From Market Underdog to Tech Titan| AppLovin’s Explosive Growth AppLovin: Making Ads Great Again, One Algorithm at a Time

AppLovin Corp, a prominent software company valued at $57 billion, offers an advanced mobile marketing platform. Over the past year, its stock price has surged by an impressive 500%, far outpacing the S&P 500’s 39% increase. The company’s financial growth is equally remarkable, with a year over year revenue boost of 40%, a 188% jump in operating profits, and a 300% surge in net income in its latest quarterly report

With 40% of the company held by insiders and a shareholder friendly stance that includes share buybacks, AppLovin presents a compelling investment opportunity. Additionally, its valuation remains competitive relative to other software companies, supporting my "buy" rating.

From Ad Nerds to Tech Lords, AppLovin’s Secret to Winning Over Wall Street

AppLovin operates a comprehensive software platform that helps clients achieve crucial KPIs, such as revenue growth and business expansion. Leveraging AI, its software platform stands out as a powerful tool for advertisers, providing capabilities like automated marketing, customer engagement, and monetization. It’s built to optimize targeted content delivery to the most suitable audience, supported by analytics and monetization features that drive maximum value.

At the core of AppLovin’s technology is AXON, an AI engine that powers AppDiscovery. This feature matches advertiser demand with publishing opportunities through a sophisticated real-time auction algorithm, shifting from traditional waterfall systems to an intelligent, programmatic approach.

AppLovin has positioned itself as a leader in the future of advertising, driven by its cutting-edge AI capabilities. I believe there’s immense growth potential here that the company is just beginning to explore.

Performance

In the third quarter, AppLovin reported a 39% year-over-year revenue increase, moving from $864 million to $1.2 billion. This marks its highest-ever quarterly revenue and extends its streak of sequential topline gains to seven quarters. For the first nine months of 2024, AppLovin saw a 43% year-to-date revenue increase, largely fueled by a 76% rise in software platform revenue. This growth was driven by AppDiscovery, whose installations surged by 39% in Q3, underscoring its strong appeal to advertisers.

Beyond software platform growth, AppLovin’s in-app purchases and advertising revenues also increased modestly by 3% and 7%, respectively, despite challenging comparisons, supported by a 53% boost in advertising impressions.

The company achieved record operating cash flows of over $550 million in Q3, alongside significant margin improvements across gross, operating, and EBITDA levels. These gains highlight the company’s explosive growth and underscore the stock’s 500% rise over the past year.

Given AppLovin’s strategic success and positive advertiser response, I anticipate ongoing improvements in cash flow and profit margins. With over $3.3 billion spent on share buybacks since 2022—$980 million in 2024 alone—the company continues to reward its shareholders while capitalizing on its profitable AI-driven platform.

Valuation

Although APP’s trailing P/E ratio of 74.52 and PS ratio of 19.33 might appear high compared to the IT sector averages, a comparison with peers in the Application Software industry reveals a different perspective.

In a peer group of large software companies, APP ranks third in EV/Sales ratio at 18.65 but also boasts a forward topline growth rate of over 24.1%, placing it among the top performers. This high growth potential appears to justify the stock’s premium, positioning it attractively in terms of PS ratio relative to anticipated growth.

Despite recent heavy buying, APP remains an appealing value investment. As long as it maintains its relative positioning, I continue to view the stock favorably.

Risks

Despite my optimism, I recognize that AppLovin’s momentum could be part of a broader AI-driven market surge, raising concerns about a potential AI bubble. If the market faces a downturn similar to the dot-com bubble, APP could experience a sharper decline than its peers, especially given its relatively weak balance sheet.

Additionally, with an RSI of 96 signaling heavy overbuying, there may be potential for a future correction. While APP’s 500% rise is impressive, it could be vulnerable if the market undergoes a broader correction

Conclusion

Advertising is on the cusp of an AI driven transformation, and AppLovin is well-positioned to capitalize on this shift with its powerful AI-enabled platform. Despite the stock’s impressive 12-month performance, there’s still significant growth potential

Stockpicks

How Ride the AI Wave in 2025 | Top AI Stocks The AI boom is still making waves on Wall Street

Over the past 15 months, investors have injected more than $ 5 billion into tech sector funds. This surge was fueled by three consecutive interest rate cuts by the Federal Reserve in 2024, coupled with Donald Trump's presidential victory, which led investors to pour over $140 billion into the stock market, hoping tax reforms would boost corporate profits. A significant portion of this activity has been driven by the growing interest in artificial intelligence, with AI driven companies leading a remarkable 25% rally in the S&P 500 this year. Nvidia (NVDA), a key player in the AI sector, has soared 149% in the past year, while major tech firms like Microsoft (MSFT) and its collaboration with OpenAI, and Google’s (GOOG) Gemini project, have also contributed to the rise in stock prices.

The AI market is expected to expand from approximately $540 billion last year to over $1.8 trillion by 2030, with a projected compound annual growth rate (CAGR) of 20% through 2032. In the final weeks of his presidency, Joe Biden's administration introduced new regulations to block the export of US-made semiconductors to adversarial nations, including Russia and China. This move is part of the ongoing AI arms race, with the US aiming to maintain its lead in manufacturing the chips essential for powering AI technology.

AI Stocks: The Only ‘Bubble’ You Want to Be In

North America held the largest share of the global AI market in 2023, accounting for nearly 37%. Europe, Asia Pacific (APAC), and Latin America followed with shares of 25.5%, 24%, and 13.6%, respectively.

Whoever controls AI holds the power and the same is true in the corporate world. AI related stocks, such as Palantir Technologies (PLTR) and Nvidia, delivered triple digit returns and led the market in 2024. Growing investor interest has also made it easier to trade AI focused exchange-traded funds (ETFs), which offer exposure to broader industry themes rather than individual companies. However, performance can vary.

For instance, the Defiance Quantum ETF (QTUM) and the Invesco Semiconductors ETF (PSI) have shown comparable results since 2020, consistently outperforming the broader market.

Meanwhile, the iShares Future AI & Tech ETF (ARTY) has underperformed compared to the S&P 500. So, how can you identify the top AI stocks when certain ETFs are lagging? This is where the Quant Rating System comes in. Quant Ratings combine proprietary computer processing technology with "quantamental" analysis, allowing you to filter out the noise and focus on AI stocks with strong fundamentals that are expected to grow earnings at an above average rate.

Leading AI Companies Worldwide

Major tech giants like Amazon (AMZN), Google, Apple (AAPL), Meta (META), Microsoft (MSFT), and IBM (IBM) have invested billions into AI research to secure a dominant position in this highly profitable space. Whether it's backing high-potential startups like MSFT’s $11 billion stake in OpenAI, or supplying crucial AI hardware such as Nvidia's (NVDA) graphic processing units (GPUs), these companies are striving to stay ahead of competitors.

While generative AI tools like ChatGPT are undeniably shaping the global economy, the potential for significant returns from AI stocks is more nuanced. For instance, Palantir Technologies (PLTR) has dropped over 20% from its all-time high in December, receiving a "hold" rating from Seeking Alpha's Quant system and analysts across Wall Street as of January 9, 2025. Even Nvidia, despite a strong performance in 2024, has seen its stock show signs of stagnation. Other AI stocks are showing signs of potential overvaluation. For example, SoundHound AI (SOUN) recently dropped more than 16%, with analysts highlighting concerns over its unsustainable valuation given its weak fundamentals.

2025 Top AI Stocks

The hype in Silicon Valley can make it challenging to distinguish between AI stocks with long-term potential and those that are overhyped

Our data driven Quant system uses advanced computer processing and proprietary algorithms to analyze thousands of stocks in real time across a range of metrics like value, growth, profitability, EPS revisions, and momentum. To find the top performing AI stocks, I analyzed securities from three leading AI focused ETFs Global X Robotics & Artificial Intelligence ETF (BOTZ), Robo Global Robotics and Automation Index ETF (ROBO), and Global X Artificial Intelligence & Technology ETF (AIQ). From this analysis, I selected six top-performing stocks—three largecap and three small-to-medium-cap (SMID)—which represent the diverse opportunities in the AI space. These stocks, both from tech companies providing AI solutions and non-tech firms utilizing AI to enhance productivity, boast an average levered free cash flow margin of about 18.6% and have returned an average of 60% more than the past 12 months.

1. Twilio Inc

Market Capitalization $16.6B

Twilio, a cloud communications company, has returned nearly 51% over the past year and ranks second in the Top Internet Services and Infrastructure sector, just behind Kingsoft Cloud Holdings. The company’s growth has been driven by stronger revenues, reduced losses, increased cash flow, and the completion of a high-profile ETF investor Cathie Wood’s stake sale. Twilio’s strong Q3’24 earnings suggest it’s well-positioned to capitalize on the growing AI trend well into 2025, with its stock more than doubling since May.

Like many cloud computing companies, Twilio, based in San Francisco, gained prominence during the COVID-19 pandemic but initially struggled with high expenses and slow revenue growth. However, the surge in demand for generative AI, particularly through Twilio's CustomerAI platform which leverages large language models (LLMs) and natural language processing (NLP) to analyze customer data has played a key role in its remarkable recovery.

TWLO Revisions, Momentum, and Valuation

Over the past 90 days, Twilio has seen a remarkable 23 upward revisions to its earnings per share (EPS) and 27 revisions to its revenue projections from analysts, signaling a strong financial rebound. This turnaround is reflected in its ‘A’ Momentum Score, with six-month and nine-month price performances of 93.5% and 81.3%, respectively—both figures vastly outperforming the sector medians by over 1000%. As a result, Twilio has nearly doubled the performance of the S&P 500 in recent months.

Twilio also demonstrates solid growth prospects, with a forward EBITDA growth rate of 50.6% (783% higher than the sector median), year-over-year operating cash flow growth of 520.8% (3,348.45% above the sector median), and an impressive levered free cash flow margin of 107% (603% above the sector median). However, its average forward price-to-earnings (P/E) ratio of 30x indicates that Twilio trades at a premium compared to its peers, nearly 20% higher than the sector median.

2. Celestica Inc

Market Capitalization $12B

Celestica has seen a remarkable 255% increase in its stock price over the past year, driven by its strategic pivot toward AI infrastructure manufacturing. The company has carved out a niche in producing networking switches for data centers, and its Connectivity & Cloud Solutions segment, which makes up 67% of total revenue, has grown 42% year-over-year as tech companies invest more in AI-powered data centers. Its Q3 '24 results highlighted a 22% increase in revenue to $2.5 billion and record adjusted EPS of $1.04.

CLS Valuation, Momentum, and Growth

Celestica stands out for its attractive valuation, even with impressive returns in 2024. With a forward price-to-earnings growth (PEG) ratio of 0.87, the stock appears undervalued compared to its peers. It boasts an ‘A+’ Momentum Grade, having received six upward EPS revisions and eight revenue revisions from analysts in the past 90 days. Its Growth Grade has improved significantly, rising from ‘C+’ to ‘B+’ due to forward EPS growth of 49% and year-over-year diluted EPS growth of 88%, both significantly outperforming the sector median.

3. DocuSign

Market Capitalization $18.3B

DocuSign, known for its electronic signature services, has embraced AI in innovative ways, particularly by adding new AI features to streamline contract agreement processes. These AI-driven tools have helped the company’s stock surge more than 21% following its impressive Q3 '24 earnings, and the growth trajectory is expected to continue in 2025 as DocuSign expands into new markets, both domestically and in Europe. As SA Analyst Noah’s Arc Capital Management notes, DocuSign's AI features have proven invaluable for businesses, simplifying the often complex task of reviewing and managing contracts.

DOCU Growth, Valuation, and Profitability

DocuSign has demonstrated exceptional growth, including an ‘A+’ EBIT growth rate of 239.21% (10,710% above the sector median) and year-over-year diluted EPS growth of 1,852.2% (24,971% higher than its peers). While its overall ‘C+’ Growth Score is somewhat tempered by a low forward return on equity growth forecast of -29.58%, the company’s valuation looks compelling. Its trailing and forward P/E GAAP ratios of 18.6 and 17.9 are 38.6% and 41.5% lower than the sector medians, suggesting that DocuSign's shares are undervalued. Furthermore, its ‘A+’-Rated PEG ratio of 0.01, a 99% difference from the sector median, points to a strong value proposition for investors.

4. FARO Technologies

Market Capitalization $478.2M

FARO Technologies, based in Lake Mary, Florida, specializes in 3D measurement technology and has leveraged AI to establish itself as a leader in "smart factories" and "intelligent automation." Its scanning technology has been instrumental in improving productivity and accelerating production timelines. The company has seen nearly 54% growth over the past six months, benefiting from the expanding global 3D scanning market, projected to grow to $11.85 billion by 2032 at a compound annual growth rate (CAGR) of 13.11%.

In Q3, FARO reported $0.21 of nonGAAP EPS, marking its sixth consecutive quarter of exceeding expectations. This success is part of the company’s strategic plan, which includes the launch of a new line of laser scanners.

FARO Growth and Valuation

FARO's growth metrics stand out, with forward EBIT growth of 112.48%, 1,410.71% higher than the sector median, and an astonishing year-over-year levered free cash flow growth of 24,214.19%, 164,037% above the sector median. The company's forward EBITDA growth of 42.76%, 639.9% higher than the sector median, indicates robust growth ahead.

FARO's stock is undervalued according to its metrics. It has an EV/sales ratio of 1.41, 59% lower than the sector median, and a price-to-book ratio of 1.9, 45% below the sector median, making it an attractive investment at its current valuation.

5. Proto Labs

Market Capitalization $897 M

Proto Labs, a Minnesota-based company, specializes in on-demand manufacturing solutions, enabling businesses to avoid the costs associated with stocking large quantities of products. Despite a recent dip of around 16% in share price, Proto Labs remains a promising investment due to its strong profitability and its impressive cash flow of $24.8 million in Q3 2024, the highest since its 2020 acquisition of 3D printing company 3D Hubs.

Proto Labs has also seen five upward revisions to its EPS and five to its revenue over the last 90 days, signaling stronger-than-expected growth prospects. The company is positioned to benefit from the strong sector tailwinds of the global print-on-demand market, which was valued at $6.18 billion in 2022 and is expected to grow at a CAGR of 25.8% through 2030.

PRLB Valuation

Proto Labs boasts an impressive long-term growth rate of 25%, 119% higher than the sector's 11.4%, and a year-over-year capital expenditure (capex) growth of 74.4%, significantly outpacing the sector's 4.3%. This suggests that Proto Labs is reinvesting a large portion of its cash back into its operations to fuel future growth.

The stock is fairly valued with a forward PEG ratio of 0.06, indicating that it is significantly undervalued compared to its peers, at a 49.3% discount from the sector. Its price-to-book ratio of 1.36 is also an attractive metric, 52.83% lower than the sector median. However, its ‘D’-rated forward and trailing P/E ratios of 39.9 and 48.8, respectively, reflect its recent price decline, leading to an overall Valuation Grade of ‘C’.

6. Freshworks

Market Capitalization $4.9 B

Freshworks, a cloud based SaaS company founded in India, is a strong candidate for a "buy the dip" opportunity. After a rough 2024, shares in Freshworks have begun to rebound, thanks to increasing demand for its AI-enabled software solutions. The company serves over 68,000 customers, including global brands like American Express, Shopify, and Airbus. Its Q3’24 financial results were filled with positive indicators:

- 22% YoY revenue growth to $186.6M

- 21% YoY increase in free cash flow

- Raised full year guidance

- Announced a $400M buyback plan

- Maintains a debtfree balance sheet with strong liquidity

Freshworks also announced a 13% reduction in headcount, which is expected to improve margins further, in addition to the impact of its share repurchase program. The company is poised to benefit from the booming AI SaaS market, which is projected to grow at a CAGR of over 30% by 2031.

FRSH Growth, Valuation, and Momentum

Freshworks boasts an impressive A-’ Growth Score, underpinned by its solid revenue growth and forward revenue expansion of 17.8%, a 221.8% difference from the sector median. The company also has a 3-5 year long-term CAGR of 27.5%, significantly outpacing the sector by 824.2%. Its year-over-year capital expenditure growth stands at 83.3%, signaling reinvestment in future growth.

In terms of valuation, Freshworks has a forward PEG of 1.51, suggesting that the stock is available at a slight discount to its peers. Similar to Proto Labs, its higher-than-average P/E ratios are likely due to its recent dip of around 9.3% over the past month. One of the standout features of Freshworks’ stock is its ‘A’ Revisions Score, which reflects 17 EPS upward revisions and 16 revenue upward revisions in the past three months.

As the AI frenzy continues to dominate Wall Street, some of the valuations of major AI driven companies may be edging into overinflated territory. However,so far my Quant System highlights six ‘Strong Buy’ stocks that still exhibit strong fundamentals. These companies have, on average, risen about 60% over the past year, showcasing strong bullish momentum and solid valuations. For investors looking to integrate AI into their portfolios without succumbing to the hype, these stocks present a promising opportunity

Which AI stock are you loading and why?

Atlassian | Transitioning from Server to Cloud & Now to AI Atlassian’s Secret to Success: Free Stuff, Fancy Upgrades, and Lots of AI

In 2020, Atlassian, the Australian software leader known for tools like Jira and Confluence, initiated its transition to a cloud-first model, phasing out its legacy Server business. This strategic pivot has reshaped its revenue model and driven significant growth.

Cloud Momentum

Atlassian’s Cloud revenue surged 31% year-over-year in Q1 FY25 to $792 million, surpassing investor expectations. The transition highlights the company’s agility and sustained expansion in a competitive market.

SaaS Growth Strategy

Atlassian employs a "land-and-expand" SaaS model, attracting customers with low-cost or free products and encouraging upgrades to premium features and additional solutions.

Key Highlights

-💻 300,000+ customers, including 84% of Fortune 500 companies, spanning software development, IT, and business teams.

- 🏢 524 enterprise customers generating $MIL:1M+ ARR, reflecting deeper engagement with large organizations.

-🤖 AI adoption: A 10x increase in Atlassian Intelligence usage this year has driven premium upgrades and enhanced productivity.

Innovation and Expansion

Atlassian continues to focus on product-led growth with recent launches like Atlassian Focus for enterprise strategy and Advanced Editions , offering premium features for existing tools.

Financial Perspective

-Profitability challenges: Q1 FY25 saw a $32 million operating loss (3% loss margin), a slight decline from last year. This is due to sustained R&D investments (51% of revenue, +2pp YoY), reflecting a long-term growth strategy over immediate profitability.

-Server phase-out: Ending the Server business has boosted cloud and data center revenue.

-Data Center growth: Revenue grew 38% YoY to $336 million, serving as a transitional solution for customers not yet ready for full cloud migration. Atlassian is positioning Data Center as a stepping stone rather than a permanent option.

Future Outlook

Atlassian is well placed to leverage rising demand for cloud based tools and AI advancements. However, challenges persist, including macroeconomic uncertainties, competition, and profitability pressures.

While generative AI offers new opportunities, it also presents risks such as increased competition and the potential slowing of paid seat growth, a critical revenue stream. Atlassian’s ability to navigate these challenges will determine its long-term success in this transformative phase.

TSLA Weekly: Bullish BreakoutTesla's weekly chart showcases a bullish breakout from a symmetrical triangle pattern. The RSI on the same timeframe remains supportive, adding weight to the potential for price increases. This is a promising technical setup, but a major event looms – earnings on Tuesday after the market closes. The post-earnings price action will be crucial in determining Tesla's next move. Stay tuned!

HGINFRA BUY Stock Name - H.G.INFRA ENGINEERING

Strong Fundamental and Good Technical Terms are right now .

Start Buying ..

Trade Reason :

Monthly - Strong Higher Low

Monthly Support and Fib golden Ratio Level - 0.618

Day - Trendline Breakout - Entry Initiated

Entry - 1348 or Entry at current Price

Target - 1761 Rs

Stoploss - 1167 Rs

Happy trading ..

Can Tencent salvage Ubisoft's sinking ship?Ubisoft’s stock pumped 35% couple of days ago following a Bloomberg report suggesting that Tencent may either acquire the company or take it private

Although the French gaming company didn’t confirm or deny the speculation, it did state that it’s considering "all strategic options" for the benefit of its stakeholders and will notify the market when necessary

If Tencent proceeds, it would mark another significant acquisition in a wave of major gaming deals over recent years:

- Activision Blizzard acquired by Microsoft for $69 billion in 2023.

- Zynga acquired by Take-Two for $12.7 billion in 2022.

- ZeniMax Media acquired by Microsoft for $7.5 billion in 2021.

- Savvy Games acquired by Scopely for $4.9 billion in 2023.

- Bungie acquired by Sony for $3.7 billion in 2022.

- Glu Mobile acquired by EA for $2.4 billion in 2021.

- Keywords Studios acquired by EQT for $2.4 billion in 2024.

Ubisoft’s valuation sits at just $2 billion, nearly 90% below its peak in 2021! The stock fell by more than 40% in September alone, so this recent surge is only a brief reprieve. Given its diminished value, a potential buyer offering a premium wouldn’t necessarily be a massive win.

So, how should we interpret this news, and what can we anticipate for future gaming M&A activity? Let’s break it down.

Key Points

1.Ubisoft’s Challenges

2.Potential Buyers

3.IP Gold Rush

4.Future of Gaming M&A

1. Ubisoft’s Challenges

Ubisoft has faced setbacks including canceled games, delays, and a dip in quality in the post-pandemic era. Let’s take a look at the fiscal year 2024, which ends in March.

Consider this metric reflects the total amount spent by users within a period, covering game sales, in-game purchases, subscriptions, and downloadable content (DLC). It’s an important measure of business performance, with net bookings recognized as revenue over time, depending on content delivery and user engagement

Key takeaways:

Digital-first: 86% of Ubisoft's net bookings come from digital sales (premium, free-to-play, and subscriptions). It was 12% in 2013, illustrating the transformative past decade.

Far behind on mobile: Ubisoft has trailed its peers, with only 7% of revenue coming from mobile. In contrast, nearly half of the industry’s revenue comes from smartphones.

Margins improved after cost-cutting: Digital games are a high gross margin business, particularly with the back catalog (title released in previous years) making up nearly two-thirds of net bookings. Targeted restructurings impacted FY23, making the short-term margin trend misleading. Ubisoft laid off 1,700 employees between September 2022 and March 2024, roughly 6% of its workforce.

Short-lived turnaround: FY23 was a challenging year, with Net bookings collapsing by 18% with the underperformance of Mario + Rabbids: Sparks of Hope and Just Dance 2023. In FY24, Net bookings rebounded sharply, growing 34% with the successful release of Assassin’s Creed Mirage and The Crew Motorfest.

FY25 Collapses in a Week: After the underperformance of Star Wars Outlaws (released at the end of August and originally expected to be a blockbuster) and the delayed launch of Assassin’s Creed Shadows from November to February, Ubisoft revised its FY25 net bookings forecast down to €1.95 billion, a 16% decline year-over-year (compared to the "solid growth" expected earlier). The company now anticipates barely breaking even on an adjusted basis.

The decision to delay Assassin’s Creed Shadows just weeks before its scheduled release was influenced by the poor reception of *Star Wars Outlaws*. However, the three-month delay might not be enough to resolve concerns over game quality or criticisms from the Japanese community regarding historical and cultural inaccuracies.

But that’s not all!

In addition to these financial and operational difficulties, Ubisoft has faced allegations of a toxic workplace. Several former executives from the *Assassin’s Creed* studio were arrested as part of an investigation into sexual assault and harassment.

This situation mirrors the downfall of Activision Blizzard in the months leading up to its acquisition by Microsoft, which leads us to potential buyers for Ubisoft.

2. Potential Buyers

Ubisoft remains a family-run company, largely overseen by its founders.

The latest annual report reveals the following voting rights:

- The Guillemot family controls 20.5%

- Tencent owns 9.2%

In September, minority shareholder AJ Investments claimed it had gained backing from 10% of shareholders and called for Ubisoft to be sold or taken private, estimating a fair value of €40 to €45 per share. With shares currently trading at €13, this seems highly optimistic.

So, who are the likely candidates for a Ubisoft buyout?

Key Players:

-Tencent: Already a significant shareholder, Tencent could increase its stake or seek majority control. As the largest gaming company globally by revenue, Tencent has a history of acquisitions, such as its purchase of Finnish publisher Supercell (*Clash of Clans*) for $8.6 billion in 2016. However, Tencent's aggressive expansion has drawn regulatory scrutiny, especially in the US and Europe, which could complicate any attempt to acquire majority control of Ubisoft.

Guillemot Family: The founding family might be interested in reclaiming greater control of Ubisoft and steering it in a new direction. To finance the buyout, they could collaborate with a private equity firm or a strategic investor. However, given Ubisoft's current size and the significant cost associated with a buyout, it could be difficult for the Guillemot family to pursue this path on their own.

Other Potential Investors: Private equity firms or strategic investors within the gaming sector might also join a buyout consortium. These investors could be drawn to Ubisoft’s valuable intellectual property (IP) and see potential for a turnaround under new leadership.

Gaming Companies: Besides Tencent, the largest gaming revenue players in 2023 are highlighted in the visual.

-Apple and Google: Although both tech giants have been expanding into gaming, acquiring Ubisoft seems unlikely given their current antitrust scrutiny.

-NetEase, EA, and TakeTwo: These companies would find an Ubisoft acquisition to be a straightforward studio consolidation. NetEase, in particular, might find it appealing to broaden its console and PC presence in the West, but Tencent’s involvement could complicate this.

-Sony and Microsoft: As first-party publishers, both would benefit from boosting their subscription services with exclusive content. They’ve aggressively acquired studios in recent years. Given that the Activision Blizzard deal was approved, there’s no reason a Ubisoft acquisition couldn’t pass as well. In their latest fiscal year, gaming accounted for 32% of Sony’s revenue and less than 9% of Microsoft’s.

3. IP Gold Rush

In the gaming industry, intellectual property (IP) is crucial. Iconic franchises like *Call of Duty*, *Mario*, and *Grand Theft Auto* are multi-billion-dollar assets that significantly impact a company’s future. As a result, many companies are eager to acquire established IPs or gain access to the teams behind them.

Why is IP so valuable?

-Lower risk: Developing a new AAA game can cost hundreds of millions and take years, with no guarantee of success. Acquiring a popular IP allows companies to tap into an existing fanbase and reduces the risk of failure.

-Brand power: Consumers are more inclined to purchase games with familiar characters, worlds, or studios behind them. Well-known creators like Hideo Kojima (*Metal Gear*) and Hidetaka Miyazaki (*Elden Ring*) are just as significant.

-Content scalability: Famous IPs can generate revenue through sequels, spin-offs, and licensing deals. Large publishers have the infrastructure to maximize returns across multiple channels.

This strategy isn’t unique to gaming. Media giants follow similar patterns:

-Amazon’s acquisition of MGM: In 2021, Amazon acquired MGM for $8.5 billion, gaining access to franchises like *James Bond* to enhance its Prime Video content.

-Disney’s acquisition of Lucasfilm and Marvel: These acquisitions have delivered massive returns through movies, TV series, and licensing opportunities.

Why now?

-Consolidation pressure: Subscription services and cross-platform gaming are driving consolidation. Big companies want to secure valuable IPs to differentiate their services and attract loyal customers. Meanwhile, smaller studios are more open to selling early to avoid competing in an increasingly crowded and capital-intensive market.

-Value in ownership: Owning IPs in gaming allows companies to create expansive worlds and engage players long-term through updates, expansions, and live services. This keeps players coming back and generates recurring revenue, which is harder to achieve in video content.

-Cross media expansion: Popular games can expand into movies, TV series, or theme parks. For instance, *The Last of Us* became a hit HBO show, and Sony is developing TV adaptations for Horizon Zero Dawn and God of War. This leads to more revenue, a broader audience, and long-lasting IP appeal.

The Ubisoft Angle

Ubisoft’s IPs, like *Assassin’s Creed*, *Far Cry*, and *Tom Clancy’s Rainbow Six*, have significant potential for future growth, despite recent struggles. However, realizing that potential might require new leadership or a fresh strategy, which a new owner could provide.

Even though Ubisoft faces challenges, its strong portfolio might attract various buyers. For the right acquirer, Ubisoft's problems could represent a chance to buy low and rework its creative direction.

As more studios seek to hedge their risks in this changing industry, we can expect more mergers and acquisitions (M&A) in the future.

4. The Future of Gaming M&A

The gaming industry is constantly evolving, and several trends are fueling a surge in mergers and acquisitions:

-Mobile-first: Mobile gaming is the largest and fastest-growing segment, making companies with a strong mobile presence attractive. Examples include Playrix (Gardenscapes,Homescapes) and Scopely (MONOPOLY GO!,Stumble Guys)

-Cross-platform: Cross-platform play is becoming the standard, and companies with expertise in this area are in high demand. Unity and Epic Games play vital roles with their popular game engines, while major studios are also building in-house solutions.

- Cloud gaming: Still in its early stages, cloud gaming has the potential to revolutionize how games are played. Companies with cloud infrastructure are becoming more valuable, with leaders like Microsoft (Game Pass Ultimate), Sony (PlayStation Plus Premium), and NVIDIA (GeForce Now) pushing the trend.

-Metaverse: Beyond AR/VR, virtual worlds like *Roblox* and *Fortnite* have created immersive, social spaces that keep players engaged beyond traditional gameplay. Companies developing these experiences are attractive targets for firms looking to capitalize on this trend.

-Web3 & Blockchain: Web3 games enable decentralized ownership and in-game economies powered by blockchain. This trend lets players own and trade digital assets, opening new revenue streams and drawing interest from companies exploring the intersection of gaming and crypto.

-AI driven studios: AI is already influencing game development, and its role will only grow. Companies with AI expertise, particularly in game design and player behavior analysis, are becoming highly sought after. As AI reduces development costs, budgets could shift towards live services and marketing.

The Big Picture

The gaming industry is consolidating, with major players acquiring valuable studios and IPs. While there will always be space for indie games—especially as AI lowers the barrier to entry—industry consolidation will likely strengthen the top companies and leave less room for those in the middle.

If a company like Ubisoft, valued at over $12 billion in 2021, is struggling to survive on its own, the future looks bleak for many smaller studios

NVDA | Unpacking NVIDIA’s Q3 FY25Building the Matrix, One GPU at a Time

This week, NVIDIA unveiled its October quarter results, capturing global attention as analysts closely monitored the stock's movements. While Wall Street often emphasizes short-term performance, a broader perspective highlights NVIDIA's remarkable rise. Over two years, its stock value has multiplied tenfold, outpacing tech giants like Alphabet and Amazon in profitability and edging closer to Microsoft and Apple in net income—a meteoric ascent for the history books.

The AI Inflection Point

NVIDIA's transformation began in November 2022 when OpenAI launched ChatGPT, described by CEO Jensen Huang as AI's "iPhone moment." Fast-forward two years, and NVIDIA's latest Blackwell GPU architecture is scaling up production, meeting surging demand. As Huang explained, "The age of AI is in full steam," driven by foundational model training and inference advancements. Two major trends underpin this shift:

-Platform evolution:Transitioning from traditional coding to machine learning.

-Emergence of AI factories:New industries powered by generative AI applications.

AI native startups are booming, and successful inference services are proliferating. If AI's trajectory mirrors the mobile revolution, this is akin to 2009 a pivotal moment with much more innovation ahead.

Q3 FY25 Highlights

NVIDIA's fiscal year ends in January, and the recently concluded October quarter (Q3 FY25) demonstrated strong momentum:

- Revenue: $35.1 billion (+17% quarter-over-quarter), exceeding expectations by $2 billion.

- Segment growth:**

- Data Center: +17% QoQ ($30.8 billion).

- Gaming: +14% QoQ ($3.3 billion).

- Automotive: +30% QoQ ($0.4 billion).

- Margins: Gross margin at 75%, operating margin at 62%.

- Cash flow: Operating cash flow of $17.6 billion; free cash flow of $16.8 billion.

- Q4 FY25 Guidance: Anticipates +7% revenue growth ($37.5 billion).

Key Drivers and Insights

-Data Center Dominance:Contributing 88% of overall revenue, driven by Hopper GPUs and the anticipated Blackwell production ramp.

-Gaming Growth:Propelled by GeForce RTX GPU demand and back-to-school sales.

-Automotive Innovation:Growth fueled by AI-powered autonomous driving solutions.

-Margins:Slight compression due to Blackwell production ramp, with recovery expected as production scales.

Looking ahead, demand for NVIDIA's Hopper and Blackwell GPUs outpaces supply, likely remaining constrained into FY26. However, challenges loom, including intensifying competition from AMD and custom AI chips.

The AI Scaling Debate

Skeptics argue AI scalability may be approaching its limits, but Huang is optimistic, citing advancements in reinforcement learning and inference-time scaling. He emphasized that AI's growth is driven by empirical laws, suggesting scalability could be extended through methods like post-training and test-time scaling.

CEO and CFO Perspectives

- Huang likens modern data centers to "AI factories," producing intelligence like power plants generate electricity.

- The shift to "physical AI" unlocks applications in industrial and robotics sectors, powered by NVIDIA's Omniverse.

- Blackwell GPUs are delivering significant cost reductions and accelerating AI workloads.

Investment Outlook

Despite valuation concerns, NVIDIA's profitability is tangible. However, the company's reliance on sustained GPU demand and a concentrated customer base presents risks. Meanwhile, competition from AMD is intensifying.

Final Thoughts

If ChatGPT was AI's "iPhone moment," the transformation is just beginning. Like the app economy in 2009, the AI-first revolution is poised to unlock entirely new markets and reshape industries. NVIDIA's leadership positions it at the forefront of this multi-trillion-dollar opportunity.

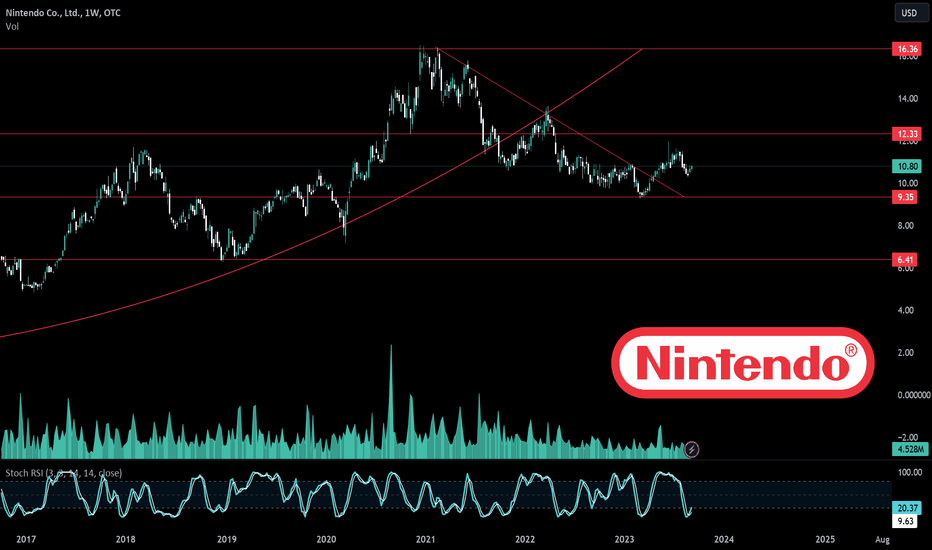

NTDOY | NINTENDO & Nintendo Switch 2 🍄The next Nintendo console might arrive in 2024

Nintendo has reportedly demonstrated the Nintendo Switch 2 behind closed doors at Gamescom last month.some trusted developers got an early look at the Switch 2 and some tech demos of how games run on the unannounced system.

There was reportedly a demo of an improved version of Zelda: Breath of the Wild that’s designed to run on the more advanced hardware inside the Nintendo Switch 2, VGC corroborated the claims and revealed that Nintendo also showcased Epic Games’ The Matrix Awakens Unreal Engine 5 tech demo running on the type of hardware Nintendo is targeting for its next console. The demo reportedly used Nvidia’s DLSS upscaling technology with ray tracing enabled, suggesting Nintendo and Nvidia are working on a significant chip upgrade for this next-gen console. in July that a new Nintendo Switch is being planned for a 2024 release.

With 43 years of making immensely popular video games under its belt, you'd think that the video game pioneers at Nintendo probably have the business of success fully figured out.

But companies must change with the times and, according to Nintendo of America president Doug Bowser, that means finding a way to engage people with the legacy brand that might never pick up a video game controller.

Bowser spoke about what the company learned this year during the Nintendo Live event in Seattle, Wa. on Sept 1, referencing the enormous box office success of the "The Super Mario Bros. Movie" as one of its key indicators that Nintendo has the ability to reach an audience beyond those that naturally reach for a controller.

"We launched The Super Mario Bros. Movie, which very quickly became the second-largest box office grossing animated film of all time at $1.3 billion," Bowser said. "We launched The Legend of Zelda: Tears of the Kingdom, which, 18 million units later after a very brief period of time, it's one of our fastest launch titles ever, and then the event today. So it's really this drumbeat of activities, entertainment-based activities where we're trying to find ways to continue to introduce more and more people, not just players, but people to Nintendo IP… So that's what we're excited about."

Bowser also spoke about the launch of Super Nintendo World at Universal Hollywood, which delivered an impressive 25% bump to Comcast's Q1 earnings this year.

"And if I think about folding into the bigger strategy, this year has really been a very unique, and I dare say banner year for Nintendo in a lot of ways," Bowser said.Nintendo also continues to benefit from the sales of its aging Nintendo Switch console, with 129.53 million units sold worldwide. That makes it the company's second best-selling console of all time, right behind the handheld Nintendo DS, which sold 154.2 million units before it was discontinued in 2014.

The success of "The Super Mario Bros. Movie" drove rumors that another big feature film based on Nintendo's flagship Legend of Zelda series was coming as well, but Nintendo hasn't made a formal announcement about that ... yet.

Gaming is in the midst of an M&A arms race. The protracted pandemic has made sure of that. Companies from all sides of the market, Microsoft, Take Two, Sony to name a few, are cutting deals to secure content. The volume and scale of those deals point to where gaming is heading - the precipice of major shake-ups across its core commercial and distribution models. Microsoft's eye bulging $69 billion deal for Activision is a testament to that shift. Costly as the deal is, it's arguably a small price to pay to secure some of the biggest franchises in gaming: Call of Duty, Warcraft, Candy Crush and Overwatch. Even more so, considering those titles span a community of 400 million active monthly players. In other words, the deal is the boldest sign yet that content is the future of gaming, not consoles.

Should you invest in Nintendo?

The question comes down to whether you are willing to pay about SGX:40B for Nintendo's IP and potential earnings powers. To me, a company that continues to produce in-demand and profitable content is worth that price tag, especially after having generated a net profit of 432.7B yen, or $2.97B in FY2023. That's a P/E of about 13.5 after subtracting out Nintendo's current assets - not a hefty sum given everything Nintendo has going for it. Nintendo's strategy seems to be working, with The Super Mario Bros. Movie not only performing well on its own but also providing a boost to other Nintendo offerings. While there are concerns, there are also plenty of catalysts moving ahead. I am excited to see new Nintendo initiatives including more theatrical releases of their IP and their (positive) effects on the rest of the company's products.

Streaming Wars | Who’s Winning, Losing, and Sharing Passwords ?Netflix Is Laughing, Cable Is Crying, and Amazon Is Sneaking Up

Highlights for Today

- Trends and Market Share

- Disney: Streaming Profits on the Rise

- Comcast: Cable Restructuring Underway

- Warner Bros : Box Office Challenges

- Paramount: Streaming Growth Amidst Challenges

In the Battle for Loyalty, One Fact Stands Out: Netflix vs the Rest

1. Trends and Market Share

Platforms like YouTube Premium, Amazon Prime, and Apple TV+ do not report quarterly numbers. Additionally, Disney+ Hotstar is excluded due to its planned merger with Reliance in 2025.

Streaming continues to replace traditional linear TV, benefiting all players. Nielsen reports streaming comprised 41% of US TV time in September 2024, a 3.5-point increase year-over-year, primarily at Cable’s expense.

Key Trends to Watch

-Password-Sharing Crackdown: Following Netflix’s success, Disney introduced paid sharing in the US in late September, with effects expected to emerge in Q4. Max is also gearing up for this initiative.

-Amazon Prime’s Growing Presence:CEO Andy Jassy revealed that Prime Video attracts over 200 million global viewers monthly. Combining exclusive content, live sports, and e-commerce integration, Amazon’s ecosystem presents a credible challenge to Netflix.

-YouTube’s Dominance in Living Rooms: YouTube accounts for over 25% of US streaming TV time (excluding YouTube TV) and continues to grow. Alphabet disclosed that YouTube’s ads and subscriptions brought in $50 billion in revenue over the last 12 months, surpassing Netflix’s $38 billion.

-Subscriber Trends: Tentpole events, like the Olympics for Peacock or hit series like House of the Dragon for Max, drove sign-ups. However, retention remains a challenge for all but Netflix.

2. Disney: Streaming Profits Rise

Disney’s fiscal year ends in September, with Q3 FY24 covering the June quarter.

-Streaming Profits:Disney’s direct2consumer (DTC) segment, which includes Disney+, Hulu, and ESPN+, posted its second consecutive profitable quarter, generating $321 million in operating income. Core Disney+ subscribers rose by 4.4 million, reaching 123 million, driven by ad-supported tiers.

-Box Office Wins: Hits like Inside Out 2 and Deadpool & Wolverine powered $316 million in studio profits. Disney became the first studio to surpass $4 billion in global box office revenue in 2024.

- Challenges in Parks: Parks and Experiences revenue dropped 6% to $1.7 billion, impacted by hurricanes, rising costs, and competition from the Paris Olympics. Domestic attendance held steady, while international parks struggled.

- Linear TV Decline: Revenue fell 6%, with profits plunging 38% to $498 million as cord-cutting and reduced ad sales weighed heavily. Disney plans to integrate streaming and linear TV rather than divest assets.

- Optimistic Outlook: Disney expects earnings growth in FY25 (high single digits) and double digits in FY26 and FY27. Blockbusters like Moana2 and Mufasa:The Lion King are anticipated to maintain momentum.

Takeaway: Disney’s Q4 highlighted strides in its streaming turnaround, buoyed by box office wins. However, the decline in linear TV underscores the challenges of transitioning in a shifting media landscape. Strong content and a focus on profitability position Disney for success under Bob Iger’s leadership.

3.Comcast: Cable Restructuring

-Olympics Drive Growth:The Paris Olympics boosted NBCUniversal’s revenue by 37%, generating $1.2 billion in advertising and adding 3 million Peacock subscribers, which now total 36 million.

-Streaming Expansion: Peacock’s revenue rose 82% year-over-year to $1.5 billion, with losses narrowing to $436 million from $565 million last year.

-Cable Struggles: Cord-cutting led to a loss of 365,000 cable TV subscribers, with video segment revenue down 6.2%. Comcast is exploring a spinoff of cable networks like Bravo and CNBC to prioritize growth areas.

-Theme Parks Slow: Theme park revenue dipped 5% to $2.3 billion as domestic attendance normalized post-COVID.

-Broadband Trends:Despite losing 87,000 broadband customers, revenue increased 3%, with higher average revenue per user.

Takeaway:Comcast’s Q3 reflected both opportunities and challenges. While the Olympics showcased its media strength, declines in cable TV and theme parks persist. Streamlining through a cable spinoff could sharpen its focus, but sustaining growth in Peacock and broadband remains critical.

4.Warner Bruh : Box Office Challenges

-Streaming Growth:Max gained 7.2 million subscribers, reaching 110.5 million globally, supported by international expansion and hits like *House of the Dragon*. Streaming revenue rose 9%, marking Warner’s first profit since 2022.

-Box Office Struggles:Studio revenue declined 17%, with theatrical revenue falling 40% due to a weaker film slate (*Beetlejuice Beetlejuice* and *Twisters* compared to last year’s *Barbie*). Video game revenue dropped 31%.

-Mixed Network Results:Network revenue grew 3% from the Olympics and *Shark Week*, but advertising revenue fell 13%. The $9.1 billion NBA impairment from Q2 continues to loom.

-Debt and Cash Flow Issues:** Free cash flow dropped 69% to $632 million, with $41 billion in debt. Warner renewed its Charter Communications deal to bolster stability.

-CEO’s Confidence:David Zaslav emphasized Max’s momentum, projecting $1 billion in streaming profits by 2025 and hinting at password-sharing monetization.

Takeaway:Warner’s Q3 highlighted streaming success but underscored its dependence on Max as traditional film and TV segments falter. Balancing debt, declining cash flow, and expanding streaming profitability will be key to its stability.

5.Paramount: Streaming Growth

-Streaming Success:Paramount+ gained 3.5 million subscribers, reaching 72 million, thanks to sports like the NFL and UEFA and shows like *Tulsa King*. The streaming unit achieved a $49 million operating income, its second consecutive profitable quarter.

-TV and Film Challenges:TV revenue fell 6% due to lower ad sales and declining cable subscribers. The film division saw revenue plummet 34%, with theatrical revenue dropping 71%.

-Merger Progress:Paramount’s merger with Skydance Media is on track for early 2025, following the exploration of 12 potential bidders.

-Cost-Cutting:Paramount has completed 90% of its $500 million cost reduction initiative, resulting in layoffs and asset write-downs.

-Strategic Shift:Paramount is seeking a streaming joint-venture partner to better compete with Netflix and Disney while managing cable TV’s decline.

Takeaway: Paramount’s streaming gains are encouraging, but traditional TV and film struggles persist. The Skydance merger offers a potential transformation, though stabilizing legacy businesses remains a significant hurdle.

The Big Exit | How One Auditor Walked Away from Super MicroThe Governance Shortfall: Inside Super Micro’s Auditor Crisis

On Wednesday, shares of the high performance server and storage solutions provider faced renewed selling pressure after the unexpected resignation of its audit firm, Ernst & Young LLP(EY)

In July 2024, EY alerted the Audit Committee about several concerns related to governance, transparency, internal controls, and the risk of delayed filing of the company's annual report. In response, the Board formed an independent Special Committee to investigate these matters, engaging Cooley LLP and forensic accounting firm Secretariat Advisors, LLC. Although EY and the Board received preliminary updates on the investigation, the final conclusions have not yet been shared.

The ongoing review raised doubts for EY regarding the company’s adherence to the COSO Framework principles for internal controls. EY questioned the company’s commitment to integrity, the independence of the Audit Committee, and the reliability of management’s and the Audit Committee's representations.

In its resignation letter, EY expressed its inability to rely on these representations or be associated with the company's financial statements, citing legal and professional obligations.

Despite the developments, Super Micro has indicated no expected changes to previously issued financial statements. The company plans to provide a Q1/FY2025 business update next week. However, it’s surprising that management didn’t include preliminary Q1 results in Wednesday's announcement, which could have mitigated the negative impact on its stock.

Super Micro is nearing a Nasdaq deadline to either regain compliance with listing requirements or submit a plan. With the auditor’s unexpected departure, it may be difficult for the company to present a viable plan, raising the risk of a near-term delisting.

This resignation comes at a critical time for Super Micro, as its rapid growth requires substantial working capital. Based on management’s projections, FY2025 cash needs could reach up to $3 billion, likely necessitating additional capital early next year. However, raising funds without audited financials could be challenging, potentially forcing Super Micro to relinquish market share to competitors like Dell Technologies or Hewlett Packard Enterprise.

In my view, EY’s departure increases the likelihood of a prolonged accounting review, which could hinder Super Micro’s ability to secure funding for anticipated growth. Therefore, it is crucial for the company to report strong preliminary Q1/FY2025 results and present a positive outlook next week.

Super Micro Computer’s troubles continue, as its auditor resigned due to concerns over management’s integrity and the Audit Committee's independence. This situation makes it unlikely for the company to achieve compliance with Nasdaq requirements soon, raising the potential for a near-term delisting.

With a need to re-enter the capital markets in early 2025, audited financials remain essential. A failure to secure funding could result in significant market share loss to major competitors like Dell Technologies and Hewlett Packard Enterprise.

Given these challenges, the increased risk of prolonged financial review, and a likely near-term delisting, I am reaffirming my "Sell" rating on Super Micro Computer's common shares.

TCI EXPRESS Massive Short Trade Caught on RisologicalTechnical Analysis: TCI Express (15-Minute Timeframe)

The chart demonstrates a highly successful short trade on TCI Express, with a stellar 12% decline captured within just five trading days. Here's a breakdown of the technical scenario:

Trade Overview

Stock: TCI Express

Timeframe: 15-Minute

Entry Price: ₹986 (on 7th November)

Current Market Price: ₹867

Price Movement: -₹119 (-12%) in approximately 5 days.

Trend Confirmation:

The chart showcases a well-defined downtrend with consistent lower highs and lower lows. This structure highlights strong bearish momentum.

Indicators in Action:

The visible red bands represent a dynamic resistance zone (Risological Trading Indicator). The price has consistently respected these resistance levels, confirming the strength of the sell-off.

Volume Support:

The volume aligns with the price action, increasing volume during the breakdown reinforced the bearish sentiment.

Momentum Breakdown:

The significant gap and subsequent bearish continuation patterns suggest that sellers are in complete control, with no signs of reversal yet. The tight clustering of the Risological resistance bands further validates the ongoing strength of the downtrend.

Performance

This short trade has outperformed expectations by delivering a 12% return in just five days, underscoring the precision of the entry at ₹986. Such rapid declines in a short timeframe highlight the effectiveness of the technical analysis and adherence to trend-following strategies.

Outlook

Support Zone: The price may find psychological support near ₹850, where traders should watch for potential profit booking or consolidation.

Next Levels to Watch : A break below ₹850 could trigger further downside, targeting ₹820 or lower.

Reversal Triggers: Reversal signals, such as a strong bullish engulfing pattern or price closing above the resistance bands, could indicate an exit point.

Key Takeaway

This short trade exemplifies disciplined execution, leveraging technical indicators and market momentum to achieve remarkable gains in a short timeframe. With the stock still in a robust downtrend, traders should continue monitoring for trailing stop adjustments to maximize profits while managing risk effectively.

Intel in Trouble or Ready for Redemption?There is growing potential for QUALCOMM Incorporated to acquire Intel.

I now believe that this development has advanced enough to warrant a fresh look at the stock

Qualcomm recently approached Intel about a takeover. According to WSJ , Qualcomm has expressed interest in acquiring Intel, which, if realized, would mark one of the most significant deals in recent history

Initially, this seemed like a long shot, with limited details emerging from the report. However, QCOM has continued to pursue the idea. Also QCOM has been in contact with Chinese antitrust regulators over the past month about this potential deal and is waiting until after the US presidential election to decide on making a formal offer. Since the election is just less than a month away, I believe this acquisition is becoming more of a possibility that investors should factor into their assessment of INTC. If a deal goes through, it’s likely that the acquisition will come at a premium to the current stock price, creating an opportunity for significant short term gains for investors

There is always a chance that no deal will occur. In that case, potential investors should evaluate whether the stock is worth holding as a long-term investment. My outlook here is not optimistic, and I’ll delve into INTC's competitive position, as indicated by its latest inventory data, in the next section

Given these two potential scenarios, I am upgrading my rating from "Sell" to "Hold." In summary, the possibility of QCOM acquiring INTC introduces a major upside catalyst that I hadn’t accounted for in my previous analysis. This potential acquisition helps offset some of the concerns about INTC as a standalone company.

Unlike many financial metrics that can be interpreted in different ways, inventory levels are more straightforward. He also explained that inventory trends can provide early indicators of business cycles. For cyclical industries, rising inventories can signal overproduction as demand wanes, while shrinking inventories can indicate strong demand

As shown in INTC’s most recent balance sheet, its inventory levels have generally been on the rise. For instance, in December 2014, inventory was valued at $ 4.273 billion, while the most recent figures show an increase to $ 11.244 billion. In some cases, rising inventory can signal business growth with increasing demand and production capacity, which was true for Intel in the early part of the last decade.

When inventory growth exceeds the pace of business growth, it becomes a red flag. In this scenario, rising inventory suggests weakened competitiveness and declining market position—an issue that Intel currently faces, in my opinion. The following chart helps illustrate this point, showing a comparison of days of inventory outstanding (DIO) for Intel and NVIDIA over the last five years, from 2020 to 2024. DIO is a measure of how many days it takes a company to sell its inventory

Given Intel's inventory buildup and declining competitive edge, I find its current valuation multiples hard to justify. Specifically, the chart highlights a comparison of price-to-earnings (P/E) ratios between Intel, NVIDIA, and AMD. Focusing on non-GAAP earnings estimates for fiscal years FY1 through FY3, Intel is currently trading with the highest P/E ratio for FY1 at 87.7 almost twice the multiple of NVIDIA and AMD, which are at 46.29 and 46.25, respectively

That said, the outlook changes somewhat when considering the years further ahead. For instance, in FY2, NVIDIA’s expected P/E ratio rises to the highest at 32.77, compared to Intel's 20.02 and AMD's 29.02. However, I want to emphasize the substantial uncertainty in Intel's earnings forecasts. As shown in the next chart, the consensus estimates for Intel's earnings per share (EPS) in FY 2024 range from a low of $0.15 to a high of $0.31 (a more than twofold variation) and from a low of $0.65 to a high of $2.1 (an almost fourfold variation). Given such uncertainty, I believe investors should be cautious about relying too heavily on forward P/E ratios too far into the future.

Both Intel and NVIDIA have experienced significant fluctuations in DIO over the years. Notably, both companies saw a spike in 2023 due to the COVID pandemic, which disrupted global supply chains. As the disruption faded, both firms saw a recovery (ie, a reduction in DIO). the difference in recovery is striking. Intel's DIO peaked at over 150 days in 2023 and has since decreased to 125 days a modest reduction but still above its historical average of 114 days. In contrast, NVIDIA's DIO surged to over 200 days but has rapidly dropped to 76 days, which is not only below its four-year average of 97.9 days but also near its lowest level in four years.

I expect Intel to face increasing competitive pressure as rivals like NVIDIA and AMD roll out their next-generation chips, particularly NVIDIA’s Blackwell chips. I recommend potential investors keep a close eye on inventory data, as it can signal changes in competitive dynamics for the reasons discussed here.

In addition to inventory issues and valuation risks, Intel faces a few other specific challenges. A significant portion of Intel’s current product lineup is concentrated in certain segments, such as PCs, which I believe are nearing market saturation plus a large share of Intel’s revenue comes from China. Given the ongoing trade tensions between the US and China, this heavy reliance on China poses a considerable geopolitical risk. These factors may limit Intel’s ability to adapt to technological advancements and shifting geopolitical conditions

The potential for a QUALCOMM acquisition has emerged as a new major upside catalyst. While my outlook on Intel’s business remains pessimistic based on the latest inventory data, the acquisition possibility partially offsets these negatives, leading me to upgrade my rating from Sell to Hold or if you are risk taker like Me, load the dip

Estee Lauder’s 26% Plunge: Revenue Miss & All Short Targets Hit!Estee Lauder (EL) Stock Analysis:

Estee Lauder (EL) saw a dramatic 26% drop, marking a significant bearish turn as all short trade targets on the 15-minute timeframe were swiftly reached. The chart reflects intense selling pressure, with shares plummeting after disappointing earnings and cautious guidance.

Key Trade Details:

Entry Level: 88.29

Target Levels:

TP1: 87.89

TP2: 87.29

TP3: 86.58

TP4: 86.17

Stop Loss: 88.62

Key Market Insights:

Revenue Miss and Guidance Withdrawal: Estee Lauder missed revenue expectations, reporting a 4% YoY decline, and pulled its fiscal 2025 outlook, signaling incremental uncertainty in the Chinese market and Asia’s travel retail sector. The company now plans to provide only quarterly guidance.

Challenges in China and Travel Retail: Weak consumer sentiment in China and reduced demand in Asia travel retail, including low conversion rates in Hong Kong, led to a 5% drop in organic net sales, impacting overall performance.

Summary:

Estee Lauder’s sharp decline capitalized on bearish momentum, achieving all short trade targets quickly. The disappointing earnings, along with withdrawn guidance, underscore the headwinds Estee Lauder faces in a slowing global economy, particularly in Asia. This setup demonstrates the high-risk, high-reward potential for short-term trades in volatile stocks.

GANDHAR OIL BUY NOW Stock Name - GANDHAR OIL REFINERS

Trend - Uptrend Focus on Buy

Good Fundamentals take this stock .

Trade Reason :

Day - Uptrend and Complete Correction at Golden ratio Level 0.618 .

1Hr - Trend Reversed - Confirm the Entry .

Entry - 225 Rs

Stoploss - 217 Rs

Target - 244 Rs

Happy Trading ...

ZensarTec Ready to Rally! Waiting for Targets to Fire!Technical Analysis:

ZensarTec on the 15-minute timeframe is poised for a long trade after a solid entry signal. The price is currently moving upward, following the support from the Risological Dotted Trendline, confirming the strength in momentum.

Key Levels:

Entry: 680.00

Stop Loss (SL): 658.20

Target 1 (TP1): 706.90 (Next target)

Target 2 (TP2): 750.50

Target 3 (TP3): 794.05

Target 4 (TP4): 821.00

Observations:

The price has recently shown signs of strength, bouncing off the Risological Dotted Trendline and gaining bullish momentum.

With volume support, the price is likely to hit the initial target of TP1 soon, potentially leading to a cascade of target completions.

ZensarTec is gearing up for an upward breakout as it tests its first target. Watch for TP1 to confirm and the possibility of higher targets being hit as bullish momentum builds. Stay tuned for a strong price movement ahead!

Mastercard May Rise to 519.00 - 526.00 (READ DESCRIPTION)Mastercard May Rise to 519.00 - 526.00

Pivot Point: 482

The pivot point at 482 is a crucial support level for Mastercard. As long as the stock price remains above this level, the outlook is bullish, indicating potential for upward movement. A drop below this level would signify a change in sentiment and a potential shift toward bearish pressure.

Primary Strategy (Our Preference):

Entry Point: Look for long positions as long as the price holds above the pivot point of 482.

Target Levels:

519.00: This target indicates a significant potential gain, suggesting that bullish momentum is strong enough to push prices higher. Achieving this target would reflect positive market sentiment towards Mastercard.

526.00: The next target represents further upside potential, reinforcing the bullish outlook if the stock can sustain its momentum.

Alternative Scenario:

If the stock falls below the pivot point at 482, traders should consider short positions.

Entry Point: Initiate short positions if the price breaks and remains below 482.

Target Levels:

470.00: This level marks the first downside target, indicating potential bearish momentum if selling pressure increases.

464.00: The next target level suggests a further decline, highlighting risks if the stock continues to trend downward.

Technical Outlook:

RSI Indicator: The RSI is above its neutral level at 50, indicating that bullish momentum is in play, as buying pressure exceeds selling pressure.

MACD Indicator: The MACD is positive but below its signal line, suggesting that while the current trend is bullish, there may be a potential retracement or consolidation in the short term.

Moving Averages: Mastercard is trading above both its 20-day and 50-day moving averages (respectively at 493.93 and 477.84), further confirming the positive outlook and suggesting the stock is in a bullish trend.

Market Dynamics:

As long as Mastercard holds above the pivot point of 482, there is significant potential for upward movement toward the target levels of 519.00 and 526.00.

If the price falls below the pivot, market sentiment could shift, leading to potential declines toward support levels of 470.00 and 464.00.

The pivot point at 482 is critical for maintaining a bullish outlook for Mastercard. Holding above this level opens the possibility for price increases toward 519.00 and 526.00.

Current technical indicators support the bullish sentiment, but traders should remain cautious for any signs of retracement, especially if the price breaches the pivot support.