$COFORGE: Coforge Ltd. – AI Travel Tech Titan or Overhyped?(1/9)

Good afternoon, everyone! 🌞 NSE:COFORGE : Coforge Ltd. – AI Travel Tech Titan or Overhyped Split?

Coforge snags a $1.56B Sabre deal and a 1:5 stock split—shares spike 10%! Is this IT gem ready to soar or just riding AI hype? Let’s unpack the buzz! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Recent Surge: Shares up 10% post-Sabre deal news 💰

• Stock Split: 1:5 split announced, boosting accessibility 📏

• Sector Trend: IT outsourcing on fire, per X posts 🌟

It’s a hot streak, fueled by big moves! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: Not specified, but shares soaring 🏆

• Operations: Global IT player, travel tech focus ⏰

• Trend: $1.56B deal lifts travel sector outlook 🎯

Firm, staking its claim in AI-driven IT! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Sabre Deal: $1.56B, 13-year AI partnership 🔄

• Revenue Boost: Travel sector growth projected, per analysts 🌍

• Market Reaction: 10% jump, analyst upgrades flying 📋

Scaling up, with AI as the jet fuel! 💡

(5/9) – RISKS IN FOCUS ⚡

• Execution Risk: Big deal, big delivery pressure 🔍

• Hype Factor: AI buzz could overinflate expectations 📉

• Competition: IT giants crowding the space ❄️

High stakes, but risks are real! ⚠️

(6/9) – SWOT: STRENGTHS 💪

• Mega Deal: $1.56B Sabre contract, 13 years locked 🥇

• Travel Tech: Niche expertise shining 📊

• Split Appeal: 1:5 makes it investor-friendly 🔧

Loaded with ammo for growth! 💼

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Execution hiccups could trip it up 📉

• Opportunities: AI adoption, travel sector boom 📈

Can it deliver or just dazzle? 🤔

(8/9) – 📢Coforge shares up 10%, $1.56B deal in pocket—your take? 🗳️

• Bullish: Skyrocketing on AI wings 🐂

• Neutral: Solid, but watch execution ⚖️

• Bearish: Hype outpaces reality 🐻

Drop your vote below! 👇

(9/9) – FINAL TAKEAWAY 🎯

Coforge’s $1.56B Sabre deal sparks a 10% surge 📈, with a 1:5 split sweetening the pot 🌱. Volatility’s our playground—dips are DCA gems 💰. Snag ‘em cheap, ride the wave! Goldmine or glitter?

Stocksplit

AVGO, Split coming? On it's way to 1550?The chart for Broadcom Inc. (AVGO) on the NASDAQ shows a bullish breakout from a falling wedge pattern, indicating a potential upward price movement.

After the breakout, the price has consolidated around the $1,406.64 level, suggesting a healthy pause before the next move.

The RSI at 57.48 indicates neutral to slightly bullish momentum, and increased volume during the breakout adds credibility to this move.

The projected path suggests the price will consolidate around $1,407.78 before breaking out to $1,419.17 and potentially reaching $1,438.35 and $1,445.40. Considering these factors, entering a long position if the price breaks above $1,419.17

with strong volume could be beneficial, with a stop loss below $1,391.91 to manage risk and targets at $1,438.35 and $1,445.40.

This could easily tun to 1550 with a 10% implied move on earnings.

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Always conduct your own research and consult a financial advisor before making any trading decisions.

CMG to split price SHORTCMG has announced a split. Makes sense to make shares more affordable but fractionals are

widely available. CMG may be fundamentally challenged by the underpinnings of the fast food

markets. that is overeating and rising prices. In the meanwhile the anti-obesity and anti-

diabetes trends are pushing hard led by the bological injectable meds from LLY, NVO and

others. One third of the people eat one half of the food and now an effective treatment

for that addiction is becoming increasingly available. The writing is on the wall and food biz

executives can read that writing. Enough said.

I am going short on CMG. It's best days of growth may behind it. The company announced plans

for 4000 more stores nationwide. Really? Time will tell. I vote with my wallet. My position

will not be small. The predictive algo has its forecast. My education included both medicine

and engineering. I understand the power of biology and mathematics. I deeply respect

both.

2X $TSLA 1D Tech. Analysis! (DBL TOP/M Formation) (1:4 R/R) TSLA is headed for a downhill ride if this pattern plays out! Some may say a stock split is coming up but that only changes the price the chart is traded at! Do not buy calls unless you are scalping for a day trade, but I am bearish on TSLA based off price action!

AMC - APE stock splitSo AMC decided to do a clever trick and take advantage of the hype coming back into stocks and even meme stocks. Retail traders have taken a hit, with many retail-heavy companies like Gamestop, Coinbase and Robinhood, etc., taking massive hits. However, GME has been doing well, COIN doubled off its lows, and HOOD looks decent.

As stocks are bouncing and the bull could be back, AMC decided to do an intelligent stock split by issuing new preferred stock they can sell. They named it APE, like the Apecoin, a popular NFT-related token, which could create a lot of hype around it. Essentially, it is a trap for retail to go and buy APE without hurting the price of AMC as much and allowing the company to raise the cash it needs. Last year, AMC dumped all of the company shares onto retail on the way up and raised 2B dollars that it has essentially spent and needs fresh cash as it still has a lot of debt. At the same time, they made this look like an airdrop, and it is like an airdrop, but one in which the company controls the majority of the shares.

The company's price looks pretty good regarding TA, as it bottomed nicely. First, it had an 86% correction, which means the entire bubble popped, and there is no froth in the market. It retested some key levels and then reclaimed some key support levels. Since May, it has essentially been in accumulation mode, and today we had the confirmation of the breakout, as the market initially gapped down and then had a massive rally. In my opinion, this rally could last for a while, with the price increasing to 50-60$ before it goes back down again. It wouldn't be surprising if we saw the market go up for the next two weeks and top close to the date of the airdrop/split (22nd of August).

This one trade will make me a LEGEND...We have a once in a lifetime trading opportunity that will be occurring at the end of the trading day.

It is very rare that we know an asset will drop and the date that it will be dropping.

GOOG is experiencing a 1-20 stock split which means for every share that someone holds of GOOG, they will receive 20.

I am taking advantage of this drop on my Forex broker by selling GOOG.

The price of GOOG will be reduced by 95% at the end of the market close today.

If you have a broker that will allow you to SELL GOOG, go ahead and make that happen before 4:00 PM EST when the market closes.

Thank me on Monday.

Remember my name, Jeffery Boston Weatherford.

I will be legendary in this field.

You heard it hear first.

Many blessings trader.

Enjoy Jeffery's Comet 🌠

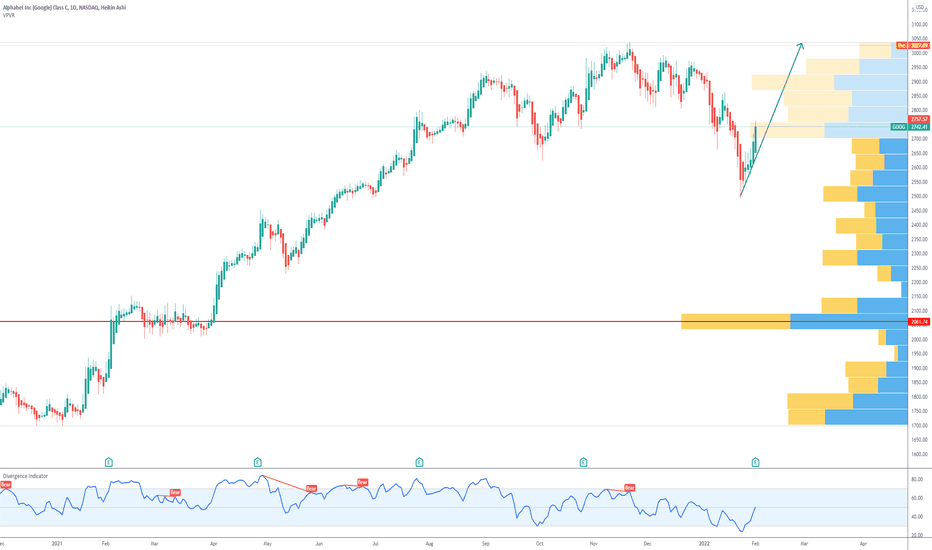

GOOG Alphabet Stock SplitGOOG 20-for-1 stock split is scheduled to occur on July 15.

Companies that that did stock splits statistically had outperform the market in the 12 months following the split.

I think we will se GOOG trading at $2350 ahead of the split.

Looking forward to read your opinion about it.

Doing the Splits (Amazon)Amazon

Short Term - We look to Sell at 136.62 (stop at 146.49)

Preferred trade is to sell into rallies. Previous support, now becomes resistance at 137.00. There is scope for mild buying at the open but gains should be limited. The 50% Fibonacci retracement is located at 136.05 from 170.83 to 101.26.

Our profit targets will be 102.56 and 91.98

Resistance: 137.00 / 150.00 / 170.00

Support: 115.00 / 102.00 / 85.00

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis, like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis, as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

What The Chart Says Upon Amazon's SplitAmazon stock AMZN had started trading with the split-adjusted price around $125 yesterday. The stock split usually increases the liquidity of the shares making it accessible to more investors who are not comfortable buying pricey stocks.

Also, BofA Global Research has found that splits "historically are bullish" for companies that enact them, with their shares marking an average return of 25% one year later versus 9% for the market overall.

From a technical perspective, Shares of Amazon AMZN advanced 1.99% to $124.79 Monday, however, prices struggled to make it through the $130.00 resistance levels - that represents the double bottom's minimum target - on the daily chart. So, a slight probable pullback is expected to test $122.20 - $119.85 - $119.00 support levels that may serve as an entry points, in order to hit back $130.34 - $135.78 targeted resistance levels.

AMZN Amazon 20-for-1 Split on Monday, June 6AMZN Amazon was the last giant company which didn`t split its stock.

And the $2510 price was somehow prohibitive for retail investors.

The 20-for-1 Split will be more retail investor friendly and we could play some options at a decent price for AMZN.

Statistically we saw an increase in price of every company that did a stock split so far, so i expect the same for AMZN Amazon.

My price target is $2738 or its split equivalent by the end of next week.

I see an 11.30% upside from here.

Looking forward to read your opinion about it.

$AMZN DOUBLE BOTTOM BAGa real money maker right here boa.

$AMZN in a very similar double bottom pattern to previously mentioned charts from $SPY and $NVDA. $AMZN also has a stock split June 6th, stocks are known to run in anticipation to their split and I don't think $AMZN will be any different. Kind of expecting some parabolic price action.

My price targets are noted by the green lines; and dare I say $AMZN may begin to fill the gap at around $2615?? I say it's quite possible.

Not financial advice

Buy Tesla now or waitNASDAQ:TSLA

Are you waiting to buy Tesla like me?

Do you think you can buy Tesla in the $700s?

Are you concerned about the impact of supply chain issues on EV companies?

News: Just a few hours ago, TESLA in a securities filing said that it wouldn’t be able to file a proxy statement until sometime later this year, and did not provide a specific timeline. They missed the April 30 deadline for filing its shareholder proxy after the end of its fiscal year on Dec. 31.

Like you all, I'm waiting on details of the anticipated share-issuance vote which should “enable a stock split".

In the meantime, let's see what the charts are saying (keeping in mind that we have a major catalytic event coming up on May 3rd & 4th; increase of interest rates by 50 basis point).

EMA ( Exponential Moving Average ): Price action is below the 200 EMA (discount buying opportunity) Price is also below 20/50/100/200 EMA and are all pointing downwards! With the 20 EMA crossing the 50 EMA and both pointing downwards, this is bad news; we have a death cross in the making.

TTM Squeeze: Squeezing to the bottom; and price currently at a hidden resistance.

Fib Levels: with the price below the 1 fib and headed towards the 1.618, their is a high probability that if it fails this current resistance (support line) it would go $800 (1.618 fib level). Worst case scenario, we could get an opportunity at $733.

Candle Stick: Summary of last 5 candles equate to a bearish movement. The last pairs look like a Bearish Harami or Tweezer... weird... didn't even allow for the 3 black crow.

RSI: Not overbought or oversold. At 37, it would be nice if it comes down to 30 or lower for a good entry point

Pattern: Down by the sea ... off to the Falling Wedge

History: The stock is down about 19% so far this year... Everyone and their mama is talking about this stock (Every stock split is the poor man's gold)

Company is worth Trillions and the consumer base love Tesla to the point that the have a cult like following... hmm... I really need to be buying the bottom.

My HIGHEST CONVICTION trades of 2022 - Amazon and GoogleThis is the chart video for my Best of Us Investors production detailing why I put Amazon NASDAQ:AMZN and Google NASDAQ:GOOG as my highest conviction trades of 2022. The past tech stock splits of Apple NASDAQ:AAPL Tesla NASDAQ:TSLA and NVidia NASDAQ:NVDA inform my thesis going into these future splits.

"OK Google, what is patience?"Since the pop on earnings and the split news I have been watching for a good pullback on Google NASDAQ:GOOG . I am operating under the thesis that the pre-split price action will signal a rally as in other past tech stocks. This rally may take a while because the July 15th split date is relatively far out. For the last several days I have been waiting for the price to come to the 2775 level it must hold to remain bullish to retest and break the high.

AZMN the only giant who hasn`t made a stock split (yet)If you haven`t bought the dip:

Then you should know that AMZN is the only giant who hasn`t made a stock split yet.

Alphabet Inc. announced a 20-to-1 Stock Split yesterday.

And you all know how appealing were Apple , Tesla and Nvidia for retail investors after the stock splits!

My short term price target is $3150.

Looking forward to read your opinion about it.

GOOG Alphabet Inc. 20-to-1 Stock SplitRuth Porat, Alphabet CFO: “The reason for the split is it makes our shares more accessible”

Alphabet Inc . 20-to-1 Stock Split on July 15 could lead to Alphabet’s listing on the Dow Jones Industrial Average , the indexs that holds 30 blue-chip companies.

And you all know how appealing were Apple , Tesla and Nvidia for retail investors after the stock splits!

My short term price target is the all time high, $3037.

Looking forward to read your opinion about it!

GOOGLE Stock Split - Big opportunity!Today on earnings NASDAQ:GOOG announced an upcoming 20 to 1 stock split. This is a major news event with a history we can look back on. There are three instances from the last two years (TSLA, AAPL, NVDA) where tech stocks announced splits and then proceeded to FOMO rally. Trade with proper risk controls but look for opportunity NOW in Google!

I talked about this trade last year with Nvidia when that stock did a split. It is the same trade. Check link below:

TESLA STOCKSPLIT MONDAY NOV 15I think Tesla will do a stocksplit next Monday and we will see the stock soaring to 2300 at the very least. But the stock will go sideways and reaccumulate again around 1240 and 1160 before the stocksplit announcement on Monday.

After the bullrun the stock will crash down to the diagonal line that we see since 2020 that is more visible in 2 diagonal blue lines on my previous posts.

NVDA Buy Levels [Post-Stock Split]So things got a little weird today at the open with the stock split as many traders checked their holdings to see NVDA down -70% today.

Once it adjusted and all of the speculative traders jumped ship, Nvidia found itself spending most of the day battling at our .236 fib level, which is now $185 approximately. For now it has found itself above this level after bouncing beautifully off of the floor of the fib extension at around $178.

As always, I am waiting patient for a full body candle close above our .236 fib level on the 4 hour.

Keep an eye on the open tomorrow, as this asset is still most likely trying to regain its footing after what has been a very volatile past 2 weeks.

It is in my opinion that as long as we hold where we are currently, entries for a long is fair game. HOWEVER, beware that if you open below this level tomorrow, or confirm a 4 hour candle close below this level, all bets are off and you would be wise to keep patient and allow the price action to play out as risk below the .236 becomes difficult to size up.

If you are long, make sure you have either stops or at the very least price alerts set up for $185 incase it breaks.

Considering the wicks we had today both to the upside and downside on the 4 hour chart, things are very indecisive at the moment so I am ok with simply continuing to monitor.

Also, if this level does break down and confirm, a retest of $178 would be in store. From a trader perspective, if there is a retest it will be important that it bounces and does not come back to it again anytime soon. Too many retests of $178 would put this fib retracement at risk of being violated.

On the flipside, respect and support of the current fib near $185 (.236 fib) could be the buy opportunity patient traders have been waiting for.

Below you will find my price levels after the stock split I am looking at. This was found using the same method as in the pre-stock split idea.

The same buy ladder from that idea can be applied here as well. The beauty of this is that the buy ladder works better on the way up than it does when price is falling down.

$178

$185

$190

$194

$198

$203

$210

PLZ USE ALERTS AND OR STOP LOSSES