Stratis STRAT, Wedge and Inverse H&SSo far following the previous analysis quite well, with the possible 'fractal'. The past days there have been a few attempts to break that resistance around 0.845, but each time it just fails. Volume is not enough yet, but of course it's because Bitcoin' is moving slowly downwards as well.

There is small chance the market might move up now, Bitcoin' seems to be turning up now. But it really has to break the 3620 though, then the bull flag will be alive again and decreases the chances for a Bart move. There is clear range now between the red and green zone, a break of one of those should give us the direction of the coming days.

Previous analysis:

Stratusd

Stratis STRATI am seeing some similarities now and the Dec rally. In the chart below we can see that Stratis' the rally a day later than Bitcoin'. It looks like the same is going on this time. Also see a wedge again and a breakout and currently a retest. Based on the fractal, we should stay above the green support zone now, just like in Dec

When zooming in, it shows we are most likely in the yellow circle now. Got some rejection from blue line this time as well. So if Bitcoin would be able to make a good bull flag here, like in Dec, we should see a break of the blue line and maybe see a good rally after that stage as well

STRATIS NEAR BOTTOM EXPERIENCEThere are chances that stratis reached the bottom.

I base my supposition on the daily timeframe.

The bullish impulse of the second half of december is a very atypical movement in the context of the bear market.

The RSI confirm this supposition as the negative trend of the buying strenght was broken.

In the DMI there are also very interesting movements.

The ADX during the second half of the bear market increased during the sell periods and came back to the cool zone during the consolidation. After the important sell of last november, a green waves brought the price back at the same price than before the november sell. Like a last shake out!

Now ADX is back in the cool zone and the price is coming slowly down direction last support. The logic says that the ADX will increase again in the next time and probably through a new bullish impulse. With that the bottom would be on place.

BIO

Megalodon Pro Automated Trader - Strat - Short Term Bull Megalodon Pro Automated Trader is giving short term buy signals(orange) on hourly time frame.

----------------------------------------------------------------------------

We believe that enlightening others is an incredible way to make this world a better place. That's why we created the tools you need to stop worrying about your investments and focus on what really matters in your life.

What is Megalodon ?

Megalodon uses Artificial Intelligence that combines 574 back-tested indicators and 2674 back-tested setups, simultaneously.

Megalodon works with any kind of asset , market state and time frame .

What is the win rate?

Megalodon is extremely accurate and offers insane profits as long as the fundamental analysis is done right .

Backtesting results can be found on our social media or down below .

How to use Megalodon Pro Automated Trader?

Simply, orange rectangles are buy signals and purple rectangles are sell signals .

Green clouds show buy signals and red clouds show sell signals.

Yellow line shows the difference between buy and sell counts.

How to set alarms on Megalodon Pro Automated Trader?

Click on Alert, select Megalodon Pro Automated Trader and click on Buy-Signal or Sell-Signal. More details can be found on our social media.

You may also watch our Megalodon Investing Tutorials on Youtube for more information.

How to purchase?

Megalodon is totally FREE .

You may upgrade to Megalodon Pro for the most important features , including automizing your trading on any asset profitably, setting up alarms to get notified , joining to our VIP telegram channel to learn and our VIP telegram group to interact with the community. Simply go to our website on our TradingView page for learning more and joining us for free.

Some of the backtesting results are:

BTC/USD for longer time frame trading in the bear market for the last year.

APPLE for longer time frame trading in the bull market for the last 10 years.

EURO/USD for day trading in the neutral market for the last month.

BTC/USD for day trading in the bull market for the last 15 days.

APPLE for day trading in the neutral market for the last 2 days and 6 hours.

There is a trading opportunity to buy in STRATUSDTechnical analysis:

. STRATIS/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 57.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (1.22317800 to 0.91432000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (1.22317800)

Ending of entry zone (0.91432000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 2.09905

TP2= @ 3.13100

TP3= @ 4.03000

TP4= @ 5.55650

TP5= @ 6.88000

TP6= @ 8.69800

TP7= @ 11.2266

TP8= @ 13.7495

TP9= @ 17.3387

TP10= 21.9115

TP11= Free

[STRAT/BTC] GET READY WHEN TAKE OFF [ 25-300% POT PROFIT ]#STRAT / BTC ( Many exchanges )

Buy Range : 0.00235-245

Stop Loss : Not recommend ( only sell if got delisted, really cheap price )

Target 1 : 0.00032

Target 2 : 0.00045

Target 3 : 0.00086

This coin is giving me very good feelings when i look into Daily and Weekly Chart.

On daily chart, you can take a look how its going into ichimoku cloud. I'm expecting we touch the top of it ( at least ) which would be my personal target 1 .

If we look into Weekly Chart, we see differents positive indicators.

- MACD looks really nice. Its already turning into positive and crossing. Very good signal

- SAR is really near to reverse after big bloodbath

- Stoch RSI is ready to take off, each time this indicator move to the top Strat doubled its price.

- RSI touched oversold which is always a very good indicator to confirm that bears are exhausted

- TD sequential confirm good performance. After bear 8, we got a green 2 after green 1.

STRAT Trading AdviceBuy Price: Yellow Line

TP: Green Lines

Moon: White Line

Support: Blue Line

SL: Red Line

Invest Suggestion: 5-10 Percent

Profit Expectations: 5, 10 or >20 Percent

Just hold and watch. Sell while you get some profit. Good Luck!

Looks Good? Leave a like, share and tell me in comments if my trading advices are working for you.

Thanks for visiting.

START Coin Next Move 80% !!Strat Coin are Coming on the Bottom then We can Etntry For Longterm or Midterms Period , in Both Conditions are VeryGood Coin.

Buying Zone 2000-2050

Sell 2750, 3550

StopLoss 1750

I hope that Price can fly From Buying zone.

Share Your Opinion in Comments.

if You Satisfied With My idea Then Dont Forgot To Hit Like.

Warning- I m Not a Financial Advisor this idea Only For Educational Purpose Only.

Thank You !!

STRAT/BTC from 80% to 850% potentialHello!

In last year BINANCE:STRATBTC gave a bunch of profits to his patient holders, let's see what will happen.

I singled out all the main resistances.

ITS NOT financial advice!

A trading opportunity to buy in STRATUSDTechnical analysis:

. STRATIS/USDOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 51.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (1.08220000 to 1.08000000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (1.08220000)

Ending of entry zone (1.08000000)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 2.09905000

TP2= @ 3.13100000

TP3= @ 4.03000000

TP4= @ 5.29000000

TP5= @ 6.88000000

TP6= @ 8.39000000

TP7= @ 9.50000000

TP8= @ 12.10000000

TP9= @ 14.70000000

TP10= @23.10000000

TP11= Free

A trading opportunity to buy in STRATUSDTechnical analysis:

. STRATIS/USDOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 51.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (1.08220000 to 1.08000000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (1.08220000)

Ending of entry zone (1.08000000)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 2.09905000

TP2= @ 3.13100000

TP3= @ 4.03000000

TP4= @ 5.29000000

TP5= @ 6.88000000

TP6= @ 8.39000000

TP7= @ 9.50000000

TP8= @ 12.10000000

TP9= @ 14.70000000

TP10= 23.10000000

TP11= Free

STRATIS BTC BREAKOUTStratis agains BTC is situated into a BULLFLAG IN 1D TIMEFRAME so we have chance to see a great breakout.This setup is easy,volume it s still good for this breakout

STOPLOSS AT 2388 sats.

You have the targets above.still easy breakout setup.

ENJOY

STRAT great place to DCAG'day fellas.

I know I've signalled STRAT in the past and unfortunately incurred more than a 50% loss had you taken the trade.

apologies for that.

I'm happe to say that I've learnt a lot more as of those times and would like to extend my new found knowledge and I guess excitement as I apply these concepts into action.

Anyways,

STRAT is currently chilling on previous resistance, Novmeber 11 2016 resistance (gee a long time ago). Resistance now turned support.

This is also confluent with a daily bullish OB (weekly, 2W, Monthly all show nothing) and would mean a fair dinkum of a spot to start to Dollar cost average.

I've outlined another zone of buying just below this current OB that prices should find itself (this zone is confluent with a beautiful looking monthly OB, and ugly 2W and W OBs and 3D ob and 1D ob)

Anyways.

I'm not stop lossing this trade, because I'm OK risking this amount or losing this amount of money should poop hit the fan.

Buy zone 1

18k - 21k sats.

Buy zone 2

7.4k - 8.3k sats.

Adding this stuff to my longterm bag.

Let's see how we go.

STRAT possible long entry Timeframe: 240M

Main Scenario: The pair STRAT/BTC has been dropping considerably since Jul 18 and touched the 0.00031130 (April 2017) and possibly we will see a retracement from this level the indicators are showing oversold levels and pointing up and we can wait for a confirmation for and long entry if the price manages to cross the Pivot S1 at 0.00034352

Alternative Scenario: The price could bounce in the Pivot S1 and could fail to look for lower lows this week.

Entry/Stop Loss/ Take Profit:We would go short on this pair if the price crosses the $ 0.00034683 with 3 main targets

T1 = 0.00037074 (5 %) Just over the 38.2% Fib Retracement

T2 = 0.00038820 (10 %) Just over the 50% Fib Retracement

T3 = 0.00040920 (16%) Just over the 61.8% Fib Retracement

The Stop Loss can be placed at $ 0.00032255 (-7%)

Duration: This is a Medium-Long term trade

Consolidation/Ratification level: If the price crosses the first target, you can drag the stop loss to the entry point.

Warning Level: A further drop below the minimum of the Pivot S3 will invalidate this setup.

Risk Management: Risk/Reward Ratio: 2.57. If this becomes a valid setup you could have a very good profit of between 5% and 18%.

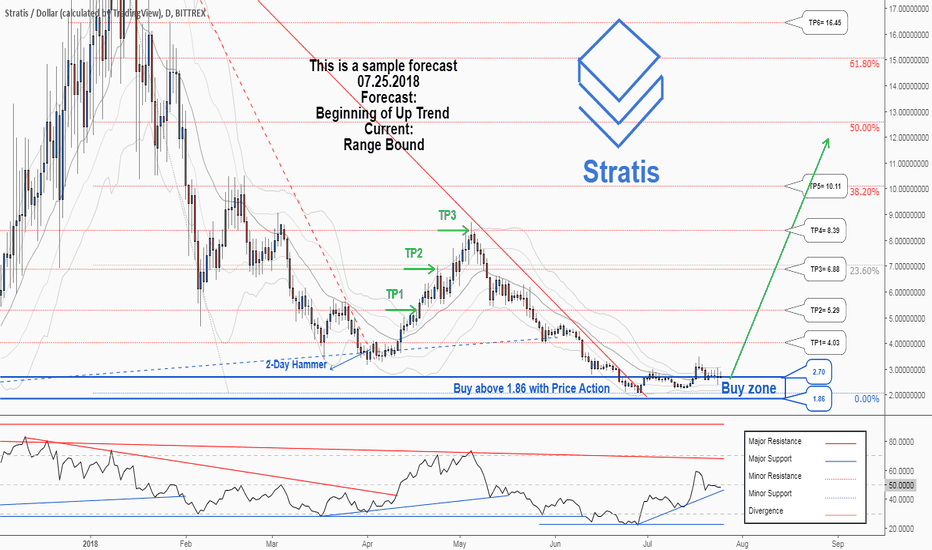

There is a possibility for the beginning of uptrend in STRATUSDTechnical analysis:

. STRATIS/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. The price is in the support zone (2.70 to 1.86), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (2.70)

Ending of entry zone (1.86)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 4.03

TP2= @ 5.29

TP3= @ 6.88

TP4= @ 8.39

TP5= @ 10.11

TP6= @ 16.45

TP7= @ 23.12

TP8= Free

There is a possibility for the beginning of uptrend in STRATUSDTechnical analysis:

. STRATIS/DOLLAR is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 49.

Trading suggestion:

. The price is in the support zone (2.70 to 1.86), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (2.70)

Ending of entry zone (1.86)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 4.03

TP2= @ 5.29

TP3= @ 6.88

TP4= @ 8.39

TP5= @ 10.11

TP6= @ 16.45

TP7= @ 23.12

TP8= Free

Stratis - This is going to be legen... wait for it DARY.

Falling wedge, bullish divergences on Histogram and OBV on the weekly chart.

I expect a beautiful second half year for Stratis reaching further beyond the ATH.

But first waiting if the USD price breaks through the falling wedge.

Main resistance area is around 3.50$-4$

Why Stratis is again a bargain buy + total altcoin review! Alright, as discussed I wanted to post a new updated posted on Stratis here. I think this is the best moment to buy Stratis and probably we won't see the same opportunity once again here.

As already explained in the Bitcoin post on TradingView, I'm assuming that the G20 event is going to trigger another run on the fields for the altcoins and the whole crypto market. Why? We've seen a huge run up with the futures earlier. The scenario is called: buy the rumor, sell the news. Currently we see a huge dump going in to a significant big event for the market: sell the rumor (dump in to the event) and buy the news (pump when the news is out).

Also, we've seen that Stratis have been releasing tons of stuff in the past weeks and generally checking the chats and tweets on Stratis, people are fed up by the fact that this doesn't influence the market at all --> depression phase. Bubble pattern aligns perfectly with the stages we're in. Back in april it was also a nice buy, which induced 150% profits.

Another example, we've seen Bitcoin being surpressed down in the past weeks, while there were numerous things of bullish perspectives coming out. It's the exact same thing, only Bitcoin is ahead of the altcoins right now.

Then: check the TA point of view we're at right now. Strong bullish divergences + broken horizontal RSI resistance on the daily + historical background of the bullish divergences perspective can be seen here too.

Then indicators:

Strat/USD:

1 Day: RSI strong bullish divergence, horizontal resistance broken. Bullish divergence on Stoch and also on MACD/Histo.

2 Days: Same conclusion here on the bullish divergences as on the daily timeframe.

3 Days: Same conclusion here. Even bullish divergences on the MACD since the period of March/April, as this level is another lower low.

1 Week: Histogram bullish divergence + MACD turning upwards.

Strat/BTC:

1 Day, 2 Days and 3 Days same conclusion as on Strat/USD.

1 Week: Stoch bottomed out, potential bullish divergence on Stoch if we reverse here in the coming weeks. MACD and histo bullish divergence since April.

What more? Well, falling wedge pattern & elliott wave counts could be applied here.

What am I expecting? A rally towards $8-10 zone in the coming months. End of september/beginning October we can be there --> disbelief stage.

Thanks for reading!

Why Stratis is again a bargain buy right now, depression phase! Alright, welcome all with my posts on TradingView. First task: updating the coins I posted here a few months back, so all the charts are back up to date once again.

First our friend Stratis. People are losing faith in this one --> strong indicator of a bottom coming in.

We’ve expected upwards movements in April from $3 to $8, as the $8 is a strict resistance area, which was quite hard to break. What did we also see? Bitcoin went to $10.000 the same time and couldn’t break it due to bearish divergences.

Let’s see what we see on the 12h chart here.

RSI: bullish divergence and about to break the downtrend on the RSI.

Stoch: no bullish divergence.

MACD: strong bullish divergence since the middle of May.

Histo: bullish divergence.

Let’s check this on the daily and the 2d charts, what we can see there too.

1 Week chart: Stoch bottomed out for the first time since the end of March.

3 Day chart: RSI <30 for the first time ever. Stoch bottomed out for some time now. No bullish divergences. Turning here could create them.

2 Day chart: Stoch strongly bottomed out, RSI on all time low of 24, MACD negative with Histo bullish divergence since middle of may.

1 Day chart: Bullish divergence on the RSI. On the final drop also on Stoch. MACD & Histogram both have bullish divergences.

From a fundamental point of view: Stratis has been releasing tons of updates and products lately, still not reacted on the price, which means that the price is being pushed down.

What can we conclude from this? Both Bitcoin and Stratis will move up. Stratis against Bitcoin shows the same bullish divergences and indications for a reversal. Bitcoin against USD does too.

This chart: Strat against USD is two charts in one: STRAT/BTC and BTC/USD, which is a good argumentation to build from when you’re positioning yourself or when you need to find answers when Bitcoin is going to reverse or not. Mostly you’ll find the same indications on altcoins, as they move hand in hand.

Targets first: $3 level, later on $5 level. Probably the depression phase for now, as we can make that out of this one too and then we’re done.

Strat/BTC BUY Opportunity!Nice and simple technical analysis - breakout trade!

If You see something breakthrough from a box, from a triangle, form a support then just wait to retest, there You get a better price and better risk/reward ratio!

At the moment this retest looks very strong because 200EMA is exactly there where is retest area!

Good Luck!