will expire five years from the date of issuance.

The closing of the offering is expected to occur on or about February 8, 2021, subject to the satisfaction of customary closing conditions.

finance.yahoo.com

ANNOUNCES CLOSING OF $50 MILLION REGISTERED DIRECT OFFERING PRICED AT-THE-MARKET UNDER NASDAQ RULES

finance.yahoo.com

What we can learn from the registered direct offerings?

PLTR Abandoned Baby SetupA classic textbook example of Abandoned Baby setup could be seen in PLTR.

Technical Analysis:

- Price is currently on a support area

- A candle has pierced through the lower bollinger band with a bullish confirmation candle on the following day

- Stochastic entered the oversold zone have started to reverse

- Strong sign of momentum via relative strength

Generally the Technology sector and Software industry are on a strong uptrend. I do believe the market psychology will bring a positive effect on this stock too.

I personally like this Abandoned Baby setup a lot due to the significant buying volume on both the "baby" candle and the confirmation candle.

However, do take note that the price action had failed to form a higher high & higher low.

Also the stock market is currently on a retracement, which might affect the setup.

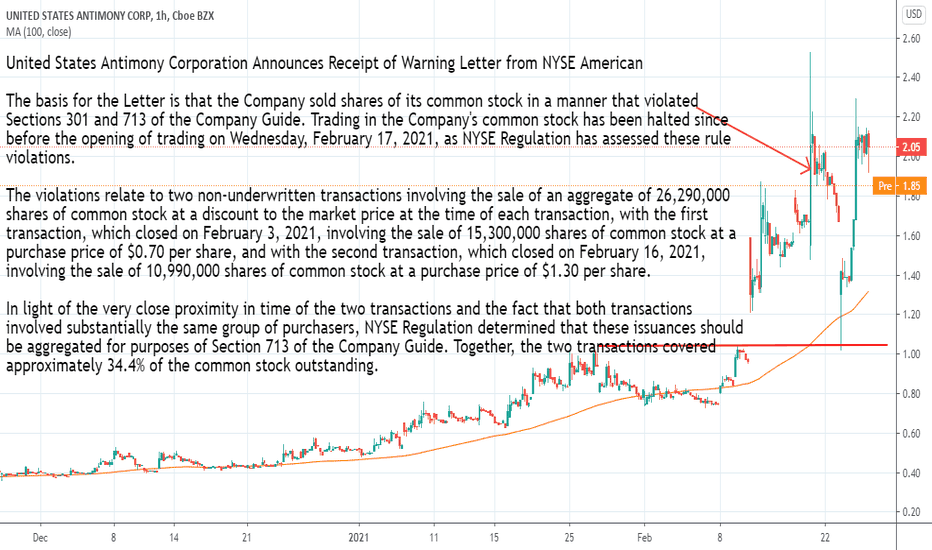

$UAMY Announces Receipt of Warning Letter from NYSE AmericanUnited States Antimony Corporation Announces Receipt of Warning Letter from NYSE American

The basis for the Letter is that the Company sold shares of its common stock in a manner that violated Sections 301 and 713 of the Company Guide. Trading in the Company's common stock has been halted since before the opening of trading on Wednesday, February 17, 2021, as NYSE Regulation has assessed these rule violations.

The violations relate to two non-underwritten transactions involving the sale of an aggregate of 26,290,000 shares of common stock at a discount to the market price at the time of each transaction, with the first transaction, which closed on February 3, 2021, involving the sale of 15,300,000 shares of common stock at a purchase price of $0.70 per share, and with the second transaction, which closed on February 16, 2021, involving the sale of 10,990,000 shares of common stock at a purchase price of $1.30 per share.

In light of the very close proximity in time of the two transactions and the fact that both transactions involved substantially the same group of purchasers, NYSE Regulation determined that these issuances should be aggregated for purposes of Section 713 of the Company Guide. Together, the two transactions covered approximately 34.4% of the common stock outstanding.

Section 301 of the Company Guide states that a listed company is not permitted to issue, or to authorize its transfer agent or registrar to issue or register, additional securities of a listed class until it has filed an application for the listing of such additional securities and received notification from the NYSE American that the securities have been approved for listing.

Section 713 of the Company Guide requires shareholder approval when additional shares to be issued in connection with a transaction involve the sale, issuance, or potential issuance of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding stock for less than the greater of book or market value of the stock.

As stated in the Letter, the Company failed to submit a completed listing application in advance of the February 16, 2021 transaction to obtain advance approval as required by Section 301 of the Company Guide and also did not obtain shareholder approval for the aggregate issuance of 26,290,000 shares that exceeded 20% of the common stock of the Company outstanding as required by Section 713 of the Company Guide. NYSE Regulation noted in the Letter that, after it became aware that the Company had entered into a purchase agreement in relation to the second transaction, NYSE Regulation informed representatives of the Company that it would be a violation of the applicable NYSE American rules for the Company to close the second transaction without first obtaining shareholder approval . Notwithstanding this clear guidance from NYSE Regulation, the Company went ahead with closing the transaction without notifying the Exchange.

The Company has been advised by NYSE Regulation that the Company's common stock will resume trading on the NYSE American following the issuance of this press release and the filing of a Current Report on Form 8-K disclosing the receipt of the Letter, which the Company anticipates will be prior to the open of trading on Friday, February 19, 2021.

finance.yahoo.com

$PRHL Buy the breakoutIt has tested resistance a few times not and is going to explode.

Golden cross on the daily!

Take profit marked out if interests you. Could go much higher as well.

Why $CTIB stock soared yesterday?investors also need to note that there has been no news regarding Yunhong this morning that could have triggered such a move.

It appears that the Yunhong stock is a target of users across social media platforms like StockTwits, Reddit, Facebook, and Twitter. Investors are buying up the stock in order to force short sellers to cover their positions and when that happens, the stock price usually rises further. Hence, it might be a good idea for investors to keep an eye on the Yunhong stock this morning.

ownsnap.com

KeyBanc Capital analyst Philip Gibbs raised rating- $10 target $TMST surged higher on very heavy volume, after KeyBanc Capital analyst Philip Gibbs said it's time to buy the steel maker's stock as the macro recovery is unfolding.

Gibbs raised his rating to overweight, after being at sector weight since July 2018, and set a $10 target for the stock, which is 19.8% above current levels. Gibbs said his new bullish view "post due diligence" reflects the macroeconomic recovery, better contract and spot pricing and widening raw material spreads, as well as "self-help," which includes cost cuts. The latest available data showed that short interest was 9.72% of the public float.

$RETO Stock surged on Two RumorsWhile the stock is running for the top, there has been nothing by way of press releases or SEC filings. So, what’s the deal?

- ReTo Eco-Solutions May Be an Olympic Provider. According to various social media posts, investors are awaiting an announcement surrounding involvement in the Olympic Games in Beijing. The rumor suggests that the company’s work with the 2022 Olympics in Beijing will be expanded, exciting investors.

- Merger With Apple Rumor. There’s another rumor hitting the tape too, and this one’s the big one. According to various social media posts, investors are awaiting the announcement of a merger. According to these rumors Apple is interested in merging with RETO.

- The Short Squeeze. the heavy short interest on the stock, combined with the ultra-tiny public float of under 15 million shares could lead to supply and demand related jumps in value. Ultimately, as the shorts race to cover their positions, demand for shares rockets, but with only under 15 million shares available to the public, the demand increase for RETO shares could lead to tremendous gains.

cnafinance.com

$NCTY Purchased Filecoin Mining Machines for US$10 millionThe9 Signed a US$10 million Framework Agreement on the Purchase of Filecoin (FIL) Mining Machines.

The9 had already purchased and deployed Filecoin mining machines, and Filecoin mining has been started. Currently The9 owns an independent node on Filecoin blockchain and 8 Pebibyte of effective storage mining power in the Filecoin network.

The9 will continue to purchase Filecoin mining machines under the Framework Agreement based on the trend of Filecoin price and Filecoin's economic incentive model.

finance.yahoo.com

$CTXR Announces Closing of $76.5M Registered Direct OfferingCitius Pharmaceuticals Announces $76.5 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules.

today announced that it has entered into definitive agreements with certain healthcare-focused and institutional investors for the purchase of an aggregate of 50,830,566 shares of its common stock and accompanying warrants to purchase up to an aggregate of 25,415,283 shares of its common stock, at a purchase price of $1.505 per share and accompanying warrant in a registered direct offering priced at-the-market under Nasdaq rules.

The warrants have an exercise price of $1.70 per share, will be immediately exercisable, and will expire five years from the issue date.

finance.yahoo.com

Citius Pharmaceuticals Announces Closing of $76.5 Million Registered Direct Offering Priced At-the-Market under Nasdaq Rules

finance.yahoo.com

Shares of $VIOT surges due to hype in social mediaShares of $VIOT SURGES higher due to the uptick in discussions about this stock has been surging on social media platforms like Reddit, Twitter, StockTwits, Facebook, and Discord. In a StockTwits post, Insider-Analysis.com pointed out that 7 institutions increased their positions in the stock while 3 decreased as of this past quarter.

There is also a bullish report published about the company at Xueqiu.com. After translating the article to English, I read that Xueqiu believes that VIOT is expected to grow 10x this year due to its leadership position in appliances and Internet of Things devices.

VIOT was also listed on a number of day trading watch lists on Reddit. And VIOT was listed in the “Daily Movers” on the Robinhood trading platform — which also added to the momentum of this shares.

pulse2.com

Boeing-Backed Aerion Is in Talks for $ALTU SPAC ListingBoeing-Backed Aerion Is in Talks for Altitude SPAC Listing

The companies are discussing a deal that would value the combined firm at up to $3 billion, said the people, who asked to not be identified because the matter isn’t public. A deal could be announced as soon as this month, the people said.

The talks could still fall apart and end without an agreement, they said.

Aviation giant Boeing Co. announced a partnership with Aerion in 2019, along with a significant investment in the company, according to a statement at the time. Aerion had planned to finalize the design of its first supersonic business jet model last year, according to its website. Manufacture of the AS2 will start in 2023 with plans for it to be in service in 2027.

www.bloomberg.com

Why $DNK stock price surged heavily in november?Why DNK stock price surged heavily in november?

What triggered the stock price surge is a report by Chinese media outlet Thepaper.cn saying that 5I5J Holding Group (owner of Danke’s rival Xiangyu) is in takeover to buy Danke.

There have been reports that Danke was pursuing bankruptcy, but the company denied those reports on its Weibo account earlier then, according to South China Morning Post. One of the reasons why there is speculation about Danke filing for bankruptcy is due to upfront payments being collected from Danke tenants, but there was a failure to pay the landlords. This is why tenants and landlords protested at Danke offices later.

pulse2.com

Why $BRN skyrocketed in January?Barnwell Industries Reaches Agreement With MRMP Stockholders to End Potential Proxy Contest

$BRN is pleased to announce today that it has entered into a cooperation and support agreement with MRMP Stockholders, with respect to the potential proxy contest pertaining to the election of directors to our Board of Directors (the “Board”).

the Company will nominate its current slate of directors, which includes three of the MRMP nominees and two new independent directors elected in 2020, to stand for reelection to the Board at the upcoming 2021 annual meeting of stockholders.

The MRMP Stockholders have agreed to vote their shares of common stock of the Company in favor of the election of the designated slate, and the MRMP Stockholders have agreed to withdraw their proposed slate of directors.

I’m gratified that the Board of Directors will be unchanged from last year and be able to continue its efforts to move the Company forward.

The agreement that we have forged with the Company should avoid distraction and unnecessary expense allowing our Board to continue to position Barnwell for long term positive cash generation and further share price appreciation.”

finance.yahoo.com

$PHCF low float chinese stockSince the company has not announced any news directly and there are no SEC reports to trigger a stock price increase, it appears there was a coordinated move on social media to drive the price up.

I am seeing references to $PHCF in Twitter hashtags, Many of these posts mentioned the advantages of the high volume and relatively low float chinese stock.

BlackSky to List on NYSE via Merger $SFTWBlackSky, a Leading Real-Time Geospatial Intelligence, Imagery and Data Analytics Company, to List on NYSE Through a Merger With Osprey Technology Acquisition Corp.

The business combination agreement is expected to provide approximately $450 million of net proceeds to the combined company, assuming no redemptions, to fund expected future growth, including a fully committed $180 million common stock PIPE with participation from leading institutional investors including Tiger Global Management, Mithril Capital (co-founded by Ajay Royan and Peter Thiel), Hedosophia, and Senator Investment Group. Additionally, Osprey’s sponsor and its affiliates are investing over $20 million in the PIPE.

Pro forma equity value of the merger is expected to be nearly $1.5 billion at the $10.00 per share PIPE price.

BlackSky has established contracts with multiple government agencies in the United States and around the world. BlackSky’s pipeline of opportunities grew by $1.1 billion in the last twelve months and stands at $1.7 billion today.

The transaction is expected to close in July 2021.

finance.yahoo.com

Why $ELYS Game Technology soared in 2021Why Elys Game Technology soared in 2021

On november 25. Company Announced Appointment of Senior Gaming Industry Executive Matteo Monteverdi to CEO.

Matteo has been leading world-class B2B and B2C teams in the technology and digital industry for over 20 years between Silicon Valley and Boston. He spent the last decade of his career at the intersection of social gaming, digital betting, i-gaming and media working for international organizations in high growth segments.

finance.yahoo.com

Elys Game Technology Revenue Increases 44% to $9.7 Million for the Third Quarter of 2020

finance.yahoo.com

$TUSK awarded a contract of $40 million in revenue Mammoth Energy Announces Growth of Engineering Services Company

$TUSK today announced that its wholly owned subsidiary, Aquawolf, LLC (“Aquawolf”), has been awarded a contract by a major utility to provide engineering and design services. The three-year contract is expected to generate up to approximately $40 million in revenue over the contract term.

finance.yahoo.com