Take Two | TTWO & GTA VI. Part IITakeTwo Interactive is preparing for the biggest catalyst in the company's history with the release of GTA 6. Although no definitive timetable has been set for GTA 6, the game will almost certainly release in 2024 or 2025 at the latest given all the information that has come out. Moreover, TTWO itself has started opening up about GTA 6, which is a hint that an announcement is near. The impact that GTA 6 will have on TTWO cannot be understated, given how much resources have been spent developing GTA 6 and the growing consumer frenzy surrounding the title.TTWO could see more upward momentum as GTA 6's release closes in.

GTA 6 is by far the most anticipated video game in the industry's history. The game is so hyped, in fact, that individuals have crashed televised events purely to protest for the release of GTA 6. Even Starfield, which is an incredibly hyped game in its own right, had it Gamescon presentation disrupted by a fan calling for GTA 6. GTA 6 has not even been announced yet, and it seems to have fully captured the attention of the gaming world.

This level of organic hype is an incredibly positive sign for TTWO and its investors. Despite the fact that GTA 5 had nowhere near the hype as GTA 6 at similar stages in their development, GTA 5 still managed to become the best-selling triple A game ever made, with ~185 million units sold. This is a testament to GTA 6's potential, both on a commercial and even cultural standpoint.

If GTA 6 manages to meet or exceed consumer expectations, TTWO should see its shares surge. Given the hysteria surrounding the title, positive reviews will only supercharge demand as consumers will likely find any reason to get their hands on the game. Considering the amount of resources TTWO is rumored to be spending on developing GTA 6, coupled with Rockstar's track record of producing masterpieces, there is very little chance that GTA 6 disappoints.

While GTA is TTWO's most important IP, the company also boasts a strong lineup beyond GTA. In fact, some of its other franchises are bestsellers in their own right. Red Dead Redemption, for instance, has sold more than 55 million units and continues to sell at a solid pace despite the game being nearly 5 years old. Red Dead Redemption has also been critically praised as one of the best triple A games ever made.

TTWO currently has one of its most robust product pipelines in the history of the company across all of its studios. The company has even diversified into mobile gaming, which is proving to be an increasingly large segment in the gaming industry. In fact, TTWO made a huge acquisition in Zynga for a whopping $12.7 billion. Zynga is one of the largest mobile gaming studios in the world and owns massively popular IPs like FarmVille.

Despite TTWO's growing pipeline, the company is still relatively top-heavy compared to peers like EA (EA) or Activision Blizzard (ATVI). This means that underperformance for its flagship franchises, especially GTA, will almost certainly cause the company's value to plummet. So much of TTWO's future prospects are dependent upon the success of GTA 6, especially considering how much revenue the game is expected to pull in.

To gain some perspective on how important the GTA franchise is for TTWO, GTA has generated over $8 billion in revenue since GTA 5's release in 2013. TTWO itself is only worth ~$23 billion. GTA online, for instance, still contributes heavily to the company's recurring revenue and bookings, which came in at $1.2 billion in its most recent quarter.

TTWO has a huge opportunity with GTA 6. The game has garnered unprecedented hype that is starting to grow to a fever pitch. If TTWO delivers a solid sequel, GTA 6 could potentially deliver revenues upwards of ~$20 billion over the next decade, given the revenue trajectory of GTA sequels. At TTWO's current valuation of $23 billion, the company has far more upside, given the potential of GTA 6 and the company's growing pipeline of popular titles.

Stockanalysis

Microsoft (MSFT) Share Price Jumps Nearly 9% – What’s Next?Microsoft (MSFT) Share Price Jumps Nearly 9% – What’s Next?

As the chart shows, Microsoft (MSFT) shares surged sharply, forming a large bullish gap: while trading closed around $391 on 30 April, yesterday’s candlestick closed just below the $425 mark.

What Drove the Rally in Microsoft Shares?

Microsoft released its financial results for the first quarter of 2025, exceeding Wall Street expectations on both revenue (actual = $70.1 billion, 2.4% above forecasts) and earnings per share (actual = $3.46, 7.4% above forecasts).

Particular attention was drawn to the strong performance of Azure – revenue from Azure and other cloud services soared by 33% year-on-year. A significant part of this growth was fuelled by robust demand for artificial intelligence services, which helps ease concerns about the return on large-scale infrastructure investments related to AI.

In addition, Microsoft issued an upbeat outlook for the next quarter, which ultimately triggered the sharp rise in its share price.

Technical Analysis of MSFT Chart

Yesterday’s candlestick closed near its low (highlighted by the arrow), indicating that bears were active during the trading session. From a technical analysis perspective, this can be explained by the proximity of the price to two key resistance lines:

1 → The upper boundary of a descending channel drawn from significant price action patterns (marked in red). The relevance of this channel is confirmed by the price’s behaviour near its median line (dashed).

2 → A former trendline that served as support throughout 2024.

Therefore, a short-term correction cannot be ruled out following the sharp rally in MSFT shares, potentially tempering some of the enthusiasm generated by Microsoft’s strong quarterly report.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Fall Down to $70 ApproachingWith the RSI above average since mid-April 2025, the trend has been steadily rising up to $82 per share even breaking the highs from late February and March.

Price projected onto both (A and B) Inside pitchforks is well above the median line. In the pitchfork A the price is even directly touching the upper parallel line.

Reversal near the highest achieved price this year on 21st February is probable

Based on these indications, we can expect a fall to around $70 somewhere in the middle of May.

Key details:

RSI over "overbought" level

Price in both Inside pitchforks near the upper parallel line

Longer uptrend = breakdown necessary

Invest in STRL: Ride the Coming US Digital Infrastructure Surge◉ Abstract

Sterling Infrastructure (NASDAQ: STRL) is a top pick to benefit from America's digital infrastructure boom, with the sector expected to grow 26% annually through 2034. The company specializes in data centers, 5G networks, and smart city projects, supported by a $1 billion backlog and improving profit margins. While risks like regional market shifts and housing demand exist, STRL's fundamentals are strong—revenue grew 7% in 2024, debt is manageable, and its P/E ratio (17.9x) looks cheap compared to peers (70.5x).

Technically, the stock shows bullish patterns after pulling back 35% from highs. With government infrastructure spending rising and strategic acquisitions likely, STRL could deliver 35-40% returns in the next 12-14 months. A good option for long term investing!

Read full analysis here...

◉ Introduction

The U.S. digital infrastructure market, valued at approximately USD 140 billion in 2024, is expanding rapidly, with a projected CAGR of 26.4% through 2034. This growth is driven by factors like the expansion of 5G networks, increased demand for data centers, rising cloud services adoption, AI automation, and investments in smart cities and edge computing. The 5G infrastructure segment alone is expected to grow at a CAGR of 20.2%, reaching USD 17.26 billion by 2030. North America holds a 42.8% share of the global market.

◉ Key Trends and Opportunities

1. Data Centers: Demand continues to rise, driven by cloud computing, AI, and data-intensive applications. Power availability and location are becoming critical, with providers moving to secondary markets to secure reliable energy sources.

2. Fiber Networks: Expansion is underway to support new data centers and remote connectivity needs. Middle-mile and long-haul fiber, as well as fiber-to-the-home (FTTH), are key areas of investment and consolidation.

3. 5G and Wireless: Ongoing rollout of 5G networks is fueling growth in hardware and network densification, with increased activity expected in wireless infrastructure and tower markets.

4. Edge Computing and Smart Cities: The proliferation of IoT devices and smart city initiatives is driving demand for edge data centers and low-latency networks.

5. Mergers and Acquisitions: The market is seeing consolidation, especially in fiber and data center segments, as major players acquire smaller firms to expand their footprint and capabilities.

Today, we’ll focus on Sterling Infrastructure (STRL), a key player navigating the U.S. infrastructure market.

This report provides a detailed look at STRL's technical and fundamental performance.

◉ Company Overview

Sterling Infrastructure Inc. NASDAQ:STRL is a U.S.-based company specializing in e-infrastructure, transportation, and building solutions. It operates through three key segments: E-Infrastructure Solutions, which focuses on site development for data centers, e-commerce warehouses, and industrial facilities; Transportation Solutions, handling infrastructure projects such as highways, bridges, airports, and rail systems for government agencies; and Building Solutions, providing concrete foundations and construction services for residential and commercial projects. Originally founded in 1955 as Sterling Construction Company, the firm rebranded to its current name in June 2022. Headquartered in The Woodlands, Texas, the company serves a wide range of sectors, including logistics, manufacturing, and public infrastructure.

◉ Investment Advice

💡 Buy Sterling Infrastructure NASDAQ:STRL

● Buy Range - 148 - 150

● Sell Target - 200 - 205

● Potential Return - 35% - 40%

● Approx Holding Period - 12-14 months

◉ SWOT Analysis

● Strengths

1. Strong E-Infrastructure Backlog – With over $1 billion in backlog, Sterling has a robust pipeline of future projects, ensuring sustained revenue growth.

2. Higher-Margin Services Shift – The company’s strategic focus on higher-margin work (21% gross profit margin in Q4) improves profitability without relying solely on volume.

3. E-Infrastructure Growth Potential – Expected 10%+ revenue growth and 25%+ operating profit growth in 2025 position Sterling for strong earnings expansion.

4. Strategic M&A Opportunities – Strong liquidity allows for accretive acquisitions, enhancing market share and service offerings.

5. Share Repurchase Program – Active buybacks reduce outstanding shares, potentially boosting EPS and shareholder value.

● Weaknesses

1. Texas Market Transition Risks – Moving away from low-bid work in Texas may slow revenue growth in the Transportation segment if not managed well.

2. Revenue Loss from RHB Deconsolidation – Excluding $236 million in RHB revenue could distort growth metrics and reduce reported earnings.

3. Residential Market Pressures – A 14% decline in residential slab revenue (due to DFW affordability issues) could persist if housing demand weakens further.

4. Geographic Expansion Challenges – High costs and logistical hurdles in expanding data center projects outside core regions may limit growth opportunities.

5. Competitive Bidding & Acquisition Risks – Difficulty in securing profitable acquisitions or winning competitive bids could hinder margin and revenue growth.

● Opportunities

1. Data Center & E-Commerce Boom – Rising demand for data centers and distribution facilities presents long-term growth potential for E-Infrastructure.

2. Government Infrastructure Spending – Federal and state investments in highways, bridges, and airports could boost Transportation Solutions revenue.

3. Strategic Acquisitions – Pursuing complementary M&A deals could expand capabilities and market reach.

4. Diversification into New Regions – Expanding into underserved markets could reduce dependency on Texas and mitigate regional risks.

5. Operational Efficiency Improvements – Further margin expansion through cost optimization and technology adoption.

● Threats

1. Economic Slowdown Impact – A recession could reduce demand for residential and commercial construction, affecting Building Solutions.

2. Rising Interest Rates – Higher borrowing costs may pressure profitability and delay large-scale projects.

3. Labor & Material Cost Inflation – Increasing wages and supply chain disruptions could squeeze margins.

4. Intense Competition – Rival firms competing for the same infrastructure projects may drive down pricing and profitability.

5. Regulatory & Permitting Delays – Government approvals and environmental regulations could slow project execution.

◉ Revenue & Profit Analysis

● Year-on-Year

➖ FY24 sales reached $2,116 million, reflecting a 7.28% increase compared to $1,972 million in FY23.

➖ EBITDA rose to $334 million, up from $264 million in FY23.

➖ EBITDA margin improved to 15.8%, up from 13.4% in the same period last year.

● Quarter-on-Quarter

➖ Q4 sales decreased to $499 million, down from $593 million in Q3, but showed a slight increase from $486 million in Q4 of the previous year.

➖ Q4 EBITDA was $80.3 million, down from $105 million in Q3.

➖ Q4 diluted EPS saw a notable rise, reaching $8.27 (LTM), up from $5.89 (LTM) in Q3 2024.

◉ Valuation

1. P/E Ratio (Price-to-Earnings)

● Current vs. Peer Average

➖ STRL’s P/E ratio is 17.9x, much lower than the peer average of 70.5x, suggesting the stock is undervalued compared to peers.

● Current vs. Industry Average

➖ Compared to the broader industry average of 22.9x, STRL again looks relatively inexpensive at 17.9x.

2. P/B Ratio (Price-to-Book)

● Current vs. Peer Average

➖ STRL’s P/B ratio stands at 5.7x, slightly higher than the peer average of 5x, indicating overvaluation.

● Current vs. Industry Average

➖ Against the industry average of 3.6x, STRL’s 5.7x P/B ratio suggests a noticeable overvaluation.

3. PEG Ratio (Price/Earnings to Growth)

➖ STRL’s PEG ratio is 0.21, which means the stock appears undervalued relative to its strong expected earnings growth.

◉ Cash Flow Analysis

➖ Sterling Infrastructure's operating cash flow grew to $497 million in FY24, up from $479 million in FY23, showing steady financial strength.

◉ Debt Analysis

➖ The company's debt-to-equity ratio is 0.38, indicating a healthy balance sheet with manageable debt levels.

◉ Top Shareholders

➖ The Vanguard Group has significantly increased its investment in this stock, now owning an impressive 8.3% stake, which marks a 30% rise since the end of the September quarter.

➖ Meanwhile, Blackrock holds a stake of around 8% in the company.

◉ Technical Aspects

➖ On the monthly chart, the stock remains in a strong uptrend.

➖ On the daily chart, an Inverted Head & Shoulders pattern has formed, signaling a potential breakout soon.

➖ The stock is currently trading at about 35% below its all-time high, making it an attractive investment opportunity.

◉ Conclusion

Sterling Infrastructure (STRL) stands out as a strong investment candidate, backed by solid financial performance, a growing E-Infrastructure backlog, and a strategic focus on higher-margin projects. Its attractive valuation, healthy cash flow, and low debt levels provide further confidence in its growth potential. While there are challenges—such as market competition, geographic expansion hurdles, and economic uncertainties—Sterling’s strengths, including a robust project pipeline, strategic acquisitions, and exposure to high-growth sectors like data centers and 5G infrastructure, offer a favorable risk-reward balance. Overall, Sterling is well-positioned to benefit from the ongoing U.S. e-infrastructure boom, making it an attractive long-term investment opportunity.

IBM Share Price Falls Following Earnings ReportIBM Share Price Falls Following Earnings Report

Yesterday, after the close of the main trading session, International Business Machines (IBM) released its Q1 earnings report, exceeding Wall Street analysts’ expectations in several key areas. According to FactSet:

→ Earnings per share came in at $1.60 (forecast = $1.42), although this was below last year’s figure of $1.68.

→ Quarterly revenue reached $14.54 billion (forecast = $14.39 billion), marking a 1% increase year-on-year.

Initially, IBM shares rose on the news, but then dropped by approximately 6% during after-hours trading, according to Google Finance.

This suggests that today’s trading session may see IBM shares open below the $230 mark.

Market participants may have been disappointed by the following:

→ IBM’s mainframe business (large-scale computing systems designed for high-volume data processing) continued its decline, falling by 6% year-on-year.

→ Revenue from software and consulting divisions increased, but only by 3% compared to the same period last year.

→ The revenue forecast for Q2 stands at $6.6 billion – a 3% decline relative to the same quarter in 2024.

Technical Analysis of IBM Share Price

The chart shows signs of seller activity above the psychological level of $250. As indicated by the arrows, the price attempted several rallies above this level with varying momentum, but each time retreated back.

At the same time, price fluctuations formed a downward channel, which was extended to the downside in early April amid news regarding new tariffs in international trade.

Price stabilisation observed between 15–17 April suggests that supply and demand were temporarily balanced ahead of the earnings release. However, the negative market reaction to the report may shift sentiment and act as a catalyst for further price movement towards the lower boundary of the channel, around the key support level of $215.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nintendo Co., Ltd. (NTDOY) – Powering Up for the Next Level Company Snapshot:

Nintendo OTC:NTDOY continues to dominate global entertainment with iconic franchises, cross-platform expansion, and the highly anticipated Switch 2 in 2025.

Key Catalysts:

Switch 2 Launch in 2025 🚀

150M+ Switch units sold → massive installed base

Backward compatibility + hardware upgrades could drive a super-cycle in hardware/software sales.

Franchise Diversification 💡

Digital Pokémon card game gaining momentum → strong in-app revenue potential

The Super Mario Bros. Movie surpassed SEED_TVCODER77_ETHBTCDATA:1B + in global box office 🍿

Expanding theme park partnerships (Universal Studios) enhance recurring brand engagement

Multi-Channel Monetization 📱🎢

Transitioning beyond consoles: movies, mobile, merchandise, and theme parks

Reinforces IP value and opens new revenue verticals

Investment Outlook:

✅ Bullish Above: $15.50–$16.00

🚀 Upside Target: $27.00–$28.00

📈 Growth Drivers: Switch 2 super-cycle, diversified IP monetization, and brand strength

🍄 Nintendo – Not just gaming, but a global entertainment powerhouse. #NTDOY #Switch2 #Nintendo

Nano Nuclear Energy – Pioneering Next-Gen Small Modular ReactorsCompany Overview:

Nano Nuclear Energy NASDAQ:NNE is revolutionizing clean, compact nuclear power with small modular reactors (SMRs), addressing data centers, remote sites, and disaster relief energy needs.

Key Catalysts:

ZEUS Microreactor Development 🚀

Successfully assembled first hardware, marking a key milestone toward commercialization & revenue generation.

Patent-Backed Innovation 🏆

Filed four new patents in February 2025 for its Annular Linear Induction Pump (ALIP).

Strengthens NNE’s edge in molten-salt & liquid-metal reactor technology.

Surging Global Electricity Demand ⚡

Aligns with the growing need for cost-effective, sustainable energy solutions.

Ideal for off-grid, military, and high-demand industrial applications.

Investment Outlook:

✅ Bullish Above: $21.50-$22.00

🚀 Upside Target: $44.00-$47.00

📈 Growth Drivers: Breakthrough SMR tech, patent leadership, and clean energy demand.

🔥 Nano Nuclear – Powering the Future, One Microreactor at a Time. #NNE #NuclearEnergy #CleanTech

Moderna (MRNA) Shares Plunge Nearly 9%Moderna (MRNA) Shares Plunge Nearly 9%

Moderna (MRNA) shares tumbled by approximately 8.9%, falling below $29—marking their lowest level since April 2020, when global markets were shaken by the COVID-19 pandemic.

Since the start of 2025, MRNA’s share price has declined by around 32%.

Why Did MRNA Shares Drop?

On Monday, MRNA led the decline among US biotech stocks following the resignation of Peter Marks, director of the FDA’s Center for Biologics Evaluation and Research. Marks had held this position for over a decade.

During Trump’s first term, Marks oversaw the rollout of COVID-19 vaccines and established guidelines for emerging treatments such as cell and gene therapy.

However, in Trump’s second term, Robert F. Kennedy Jr. now serves as Health Secretary. According to The Wall Street Journal, Marks criticised Kennedy’s stance on vaccines in his resignation letter, calling it “misinformation and lies.”

The pharmaceutical industry was already under pressure amid speculation that Trump’s tariff plans could extend to prescription drugs, which are typically exempt from such measures. Marks' departure has further intensified uncertainty regarding regulatory decisions under the new administration.

Technical Analysis of MRNA Shares

The chart indicates that:

➝ The stock remains in a downtrend that began with a sharp drop in August last year (reinforced by the moving average).

➝ Over the past five months, it has been forming a descending channel (marked in red).

➝ The lower boundary of this channel acted as support yesterday.

The formation of higher lows and highs (marked in blue) had given bulls some hope in March 2025. However, yesterday’s bearish gap appears to have shattered that optimism.

It is possible that the lower blue trendline and the median of the red channel will act as resistance moving forward, further darkening the outlook for MRNA’s share price—especially given the ongoing negative news surrounding the stock.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Comstock Resources (CRK) – Expanding U.S. Natural Gas DominanceCompany Overview:

Comstock Resources NYSE:CRK is accelerating natural gas production, reinforcing its position in the Western Haynesville play, a key U.S. gas region.

Key Catalysts:

Production Expansion & Strategic Acquisitions ⛽

Increasing drilling rigs from 5 to 7 for higher output.

Acquired 64,000 net acres in Haynesville, boosting reserves & market share.

Investment in Drilling & Midstream Infrastructure 🏗️

$1.0-$1.1 billion planned for 46 horizontal wells in 2025.

$130-$150 million allocated to midstream development, optimizing gas transport & profitability.

Market Strength & Growth Outlook 📈

Positioned to capitalize on rising U.S. natural gas demand & global LNG expansion.

Investment Outlook:

Bullish Case: We are bullish on CRK above $15.50-$16.00, supported by production growth & infrastructure investment.

Upside Potential: Our price target is $30.00-$31.00, driven by expansion, operational efficiency, and market strength.

🔥 CRK – Fueling the Future of U.S. Natural Gas. #CRK #NaturalGas #EnergyStocks

Harmony Gold Mining (HMY) – Strong Growth & Rising ProfitabilityCompany Overview:

Harmony Gold Mining NYSE:HMY continues to outperform expectations, delivering higher grades, cost efficiency, and production expansion.

Key Catalysts:

High-Quality Gold Extraction ⛏️

Underground recovered grades surged to 6.4 g/t, exceeding full-year guidance.

Reinforces HMY’s ability to extract high-quality ore.

Cost Efficiency & Rising Gold Prices 📈

All-in sustaining costs at ZAR 972,000/kg, well-managed despite inflationary pressures.

Gold’s safe-haven demand surging due to geopolitical tensions, boosting HMY’s margins.

Expansion & Future Growth 🚀

New high-grade mining site announced, set to enhance future production & revenue growth.

Investment Outlook:

Bullish Case: We remain bullish on HMY above $10.50-$11.00, supported by cost control & rising gold prices.

Upside Potential: Our price target is $17.00-$18.00, driven by high-margin production & increasing investor interest in gold.

🔥 HMY – Unlocking Gold’s Full Potential. #HMY #GoldMining #SafeHavenAsset

Boeing (BA) Share Price Rally Slows Near Key ResistanceBoeing (BA) Share Price Rally Slows Near Key Resistance

The Boeing (BA) stock chart shows that since its March low, the price has surged by approximately 25%, significantly outperforming the S&P 500 index (US SPX 500 mini on FXOpen).

This rally was driven by the news that Boeing secured a contract to develop the next generation of fighter jets for the U.S. Navy, beating its main competitor, Lockheed Martin.

According to Business Insider, this success is tied to Boeing’s development of the F-47 fighter jet under the Next Generation Air Dominance (NGAD) programme, which will bring the company contracts worth around $20 billion.

Technical Analysis of Boeing (BA) Stock

Throughout March, bulls managed to break through local resistance around $172 (as indicated by orange arrows). However, the rally has now reached a stronger obstacle—the $188 level:

This area marks the 2025 high.

Bulls also struggled to sustain prices above $188 in mid-2024.

With the RSI indicator nearing overbought levels, a correction after such an impressive two-month rally seems like a plausible scenario.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

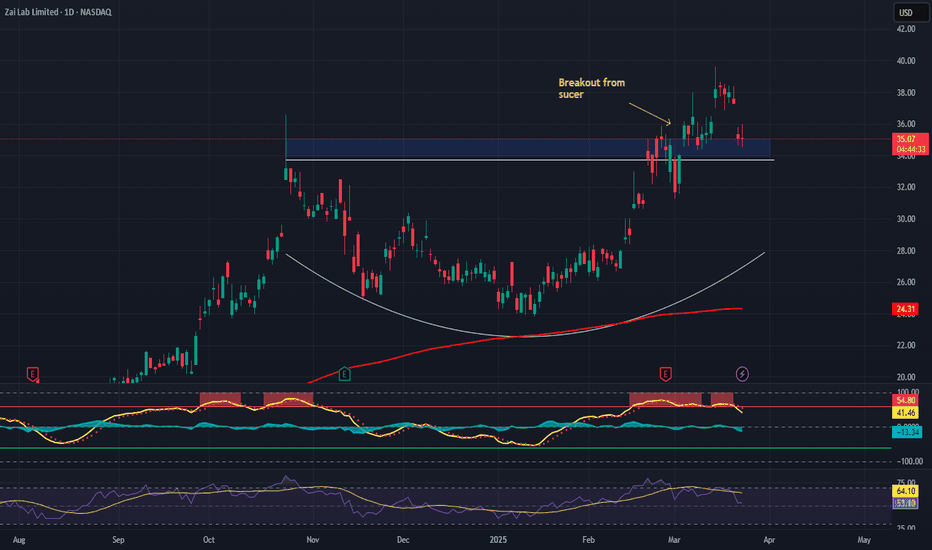

Zai Lab (ZLAB) – Biotech Growth & Profitability PathCompany Overview:

Zai Lab NASDAQ:ZLAB , a leading Chinese biotech firm, is on track for non-GAAP profitability by Q4 2025, driven by strong revenue growth & cost management.

Key Catalysts:

Financial Discipline & Expansion 💰

Operating losses fell 45% in Q4 2024, highlighting cost efficiency while scaling operations.

Analysts project $2 billion in annual revenue by 2028, reinforcing long-term value creation.

Blockbuster Drug Pipeline 💊

VYVGART generated $93.6M in its first full launch year, demonstrating strong adoption.

KarXT & bemarituzumab are key upcoming growth drivers, expanding ZLAB’s market footprint.

Investment Outlook:

Bullish Case: We are bullish on ZLAB above $34.00-$35.00, supported by financial execution & product expansion.

Upside Potential: Our price target is $54.00-$55.00, driven by strong product adoption & long-term growth trajectory.

🔥 Zai Lab – Unlocking the Future of Biotech Innovation. #ZLAB #Biotech #GrowthStocks

BRK.B Share Price Reaches All-Time HighBRK.B Share Price Reaches All-Time High

As shown on the chart, the Class B shares of Berkshire Hathaway (BRK.B) have surpassed $520 for the first time in history. Notably, US stock indices remain below their record highs, further highlighting Warren Buffett’s investment acumen.

In late December, we noted that:

→ Berkshire Hathaway (BRK.B) had significantly reduced its position in Apple (AAPL) and refrained from making new purchases.

→ This suggested that Warren Buffett believed US stocks were overvalued and that a market correction was likely.

Once again, Buffett has been proven right. The Telegraph reports that the legendary investor correctly anticipated that Donald Trump would send Wall Street tumbling.

Additionally, Berkshire Hathaway’s latest earnings report, released yesterday, revealed that the company has been investing in the Japanese stock market—likely contributing to the optimism surrounding BRK.B shares.

Technical Analysis of BRK.B Shares

Key points for constructing the upward price channel are marked in blue, with:

→ The median line shifting from resistance to support (as indicated by arrows).

→ The price approaching the upper boundary of the channel, which could act as resistance.

→ The price action following the breakout above the psychological $500 level displaying strong bullish confidence.

Given these factors, if BRK.B shares enter a correction phase after the sharp rally (potentially reversing from the upper channel boundary), the $500 level is likely to act as support.

Another key support level is $483, which served as resistance in 2024 but has yet to be tested following the bullish breakout.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Spotify (SPOT) Shares Rise by Nearly 7%Spotify (SPOT) Shares Rise by Nearly 7%

According to the stock chart of music streaming giant Spotify (SPOT), the share price:

→ Increased by almost 7% by the end of trading on Friday.

→ Has surged approximately 28% since the start of 2025—one of the strongest performances in the stock market.

→ Has nearly doubled over the past 12 months.

Why Is Spotify (SPOT) Stock Rising?

As we noted late last year, investors have responded enthusiastically to the launch of the “Premium” plan, which offers higher-quality, ad-free music streaming and is expected to boost the company’s revenue.

Additionally, on Friday, Spotify announced that it had paid out around $10 billion in royalties to artists during 2024. By comparison, in 2014, this figure was “just” $1 billion.

Technical Analysis of Spotify (SPOT) Stock

Drawing a parallel with musical notes on a staff, the price action appears to be playing a "bullish melody," rising while interacting with a structure of four ascending lines that alternate between support (one of many examples marked with an arrow) and resistance.

In March, the price tested support at Line Two, which was reinforced by the psychological level of $500 per share. If bullish momentum remains strong, buyers may attempt to push the stock back into the range between Lines Three and Four.

Spotify (SPOT) Stock Forecast

According to TipRanks:

→ Analysts have an average 12-month price target of $671 for SPOT shares.

→ 17 out of 26 analysts recommend buying SPOT stock.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Rocket Companies (RKT) – Fintech-Driven Mortgage GrowthCompany Overview:

Rocket Companies NYSE:RKT is a fintech leader in mortgage and real estate solutions, leveraging AI-driven efficiency to enhance profitability and market share.

Key Catalysts:

Surging Profitability & Efficiency 💰

Adjusted EBITDA margin rose to 18% in Q4 2024, up from 2% a year prior, reflecting strong financial performance.

Rocket Mortgage Growth 📊

Net rate lock volume surged 47% YoY to $23.6 billion, far outpacing industry trends.

Expanding Servicing Portfolio 📈

The $593 billion servicing portfolio (+17%) provides stable revenue and cross-selling opportunities, acting as a hedge against rate volatility.

Resilient Market Share Expansion 🏆

Despite industry headwinds, Rocket continues to grow market share, proving its competitive edge in mortgage lending.

Investment Outlook:

Bullish Case: We are bullish on RKT above $11.80-$12.00, driven by profitability gains, market expansion, and portfolio strength.

Upside Potential: Our price target is $20.00-$21.00, reflecting sustained growth and operational efficiency.

🔥 Rocket Companies – Powering the Future of Mortgage & Fintech. #RKT #MortgageTech #FintechGrowth

$CDRE: Cadre Holdings – Riding the Safety Wave?(1/9)

Good afternoon, everyone! 😊

NYSE:CDRE : Cadre Holdings – Riding the Safety Wave?

With CDRE at $30.20, is this stock a safe bet or a risky ride? Let's dive into the world of safety gear and see if Cadre's holdings hold up! 😎

(2/9) – PRICE PERFORMANCE

• Current Price: $30.20 as of March 12, 2025 😏

• Recent Moves: Down 11% from $34.02 a week ago 😬

• Sector Vibe: Safety equipment sector is growing, driven by stricter regulations and demand for safer workplaces. 📈

Short commentary: The stock's taken a hit, but the sector's looking good. Maybe it's just a temporary dip? 🤔

(3/9) – MARKET POSITION

• Market Cap: Approximately $1.23 billion 💰

• Operations: Manufacturing and distributing safety and survivability products for law enforcement, first responders, military, and now, the nuclear market. 🛡️

• Trend: Expanding into new markets with the acquisition of nuclear safety brands. 🚀

Short commentary: They're diversifying, which is usually a good sign. More markets mean more opportunities. 😉

(4/9) – KEY DEVELOPMENTS

• Acquisition of Carr's Engineering Limited's Engineering Division for nuclear safety solutions, announced on January 16, 2025. 📈

• Expected to close in the first half of 2025. ⌛

• Market Reaction: The stock has seen a recent dip, possibly reflecting integration concerns or broader market volatility. 😐

Short commentary: This should bring in new revenue streams and expand their international presence. Let's see how it plays out. 🌍

(5/9) – RISKS IN FOCUS

• Integration risks from the acquisition. ⚙️

• Supply chain disruptions. 🚚

• Regulatory changes in the nuclear sector. 📜

Short commentary: These are all things to keep an eye on, but every company has some risks. Stay vigilant! 🕵️

(6/9) – SWOT: STRENGTHS

• Strong reputation in safety equipment. 🏆

• Diverse product portfolio. 🌈

• Recent acquisition expanding into the nuclear market. 🌟

Short commentary: They're well-known and have a broad range of products, which is great. Keep up the good work! 👍

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Potential over-reliance on government contracts, integration challenges. ⚠️

• Opportunities: Growth in nuclear safety market, increasing global demand for safety products. 🌐

Short commentary: They need to manage their dependencies and make sure the acquisition goes smoothly, but there's a lot of potential for growth. Let's hope they nail it! 📈

(8/9) – CDRE at $30.20 – what's your call? 🗳️

• Bullish: Price could rise to $35+ soon, due to successful acquisition and sector growth. 🚀

• Neutral: Price remains steady, as the market digests the acquisition news. 😐

• Bearish: Price could drop to $25, due to integration risks and market volatility. 📉

Drop your pick below! 💬

(9/9) – FINAL TAKEAWAY

Cadre Holdings' $30.20 stance shows a robust portfolio and strategic expansion, but recent price dips and integration risks are concerns. Volatility’s our ally—dips are DCA treasure. Snag low, soar high!

NIO Share Price Soars by Approximately 17%NIO Share Price Soars by Approximately 17%

The stock chart of Chinese electric vehicle manufacturer NIO shows that its price has reached a new high for 2025, following a 10% surge yesterday.

In the process, the stock formed a wide bullish gap and successfully broke through the psychological $5 per share level.

Why Has NIO’s Share Price Risen?

The bullish sentiment is largely driven by anticipation of the company's upcoming earnings report. Last year, NIO achieved record-breaking monthly EV deliveries, reaching 31,000 units in December.

Investors are now eagerly awaiting further details about NIO’s two new mass-market brands, Onvo and Firefly. Onvo has already launched, while pre-orders for Firefly—a compact and intelligent EV priced at around $20,500—have begun.

Additionally, some investors may be shifting capital from TSLA shares (which have been experiencing a bearish trend, as reported yesterday) into NIO stock.

Technical Analysis of NIO’s Stock Chart

Looking at the bigger picture, NIO’s share price remains within a long-term downward trend (marked by the red descending channel). Since the start of 2025, the stock has fluctuated around the median line without dropping below $4 per share, a level where supply and demand have historically balanced out.

However, yesterday’s strong upward momentum suggests that the balance may have shifted in favour of the bulls. Given the positive fundamental outlook, buyers could maintain the recent gains, potentially pushing the share price towards the upper boundary of the red channel—following the trajectory outlined by the blue lines on the chart.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Apple (AAPL) Share Price Drops Over 7% in Two DaysApple (AAPL) Share Price Drops Over 7% in Two Days

As previously reported, AAPL shares had their worst January since 2008, but the challenges for investors have continued. The Apple (AAPL) stock chart shows that:

- Yesterday, the price dropped below $218 during trading—the lowest level since September last year.

- Compared to Friday’s closing price, the decline over the first two days of this week amounted to approximately 7.7%.

Why Has AAPL Stock Fallen?

Yesterday, we noted that bearish sentiment was prevailing in the stock market, leading the Nasdaq 100 index into correction territory. Market conditions were further dampened by news that Apple had delayed the release of an AI-powered update for its digital assistant, Siri 2.0, increasing selling pressure.

What Could Happen Next?

Technical Analysis of Apple (AAPL) Stock

Key price reversals, marked with red dots, outline a downward channel (shown in red). The median line, which previously acted as support (indicated by an arrow), has now been broken, suggesting that bears may expect it to act as resistance going forward.

From a bullish perspective, the lower boundary of the red channel, reinforced by the September low around $214, could serve as an area where selling pressure might ease—if AAPL continues to decline.

AAPL Share Price Forecast

According to TipRanks:

- 18 out of 33 surveyed analysts recommend buying AAPL stock.

- The average 12-month price target for AAPL is $251.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Unipro UPRO Stock Technical Analysis and Fundamental Analysis📊 Technical Analysis of Unipro ( RUS:UPRO ) Stock

Current Price: 2.043 RUB (+2.46%)

Trend: The stock is in a growth phase, but signs of overbought conditions are emerging.

RSI (14): 78.91 (overbought, possible correction ahead)

MACD (12,26,9): +0.13 (bullish signal, but a reversal is possible)

Support Levels: 1.95 RUB and 1.80 RUB

Resistance Levels: 2.10 RUB and 2.30 RUB

Entry Points:

A pullback to 1.95 RUB may be a good opportunity for long positions.

If the price consolidates above 2.10 RUB, further growth toward 2.30 RUB is likely.

Stop-Loss: 1.85 RUB (if breached, the trend could reverse downward)

📈 Fundamental Analysis

Financial Performance:

Revenue remains stable, but growth rates are slowing.

Net profit declined in 2024 due to rising operating expenses.

Debt burden is low, ensuring resilience to macroeconomic shocks.

Impact of the Russian Central Bank:

The high key interest rate is limiting market capitalization growth.

Investors are waiting for rate decisions—any cuts could accelerate stock growth.

Dividends:

Expected to remain at 6 RUB per share.

Dividend yield remains attractive for long-term investors.

Macroeconomic Factors:

External sanctions and political risks may influence business growth.

A potential IPO of RTK-DPC (a Unipro subsidiary) could strengthen the company’s financial position.

🔍 Conclusion

Short-term: The stock may experience a correction due to overbought conditions. The best entry point is around 1.95 RUB.

Mid-term: If the price consolidates above 2.10 RUB, growth toward 2.30 RUB is likely.

Long-term: Unipro remains attractive for investors focused on dividends and stability.

❗ Keep an eye on Russian Central Bank decisions and overall market sentiment.

Netflix (NFLX) Shares Among the Biggest Losers in the US MarketNetflix (NFLX) Shares Among the Biggest Losers in the US Stock Market

According to market charts:

→ Netflix (NFLX) shares fell by approximately 8.5% during yesterday’s trading session, indicating that bulls failed to sustain the price above the psychological $1,000 per share level.

→ The S&P 500 index (US SPX 500 mini on FXOpen) hit a new low for 2025, closing down around 1.3%.

These declines reflect bearish sentiment in the US stock market, which may be driven by:

→ Uncertainty over Trump’s trade tariff policies. Yesterday, the White House postponed the introduction of tariffs on trade with Canada and Mexico for a second time, now pushing the deadline to early April.

→ Anxiety ahead of the Non-Farm Employment Change report release (scheduled for today at 16:30 GMT+3), as recession fears continue to mount.

Selling pressure was particularly strong in Netflix (NFLX) shares, as analysts (according to media reports) issued a cautious outlook on subscriber growth for the streaming giant. This may stem from concerns that the company's low-cost, ad-supported subscription model is losing its initial positive impact.

Technical Analysis of Netflix (NFLX) Stock Chart

Price movements in 2025 have formed an upward channel (marked in blue), which remains intact for now.

The $955 level, which previously acted as support, may now serve as resistance. If bearish sentiment persists, the price could continue its downward trajectory. However, bulls may find hope in key support areas, including:

→ The lower boundary of the current price channel.

→ The $870 level, which marks the lower limit of a broad bullish gap formed after a strong quarterly earnings report (as we noted on 23 January). This level has also acted as a key reversal point multiple times.

Analysts’ Forecasts for Netflix (NFLX) Stock

Overall, analysts remain optimistic. According to TipRanks:

→ The average 12-month price target for NFLX is $1,100.

→ 29 out of 37 analysts recommend buying NFLX shares.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Ford (F) Stock Price Rises Following Trump's DecisionFord (F) Stock Price Rises Following Trump's Decision

The White House announced on Wednesday that automakers will receive a one-month exemption from tariffs on imports from Mexico and Canada for vehicles that comply with the free trade agreement between these two countries and the United States.

White House Press Secretary Karoline Leavitt stated that this move came in response to a request from the heads of Ford Motor, General Motors, and Stellantis. The American Automotive Policy Council expressed gratitude to President Trump in a statement and noted that companies would work with the administration to boost vehicle production in the U.S. and expand exports.

This fundamental backdrop triggered a bullish momentum in the stock market for these automakers. In particular, Ford (F) shares rose by more than 6%, while the S&P 500 (US SPX 500 mini on FXOpen) gained about 1.1%.

As shown in Ford (F) stock's price chart today, the stock has rebounded from a four-year low.

Technical Analysis of Ford (F) Stock Chart

As we noted in our February 7 analysis of Ford (F) stock, special attention should be paid to the level marked by the blue line. This area, around $9.65–$9.75, acted as support in 2023 and 2024 (indicated by arrows), preventing bears from pushing the price below the psychological threshold of $10 per share.

We also highlighted the "Trump factor" and the fact that the newly inaugurated president could drastically alter the landscape for the iconic American automaker by imposing tariffs on foreign car manufacturers. The impact of this price driver on Ford (F) shares is visible on the chart: a sharp upward reversal (marked by a curved arrow) indicates that the bears’ attempt to push the stock below its previous low has failed.

It is reasonable to assume that bulls now have the initiative. If they manage to push Ford (F) stock above the resistance of the blue line, this level could turn into future support.

Ford (F) Stock Price Forecasts

Analysts remain cautious in their assessments. They may believe that one month is too short a period to significantly alter supply chains and relocate production to the U.S., where, according to Trump's statements, no tariffs would be imposed.

According to TipRanks:

→ Only 4 out of 14 analysts recommend buying Ford (F) stock.

→ The average 12-month price forecast for Ford (F) is $10.76.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.