AMAZON SWING LONG FROM SUPPORT|LONG|

✅AMAZON fell again to retest the support of 190.79$

But it is a strong key level

So I think that there is a high chance

That we will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Stocks

Bullish Play on (BABA) Ahead of Chinese Economic Data & Alibaba (BABA) is forming a triple top pattern near the $142-$145 resistance zone ahead of key economic data releases and potential positive stimulus measures from the Chinese Congress meeting. While a triple top is traditionally seen as a bearish formation, a breakout above resistance could signal strong bullish momentum, fueled by market optimism regarding Chinese economic support and potential tariff relief.

Trade Setup: Long Position on BABA

📈 Entry Point:

Breakout confirmation above $145 (previous resistance).

If momentum is strong, consider scaling in at $143-$144 for an early entry.

🎯 Target Price:

First Target: $155 (short-term resistance from early 2023).

Second Target: $165 (next major psychological level if sentiment remains strong).

🛑 Stop-Loss:

Below $138 (recent swing low and key support zone).

Alternatively, a trailing stop-loss to secure profits as the price rises.

Catalysts Supporting a Bullish Breakout:

1️⃣ China’s Economic Stimulus 🏦

The Chinese government is expected to announce new stimulus measures to support growth, which could boost investor confidence in Alibaba and other Chinese tech stocks.

Potential fiscal easing & liquidity injections may drive funds into large-cap Chinese equities.

2️⃣ Positive Economic Data Expectations 📊

Retail Sales & Industrial Production (March 17, 2025)

Strong numbers would indicate a rebound in consumer spending & manufacturing, benefiting Alibaba’s core e-commerce business.

3️⃣ Tariff Reduction Speculations 🌎

If the Chinese Congress signals progress on easing U.S.-China tariffs, Alibaba could see increased foreign investment & improved profitability.

4️⃣ Technical Breakout Potential 🔍

The triple-top pattern could turn into a breakout if volume surges past resistance ($145).

A move above this level could trigger short-covering & FOMO buying, leading to a quick rally.

What If the Data Disappoints?

If economic data underwhelms, BABA could reject resistance and pull back toward $130-$135.

In this case, waiting for a confirmed breakout before entering long positions is advisable.

📌 Final Thought:

BABA is at a critical inflection point. If economic optimism and stimulus expectations materialize, a breakout past $145 could fuel a strong rally toward $155-$165. Traders should watch for volume confirmation and be prepared to ride the upside while managing risk carefully. 🚀💹

Check out my other ideas about chineese stocks and more:

Nauticus Robotics - The Roaring $KITTNauticus Robotics ( NASDAQ:KITT ) is a picture-perfect pick-up for the coming market conditions. With capital about to be re-allocated into markets, following the month long sell-off of late and rotation into precious metals/bonds.

Technicals

Already broken-out of its downwards wedge pattern on high volume, NASDAQ:KITT recently just put in a double bottom.

If the initial move from December 19th to 6th January, was an Elliott Wave 1, I would wait & prepare for volatility to come, and if to the upside it will put some of the most volatile cryptocurrency tokens to shame.

Wave 2 should now be complete, having bottomed on March 4th. Friday March 14th should have been the completion of its 1st higher low.

As early as next week, I am expecting NASDAQ:KITT to reach $2.80. This coincides with the 0.618 fibonacci level, resulting from its recent decline. From there, a shallow retrace into the end of the month before catapulting itself to levels not seen since September 2023 at around $80.

That would conclude Wave 3, the most volatile of moves in Elliott Wave theory, between May and June. Reaching the 2.272 fib level at $80.

The entire move can reach a final impulse conclusion of around $155 of the 2.618 fib level 👀. A potential 150x in just a few short months.

-----

Fundamentals

Nauticus Robotics is creating an entirely new industry right before our eyes. They are pioneers and future monopolists for the underwater economy, just like Tesla are becoming to battery, automation & automotive technology.

Think deep-sea oil refining, precious metal mining, environmental studies and even underwater city construction. Combined with a domestic administration that for the first time in decades is supportive of such novel energy & infrastructural investments.

For those expecting an AI bubble to soon take hold of markets, this stock is arguably one of the few companies that could simply not exist without artificial intelligence. Thanks to this new technology, it opens up commercially and fundamental new opportunities to deploy unmanned robotics deep into our oceans, for days at a time without costly supervision.

Currently (at $1.06) with a market cap of $6.79 million , there is far too much upside to this stock. One that employs dozens of ex-NASA engineers.

This stock is one of the 100 most highly shorted stocks on markets. With RICO and an administration hostile towards & actively investing such practices, this stock is likely to undergo a swift revaluation.

All of this combined, suggests to me the ocean tide is on your side with $KITT.

S&P 500 Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

During the recent weekly trading session, the S&P 500 reached the designated target of the Outer Index Dip at 5576, showing considerable volatility. On the last day of the trading session, the index experienced a significant rebound, leading to an impressive upward trajectory from that position. As a result, it is now aiming for the Inner Index Rally target set at 5712, with a potential subsequent target identified at the Mean Resistance level of 5840. Therefore, upon reaching the Inner Index Rally target 5712, or if there is a decline from its current price level, the index is expected to retest the completed Outer Index Dip at 5521, potentially reinstating the upward rally.

BROADCOM: Is this a legit recovery on the 1D MA200?AVGO is almost neutral on its 1D technical outlook (RSI = 44.867, MACD = -8.280, ADX = 49.944) as it has stabilized following a direct contact with the 1D MA200. That was the first time the price hit that level since the September 9th 2024 low. This is also a technical HL at the bottom of the 9 month Channel Up, while also the 1D RSI is rebounding on its S1 Zone. The Sep 9th 2024 rebound hit its upper R1 level, so our worst case target is 250 (TP1), while the November 27th 2024 low rose by +59.97%, which gives a best case target of 285 (TP2).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Bitcoin, S&P, Gold: Market Decline & DivergenceThe intricate dance of financial assets often reveals hidden correlations and predictive patterns. Recently, the synchronized decline of Bitcoin and the S&P 500 has raised concerns, while gold's historic rally has left Bitcoin trailing. However, a deeper dive into the data suggests a potential turnaround, hinting at a shift in market dynamics.

For much of the past few years, Bitcoin has exhibited a strong correlation with the S&P 500, behaving as a risk-on asset.1 When the stock market surged, Bitcoin often followed suit, and conversely, market downturns typically coincided with Bitcoin's price depreciation. This correlation stems from shared macroeconomic drivers, such as interest rate expectations, inflation concerns, and overall investor sentiment. The recent parallel decline reflects anxieties surrounding persistent inflation, potential interest rate hikes, and geopolitical uncertainties.

However, this synchronized movement doesn't tell the whole story. While Bitcoin and the S&P 500 have been grappling with downward pressure, gold has embarked on a remarkable rally, reaching unprecedented heights. This surge is fueled by several factors, including substantial inflows into gold ETFs, escalating geopolitical tensions, and heightened market volatility. Gold's traditional role as a safe-haven asset has been reaffirmed, as investors seek refuge from the turbulence in equity and cryptocurrency markets.

The divergence between Bitcoin and gold is particularly striking. The Bitcoin-to-gold ratio, a metric that reflects the relative value of Bitcoin compared to gold, has broken a 12-year support level. This breach signals a significant shift in investor preference, with gold emerging as the dominant asset. The recent climb of gold to a hypothetical $3,000 mark (or equivalent in other currencies) further underscores this trend, demonstrating its resilience in the face of economic uncertainty.

The observed pattern of Bitcoin breaking its multiyear uptrend against gold bears a striking resemblance to the market behavior witnessed between March 2021 and March 2022. During that period, Bitcoin experienced a similar decline relative to gold, ultimately leading to a substantial drop in its dollar value. This fractal pattern suggests that Bitcoin may be poised for further depreciation, potentially falling below the $65,000 mark.

However, it's crucial to acknowledge that historical patterns are not infallible predictors of future performance. Market dynamics are constantly evolving, and unforeseen events can significantly alter the trajectory of asset prices. While the current data points towards a potential decline for Bitcoin, there are countervailing factors that could trigger a reversal.

One such factor is the increasing institutional adoption of Bitcoin. As more institutional investors allocate a portion of their portfolios to cryptocurrencies, the market may become less susceptible to short-term fluctuations driven by retail sentiment. Moreover, the long-term potential of Bitcoin as a decentralized store of value remains a compelling narrative for many investors.

Additionally, the regulatory landscape surrounding cryptocurrencies is gradually becoming clearer. As governments and regulatory bodies establish frameworks for the operation of digital asset markets, investor confidence may improve, leading to renewed interest in Bitcoin. The upcoming Bitcoin halving is also anticipated to reduce the supply of new Bitcoin entering the market, which could potentially drive up its price.

While the current correlation between Bitcoin and the S&P 500 may persist in the short term, the underlying fundamentals of Bitcoin suggest a potential decoupling in the long run. As the cryptocurrency market matures and gains wider acceptance, its correlation with traditional asset classes may weaken.

The recent divergence between Bitcoin and gold highlights the importance of diversifying investment portfolios. While gold has proven its resilience in times of uncertainty, Bitcoin offers the potential for substantial returns in the long term. Investors should carefully consider their risk tolerance and investment objectives when allocating capital to these assets.

The breakdown of the Bitcoin to gold ratio is a concerning indicator, however, the cryptocurrency world moves quickly. The market is driven by new innovation, and adoption. The market has been known to have large pullbacks, followed by even larger rallies. The current market may be pricing in a large amount of fear, and a simple change in the news cycle could cause a large change in the price of bitcoin.

In conclusion, the current market dynamics present a complex picture. The synchronized decline of Bitcoin and the S&P 500, coupled with gold's historic rally, suggests a potential downturn for Bitcoin. However, the long-term potential of Bitcoin, coupled with increasing institutional adoption and a maturing regulatory landscape, could trigger a reversal. Investors should remain vigilant, monitor market trends, and make informed decisions based on a comprehensive understanding of the underlying fundamentals. The data suggests a potential turn around, but only time will tell if the market will comply.

Amd - Please Look At The Structure!Amd ( NASDAQ:AMD ) is about to retest massive support:

Click chart above to see the detailed analysis👆🏻

For about 5 years Amd has been trading in a decent rising channel formation. That's exactly the reason for why we saw the harsh drop starting in the beginning of 2024. But as we are speaking, Amd is about to retest a massive confluence of support which could lead to a beautiful reversal.

Levels to watch: $100

Keep your long term vision,

Philip (BasicTrading)

Rocket Companies (RKT) – Fintech-Driven Mortgage GrowthCompany Overview:

Rocket Companies NYSE:RKT is a fintech leader in mortgage and real estate solutions, leveraging AI-driven efficiency to enhance profitability and market share.

Key Catalysts:

Surging Profitability & Efficiency 💰

Adjusted EBITDA margin rose to 18% in Q4 2024, up from 2% a year prior, reflecting strong financial performance.

Rocket Mortgage Growth 📊

Net rate lock volume surged 47% YoY to $23.6 billion, far outpacing industry trends.

Expanding Servicing Portfolio 📈

The $593 billion servicing portfolio (+17%) provides stable revenue and cross-selling opportunities, acting as a hedge against rate volatility.

Resilient Market Share Expansion 🏆

Despite industry headwinds, Rocket continues to grow market share, proving its competitive edge in mortgage lending.

Investment Outlook:

Bullish Case: We are bullish on RKT above $11.80-$12.00, driven by profitability gains, market expansion, and portfolio strength.

Upside Potential: Our price target is $20.00-$21.00, reflecting sustained growth and operational efficiency.

🔥 Rocket Companies – Powering the Future of Mortgage & Fintech. #RKT #MortgageTech #FintechGrowth

MICROSOFT Channel Down bottom formation targets $440.Microsoft (MSFT) has been trading within a Channel Down since the July 05 2024 High. The stock is on its latest Bearish Leg in the past 3 months and almost completed a -17.62% decline, similar with the Bearish Leg that led to the August 05 2024 Low.

As the 1D RSI has Double Bottomed, which is what it did on the April 30 2024 Low that kick started a rally of +20.63%, we expect the stock to initiate its new Bullish Leg of the Channel. The previous one was +18.16%, so we expect a similar range and target $440.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Intel (INTC) Shares Surge by Approximately 14%Intel (INTC) Shares Surge by Approximately 14%

As shown in the Intel (INTC) stock chart:

→ Trading opened yesterday with a strong bullish gap.

→ By the end of the session, shares had risen by approximately 14% compared to the previous day's closing price.

According to Dow Jones Market Data, INTC shares recorded their largest percentage gain since 13 March 2020, making them the top-performing stock in the S&P 500 index (US SPX 500 mini on FXOpen) on Thursday.

Why Did Intel (INTC) Shares Rise?

The surge followed the company's announcement of a new CEO appointment. Lip-Bu Tan, a former board member, has been named the new Chief Executive Officer, set to assume the role on 18 March. Investors reacted positively to the decision, as Tan previously achieved significant success as CEO of Cadence Design Systems.

As the Wall Street Journal put it:

"Lip-Bu Tan is Intel’s best hope for a turnaround—if Intel can be fixed at all."

Technical Analysis of Intel (INTC) Stock

In our previous analysis of INTC price movements, we identified an upward channel (marked in blue), which remains relevant.

The current bullish momentum may lead to a breakout above the long-term downward trendline (marked in red). If this happens, it could pave the way for a move towards the psychological level of $30, which served as support last year.

Intel (INTC) Stock Price Forecasts

"We really like the new CEO appointment," wrote BofA Securities analyst Vivek Arya in a note, upgrading Intel’s rating from "Underperform" to "Neutral" and raising the target price from $19 to $25.

According to TipRanks:

→ Only 1 out of 23 analysts surveyed recommends buying INTC shares.

→ The average 12-month target price for INTC is $23.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Nightly $SPY / $SPX Scenarios for March 14, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🇺🇸⚠️ Potential U.S. Government Shutdown ⚠️: The United States faces a potential government shutdown on March 14 if lawmakers fail to agree on the 2025 budget. This impasse could lead to the closure of government agencies and furloughs of federal employees, impacting various sectors and potentially affecting market sentiment.

📊 Key Data Releases 📊:

📅 Friday, March 14:

🛒 University of Michigan Consumer Sentiment Index (10:00 AM ET) 🛒:This index measures consumer confidence regarding personal finances, business conditions, and purchasing power, providing insights into consumer sentiment.

Forecast: 64.0

Previous: 64.7

🛢️ Baker Hughes Rig Count (1:00 PM ET) 🛢️:This report provides the number of active drilling rigs in the U.S., offering insights into the oil and gas industry's health.

Previous: 592

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

WE ARE COMING OUT OF A RECESSION. NOT GOING INTO ONE.This chart shows 10-year yield, which is closely tied to mortgage rates, minus the Federal funds rate.

When this figure is negative, it typically indicates that we are experiencing a recession or economic downturn.

Conversely, a positive number usually aligns with economic growth, often referred to as the good times.

While it's up to you to determine the reasons behind a official recession not being declared during the Biden administration, the undeniable data reflects a prolonged period of economic strain.

However, the current trend seems to be shifting towards a positive reading, which should lead to more accessible lending and economic growth.

AKA The good times are coming.

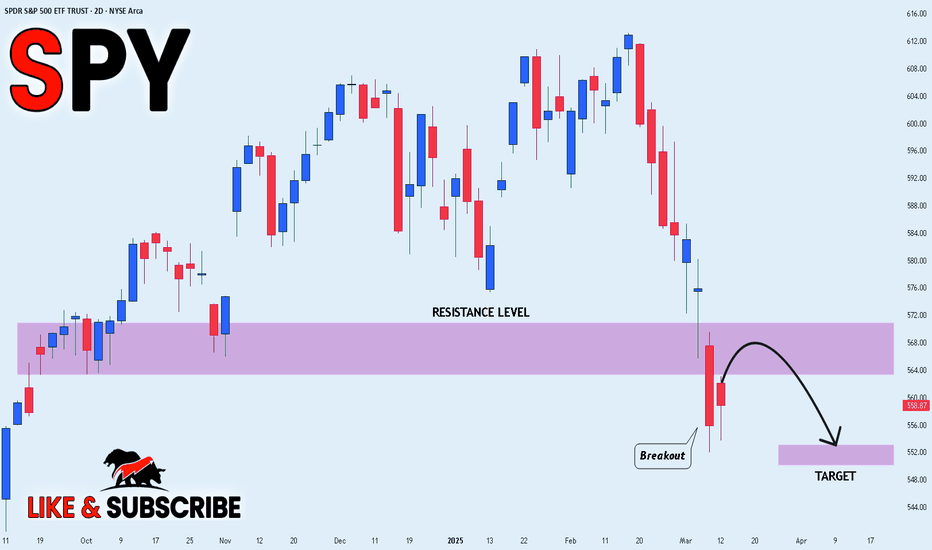

A Huge Technical Re-Test of This Important TL Has Just Occurred!Trading Family,

Tariff FUD is recking traders rn. After breaking important support which started in Nov. '24, I knew the SPY was in trouble. My first target down was 563. We hit that and broke it. My second target down was 550. We are there right now! Will it hold? I don't know. TBH, I don't think any analyst that is honest knows. Investors have never seen Tariffs levied like they have been recently by the Trump admin. Noone really knows how this is going to impact the current economy, which is now global (big diff from the last U.S. tariff econ in the late 1800's).

But I can say that this is a big support which is the neckline of our large long-term Cup and Handle pattern started all the way back in Jan. of 2022! We did have one retest already. Usually, this is all that is needed. But apparently, the market wants another. Though the support is strong, remember, every time it is tagged, it weakens. Thus, if it can't hold this current downturn, I suspect it will drop hard from here should it break, possibly dropping all the way to 460. Be prepared for this and watch your trendline closely!

On the other hand, if it holds, I see a huge bounce incoming! We'll probably then go all the way back up to test the underside of that support (red with two with lines) that we broke. Hold on to your hats! We are living in unprecedented times with unprecedented market volatility.

The last item to note is that, once again, this all seems to be occurring at the same time that U.S. congress and senate are voting on a continuing resolution. Correlation does not necessarily equal causation however, in this case, I would suggest that should a U.S. gov't shutdown occur, our support will break and down we'll go. Should a CR pass, big bounce incoming. Stay tuned and watch the news closely for this. It seems to be a news driven event.

✌️ Stew

APPLE Buy opportunity on the 1W MA50.Apple Inc. (AAPL) has been trading within a 2-year Channel Up since the January 03 2023 bottom and in the past 3 months (December 26 2024) has been forming the latest Bearish Leg. On Tuesday this Leg broke below its 1W MA50 (red trend-line) for the first time in 10 months (since May 08 2024), which is the strongest buy signal since the April 19 2024 Higher Low bottom of the Channel Up.

As you can see, even the 1D RSI pattern is similar with the one that made the October 26 2023 1W MA50 test. That was also on the 0.618 Fibonacci retracement level from the respective previous Low.

As a result, it is now highly likely to see a rebound, especially if the 1W candle closes above the 1W MA50, to test the previous High and 1.0 Fib at $260, like the December 14 2023 High did.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

TESLA road map !!!Tesla's price can drop below $200 and then have a good increase.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

Nvidia (NVDA) Share Price Rises Over 6%Nvidia (NVDA) Share Price Rises Over 6%

The NVDA stock chart shows that following yesterday’s trading session, the share price climbed over 6%, outperforming the Nasdaq 100 index (US Tech 100 mini on FXOpen), which gained just over 1%.

Despite this recovery from a six-month low, NVDA shares remain down 15% year-to-date.

Why Did Nvidia (NVDA) Shares Rise Yesterday?

Positive sentiment swept through the stock market after U.S. inflation data came in lower than expected. The Consumer Price Index (CPI) for the month stood at 0.2%, below analyst forecasts of 0.3% and the previous reading of 0.4%.

Investors may now be looking for opportunities following the March sell-off, triggered by Trump’s tariff policies and recession fears—and NVDA shares appear attractive in this context.

Barron’s suggests that NVDA stock may currently be undervalued, while MarketWatch cites BofA analyst Vivek Arya, who advises investors to focus on Nvidia’s gross profit margins as a key driver of significant share price growth.

Technical Analysis of NVDA Stock

Earlier this month, we identified a descending channel (marked in red) and suggested that its lower boundary could act as support—which was confirmed (highlighted by the circle).

Bullish perspective:

- The stock opened with a bullish gap and gained throughout the session, failing to hold below the psychological $110 level.

Bearish perspective:

- The price remains within the descending channel, with the median line potentially acting as resistance.

- The $117.50 level, previously a support, has turned into resistance (as indicated by the arrows) and may pose a challenge to further recovery.

NVDA Share Price Forecast

According to TipRanks:

- 39 out of 42 analysts recommend buying NVDA stock.

- The average 12-month price target for NVDA shares is $177.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Indian market cannot go bullish until RUPEE becomes strong !a lot of analysts saying Dollar is going to week vs rupees but seeing technical chart, dollar is traded above 50 EMA and never come to touch since October. currently Dollar completed Symmetrical Pattern showing any upcoming momentum may happen, either bullish or bearish is just could say after seeing breakout/breakdown this pattern. To gain strength in Rupee it is required to give USDINR 50EMA breakdown or bearish crossover. Till then the rupee will remain weak and Indian stock market also.

Nightly $SPY / $SPX Scenarios for March 13, 2025 🔮 🔮

🌍 Market-Moving News 🌍:

🇰🇷🇺🇸 South Korea's Trade Minister Visits U.S. 🇰🇷🇺🇸: South Korea's Trade Minister, Cheong In-kyo, is visiting Washington, D.C., from March 13 to 14 to discuss trade issues, including reciprocal tariffs and investment opportunities, with U.S. counterparts. This visit aims to address concerns about tariffs following President Trump's comments regarding disparities between U.S. and South Korean tariffs. The outcome of these discussions could impact sectors reliant on U.S.-South Korea trade relations.

🇩🇪🛠️ German Debt Reform Debates 🇩🇪🛠️: Germany's Bundestag is set to begin debates on debt reform plans starting March 13, focusing on increasing infrastructure spending and reforming state borrowing rules to fund defense. The proposed creation of a €500 billion infrastructure fund aims to stimulate the economy. These reforms could influence European economic stability, indirectly affecting U.S. markets through global economic interconnections.

📊 Key Data Releases 📊:

📅 Thursday, March 13:

🏭 Producer Price Index (PPI) (8:30 AM ET) 🏭:The PPI measures the average change over time in selling prices received by domestic producers, offering insights into wholesale inflation trends.

Forecast: +0.3% month-over-month

Previous: +0.4% month-over-month

📉 Initial Jobless Claims (8:30 AM ET) 📉:This weekly report indicates the number of individuals filing for unemployment benefits for the first time, providing insight into the labor market's health.

Forecast: 226K

Previous: 221K

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult with a professional financial advisor before making investment decisions.⚠️

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

AMD: Bottomed and can rally by as much as +140%.AMD is bearish on its 1D technical outlook (RSI = 40.266, MACD = -4.630, ADX = 52.178) but technically appears to be forming a new multi-month bottom after exactly 1 year of downside. The 1D RSI hit the S1 level, which priced the October 10th 2022 bottom. The outcome of that bottom was a +142.42% rally, same as the October 23rd 2023 Low, whose +142.42% rally formed the March 2024 ATH. This time this week's low has come very close to the S1 level, which is the strongest support level on the long term. A new potential +142.42% rally from the current levels would make a marginal ATH (TP = 230) and that's our current target for the end of the year.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##