$GM the battle of faith$GM has always been a good indicator of $DJIA and the way it could move in the future. Last week swing high in this stock is highly unusual taking into an account indebtness and GDP fall and consumers uncertainty invoked by COVID-19. 38-38.4 is that magic line this stock needs to cross above or te be rejected from. It will be good for trading.

Stockstrading

BUY CLOSED ON ROKU! +9% ACC GAIN! 🤪Great BUY here achieving a total account gain of 9%! from risking just 1% per trade! SELL NOW OPEN! LETS SEE WHAT WE CAN BANK!

HOLD YOUR WINNERS! STICK TO YOUR PLAN!

What is our strategy?

Our strategy is a trend following strategy - that is coded in pine script to use with the trading view platform - the entries are shown automatically! NOTHING is done manually, it can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too!

What's in for the SPY in the short-term?Hello, traders!

SPY, the ETF that tracks the SPX performance has managed to remarkably recover from the lows of spring this year as the COVID -19 virus threat became real.

The ETF has drawn up a very determined short-term uptrend, supported by the FED's interventions in the CEF, ETF and Bond markets.

Currently the ETF has been trading in a range since September and has managed to form two tops circa the 360 (figure) level. My overall expectations are for the instrument to test the trendline support and from there to:

1. Bounce back inside the uptrend and to continue again towards 360 or;

2. A breakout towards the 320 zone to form the neck of the double top;

2.1. Strong bounce up again for the price to return back inside the trend or;

2.2. Push below the neckline;

3. Test the neckline and successfully and start to execute the double top

3.1. Directly drop from the breach if the selling accelerates.

First target and a possible support will be the 200SMA, which slope will probably curve around the 308-310 level.

Overall target of the formation is below the 50 Fibo zone circa 280 level.

MACD's two MA's are also crossing, triggering a sell signal. The volume histogram is also fading, showing deacceleration in buying which may be an additional trigger for selling pressure.

S&P 500 SHORT RISK FREE AND RUNNING + 2% ACCOUNT GAINSPX500 trade made a great move, hit a couple of loser on the way before the sell took off. Let's see what happens !

BASED ON 1% RISK YOUR ACCOUNT WOULD BE RUNNING +2%

OUR STRATEGY EXPLAINED:

The entry price, SL and multiple TPs are shown on the chart.

Our back testing and money management strategy itself is holding until a reverse signal to ride a big trend, but as you will not see the next signal - manage the trade as you wish should you decide to enter.

What is our strategy?

Our strategy is a trend following strategy, can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too - how cool is that? The strategy will confirm and support every open and closed position - so its quite easy to follow.

We just have to do what Percy does.

Please see our related ideas below for more information to explain what we do and how it can help you.

FTSE 100 MOVING NICELY + 3.7% USING CUSTOM STOCKS STRATEGY UK100 trade made a great move! Let us know if you're in.

If you're not in, join our community to get alert's like this.

BASED ON 1% RISK YOUR ACCOUNT WOULD BE RUNNING +3.7%

OUR STRATEGY EXPLAINED:

The entry price, SL and multiple TPs are shown on the chart.

Our back testing and money management strategy itself is holding until a reverse signal to ride a big trend, but as you will not see the next signal - manage the trade as you wish should you decide to enter.

What is our strategy?

Our strategy is a trend following strategy, can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too - how cool is that? The strategy will confirm and support every open and closed position - so its quite easy to follow.

We just have to do what Percy does.

Please see our related ideas below for more information to explain what we do and how it can help you.

IBM LONG SET UP (SIGNAL)TITLE : IBM BUY LIMIT ORDER

ASSETS : STOCK

SYMBOL : IBM

ORDER TYPE : (EP1) MARKET ORDER (1/2) position size (partial low lot entry)

(EP2) BUY LIMIT ORDER (2/2) (Now enter rest of position)

TF : Daily

ENTRY PRICE 1: $125.30

ENTRY PRICE 2: $122.30

STOP LOSS : $118.30 (70 PIPS)

TAKE PROFIT 1- $132.30 (70 PIPs)

TAKE PROFIT 2- $139.30 (140 PIPs)

TAKE PROFIT 3-$146.30 (210 PIPs)

STATUS : active

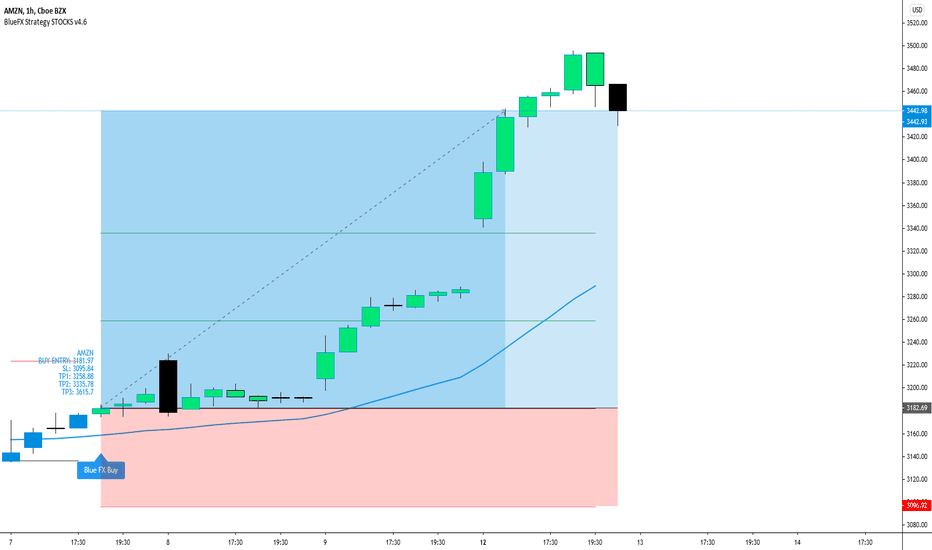

Stocks moving nicely! Amazon running +3% gaininitial buy price here was 3182.70, price now at 3442.98 with a running acc gain of 3%!

Stocks strategy file now released! below youll see our list of stocks we have found optimal settings for!

Amazon

Apple

Tesla

Cineworld

Facebook

Netflix

BABA

US30

DAX - DE30EUR

US500

NAS100

SPX500USD

Google

ROKU

UK100

BA - Boeing

Zoom ZM

Barclays

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

What is our strategy?

Our strategy is a trend following strategy - that is coded in pine script to use with the trading view platform - the entries are shown automatically! NOTHING is done manually, it can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too!

NETFLIX INC - Hello Friends ! Please support us with like and comment if you have any opinion

the netflix stock market is pushing upwards by constituting an uptrend , so you can enter the market as a buyer and take your profit at the first red candle that follows this trend and exit with a very good trade

Thank you .

Sell Facebook 24/9/2020 Facebook stock is moving in a short term downtrend

EMA 13 broke down EMA 34 with prices dropping when testing it

So it can sell

Target 215.25 stop losses 264.6

GREAT SELL RUNNING ON GOOGLE!Stocks strategy file now released! below youll see our list of stocks we have found optimal settings for!

Amazon

Apple

Tesla

Cineworld

Facebook

Netflix

BABA

US30

DAX - DE30EUR

US500

NAS100

SPX500USD

Google

ROKU

UK100

BA - Boeing

Zoom ZM

Barclays

SELL triggered on GOOGLE at 1637.69 we then closed in profit down at 1471.36

net account gain of 4.8% risking just 1% per trade.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

What is our strategy?

Our strategy is a trend following strategy - that is coded in pine script to use with the trading view platform - the entries are shown automatically! NOTHING is done manually, it can be used on any instrument and time frame. However, we have hard coded specific parameters for when trading the H1 time frame, so we can back up over 4200 previous trades to confirm our edge from previous data. This gives us confidence in execution and belief in our trading strategy for the long term.

The strategy simply sits in your trading view, so you will see exactly what we see - the trade, entry price, SL and multiple TPs (although we hold until opposite trade as this is the most profitable longer term plan), lot size, etc.

This could be on your phone trading view app, or laptop of course.

The hard work is done, so we have zero chart work time, no analysis, no time front of the chart doing technical analysis - technical analysis is very subjective - you may see different things at different times - how do you have a rigid trading plan on a H&S shoulder pattern? Your daily routine, diet, sleep, exercise can affect what you 'see' and your decision making, this doesn't happen when a strategy is coded like this; what we do have is a mechanical trading strategy...

What does this mean?

It means, we are very clear on our entry and our exit and use strict risk management (this is built in - put in your account size, set your risk in % or fixed amount and it will tell you what lot size to trade!) so we have no ego with our position and we are comfortable with all outcomes - its simply just another trade. This free's our mindset from worry and anxiety as we take confidence from knowing our edge is there and also that we have used sensible risk management.

The strategy itself can be used as a live trading journal too!