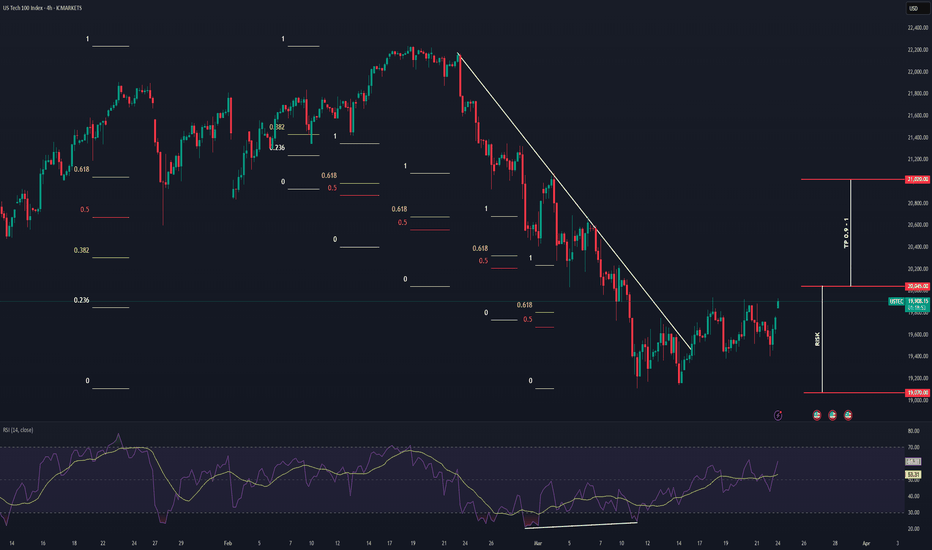

NASDAQ Bullish Reversal (Potential Tariff Resolution?) NASDAQ price action went through a massive correction with a drop from the top worth approx. 14%.

However after the passing of the latest FOMC Meeting, we may finally see a direction towards the resolution of widespread tariff based uncertainty across the macro economic landscape.

This presents us with a potential Reversal opportunity if we see the formation of a credible Higher High (given a potential proper break out) on the 4 HR and shorter timeframes.

Trade Plan :

Entry @ 20045

Stop Loss @ 19070

TP 0.9 - 1 @ 20923 - 21020

Stockmarketanalysis

TSLA Volatility Continues?NASDAQ:TSLA

Outlook - -GEX and -DEX with put support at 220 which would fill the Earnings gap up from last October.

Weekly -- Rejected the EMA

Daily -- Closed right above EMA

Hourly -- Consolidating

10m -- Consolidating

Bias - Neutral until one side breaks. Too much volatility to pick a side.

Pivot - 263.5

Upside Targets:

* 263.46--274.06--277.63--287.26

Downside Targets:

* 258.04--256.43--253.48--249.63

Tencent Holdings LtdIs Tencent Stock a Buy Now?

Tencent posted its third quarter earnings report on Nov. 16. The Chinese tech giant's revenue fell 2% year over year to 140.1 billion yuan ($19.8 billion), which represented its second consecutive quarter of declining revenue since its IPO in 2004. Its net profit rose 1% to 39.9 billion yuan ($5.6 billion). On an adjusted basis, which excludes its investments and other one-time items, its net profit grew 2% to 32.3 billion yuan ($4.5 billion). Those growth rates seem anemic, but Tencent's stock had already been cut in half over the past two years amid concerns about China's tightening regulations, slowing economic growth, and COVID19 lockdowns. So is it the right time to take the contrarian view and buy Tencent as a turnaround play? Let's review its core businesses and valuations to decide.

Tencent generated 31% of its third quarter revenue from its video game business. Domestic games, which include its blockbuster game Honor of Kings, accounted for 73% of that total. The remaining 27% came from overseas hits like League of Legends, Valorant, and PUBG Mobile.Its domestic gaming revenue fell 7% year over year, representing its third consecutive quarter of shrinking revenue, as it grappled with tighter playtime restrictions for minors in China over the past year. Those restrictions also coincided with a temporary suspension on new video game approvals in China, which started last July and ended this April.Its international gaming revenue rose 3% year over year, accelerating from its 1% decline in the second quarter, as new games like Tower of Fantasy and Goddess of Victory: Nikke attracted new players. Unfortunately, its overseas growth still couldn't offset its declining domestic revenue.

As a result, Tencent's total VAS (value-added service) revenue which includes its gaming divisions, social media platforms, and streaming media subscriptions -- declined by 3% in the third quarter but still accounted for more than half of its top line. This core business might gradually stabilize as Tencent expands its international gaming business, but it will likely remain under intense pressure as long as the Chinese government continues to scrutinize the gaming industry.

200$ was one of the biggest support and great opportunity to buying the dip. 300-320$ is a big resistance level for tencent and if bulls win that battle then 350$ is next but

can we back 250 or even 200$ again? YES

Tesla - There Is Hope For Bulls!Tesla ( NASDAQ:TSLA ) is just crashing recently:

Click chart above to see the detailed analysis👆🏻

After Tesla perfectly retested the previous all time high just a couple of weeks ago, we now witnessed a quite expected rejection of about -50%. However market structure remains still bullish and if we see some bullish confirmation, a substantial move higher will follow soon.

Levels to watch: $260, $400

Keep your long term vision!

Philip (BasicTrading)

Chevron (CVX) – Strong Growth & Cash Flow ExpansionCompany Overview:

Chevron NYSE:CVX continues to demonstrate strong operational efficiency, strategic expansion, and record-breaking U.S. production.

Key Catalysts:

Production Growth & Profitability 🚀

Global production up 7% in 2024.

U.S. output surged 19% to record levels.

Permian Basin nearing 1M bpd, reinforcing cash flow strength.

Strategic Expansion & Sustainability 🌍

Gulf of Mexico projects targeting a boost from 200K to 300K bpd.

Future Growth Project in Kazakhstan enhances long-term production & ESG alignment.

Navigating Venezuelan challenges while leveraging stable U.S. policies for continued growth.

Investment Outlook:

Bullish Case: We remain bullish on CVX above $139.00-$140.00, backed by resilient production growth & execution.

Upside Potential: Our price target is $215.00-$220.00, supported by strong cash flow & expansion initiatives.

🔥 Chevron – Powering the Future with Growth & Stability. #CVX #EnergyStocks #OilAndGas

Gold Prices Doubled in 5 years. What Does It 'Historically' MeanOver the past five years, Gold prices OANDA:XAUUSD have experienced a significant surge, doubling in value over the past 5 years, from mid-March 2020 to mid-March 2025.

This is the 3rd time in history ever, the price of gold doubled in U.S. dollars (we counted only events when it has been observed first time only over 5-years time span).

🥇 The 1st time "A Doubling" event happened in the first quarter of 1973, when Gold hit $80 mark per ounce (google: "1973 Arab–Israeli War").

⚒ What happened next with Gold prices after that? - Hmm.. Gold doubled in price again! (and even more) over the next three years. Watch historical charts to learn more.

⚒ S&P500 Index folded in half over the same next three years.

🥇 The 2nd time "A Doubling" event happened more than 30 years later, in the first quarter of 2006 when Gold prices hit $500 barrier by the end of the year 2005, for the first time since 1987.

Some analysts blamed inflation in the US and concerns about the state of the global economy.

⚒ What happened next with Gold price after that? - Hmm.... Gold price also doubled in price again! (and even more) over next three years. Watch again historical charts to learn more.

⚒ S&P500 Index folded in half again over the same next three years (google: "2008 financial crisis").

🥇 Now is the 3rd time "A Doubling" event has happened with Gold prices, first time over last almost 20 years.

Several factors have contributed to this increase, including economic uncertainty, inflation fears, geopolitical tensions, central bank activity, and investment demand.

Economic Uncertainty: Times of economic turmoil often drive investors towards gold as a safe haven asset. The increase in global economic uncertainty has been a primary driver of gold's price surge.

Inflation: The threat of inflation also contributes to the rising price of gold. Investors often turn to gold as a hedge against the devaluation of fiat currencies during inflationary periods.

Geopolitical Tensions: Geopolitical instability encourages investors to seek safe-haven assets like gold. The Ukraine war, along with conflicts in the Middle East, have further fueled the rise in gold prices.

Central Bank Demand: Central banks' buying and easing cycles influence gold prices. Central banks often purchase gold to diversify their reserve holdings, and this demand can impact gold prices significantly.

Investment Demand: Demand from technology, jewelry, and investors influences gold prices. Gold price movements are sometimes driven by investor demand.

--

Best #GODL (Gold On Dear Life) wishes,

@PandorraResearch Team

Starbucks (SBUX) Brewing a Breakout? Don’t Miss This $100 BattleStarbucks (SBUX) 2-Hour Chart Breakdown

Hey traders, let’s dive into Starbucks (SBUX) on the 2-hour chart and see what’s cooking. The price is sitting at $99.65 right now, up a tiny 0.01%, but don’t let that small move fool you—this chart has been a wild ride lately, and I think we’re at a really interesting spot for a potential trade.

What’s Been Happening with the Price?

If you look at the chart, you’ll see Starbucks hit a high of $112.38 back on March 17th. That was the peak, and man, did it come crashing down after that! The price tanked all the way to $97.34 by early April, a pretty steep drop. Since then, though, things have calmed down a bit, and we’ve been stuck in this tight range between $97.34 and $100.00. Lately, the price has been pushing toward the upper end of that range, and it’s got my attention.

Let’s Talk Trends

From mid-March to early April, we were in a clear downtrend. You can see it on the chart—lower highs, lower lows, and a descending trendline that kept the price in check as it slid down. It was a bear’s paradise, and there’s even a sell signal marked on the chart from that $112.38 peak that caught a massive 27.96% profit on the way down. Not bad at all!

But now, things are starting to shift. After hitting that $97.34 low, the price has been consolidating, and just recently, it broke above that descending trendline. That’s a big deal because it tells me the bears might be losing their grip. We’re not in a full-on uptrend yet, but the momentum feels like it’s tilting toward the bulls, especially with the price testing that $100.00 level.

Key Levels to Watch

Let’s zoom in on the levels that matter here. On the downside, $97.34 has been a rock-solid support. The price has bounced off that level a couple of times in early April, so it’s a spot I’m keeping an eye on. If we drop back down, that’s where I’d expect buyers to step in again.

On the upside, $100.00 is the big resistance we’re testing right now. The price has struggled to break through here before, so it’s a critical level. If we can get a clean break above it, I think we could see a nice move higher. The next big resistance after that would be around $107.00, which was a swing high from late March, and then up toward $111.00 or even that $112.38 peak if things really get going.

What the Past Signals Tell Us

The chart has a couple of trade signals marked, which give us some context. That sell signal at $112.38 was a home run, as I mentioned—27.96% profit as the price collapsed. Then there’s a buy signal at the $97.34 low on April 5th, but that one only managed a peak profit of 0.27%. Not exactly a big win, and it makes sense because the price has been stuck in this range since then. It’s like the market’s been taking a breather, trying to figure out its next move.

Digging into the Technicals

Alright, let’s get into the nitty-gritty of what’s happening on the chart. That break above the descending trendline is a bullish sign for me. It’s like the price is saying, “I’m done with this downtrend, let’s try something new.” We’re also in this consolidation range between $97.34 and $100.00, and when I see a range like that, I know a breakout is usually coming. The question is, which way?

One thing that’s catching my eye is the potential for a double bottom pattern. We’ve got two tests of that $97.34 support, and if we can break above $100.00, that would confirm the pattern. If that happens, I’d measure the height of the pattern and project it upward, which could take us toward $107.00 as a first target. That’s something to watch for.

I’d love to see volume on this chart to confirm the breakout, but from the price action alone, it feels like there’s some buying interest building as we push toward $100.00. If we get a strong candle closing above that level, I’ll be a lot more confident in the bulls.

How I’d Trade This Setup

So, what’s the play here? I see a few ways to approach this, depending on what the price does next.

First, let’s talk about the bullish case. If we get a solid break above $100.00—ideally with a strong 2-hour candle and some good volume—I’d be looking to go long. My first target would be $107.00, and if we get some momentum, maybe even $111.00 or $112.38. I’d set my stop loss just below the recent swing low around $98.00 to protect myself in case this breakout fails. That trendline break and the potential double bottom make me think the bulls have a shot here.

On the flip side, if the price gets rejected at $100.00—and I’ll be watching for something like a shooting star or a bearish engulfing candle—I’d consider a short. If we drop back down, $97.34 is the first target, and if that support breaks, we could even see $94.00, which is a psychological level and a spot where I’d expect some buyers to show up. For a short, I’d set my stop loss just above $100.65 to give it a little room.

If you’re more of a scalper, you could play the range while we’re stuck in it. Buy near $97.34, sell near $100.00, and use tight stops outside the range—say, below $97.00 for longs and above $100.65 for shorts. It’s a decent way to grab some quick profits while we wait for the bigger move.

A Word on Risk

One thing I always remind myself is to keep risk in check. Starbucks has been volatile—look at that 27.96% drop from the peak! So, I’d be careful with my position size and aim for at least a 1:2 risk-reward ratio on any breakout trade. Also, keep an eye out for any news that might shake things up, like earnings reports or big economic data releases. Starbucks is in the consumer discretionary sector, so things like consumer spending trends or even coffee prices could move the stock.

The Bigger Picture

Speaking of the broader market, Starbucks can be influenced by how the NASDAQ 100 is doing, since it’s listed there. If the overall market is feeling optimistic, that could help push SBUX higher. On the other hand, if there’s a risk-off vibe, we might see that $100.00 resistance hold strong. It’s always good to check the bigger picture before jumping into a trade.

Wrapping It Up

So, where does that leave us? Starbucks is at a really interesting spot right now, testing that $100.00 resistance after breaking above the descending trendline. I’m leaning toward a bullish breakout, especially with that potential double bottom pattern, but I’ll be watching closely to see if we get confirmation above $100.00. If we do, I think $107.00 is a realistic target, with $111.00 or higher in play if the bulls really take control. But if we get rejected here, $97.34 is the level to watch on the downside.

For now, I’d say be patient and wait for the price to show its hand. Whether you’re looking for a breakout or playing the range, there’s definitely an opportunity here. Just make sure to manage your risk and stay on top of any news that might move the stock. Let’s see how this plays out I’ll be watching this one closely!

S&P500 - Donald Trump Is Crashing Markets!S&P500 ( TVC:SPX ) is starting a correction:

Click chart above to see the detailed analysis👆🏻

Since Donald Trump was elected the markets have been super volatile and clearly not too easy to trade. But now it seems like bears are slowly taking over the entire U.S. stock market after we just saw a drop of -10% within a couple of days and a correction becomes more and more likely.

Levels to watch: $6.100, $4.800

Keep your long term vision,

Philip (BasicTrading)

Ion Beam Applications S.A. (IBAB) 1WTechnical Analysis

The chart shows a breakout of the weekly ascending trendline and the formation of a "rising wedge", indicating a potential decline.

Key Levels:

- Support: 11.46 EUR, 9.00 EUR

- Resistance: 13.06 EUR, 14.01 EUR

Fundamental Analysis

Ion Beam Applications is a leader in radiation therapy and medical accelerators.

Factors influencing the stock:

- Financials: Revenue growth but high volatility.

- Macroeconomics: Interest rate impact on the tech sector.

- Competition: Rivalry with Varian and Elekta.

A breakdown below 11.46 EUR could open the way to 9.00 EUR. To regain an uptrend, the stock needs to reclaim 13.06 EUR.

Nasdaq 100 Volatility. US Tech Stocks Remain 'Runoff Smelling'It's gone two months or so... (Duh..? WTF.. only two monts, really? 😸) since comrade Trump entered The White House (again).

Everyone was on a rush, chatting endless "Blah-Blah-Blah", "I-crypto-czar", "crypto-capital-of-the-world", "we-robot", "mambo-jumbo", "super-duper", AI, VR and so on hyped bullsh#t.

- And now?..

- It's gone. It's absolutely gone..!

Leveraged bets and crypto assets turned into Bearish market; all four major US indices (S&P500, DJIA, Nasdaq 100 and Russell 2000) are negative over the past two months, while Gold OANDA:XAUUSD has doubled in price over the past 5 years (4th time in history ever), and remain the only is premium positioned.

This is why we at our 💖 Beloved @PandorraResearch Team decided to paint this idea for Nasdaq 100 Volatility Index CBOE:VXN to emphasize (again) that nothing last forever and no one should chase a feather, or dust in the wind.

Broadly-known ominously among investors as the "fear index" and launched by the Chicago Board Options Exchange (now the Cboe) in 1993, the Volatility Index (VIX) is meant to present the market's expectation of volatility over the coming 30 days. The metric is derived from options prices on the S&P 500 Index and captures the anticipated swings that drive investor sentiment.

In recent years, the VIX has become a far more central index, especially during periods of financial turbulence, such as the 2008 financial crisis and the COVID-19 pandemic. During these stretches, spikes in the VIX reflected widespread anxiety; during others, it's been a crucial barometer for market participants seeking a glimpse into investors' collective psyche. When the VIX is low, this suggests calm seas ahead. When it spikes, it signals approaching storms.

Every single stock index do have its own volatility.

This story (again) is about Cboe NASDAQ-100 Volatility Index CBOE:VXN

The Cboe NASDAQ-100 Volatility Index (VXN) is a key measure of market expectations of near-term volatility conveyed by NASDAQ-100 Index (NDX) option prices. It measures the market's expectation of 30-day volatility implicit in the prices of near-term NASDAQ-100 options. VXN is quoted in percentage points, just like the standard deviation of a rate of return, e.g. 19.36. Cboe disseminates the VXN index value continuously during trading hours.

The VXN Index is a leading barometer of investor sentiment and market volatility relating to the NASDAQ-100 Index.

Learn more about Methodology for Calculation of the VXN Index, using official CBOE website.

Technical observations

The main technical graph indicates that CBOE:VXN Index has recently jumped to current 'above 20' basic points.

In nowadays 'above 20' VXN levels indicate on further potentail Bearish progress in US Tech Stocks (Nasdaq 100 Index NASDAQ:NDX ).

--

Best wishes,

@PandorraResearch Team

RITES: INVERSE H&S BREAKOUTThe Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components:

Structure of the Pattern:

Left Shoulder: A price decline followed by a temporary rally.

Head: A deeper decline forming the lowest point, followed by another rally.

Right Shoulder: A decline similar in size to the left shoulder but not as deep as the head, followed by a move higher.

Neckline: A resistance level that connects the highs of the two rallies after the left shoulder and head.

The Inverse Head and Shoulders pattern in RITES, with a neckline at ₹225, indicates a potential bullish reversal. The stock has formed a well-defined left shoulder, head, and right shoulder, suggesting that selling pressure is weakening. The target price for this breakout is ₹263 calculated by measuring the distance from the head’s low to the neckline and projecting it upwards. If the stock sustains above the neckline, it could gain further momentum. However, traders should consider placing a stop-loss at 212 to manage risk in case of a failed breakout.

NIKE INC. AMERICAN SHOOES LOOSING GLOSS, AHEAD OF U.S. RECESSIONNIKE Inc. or Nike is an American multinational company specializing in sportswear and footwear.

The company designs, develops, markets and sells athletic footwear, apparel, accessories, equipment and services.

The company was founded by William Jay Bowerman and Philip H. Knight more than 40 years ago, on January 25, 1964, and is headquartered in Beaverton, Oregon.

As of July 15, 2024, NIKE (NKE) shares were down more than 33 percent in 2024, making them a Top 5 Underperformer among all the S&P500 components.

Perhaps everything would have been "normal", and everything could be explained by the one only unsuccessful December quarter of 2023, when the Company’s revenue decreased by 2 percentage points to $12.6 billion, which turned out to be lower than analyst estimates.

But one circumstance makes everything like a "not just cuz".

This is all because among the Top Five S&P500 Outsiders, in addition to NIKE, we have also shares of another large shoe manufacturer - lululemon athletica (LULU), that losing over 44 percent in 2024.

Influence of macroeconomic factors

👉 The economic downturn hurts most merchandise retailers, but footwear companies face the greatest risk to loose profits, as higher fixed costs lead to larger profit declines when sales come under pressure.

👉 The Nasdaq US Benchmark Footwear Index has fallen more than 23 percent since the start of 2024 as consumer spending is threatened by continued rising home prices, banks' reluctance to lend, high lending rates, and high energy and energy costs. food products - weaken.

👉 In general, the above-mentioned Footwear Sub-Industry Index continues to decline for the 3rd year in a row, being at levels half as low as the maximum values of the fourth quarter of 2021.

Investment Domes worsen forecasts...

👉 In the first quarter of 2024, Goldman Sachs made adjustments to its forecast for Nike shares, lowering the target price to $120 from the previous $135, while maintaining a Buy recommendation. The company analyst cited ongoing challenges in Nike's near-term growth trajectory as the main reason for the adjustment, anticipating potential underperformance compared to market peers, noting that Nike's 2025 growth expectations have become "more conservative."

👉 Last Friday, Jefferies Financial Group cut its price target from $90.00 to $80.00, according to a report.

👉 Several other equity analysts also weighed in on NKE earlier in Q2 2024. In a research note on Friday, June 28, Barclays downgraded NIKE from an "overweight" rating to an "equal weight" rating and lowered their price target for the company from $109.00 to $80.00.

👉 BMO Capital Markets lowered their price target on NIKE from $118.00 to $100.00 and set an overweight rating on the stock in a research report on Friday, June 28th.

👉 Morgan Stanley reaffirmed an equal-weight rating and set a $79.00 price target (up from $114.00) on shares of NIKE in a research report on Friday, June 28th.

👉 Oppenheimer reiterated an outperform rating and set a $120.00 price target on shares of NIKE in a research report on Friday, June 28th.

👉 Finally, StockNews.com downgraded NIKE from a "buy" rating to a "hold" rating in a research report on Friday, June 21st.

...and it becomes a self-fulfilling prophecy

Perhaps everything would have been fine, and all the deterioration in forecasts could have been attributed to the stretching spring of price decline, if not for one circumstance - it is not the ratings that are declining due to the decline in share prices, but the shares themselves are being pushed lower and lower, as one after another depressing ones are released analytical forecasts from investment houses.

16 years ago. How it was

On January 15, 2008, shares of many shoe companies, including Nike Inc. (NKE) and Foot Locker Inc. (FL) fell after investment giant Goldman Sachs (GS) slashed its stock price targets, warning that the U.S. recession would drag down the companies' sales in 2008 as consumers spend more cautiously. "The recession will further increase the impact of the key headwind of a limited number of key commodity trends needed to fuel consumer interest in the sector," Goldman Sachs said in a note to clients.

In early 2008, Goldman downgraded athletic shoe retailer Foot Locker to "sell" from "neutral" and cut its six-month share price target from $17 to $10, saying it expected U.S. sales margins to continue to decline in 2008 despite store closures.

The downgrade was a major blow to Foot Locker, which by early 2008 had already seen its shares fall 60 percent over the previous 12 months as it struggled with declining sales due to declining demand for athletic shoes at the mall and a lack of exciting fashion trends in the market. sports shoes.

Like now, at those times Goldman retained its recommendation rating to “buy” Nike Inc shares, based on general ideas about the Company’s increasing weight over the US market, topped off with theses about the Company’s international visibility, as well as robust demand ahead of the Beijing Olympics.

However Goldman lowered its target price for the shares from $73 to $67 ( from $18.25 to $16.75, meaning two 2:1 splits in Nike stock in December 2012 and December 2015).

Although Nike, at the time of the downturn in forecasts, in fact remained largely unscathed by the decline in demand for athletic footwear among US mall retailers, it reported strong second-quarter results in December 2007 (and even beating forecasts for strong demand for its footwear in the US and growth abroad) , Goldman Sachs' forecasts for Nike's revenue and earnings per share to decline were justified.

Later Nike' shares lost about 45 percent from their 2008 peaks, and 12 months later reached a low in the first quarter of 2009 near the $40 mark ($10 per share, taking into account two stock splits).

The decline in Foot Locker shares from the 2008 peaks 2009 lows was even about 80 percent, against the backdrop of the global recession and the banking crisis of 2007-09.

Will history repeat itself this time..!? Who knows..

However, the main technical graph says, everything is moving (yet) in this direction.

GUJRAT GAS: INVERSE H&SThe Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components:

Structure of the Pattern:

Left Shoulder: A price decline followed by a temporary rally.

Head: A deeper decline forming the lowest point, followed by another rally.

Right Shoulder: A decline similar in size to the left shoulder but not as deep as the head, followed by a move higher.

Neckline: A resistance level that connects the highs of the two rallies after the left shoulder and head.

The Inverse Head and Shoulders pattern in Gujrat Gas, with a neckline at ₹396, indicates a potential bullish reversal. The stock has formed a well-defined left shoulder, head, and right shoulder, suggesting that selling pressure is weakening. A breakout above ₹406, supported by strong volume, could confirm the pattern and trigger an upward move. The target price for this breakout is ₹440, calculated by measuring the distance from the head’s low to the neckline and projecting it upwards. If the stock sustains above the neckline, it could gain further momentum. However, traders should consider placing a stop-loss below the right shoulder i.e. 376 to manage risk in case of a failed breakout.

Micron Technology - Fully Resisting The Stock Market Crash!Micron Technology ( NASDAQ:MU ) is one of the few bullish stocks:

Click chart above to see the detailed analysis👆🏻

Despite the stock market kind of "crashing" lately, Micron Technology is one of the few stocks which remains in a rather bullish environment. Following the uptrend, the bullish break and retest and the beautiful cycles on Micron Technology, this strength will soon become reality.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

US Technology Sector Futures. The Heartbreak HotelPresident Donald Trump's tariffs on imported tech goods, targeting China, the EU, Canada, and Mexico, are reshaping the U.S. technology sector through higher costs, supply chain disruptions, and retaliatory trade risks. While intended to boost domestic manufacturing and reduce trade deficits, these measures are creating immediate economic strain across critical industries. Below is an analysis of their key negative impacts:

Rising Consumer Prices and Hardware Costs

The 25% tariff on EU semiconductors, 10% levy on Chinese goods, and 25% duties on Canadian/Mexican imports are projected to add $50 billion in new costs to North American tech supply chains. This directly affects consumer electronics:

Smartphones and laptops. Apple’s iPhone production in China exposes it to 10% tariffs, likely forcing U.S. price hikes.

Semiconductors. The U.S. relies on China and Taiwan for 80% of 20-45nm chips and 70% of 50-180nm chips, with tariffs disrupting access to essential components.

Cloud/AI infrastructure. Steel and aluminum tariffs (25%) increase data center construction costs, potentially raising prices for AWS, Google Cloud, and Microsoft Azure services.

Experts warn companies may pass 60-100% of tariff costs to consumers rather than absorb profit losses.

Supply Chain Disruptions and North American Integration

The tariffs jeopardize tightly integrated North American production networks:

Cross-border dependencies. Components often cross U.S.-Mexico or U.S.-Canada borders multiple times during manufacturing. Christine McDaniel of the Mercatus Center notes this integration means tariffs “hurt the pricing power of the U.S.” by inflating domestic costs.

Critical material shortages. Canada supplies nickel and cobalt for batteries, while Mexico handles assembly for firms like Foxconn. Tariffs risk delays and renegotiations with suppliers.

Retaliatory measures. The EU may respond with fines or trade barriers against U.S. tech giants like Apple and Google, escalating tensions.

Sector-Specific Challenges

Semiconductors and Hardware

Chip shortages. With limited domestic foundry capacity, tariffs on EU semiconductors threaten AI development and device manufacturing.

Networking equipment. Proposed 10% tariffs on Chinese-made routers and modems could disrupt cloud providers reliant on these components.

Data Centers and AI

Construction delays. Steel/aluminum tariffs increase costs for server racks and cooling systems, potentially delaying $80 billion in planned U.S. data center investments.

AI infrastructure. Projects like the $500 billion Stargate initiative face higher expenses for imported components, slowing AI adoption.

Macroeconomic Risks

Trade deficit growth. Despite tariffs aiming to reduce the $1 trillion U.S. goods trade deficit, S&P Global warns retaliatory Chinese tariffs could worsen imbalances.

Job losses. Economic modeling suggests tariffs may cost 125,000+ U.S. tech jobs through reduced consumer spending and IT budget cuts.

Innovation slowdown. While firms like TSMC and Intel accelerate U.S. fab construction, short-term supply chain reallocations divert R&D funding.

Corporate Responses and Limitations

Some companies are attempting mitigation strategies:

Stockpiling. NVIDIA and AMD are urging partners to increase pre-tariff production.

Domestic shifts. Apple plans $500 billion in U.S. manufacturing, while TSMC pledged $160 billion for stateside fabs.

However, these efforts face scalability issues. Building advanced chip foundries takes 3-5 years, leaving gaps in critical components. Meanwhile, 65% of IT firms report difficulty finding tariff-free alternatives for Chinese inputs.

Technical challenge

The main technical graph for US Technology Select Sector Futures CME_MINI:XAK1! (CME Group mode of AMEX:XLK - SPDR Select Sector Fund - S&P500 Technology ETF) indicates on further Bearish market in development since major support of 52-week SMA has been broken already, with possible upcoming Bearish cascade effects in the future.

It is also important to note the almost complete absence of a Trump-a-rally in the 2024 holiday quarter, which contributed to the formation of a multi-resistance top.

Conclusion

While the tariffs aim to strengthen U.S. tech autonomy, their immediate effects—higher prices, supply instability, and strained international relations—outweigh potential long-term benefits. With global IT spending still projected to grow 9% in 2025, the sector’s resilience is being tested by policy-driven headwinds that threaten America’s competitive edge in semiconductors, AI, and consumer electronics.

Investing in S&P500 Technology Sector Futures / ETFs seeks to provide precise exposure to companies from technology hardware, storage and peripherals; software; communications equipment; semiconductors and semiconductor equipment; IT services; and electronic equipment, instruments and components industries; allows investors to take strategic or tactical positions at a more targeted level than traditional wide style based investing.

S&P500 Technology Sector Futures / ETFs are designed for investing at a more targeted Technology level, since nearly 50 percent of holdings weight just a five well-known names:

Name Weight

APPLE INC NASDAQ:AAPL 15.61%

MICROSOFT CORP 12.83%

NVIDIA CORP NASDAQ:NVDA 11.91%

BROADCOM INC NASDAQ:AVGO 5.18%

SALESFORCE INC NYSE:CRM 3.11%

--

Best 'Heartbreaking' wishes,

@PandorraResearch Team 😎

BHARAT FORGE: INVERSE H&SThe Inverse Head and Shoulders pattern is a bullish reversal chart pattern that signals a potential trend reversal from bearish to bullish. It consists of three key components:

Structure of the Pattern:

Left Shoulder: A price decline followed by a temporary rally.

Head: A deeper decline forming the lowest point, followed by another rally.

Right Shoulder: A decline similar in size to the left shoulder but not as deep as the head, followed by a move higher.

Neckline: A resistance level that connects the highs of the two rallies after the left shoulder and head.

The Inverse Head and Shoulders pattern in Bharat Forge, with a neckline at ₹1100, indicates a potential bullish reversal. The stock has formed a well-defined left shoulder, head, and right shoulder, suggesting that selling pressure is weakening. A breakout above ₹1100, supported by strong volume, could confirm the pattern and trigger an upward move. The target price for this breakout is ₹1200, calculated by measuring the distance from the head’s low to the neckline and projecting it upwards. If the stock sustains above the neckline, it could gain further momentum. However, traders should consider placing a stop-loss below the right shoulder to manage risk in case of a failed breakout.

SRF: Breakout of Symmetrical TriangleA symmetrical triangle is a chart pattern in technical analysis that forms when the price consolidates with lower highs and higher lows, creating a converging triangle shape. This pattern indicates a period of consolidation before the price breaks out in either direction.

SRF stock has already given a bullish breakout. One should go long on the stock with Stop loss below 2550 for the measured target of 3475-80 zone.

S&P500 Index Goes 'DRILL BABY DRILL' Mode due to Tariffs BazookaThe Trump administration's aggressive use of tariffs — we termed at @PandorraResearch Team a "Tariff' Bazooka" approach due to their broad, unilateral application — has exerted significant downward pressure on the S&P 500 index through multiple channels. These include direct impacts on corporate profitability, heightened trade war risks, increased economic uncertainty, and deteriorating market sentiment.

Direct Impact on Corporate Earnings

Tariffs raise costs for U.S. firms reliant on imported inputs, forcing them to either absorb reduced profit margins or pass costs to consumers. For example, intermediate goods like steel and aluminum—key inputs for manufacturing—face steep tariffs, squeezing industries from automakers to construction. Goldman Sachs estimates every 5-percentage-point increase in U.S. tariffs reduces S&P 500 earnings per share (EPS) by 1–2%. The 2025 tariffs targeting Canada, Mexico, and China could lower EPS forecasts by 2–3%, directly eroding equity valuations6. Additionally, retaliatory tariffs from trading partners (e.g., EU levies on bourbon and motorcycles) compound losses by shrinking export markets.

Trade Escalation and Retaliation

The EU’s threat to deploy its Anti-Coercion Instrument—a retaliatory tool designed to counter trade discrimination—could trigger a cycle of tit-for-tat measures. For instance, Canada and Mexico supply over 60% of U.S. steel and aluminum imports, and tariffs on these goods disrupt North American supply chains. Retaliation risks are particularly acute for S&P 500 companies with global exposure: 28% of S&P 500 revenues come from international markets, and prolonged trade wars could depress foreign sales.

Economic Uncertainty and Market Volatility

The U.S. Economic Policy Uncertainty Index (FED website link added for learning purposes) surged to 740 points early in March 2025, nearing levels last seen during the 2020 pandemic. Historically, such spikes correlate with a 3% contraction in the S&P 500’s forward price-to-earnings ratio as investors demand higher risk premiums. Trump’s inconsistent tariff implementation—delaying Mexican tariffs after negotiations but accelerating others—has exacerbated instability. Markets reacted sharply: the S&P 500 fell 3.1% in one week following tariff announcements, erasing all post-election gains.

Recession Fears and Sector-Specific Pressures

Tariffs have amplified concerns about a U.S. recession. By raising consumer prices and disrupting supply chains, they risk slowing economic growth—a fear reflected in the S&P 500’s 5% decline in fair value estimates under current tariff policies. Industries like technology (dependent on Chinese components) and agriculture (targeted by retaliatory tariffs) face acute pressure. For example, China’s tariffs on soybeans and pork disproportionately hurt rural economies, indirectly dragging down broader market sentiment.

Long-Term Structural Risks

Studies show tariffs fail to achieve their stated goals. MIT research found Trump’s 2018 steel tariffs did not revive U.S. steel employment but caused job losses in downstream sectors8. Similarly, the 2025 tariffs risk accelerating economic decoupling, as firms diversify supply chains away from the U.S. to avoid tariff risks. This structural shift could permanently reduce the competitiveness of S&P 500 multinationals.

Conclusion

In summary, Trump’s tariff strategy has destabilized equity markets by undermining corporate profits, provoking retaliation, and fueling macroeconomic uncertainty.

Overall we still at @PandorraResearch Team are Bearishly calling on further S&P 500 Index opportunities with further possible cascading consequences.

The S&P 500’s recent slump reflects investor recognition that tariffs act as a tax on growth—one with cascading consequences for both domestic industries and global trade dynamics.

--

Best 'Drill Baby, Drill' wishes,

@PandorraResearch Team 😎

A Huge Technical Re-Test of This Important TL Has Just Occurred!Trading Family,

Tariff FUD is recking traders rn. After breaking important support which started in Nov. '24, I knew the SPY was in trouble. My first target down was 563. We hit that and broke it. My second target down was 550. We are there right now! Will it hold? I don't know. TBH, I don't think any analyst that is honest knows. Investors have never seen Tariffs levied like they have been recently by the Trump admin. Noone really knows how this is going to impact the current economy, which is now global (big diff from the last U.S. tariff econ in the late 1800's).

But I can say that this is a big support which is the neckline of our large long-term Cup and Handle pattern started all the way back in Jan. of 2022! We did have one retest already. Usually, this is all that is needed. But apparently, the market wants another. Though the support is strong, remember, every time it is tagged, it weakens. Thus, if it can't hold this current downturn, I suspect it will drop hard from here should it break, possibly dropping all the way to 460. Be prepared for this and watch your trendline closely!

On the other hand, if it holds, I see a huge bounce incoming! We'll probably then go all the way back up to test the underside of that support (red with two with lines) that we broke. Hold on to your hats! We are living in unprecedented times with unprecedented market volatility.

The last item to note is that, once again, this all seems to be occurring at the same time that U.S. congress and senate are voting on a continuing resolution. Correlation does not necessarily equal causation however, in this case, I would suggest that should a U.S. gov't shutdown occur, our support will break and down we'll go. Should a CR pass, big bounce incoming. Stay tuned and watch the news closely for this. It seems to be a news driven event.

✌️ Stew

Indian market cannot go bullish until RUPEE becomes strong !a lot of analysts saying Dollar is going to week vs rupees but seeing technical chart, dollar is traded above 50 EMA and never come to touch since October. currently Dollar completed Symmetrical Pattern showing any upcoming momentum may happen, either bullish or bearish is just could say after seeing breakout/breakdown this pattern. To gain strength in Rupee it is required to give USDINR 50EMA breakdown or bearish crossover. Till then the rupee will remain weak and Indian stock market also.

S&P, NASDAQ, DOW JONES Weekly Market Forecast: Mar 10-14 In this video, we will analyze the S&P 500, NASDAQ, AND DOW JONES Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

Markets have been bearish due to mixed numbers employment, Fed statements, and uncertainty in US trade policies. Are the markets poised for a bounce back week? Perhaps. Traders will need to exercise patience before jumping in these volatile markets, waiting for the proper confirmations before we determine a bias. Once the markets tip their hand in that way, we can take advantage.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.