Premier Explosives is exploding on charts. Premier Explosives Ltd. engages in the manufacture of explosives, detonators, propellants, services, and other traded items. Its product portfolio includes defense products and commercial explosives. Premier Explosives Ltd. Closing price is 493.50.

The positive aspects of the company are Companies with Low Debt, Strong cash generating ability from core business - Improving Cash Flow from operation, Companies with Zero Promoter Pledge, RSI indicating price strength and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are high Valuation (P.E. = 83.7), Stocks Underperforming their Industry Price Change in the Quarter, Companies with growing costs YoY for long term projects and MFs decreased their shareholding last quarter.

Entry can be taken after closing above 496 Historical Resistance in the stock will be 530, 583 and 605. PEAK Historic Resistance in the stock will be 633 and 673. Stop loss in the stock should be maintained at Closing below 429 or 405 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Stocksgivenbymeinsmartplusfinancialweekly

IRFC trying to break out on a fast track. Indian Railway Finance Corp. Ltd. engages in the business of borrowing funds from the finance markets to finance the acquisition of assets which are leased out to the Indian Railways as finance lease. Indian Railway Finance Corp. Ltd. Closing price is 138.61.

The positive aspects of the company are Stocks Outperforming their Industry Price Change in the Quarter, Companies with Zero Promoter Pledge, RSI indicating price strength, Strong cash generating ability from core business - Improving Cash Flow from operation and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are high Valuation (P.E. = 27.9), PE higher than Industry PE, Companies with high market cap, lower public shareholding and MFs decreased their shareholding last quarter.

Entry can be taken after closing above 140 Historical Resistance in the stock will be 152 and 165. PEAK Historic Resistance in the stock will be 176 and 189. Stop loss in the stock should be maintained at Closing below 122 or 108 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

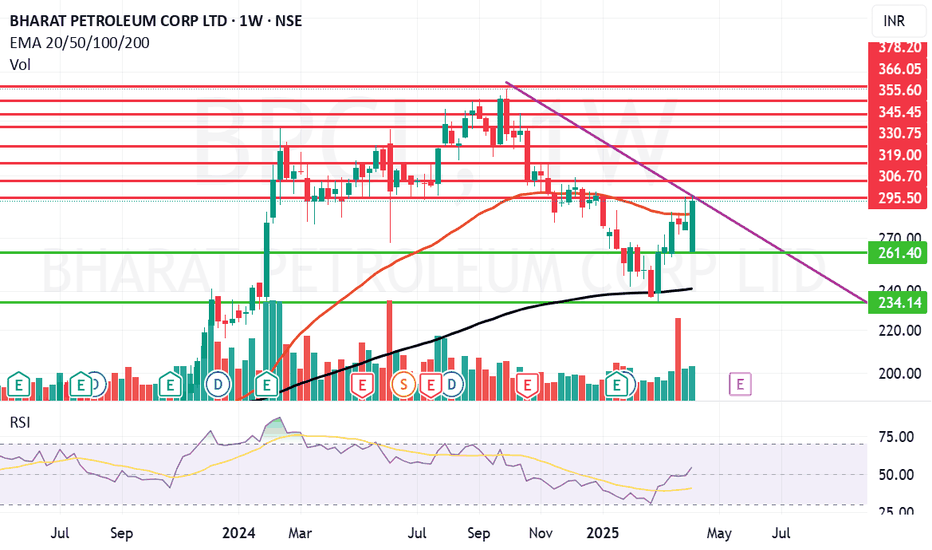

BPCL looking strong on Weekly Charts. Bharat Petroleum Corp. Ltd. is a holding company, which engages in the business of refining of crude oil and marketing of petroleum products. It operates through the Downstream Petroleum and Exploration & Production (E&P) segment. The Downstream Petroleum segment includes the refining and marketing of petroleum products. The E&P segment focuses on hydrocarbons.

Bharat Petroleum Corp. Ltd. Closing price is 293.20. The positive aspects of the company are Very Attractive Valuation (P.E. = 9.3), Companies with reducing Debt, Companies with Zero Promoter Pledge, Stocks Outperforming their Industry Price Change in the Quarter, Growth in Net Profit with increasing Profit Margin and MFs increased their shareholding last quarter. The Negative aspects of the company are Declining Net Cash Flow : Companies not able to generate net cash and Companies with growing costs YoY for long term projects.

Entry can be taken after closing above 296 Historical Resistance in the stock will be 306, 319 and 330. PEAK Historic Resistance in the stock will be 345, 355 and 366. Stop loss in the stock should be maintained at Closing below 261 or 234 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

GSFC can grow and make it greenGujarat State Fertilizers & Chemicals Ltd. engages in the manufacture and distribution of fertilizers and chemicals. It operates through the following segments: Fertilizer Products and Industrial Products. The Fertilizer Products segment includes urea, ammonium sulphate, di-ammonium phosphate and ammonium phosphate sulphate and nitrogen-phosphorus-potassium products. The Industrial Products segment comprises of caprolactam, nylon-6, nylon filament yarn and nylon chips, melamine and polymer products.

Gujarat State Fertilizers & Chemicals Ltd. CMP is 224.13. The positive aspects of the company are Attractive Valuation (P.E. = 16.9), Company with Low Debt, Company with Zero Promoter Pledge, MFs increased their shareholding last quarter and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company fall in Quarterly Revenue and Net Profit, Declining Net Cash Flow : Companies not able to generate net cash and Increasing Trend in Non-Core Income.

Entry can be taken after closing above 227 Targets in the stock will be 232, 241 and 250. The long-term target in the stock will be 258, 268 and 283. Stop loss in the stock should be maintained at Closing below 218 or 188 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Redington looking red hot. Redington Ltd. provision of machinery, equipment and supplies. It includes computers, computer peripheral equipment, software, electronic, and telecommunications equipment and parts. It operates through the India, and Overseas segments.

Redington Ltd. CMP is 193.37. The Negative aspects of the company are MFs decreased their shareholding last quarter. The positive aspects of the company are Attractive Valuation (P.E. = 12.5), Company with Low Debt, Company with Zero Promoter Pledge, Dividend yield greater than sector dividend yield, High Volume, High Gain and Stocks Outperforming their Industry Price Change in the Quarter.

Entry can be taken after closing above 199 Targets in the stock will be 204, 212 and 220. The long-term target in the stock will be 225 and 236. Stop loss in the stock should be maintained at Closing below 180 or 169. depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Vimta Labs trying to be victorious.Vimta Labs Ltd. engages in the provision of contract research and testing. It services include cGMP laboratory services; analytical food and water; preclinical research; clinical research; biopharma; environmental assessments; and clinical reference lab.

Vimta Labs Ltd. CMP is 558.20. The positive aspects of the company are Company with Low Debt, Company with Zero Promoter Pledge, Mutual Funds Increased Shareholding in Past Month and Good Aggregate Candlestick Strength. The Negative aspects of the company are High Valuation (P.E. = 30.2), Declining Net Cash Flow and Inefficient use of assets to generate profits.

Entry can be taken after closing above 569 Targets in the stock will be 599, 617 and 643. The long-term target in the stock will be 667 and 702. Stop loss in the stock should be maintained at Closing below 517 or 503 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Titagarh Rail systems catching the train. Titagarh Rail Systems Ltd. operates as a holding company, which engages in the manufacture and sale of freight wagons, passenger coaches, and steel castings. It operates through the following segments: Freight Rolling Stock, Passenger Rolling Stock, Shipbuilding, and Others. The Others segment includes miscellaneous items like specialized equipment's for defence, bridge girders, tractors, and others.

Titagarh Rail Systems Ltd CMP is 1197.50. The positive aspects of the company are Company with Low Debt, Rising Net Cash Flow and Cash from Operating activity, Annual Profit Growth higher than Sector Profit Growth AND Strong Annual EPS Growth. The Negative aspects of the company are High PE (PE=55.3), High promoter stock pledges AND Companies seeing significant coronavirus impact.

Entry can be taken after closing above 1283. Targets in the stock will be 1338, 1509 AND 1596. The long-term target in the stock will be 1710, 1795 AND 1876. Stop loss in the stock should be maintained at Closing below 1049.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Kopran can climb further. Kopran Ltd. is a holding company, which engages in the manufacturing of pharmaceuticals and related products. It operates through the following business units: Formulations, and Active Pharmaceutical Ingredients. The firm's products include Amyn, Lokit, and Ciproquin.

Kopran Ltd CMP is 320. The positive aspects of the company are Company with Low Debt, Company with Zero Promoter Pledge, FII / FPI or Institutions increasing their shareholding, Annual Profit Growth higher than Sector Profit Growth AND Mutual Funds Increased Shareholding in Past Month. The Negative aspects of the company are Declining Net Cash Flow : Companies not able to generate net cash AND Stocks in the sell zone based on days traded at current PE and P/BV.

Entry can be taken after closing above 321. Targets in the stock will be 330 and 342. The long-term target in the stock will be 352 AND 368. Stop loss in the stock should be maintained at Closing below 291.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Chembond can bond well in your medium term portfolio.Chembond Chemicals Ltd. engages in the manufacture and sale of specialty chemicals. Its products include water treatment, polymers, construction chemicals, coatings, animal nutrition's, and industrial biotech products.

Chembond Chemicals Ltd. CMP is 617.25. The positive aspects of the company are moderate Valuation (P.E. = 19), Company with Low Debt, Book Value per share Improving for last 2 years, Company with Zero Promoter Pledge, Annual Profit Growth higher than Sector Profit Growth and Strong Performer, Under Radar Stocks. The Negative aspects of the company are Fall in Quarterly Revenue, net profit and increase trend of non-core income.

Entry can be taken after closing above 624 Targets in the stock will be 656 and 677. The long-term target in the stock will be 706 and 746. Stop loss in the stock should be maintained at Closing below 586 or 553 depending on your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.