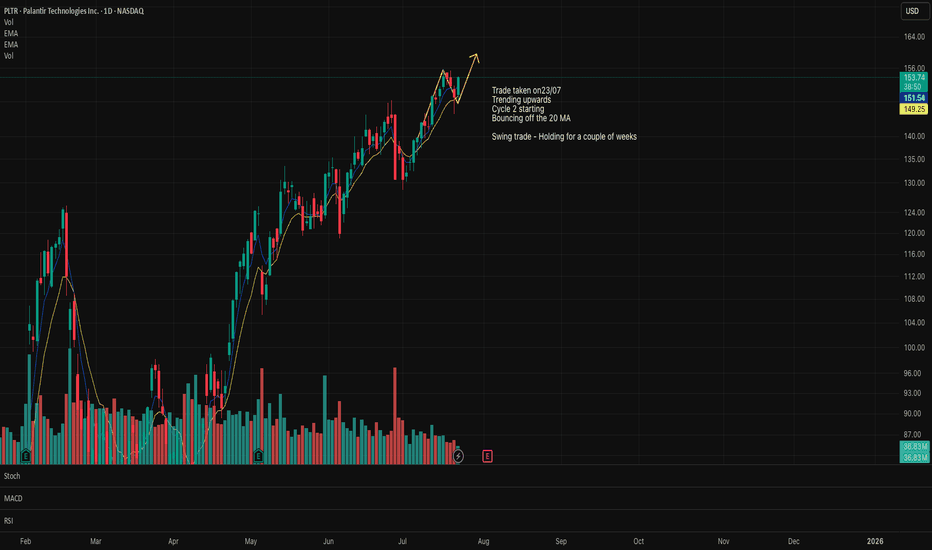

PLTR moving higherPLTR expected to move higher.

The price is bouncing off the 20MA and respecting it.

Making new higher/highs and higher lows.

Earnings is due shortly, which could have a negative impact to the price.

However, the long term outlook for the company is still strong.

Anyone else have thoughts on this stock?

Stockpicking

Discovering profitable stocks for intraday trading █ Discovering profitable stocks for intraday trading: Simplifying the BeSt System

Intraday trading style capitalizes on the market's daily fluctuations to generate profits, appealing to traders seeking quick returns. However, the rapid pace and high associated volatility require precise decision-making and a deep understanding of market dynamics. For intraday traders, the key to success lies in predicting market movements and identifying stocks that offer the best potential for profit within a limited timeframe. The BeSt system , short for Best Stock Finder, is a pioneering approach that uses data analysis to pinpoint promising stocks for daily trades. This article explores how this system works and what it means for the everyday trader.

The primary goal of this research is to unearth effective strategies for selecting stocks that are most likely profitable for intraday trading.

The relevance of this study is particularly pronounced in the current market environment, characterized by heightened volatility and increased trading volumes. These conditions heighten the risks associated with intraday trading and open up new opportunities for savvy traders.

█ Understanding the BeSt System

At its core, the best system employs a sophisticated blend of regression and sequence mining techniques to analyze historical stock data. By examining patterns in stock price movements and predicting future trends, the system identifies stocks most likely to experience significant price changes within the same trading day.

⚪ How Does the BeSt System Work?

Regression Techniques: These algorithms predict future price variations by analyzing historical price data. The stocks showing the highest potential for price fluctuations are highlighted as prime candidates for trading.

Sequence Mining: This method goes beyond simple price predictions by looking for recurring sequences in stock performance. It identifies patterns indicating which stocks are likely to perform well, based on their historical sequence of returns.

Weighted Sequences: By assigning different weights to stock occurrences based on their profitability, the system prioritizes stocks that have consistently shown higher returns following specific patterns.

⚪ Simplifying How the BeSt System Works

Predicting Price Changes: At its heart, the system uses past stock price movements to forecast future activity. Imagine being able to predict a stock’s price rise before it happens—that’s what this system aims to do.

Finding Patterns: Beyond predictions, the BeSt system looks for patterns in how stocks have performed over time, identifying which stocks are likely to do well together or in sequence. This helps in anticipating market movements.

Prioritizing Profitable Stocks: Not all stocks are treated equally; the system prioritizes those that have historically provided better returns following certain patterns.

█ Conclusion: For intraday traders, the BeSt system offers a promising tool that enhances profitability and provides a deeper understanding of market dynamics. Turning complex data into actionable trading insights represents a significant step forward in the quest for optimal trading strategies. As technology and data science continue to advance, the BeSt system is well-positioned to become an indispensable part of every trader's toolkit.

█ Methodology

⚪ Regression Techniques These algorithms predict the value of continuous variables based on the analysis of historical data.The goal is to predict the daily percentage variation in the price of a stock on the next trading day by analyzing the historical prices of market stocks on the preceding days. Stocks with the maximal predicted variation are recommended as the most tradeable on the subsequent trading day.

Data Preparation: The historical price data of various stocks are collected, focusing primarily on daily percentage variations in stock prices.

Model Training: Regression algorithms are used to create predictive models. These models analyze the historical prices and try to forecast the price movements of the stocks for the next trading day.

Stock Selection: Stocks predicted to have the highest percentage variation in their prices the next day are flagged as potential candidates for trading. This prediction is based on the regression model’s output, which calculates the expected price change from one day to the next.

⚪ Sequence Mining This involves the use of unsupervised data mining techniques to discover recurrent sequences of items in large datasets. In this context, items are stocks, and the time stamps correspond to the closures of consecutive trading days. A sequence is an ordered list of itemsets, where an itemset is a set of items occurring at a given time stamp. Given the best-performing stocks on past and current trading days, a sequence indicates that if an arbitrary set of stocks is in the top list on preceding days, a given stock is likely to occur in the top list on the next day. Weighted sequences, rather than traditional ones, are used to weigh differently the occurrences of different stocks on the same trading day according to their daily profits.

Data Handling: The process starts with collecting historical stock data, particularly focusing on the closing prices across consecutive trading days. This data is then prepared into a sequence format where each sequence represents the ordered list of stock performances over multiple days.

Mining Process: Using sequence mining algorithms, the system searches for common patterns or sequences in the stock data. These patterns reveal which stocks frequently perform well in sequence—meaning if certain stocks are performing well today, which stocks are likely to perform well tomorrow based on historical patterns.

Weighted Sequences: To refine the selection, the concept of weighted sequences is applied. This approach gives different weights to the occurrences of stocks based on their profit performances on particular days. For example, if a stock consistently shows higher gains than others on specific days following certain trends, it will be weighted more heavily in the predictive model.

Stock Recommendations: The system identifies sequences with the highest recurrence and profitability. Stocks appearing in these sequences are recommended for trading. These stocks are expected to perform well in the short term, aligning with intraday trading goals.

█ Data Set Used

The data set used for this study consisted of a broad range of stocks across various sectors, including technology, finance, and consumer goods. To ensure the reliability of the data, the study focused on stocks listed on major exchanges like the NYSE and NASDAQ.

█ Key Findings

High Profitability: The BeSt system outperforms traditional stock selection methods like Support Vector Machines, Linear Regression, and random selection strategies. The sequence-based strategies used by BeSt, in particular, have proven to yield higher profits, demonstrating the system's ability to effectively identify the most promising stocks for intraday trading.

Effective Trend Capture: The system is highly adept at identifying underlying trends in stock price movements. This capability allows traders to make informed decisions based on a solid analysis of historical data, ensuring that trades align with the most likely future movements of the market.

[* ]Scalability: The BeSt system can handle large datasets efficiently, making it suitable for analyzing the numerous stocks listed on major stock exchanges. This scalability is crucial for intraday traders who need to quickly sift through vast amounts of data to identify trading opportunities.

Interpretability of Results: Unlike many other data-driven trading systems, the BeSt system provides interpretable results. This feature is particularly beneficial for traders who prefer to understand the logic behind the recommended trades. The system's transparency helps build trust and allows users to learn from the system's insights.

█ Practical Applications

Even if you don’t have access to the BeSt system itself, understanding its principles can improve how you approach trading:

⚪ Look for Patterns: Start tracking how certain stocks perform in relation to each other and over various days. You might begin to notice patterns that can guide your trading decisions.

⚪ Use Available Tools: Many trading platforms offer basic tools for analyzing stock trends and predicting movements. Use these to start making more informed decisions.

█ Limitations

While the findings of this study are valuable, they come with limitations that traders should consider. The study focused on large-cap stocks listed on major exchanges, which may not apply to smaller-cap stocks or those on less liquid markets. Additionally, the historical data may not fully account for the market's future conditions as market dynamics continually evolve.

█ Reference

Baralis, E., Cagliero, L., Cerquitelli, T., Garza, P., & Pulvirenti, F. (2017). Discovering profitable stocks for intraday trading. Information Sciences, 405, 91-106.

-----------------

Disclaimer

This is an educational study for entertainment purposes only.

The information in my Scripts/Indicators/Ideas/Algos/Systems does not constitute financial advice or a solicitation to buy or sell securities. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on evaluating their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My Scripts/Indicators/Ideas/Algos/Systems are only for educational purposes!

CSCO Cisco Systems Options Ahead of EarningsIf you haven`t sold CSCO here:

Or reentered here:

Then analyzing the options chain and the chart patterns of CSCO Cisco Systems prior to the earnings report this week,

I would consider purchasing the 53usd strike price Calls with

an expiration date of 2023-8-18,

for a premium of approximately $1.77.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

FSLY Fastly Options Ahead of EarningsIf you haven`t sold FSLY Head and Shoulders bearish Chart Pattern here:

Then analyzing the options chain and the chart patterns of FSLY Fastly prior to the earnings report this week,

I would consider purchasing the $17.50 strike price Calls with

an expiration date of2023-9-15,

for a premium of approximately $1.97.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Weekly stock pick #2 #SHLX My 2nd stock pick for the week. I like the macro fundamentals long-term and he TA set up here to buy and hold for awhile.

Please follow and like and ill start doing these weekly. Whenever I take a position.

NYCB - Swing Trade

Buying in now at $12.59

Sell at $14

New York Community Bancorp is trading below fair value. I anticipate when tech stocks make reversal we will see bank stocks gain more steam as investors swing back into more value stocks.

RSI is at ideal level, and Squeeze Indicator is showing good momentum.

Big Winners For Monday 8/30/21 According To My AIThe below is a list of the top estimates for tomorrow according to my AI program and I have included the estimate as well as the score that my AI has assigned to each pick. The higher the score, the more confidence has in the pick. I made SNTG the default chart just because it was the first pick on the list. For those of you who have been following my posts on here, I only post these when I do a big update and to also show you guys the progress of how the AI is getting smarter each time. A bit of a humble brag though is that I showed a bit of my process to John Ehlers and he approved so I'm happy about that. Feel free to share your thoughts and I will update these with the actual amounts at the end of Monday!

NASDAQ:SNTG

Score: 3838

Est: 7.78

EstPct: 50.38

NASDAQ:ADVM

Score: 1393

Est: 4.03

EstPct: 67.77

NASDAQ:STIM

Score: 1378

Est: 18.05

EstPct: 171.32

AMEX:FURY

Score: 909

Est: 4.13

EstPct: 450.79

NASDAQ:KPTI

Score: 454

Est: 7.58

EstPct: 35.70

NASDAQ:APRE

Score: 392

Est: 4.83

EstPct: 13.12

NASDAQ:QLGN

Score: 374

Est: 1.54

EstPct: 16.30

NASDAQ:EVFM

Score: 324

Est: 1.10

EstPct: 38.76

NASDAQ:ASMB

Score: 267

Est: 4.12

EstPct: 10.77

NASDAQ:VECT

Score: 246

Est: 8.31

EstPct: 17.42

What is Stock Valuation ? Stock Valuation

━━━━━━━━━━━━━

The actual price of a stock is determined by market activity. When making the decision to buy or sell, the investor will often compare a stock’s actual price to its fair value. For example, if a stock is trading at $30 per share and its fair value is $35, it may be worth purchasing. Conversely, if it trades at $30 but its fair value is $25, the stock would be considered overvalued and the investor would be wise to avoid it. What is a stock’s fair value and how do you calculate it? Ideally, it would be based on some standardized formula. However, there are many ways to derive this figure. One method is to combine the value of a company’s assets on its balance sheet, minus depreciation and liabilities. Another is to determine its intrinsic value, which is the net present value of a company’s future earnings. We have briefly discussed two methods. There are a number of others. Because the methods yield a slightly different result, it’s sometimes difficult to know if a stock is overvalued, undervalued, or fairly valued. And even if it is overvalued, that doesn’t mean investors will suddenly sell and the price will fall.

Closing of $103.5 Million Upsized Initial Public OfferingLMF Acquisition Opportunities, Inc. Announces Closing of $103.5 Million Upsized Initial Public Offering, Including Full Exercise of the Overallotment Option

the closing of its upsized initial public offering of 10,350,000 units, which included the full exercise of the underwriters' over-allotment option, at a price of $10.00 per unit.

Each unit consisted of one share of Class A common stock and one redeemable warrant, each warrant entitling the holder thereof to purchase one share of Class A common stock at a price of $11.50 per share.

finance.yahoo.com

Understanding range highs and lows are all you need. #stocksBack on October 27th I made a post highlighting a potential reversal as we approached the range lows from back in June. Over the future months the stock tested the lows, found support, and is not heading toward highs. Range highs and lows and major support and resistance areas have value because they indicate where there is likely to be heavy order flow. In this case it AMGN reacted well and held the lows creating a great risk/reward opportunity.

AVAV to Acquire Arcturus UAV, Expanding Product PortfolioAeroVironment to Acquire Arcturus UAV, Expanding Product Portfolio and Reach into Group 2 and 3 Unmanned Aircraft Systems Segments

Total transaction value of $405 million in cash and stock, including $355 million in cash and $50 million in AeroVironment stock.

Arcturus UAV has a demonstrated track record of solid performance, with topline growth exceeding 20 percent for each of its last two fiscal years.

Arcturus UAV’s complementary capabilities provide program diversification, increase key customer penetration and enhance shareholder value

Arcturus UAV is well positioned for ongoing United States Special Operations Command (USSOCOM) Mid-Endurance UAS (MEUAS) task orders, United States Army Future Tactical UAS (FTUAS) program delivery orders and international contracts

Expected to be immediately accretive to revenue growth, adjusted EBITDA margin and non-GAAP diluted EPS, excluding intangible assets, amortization expense and deal and integration costs, and accretive to GAAP diluted EPS by fiscal year 2022

Group 2 and 3 UAS and services, collectively, potentially represent more than one billion dollars in annual contract value, according to an independent forecast.

The Arcturus UAV team has produced strong growth in recent years and has secured strategically important wins in the MEUAS and FTUAS programs, positioning Arcturus as a leader for next-generation program requirements

In connection with the acquisition, AeroVironment has received commitments for a $200 million Term Loan Facility and $100 million revolver (undrawn at close) with Bank of America, N.A. acting as Administrative Agent, and with BofA Securities, Inc., JPMorgan Chase Bank, N.A. and U.S. Bank National Association acting as arrangers. AeroVironment will fund approximately $155 million of the acquisition from cash on hand.

finance.yahoo.com

GOOS stock price march towards 36$~42$I'm thirst for GOOS stock below 30$.

It's better that GOOS fall below 30$, I'll buy more GOOS.

GOOS stock price seems like hardly being cheap, so buying GOOS within 32$~31$ is OK.

Safe long price: 30.67 / 29.93 / 29.6 / 28.81

Stop-Loss price : 28.61

stock analysis by Jiucai334

13 Jan 2021

Why CNET 3D-Printing Stock Soared YesterdayShares of 3D-printing companies rose sharply on Thursday after 3D Systems (NYSE:DDD) reported blockbuster preliminary results for the fourth quarter.

This news has given investors hope that other companies in the sector will report similarly strong results.

in the first three quarters of 2020, Stratasys's total revenue fell by more than 20% year over year.

The strong preliminary results from 3D Systems are sparking investor optimism that the 3D-printing industry is about to come roaring back as manufacturing activity picks up and economies start to recover from the havoc caused by the pandemic.

www.fool.com

SOS to Expand into Digital Assets Security IndustryDr. Huazhong (Eric) Yan A Renowned Cryptocurrencies Security Expert Joins SOS to Spearhead SOSs Effort to Expand into Digital Assets Security Industry

Dr. Yan is expected to utilize his cryptocurrency mining, protection, insurance expertise and his industry resources to lead SOS's efforts to set up a new business to apply blockchain-based security and insurance technologies in the safeguard of cryptocurrencies and digital assets, and strategically upgrade SOS's existing portfolios of products and services. SOS plans to set up a new wholly owned subsidiary SOS Digital Technologies Inc., to be led by Dr Yan.

SOS anticipates to utilize the new subsidiary to be spearheaded by Dr. Yan to provide the infrastructure services in blockchain security for its big data insurance marketing and rescue services, and even providing insurance and banking services for digital assets and cryptocurrencies.

Dr Yan has applied seven patents in China related to decentralized cryptocurrency wallets and exchanges, the protections and insurance for digital assets and cryptocurrencies, and blockchain-based security framework and solutions.

The truly decentralized cryptocurrency wallet and exchange technologies developed by Dr Yan have been proven to be bullet-proof. Once SOS Digital Technologies Inc is created, SOS plans to launch the first digital assets insurance company and the first cryptocurrency bank in the world, backed up by Dr Yan's technologies.

This venture is urgent as about 20% of cryptocurrencies are stolen or lost every year. Such venture is highly necessary as DCEP, the sovereign cryptocurrency offered by the central Bank of China, is in its testing stage and other sovereign cryptocurrencies are coming soon."

finance.yahoo.com

The Peck Company Holdings to Acquire iSun Energy LLCThe Peck Company Holdings to Acquire iSun Energy LLC, Award-Winning Solar-Powered Electric Vehicle Infrastructure Provider and Clean Energy Product Innovator

Accretive acquisition with $2M near-term revenue commitments, 30-40% project gross margin and a software platform for recurring energy service revenues.

Combining Peck’s profitable EPC business for solar, data and electrical contracting with award-winning products and platforms that are modular, scalable and connected is a powerful combination that differentiates the company from other solar EV charging companies.

iSun Energy near term pipeline is in Connecticut, Massachusetts, New York and other locations, to be announced shortly.

Timely market expansion capitalizes on the Biden administration’s plan to make major public investments in renewables and electric mobility infrastructure, including in 500,000 electric vehicle charging stations.

Industry experts anticipate 100 GWs of solar infrastructure will be constructed over the next 5 years, representing 50% growth.

finance.yahoo.com

Stifel analyst with a buy rating and $13.25 price targetThe miner of material for batteries received some positive analyst coverage Tuesday night, with a price target still above where shares closed today.

Yesterday, Stifel analyst Anoop Prihar initiated coverage of Lithium Americas with a buy rating and $13.25 price target. That represents another 7% potential on top of today's bounce.

The latest coverage comes as the Canadian miner continues to advance development of lithium projects in Argentina and in Nevada.

The Stifel analyst cites its growth in those projects as a move toward becoming one of the largest global lithium suppliers. Though Prihar says that the stock offers "attractive upside potential" from its growth strategy, investors should note that the Nevada project won't be operational until at least 2024.

But the Thacker Pass project in Nevada should reinforce the battery supply chain domestically . In October, President Trump signed an executive order declaring a national emergency in the mining industry , saying it was "particularly concerning" that the United States imports 80% of its rare-earth elements directly from China.

The order also stated that the "United States must broadly enhance its mining and processing capacity." Long-term investors are looking to companies like Lithium Americas to supply those needs.

www.fool.com

Lithium Americas earned $0.07 in the third quarter, compared to $0.06 in the year-ago quarter.

BARK to List on NYSE Through Merger with STICBARK, A Leading Brand for Dogs, to List on NYSE Through Merger with Northern Star Acquisition Corp.

BARK serves over 1 million dogs monthly through BarkBox and Super Chewer subscriptions and broad retail distribution of its comprehensive suite of best-in-class, proprietary products

projected revenues of approximately $365 million and gross margins of approximately 60% for fiscal year ending March 31, 2021, 179% YoY increase in revenue from new product lines in first half of FY2021, and net revenue CAGR FY2020-FY2023 of over 40%

Transaction values BARK at an enterprise value of approximately $1.6 billion and is expected to provide up to $454 million of gross cash proceeds to invest in the acceleration of new and existing product lines as well as international expansion

Top-tier institutional investors, including Fidelity Management & Research Company LLC, Senator Investment Group, the Federated Hermes Kaufmann Funds, and affiliates of the Santo Domingo Group, among others, are supporting the transaction with an upsized $200 million fully-committed PIPE

The Northern Star and BARK Boards of Directors have unanimously approved the proposed merger and the related transactions, which are expected to be completed early in the second quarter of 2021,

www.prnewswire.com

500.com Limited Announces Private Placement500.com Limited Announces Private Placement and Appointment of New Officers

500.com Limited (NYSE: WBAI) ("500.com" or the "Company"), an online sports lottery service provider in China, today announced that it has entered into a definitive share subscription agreement (the "Agreement") with Good Luck Information Technology Co., Limited ("Good Luck Information"), a company incorporated in Hong Kong, for the issuance and sale of newly issued Class A ordinary shares of the Company ("Class A Shares").

Pursuant to the Agreement, Good Luck Information will purchase 85,572,963 newly issued Class A Shares for a total purchase price of approximately US$23 million, to be settled in U.S. dollars or in crypto-currencies, including Bitcoin (BHC), to be determined chosen by the Company within one month of the date of the Agreement. Good Luck Information shall make full payment of the purchase price in currencies determined by the Company within one month of the Company's determination. The per share purchase price of US$0.269 is the closing trading price of the Company's ADSs on December 18, 2020, the last trading day immediately preceding the date of the purchase agreement. as adjusted by a 1-to-10 ADS to ordinary shares ratio.

Good Luck Information has agreed to subject all the shares it or its affiliate will acquire in the transaction to a contractual lock-up restriction for 180 days after the closing. The closing is expected to take place on or before February 20, 2021, upon satisfaction of customary closing conditions.

Good luck Information is controlled by Mr. Man San Vincent Law, a founder of the Company, who currently holds less than 5% of the Company's outstanding share capital. Upon closing, Good Luck Information will hold 16.6% of the Company's issued and outstanding ordinary shares.

finance.yahoo.com

AvePoint going public via merger with blank-check company ApxtAvePoint, the Largest Microsoft 365 Data Management Solutions Provider, Announces $2bn Merger.

- Transaction includes a fully committed PIPE of $140 mm anchored by top-tier investors

-Has entered into a definitive business combination agreement

- the combined company will be named AvePoint and will remain a publicly traded company listed on the Nasdaq Stock Market under a new ticker symbol, "AVPT."

- In addition to the approximately $352 million held in Apex’s trust account as of September 30, 2020, assuming no redemptions by Apex’s public stockholders, the combined company will benefit from $140 million in proceeds from a group of institutional investors participating in the transaction through a committed private investment ("PIPE").

- The transaction, valuing the combined company at an equity value of approximately $2 billion on a pro forma basis after giving effect to the PIPE and assuming minimal Apex stockholder redemptions, is expected to close in the first quarter of 2021. Upon completion of the proposed transaction, existing AvePoint shareholders are expected to own

- approximately 72% of the combined company, which is expected to have approximately $252 million of cash on the balance sheet assuming no redemptions by Apex’s public stockholders.

finance.yahoo.com

Bft spac company and Paysafe Announce MergerFoley Trasimene Acquisition Corp. II and Paysafe, A Leading Global Payments Provider Focused on Digital Commerce and iGaming, Announce Merger

Transaction values Paysafe at pro-forma enterprise value of $9 billion upon consummation of transaction ~

~ Transaction Includes a $2.0 Billion Fully Committed PIPE from Investors including a $500 million investment from Fidelity National Title Insurance Co., Chicago Title Insurance Co., Commonwealth Land Title Insurance Co. and Fidelity & Guaranty Life Insurance Co., and a $350 million investment from Cannae Holdings, Inc. Other institutional investors include Third Point LLC, Suvretta Capital Management, Hedosophia and the Federated Hermes Kaufmann Funds ~

- Upon closing of the transaction, the newly combined company (the "Company") will operate as Paysafe and plans to list on the New York Stock Exchange (NYSE) under the symbol PSFE.

- The balance of the consideration will consist of equity in the combined company. Existing Paysafe equity holders, including Blackstone, CVC and management, will remain the largest investors in the Company.

- The transaction is expected to close in the first half of 2021.

www.businesswire.com stock