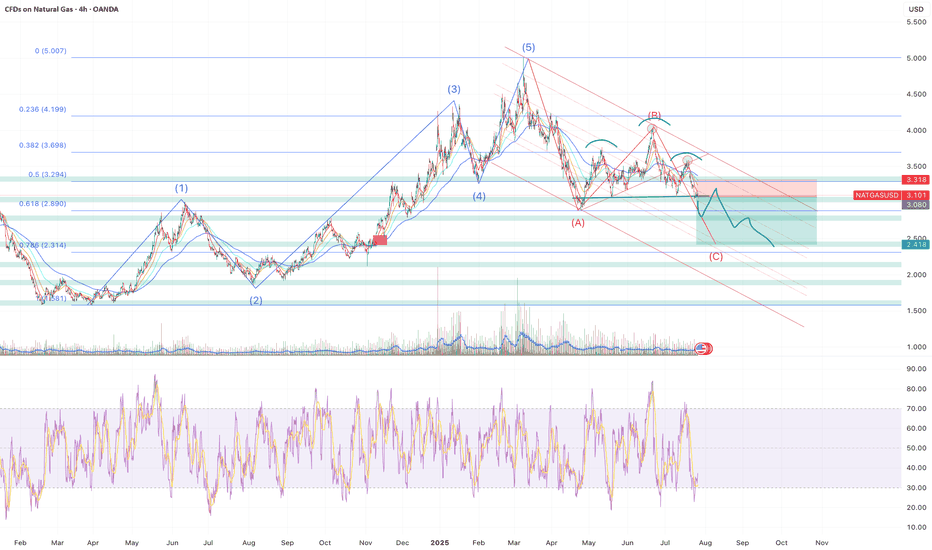

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

Storage

TradeCityPro | WAL: Squeezing Tight Before the Breakout👋 Welcome to TradeCity Pro!

In this analysis, I want to review the WAL coin for you. This coin belongs to the Walrus project, which is part of the SUI ecosystem and falls under the DePIN and Storage categories.

⚡️ After its airdrop, this project’s token has managed to maintain its hype and, with a market cap of $589 million, is currently ranked 97th on CoinMarketCap. Since this token has just recently launched, the analysis will be done on the 4-hour time frame.

⏳ 4-Hour Time Frame

As you can see in the 4-hour time frame, after this token’s launch on March 27, the price has formed a low and a high at the 0.3899 and 0.5903 zones respectively. It is still trading between these two levels and has yet to start a clear trend.

✔️ Currently, a descending triangle has formed. The price is forming lower highs, while maintaining equal lows, and each time the price touches these lows, the probability of a breakdown from the triangle increases.

📉 So, for a short position, I suggest definitely having a position open if the 0.3899 zone breaks. You can open this position earlier by entering on a rejection from the descending trendline or the break of 0.4101, but keep in mind that these are not the main triggers—they're just early entries in anticipation of a breakdown, so you’ll have a position ready if the zone breaks.

🔼 For a long position, the first high formed was at 0.4362. The price is currently above this level, but the breakout candle isn’t very strong, and the price hasn’t confirmed stabilization above this level yet. Also, this zone is very close to the descending trendline, so it’s not logical to enter a long position while this trendline remains unbroken.

📈 Therefore, for a long, wait for the break of the descending trendline and a pullback to this dynamic level before entering. The next triggers for upward movement are the 0.5167 and 0.5903 zones.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | AR: Key Triggers in Web3 Storage Coin’s Downtrend👋 Welcome to TradeCity Pro!

In this analysis, I want to review the AR coin for you. This project is one of the Storage and Web3 platforms, and the coin of this project, with a market cap of $352 million, is ranked 124th on CoinMarketCap.

⏳ 4-Hour Time Frame

In the 4-hour time frame, as you can see, this coin is in a downtrend, and in its latest leg, after being rejected from the 7.70 top, it started to drop, and this decline continued down to the 4.78 zone.

✔️ Currently, the price has retraced to the 0.382 Fibonacci level and has created a range box between 4.78 and 5.65. A break of this box can determine the trend of this coin for the coming days or even weeks.

✨ The SMA99 indicator has so far acted well as a dynamic resistance, and within the current box, the price has already reacted to it once and is now again pulling back to this moving average.

💥 If the price is rejected from this indicator and forms a lower high than 5.65, the probability of breaking the 4.78 bottom increases significantly, and the price could move toward lower lows.

⚡️ The 4.78 support is actually a support range between 4.78 and 4.92, and to confirm a bearish move, the risky trigger is 4.92, and the main trigger is 4.78.

🔼 For a long position or spot buy, we should first wait for the SMA99 to break and for the 5.65 zone to activate. The break of this zone would be the first confirmation of a trend reversal, and the main confirmation would come after the price makes a higher low and higher high above the 5.65 zone.

🎲 The main resistance levels above this area are the 0.5, 0.618, and 0.786 Fibonacci levels. Another key resistance is the 7.70 zone.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

(jasmy) JASMYperhaps the numerical ideologies are not here, perhaps the theoretical possibility is not strong, perhaps the chance, rare, perhaps perhaps; what else can a person do other than wait and wonder and watch as the world storms to the top, only to crash all the way back down. What is learned is nothing other than the same redundant story about how to wait for the moment to jump from the top and be freed of the burden of care running off into the sunset never to worry about anyone left behind.

TradeCityPro | AR : Resistance Levels and Potential for Recovery👋 Welcome to TradeCityPro!

In this analysis, I want to review the AR coin for you. This coin specializes in data storage on the blockchain and has its own dedicated blockchain for this purpose.

📅 On the daily timeframe, after the price reached the resistance at 48.01, it entered a correction phase, dropping to 16.99 and even reaching 13.03. Along this decline, a descending trendline was formed. After buying volume entered the market and the trigger at 20.09 was broken, this trendline was also breached, and the price began to rise.

📈 Currently, after reaching the resistance at 28.85, the price underwent a deep correction, dropping in a single candle back to the area of 20.09. This type of correction is natural in a market with a sharp trend, and most of the time, prices quickly recover from such corrections.

🔑 However, looking at the charts of many altcoins, it is difficult to conclude that we are in a sharply bullish trend. For example, AR itself. The reference to this trend pertains to the overall market trend, with Bitcoin leading the market. Observing Bitcoin's chart shows a very strong bullish trend, and the behavior of altcoins tends to follow Bitcoin's.

✨ In the 45.20 zone, there is critical support on the RSI. As long as the RSI remains above this area and the price stays above the 20.09 zone, the momentum will remain bullish. If the RSI and price drop below these levels, the market momentum will reset.

🔽 For further corrections, the next support levels are 16.99, 13.03, and 10.92, respectively. However, if the price stabilizes above the 28.85 area, it could move toward targets of 37.06 and 48.01.

🚀 The 48.01 resistance is one of the strongest resistances for this coin. If it manages to break this level, the next target will be the resistance at 86.39, which is near the ATH.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Siacoin (SC)Siacoin is one of the first pioneers in the field of blockchain-based distributed decentralized cloud storage platforms. Sia acts as a secure, trustless marketplace for cloud storage in which users can lease access to their unused storage space. As can be seen, in the past, SC has grown a lot. SC has been oscillating in a huge triangle pattern. Recently, it seems SC has started an upward wave; could this wave be the one that breaks the huge triangle pattern upward? Let's see what happens.

#ARBTC #1W (Binance) Huge descending channel breakout and retestArweave seems about to print a dragonfly doji above 100EMA weekly support, looks like a great swing opportunity in sats.

⚡️⚡️ #AR/BTC ⚡️⚡️

Exchanges: Binance

Signal Type: Regular (Long)

Amount: 3.1%

Current Price:

0.0004235

Entry Targets:

1) 0.0004080

Take-Profit Targets:

1) 0.0010729

Stop Targets:

1) 0.0002749

Published By: @Zblaba

CRYPTOCAP:AR BINANCE:ARBTC #Arweave #Web3 #Storage arweave.org

Risk/Reward= 1:5.0

Expected Profit= +163.0%

Possible Loss= -32.6%

Estimated Gaintime= 6-10 months

Looks Interesting HereTraders,

Though the alts are waiting on Ethereum for confirmation of further price direction, Storj looks like it's found its support and local low here. It's been in this accumulation phase/channel since April and both the RSI and AO are suggesting is is time to run. Also, after breaking the upside of that huge bullish triangle, we have already gotten the retest out of the way. I don't know where it goes from here but I can imaging doubling would not be out of the question.

CLS: $0.07 a different kind of CLOUD in the DeFi/Cen Generationbespoke for Decentralized activities deals

if MATiC is the internet of BLOCKCHAiNS

then Coldstack is the MOTHERSHiP of Oracles Data in the network of autonomous storage

quite bold and unique

like United Nations coming together for the INTEGRiTY of mankind

in this case a HARMONiOUS integration of ARWEAVE FILECOIN and future storage PLAYERS whod like to hook up

CHATGPT sucks all the knowledge and curates it for the interest of the TOP SPONSORS

COLDSTACK the closest to the truth in filtering data

Price is regulated.. it can go either way

for now Handler is dressing up for LONDON Event DUBAi Circus and Halving 2024

Could be at Par with Filecoin Ankr Arweave someday

CRUST: $0.74 | an Ambitious Engagementwhen Google's CEO Eric S. announced the cloud service project in 2000

it was alien to most.. especially to the number 1 Tech Leader Elison of Oracle..

I recall he said.. "what the hell is a CLOUD"

few years later a decade i think Obama launched the cloud project for the GOVERENMENT

i take it was a validation of Google CLOUD business which was DOMinATED by AMAZON shadowing Eric's key note

CRUST may just be the Google or AMAZON shadowing filecoin arweave and the OGs in the space

it only needs one POSTER BOY for POLKADOT to present... Just like AVALANCHE subtle deal with AMAZON

good luck.. this one is a gem if it pans out well in the next 100 dayys

RNDR Long Set-UpA long here with the sessions vwap being the first TP and aiming for the daily level above (purple line) which was the last level relevant untested level before the recent sell off, seems like the best move.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

GRT The Graph $Grt #Grt The Graph is a great project that not only survived the bear but also has continued to build during the bear as well as create more real-world partnerships and use cases.

Just 2 months ago in the start of March it hit $0.50 (50cents) and has since then suffered from a dramatic 60% correction that IMO was somewhat over done but i was grateful for another shot at buying lower to later sell higher. We have already had a nice bounce over the last couple weeks and i gain trimmed my position for profits/gains.

If BTC continues to see some more downward pressure this week we may also see some more downside again and go back and test the lows.

I'm personally already nibbling at this range and will continue to DCA all the way down and create a new larger bag again and take what the market gives me with intentions of selling in the next MAJOR pump we get and or true alts season if and when it comes.

I would be buying like CRAZY if we get enough drama to give us that lower range in the 13-16 cents areas.

In will be buying in a semi aggressive manner if we come back for a retest of this 20cents range, but I'm not quite sure we get that hence why I began nibbling here. Regardless I'm up on the play fir the cycle and can afford to take some risk with it overall.

In the bigger picture i think it's one of the better plays to get into a situation where you end up holding it longer term and or if you wanted to only buy projects that you can set it and forget it. I think they will continue to do well in this cycle as well as make it through the next bear and be fine in the following cycle.

Ain't nobody got time for $Algo?Strong buy volume on the weekly candle above the 50 EMA + upper cloud.

Triggered a buy signal in my personal indicator.

Price is also at 2019 lows!

Cryptos could still drop before and after halving mercilessly, this will be the opportunity.

Open Long Position from 0.2500 with 10x leverage.

Arweave #AR Inverse head and shoulders Should give you a double.Pretty clean inverse head and shoulders

Arweave has already been a big winner for us

as we identified a falling wedge pattern which gave us massive opportunity for upside profit potential ..

This target may take a little longer to achieve

but early entry holders could easily be sitting on a 5-6X by then on their spot purchases!

StorjStorj, pronounced as “storage,” is an open-source cloud storage platform in which people with hard drive space and good internet connectivity can participate in the network to become a node in the network, and be rewarded by Storj tokens. Anyway, STORJ chart is a little stochastic and noisy, but there are clear upward and downward trends. After storj broke the major downtrend line, it started oscillating in an inverted wedge pattern. Now it seems storj has started an upward impulse wave and trying to break this inverted wedge. Let's see what happens.

Natural Gas: Over storage due to recency bias?So far we’ve covered Natural Gas twice, once in October 2022 , followed by another in May 2023 .

As highlighted in both pieces we are generally longer-term bullish on natural gas but we do see some opportunities for a short-term tactical position now.

As winter approaches, the harrowing memories of natural gas price movements during the previous winter seasons keep us vigilant. Some key points we find interesting now include the natural gas storage levels in the EU and US, unseasonal weather, price seasonality, and natural gas price action.

Natural gas storage

Natural Gas storage typically follows two clear seasonal trends: the winter withdrawal season and the summer injection season, with the summer months being April to October and winter from November to March.

The chart below shows the storage level across time in the US. Current US Storage levels are close to the previous high in 2020.

While in the EU, current gas storage levels are the highest they've been over the last five years.

These high storage levels come off the back of a massive rally in natural gas prices in the 2021-2022 period. Which leads us to question, could this be attributed to recency bias? Have markets become over-prepared, with storage levels so high?

Unseasonal weather

One rationale for high storage levels is preparation for a harsh winter. The build-up of gas storage in the EU, particularly, was spurred by a warmer-than-expected start to the winter, resulting in less gas usage for heating.

Forecasts also predict the 2023 winter in the EU & US to be warmer than average. A recent Bloomberg article on Natural Gas states:

“Data generated by the Copernicus Climate Change Service signals a minimum 50% probability that most of Europe will experience well-above average temperatures between December and February. The Balkans, Italy and the Iberian peninsula have a 60% to 70% chance of exceeding median historical temperatures over the past three decades.”

The EIA adds:

“We estimate that U.S. natural gas inventories totaled 3,835 billion cubic (Bcf) feet at the end of October, 6% more than the five-year (2018–2022) average. We forecast U.S. natural gas inventories will end the winter heating season (November–March) 21% above the five-year average with almost 2,000 Bcf in storage. Inventories are full because of high natural gas production and warmer-than-average winter weather, which reduces demand for space heating in the commercial and residential sectors.”

High storage levels, coupled with lower-than-expected demand due to warm weather, could signal further weakness for Natural Gas…

Price Seasonality

Adding to this is the general price seasonality of Natural Gas. Over the past six years, the August to end-of-October period generally sees a gradual rise, followed by a decline from December to January. With this year’s price behavior aligning with past trends, we could very likely see a downturn in prices heading towards the end of the year and into January.

Price Action

On a longer-term time frame, the 3.610 level has repeatedly served as both support and resistance.

On a shorter timeframe, natural gas has been trading in a defined broadening formation, likely indicating increased price volatility.

To express our short-term bearish view, we can take a short position on the CME Henry Hub Natural Gas Futures at the current level of 3.089, setting the stop at the resistance above at 3.26 and take profit of 2.62. Each 0.001 point move in the Henry Hub Natural Gas Futures is for 10 USD.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.eia.gov

www.bloomberg.com

www.eia.gov

www.bloomberg.com

www.bloomberg.com

www.cmegroup.com

#STORJ/USDT 12h (ByBit) Small rising wedge near breakdownStorj is about to print an evening star, could lead to a leg down to 200MA support.

⚡️⚡️ #STORJ/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Short)

Leverage: Isolated (3.8X)

Amount: 5.0%

Current Price:

0.4425

Entry Targets:

1) 0.4455

Take-Profit Targets:

1) 0.3515

Stop Targets:

1) 0.4925

Published By: @Zblaba

$STORJ BYBIT:STORJUSDT.P #Storage storj.io

Risk/Reward= 1:2.0

Expected Profit= +80.2%

Possible Loss= -40.1%

Estimated Gaintime= 1-2 weeks

#BLZ/USDT 4h (Binance Futures) Ascending wedge on resistanceBluzelle broke down the small rising wedge and has been forming a bigger one which may end up breaking bearish as well, leading to a retest of 200MA support.

⚡️⚡️ #BLZ/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Short)

Leverage: Isolated (4.0X)

Amount: 6.4%

Current Price:

0.15552

Entry Targets:

1) 0.16459

Take-Profit Targets:

1) 0.12635

Stop Targets:

1) 0.18375

Published By: @Zblaba

FWB:BLZ BINANCE:BLZUSDT.P #Bluzelle #Storage bluzelle.com

Risk/Reward= 1:2

Expected Profit= +92.9%

Possible Loss= -46.6%

Estimated Gaintime= 4-8 days

Renewable energy -hope for a sustainable futureThe damaging effects of climate change are already upon us. So far this year, locals and tourists have been forced to flee raging wildfires in the beautiful islands of Greece. In Madagascar, more than a million people are suffering from hunger and malnutrition due to the worst drought in 40 years1. Flash floods in Sudan have displaced large populations and damaged infrastructure and crops. In China, wild weather swings have brought torrential rains in some parts, while other regions bake in scorching heat.

That is anything but an exhaustive list. And so, we must act now to stop human induced climate change. Fortunately, the world has awakened to this realisation. The gap between global investment in clean energy versus that in fossil fuels is starting to widen.

This blog outlines some of the biggest renewable energy mega projects happening around the world which show that, when bold ambition meets innovation, there is hope for a more sustainable future.

Energy Island, Denmark

Denmark is building an artificial island capable of powering the entire country in what the Danish government claims is a ‘gigantic green quantum leap’. The island will be built 60 kilometres (km) offshore to benefit from stronger winds, be the size of 18 football pitches, and could house up to 600 giant wind turbines. Denmark plans to complete the project by 2030 with the aim of supplying 3-4 gigawatts (GW) of energy and ultimately expanding to almost 10GW. This future expansion will allow Denmark to export energy generated from the island2.

Denmark constructed the world’s first offshore wind farm in 19913 and has, since then, had a strong focus on generating renewable energy from the strong winds in the North Sea. This project will be a monumental culmination of that policy focus. In addition to wind power generation, the island will also have battery storage and an electrolysis plant to produce green hydrogen.

This trio of technologies that will be situated on the island neatly illustrates their interconnectedness. Battery storage is essential to make wind a dependable source of energy, by enabling it to be deployed as and when required, particularly over shorter durations of time. The production of green hydrogen requires a current of renewable energy to be passed through water to separate hydrogen from oxygen. That hydrogen can then serve as a store of energy for long periods of time, like days or weeks, and can be converted back into electrical energy through fuel cells. Scaling up all three together is a smart course of action.

Gansu Wind Farm, China

The Gansu Wind Farm in China’s first phase was completed in 2010 with a 5.16GW capacity and has since held the spot as the world’s largest wind farm. The project continues to expand and, in 2021, its capacity reached 10GW. When finished, it will comprise 7000 wind turbines and reach a capacity of 20GW4.

The Gansu Wind Farm sits on the outskirts of the Gobi Desert in northern China, considered an extremely remote and hostile area. To get electricity from the wind farm, China has built a 2,383 km transmission line5.

The Gansu Wind Farm highlights how, with enough willpower, onshore wind (turbines on land) can be deployed at scale. Onshore wind projects often face their own set of challenges when land is at a premium. There is often an opportunity cost of building large onshore wind farms if space must be taken away from agriculture or housing, or if there are ecological risks. By contrast, the Gansu Wind Farm resides in an uninhabitable part of the world with very windy conditions making it a highly fruitful endeavour for harnessing onshore wind, albeit one requiring a bit more effort to build and maintain.

Bhadla Solar Park, India

What else is abundant in a desert? Sunshine. The Bhadla Solar Park in India’s desert state of Rajasthan is the largest solar farm in the world, spanning over an area of 14,000 acres. The farm was commissioned in 2017, has a capacity of 2.25GW, and contains over 10 million solar panels6.

One of the challenges faced by solar power projects situated in deserts is that sand can form a layer over the modules restricting the amount of sunlight that goes through. To overcome this challenge, the facility uses robotic cleaners that employ microfibre rollers to clean the panels7.

For a country like India where there is plenty of sunlight, solar power makes a lot of sense. Again, deserts may be hostile environments for installing and maintaining such projects, but these projects minimise the opportunity cost of using land for creating solar power. For an emerging economy with a large population and substantial energy needs, such projects also reduce the country’s dependence on fossil fuel imports, a great outcome for both the environment as well as the economy.

Dezhou Dingzhuang Floating Solar Farm, China

The Dezhou Dingzhuang Floating Solar Farm in Dezhou, China is the largest floating solar farm in the world. The solar panels float on a reservoir in Shandong – an eastern province of China on the Yellow Sea. The total capacity of this project is 320 megawatts (MW). It is also connected with 8 megawatt hours (MWh) of battery storage and a 100 MW wind farm which together make up the Huaneng Dezhou Dingzhuang Integrated Wind and Solar Energy Storage project8.

Floating solar offers numerous benefits, including maximising land use efficiency, conserving water resources by reducing evaporation, improving solar panel efficiency through cooling effects, and enhancing grid stability by being located closer to where the demand is.

A final word

Renewable energy projects are becoming bolder, more innovative, and being built with a greater sense of urgency. This has exciting implications for the renewable energy value chain. For example, more modules need to be manufactured so they can be installed in large solar farms around the world. Wind turbines, which are becoming bigger and bigger, need to be manufactured at scale to establish onshore and offshore wind farms. Hydrogen electrolysers are required to produce green hydrogen and fuel cells are needed to use green hydrogen as a fuel source. Similarly, when wind turbines or solar modules float on water, specific components are needed to make that happen. All of this creates promising opportunities for investors in the renewable energy value chain.

Sources

1 Source: United Nations, July 2023.

2 World Economic Forum, The Danish Energy Agency (part of the Ministry of Climate, Energy and Utilities), 2023.

3 The Danish Energy Agency (part of the Ministry of Climate, Energy and Utilities), 2023. ens.dk

4 Discover Clean Tech, 2023. discovercleantech.com

5 Discovery UK, 2023. www.discoveryuk.com

6 Ornate Solar, 2023. ornatesolar.com

7 National Geographic India.

8 YSG Solar, 2022.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.