Investing in Health: Reasons Why Novartis AG Stock Stands OutIn an era where health is wealth, and the global healthcare sector is booming like never before, savvy investors are looking for opportunities that promise growth and a meaningful impact on people’s lives. Enter Novartis AG—a powerhouse in pharmaceuticals that’s not only redefining treatments but also setting new standards in innovation and sustainability.

A strong monthly demand imbalance at $97.13 per share has recently taken control. Expecting a decent reaction from this price level in the following weeks.

Stockstotrade

AMBER: Wave 5 Setup in Progress AMBER Enterprises (AMBER): Wave 5 Setup in Progress

Wave Analysis:

The stock is currently in the Wave 4 corrective zone between 5,762 - 5,667 INR, a key support area.

A potential liquidity sweep below 5,667 INR could attract strong buying interest.

Target zones for Wave 5 completion are 6,976 - 7,127 INR.

Key Observations:

Wave Structure: Completion of Waves 1, 2, and 3; Wave 4 is nearing a reversal zone.

Liquidity Sweep Potential: A dip below 5,667 INR might collect stop-loss liquidity before reversing.

Trading Plan:

Entry:

Look for entry near 5,762 - 5,667 INR upon confirmation of reversal (e.g., bullish candle with volume).

Monitor behavior if prices dip below 5,667 INR and recover sharply.

Stop-Loss: Place stop-loss below 5,060 INR (invalidates Wave 4).

Target Levels:

First target: 6,500 INR (partial profit booking).

Final target: 7,000+ INR (completion of Wave 5).

Indicators to Monitor:

RSI for oversold conditions at entry zones.

Volume confirmation during reversal.

Disclaimer: This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please do your own research or consult a financial advisor before trading.

Sonata Software Races to ₹675! TP4 Within Reach!Sonata Software, on the 1-hour timeframe, demonstrates a strong bullish momentum with TP1, TP2, and TP3 successfully achieved. TP4 is within close range and is likely to hit as the trend continues on the Risological Swing Trading Indicator.

Sonata Software Key Levels:

TP1: 587.45 ✅

TP2: 621.10 ✅

TP3: 654.75 ✅

TP4: 675.55 (Pending)

Sonata Software Technical Analysis:

The trade was initiated at 566.65, following a clear breakout above the Risological Trend Line. The consistent upward momentum indicates a strong trend, with well-marked take-profit levels and a tight stop-loss at 549.85 to manage risk effectively.

With TP4 nearly achieved, the bullish momentum suggests further upside potential. Traders should closely monitor the price action near TP4 for possible profit-taking or further extension.

Namaste!

SAP’s Cloud & AI MomentumSAP’s Cloud and AI Momentum: Why This Tech Giant Remains a Top Buy in 2024

SAP is a Germany based company specializing in enterprise application software

It operates through three key segments:

1.Applications, Technology & Services: This segment focuses on selling software licenses, subscriptions to SAP’s cloud applications, and related services. It encompasses support services, various professional services, implementation services for SAP’s software products, and educational services to help customers effectively use SAP solutions

2.SAP Business Network:This segment includes SAP’s cloud-based collaborative business networks and related services. It covers cloud applications and professional and educational services related to the SAP Business Network. This segment also encompasses cloud offerings developed by SAP Ariba, SAP Fieldglass, and Concur, which facilitate supplier collaboration, workforce management, and expense management.

3.Customer Experience:This segment offers both on-premise and cloud-based products designed to manage front-office functions, focusing on customer experience management. It provides solutions that help businesses enhance and streamline interactions with customers.

These segments enable SAP to offer a wide range of solutions, addressing enterprise needs from back-office functions to collaborative networks and customer-facing operations.

SAP remains a top pick, with clear growth momentum that could accelerate further and potential for margin improvements. My buy rating remains unchanged.

SAP reported its Q3 2024 earnings, showing a 10% year-over-year revenue increase in constant currency (CC) to €8.5 billion, maintaining the same growth momentum as Q2 2024. The highlight is the cloud segment’s revenue growth, reaching €4.35 billion, with a y/y CC growth rate accelerating from 25% in Q2 2024 to 27% in Q3 2024. This aligns well with my expectations, as the current cloud backlog (CCB) grew by 29% y/y CC, improving 100 basis points from Q2 2024. By product category, the Cloud ERP Suite showed 36% y/y CC growth, a 300bps sequential improvement. License revenue, though still declining, saw a slower drop from -27% in Q2 to -14% in Q3, and maintenance revenue declines also eased from -3% to -2%. This solid revenue performance contributed to a strong profit outcome, with adjusted EBIT beating estimates by approximately 9% at €2.24 billion, and a major free cash flow (FCF) beat of €1.25 billion, far surpassing the consensus of -€676 million.

Given this strong performance, it wasn’t surprising that management raised guidance, which is certainly encouraging. They now forecast adjusted EBIT in the range of €7.8 to €8 billion, a €150 million increase at the midpoint, implying y/y growth of 20% to 23% CC, up from the previous 17% to 21%. Cloud and software revenue guidance also increased by €400 million at the midpoint, with a new range of €29.5 to €29.8 billion, reflecting 10% to 11% y/y CC growth versus the previous 8% to 10%. Additionally, adjusted FCF is now projected between €3.5 to €4 billion, compared to the prior €3.5 billion.

I am confident that SAP can meet these targets for several reasons. First, the S/4HANA migration remains strong, as indicated by 29% y/y CC CCB growth and 36% y/y CC growth in the Cloud ERP Suite, which accounts for approximately 84% of total cloud revenue. Second, nearly one-third of deals signed in the quarter involved AI, highlighting increased demand for embedded AI solutions. This reinforces my previous view that AI adoption is driving SAP’s cloud migration efforts, as customers must utilize the cloud to fully leverage these AI capabilities. Notably, SAP is moving to the “expand” phase of its strategy by adding generative AI (GenAI) capabilities.

With SAP introducing more AI features, the company is well-positioned to continue capitalizing on this growth driver. For example, its AI-based assistant, Joule, now offers collaborative agent capabilities, allowing it to manage multiple AI agents for complex tasks—resulting in significant productivity gains. Additionally, the Knowledge Graph, a part of SAP’s GenAI suite, connects language and data to help users navigate SAP systems more efficiently. SAP has over 100 GenAI use cases and has added more than 500 skills to Joule so far, suggesting substantial growth potential.

AI adoption remains robust, as evidenced by AI’s central role in SAP’s sales strategy. Around 20% of deals now include premium AI features, and all ERP and LoB deals involve discussions around AI, signaling that AI is a key growth driver for SAP, especially considering that AI integration was minimal a few years ago.

I reaffirm my model assumptions and see continued attractive upside potential, even after SAP’s strong year-to-date share price rally. SAP is increasingly likely to achieve 10% growth for FY24, with further acceleration expected in FY25/26, driven by strong cloud migration and rising AI demand. Management’s upward revision of FY24 adjusted EBIT indicates that earnings margins will improve. Year-to-date, the adjusted earnings margin stands at around 21.1%, making my full-year target of 21.5% feasible. As growth accelerates and SAP completes its restructuring (which impacts 9,000 to 10,000 positions as announced in January 2024), margins should rise to the mid-20% range. I’ve added 300 basis points based on trends from FY22 to FY24. Additionally, with no visible slowdown in growth momentum, I expect the market to continue valuing SAP at a premium, at 36x forward PE compared to the three-year average of 23x.

The macroeconomic environment poses risks, especially if supply chain challenges persist or interest rates rise. Political uncertainties, such as the upcoming U.S. election, could lead to reduced business investment, impacting corporate IT budgets and SAP’s sales. Additionally, if SAP’s S/4HANA and cloud products underperform, or if there are delays in product development or launches, investor expectations may be disappointed, particularly regarding S/4HANA.

To conclude, I maintain my buy rating on SAP. The company’s strong Q3 2024 performance and revised guidance have reinforced my positive view. The accelerating growth in cloud revenue, driven by solid S/4 HANA migration and increased AI adoption, is highly encouraging. While macro risks remain, SAP’s robust fundamentals and favorable growth outlook support a buy rating.

ADANI GREEN, 45% SHORT TRADE CAUGHTADANI GREEN Trade Overview:

Adani Green saw a sharp 45% drop on the 4-hour timeframe, perfectly captured by the Risological Swing Trading System . This short trade setup successfully achieved all profit targets, providing traders with a significant opportunity to capitalize on the bearish momentum.

ADANI GREEN Key Levels:

TP1: 1789.10 ✅

TP2: 1602.55 ✅

TP3: 1415.95 ✅

TP4: 1300.65 ✅

ADANI GREEN Technical Analysis:

The entry was confirmed at 1904.45 as the Risological Red Lines indicated strong downward pressure. Adani Green continued to follow this bearish trend with no signs of reversal, allowing for precise execution of all targets. Traders who maintained their positions benefited immensely from this clear and systematic setup.

The final breakdown past TP4 marked the culmination of the trade, further affirming the system's accuracy in identifying reliable entry and exit levels.

The strategic placement of the stop-loss at 1997.70 ensured risk management was intact throughout the move.

JINDAL WORLDWIDE - Massive Intraday LONG TradeJINDAL WORLDWIDE (15-Minute Timeframe) - Massive Long Trade Secured

Trade Setup:

A powerful bullish breakout captured on the 15-minute timeframe using the Risological Trading Indicator. This trade highlights an impressive rally with all targets hit.

Key Levels:

Entry: 282.75

Stop Loss (SL): 278.30

Take Profit Targets:

TP1: 288.20

TP2: 297.00

TP3: 305.85

TP4: 311.30

Technical Overview:

The price action reflects strong bullish momentum, supported by upward-trending moving averages and consistent buying pressure.

The Risological Indicator provided a timely entry signal, capitalizing on this rapid uptrend.

Results:

The trade successfully achieved all profit targets, delivering substantial gains for intraday traders. The well-defined stop-loss ensured controlled risk, allowing traders to maximize their returns.

Insight:

This trade underscores the effectiveness of the Risological Indicator in identifying high-probability entries and exits in dynamic market conditions.

Keep monitoring for further setups!

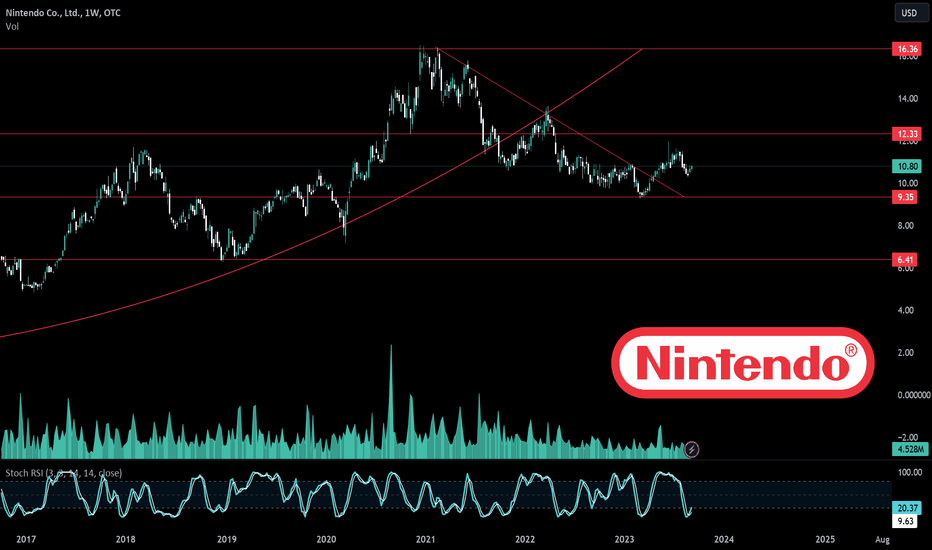

NTDOY | NINTENDO & Nintendo Switch 2 🍄The next Nintendo console might arrive in 2024

Nintendo has reportedly demonstrated the Nintendo Switch 2 behind closed doors at Gamescom last month.some trusted developers got an early look at the Switch 2 and some tech demos of how games run on the unannounced system.

There was reportedly a demo of an improved version of Zelda: Breath of the Wild that’s designed to run on the more advanced hardware inside the Nintendo Switch 2, VGC corroborated the claims and revealed that Nintendo also showcased Epic Games’ The Matrix Awakens Unreal Engine 5 tech demo running on the type of hardware Nintendo is targeting for its next console. The demo reportedly used Nvidia’s DLSS upscaling technology with ray tracing enabled, suggesting Nintendo and Nvidia are working on a significant chip upgrade for this next-gen console. in July that a new Nintendo Switch is being planned for a 2024 release.

With 43 years of making immensely popular video games under its belt, you'd think that the video game pioneers at Nintendo probably have the business of success fully figured out.

But companies must change with the times and, according to Nintendo of America president Doug Bowser, that means finding a way to engage people with the legacy brand that might never pick up a video game controller.

Bowser spoke about what the company learned this year during the Nintendo Live event in Seattle, Wa. on Sept 1, referencing the enormous box office success of the "The Super Mario Bros. Movie" as one of its key indicators that Nintendo has the ability to reach an audience beyond those that naturally reach for a controller.

"We launched The Super Mario Bros. Movie, which very quickly became the second-largest box office grossing animated film of all time at $1.3 billion," Bowser said. "We launched The Legend of Zelda: Tears of the Kingdom, which, 18 million units later after a very brief period of time, it's one of our fastest launch titles ever, and then the event today. So it's really this drumbeat of activities, entertainment-based activities where we're trying to find ways to continue to introduce more and more people, not just players, but people to Nintendo IP… So that's what we're excited about."

Bowser also spoke about the launch of Super Nintendo World at Universal Hollywood, which delivered an impressive 25% bump to Comcast's Q1 earnings this year.

"And if I think about folding into the bigger strategy, this year has really been a very unique, and I dare say banner year for Nintendo in a lot of ways," Bowser said.Nintendo also continues to benefit from the sales of its aging Nintendo Switch console, with 129.53 million units sold worldwide. That makes it the company's second best-selling console of all time, right behind the handheld Nintendo DS, which sold 154.2 million units before it was discontinued in 2014.

The success of "The Super Mario Bros. Movie" drove rumors that another big feature film based on Nintendo's flagship Legend of Zelda series was coming as well, but Nintendo hasn't made a formal announcement about that ... yet.

Gaming is in the midst of an M&A arms race. The protracted pandemic has made sure of that. Companies from all sides of the market, Microsoft, Take Two, Sony to name a few, are cutting deals to secure content. The volume and scale of those deals point to where gaming is heading - the precipice of major shake-ups across its core commercial and distribution models. Microsoft's eye bulging $69 billion deal for Activision is a testament to that shift. Costly as the deal is, it's arguably a small price to pay to secure some of the biggest franchises in gaming: Call of Duty, Warcraft, Candy Crush and Overwatch. Even more so, considering those titles span a community of 400 million active monthly players. In other words, the deal is the boldest sign yet that content is the future of gaming, not consoles.

Should you invest in Nintendo?

The question comes down to whether you are willing to pay about SGX:40B for Nintendo's IP and potential earnings powers. To me, a company that continues to produce in-demand and profitable content is worth that price tag, especially after having generated a net profit of 432.7B yen, or $2.97B in FY2023. That's a P/E of about 13.5 after subtracting out Nintendo's current assets - not a hefty sum given everything Nintendo has going for it. Nintendo's strategy seems to be working, with The Super Mario Bros. Movie not only performing well on its own but also providing a boost to other Nintendo offerings. While there are concerns, there are also plenty of catalysts moving ahead. I am excited to see new Nintendo initiatives including more theatrical releases of their IP and their (positive) effects on the rest of the company's products.

Streaming Wars | Who’s Winning, Losing, and Sharing Passwords ?Netflix Is Laughing, Cable Is Crying, and Amazon Is Sneaking Up

Highlights for Today

- Trends and Market Share

- Disney: Streaming Profits on the Rise

- Comcast: Cable Restructuring Underway

- Warner Bros : Box Office Challenges

- Paramount: Streaming Growth Amidst Challenges

In the Battle for Loyalty, One Fact Stands Out: Netflix vs the Rest

1. Trends and Market Share

Platforms like YouTube Premium, Amazon Prime, and Apple TV+ do not report quarterly numbers. Additionally, Disney+ Hotstar is excluded due to its planned merger with Reliance in 2025.

Streaming continues to replace traditional linear TV, benefiting all players. Nielsen reports streaming comprised 41% of US TV time in September 2024, a 3.5-point increase year-over-year, primarily at Cable’s expense.

Key Trends to Watch

-Password-Sharing Crackdown: Following Netflix’s success, Disney introduced paid sharing in the US in late September, with effects expected to emerge in Q4. Max is also gearing up for this initiative.

-Amazon Prime’s Growing Presence:CEO Andy Jassy revealed that Prime Video attracts over 200 million global viewers monthly. Combining exclusive content, live sports, and e-commerce integration, Amazon’s ecosystem presents a credible challenge to Netflix.

-YouTube’s Dominance in Living Rooms: YouTube accounts for over 25% of US streaming TV time (excluding YouTube TV) and continues to grow. Alphabet disclosed that YouTube’s ads and subscriptions brought in $50 billion in revenue over the last 12 months, surpassing Netflix’s $38 billion.

-Subscriber Trends: Tentpole events, like the Olympics for Peacock or hit series like House of the Dragon for Max, drove sign-ups. However, retention remains a challenge for all but Netflix.

2. Disney: Streaming Profits Rise

Disney’s fiscal year ends in September, with Q3 FY24 covering the June quarter.

-Streaming Profits:Disney’s direct2consumer (DTC) segment, which includes Disney+, Hulu, and ESPN+, posted its second consecutive profitable quarter, generating $321 million in operating income. Core Disney+ subscribers rose by 4.4 million, reaching 123 million, driven by ad-supported tiers.

-Box Office Wins: Hits like Inside Out 2 and Deadpool & Wolverine powered $316 million in studio profits. Disney became the first studio to surpass $4 billion in global box office revenue in 2024.

- Challenges in Parks: Parks and Experiences revenue dropped 6% to $1.7 billion, impacted by hurricanes, rising costs, and competition from the Paris Olympics. Domestic attendance held steady, while international parks struggled.

- Linear TV Decline: Revenue fell 6%, with profits plunging 38% to $498 million as cord-cutting and reduced ad sales weighed heavily. Disney plans to integrate streaming and linear TV rather than divest assets.

- Optimistic Outlook: Disney expects earnings growth in FY25 (high single digits) and double digits in FY26 and FY27. Blockbusters like Moana2 and Mufasa:The Lion King are anticipated to maintain momentum.

Takeaway: Disney’s Q4 highlighted strides in its streaming turnaround, buoyed by box office wins. However, the decline in linear TV underscores the challenges of transitioning in a shifting media landscape. Strong content and a focus on profitability position Disney for success under Bob Iger’s leadership.

3.Comcast: Cable Restructuring

-Olympics Drive Growth:The Paris Olympics boosted NBCUniversal’s revenue by 37%, generating $1.2 billion in advertising and adding 3 million Peacock subscribers, which now total 36 million.

-Streaming Expansion: Peacock’s revenue rose 82% year-over-year to $1.5 billion, with losses narrowing to $436 million from $565 million last year.

-Cable Struggles: Cord-cutting led to a loss of 365,000 cable TV subscribers, with video segment revenue down 6.2%. Comcast is exploring a spinoff of cable networks like Bravo and CNBC to prioritize growth areas.

-Theme Parks Slow: Theme park revenue dipped 5% to $2.3 billion as domestic attendance normalized post-COVID.

-Broadband Trends:Despite losing 87,000 broadband customers, revenue increased 3%, with higher average revenue per user.

Takeaway:Comcast’s Q3 reflected both opportunities and challenges. While the Olympics showcased its media strength, declines in cable TV and theme parks persist. Streamlining through a cable spinoff could sharpen its focus, but sustaining growth in Peacock and broadband remains critical.

4.Warner Bruh : Box Office Challenges

-Streaming Growth:Max gained 7.2 million subscribers, reaching 110.5 million globally, supported by international expansion and hits like *House of the Dragon*. Streaming revenue rose 9%, marking Warner’s first profit since 2022.

-Box Office Struggles:Studio revenue declined 17%, with theatrical revenue falling 40% due to a weaker film slate (*Beetlejuice Beetlejuice* and *Twisters* compared to last year’s *Barbie*). Video game revenue dropped 31%.

-Mixed Network Results:Network revenue grew 3% from the Olympics and *Shark Week*, but advertising revenue fell 13%. The $9.1 billion NBA impairment from Q2 continues to loom.

-Debt and Cash Flow Issues:** Free cash flow dropped 69% to $632 million, with $41 billion in debt. Warner renewed its Charter Communications deal to bolster stability.

-CEO’s Confidence:David Zaslav emphasized Max’s momentum, projecting $1 billion in streaming profits by 2025 and hinting at password-sharing monetization.

Takeaway:Warner’s Q3 highlighted streaming success but underscored its dependence on Max as traditional film and TV segments falter. Balancing debt, declining cash flow, and expanding streaming profitability will be key to its stability.

5.Paramount: Streaming Growth

-Streaming Success:Paramount+ gained 3.5 million subscribers, reaching 72 million, thanks to sports like the NFL and UEFA and shows like *Tulsa King*. The streaming unit achieved a $49 million operating income, its second consecutive profitable quarter.

-TV and Film Challenges:TV revenue fell 6% due to lower ad sales and declining cable subscribers. The film division saw revenue plummet 34%, with theatrical revenue dropping 71%.

-Merger Progress:Paramount’s merger with Skydance Media is on track for early 2025, following the exploration of 12 potential bidders.

-Cost-Cutting:Paramount has completed 90% of its $500 million cost reduction initiative, resulting in layoffs and asset write-downs.

-Strategic Shift:Paramount is seeking a streaming joint-venture partner to better compete with Netflix and Disney while managing cable TV’s decline.

Takeaway: Paramount’s streaming gains are encouraging, but traditional TV and film struggles persist. The Skydance merger offers a potential transformation, though stabilizing legacy businesses remains a significant hurdle.

JIOFIN: Intraday and Swing Trading Opportunities

Timeframe: 15-Minute for Intraday & Multi-Day for Swing Traders.

Intraday Outlook: For aggressive traders, the Risological Indicator signals a confirmed bullish move with GREEN lines. If the GREEN indicator flips to RED, it’s time to book profits and exit the trade.

Swing Trade Outlook: Using the Risological Swing Trader, TP (Take Profit) targets are clearly marked:

TP1: 319.85

TP2: 333.35

TP3: 346.85

TP4: 355.20

Entry: 311.50

Stop Loss (SL): 304.75

This setup highlights the versatility of the Risological Indicator for both quick intraday decisions and strategic swing trades!

SUZLON: 27% Gains in 42 Days!SUZLON ENERGY Stock - Short Trade

Trade Summary:

The 4-hour chart of Suzlon Energy showcases a textbook short trade setup, with Targets 1, 2, and 3 already achieved using the Risological swing trading indicator.

This trade has delivered a remarkable 27% profit in just 42 days since the entry.

Target 4 is now firmly in sight, with strong bearish momentum supporting the trend.

Trade Highlights:

Entry Price: ₹76.90

Stop Loss: ₹81.47 (strategic risk placement)

Profit Targets :

TP1: ₹71.26 ✅

TP2: ₹62.12 ✅

TP3: ₹52.98 ✅

TP4: ₹47.33 (nearing completion)

Analysis:

Bearish Momentum: The price remains under the influence of a downsloping Risological Swing Trader indicator , confirming sustained selling pressure.

Steady Decline: The stock has consistently formed lower highs and lower lows, with the red EMA line reinforcing the downtrend.

Next Steps:

For those already in the trade, tighten trailing stops to safeguard profits while giving the trade room to hit TP4.

For new entrants, consider waiting for a retracement before entering to manage risk effectively.

Patience is key—TP4 is well within reach! 🧘♂️📉

The Big Exit | How One Auditor Walked Away from Super MicroThe Governance Shortfall: Inside Super Micro’s Auditor Crisis

On Wednesday, shares of the high performance server and storage solutions provider faced renewed selling pressure after the unexpected resignation of its audit firm, Ernst & Young LLP(EY)

In July 2024, EY alerted the Audit Committee about several concerns related to governance, transparency, internal controls, and the risk of delayed filing of the company's annual report. In response, the Board formed an independent Special Committee to investigate these matters, engaging Cooley LLP and forensic accounting firm Secretariat Advisors, LLC. Although EY and the Board received preliminary updates on the investigation, the final conclusions have not yet been shared.

The ongoing review raised doubts for EY regarding the company’s adherence to the COSO Framework principles for internal controls. EY questioned the company’s commitment to integrity, the independence of the Audit Committee, and the reliability of management’s and the Audit Committee's representations.

In its resignation letter, EY expressed its inability to rely on these representations or be associated with the company's financial statements, citing legal and professional obligations.

Despite the developments, Super Micro has indicated no expected changes to previously issued financial statements. The company plans to provide a Q1/FY2025 business update next week. However, it’s surprising that management didn’t include preliminary Q1 results in Wednesday's announcement, which could have mitigated the negative impact on its stock.

Super Micro is nearing a Nasdaq deadline to either regain compliance with listing requirements or submit a plan. With the auditor’s unexpected departure, it may be difficult for the company to present a viable plan, raising the risk of a near-term delisting.

This resignation comes at a critical time for Super Micro, as its rapid growth requires substantial working capital. Based on management’s projections, FY2025 cash needs could reach up to $3 billion, likely necessitating additional capital early next year. However, raising funds without audited financials could be challenging, potentially forcing Super Micro to relinquish market share to competitors like Dell Technologies or Hewlett Packard Enterprise.

In my view, EY’s departure increases the likelihood of a prolonged accounting review, which could hinder Super Micro’s ability to secure funding for anticipated growth. Therefore, it is crucial for the company to report strong preliminary Q1/FY2025 results and present a positive outlook next week.

Super Micro Computer’s troubles continue, as its auditor resigned due to concerns over management’s integrity and the Audit Committee's independence. This situation makes it unlikely for the company to achieve compliance with Nasdaq requirements soon, raising the potential for a near-term delisting.

With a need to re-enter the capital markets in early 2025, audited financials remain essential. A failure to secure funding could result in significant market share loss to major competitors like Dell Technologies and Hewlett Packard Enterprise.

Given these challenges, the increased risk of prolonged financial review, and a likely near-term delisting, I am reaffirming my "Sell" rating on Super Micro Computer's common shares.

Why Bioceres Crop Solutions is the Top Stock to Buy in 2024As the world grapples with increasing food demands and the urgent need for sustainable agricultural practices, one company stands at the forefront of this vital transformation: Bioceres Crop Solutions. With its innovative approach to crop enhancement and a robust portfolio of groundbreaking agricultural technologies, Bioceres is not just reshaping how we grow our food—it’s also poised to deliver impressive returns for savvy investors in 2024. in this supply and demand and price action analysis, I will explore why Bioceres Crop Solutions is more than just a stock; it’s a beacon of hope for sustainable farming and an investment opportunity you can’t miss!

With a strong foundation built on years of experience, impressive financial performance and a very strong demand imbalance at $6.20 per share, which took control in November 2024, we expect a decent reaction. The stock could rally more than 70% in the following weeks.

Chennai Petroleum's Sharp Drop Hits All Targets in 15m TradeAnalysis: Chennai Petroleum (CHENNPETRO) displayed strong bearish momentum on the 15-minute chart using Risological Swing Trader , leading to a successful short trade where all targets have been achieved.

Trade Summary:

Entry Level: 912.85

Target Levels:

TP1: 859.65 ✅

TP2: 773.50 ✅

TP3: 687.35 ✅

TP4: 634.10 ✅

Stop Loss: 955.95

Key Points:

Consistent Downtrend: The stock has followed a consistent downtrend, highlighted by the descending red moving average, indicating continued selling pressure.

Sector Impact: The broader energy sector may also be experiencing pressure, impacting stocks like Chennai Petroleum. Recent economic shifts could be contributing to the bearish outlook.

Conclusion:

The Chennai Petroleum short trade has successfully reached all marked targets. This movement reinforces the bearish sentiment in the stock, offering potential opportunities for traders monitoring short positions.

Estee Lauder’s 26% Plunge: Revenue Miss & All Short Targets Hit!Estee Lauder (EL) Stock Analysis:

Estee Lauder (EL) saw a dramatic 26% drop, marking a significant bearish turn as all short trade targets on the 15-minute timeframe were swiftly reached. The chart reflects intense selling pressure, with shares plummeting after disappointing earnings and cautious guidance.

Key Trade Details:

Entry Level: 88.29

Target Levels:

TP1: 87.89

TP2: 87.29

TP3: 86.58

TP4: 86.17

Stop Loss: 88.62

Key Market Insights:

Revenue Miss and Guidance Withdrawal: Estee Lauder missed revenue expectations, reporting a 4% YoY decline, and pulled its fiscal 2025 outlook, signaling incremental uncertainty in the Chinese market and Asia’s travel retail sector. The company now plans to provide only quarterly guidance.

Challenges in China and Travel Retail: Weak consumer sentiment in China and reduced demand in Asia travel retail, including low conversion rates in Hong Kong, led to a 5% drop in organic net sales, impacting overall performance.

Summary:

Estee Lauder’s sharp decline capitalized on bearish momentum, achieving all short trade targets quickly. The disappointing earnings, along with withdrawn guidance, underscore the headwinds Estee Lauder faces in a slowing global economy, particularly in Asia. This setup demonstrates the high-risk, high-reward potential for short-term trades in volatile stocks.

Tharimmune (THAR) Soars with Positive EMA Feedback!Analysis:

Tharimmune (THAR) is showing strong upward momentum on the 15-minute timeframe, setting up for a promising long trade. Recent entry at 5.23, with clear targets ahead:

Target 1: 7.31

Target 2: 10.69

Target 3: 14.07

Target 4: 16.16

Key Driver:

Positive regulatory feedback from the European Medicines Agency (EMA) on Tharimmune’s TH104 clinical program for treating chronic pruritus in primary biliary cholangitis has fueled significant investor interest, pushing the stock upward.

Technical Overview:

The chart illustrates a breakout pattern with well-defined support and resistance levels. If momentum continues, the stock is positioned to hit all targets as shown using the Risological Swing Trader as investor confidence builds.

TRENT Tumbles! Short Trade Hits First 2 Targets – More Downside?TRENT has exhibited strong bearish momentum since the short entry at 8161.30 on 15th October at 9:45 AM, successfully reaching Take Profit 1 (TP1) and Take Profit 2 (TP2).

Key Levels

Entry: 8161.30 – The short position was initiated as the price broke below this level, indicating a bearish trend.

Stop-Loss (SL): 8253.15 – Placed above recent resistance to protect against a potential price reversal.

Take Profit 1 (TP1): 8047.75 – The first target was reached, confirming the initial strength of the downtrend.

Take Profit 2 (TP2): 7864.00 – Continued selling pressure led to this target being achieved.

Take Profit 3 (TP3): 7680.30 – The next target in sight if the bearish trend persists.

Take Profit 4 (TP4): 7566.75 – The ultimate target, suggesting a significant downward move.

Trend Analysis

The price is trading below the Risological Dotted trendline, indicating a strong bearish trend. The sustained downward movement suggests further downside potential, with TP3 likely to be reached if the current momentum holds.

The short trade on TRENT is performing well, with TP1 and TP2 already achieved. With bearish momentum intact, the next targets at 7680.30 and 7566.75 could be within reach.

INDIAMART BUY VIEW Good Potential Stock - INDIAMART Buy Now

Trade Reason :

1) Weekly - Buying view - Market uptrend and Take support

2) Fib Retracement - 0.50 % correction Completed

3)Day Timeframe - Trend Reversed

4)Aggressive Trader - Entry Now

5)Conservative Trader - Wait for Little Correction in DAY timeframe

Entry - 2905 Rs

Stoploss - 2625 Rs

Target 1 - 3032 Rs

Target 2 - 3226 Rs

Use Proper Risk management ... Happy Trading

Review and plan for 26th July 2024Nifty future and banknifty future analysis and intraday plan in kannada.

STOCKS TO WATCH- included.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

BCL INDUSTRIES BUY NOW BCL INDUSTRIES - UPTREND

Trade Reason :

1) Fundamental Very Strong Stock

2) Monthly Uptrend and Correction completed for 61.8 % Golden ration level Respected .

3) Day - Trend Reversed and Trend line Breakout .

Entry - Current Price 62 - 63 Rs or Retest Level

Target - 76 Rs

Stoploss - 45 Rs

Happy Trading ...

Review and plan(stocks to watch) for 28th May 2024Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT