Signal-to-Noise Ratio: The Most Misunderstood Truth in Trading█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading

Most traders obsess over indicators, signals, models, and strategies.

But few ask the one question that defines whether any of it actually works:

❝ How strong is the signal — compared to the noise? ❞

Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why some strategies succeed and most fail.

█ What Is Signal-to-Noise Ratio (SNR)?

⚪ In simple terms:

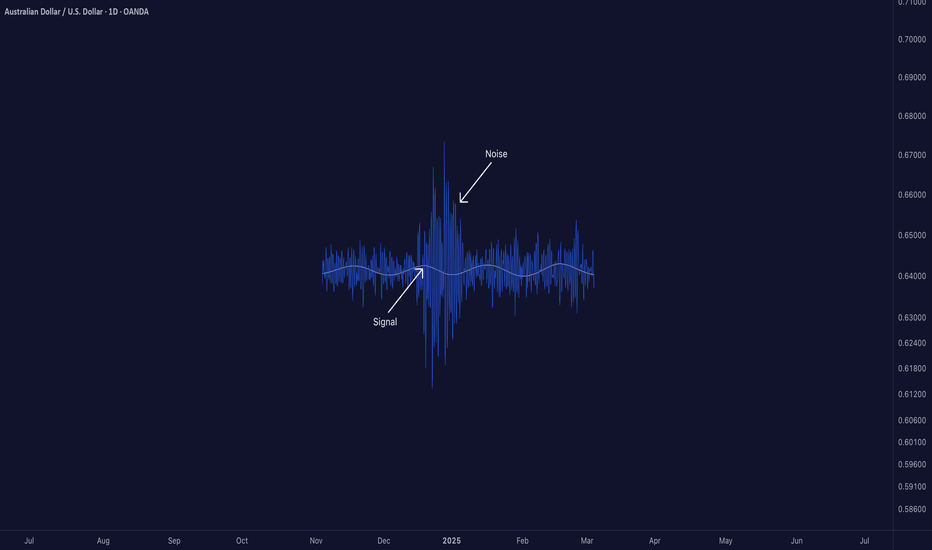

Signal = the real, meaningful, repeatable part of a price move

Noise = random fluctuations, market chaos, irrelevant variation

SNR = Signal Strength / Noise Level

If your signal is weak and noise is high, your edge gets buried.

If your signal is strong and noise is low, you can extract alpha with confidence.

In trading, SNR is like trying to hear a whisper in a hurricane. The whisper is your alpha. The hurricane is the market.

█ Why SNR Matters (More Than Sharpe, More Than Accuracy)

Most strategies die not because they’re logically flawed — but because they’re trying to extract signal in a low SNR environment.

Financial markets are dominated by noise.

The real edge (if it exists) is usually tiny and fleeting.

Even strong-looking backtests can be false positives created by fitting noise.

Every quant failure story you’ve ever heard — overfitting, false discoveries, bad AI models — starts with misunderstanding the signal-to-noise ratio.

█ SNR in the Age of AI

Machine learning struggles in markets because:

Most market data has very low SNR

The signal changes over time (nonstationarity)

AI is powerful enough to learn anything — including pure noise

This means unless you’re careful, your AI will confidently “discover” patterns that have no predictive value whatsoever.

Smart quants don’t just train models. They fight for SNR — every input, feature, and label is scrutinized through this lens.

█ How to Measure It (Sharpe, t-stat, IC)

You can estimate a strategy’s SNR with:

Sharpe Ratio: Signal = mean return, Noise = volatility

t-Statistic: Measures how confident you are that signal ≠ 0

Information Coefficient (IC): Correlation between forecast and realized return

👉 A high Sharpe or t-stat suggests strong signal vs noise

👉 A low value means your “edge” might just be noise in disguise

█ Real-World SNR: Why It's So Low in Markets

The average daily return of SPX is ~0.03%

The daily standard deviation is ~1%

That's signal-to-noise of 1:30 — and that's for the entire market, not a niche alpha.

Now imagine what it looks like for your scalping strategy, your RSI tweak, or your AI momentum model.

This is why most trading signals don’t survive live markets — the noise is just too loud.

█ How to Build Strategies With Higher SNR

To survive as a trader, you must engineer around low SNR. Here's how:

1. Combine signals

One weak signal = low SNR

100 uncorrelated weak signals = high aggregate SNR

2. Filter noise before acting

Use volatility filters, regime detection, thresholds

Trade only when signal strength exceeds noise level

3. Test over longer horizons

Short-term = more noise

Long-term = signal has more time to emerge

4. Avoid excessive optimization

Every parameter you tweak risks modeling noise

Simpler systems = less overfit = better SNR integrity

5. Validate rigorously

Walk-forward, OOS testing, bootstrapping — treat your model like it’s guilty until proven innocent

█ Low SNR = High Uncertainty

In low-SNR environments:

Alpha takes years to confirm (t-stat grows slowly)

Backtests are unreliable (lucky noise often looks like skill)

Drawdowns happen randomly (even good strategies get wrecked short-term)

This is why experience, skepticism, and humility matter more than flashy charts.

If your signal isn’t strong enough to consistently rise above noise, it doesn’t matter how elegant it looks.

█ Overfitting Is What Happens When You Fit the Noise

If you’ve read Why Your Backtest Lies , you already know the dangers of overfitting — when a strategy is tuned too perfectly to historical data and fails the moment it meets reality.

⚪ Here’s the deeper truth:

Overfitting is the natural consequence of working in a low signal-to-noise environment.

When markets are 95% noise and you optimize until everything looks perfect?

You're not discovering a signal. You're just fitting past randomness — noise that will never repeat the same way again.

❝ The more you optimize in a low-SNR environment, the more confident you become in something that isn’t real. ❞

This is why so many “flawless” backtests collapse in live trading. Because they never captured signal — they captured noise.

█ Final Word

Quant trading isn’t about who can code the most indicators or build the deepest neural nets.

It’s about who truly understands this:

❝ In a world full of noise, only the most disciplined signal survives. ❞

Before you build your next model, launch your next strategy, or chase your next setup…

Ask this:

❝ Am I trading signal — or am I trading noise? ❞

If you don’t know the answer, you're probably doing the latter.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Strategytesting

Are You Backtesting or Backfilling Your Ego?You build the setup.

You run the test.

It’s not quite what you hoped for…

So you tweak it. Then tweak it again. Then again. And again.

Before you know it, you’re not testing a strategy anymore

you’re editing reality until it flatters you.

That’s not refinement.

That’s backfilling your ego.

The urge to make it look right

We’re human.

Nobody likes drawdowns.

Inconsistency feels uncomfortable.

And let’s be real.. win-rates under 50% just look bad.

We don’t want to see our promising idea fall apart in the data.

So instead of facing it, we start sculpting the results to make them easier to accept.

We don’t want to see our promising idea fall apart in the data.

So instead of facing it, we start sculpting the results to make them easier to accept.

Widen the stop just a little.

Tighten the take-profit, Perfect! Now my win-rate is 60%

Add a filter that “feels logical.”

Nudge the indicator setting.

Remove the choppy day, “that was news anyway.”

And just like that, the curve is smoother.

The stats are cleaner.

You feel better.

But here’s the problem:

You’re not building a strategy that works.

You’re building a strategy that looks like it works.

Optimization isn’t the enemy, but your intentions might be

Of course, tuning is part of the process.

You should test different inputs and variables.

But stop and ask yourself: why are you doing it?

If you're refining to understand the behavior of your system, that’s good.

If you're changing things to avoid discomfort? That’s not testing. That’s denial.

The market doesn’t care how hard you worked.

It doesn’t reward effort. It rewards resilience.

If your strategy only performs when everything’s perfectly aligned

when the moving average is exactly 13.53661,

and the RSI is 42.122 instead of 40,

and your entry is two bars after a wick touch…

Then you don’t have a strategy.

You have a sandcastle.

And when the tide shifts, it’s gone.

All because you wanted it to work so badly, you sculpted the data until it told you what you wanted to hear.

A strategy worth trading doesn’t just survive the good times

Anyone can build a system that performs in a trending market.

Or when volatility is ideal.

Or when the dataset ends right before the storm hits.

But markets don’t hand out clean conditions on demand.

So ask yourself:

Have you tested your strategy in stress conditions?

Have you run it through market noise, sideways action, volatility spikes, and traps?

Have you studied its worst stretch and still said, “Yes… I’d take these trades”?

Because if the answer is no, your system isn’t ready.

You’re not building a strategy to trade.

You’re building one to feel safe.. and that’s far more dangerous.

Break it before the market does

The best traders do the opposite of comfort:

They try to break their systems before live money does it for them.

Run a Monte Carlo simulation.

Shuffle the order of trades.

Randomize outcomes.

Apply slippage or missed entries.

If your equity curve collapses under that pressure, if your belief in the system evaporates when the trades aren’t perfectly sequenced, then you didn’t build robustness.

You built a lucky curve.

Loss streaks aren’t a bug, they’re the cost of playing

Too many traders design systems that avoid losing…

instead of building ones that know how to lose..

Every real edge has pain points.

Every equity curve has drawdowns.

Every stretch of performance has some ugly days.

If your backtest doesn’t show that? Be suspicious, because the market will definitely do.

So stop trying to eliminate every loss, and start asking better questions:

Where does this strategy actually break?

What’s the worst losing streak I can expect?

Can I survive that financially and emotionally?

bottom line:

It’s truth over comfort.

Clarity over illusion.

Edge over ego.

Test it honestly, or the market will ..

“Does size matter?” when it comes to backtesting?It’s the kind of question that gets a few smirks, sure. But when it comes to backtesting trading strategies, it’s not a joke, it’s the difference between confidence and false hope.

Let’s get real for a minute: the size of your candles absolutely matters.

What you don’t see can hurt you

Most people start testing on bigger timeframes. It’s faster, easier on the eyes, and the results look clean. But clean doesn’t mean correct.

Larger candles blur the details. That one nice-looking 4-hour candle? Inside, price could’ve spiked, reversed, chopped around, or triggered your stop before closing where it did. You’d never know. And that’s the problem.

You might think your entry worked beautifully… but only because the data smoothed out everything that actually happened.

A backtest should feel like a real trade

Trading isn't just about the final price. It’s about what price does to get there. That messy movement inside the candle? That’s where most trades are made or broken.

If your strategy is even remotely reactive, waiting for structure, confirmation, retests, or anything time-sensitive, you need to see what price did between the open and close.

And the only way to see that? Use smaller candles.

Smaller data, clearer picture

1-minute candles might look overwhelming at first, but they give you something the higher timeframes just can’t: behavior.

Not just outcomes. Not just win/loss stats. But the actual shape of the move, the hesitation, the fakeouts, the precise moment when the trade made sense—or didn’t.

And once you start testing with that level of detail, your strategy either earns your trust… or shows its cracks.

So how small should you go?

There’s no one-size-fits-all here. But as a general rule: if your idea relies on precision, go small. Test it on 1-minute or 5-minute charts, even if you plan to execute on higher timeframes. You’ll quickly see if the entry makes sense, or if you’ve been relying on candle-close hindsight.

Yes, it takes longer. Yes, you’ll stare at noisy charts for hours. But your strategy will thank you.

Watch out for “too good to be true”

One last thing, if your backtest results look flawless on 1h or 4h candles, pause. That’s often a sign that you’re testing a story, not a strategy.

Zoom in. See what actually happens. You might be surprised at how different the same trade looks when you’re not glossing over the details.

TL;DR:

In backtesting, size absolutely matters. Smaller candles reveal real behavior. Bigger ones hide the truth. So if you care about how your strategy actually performs not just how it looks.

go smaller. Your backtesting will get sharper, and your confidence? Way more earned.

Do You Know the Difference Between an Indicator and a Strategy?A lot of traders jump into Pine Script or apply a script on TradingView without understanding one key difference:

Indicators and Strategies are not the same — especially when it comes to real-time performance and backtesting.

---

What’s the Key Difference?

Indicators

Indicators are visual tools designed to help you analyze price action in real time . They do not track trade performance or simulate trades automatically.

You can use them to:

- Generate signals

- Stack confluences

- Set custom alerts

- Overlay custom visuals on charts

Best for: Chart analysis, signal confirmation, and manual or semi-automated alerts.

---

Strategies

Strategies are built for backtesting . They simulate how your trade logic would have performed historically, using `strategy.entry`, `strategy.exit`, and related functions.

They automatically calculate:

- Hypothetical P&L

- Win/loss ratio

- Drawdowns

Best for: Validating trade logic, optimizing entries and exits, performance tracking.

---

But Here’s the Catch

Many traders assume that once a strategy backtest looks good, it will behave exactly the same in live trading. This assumption can lead to poor decision-making.

❌ Why Forward Testing Isn't Perfect

When you set alerts based on a strategy, you're asking a backtest engine to behave like a live trading engine — and that’s not what it was designed for.

TradingView strategies:

- Only execute on candle close

- Do not simulate intrabar price action

- Do not account for slippage

- Do not reflect real-time market volatility

So:

- Your strategy alert may fire late compared to actual price movement

- Your SL/TP may be hit within a candle, but the strategy won’t know until close

- You may see better backtest results than what happens live

---

Takeaway

If you're using strategies with alerts, it’s critical to understand these constraints:

TradingView’s strategy engine is optimized for historical testing, not for real-time execution. It provides insight into the validity of your logic — but it’s not a replacement for a live execution engine.

Best Practice Recommendations:

- Always forward-test on a demo or paper account first

- Monitor how alerts perform in real-time

- Be ready to adjust parameters based on your asset and timeframe

If you need better responsiveness or real-time adaptability, consider using indicators to generate your alerts. Indicators react to price in real time and are often more suitable for live market conditions.

---

Final Note

Some strategies are built with these limitations in mind. They can still be useful in real-time trading as long as you're aware of how they work.

Transparency is key. Backtesting is a guide, not a guarantee.

Trade smart, stay informed.

Feel free to reach out if you have questions or insights to share!

A Strategy for Renko ChartsThe first thing that may jump out at you on the chart is that it is not a Renko chart. TradingView does not allow strategies to be posted when on a Renko chart. However, I wanted to publish the following ideas from my journey in creating a trading strategy for a Renko chart. I didn't realize I wouldn't be able to publish it on the chart itself (or anywhere) until after I'd completed the first phase of it.

To see this on a Renko chart, you can convert the chart to Renko, set the timeframe to 1 minute and then the blocksize to 20 (for CL1! or WTI) using a close, traditional setting, and no wicks.

I had several goals I wanted to achieve when I started building this strategy.

Learn PineScript. The best way to learn a new programming language is to have a practical target to reach.

Codify some of the ideas I have been putting together over the past several years on trading with Renko charts.

Have a way to remove emotions out of entering and exiting trades.

TradingView does not allow for strategies to be published on Renko charts due to some of the nuances with the charts that can distort results of tests. However, once you understand some of these scenarios, you can look for them and adjust.

As for the strategy, to-date, it is based on three indicators: the Least Squares Moving Average , Donchian Channels , and Linear Regression . I wanted all of the inputs to be configurable like the underlying indicators themselves. As I got into the development and testing of ideas (I started over many different times :D), I realized there were other parameters I wanted be able to configure and added the as I went.

The approach (as of now):

Create a TV strategy that could be used for back testing

The strategy should be well supported on Renko charts with a common setup and configurations

The strategy could be applied to Renko charts and be configurable enough to support all types of markets

For the Renko charts, I typically go with a static setup. As an example, for CL1! or WTI, I use a blocksize of 0.20 or 20 ticks using the closing price and a traditional configuration. I do not use wicks on the charts. I set the timeframe to 1 minute (this is the length of time needed at the sustained price to print the specific brick). In TV strategies, my understanding is that until the brick prints, the strategy won’t be executed for the strategy. I touch on some of the ramifications later but for now know this is probably one of many reasons strategies won’t be published on Renko charts.

For the strategy, I wanted to create something that is reactive. I wanted it to be able to detect patterns or the beginnings of some type of pattern and then look for some type of evolution on the incoming bars. One thing I realized during testing is that having a “lookback” introduced latency.

Think of the strategy as a series of or layers of filters. As the strategy moves through the execution process for each bar/brick, the filters become more restrictive and constrained. My goal was to be able to back test ideas that gave me the largest profit factor with a minimum number of trades and drawdown.

Least Squares Moving Average (LSMA): This is the first layer of the three filters. J Basically, there is an entry and exit threshold that the LSMA is compared against to determine if there is a change in direction with either a crossover or crossunder. If there is a cross, then the first condition to enter a trade is met. In the strategy, this is the only configuration that is turned on by default.

Use the LSMA for Flat Detection : If enabled, will detect if the LSMA has not changed brick over brick. If this condition is detected, it will disable the entry of both longs and short. The rationale being that if flat, the market is in short term consolidation and new entries should not be made. With the LSMA length default set to 5, this rarely happens.

Use the LSMA for Full Direction Detection : This enables a couple of additional checks that can influence the order process.

Is the LSMA direction cross in sync with the price direction (e.g., if the LSMA is crossing over (up) but the brick direction is red (down), then the two are not in sync and entries should be disabled

Is the LSMA, on a crossover (up) greater than the last LSMA high (vice versa for a cross under (down)). This can detect scenarios where price is consolidating but not necessarily making new highs or lows. This will keep trades for triggering during this consolidation.

Donchian Channels : The second layer in the filters.

The initial setting for this is a length of 5. By default, this layer is disabled. If enabled, then the Basis of the DC is used to filter out trades where the price is positioned contrary to it. If the DC is enabled, to enter a long trade, the close must be above the Basis and for a short, the close must be below the Basis. Otherwise, entries are disabled.

Use the Basis for Flat Detection : Like the LSMA, if bar over bar the Basis of the DC turns flat, any trades will be disabled. Like the LSMA, the purpose of this flat detection is for consolidation and to not take trades while the market is consolidating.

Use the Basis for Full Direction Detection : If enabled, like the LSMA, enforces alignment of the DC’s Basis and price direction. And, like the LSMA, if the Basis has not taken out the previous high or low, then the entry process is disabled.

For both the LSMA and the DC Channel, enabling these last two configs can become restrictive. As you experiment with them with the market of your choice, you can fine tune them to fit your trading / account style. The intent of both flat detection and the current to previous high/low is to filter out conditions that lead to price churn and trading thrash.

The indicators up to now have been reactionary to price movement. Regardless of a larger view of direct or bias, an entry is triggered; long or short.

What if you want to trade with a bias or at least back test to see how it may influence your trades? What can you use to determine a bias. The method I chose in this strategy is Linear Regression.

Linear Regression : The third layer of the filters. This filter is used to determine if the trend is up, down, or flat (transitioning between up and down). Once enabled, trades will only be taken in the direction of the trend (unless in transition). With this filter, you can configure the length and the threshold to detect consolidation. The length will tune how fast a change in direction is detected while the threshold will determine how far from 0 the slope of the regression must be for it to indicate neutral.

Additional configurations :

Brick Threshold to Pull Rip Cord : Once an entry is made, it can go contrary to your thinking. This setting will let you control how far you are willing for price to drive from original entry contrary to what you were thinking.

Close the Position on First Brick: To keep profits close, this will exit any position (long or short) once the first brick contrary to the current position is printed. You will want to experiment with this and back test. Once it does exit, if the position is triggered again in the next several blocks, it will try to enter.

Consolidation Length : This config controls the slope threshold in the LR to differentiate from up and down.

Again, full disclosure, TradingView does not allow strategies to be published on Renko charts. If you want to experiment with it, you can convert the chart to Renko and configure it as outlined above. Then, you can experiment with various configurations and see what type of results you get.

Some things to watch out for:

If you apply this to a US stock and focus on the regular session, then there will be gaps at the open that won’t appear as gaps on Renko charts. However, the strategy can try to make it look like you had a great fill on the open (which most likely is not the case). Additional work needs to be done to filter out this specific scenario

Limit orders should not be considered in the strategy on a Renko chart because the brick will only be executed when the brick prints. Market orders should only be used and only when the close for the brick prints.

AT&T - Long active !!Hello traders!

‼️ This is my perspective on AT&T.

Technical analysis: Here we are in a bullish market structure from daily timeframe perspective, so I look for a long. I expect bullish price action after price took liquidity below equal lows and then broke LZ.

Like, comment and subscribe to be in touch with my content!

Paper Trading Challenge: Which Strategy Did the Best, Winner is The winner has now been decided! In this thrilling paper trading battle, we put four powerful trading strategies to the test: Harmonics Trading Strategy, Sentiment Trading Strategy, RSAI Blueprint Strategy, and Market Structure Strategy.

Throughout this episode, we:

Explained the fundamentals of each strategy.

Demonstrated real-time application of each trading approach.

Tracked and analyzed trades executed by each strategy.

Compared performance metrics including win/loss ratio, average return, and overall profitability.

Whether you're a seasoned trader or just starting out, this video offers valuable insights into the practical application of these popular trading techniques. Watch till the end to see which strategy emerges victorious and to learn tips and tricks you can incorporate into your own trading practice.

🔔 Don't forget to like, comment, and subscribe for more trading strategy battles and tutorials!

TradingView Masterclass: The power of Bar Replay🚀 Unlocking Your Trading Potential with Bar Replay on TradingView

In the whirlwind of trading, having ace tools up your sleeve can dramatically shape your strategy and success. The spotlight shines bright on TradingView’s Bar Replay feature, a gem that offers a rewind on market movements, setting the stage for strategic mastery. Let's dive into what makes Bar Replay a must-use for traders eager to refine their game.

🕒 Understanding Bar Replay on TradingView

Bar Replay is one of TradingView's standout features, allowing traders to select any point in history on their chart and watch the market's movements replay from that moment. It's a game-changer for visualizing price actions and volume changes without the stakes of live trading. Whether you're aiming for an in-depth analysis or a quick market recap, the adjustable speed of Bar Replay caters to all your needs with unmatched flexibility.

🤿 Why Dive into Bar Replay ?

The magic of Bar Replay lies in its exceptional ability to simulate market scenarios, offering a practice ground for strategy testing and gaining insights from historical market behavior. Newcomers find a safe space to learn and experiment, while the pros get a robust tool for refining strategies. Our tutorial video steps it up by walking you through practical uses on a top company's chart—marking crucial levels, applying indicators, and making trade decisions, all within the Bar Replay environment.

✨ Conclusion: ReplayYour Path to Trading Excellence

Bar Replay isn't just another tool; it's your companion in the quest for trading excellence, turning theory into actionable insight. Whether you're just starting or fine-tuning your strategy, it bridges the gap to more informed and decisive trading.

Ready to explore Bar Replay 's power and make each session a step closer to your trading goals? Let's embark on this journey together.

❓ Ever tried Bar Replay in your trading adventures?

We're all ears! 📢 Whether it's been a strategy game-changer or you're navigating its integration, drop your stories below. Let’s navigate the market's waves together.

💖 TradingView Team

PS: Check out our other Masterclasses in the Related Ideas below 👇🏽👇🏽👇🏽 and give us a 🚀 and a follow if you don't want to miss any of our future releases!

RESULT ONE-WEEK GETTING REWARD-1In this post, you will see a week of receiving one-to-one rewards for all positions , which ended with a win-rate of 80%, and this is a strong strategy to get one reward, and in the second week, we will go to R/R-1.5 rewards and that too. We test with our strategy.

Thank you for your support and support🙏✨❤️

DXY to continue declineDXY started a recovery from 100.257 from the heavy decline due to the pause in the interest rate hikes back in December 13th, 2023. The index started to recover from 28th December and to 102.723 due to the positive news from the last Friday NFP fundamentals. Price was quickly knocked down by the negative news on the ISMs late Friday.

DXY January candle has done a retracement unto the 61.8%-78.6% (EMA 20) of the December bearish candle. As a result of the retracement on the December candle, the DXY is expected to retest the weekly EMA 200 on the key level 100.500 and as at the ending of last Friday, price was resisted by the weekly resistance.

On the Daily, the DXY index is expected to retest the EMA 200 at 101.706 and subsequently retest the key level 101.500 again.

The important fundamentals this week are mainly the Thursday's Core CPI m/m and the Friday's PP1 m/m where the economists are projecting a negative news for the CPI. We need to keep an eagle eye on the news this week to make informed decisions.

RECOGNISING CHART FORMATION 🧠Hello Traders!

In this post, I want to present how important is to recognize chart formation, set up correctly resistance levels, and find a good position to execute the trade.

For better practice, I will recommend analyzing the history of any chart and trying to search for resistance levels, order blocks, and breakout points, and anticipate a good position for trade execution.

This exercise will help us to have better visibility of the chart and will help us to anticipate future movements.

Keep in touch!

Follow me for more trade ideas and perspectives!

www.tradingview.com

Demo of first complete TradingView Strategy called BunnyIntroducing Bunny - the groundbreaking TradingView strategy that promises to revolutionize the world of online trading. Developed by a team of experts in the field, Bunny offers a comprehensive and innovative approach to trading by combining advanced technical analysis tools with a user-friendly interface. With its intuitive design, Bunny allows traders to easily create, test, and deploy custom strategies tailored to their unique trading preferences. Whether you are a seasoned investor or just starting in the world of trading, Bunny provides users with a fully immersive experience that unlocks the full potential of TradingView's platform. With its array of powerful features and comprehensive market data, Bunny offers the necessary tools and insights to analyze market trends, make informed trading decisions, and maximize profits. Embark on a new trading journey with Bunny and unlock the doors to success in the ever-evolving world of financial markets.

Guide: SMA and RSI for Trend ReversalsWelcome, traders! In this comprehensive guide, we'll explore a long-term trading strategy that leverages two powerful technical indicators: the Simple Moving Average (SMA) and the Relative Strength Index (RSI). By the end, you'll have a solid understanding of how to use these tools to identify trend reversals and make informed trading decisions with a focus on the bigger picture. 📉📈

Educational Objectives:

Understand the concept of long-term trading and its benefits.

Learn how to use the Simple Moving Average (SMA) to identify trends.

Master the Relative Strength Index (RSI) for spotting overbought and oversold conditions.

Combine SMA and RSI for a comprehensive long-term trading strategy.

Recognize key points of trend reversal for well-timed entries.

📌 Part 1: The Foundation of Long-Term Trading

Long-term trading focuses on capturing significant price movements over extended periods.

It requires patience, discipline, and the ability to ignore short-term noise.

📌 Part 2: Understanding the Simple Moving Average (SMA)

SMA is a trend-following indicator that smooths price data to reveal the underlying trend.

The 200-day SMA is particularly useful for long-term analysis, indicating the overall trend direction.

An upward-sloping 200-day SMA suggests a bullish trend, while a downward slope indicates a bearish trend.

📌 Part 3: Mastering the Relative Strength Index (RSI)

RSI measures the speed and change of price movements, helping identify overbought and oversold conditions.

An RSI above 70 suggests overbought conditions and a potential trend reversal.

An RSI below 30 indicates oversold conditions, potentially signaling a trend reversal to the upside.

📌 Part 4: Combining SMA and RSI for Long-Term Trading

Look for confluence: Confirm trend reversals when the 200-day SMA aligns with RSI overbought or oversold signals.

A bearish signal could be an overbought RSI crossing below the 200-day SMA, signaling a potential downtrend.

A bullish signal might be an oversold RSI crossing above the 200-day SMA, suggesting a potential uptrend.

📌 Part 5: Identifying Points of Trend Reversal

Key points to recognize trend reversals include:

Divergence: When the price makes new highs or lows but RSI doesn't, it signals a potential reversal.

Crossovers: Pay attention to the 200-day SMA crossing above or below the price chart.

Volume: Increasing trading volume often accompanies trend reversals.

🚀 Conclusion:

Long-term trading can be highly rewarding, but it requires a deep understanding of market trends and the right tools. By combining the SMA and RSI indicators, you gain a powerful strategy for identifying trend reversals and making well-informed trades with long-term potential. Remember that no strategy is infallible, so always employ proper risk management techniques and continuously refine your trading skills.

❗See related ideas below❗

Like, share, and leave your thoughts in the comments! Your engagement fuels our crypto discussions. 💚🚀💚

Initiation. Accumulation. PumpHow to trade coins after listing? Here is logic of IAP model

BINANCE:APTUSDT

When people get tokens after airdrop or launchpad, most likely on first candle we will see seller pressure. This model works in general only for fundamental projects, where even people who get tokens for free will hold it for long term. Because we got a lot of examples when this model doesn't work and price crashed under listing price. Also we need pay attention in what market period we see this listing. Because if it's a beginning of bear market this model most likely also will not works.

Initiation - Formation price imbalance in the broad price range at the time of listing

coins can be interpreted as an initiating impulse, who doesn't leave fair traded price zones on ways of its formation and in here will be be nearest target. We can use Fib from the bottom to the top candle before correction or just count only body of first Daily close candle.

Accumulation - Price reaction to price imbalance initiating impulse is

a direct indication of the presence or lack of accumulation character on the chart. Zones for accumulation before pump will be classic 0.618 / 0.71/ 0.86 levels by fib.

Pump - last stage of this model is a Pump, minimal target for this trade can be -0.27 and -0.618 level by fib where you can fix profit. On this example with Aptos it was over 500% pump. After pump depends of market stage and cycle price can continue parabolic move up or correction again to 0.5 or 0.618 level by same fib.

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

#RAIN...looking good from 31.07.23#RAIN...

Intraday as well as swing trade

All levels given in charts ...

IF good potential seen then we work in options also

if activate then possible a good movement Keep eye on this ...

We take trade only when it activates...

Possible to give good target

TRADING FACTS

XAAUSD Strategy to Trade any Pair Testing Phase 1so weekends for many mean relaxing, but for many of us it is, contemplating what went wrong, strategizing our risk management and tweaking our strategies.

I Had a thought that instead of trading during news and peak session, why dont we trade after the market has done what it has done and enter when the strength has weakened, this way we might cut unnecessary loss during news and peak sessions and aim for 3-5$ profits/loss.

its less stressful, you don't need to sit the entire day or half a day, the process might be long and might require patience but its worth it. This may suit swing traders who can hold position for more than a day, but my basic idea is to enter and exit before the day closes(for testing purpose only).

So basically i will take 2 EMA's 20 and 200, During the end of the day i will look to get in to the market.

Conditions : There needs to be a maribozu candle above or below the ema, depending on if its a buy trade or sell trade.

For buy trade the candles should be above both 20 and 200 ema and for the sell trade it should be below the 20 and 200 ema.

Our Entry : will be after it breaks the maribozu candle body.

Risk Ratio : 1:1 for starters

Note: This strategy is risky if you account size is below 5000$

Will backtest this and keep sharing updates.

THIS IS THE REASON YOUR STRATEGY DOESN'T WORKThe title is brash, I know. But before you click away, answer these two questions:

1) How many strategies have you tried?

2) How many strategies have you backtested through several years and thousands of trades?

If you have tried more strategies than you've backtested rigorously, then stick around because that's probably the reason why you're losing money.

Imagine this. Florence is a novice trader. He's seen the thousands of dollars in profit a kid 10 years younger than him can generate. He's seen the kid flexing his Lambo on Instagram. The kid mentions RSI a few times, so Florence assumes the RSI indicator is the secret to insane profits. Florence is chomping at the bits and loads up a fresh Webull account with $3,000. Every time the RSI is above 70 on a stock, he shorts that stock.

Lo and behold, after 5 trades, Florence's account now sits at $2,300. He concludes the indicator does not work.

Florence perseveres and is determined to find the secret strategy to quick profits. He scraps the RSI and studies "support and resistance" trading from a few youtube mentors. He reloads his Webull account back up to $3,000. With a refreshed vision, he shorts anytime a stock is at resistance and longs anytime a stock hits support. Sadly, after 10 trades, his account is down again, this time to $2,600.

Florence is flabbergasted.

The story goes on. He attempts implementing strategy after strategy and continues to lose money. Unfortunately, many of us are Florence. We did what he did. We got into the game without a blueprint or game plan.

And this is why my title is brashly stated, "If you don't read this you are going to lose money," because it's true. If you resemble Florence even in the slightest, basing the success of your trading strategy on a handful of trades, then how do you expect to know what strategy is actually successful?

I don't blame you for approaching trading like Florence. In today's age, we are seeing the market oversaturated with traders and trading coaches, or even worse, "trading influencers". As with any influx of the masses, we are going to get the scumbags trying to get you to buy their image and product by falsifying the simplicity and ease of trading.

If you are jumping between strategies without quantifying its success and failure rates over thousands of scenarios, then stop trading right now because you are going to continue losing money. Find a backtesting service or at the least log every single trade you take. Whatever it is, slow down and find proof of failure before declaring failure. I don't want you to fall into a never-ending hole of searching for the "right" indicator/strategy. The truth is, most of the strategies you've thrown away probably work and you don't even know it.

Visualizing Stochastic energy for perfect entriesThe stochastic RSI has always been a problem tool for me because of its clunky look erratic lines and the way it seems l....r each other and sometimes it doesn't.

I've always felt like the stochastic RSI had these energy waves built into it that we weren't able to see because if there's an uptrend of the stochastic then there has to be an equal or greater downtrend of energy pushing it in the other direction but what if there isn't more than that energy and what if this is a perfect balance between the two energies.

This would imply that either that there's a divergence of the energy related to how price is closing or there is a pause in the energy because they're balanced between the two and of course that means your price will pause and run flat as well.

In this video I talk about the proper way to use this new indicator and the way you used to use the stochastic RSI.

Using the information as video and the images that I plot out on the screen you'll be able to see when you should do you should enter trades long or short and why you need to know where your support and resistance lines are as well as whether you're breaking above or below your moving averages.

Let this video be a first class tutorial on perfect trades using a stochastic RSI but like all other indicators you cannot use it by itself make sure that you have confluence on your price chart.

PS as always welcome to the coffee shop.

Does 10 Minutes Per Month Beat Buy and Hold?So far, I’ve been testing day trading strategies.

Which you’d have to watch for hours per day for trading signals.

Or automate.

And after all that dang work, not one of them beat buy and hold. Ouch.

Recently, I found a strategy claiming to beat buy and hold, without any of that hassle.

They say you can run it manually and in only 10 minutes per month.

Too good to be true? Let’s find out…

Our Test

The rules are so simple, you might chuckle…

Ignore all S&P 500 price action for the whole month, until the close on the last day.

If that closing price is above the 200-day moving average, go long (or stay long if you’re already in a trade).

If it’s below the 200-day moving average, sell (or don’t get in if you’re on the sidelines).

With that in mind, let’s look at our setup a little more closely…

The Trading Truth Test Setup

Since this is a monthly strategy, I used much more data than in previous tests…

Market: the S&P 500 index (using SPY to trade it, assuming SPY existed decades ago and is exactly 1/10th the S&P 500 Index price)

Timeframe: September, 1941 to April, 2023

Bar interval: 1 day (for the moving average, even though we’re only making trading decisions at the end of each month)

Moving averages: 200-day exponential moving average

Starting Equity: $ 25,000

Max % of Equity Per Trade: 100% (just like we would with buy and hold, we’re fully investing our capital)

Commissions, fees and taxes. To keep things super simple, we’re assuming these are all zero.

The Test Results

The test ended up 152.4x to $ 3.81 million a 59% win rate. Pretty amazing, though that’s over several decades.

The maximum losing streak was $ 46,384.74, or 18.4% (from $ 252,545.60).

That said, the buy-and-hold return was up 403.0x, trouncing our test.

Especially given the tax advantages from long-term capital gains.

Note: I did this analysis in a spreadsheet, with exported TradingView data. If you see any errors, please let me know.

What Test Tweaks We Could Make

One tweak is looking at the slope of the 200-day moving average.

If it’s not pointing up enough, I wouldn’t want to go long.

We could also use some other indicators to see when a pullback is likely, for example, Bollinger Bands or Keltner channels.

What would you test? And what else would you like to see tested?

Comment below!

Testing a Youtube MACD StrategyIn previous articles, I’ve tested moving average crossovers and bounces.

But I didn’t test this famous (or infamous?) indicator related to them…

The MACD.

When I saw a video from TradingLab on Youtube called “BEST MACD Strategy,” I was curious to test his approach.

What’s a MACD Daddy-o?

It stands for Moving Averages Convergence Divergence. It’s meant to help us see momentum in the market.

So we take a shorter-duration moving average and pair it up with a longer one.

We then graph the difference between the two as its own line.

We also plot an MA of the difference, called the “signal” line.

When the signal line crosses over the difference line, we might be seeing a shift in direction.

The farther the signal line pushes away from the other, the stronger the momentum is in that direction.

Note: most charting software, including TradingView, also shows the difference as bars (a histogram).

So how are we gonna test this thing?

The Trading Truth Test Setup

We’re keeping the market and the test period the same as some of the previous tests, for easier comparison.

(The TradingLab video just says MACD works in many markets and timeframes, without limiting it to one for testing.)

Market: the S&P 500 index (using SPY to trade it, assuming SPY is exactly 1/10th the S&P 500 Index price)

Timeframe: Jan 2, 2008 to March 28, 2023

Bar interval: 1 hour

Moving averages: Unlike previous tests, where we used simple moving averages, we’re using exponential moving average here to weight recent prices more.

We use a 200 exponential moving average for overall trend direction.

For the MACD, we’re using the classic 12 bars and 26 bars to see the difference between them. And we’re the normal 9-bar MA of that difference as the signal line.

Starting Equity: $ 25,000

Max % of Equity Per Trade: 3%

Commissions, fees and taxes. To keep things super simple, we’re assuming these are all zero.

Our Test

When we get a MACD crossover between the signal line and the difference line, we look to go long.

But we only go long if:

the last closing price is above the 200 MA, and

When an upside MACD crossover (the signal line crossing up through the difference line) happens below its zero line (the lower half of the plotted indicator area).

We do the opposite to go short…

We short when price closes below the 200 MA and we get a downside MACD crossover above the zero line.

Our stop loss is 1 penny past the 200 MA value when entering the trade.

And our take-profit price is the difference between the entry price and the 200 MA (on entry) multiplied by 1.5. That’s the suggestion in the TradingLab video.

Note: The Youtube video suggests using support and resistance as another filter to avoid choppy markets. But there aren’t clear rules given, so I didn’t do that.

The Test Results

The test ended at $ 30,401.39, up 21.6% with a 46.9% win rate.

The biggest loss from the initial $ 25,000 deposit was $ 270.85, a 1.1% loss.

The maximum losing streak was $ 800.22 or 3.0% (from $ 26,908.66).

That said, the buy-and-hold return was 173.1%.

Quite a reward for sitting on your hands, especially given the tax advantages from long-term capital gains.

Note: I did this analysis in a spreadsheet, with exported TradingView data. If you see any errors, please let me know.

What Test Tweaks We Could Make

We could identify rules on when to stay out of the market.

MACD strategies, like many, get chopped up in sideways price action.

Some other MACD settings might also be interesting to test. We used only the most common settings here.

What would you test? And what else would you like to see tested?

Comment below!

Are Keltner Channel Bounces Worth Trading?Since I tested Bollinger Bands in the last article , what’s natural to think of testing next?

Rubber bands? Rock bands?

No, you silly goose! Keltner Channels…

What’s the Difference Between Keltner Channels and Bollinger Bands?

Bollinger Bands are based on chunks (called “standard deviations”) away from an average.

Keltner Channel bands are based on multiples of the average true range (ATR) away from the average.

Alrighty then. Let’s get into our test setup…

The Trading Truth Test Setup

We’re keeping this the same as our Bollinger Bands test, except for the ATR period.

Since we’re using ATR to determine the Keltner Channels, we’re going with the same period as the moving average.

Market: the S&P 500 index (using SPY to trade it, assuming SPY is exactly 1/10th the S&P 500 Index price)

Timeframe: Jan 2, 2008 to March 28, 2023

Bar interval: 1 hour

Moving averages: 50 bars (simple moving averages, meaning every bar gets equal weight, unlike with exponential)

Average true range: 50 bars

Starting Equity: $ 25,000

Max % of Equity Per Trade: 3%

Commissions, fees and taxes. To keep things super simple, we’re assuming these are all zero.

Our 2 Tests

Test A:

We’re using Keltner Channel bands 2 ATRs away from the moving average.

Any time a high pierces the upper Keltner band and then a high is below the band, go short (if we’re not already in a trade).

Any time a low pierces the lower Keltner band and then a low is above the band, go short (if we’re not already in a trade).

This way, we’re waiting for a cross back over the band after it gets pierced.

We didn’t do this for our Bollinger Bands tests, which makes this not a direct performance comparison.

Test B:

The same as Test A, except we’ll use Keltner bands 3 ATRs away from the MA instead of 2.

The Test Results

Test A's equity ended at $ 38,137.63, up 52.6%. The biggest loss from the initial $ 25,000 deposit was $ 843.16, a 3.4% loss. The maximum losing streak was $ 1,805.75 or 6.36%.

Test B's equity ended with $ 34,435.71, up 37.7%. The biggest loss from the initial $ 25,000 deposit was $ 3,027.42, a 12.1% loss. The maximum losing streak was $ 2,080.71 or 8.22%.

The worse results 3 ATRs away from the MA is surprising. Seems like that’d give us higher-quality trades.

Even Test A’s numbers don’t come close to what plain-Jane buy and hold did: ending up 173.1%.

Note: I did this analysis in a spreadsheet, with exported TradingView data. If you see any errors, please let me know.

What Test Tweaks We Could Make

Some traders wait for when Bollinger Bands or Keltner Channels get pinched (narrower in width). That’d be interesting to test vs bounces.

One well-known trader, John Carter, looks for when Bollinger Bands go inside (“squeeze into”) Keltner Channels. He sees that as an indicator of bigger-than-normal moves.

What would you test? And what else would you like to see tested?

Comment below!

Gold breakdown analysis 28/03/2023Dear traders gold start with bearish daily candle so it may still in correction after the big move l gold won’t up this week because it has a lot of secret behind the chart so as I said you should look for buy above 1957 and if price came and close below 1952 you should look for sell ...trade safe

Good luck

Which Moving Average Strategy Crushes MA Crossovers? This...If you read last week’s article, you saw results for the famous (or infamous!) moving average crossover.

It bombed vs buy and hold over the last 10 years, even when using take-profit and stop-loss levels.

So, how do moving average bounces perform with the same exit levels?

That’s what we’re testing today…

The Trading Truth Test Setup

Our setup is the same as last time, except we just need one moving average.

Market: the S&P 500 index (using SPY to trade it)

Timeframe: Jan 1, 2013 to January 31, 2023

Bar interval: 30 minutes.

Moving averages: 50 bars (simple moving averages, meaning every bar gets equal weight, unlike with exponential)

Starting Equity: $25,000

Max % of Equity Per Trade: 3%

Commissions, fees and taxes. To keep things super simple, we’re again assuming these are all zero.

How Is “Bounce” Defined?

Traders look for ricochets off moving averages in a bajillion ways.

Let’s be real: most just eyeball charts without real rules.

That won’t work for rigorous renegades like us, though. :-)

So, for Test A, here’s how we defined a bounce when price is above the MA:

A price bar’s low is above the moving average

The next price bar’s low touches or pierces the MA for one bar. (A close below the MA is ok.)

The bar touching or piercing the MA can’t go more than 0.5% below the MA

The next bar’s low must again be above the MA.

Flip these rules for a bounce when price is below the MA.

I know, I know… many bounces don’t happen until 2 bars (sometimes more) hover on or below the MA. We're keeping the criteria here simple.

We define Test B the same way, except with an extra filter:

The 50-bar MA needs to be sloping up at least 0.5% over the last 25 bars for long trades (and -0.5% or less for short trades).

Alrighty, now, let’s check out the results…

The Test Results

Like with the MA crossovers test before, let’s first look at how plain ol’ buy and hold did over the same period.

If you parked your cash in the S&P 500, your money would be worth 2.9 times as much by the end. Pretty good.

So how did Test A do?

The ending equity after 10 years was $40,112.74, 1.6 times your money with 24.27% max drawdown.

Test B, in which we only took trades if the MA was sloping (trending) enough, we ended with $43,149.00, for a 1.7x return with only 17.75% max drawdown.

That makes the return on risk much better than Test A.

Yet, while these returns beat the pants off of our MA crossover tests, boring old buy and hold still whooped them both.

What Would You Change About This Bounce Strategy?

Trade a different market?

Longer or shorter time frame?

Tweak how a bounce is defined?

Comment below to share. Also, please let me know: what else do you want to see tested?