DOGE/USDT 1D chart ReviewHello everyone, let's look at the 1D Doge chart to USDT, in this situation we can see how the price moves over the downward trend line, but fights to stay over it.

Going further, let's check the places of potential target for the price:

T1 = 0.175 $

T2 = 0.184 $

Т3 = 0.199 $

T4 = 0.223 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 0.167 $

SL2 = 0.156 $

SL3 = 0.143 $

Looking at the RSI indicator, we see

As we are approaching the center of the range again, but here the space for further continuation of growth is visible.

Stoploss

GBP-AUD Free Signal! Buy!

Hello,Traders!

GBP-AUD is trading in a

Local uptrend and the pair

Made a local correction

Of the horizontal support

Level of 2.0634 so we can

Enter a long trade with the

Take Profit of 2.0724 and

The Stop Loss of 2.0582

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD-CAD Free Signal! Sell!

Hello,Traders!

NZD-CAD made a bearish

Breakout of the key horizontal

Level around 0.8182 so we are

Bearish biased so lets let the

Pair make a pullback and

Retest the lower bound of

The new resistance level

And from there we can go

Short with the Take Profit

Of 0.8136 and the Stop

Loss of 0.8196

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SOL/USD 4H ChartHi everyone, let's look at the 4H SOL to USD chart, in this situation we can see how the price broke out from the local uptrend line at the bottom.

Let's start by defining the targets for the near future that the price has to face:

T1 = 131 USD

T2 = 136 USD

Т3 = 145 USD

Т4 = 151 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 122 USD

SL2 = 115 USD

SL3 = 107 USD

If we look at the RSI indicator we can see how the indicator has dynamically gone up despite the price not moving much, but here we can see that there is still room for a potential attempt to grow.

NZD-CHF Free Signal! Sell!

Hello,Traders!

NZD-CHF is going down

And the pair made a bearish

Breakout and it is confirmed

So we are bearish biased

And we can enter a short

Trade with the Take Profit

Of 0.5018 and the Stop

Loss of 0.5060

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP-NZD Free Signal! Buy!

Hello,Traders!

GBP-NZD is trading in an

Uptrend and the pair made

A bullish breakout of the

Key horizontal level of 2.2600

Which is now a support then

Made a retest and we are now

Seeing a bullish rebound

Already which reinforces our

Bullish bias on the pair and

Suggests that we enter

A long trade with the

Take Profit of 2.2715

And the Stop Loss of 2.2568

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC/USD 1D chart reviewHello everyone, let's look at the 1D BTC chart to USD, in this situation we can see how the price moves in the downward trend channel, in which we turn back at the top edge of the channel. Going further, let's check the places of potential target for the price:

T1 = 87100 $

T2 = 89945 $

Т3 = 93556 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 81739 $

SL2 = 77307 $

SL3 = 74353 $

Looking at the RSI indicator, we see

As we came again to the center of the range at which we could again experience the price of price.

Mastering Risk Management in Trading: The Ultimate GuideMastering Risk Management in Trading: The Ultimate Guide

In the world of trading, success isn’t measured only by big wins but by how well you protect your capital from unnecessary losses. Risk management isn’t just a safety net—it’s the backbone of sustainable trading. In this comprehensive guide, we’ll break down the principles and strategies you need to safeguard your account while still maximizing your profit potential.

---

1. Risk-Reward Ratio: The Foundation of Every Trade

- What it is:

The risk-reward ratio is the cornerstone of every trade. It tells you how much potential reward you’re targeting compared to the risk you’re willing to take. For instance, if you risk $100 and aim to make $200, your risk-reward ratio is 1:2—a commonly accepted standard in trading.

- How to use it:

- Always predefine your risk-reward ratio before entering a trade.

- For swing traders, aim for a minimum of 1:2 or 1:3 to justify holding overnight.

---

2. Position Sizing: The Key to Survival

- Why position sizing matters:

Position sizing ensures you don’t over-leverage your account or lose too much in a single trade. Many traders fail because they bet too big and get wiped out after just a few losing trades.

- How to calculate position size:

- Use this formula:

Position Size = (Account Risk $ ÷ (Entry Price - Stop-Loss Price)).

- For example, if you’re risking $100 per trade and the difference between your entry and stop-loss is $5, your position size should be 20 units (100 ÷ 5).

---

3. Stop-Loss Orders: Your Safety Net

- What is a stop-loss?

A stop-loss is your emergency brake. It’s an order you set in advance to sell your position if the price moves against you by a specified amount.

- How to set stop-losses:

- Use technical analysis to place your stop-loss below support levels for long trades or above resistance levels for short trades.

- Avoid placing stop-losses too close to your entry point, as small fluctuations might trigger them unnecessarily.

Here you can see my ratio is on the low side so i can place a tactical TP and SL in relation to liquidity lines.

---

4. The Art of Diversification: Spreading Risk

- Why diversification works:

Putting all your capital into a single trade or instrument increases your risk. Diversification spreads that risk across multiple trades or markets, reducing the impact of any single loss.

- How to diversify effectively:

- Trade across multiple sectors or currency pairs.

- Avoid overexposure to correlated assets (e.g., don’t trade EUR/USD and GBP/USD simultaneously).

---

5. Emotional Discipline: Winning the Mental Game

- Why it matters:

Even the best trading strategy can fail if emotions like fear or greed take over. Emotional trading leads to impulsive decisions, revenge trading, and overtrading.

- How to maintain discipline:

- Stick to your trading plan, no matter what.

- Use tools like meditation, journaling, or physical exercise to manage stress.

---

6. Dynamic Risk Management: Adapting to Changing Markets

- Adjusting your strategy:

Markets are dynamic, and your risk management should adapt. Volatility can change quickly, requiring you to adjust your stop-loss distance or position size.

- Use ATR (Average True Range):

The ATR is a great tool to measure market volatility and decide how much room to give your stop-loss.

---

7. Tracking and Reviewing Your Trades

- The power of a trading journal:

Every trade is a learning opportunity. Keep detailed records of your trades, including your reasoning, execution, and results.

- What to include in your journal:

- Entry and exit points.

- Risk-reward ratio.

- Mistakes or deviations from the plan.

- Lessons learned.

---

Conclusion: Plan the Trade, Trade the Plan

Risk management isn’t just a skill—it’s a habit. By understanding your risk-reward ratio, managing position sizes, using stop-losses effectively, and staying emotionally disciplined, you can protect your capital and increase your chances of long-term success.

Take a moment to reflect: How do you manage risk in your trading? Are there areas you could improve? Start implementing these strategies today, and watch how they transform your trading results.

BNB before correction?Hello everyone, let's look at the 1D BNB to USD chart, in this situation we can see how the price came out of the downtrend line, however, here it is worth observing the EMA Cross 50 and 200 indicator, which shows a fight to maintain the uptrend. Please take into account the STOCH indicator, which shows a longer movement at the upper limit of the range, which may confirm the current rebound and give a deeper correction, however, here it is important for the price to stay above the level of the last low.

Let's start by defining the goals for the near future, which the price must face:

T1 = 646 USD

T2 = 684 USD

Т3 = 732 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 612 USD

SL2 = 595 USD

SL3 = 560 USD

SL4 = 534 USD

CAD-CHF Free Signal! Sell!

Hello,Traders!

CAD-CHF has made some

Gains from the recent lows

Just as we expected but now

The pair is entering the

Horizontal resistance area

Around 0.6212 from where

We can enter a short trade

With the Take Profit of 0.6162

And the Stop Loss of 0.6233

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SPY Free Signal! Sell!

Hello,Traders!

SPY made a nice bullish

Move and will soon hit a

Horizontal support of 577.19$

From where we can enter

A short trade with the

Take Profit of 566.48$

And the Stop Loss of 583.38$

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

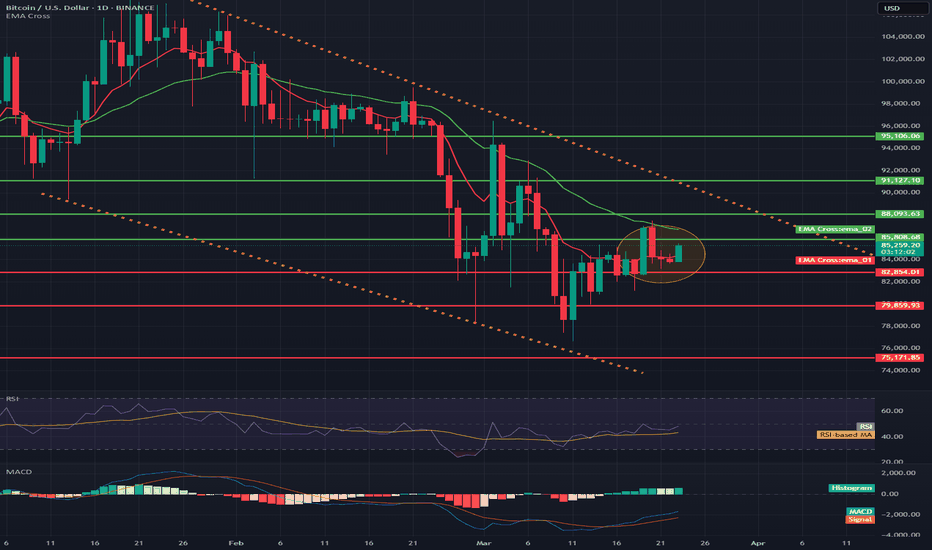

BTC/USD 1D Chart ReviewHello everyone, let's look at the 1D BTC to USD chart, in this situation we can see how the price is moving in the designated downward channel, in which the price started to grow again. What's more, we can see consolidations on the EMA Cross indicator and here it is worth watching the movement of the red line to see if it will again go up from the green line, which would confirm the return of the uptrend.

Let's start by defining the goals for the near future that the price must face:

T1 = 85808 USD

T2 = 88093 USD

Т3 = 91127 USD

Т4 = 95106 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 82854 USD

SL2 = 79859 USD

SL3 = 75171 USD

If we look at the MACD indicator, we can see how it indicates an uptrend, but we still have to wait for a return to a strong main uptrend. The RSI shows rebounds near the middle of the range, which we are approaching again, and it is worth paying attention to how the price will behave now.

NZD-USD Free Signal! Sell!

Hello,Traders!

NZD-USD made a bearish

Breakout of the key horizontal

Level of 0.5755 so we are

Bearish biased and we can

Enter a short trade with the

Target Level of 0.5695 and

The Stop Loss of 0.5775

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD-USD Free Signal! Buy!

Hello,Traders!

AUD-USD is falling down

And is locally oversold so

After the pair retests the

Horizontal support level

Of 0.6260 from where we

Can enter a long trade

With the Take Profit of 0.6292

And the Stop Loss of 0.6249

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BNB/USDT 1D chart, target and stop-lossHello everyone, let's look at the 1D BNB chart to USDT, in this situation we can see how the price came out of the top of the ongoing downward trend.

Going further, let's check the places of potential target for the price:

T1 = $ 646

T2 = $ 683

Т3 = $ 732

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = $ 592

SL2 = $ 558

SL3 = $ 535

SL4 = $ 505

Looking at the RSI indicator, we see

As we entered the upper part of the range again, however, there is still a place for the price to go higher, giving more targets.

EUR-CAD Free Signal! Sell!

Hello,Traders!

EUR-CAD made a bearish

Breakout of the key horizontal

Level of 1.5528 so we are

Bearish biased so we can

Enter a short trade with

The Take Profit of 1.5454

And the Stop Loss of 1.5576

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER LONG SIGNAL|

✅SILVER has retested a key

Support level of 33.39$

After a bearish correction

While trading in an uptrend

So we can enter a long trade

With the Take Profit of 33.89$

And the Stop Loss of 33.08$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TRUP/USDT in the coming hoursHello everyone, let's look at the 4H TRUMP to USDT chart, in this situation we can see how it has come out of the triangle on top and currently we can see a fight with the current resistance at $11.45, in a situation when it comes out of it on top it can go towards the targets at the levels:

T1 = $11.89

T2 = $12.58

Т3 = $13.08

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = $11.06

SL2 = $10.40

SL3 = $9.76

When we look at the RSI indicator we can see how on the 4h interval we have come out of the range on top, which however in the short term may give an attempt to recover the price or a temporary sideways trend.

AUD_NZD LONG SIGNAL|

✅AUD_NZD is going down to retest

A strong horizontal support of 1.0947

And the pair is clearly oversold

So after the price hits the support

We can go long on the pair expecting

A bullish correction with the

Take Profit of 1.0965 and

Stop Loss of 1.0939

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XRP/USDT 4h chart review Hello everyone, let's look at the 4H XRP chart to USDT, in this situation we can see how the price moves over the upward trend line, or rather on the upward trend line and fights to stay above the line.

However, let's start by defining goals for the near future the price must face:

T1 = $ 2.41

T2 = $ 2.49

Т3 = 2.56 $.

T4 = $ 2.63

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 2.30 $

SL2 = $ 2.25

SL3 = $ 2.22

SL4 = $ 2.17

Looking at the RSI indicator, you can see how it stays in the upper part of the range, however, you can see how there was a place for potentially re -growth.

GBP_AUD LONG SIGNAL|

✅GBP_AUD is moving down

Down now to retest a horizotnal

Support level of 2.0327 from

Where we can enter a long

Trade with the Take Profit

Of 2.0413 and SL of 2.0270

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBP_NZD NEW LONG SIGNAL|

✅GBP_NZD is going down now

But a strong support level is ahead at 2.2454

Thus I am expecting a pullback

So we can prepare to enter

A long trade with the target 2.2562

And Stop Loss of 2.2406

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-NZD Risky Long! Buy!

Hello,Traders!

EUR-NZD is approaching a

Horizontal support level

Of 1.8868 so after the

Retest of the support

A long trade with the

Target Level of 1.8947

And Stop Loss of 1.8851

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.