EURUSD (STOP LOSSES SUPPLY + CONFIRMATION ON LTF)1) On top we have MSS + 705 Fib level.

2) Now price grab ST from demand and we can wait for confirmation on LFT.

3) NON mitigate Demand zone is OB 1H, i think price come back because 0.5 is still valid.

Entry: confirmation on LTF in POI

Target: First problem zone is OB 4H

Have a profitable day and don't forget to subscribe for more updates!

If you like this idea drop a like, leave a comment.

Stoplosses

US100 - Liquidity sweep likely before bullish continuationFollowing a significant upward move last week, the US100 (Nasdaq 100 index) has entered a period of consolidation, currently exhibiting a ranging structure characterized by lower highs and relatively equal lows. This pattern typically suggests a tightening market where bullish momentum is cooling but not yet decisively reversed.

The presence of equal lows is particularly notable from a liquidity perspective. In retail trading behavior, such levels often attract a high concentration of stop-loss orders placed just below the support zone. Market participants perceive these lows as a reliable level of support, but in doing so, they inadvertently create a pocket of liquidity just beneath them.

Institutional players and market makers are well aware of these dynamics. It's common in such scenarios to witness what is known as a liquidity sweep, a short-term move below support levels to trigger stop-losses, fill large buy orders, and shake out weaker hands before the market resumes its dominant trend.

Given the current context, there's a high probability that we may see a downside sweep targeting the liquidity resting beneath the equal lows. This move would likely be swift and sharp, clearing out stop orders before a potential bullish reversal unfolds. If confirmed, such a move could mark the end of the current range and initiate a new impulsive leg higher in the broader uptrend.

Traders should watch for signs of price rejection or bullish divergence following the sweep as potential confirmation of this scenario. Until then, it’s prudent to remain patient and avoid getting trapped in the chop, especially near well-watched support zones.

-------------------------------

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

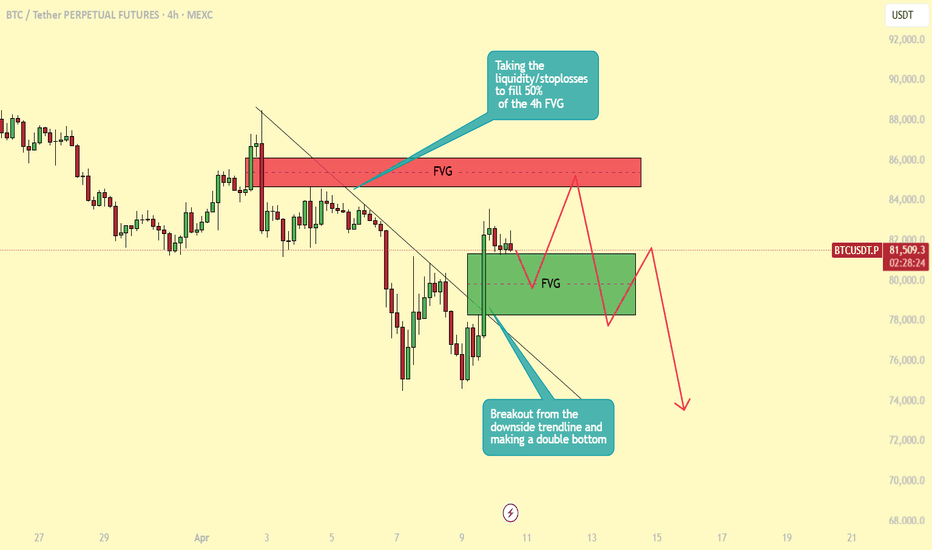

BTC - breakout or bull trap in progress?Yesterday, Bitcoin broke out of the descending trendline it had been respecting for several days, forming a clear double bottom in the process — a classic reversal pattern suggesting bullish intent. Since then, price action has shifted into a consolidation phase, hovering just beneath a key liquidity zone filled with stop-loss orders from prior short positions.

This area aligns closely with the previous 4H lower high, above which lies a fair value gap (FVG) that hasn't yet been fully filled. A move into this region seems likely, especially with liquidity resting above the prior high. We could see BTC targeting a partial fill — around the 50% mark — of that 4H FVG before any significant reaction occurs.

On the way up, BTC also created another 4H FVG. It’s likely that price could revisit and partially fill this imbalance before continuing its move higher. This zone could serve as an ideal retracement area for bulls to re-enter, especially if the market seeks to rebalance before making a stronger push.

Looking ahead, the $85.5K level stands out as a highly probable target. It marks a key psychological and technical resistance zone and is a magnet for liquidity. With momentum building and the current structure leaning bullish in the short term, a sweep of that level in the coming days is entirely plausible.

However, it's important to zoom out. Despite this bullish momentum, the broader market structure remains bearish. Unless BTC breaks above and holds above this larger structure convincingly, rallies are more likely to be liquidity grabs rather than true trend reversals. Once $85.5K is tagged, there's a real possibility of a sharp rejection — potentially sending price back toward local lows or even printing new ones.

A Risk Tolerance Test for All TradersRisk Tolerance trips up more traders than any other emotional aspect of trading stocks, or any other asset class. How is your risk tolerance? Would you say that you have a good stable risk tolerance? Or is it the main reason you take small gains or losses?

If you need help evaluating your risk tolerance, take this Risk Tolerance Test . If any of these apply, then there is a problem you need to address:

Do you get stopped out of trades and then watch as the stock moves up? This is caused by setting stops too tightly for the kind of trading style being used.

Do you panic as the stock retraces and lower the stop loss to avoid getting stopped out? This actually increases risk rather than lowering it.

Do you raise your stop loss before the stock forms a new consolidation for support? This also increases risk rather than lessening it. There is higher risk that you will get stopped out prematurely.

Do you check profit or loss everyday on your held stocks? Position traders should only be checking their balance once a month. Swing traders could wait for the end of the month but can do it weekly.

Are you a swing trader who checks your positions intraday to see what is happening? This runs the risk of reacting prematurely to intraday volatility that eventually evens out.

Have you given up on using stop losses because "they don't work"? You probably just need to learn a better method for placing stop losses.

Do you hold and hold with no stop loss, watching a stock tumble, unable to exit and ultimately exiting too late or "holding long term" instead? This is a chronic problem among retail traders that indicates the lack of a complete trading plan, one that provides a plan for when your holdings go against your intent.

To keep your risk tolerance in check try adding these simple steps to your trade analysis:

Carefully check the Risk to Reward ratio of your picks, and only trade stocks with a good probability for profit vs. loss.

Consider the amount of money at risk in each trade. Think about how you would feel if you lost that money should the trade go against you. Add this parameter to your trading rules.

Lower overall market risk by trading more than one or two stocks at a time. Spread your capital outlay over a few picks rather than putting it all on one trade.

Use stop losses on every trade. Place stops under the appropriate support levels for the chart patterns and your intent.

If you are a Swing Trader, it is important to enter trades only on strong market days. Not every flat day is a good day to swing trade. You'll keep more of your profits over time if you wait for ideal days and picks.

The simplest way to improve risk tolerance is to continually paper trade on a Simulator even after you've started trading live. Most beginners do not practice executing their trading plan sufficiently before jumping into the market. They allow emotion to cloud better judgment and let greed overwhelm decisions. Trading is the only business where normally calm, intelligent, and wise people do really greedy things that end up being foolish and risky. And it all comes down to the emotions that come with money, especially fear, greed and pride.

Traders have one thing to compete against and that is their own emotions, which can cause poor decisions. My best advice for all traders is this: compete against your own prior trading history to improve results, and ignore what is going on with everyone else.

Summary:

Emotional control comes from having a sound plan, sticking with it, and not changing it because the market has moved on a whim or some guy on social just made a lot of money. Create your trading style, which is a plan of attack for the market. Set out your strategies and use the correct ones for the current Market Condition. Only trade stocks that have a risk factor you can live with. Use stop losses appropriately, and you will be successful. Problems occur somewhere in all of this, when traders miss a step and deviate from the plan.

When you feel emotions getting out of hand, controlling your trading decisions, consider the above checklists for help evaluating and adjusting your mindset. Greed is a tough emotion to control, because it is insidious and hard to identify in ourselves. Fear is easy to identify and much easier to control or harness. A certain amount of fear is necessary and good in the market, because it keeps individuals from taking too much risk. However, fear that dominates daily emotional energy only creates constant losses. Think about this and study prior trades. If they performed well after being stopped out, then there is a risk problem to address in your trading plan.

Stop Loss Placement: Let Your Trade Cook!Intro

I tried to talk through stop-loss placement in 3 minutes here. I do not think justice was done. So let's take a look at exactly what I mean when I say "Let Your Trade Cook". Proper stop-loss placement is critical to a successful trading plan.

Don't Place Your Stop Like Everyone Else

You are guilty of this, if you have been stopped out many times just to see the price move immediately back in your favor. The picture below represents a bunch of pullbacks some long and some short and it has been color-coded to define entries combined with stop losses.

Blue = Entry

Black = Typical Stop

Orange = A Good Stop To Let Your Trade Cook

Red = An Aggressive Stop To Let The Trade Cook

Conclusion

Hopefully, the video along with this image provides you with a better system for discretionary stop losses. I tend to favor the idea that just above or below a momentum bar in the previous swing as my stop loss.

AUDJPY (6H) - tricky situation.I've been watching price action in the last few days on AUDJPY.

My balance of probability is 51% for the south, leaving 49% for the north. I know 'everybody' wants better odds than that. Well, I did say it was tricky - at least for me.

My estimates are based on my analysis. Not a 'feeling'. I wouldn't be trading this time frame anyway. I'd be looking for a nice small trend to milk - one that is nested within one of those candles. So - if a small trend moves south, I'd take that. If a small trend moves north, I'll go with that. I go where the market goes - but from 'under the hood'.

If others have a different perspective based on their own methodologies, feel free to share.

Disclaimers : This is not advice or encouragement to trade securities on live accounts. Chart positions shown are not suggestions. No predictions and no guarantees supplied or implied. Heavy losses can be expected if trading live accounts. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on opinion expressed here or on my profile and you lose your money, kindly sue yourself.