Strat

STRAT/BTC - WHAT'S NEXT AFTER GATHERING LONG TIME. SHARKS ?After hearing about next release of STRAT, I think I need to check this coin quickly! And recognize this is a big chance for earning money!

Bottom of Falling Wedge and nearly the end of this form.

01 August 2018 - Breeze Privacy (Mainnet)

"We are pleased to announce the Breeze Privacy Protocol (Mainnet) will be released on Wednesday the 1st of August!"

So, don't wait too long anymore. You can begin to find good entry and buy.

Buy : 32000-32500

Sell : 41000-57500-65000-75000

Stop-loss : 30000

Thanks for reading :)

Stratis - Last line of defense and bullish divergence Stratis is on a major support + near the end of a huge triangle + may be near a old trendline. Also we can see a bullish divergences on 1D frame.

If no up movements and support break I will buy around 6 or 7k sat

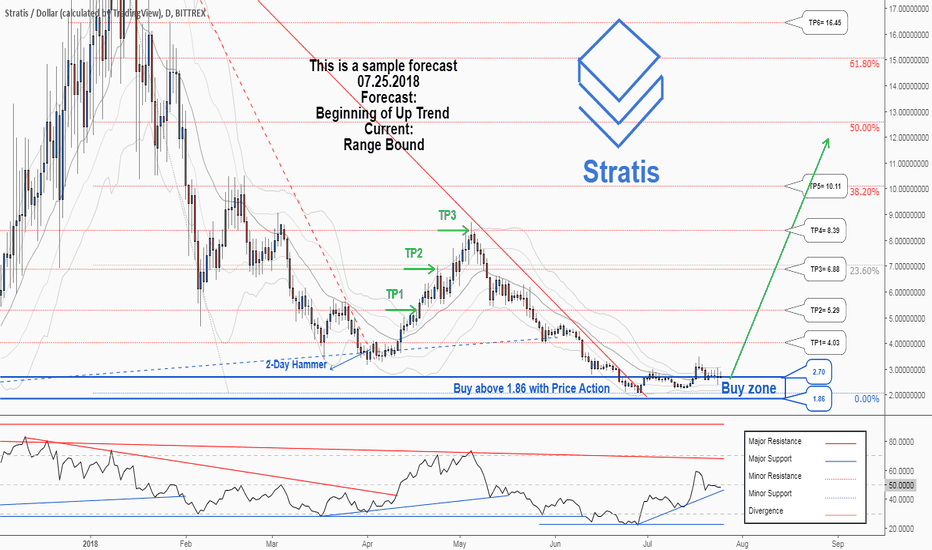

There is a possibility for the beginning of uptrend in STRATUSDTechnical analysis:

. STRATIS/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. The price is in the support zone (2.70 to 1.86), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (2.70)

Ending of entry zone (1.86)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 4.03

TP2= @ 5.29

TP3= @ 6.88

TP4= @ 8.39

TP5= @ 10.11

TP6= @ 16.45

TP7= @ 23.12

TP8= Free

There is a possibility for the beginning of uptrend in STRATUSDTechnical analysis:

. STRATIS/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. The price is in the support zone (2.70 to 1.86), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (2.70)

Ending of entry zone (1.86)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 4.03

TP2= @ 5.29

TP3= @ 6.88

TP4= @ 8.39

TP5= @ 10.11

TP6= @ 16.45

TP7= @ 23.12

TP8= Free

STRAT new cycle ahead ?strat bottomed out ? first we need to see some volume coming back and a breakout of the downtrend. Maybe new cycle ahead of us.

STRAT about to break outHey guys,

I am happy to be back after a long time gone,waiting for the bears to leave.

I decided to post more often,hoping you might see some value in my work,but i will let the tehnical analysis do the 'talking'.

To get to the point: STRAT is about to finish it's long bearish movement.Hopefully,the triangle that has been formed will break out sooner than you might expect.

How to trade: Wait for the golden cross to be done by the MA's,or set a trade right now,with a stoploss at 3.4k sats.

Target: The .5 and .618 on the fibonacci retracement pattern

None of this is trading advice,as it only represents my opinion on how things will evolve.

If this has been helpful to you in any way,please feel free to drop some change in my piggy bank, or just leave me a review in the comment section.(It would mean the world for me ;) )

BTC: 1FT5eALCLpTKtQDiwQrEvuq51ScXJQqDEZ

ETH: 0x3d2966f2cd842dd4c63cb42991d234b8f07e78b5

For any questions,leave a comment down below and i will answer as soon as i get to see it.

Cheers!

STRATIS bouncing between support and .618 Fib with falling wedgeOn the 4 hour chart. Next bounce to .618 fib with likely also test the falling wedge boundary. Breaching this can lead to very sharp bullish movement in price.

Promising stratis chart~Good fundamentals

-Price tanked for months and now at historic horizontal support from which it has bounced multiple times before starting a bull run

Why Stratis is again a bargain buy right now, depression phase! Alright, welcome all with my posts on TradingView. First task: updating the coins I posted here a few months back, so all the charts are back up to date once again.

First our friend Stratis. People are losing faith in this one --> strong indicator of a bottom coming in.

We’ve expected upwards movements in April from $3 to $8, as the $8 is a strict resistance area, which was quite hard to break. What did we also see? Bitcoin went to $10.000 the same time and couldn’t break it due to bearish divergences.

Let’s see what we see on the 12h chart here.

RSI: bullish divergence and about to break the downtrend on the RSI.

Stoch: no bullish divergence.

MACD: strong bullish divergence since the middle of May.

Histo: bullish divergence.

Let’s check this on the daily and the 2d charts, what we can see there too.

1 Week chart: Stoch bottomed out for the first time since the end of March.

3 Day chart: RSI <30 for the first time ever. Stoch bottomed out for some time now. No bullish divergences. Turning here could create them.

2 Day chart: Stoch strongly bottomed out, RSI on all time low of 24, MACD negative with Histo bullish divergence since middle of may.

1 Day chart: Bullish divergence on the RSI. On the final drop also on Stoch. MACD & Histogram both have bullish divergences.

From a fundamental point of view: Stratis has been releasing tons of updates and products lately, still not reacted on the price, which means that the price is being pushed down.

What can we conclude from this? Both Bitcoin and Stratis will move up. Stratis against Bitcoin shows the same bullish divergences and indications for a reversal. Bitcoin against USD does too.

This chart: Strat against USD is two charts in one: STRAT/BTC and BTC/USD, which is a good argumentation to build from when you’re positioning yourself or when you need to find answers when Bitcoin is going to reverse or not. Mostly you’ll find the same indications on altcoins, as they move hand in hand.

Targets first: $3 level, later on $5 level. Probably the depression phase for now, as we can make that out of this one too and then we’re done.

STRATIS FALLING WEDGE REVERSAL!Stratis has been on correction since it hit 0.0008 BTC price level and is now at 0.00036-38 price level however its correction trend has been compressing and forming a falling wedge reversal pattern so we should see Stratis on a breakout to its next price level which I see at 0.00062 BTC where we will be expecting a retracement to 0.0055 BTC price level which should be the support zone(green rectangle) where it should confirm the support with several bounces and move to the next price zone 0.00071 BTC. These would be the first three waves of the 5 waves breakout the next steps depends on the trend the market will have when we get there.

Bullish indicators:

RSI oversold (bullish)

MACD bounced and is on its way up

FALLING WEDGE REVERSAL BULLISH

Buy-in zone:0.00036-39 BTC

Targets:

1.0.00061 BTC

2.0.00071 BTC

3. 0.00082 BTC(LONG TERM)

Stop loss: 0.0003587 BTC , however it is undervalued now and is at its one of the lowest price since its all time so doing a stop loss on this trade would not be advisable but to HODL at those moments would be the best choice. But this is only an advice..

Good Luck, Traders!

STRAT about to find a bounceThis is for educational purposes and is not to be interpreted as financial advice.

Join us on discord: discord.gg

Strat, along with just about everything else in the market is finding itself in a bear movement. The trick these days is to find the ebbs and flows and use them to your advantage. What I want to focus on first is the main retrace and if we look at the fib extension from ~165000 to ~105000 and a reattempt that got stopped at ~141000, we get decent fib retracements that proved to be reliable at finding support at the 100% retrace at ~84500 which took us back up to the 61.8% retrace at almost 105000. That would have been decent profit. The final push down took us to the 161.8% retrace almost textbook at about 50000.

The above history is important.

Now let us look at the most recent move. Let's take a close look at the price points that we currently have:

1. High: ~87000

2. Low: ~65000

3. Reattempt: 80000 (23% gain from low)

Once again, we saw support at the 100% retrace around 58000 but it failed as we would have expected and is, at this very moment, sitting at the 161.8% retrace. It's important not to try and find the pivot on price action but you want to wait for a clear indication that there's a reversal.

Just as before, the second run took us up to the previous 100% retrace, therefore I am going to cautiously say that whatever entry you take that you should be conservative with your exit. That means, you should conservatively expect to exit your trade around 58000. That could be an approximately 30% increase.

Strat looking good for double bottomStrat looking good for double bottom

RSI also looking good

This is for research and not trading advice.

Always use stop loss and always monitor BTC

STRATHello,

Strat has been on a down trend for the past few months. I expect a little bit of retrace and then it will start gaining some momentum and hit my targets.

Strat's full node mainnet beta is going to be released at the end of this month. This can be the trigger of the upside movement.

Best of luck!

STRATBTC inverted head and stratisphereSTRATBTC playing out a fractal of the previous run last year + inverted H&S looks quite bullish in my opinion.

Entry up to 0.0008

Target 0.002047

STRAT BTC Long (20% short term upside)STRAT-BTC looks ready to rebound from here as long as BTC retains its strength. At a historically strong support level, and oversold on both the RSI and the Stoch. Expect those to rebound and the price to push toward 6000 satoshis. Also a nice hammer candlestick on June 16th gives me confidence the bulls are regaining strength in this area. Not rushing into a position and setting buys up over the next couple of days.

Comment Your Thoughts

*Not Financial Advice*

*DYOR*

STRAT - Stratis falling wedge Daily time frame showing falling wedge + a close MACD cross.

(This is not financial advice, this is a volatile market where anything can happen)

A possible scenario for $STRAT #001I made this only for practice purpose. Do not blindly follow it! Or you may fail.