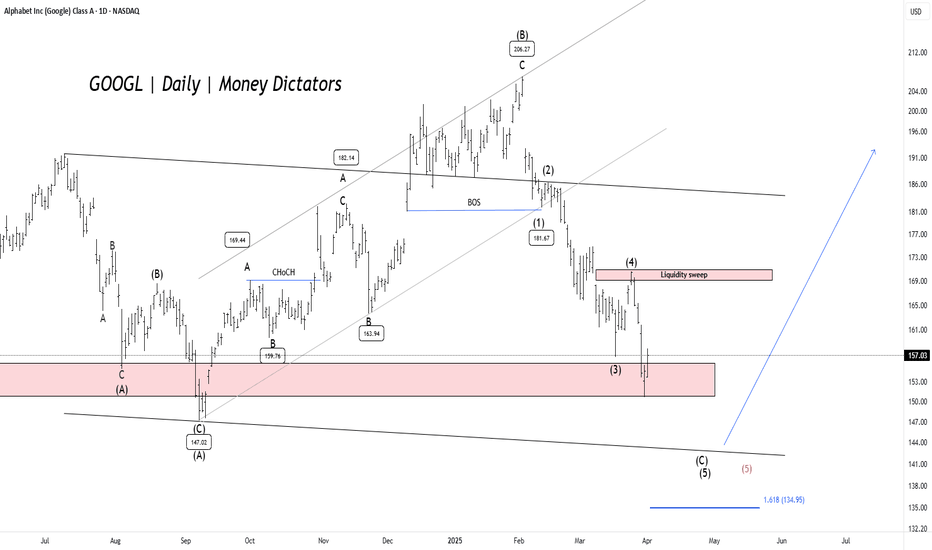

GOOGL - Elliott Wave Final ShowdownGOOGL has dropped over 27.28% , reaching a minor profit-booking zone. The $150 level serves as a key demand zone, where a potential price reversal could occur. The formation is either expanded flat or a running flat on the daily timeframe chart.

Confirmation is best observed near the lower trendline of the parallel channel. If bearish momentum persists, prices may decline further to the $142-$140 range before a strong rebound. Once the correction ends, the upside targets are $168, $180, and $195.

A new low will form if the previous low is breached. Further research will be uploaded soon.

Stocktips

Why Hermès’ margins shame the competitionThis analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

You know my favourite stocks are luxury stocks, and they’ve had a hard last year. Richemont and Moncler were the clear standouts from the most recent season (both grew sales), while Brunello did well too. Obviously, Kering did not do well. Here’s Hermes, which pretty much smashed everyone out of the park:

Revenue amounted to €15.2 billion

(+15% at constant exchange rates and +13% at current exchange rates)

Recurring operating income reached €6.2 billion, representing 40.5% of sales

Adjusted free cash flow amounted to €3.8 billion, up by 18%

Can we take a step back and please admire what smashing results those are — that’s a luxury business which does not cut corners operating on a 40.5% margin, with a free cash flow stream that is unheard of for the luxury industry. Let’s also consider that this is during what is nominally a recession.

Worth thinking about what makes Hermes special:

A hatred of meetings, corporate hogwash, and the associated.

They compete only with themselves — not others .

Human values. Hermes objects are made by people and bought by people . Corporate hogwash tends to see people as numbers, and then corporate hogwash forgets about the importance of psychology.

A fanatical obsession with product — product is the message.

No marketing team.

If your product is good enough, and the story you communicate is good enough, the people will come. The same can be said of Brunello, which I have always said is like a “mini-Hermes” — people buy Brunello for quality and the ethos it communicates. Worth re-reading Brunello’s daily routine, which does not look like the nonsense ice bath CEOs who you see on Instagram:

CFVF.N0000Next Resistance Level - 20

Support Level 33

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

Warren Buffett's Margin of SafetyIn the world of investing, few names carry as much weight as Warren Buffett. Often hailed as the Oracle of Omaha, Buffett's wisdom has guided countless investors to financial success. At the core of his investment philosophy lies a concept he considers paramount: the Margin of Safety.

Buffett once famously said that the three most important words in investing are "Margin of Safety." To delve deeper into this principle, he pointed to Chapter 20 of "The Intelligent Investor," a seminal work by Benjamin Graham, which he deemed the best chapter ever written on the subject.

Chapter 20: The Concept of a Margin of Safety

At its essence, the Margin of Safety revolves around the idea that every stock has a fair (intrinsic) value based on the underlying company. However, this fair value often deviates significantly from the stock's current market price.

No Margin of Safety: When the stock price exceeds its fair value, there is no margin of safety.

Margin of Safety: When the stock price falls below its fair value, a margin of safety exists.

Benefits of the Margin of Safety

Investing in any asset for less than its intrinsic value is a sound financial decision. However, in the world of investing, where determining precise fair values can be elusive, this principle holds even greater significance.

One can never pinpoint an exact fair value; they can only estimate a range. The Margin of Safety serves as a shield against potential errors in estimating fair value.

The Mathematical Advantage

A Margin of Safety provides two critical mathematical advantages:

Downside Protection: Avoiding losses is paramount in investing. It takes a 100% gain to recover from a 50% loss. Therefore, preventing losses should be a top priority.

Exponential Returns: Imagine a stock with a fair value of $10 but currently trading at $8, offering a 25% upside. Now, if that same stock were available for $5, the upside potential would skyrocket to 100%. A Margin of Safety can turn a good investment into an exceptional one.

Why Do Margins of Safety Exist?

The concept of Mr. Market, introduced by Benjamin Graham, plays a pivotal role in understanding the existence of Margins of Safety. Mr. Market is depicted as an impulsive individual, prone to bouts of depression (selling stocks at a discount) and exuberance (selling at a premium).

Stock markets exhibit such fluctuations due to the psychological biases and errors of market participants. Understanding this human element is crucial in grasping the significance of Margins of Safety.

In the words of Warren Buffett himself, "If you understand chapters 8 and 20 of 'The Intelligent Investor' and chapter 12 of 'The General Theory,' you don't need to read anything else." These chapters provide a foundation for investors to navigate the complexities of the market with the wisdom of a Margin of Safety.

In conclusion, the Margin of Safety isn't just a concept; it's a guiding principle that can safeguard your investments and unlock their full potential. Buffett's reverence for this idea underscores its importance in achieving success in the world of finance.

Hulamin Asc Triangle and Bearish FVG showing up signs to R5.40Ascending Triangle has formed since 13 June 2022 on Hulamin.

There are higher lows and same highs.

This means, momentum is pushing on up.

Other indicators include:

7>21 >200

RSI<50 - Higher lows

Target R3.59 and then R5.40

SMART MONEY CONCEPTS:

Now with Smart Money Concepts, we have something interesting.

A LARGE Bearish FVG (Fair Value Gap) has formed on the weekly chart.

What is a Bearish FVG?

A 3 candle structure with a down impulse candle that indicates and creates an imbalance or an inefficiency in the market.

Between candle 1 and 3, do NOT show common prices.

The price needs to move back up to rebalance and fill the gap.

During this process, it will rebalance and head on up to R3.59. Also the resistance will be broken, which will give way for the price to move to the next target of R5.40.

Why you should NOT view LOSSES as LOSSESI want you to stop thinking of trading losses as losses.

It’s having an effect on you emotionally and is stopping your full potential of growth.

Financial trading, like any other business or aspect of life, involves costs.

That’s just life.

In business, there are costs associated with equipment, rent, salaries, taxes, and legal fees.

In our personal lives, there are costs associated with household expenses like rent, groceries, insurance, medical fees, taxes, and repairs.

Similarly, in trading, there are costs associated with normal losses, daily interest charges, and drawdowns.

It’s crucial to remember that losses are an inevitable part of trading and should be viewed as a necessary cost of doing business.

Just as a business owner must invest money in equipment, rent, and salaries to run their business, traders must also be prepared to invest money in losses in order to be successful in the long run.

If you try to avoid taking a trade, because you are worried about the loses, you will miss out on the greater rewards for when profitable trading opportunities come your way.

When you see trading losses as costs…

You will be able to take a more objective and strategic approach to the trading decisions that you make going forward.

This can help you to minimize losses and maximize profits over time.

So there are few things you need to do to mange your costs (losses) emotionally and physically.

Action #1: Set realistic stop losses

Place your stop loss with every trade and never risk more than 2% of your portfolio per trade.

Action #2: Understand the concept of Risk to Reward better.

The risk-reward ratio is the ratio of the potential profit of a trade to the potential loss.

By understanding the risk-reward ratio, traders can make more informed trading decisions and can better manage their risk.

Action #3: Don’t feel your losses

If you feel 2% is too much to risk, risk less!

Get to the point with your life where a loss isn’t that much as with where the reward isn’t worth celebrating.

Overtime, you’ll slowly grow your account and your mind too.

A Trader's Guide to Market ConditionsThere are six main types of market conditions that every trader needs to know: bull quiet, bear quiet, bull volatile, bear volatile, bear sideways, and bull sideways. In this blog post, we'll dive into each of these conditions in detail, so you can understand what they mean for your investments and trading.

Bull quiet conditions may be ideal for long-term investors, with steady upward trends and low volatility. On the other hand, bear quiet conditions can make finding profitable trades a challenge. But don't despair! Short-term traders may still be able to make profits by taking advantage of small price fluctuations.

If you're looking for short-term gains, bull volatile conditions may be the way to go. These periods of economic growth and prosperity can lead to larger price swings than in bull quiet conditions. But beware, the opposite is true for bear volatile conditions. Prices are steadily declining, but with high levels of volatility. Still, traders can profit by taking advantage of large price swings.

Bear and bull sideways conditions are characterized by a lack of clear direction in price movements. While traders may find it challenging to make profits in bear sideways conditions, they can take advantage of small price fluctuations in bull sideways conditions.

Understanding these market conditions is crucial for making informed trading decisions. By being aware of each of these six conditions, you can increase your chances of making profitable trades and maximizing your returns. So if you want to elevate your trading game, backtest these market conditions and see what your trading results you'd get trading each condition.

When you should feel THRILL as a traderThrill is a dangerous emotion to have as a trader.

Especially, when you bank a winning trade, when you lock in profits during a favourable environment and when you count your profits at the end of the week.

You are only as good as your last trade. Which means, you need to forget about the past and focus on the future.

However, this doesn't mean you can't enjoy the journey during the trading day.

I've been in the markets since 2003 and yes I do get thrill and enjoyment but NOT when I bank a winning trade.

Here are 6 elements I get thrill from...

1. When analysing the markets and seeing what opportunities lie up.

2. When optimising strategies and seeing how to improve by finding new markets, removing old markets that don't work and possibly tweaking the system according to the current market environment.

3. Searching for trades always feels like somewhat a treasure hunt. When X marks the spot, we know to take action.

4. Monitoring results. This isn't monitoring daily or weekly results but rather looking at your journal over an extended period of time. Look at your drawdowns, look at where you are in terms of having your portfolio at ATH and seeing what market environment your system is in.

5 Adapting new markets and instruments...There are always new high liquid and low volatile markets that will suit your system. It's our jobs to look, analyse and adapt into the new.

6. Reading new developments. Are there better trading platforms, new indicators to help with your current system and maybe even new calculations to manage your drawdowns better? What about the instruments. I've gone from trading shares, warrants, ETFs, Futures, Spread Trading to CFDs. You never know when the next instrument will come...

I hope this helps give some enlightenment on when you should feel thrill as a trader. Cut the ego, cut the instant gratification of today's performance and focus on the marathon.

Follow for more daily trading lessons :)

Trade well, live free...

Timon

27 Ways to Save money to TradeSaving money to trade, or in general, can be a pain.

Either it drops your quality of life, or you find that you just can’t save a cent at the end of the month.

No matter what you’re earning, I’m going to show you exactly how to save money the easy way.

Here are my 27 favourite money savings tips with a couple of personal notes…

SAVINGS TIP #1: Stick to your shopping list

Write your shopping list down on a piece of paper or on your phone, and stick to it to avoid overspending.

When you are prepared for what you have to buy when it comes to your grocery shopping, this will more likely stop you from buying extra items you don’t need.

SAVINGS TIP #2: Pay with hard cash

Pay using real money instead of swiping your debit or credit cards.

When you pay with a card, instead of cash, you’ll find that you’ll spend more money on unnecessary items than you should or with money you don’t even have.

Personal note:

While I’ve been living and trading in Greece, I find this is the best savings tip I’ve used so far.

SAVINGS TIP #3: Pay yourself firstay yourself first

As soon as you’re paid your salary, wage or income for the month – deposit a portion of that money straight into your trading or savings account.

I like to use the 10% rule, but this all depends on what you can afford to deposit. This means, if you earn R60,000 per month deposit R6,000 into your trading account or savings account each month.

SAVINGS TIP #4: Don’t shop when ‘hangry’ or emotional

Avoid shopping when you’re feeling hungry, thirsty, angry or upset.

You’ll find you’ll spend more money than you should. In a recent study: Hungry mall shoppers who were hungry spent on average 64% MORE than non-hungry shoppers.

Make sure you have a nice meal and drink lots of water, before you go on your next shopping trip.

SAVINGS TIP #5: The ‘cookie-jar’ approach

When you empty your pockets, at the end of the day, drop them into a yearly cookie jar for your savings.

You’ll be surprised how many thousands of rands you’ll be able to save, collect and be able to deposit into your trading account for the next year.

SAVINGS TIP #6: Use the 24-Hour-Rule

Before paying money for non-essential and expensive items on clothes, cosmetics, appliances or even tools, just wait 24 hours before buying it.

You may find that you’ll lose that desire to buy them after 24 hours, which will save you tens of thousands of rands a year. Maybe when your parents said “sleep on it”, there was method behind their madness.

SAVINGS TIP #7: Go generic

Save a ton of money by buying the generic prescription medicines instead of paying a fortune for the name branded drugs.

Ask your local pharmacist or physician if you can have the generic prescription drugs instead of the brand-name drugs.

You’ll find that the generic products cost far less than the brand names, and will work equally well.

SAVINGS TIP #8: A quick breakfast that lasts a week

Breakfasts are not only the most important meal of the day, but can also be the quickest, easiest and most inexpensive meal for the day.

When you eat a full and healthy breakfast, you’ll find it will keep you from going out to eat an expensive lunch…

Personal note:

For the last two years, I have had the same breakfast which I make once and it lasts an entire week.

This has truly been life-changing as it makes my day start with one less decision to make before I get on with the rest of the day.

It’s called “Overnight Oats”. If you’d like to see my personal recipe feel free to click here…

SAVINGS TIP #9: Follow the 30-Day-Rule

Before you buy something really expensive, give it 30 days and then decide if it’s worth it.

I’m talking about items like jewellery, motorbikes, paintings, juice extractors and any other item that can cost over R3,000.

SAVINGS TIP #10: Don’t be fooled by sales

Avoid sales and don’t be duped by discounts, special offers, buy 1 get one free etc…

Remember this for every time you see a sale for 50% at the next Black Friday’s Special.

“You’re not saving 50% of your money, you’re spending 50% of your money that you weren’t planning to spend in the first place.”

SAVINGS TIP #11: Skip the alcohol and bottled water!

When you go out to a restaurant, avoid spending unnecessary money on alcohol and expensive water bottles.

A standard restaurant can mark up their cost of alcohol by three to five times.

Instead order just plain water or even a sugar free soda.

Personal note:

In Europe I have noticed that when you ask for tap water, they pour it from a bottle of expensive water (R30) anyway. This is due to the danger of drinking tap water in Europe.

SAVINGS TIP #12: Own your doggy bag

Ask your waiter to put the food that you didn’t finish in a doggy bag, so you can save money on lunch for the next day.

People are far too embarrassed about everything nowadays which I think needs to stop.

There should not be a stigma attached to taking leftover food home.

Everybody easts, drinks and sleeps. And when it comes to the food you ordered at the restaurant, you paid for it so why waste it?

This will also save you money, time and effort the next day for lunch, which will make your trip to the restaurant EVEN MORE WORTH IT.

SAVINGS TIP #13: Put three items back after shopping

When you’ve added extra items to your shopping that weren’t on the list, to avoid overspending, put back at least three items that you believe you can live without.

It’s very easy to walk through the final naughty aisle grabbing a whole bunch of crisps, chocolates, biltong, dried fruit and even a bottle of juice.

SAVINGS TIP #15: Cut down on smoking and drinking

Try to cut down your smoking and drinking by half the number per day.

This is really tricky to do but if you put your mind to it and challenge yourself, I know you can achieve this.

Personal note:

What I do with smoking is I’ve limited it to two in the morning, two in the afternoon and two at night.

This tip has saved me hundreds of rands per week from buying more boxes and I will continue to try cut it down until I’ve quit completely.

SAVINGS TIP #16: Fill up your milk with water

As soon as the milk reaches, the half way mark – fill it up with water. YOU WON’T TASTE THE DIFFERENCE.

As a parent or as a milk drinker, it can be extremely expensive to buy milk on a daily basis.

SAVINGS TIP #17: Become a vegetarian (at least once a week)

At least once a week, switch to meatless dishes which will help drop your grocery bill.

Replace it with: Chickpeas, couscous, okra, rice, sauerkraut, quinoa, beans, nuts, pasta dishes etc… You’ll be surprised what you can find at your local supermarket.

Personal note:

Inspired by my cousin, she insisted I cut meat out just once a week. I call this day “Meatless Monday”.

EXTRA MONEY SAVINGS TIPS

#18: Grow your own vegetables

#19: Sign up for loyalty cards

#20: Track your spending on your finance budget app

#21: Make meals that will last a week e.g. Lasagna, casserole, giouvetsi, gemista, soups, roasts, ratatouille etc…

#22: Buy the generic foods rather than the expensive name branded foods

#23: Pay careful attention to expiration dates

#24: Check your eggs in their boxes and your vegetables in their packets

#25: Freeze your foods in bulk

#26: Eat a meal before going to a restaurant

#27: Keep to Pay-As-You-Go with your cell phone account and use the Wi-Fi to call on WhatsAapp

This will be fun!

With these savings tips you can watch your money grow in your savings and trading account!

Why you should LOVE your losses 5 REASONSWe are brought up in society to WIN, WIN, WIN!

Throughout our upbringing we must either:

Achieve top grades

Drive the fanciest cars

Wear and own the best brands

In other words, we are raised to win with everything we do in life, until you get welcomed into the world of trading.

Today I’m going to be the contrarian and share with you why you should love, embrace and own your losses in order to ensure you grow your portfolio on a consistent basis.

Let’s start with:

What happens after a winning streak?

There will be a time during your trading career, where you’re going to endure a magical time where you end up taking sometimes 6, 8 to even 10 winning trades in a row.

Your portfolio will be smiling at a new all-time-high and, you’ll feel invincible. You may think that you’ve cracked the holy-grail of trading where you can quit your job and just make a living with the markets.

Research shows that individuals tend to invest and trade more actively when their most recent trading performance was successful. In fact, here are:

4 DANGEROUS Actions Traders Take During A Winning Streak:

They take on more trades.

They upper their trading positions.

They start to go against their trading strategy.

Their self-confidence and greed levels pick up.

Winning streaks are normal and INEVITABLE, but eventually they’ll end and the losing streak will begin.

No matter how good you believe you are as a trader or how perfect your trading execution skills are, there will be a time when the honey-moon phase for your trading strategy will be over and the markets will stop acting in your favour every time.

The reason is that due to the conditions of supply and demand, the markets environment will eventually change.

A market that was trending up or down, could enter into a 3-months sideways phase very easily. When this happens, you will enter into a drawdown (downside) phase.

The problem is not the downside for the next three months. The problem is how you’ll treat your trading going forward, based on the DANGEROUS actions you would have taken during your winning streak.

Let’s bring them back, to see what will happen to ‘invincible traders’ portfolios and minds with their unexpected losing streak…

They start to take on more trades –

THIS MEANS MORE LOSSES

They upper their trading positions –

THIS MEANS BIGGER LOSSES.

They start to go against their trading strategy –

THIS MEANS UNEXPECTED LOSSES.

Their self-confidence and greed levels pick up –

THIS MEANS DEPRESSION MAY KICK IN WHICH WILL LEAD TO QUITTING.

Now going back to what we said in the beginning.

When a winning streak ends, you should love, embrace and own your losses because of these five reasons.

5 Reasons To Love Your Trading Losses

Reason #1: Losses are part of your trading success journey

Once you have a winning and proven trading strategy, you’ll need to go back to your trading journal to remind you of the flow of winning streaks, losing streaks, average gain & loss per trade and other historical statistics.

I’ve back, forward and real-tested the MATI Trader System strategy for over two decades and so I know exactly what kind of winning and losing streaks are to come and that I’ll end up profitable in the medium to long term.

Reason #2: Losses help keep your emotions in check

Knowing there are inevitable losses to come, this should curb the ego, greed and fear emotions.

Reason #3: Losses should keep your risk low

With a losing streak that is inevitable to enter your trading results, this alone should be a reason to keep your losses low.

I personally never risk more than 2% or my portfolio in any one trade, no matter how many winning trades I take in a row. You can read more about the timeless money management rules in lesson three of the MATI Trader System programme.

Reason #4: Losses stop the “Hot Hand Fallacy”

Another reason that I love losses when trading is that it reminds me that the winning streak will come to an end.

This keeps me humbled and grounded to know that there will be a time where I’ll need to give back to the market, when the trading environment is less conducive to the trading strategy.

Reason #5: Losses don’t take me back to the drawing board

After a winning streak ends, you’ll find new traders will then quit trading and look for another system to find that will work for them during the changing market environment.

The thing is they don’t realise and accept that losses come with the trading territory and that one should never throw a profitable system away because a market enters into a drawdown phase.

Let me know what you thought about today's trading tutorial. I'm just sharing information I've learnt over the last 20 years as a trader.

Trade well, Live Free...

Timon

MATI Trader

Why you should never HOLD a boring trade - Rule I followGet in and get out in the shortest time possible.

This is the science of successful trading.

But what happens when a trade turns out to be more like a non-performing investment?

When you hold a long-term trade, there are a few issues that will follow including the:

Opportunity cost

You can find other higher probability trades, instead of having your money tied up aimlessly in a sluggish market.

Unnecessary impatience

You’ll eventually feel rather anxious and frustrated holding onto a long-term trade, when you are better off trading in a market that is moving.

The fake-out

With an ongoing trade, the breakout pattern may fizzle out into a low probability fake-out trade (a trade that turns against you).

I created a rule to avoid this situation from ever occurring again.

I call it a time stop loss...

After 7 weeks of holding a trade, exit the trade and look for a better opportunity.

Worst case you take a smaller loss than you thought.

Best case you take a smaller profit than you expected.

But you'll stop holding trades that aren't performing and stop paying daily costs with trading....

Sound good?

Trade well, live free.

Timon

MATI Trader

My Interview with US Successful Trader Peter L. BrandtThe Internet has truly made the world a smaller and a more accessible place.

In 2013, I stumbled across world-renown trader, author and owner Peter L.

Brandt, on Twitter and his blog. I sent him a request for him to

join one of the most elite South African trader groups on Skype.

We had some fantastic chats over the next couple of days. There are words

of wisdom that are far too essential to let them slip by.

I’ve collated some of the timeless lessons Peter L. Brandt shared with me.

I hope you enjoy the interview and find it useful for your trading career.

Timon: I’ve never met a trader who trades long time-frames on Forex and

commodities, do you believe technical charts can be used to predict market

movements?

Peter: I absolutely positively do NOT believe I can predict the markets. I

absolutely positively do NOT believe charts are predictive tools any more than

a MACD, COT, Moving Averages or anything else. My win rate is historically

around 38%, although I made some changes to the system in an attempt to

boost that to 45%. Generally, 100% of my profits come from 10% of my

trades. It is a matter of trying to keep the other 90% from being a net loss.

Timon: I agree with no one being able to predict the market movements,

however, I believe in probability predictions. If there is a breakout to the

upside, there is a higher probability for the market to continue moving in the

direction of the breakout. What is your take on when unfavourable markets

bring about a 15% or more drawdown on your portfolio?

Peter: Drawdowns come with the territory. The question to always ask for

discretionary traders is, whether their trading rules are out of sync with the

markets? If they are out of sync with their rules? or both? If I know the problem

are my rules being out of sync with the markets, I will never stop trading because I

cannot time my rules. I may cut back on the size during a losing period.

Timon: As my trading mentor and dear friend Igor Marinkovic

says, “Your biggest drawdown is still to come and so is your biggest

winning streak.” What are your thoughts on risk management principles?

Peter: As a general rule — very general rule — an excellent trader with a

great grasp of money management should have an average annual ROR that

is 1.5 to 2 times their worst drawdown, over the past three or five years. For

me, this is mandatory

Even daily patterns are made up of many hourly patterns that morphed, which

are made up of many 15-minute patterns that morphed etc... — I call it ‘Chart

Morphology’. The trick is to determine which patterns are real and which

patterns are more likely to morph.

Sometimes a market reveals itself by failing.

It is because of morphology that I seek patterns that are 10 to 12

weeks or longer. I’m also not worried about markets changing so drastically

that all conventional systems stop working. The reason is my belief that

markets are and have always been driven by fear, greed and money flows.

These things will always be the same.

Timon: Yes, that’s why I don’t believe in Holy Grail systems. I believe in

finding the system that suits your personality and risk profile. Along the way,

one should not feel scared about making mistakes, but be sure to avoid them

from being too costly. What would be your final feedback on trading in

general?

Peter: Sounds like you are well on your way to a long and profitable

career trading. Mistakes are the tuition charged by the markets for

learning. Unfortunately, the markets often decide the tuition rate, not

us. Hence, I only risk 0.5% per trade.

You have to develop your own style. I have never met another truly skilled trader who has copied his

or her style from another trader. This is true from a tactical standpoint,

but from a money management standpoint most skilled traders think

very much alike.

TCI EXPRESS Likely Rock Further :) TCIEXPRESS is specialist and leader in Express distribution in India. Established in 1996,TCIEXPRESS has honed itself with advanced technology and deep domain-expertise to offer customised solutions for express delivery.

TCI Express Ltd. reported higher than expected Ebitda and profit after tax on the back of better than expected margins. Ebitda margins have again expanded ~260 basis points QoQ/960 basis points YoY to reach 19.6%. Q4 FY21 volumes were up 15% YoY, while blended realisations including the pass-through for the diesel price hike was 2.3%. This is not akin to runaway price hikes that we see in air-express

Invested from lower level and looking to average up -

Disc: Invested , only educational purpose.

$NAKD Cup & HandleThis is a mid term hold but will be worth the wait

Take profits along the way is key!

#NAKD #Cupandhandle #Midterm #Patience